Worm Gearing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437513 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Worm Gearing Market Size

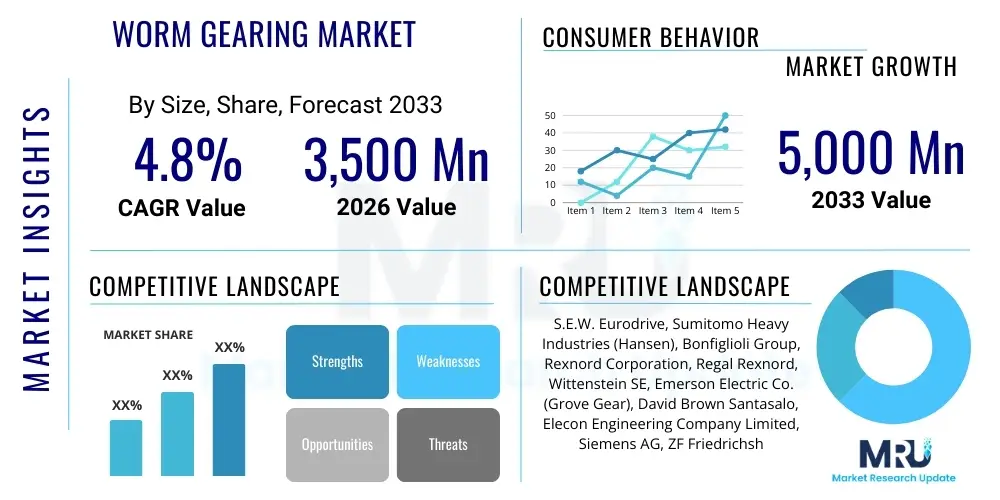

The Worm Gearing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.0 Billion by the end of the forecast period in 2033.

Worm Gearing Market introduction

The Worm Gearing Market encompasses the manufacturing, distribution, and application of specialized gear sets characterized by a screw-like worm meshing with a toothed wheel (the worm gear or worm wheel). This unique mechanical arrangement allows for extremely high-speed reduction ratios in a compact space, making it indispensable in heavy-duty and precision low-speed applications. The primary mechanism converts rotational motion between non-intersecting, non-parallel axes, often featuring a ninety-degree shaft angle. The inherently high contact ratio and sliding action, while contributing to efficiency losses compared to spur or helical gears, are fundamental to achieving quiet operation and the crucial self-locking capability, which prevents back-driving and enhances safety in lifting or positioning systems. This combination of attributes positions worm gearing as essential technology across diverse industrial sectors requiring robust, high-torque output and controlled motion.

Worm gearing products find major applications across sophisticated industrial machinery, ranging from material handling equipment, such as conveyors and elevators, to automated manufacturing systems, including robotics and indexing tables. The primary benefit driving adoption is the ability to achieve large reduction ratios in a single stage—far exceeding what is practical with conventional gear types—thus simplifying transmission design and reducing overall machinery footprint. Furthermore, the self-locking feature is a significant safety and functional benefit, particularly in lifting mechanisms where holding a load securely without external braking systems is critical. This intrinsic safety feature minimizes component complexity and improves operational reliability in scenarios demanding precise load holding.

Key driving factors accelerating the market growth include the continuous global push toward industrial automation and the resultant demand for high-precision motion control components in emerging economies. The proliferation of automated guided vehicles (AGVs) and complex robotic systems in logistics and manufacturing sectors requires reliable, high-torque gearboxes, often leveraging the advantages of worm drives. Moreover, ongoing innovations in material science and lubrication technologies are addressing historical constraints related to efficiency and wear, leading to the development of enhanced worm gear sets capable of higher power transmission densities and prolonged service life. These technological advancements ensure the sustained relevance of worm gearing components despite competition from alternative reduction technologies.

Worm Gearing Market Executive Summary

The Worm Gearing Market is experiencing robust growth fueled primarily by global expansion in the manufacturing sector and intense focus on industrial automation across developed and developing economies. Business trends highlight a strong shift toward customized, compact gear solutions that integrate sensors for condition monitoring, aligning with Industry 4.0 principles. Key manufacturers are investing heavily in advanced CNC grinding and hobbing processes to improve gear tooth accuracy, thereby minimizing backlash and increasing operational efficiency, which historically has been a key restraint for worm drives. Furthermore, strategic alliances and mergers focused on expanding geographical reach, particularly into high-growth Asian markets, and consolidating expertise in precision engineering are defining the competitive landscape.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market segment, driven by unprecedented growth in automotive manufacturing, rapid infrastructure development, and the establishment of vast manufacturing hubs in countries like China, India, and South Korea. These regions demand high volumes of durable worm gearboxes for heavy equipment and assembly line automation. North America and Europe maintain stable growth, characterized by strong demand for high-specification, specialized worm gearing used in aerospace components, advanced medical machinery, and precision machine tools, where quality and minimal noise are paramount considerations over cost.

