Wrist Watch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432200 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Wrist Watch Market Size

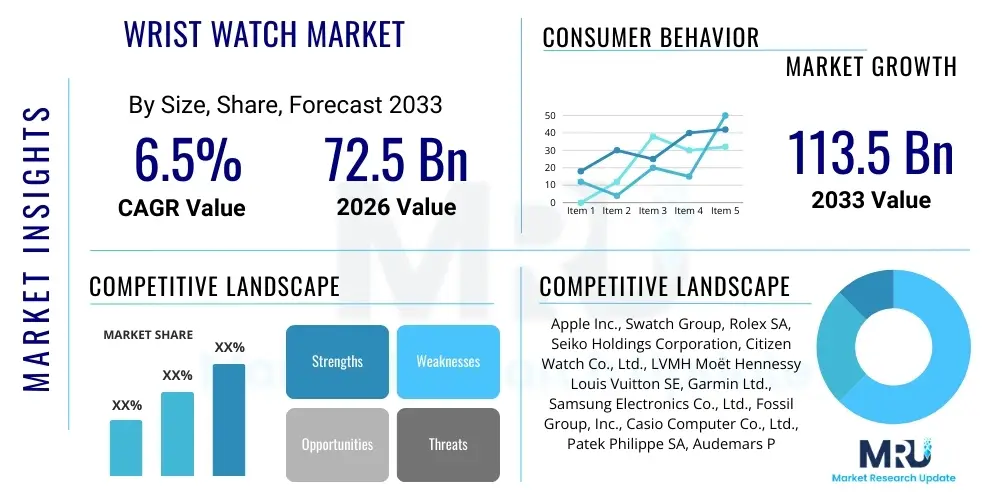

The Wrist Watch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 72.5 Billion in 2026 and is projected to reach USD 113.5 Billion by the end of the forecast period in 2033.

Wrist Watch Market introduction

The global Wrist Watch Market encompasses a diverse range of timepieces, spanning traditional mechanical and quartz movements to highly sophisticated smartwatches. Historically, the market has been segmented by functionality (analog vs. digital) and material luxury, catering to consumers seeking both utility and status. The introduction of smartwatches fundamentally redefined the product landscape, shifting the focus from pure timekeeping and aesthetics to integrated health monitoring, connectivity, and communication features. This dual nature of the market—where luxury mechanical watches command premium prices for craftsmanship and heritage, while smartwatches drive volume and technological innovation—creates a highly dynamic competitive environment.

Major applications for wrist watches extend beyond personal time management to include fashion accessory, status symbol, and comprehensive health and fitness tracking tools. The increasing consumer awareness regarding personal wellness and preventive healthcare has significantly fueled the demand for smartwatches equipped with features like heart rate monitors, sleep trackers, and SpO2 sensors. Conversely, the traditional market segment benefits from sustained demand in emerging economies, coupled with a renewed global interest in collectible and vintage luxury timepieces as investment assets, further diversifying the market’s application profile and stabilizing overall growth.

Key driving factors supporting market expansion include rising disposable incomes in the Asia Pacific region, leading to increased adoption of luxury goods; the relentless pace of technological advancement in sensor technology and battery life for smart devices; and effective marketing strategies emphasizing watches as essential components of personal style and digital integration. Furthermore, robust e-commerce penetration allows brands, both established and micro, to reach global audiences efficiently, democratizing access and stimulating diverse consumer preferences across price points and functional requirements.

Wrist Watch Market Executive Summary

The Wrist Watch Market is characterized by intense fragmentation, driven primarily by the contrasting performance of the luxury mechanical segment and the rapidly evolving technology-focused smartwatch segment. Business trends indicate a strategic move by traditional luxury watchmakers towards vertical integration, securing supply chains, and enhancing exclusivity through limited editions and personalized services. Simultaneously, technology giants dominating the smartwatch space are focusing on expanding their health ecosystem capabilities, partnering with medical institutions, and optimizing user interfaces to lock in consumer loyalty. Cross-segment partnerships, such as collaborations between fashion houses and tech firms, are increasingly common as companies seek to blend aesthetic appeal with cutting-edge functionality, appealing to a broader demographic interested in 'hybrid' timepieces.

Regionally, Asia Pacific (APAC) remains the fastest-growing market, propelled by large consumer bases in China and India exhibiting increasing purchasing power and a strong cultural affinity for premium and branded goods. North America and Europe, while mature, are primary drivers for smartwatch adoption and technological innovation, benefiting from high digital literacy and established distribution networks. Regulatory landscapes concerning data privacy and medical device certification for advanced smartwatches are emerging as critical regional considerations, impacting product launch timelines and feature availability across different geographies. The Middle East continues to show robust demand for ultra-luxury mechanical watches, driven by wealth accumulation and cultural appreciation for high horology.

Segment trends reveal that smartwatches, particularly those positioned at mid-to-high price points offering advanced features, are outpacing conventional timepieces in terms of volume growth. Within the traditional segment, entry-level quartz watches face increasing pressure from basic fitness trackers, while the high-end mechanical segment remains resilient due to its investment value and inherent scarcity. Distribution is shifting heavily towards online channels, accelerated by global events, necessitating significant investment in digital experience, secure logistics, and authorized retailer management to combat counterfeiting and maintain brand integrity across all product categories.