Segment trends reveal that the double-enveloping worm gear configuration, which offers superior torque capacity and better load distribution due to increased tooth contact, is witnessing heightened adoption, especially in demanding applications like mining equipment and heavy material conveyance systems. By material type, the use of specialized bronze alloys for the worm wheel is dominant due to optimal friction and wear properties, though polymers and advanced composites are increasingly utilized in low-load, high-precision applications seeking noise reduction and lightweighting. The material handling and lifting machinery application segment remains the largest consumer, but robotics and servo-drive applications are exhibiting the highest projected Compound Annual Growth Rate, underscoring the shift toward high-tech automation solutions.

AI Impact Analysis on Worm Gearing Market

User inquiries regarding AI's influence on the Worm Gearing Market predominantly center on how artificial intelligence can mitigate traditional operational drawbacks, specifically efficiency losses and unpredictable wear rates, and how it can optimize the complex manufacturing processes involved in gear production. Common questions relate to the feasibility of AI-driven predictive maintenance to extend the lifespan of gearboxes, the role of machine learning in optimizing gear geometry for higher efficiency, and the integration of smart sensors into traditional worm drives for real-time monitoring. Users are seeking assurances that AI integration will lead to more reliable, energy-efficient, and less costly maintenance cycles, transforming the perception of worm gearing as a lower-efficiency alternative compared to other gear types.

The strategic deployment of AI technologies is already beginning to revolutionize both the design and operational aspects of worm gearing systems. In the design phase, generative design algorithms powered by machine learning can analyze thousands of potential gear tooth profiles and material combinations to optimize the efficiency and load-bearing capacity of a worm drive, reducing friction and maximizing torque transmission while adhering to specified dimensional constraints. This speeds up product development cycles and allows manufacturers to create highly specialized, application-specific gearboxes that meet rigorous performance standards previously unattainable through traditional engineering methods.

Operationally, AI’s greatest impact is seen through advanced predictive maintenance systems. By analyzing vibrational data, temperature readings, and lubricant quality captured by embedded IoT sensors, AI models can detect subtle anomalies indicative of impending failure, such as developing surface fatigue or excessive wear, long before they escalate into catastrophic faults. This shift from time-based or reactive maintenance to predictive maintenance significantly boosts the operational uptime of industrial machinery, reduces unplanned downtime costs, and allows for precise, targeted component replacement, thereby enhancing the overall value proposition of industrial automation equipment utilizing worm gearing components.

- AI-driven predictive maintenance optimizes gearbox lifespan and reduces unexpected failures by analyzing real-time sensor data.

- Generative design using machine learning rapidly optimizes gear geometry for maximum efficiency and minimal backlash.

- AI algorithms improve precision machining processes, ensuring tighter tolerances for highly accurate worm and wheel sets.

- Enhanced supply chain management uses AI to forecast material demand, especially specialized bronze alloys, stabilizing input costs.

- Smart factories utilize AI to monitor production line efficiency, reducing scrap rates in high-precision gear manufacturing.

DRO & Impact Forces Of Worm Gearing Market

The dynamics of the Worm Gearing Market are shaped by a complex interplay of internal market demands and external technological and economic shifts, summarized by its Drivers, Restraints, and Opportunities (DRO). The primary driving force is the relentless global expansion of industrial automation and the corresponding demand for compact, high-torque density speed reducers across numerous industrial sectors, particularly in Asia Pacific manufacturing hubs. However, the market faces significant friction from inherent product limitations, notably the relatively lower mechanical efficiency dueenced by sliding friction, which necessitates advanced cooling and lubrication solutions, and the ongoing competition from increasingly efficient planetary and helical gear systems that offer comparable reduction ratios at better efficiencies.