AI Impact Analysis on Wrist Watch Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Wrist Watch Market primarily revolve around how AI enhances the utility of smartwatches, specifically concerning personalized health data analysis, predictive maintenance for luxury mechanical movements, and optimizing the consumer purchasing journey. Users frequently inquire about the accuracy of AI-driven diagnostics, the potential for customized watch recommendations based on lifestyle and fashion preferences, and whether AI can help luxury brands authenticate and manage their secondary markets more effectively. The core themes center on seeking assurance that AI will lead to more intelligent, durable, and personalized timepieces, enhancing both the functional depth of smart devices and the investment value of luxury items, rather than merely automating existing features.

AI's influence is transforming product development, particularly in the smartwatch domain, where machine learning algorithms refine biometric data interpretation, offering users predictive health alerts and highly personalized coaching based on continuous data streams. This capability moves the smartwatch beyond passive data collection into proactive wellness management, significantly increasing the perceived value and utility for health-conscious consumers. For luxury brands, AI-powered tools are crucial for supply chain optimization, counterfeit detection through complex pattern recognition of materials and serialization, and improving customer relationship management by predicting repair cycles and identifying key investment pieces based on market sentiment and historical performance.

Furthermore, AI is instrumental in enhancing the digital commerce experience, utilizing sophisticated recommendation engines to guide consumers through vast online catalogs, suggesting models that align precisely with their stated preferences, previous purchases, and social media activity. This optimization reduces decision paralysis and improves conversion rates for both mass-market and high-end brands. The long-term trajectory suggests AI integration will further blur the line between fashion technology and medical devices, making future wrist wearables integral components of a holistic digital health infrastructure.

- AI-driven personalized health coaching and anomaly detection in smartwatches.

- Machine learning algorithms optimizing battery life and energy consumption in wearable devices.

- AI used for predictive maintenance scheduling in high-precision mechanical movements.

- Enhanced counterfeit detection and authentication processes utilizing AI image recognition for luxury watches.

- Optimization of e-commerce user experience through AI-powered recommendation engines and virtual try-ons.

- Automation of design processes and material stress testing using generative AI models.

- Improved supply chain visibility and demand forecasting based on real-time global market data analysis.

DRO & Impact Forces Of Wrist Watch Market

The Wrist Watch Market is currently influenced by a strong set of countervailing forces: robust consumer appetite for high-tech wearables (Driver) competes with the high penetration of smartphones rendering basic timekeeping redundant (Restraint). The increasing incorporation of advanced biometric sensors and medical-grade functionalities into smartwatches acts as a significant market driver, attracting new users interested in holistic wellness tracking. However, enduring challenges include the relatively short replacement cycle of smart devices compared to traditional watches, and ongoing consumer hesitation regarding the high cost of mechanical luxury timepieces in economically uncertain periods. These dynamics create a polarizing effect where volume growth favors technology, while value retention remains anchored in heritage and craftsmanship.

Opportunities for growth are abundant in emerging markets, where rapid urbanization and an expanding middle class create a massive addressable demographic for mid-range and premium segment watches. Furthermore, the development of hybrid smartwatches—which successfully combine the aesthetics of traditional analog watches with the basic connectivity features of wearables—presents a crucial opportunity to bridge the gap between traditionalists and tech enthusiasts. Brands are capitalizing on the rise of sustainable consumption, offering ethical sourcing and longevity assurances, positioning luxury watches as sustainable, generational investments, thereby mitigating environmental concerns associated with short-lived electronic devices.

The primary impact force shaping the competitive landscape is the accelerating convergence of fashion, technology, and health. This convergence forces traditional horologists to invest heavily in digital platforms and connectivity, while tech companies must simultaneously enhance design aesthetics and material quality to appeal to fashion-conscious consumers. Intellectual property disputes related to sensor technology and design infringement represent a substantial latent impact force, influencing R&D spending and market entry barriers. Overall market momentum is currently positive, driven by technological enhancements that deliver superior user value, despite persistent volatility in global economic conditions.

Segmentation Analysis

The Wrist Watch Market is comprehensively segmented based on Type, Distribution Channel, End-User, and Price Range, enabling detailed market understanding and targeted strategic planning. The Type segmentation highlights the enduring divide between Analog, Digital, and the dominant Smartwatch category, reflecting diverse consumer motivations ranging from aesthetic preference to functional necessity. Distribution channels analyze the shift from traditional brick-and-mortar stores to powerful online platforms, necessitating optimized omni-channel strategies. End-User analysis focuses on the tailored design and marketing for Men, Women, and Unisex categories, responding to varying demands for size, style, and integrated features relevant to gender-specific activities or fashion trends.

- By Type:

- Analog Watch (Mechanical, Quartz)

- Digital Watch (Basic Digital, Multi-functional)

- Smartwatch (Premium, Mid-range, Basic)

- Hybrid Watch

- By Distribution Channel:

- Offline (Specialty Stores, Departmental