Impact forces are currently tilted favorably toward market expansion, primarily due to the growing reliance on the inherent self-locking feature of worm gears, an essential safety requirement in lifting and vertical conveyance applications, where alternative technologies require additional, complex braking systems. Opportunities for future growth are strongly vested in emerging high-tech sectors such as robotics, servo-driven machinery, and the electrification of commercial vehicles, where the small footprint and robust torque characteristics of worm drives are highly valued. Addressing the efficiency constraint through advanced material science—specifically, developing high-performance bronze alloys and optimizing surface coatings—remains a critical technological opportunity for market participants aiming for differentiation.

The market faces external headwinds primarily from global economic volatility, which can suppress capital expenditure on new machinery in industrial sectors, slowing down adoption rates. Regulatory pressures emphasizing energy efficiency also pose a restraint, compelling manufacturers to innovate rapidly to close the efficiency gap relative to other gearing systems. Nevertheless, the specialized nature of worm gearing, particularly its ability to handle high shock loads and provide high reduction ratios in a single stage, shields it from complete substitution, ensuring sustained demand in niche, demanding applications.

Segmentation Analysis

The Worm Gearing Market is comprehensively segmented based on product type, the materials utilized in manufacturing, the magnitude of the module (gear size), and the specific end-use application. Analyzing these segments provides deep insights into demand patterns across various industrial requirements, ranging from low-power medical devices to heavy-duty mining machinery. The segmentation structure highlights the dominance of single-enveloping worm drives in standard industrial use due to manufacturing simplicity, juxtaposed with the growing preference for double-enveloping designs in high-torque, critical load applications where enhanced contact surface area is required for maximum power transmission density and durability. This granular analysis is crucial for strategic planning and resource allocation by market stakeholders.

- By Type:

- Single-Enveloping Worm Gearing

- Double-Enveloping (Cone/Globoidal) Worm Gearing

- Non-Enveloping Worm Gearing

- By Material:

- Ferrous Materials (Steel, Cast Iron for Worm)

- Non-Ferrous Materials (Bronze Alloys, Brass for Worm Wheel)

- Polymer/Plastic Composites (for low-load, noise-sensitive applications)

- By Module/Size:

- Small Module (Precision Instruments, Robotics)

- Medium Module (General Industrial Machinery)

- Large Module (Heavy Equipment, Mining, Conveyors)

- By Application:

- Material Handling and Lifting Machinery (Cranes, Conveyors, Elevators)

- Industrial Automation and Robotics

- Machine Tools and Indexing Equipment

- Automotive (Steering, Actuators, Wiper Systems)

- Power Generation and Transmission

- Food and Beverage Processing Machinery

Value Chain Analysis For Worm Gearing Market

The value chain for the Worm Gearing Market is segmented into distinct phases, beginning with raw material procurement and culminating in distribution to diverse end-user industries. The upstream segment is dominated by specialized suppliers of high-grade metals, particularly various grades of steel for the worm shaft (which requires high hardness and surface finish) and specific phosphor bronze alloys for the worm wheel, chosen for their low friction coefficients when sliding against steel. Precision forging and casting capabilities are vital at this stage, as the quality and purity of these materials directly influence the lifespan, load capacity, and efficiency of the final gear set. Fluctuations in commodity prices for copper and steel can significantly influence the manufacturing costs in the midstream.

The midstream phase involves the core manufacturing processes, which are highly specialized and capital-intensive. This includes precision machining steps such as CNC hobbing, milling, and, crucially, high-accuracy grinding of the worm thread flanks to achieve superior surface finish and precise geometric tolerances, essential for minimizing noise and maximizing efficiency. Advanced heat treatments, such as carburizing and nitriding, are applied to the worm shaft to ensure high surface hardness while maintaining a ductile core. Manufacturers often employ sophisticated quality control methodologies, including CMM measurement and noise testing, to ensure compliance with stringent industrial standards.

The downstream distribution channel involves a mix of direct sales to large Original Equipment Manufacturers (OEMs) in sectors like robotics and automotive, and indirect sales through a network of specialized industrial distributors, gear specialists, and aftermarket suppliers. Direct channels facilitate deep technical collaboration and customized product development for major industrial clients. Indirect channels provide broader market reach, particularly for standard-sized replacement parts and smaller machinery manufacturers. Effective supply chain management and a robust distributor network are critical for ensuring timely delivery and technical support across geographically dispersed industrial bases.

Worm Gearing Market Potential Customers

The primary potential customers and end-users of worm gearing components are enterprises operating sophisticated machinery that requires high torque output, precise speed reduction, and, frequently, a fail-safe self-locking mechanism. The most substantial volume consumption originates from the material handling industry, which includes manufacturers of conveyors, escalators, hoists, and cranes, where the inherent non-back-drivability of worm drives is a critical safety feature for load retention. These industries seek robust, reliable gearboxes capable of handling continuous, heavy-duty operation with minimal maintenance intervention over long operational periods.

Another high-growth customer segment comprises manufacturers in the industrial automation, robotics, and machine tool sectors. These customers prioritize minimal backlash, high precision, and compact size to facilitate the intricate movements required by robotic arms, indexing tables, and CNC machinery. Although precision planetary or cycloidal drives are competitive alternatives, worm drives are often chosen when high single-stage reduction ratios are needed in systems where dynamic load shifts are common, such as large rotary tables or positioning systems in automated welding cells. The noise reduction capabilities inherent in worm gear design are also highly valued in these sophisticated manufacturing environments.

Furthermore, the automotive industry represents a significant, though specialized, end-user base, primarily utilizing smaller, highly precise worm gear sets for applications outside of primary drivetrain components. These include power window mechanisms, steering columns, and specialized actuators within hybrid and electric vehicle systems, where silent operation and consistent performance are paramount. Other key buyers include companies involved in food processing machinery, where stainless steel or specialized alloy worm drives meet stringent hygiene requirements, and the construction sector, utilizing them in mixers and heavy mobile equipment requiring high mechanical advantage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3,500 Million |

| Market Forecast in 2033 | $5,000 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S.E.W. Eurodrive, Sumitomo Heavy Industries (Hansen), Bonfiglioli Group, Rexnord Corporation, Regal Rexnord, Wittenstein SE, Emerson Electric Co. (Grove Gear), David Brown Santasalo, Elecon Engineering Company Limited, Siemens AG, ZF Friedrichshafen AG, NGC Transmission, Cleveland Gear Company, Rossi S.p.A., Altra Industrial Motion Corp., Boston Gear, GAM Enterprises, Inc., Nidec Corporation, Shimpo America, Inc., Cone Drive Operations. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Worm Gearing Market Key Technology Landscape

The technological landscape of the Worm Gearing Market is focused on mitigating efficiency losses and enhancing durability through precision manufacturing and material innovation. Central to modern production is the application of sophisticated Computer Numerical Control (CNC) machining centers, particularly those specializing in five-axis hobbing and grinding. These machines are crucial for achieving the extremely tight tolerances and superior surface finishes required on the worm thread profile, directly impacting friction reduction and noise levels. Advanced abrasive techniques, such as continuous generating grinding, ensure that the precise involute or non-involute profiles required for high-performance globoidal worm drives are consistently met, thereby maximizing the contact area and reducing localized wear and heat generation.

Material science and surface engineering represent another critical dimension of technological advancement. Research is heavily concentrated on developing proprietary bronze alloys (often incorporating nickel, tin, or manganese) for the worm wheel, which offer an optimal balance between strength, frictional characteristics, and machinability. Furthermore, the application of advanced surface treatments and coatings, such as plasma nitriding, carburizing, or specialized PVD/CVD coatings on the steel worm shaft, significantly increases surface hardness and wear resistance, allowing the gear set to handle higher power densities and operate with reduced lubrication requirements. These material innovations are vital for increasing the power-to-weight ratio of the gearboxes.

The integration of digital technologies, aligning with the Industry 4.0 paradigm, is transforming how worm gear systems are monitored and maintained. Key technology includes the embedding of miniaturized Industrial Internet of Things (IIoT) sensors—such as accelerometers and temperature probes—directly into the gearbox housing. These sensors feed operational data into advanced condition monitoring systems, leveraging AI and machine learning for predictive analysis of lubricant degradation, vibration signatures, and thermal fluctuations. This proactive approach significantly extends the effective operational life of the gear system, enhances reliability in critical infrastructure, and is a major technological differentiator among leading market manufacturers.

Regional Highlights

The global market for worm gearing exhibits distinct consumption patterns and growth trajectories across major geographical regions, heavily influenced by local manufacturing intensity, levels of industrial automation adoption, and regulatory frameworks governing energy efficiency in machinery.

- Asia Pacific (APAC): APAC is the largest market shareholder and is forecasted to demonstrate the highest growth rate during the projection period. This expansion is intrinsically linked to the massive scale of manufacturing operations in China, India, Japan, and South Korea, particularly across the automotive, consumer electronics, and heavy infrastructure sectors. The rapid establishment of automated assembly lines and the increased investment in material handling systems drive the high volume demand for standardized and high-torque worm gear units. Government initiatives supporting local manufacturing and infrastructure projects further accelerate market penetration in this region.

- North America: The North American market is characterized by a strong demand for high-precision, low-backlash worm gearing, particularly within advanced manufacturing, aerospace, defense, and high-specification machine tool industries. While volumes may be lower than APAC, the market commands premium pricing due to stringent quality requirements and the frequent need for customized, integrated solutions that leverage advanced materials and sensor technologies. Investments in robotics and automation driven by labor cost optimization are primary market drivers.

- Europe: Europe, anchored by Germany, Italy, and the UK, maintains a mature market distinguished by a strong emphasis on engineering excellence and energy efficiency standards. The demand here is concentrated in sectors such as precision engineering, automotive manufacturing (especially in electric vehicle component production), and specialized industrial machinery (e.g., textile and packaging). European manufacturers lead in applying advanced materials and surface coatings to enhance the efficiency of worm drives, seeking compliance with rigorous EU energy consumption directives.

- Latin America (LATAM): Growth in LATAM is primarily driven by the mining sector, infrastructure development, and agricultural machinery, particularly in Brazil and Mexico. The demand focuses on durable, large-module worm gearboxes capable of withstanding harsh operating environments and heavy shock loads, often prioritizing robust construction over maximum efficiency.

- Middle East and Africa (MEA): This region exhibits burgeoning growth tied to massive investment in oil and gas infrastructure, construction, and emerging manufacturing sectors. Demand is specialized, requiring robust gear solutions for pumping stations, material conveyance in construction projects, and desalination plants, favoring suppliers capable of providing reliable components for challenging environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Worm Gearing Market.- S.E.W. Eurodrive GmbH & Co KG

- Sumitomo Heavy Industries Ltd. (Hansen Industrial Transmissions)

- Bonfiglioli Riduttori S.p.A.

- Regal Rexnord Corporation (including brands like Grove Gear and Boston Gear)

- Wittenstein SE

- David Brown Santasalo

- Elecon Engineering Company Limited

- Siemens AG

- ZF Friedrichshafen AG

- NGC Transmission Equipment Co., Ltd.

- Cleveland Gear Company, Inc.

- Rossi S.p.A.

- Cone Drive Operations, Inc.

- GAM Enterprises, Inc.

- Nidec Corporation

- Shimpo America Corporation

- Lenze Group

- Hub City Inc.

- Chiaravalli Group S.p.A.

- Precision Gears, Inc.

Frequently Asked Questions

Analyze common user questions about the Worm Gearing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of utilizing worm gearing over helical or spur gears?

The primary advantages are the ability to achieve extremely high-speed reduction ratios in a single, compact stage, and the intrinsic self-locking feature (non-back-drivability). This self-locking capability is crucial for safety and reliability in lifting machinery and vertical positioning systems, reducing the need for external braking mechanisms.

How is the efficiency constraint of worm drives being addressed through modern technology?

Modern worm drive manufacturers address efficiency constraints through several innovations, including the use of specialized, low-friction bronze alloys for the worm wheel, advanced surface treatments (e.g., nitriding) on the steel worm shaft, improved lubricant formulations, and the adoption of double-enveloping designs to maximize contact surface area, thereby reducing heat generation and sliding friction.

In which specific industrial applications is worm gearing considered indispensable?

Worm gearing remains indispensable in heavy-duty material handling, such as elevators, escalators, hoists, and large conveying systems, due to the mandatory requirement for the self-locking function. They are also widely used in precision indexing tables, small power actuators, and specialized medical machinery where quiet operation and high mechanical advantage are essential.

Which geographical region dominates the consumption of worm gearing and why?

The Asia Pacific (APAC) region dominates the consumption of worm gearing, driven by the massive scale of its manufacturing and assembly sectors, particularly in China and India. High investment in industrial automation, infrastructure projects, and the large volume of machinery production necessitate a constant supply of reliable, high-torque reduction gearboxes.

What impact does Industry 4.0 have on the design and maintenance of worm gearboxes?

Industry 4.0 significantly impacts worm gearboxes through the integration of IoT sensors for condition monitoring. This enables AI-powered predictive maintenance, optimizing lubrication cycles and detecting early signs of wear or failure, thus maximizing operational uptime and significantly extending the service life of the gear system.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager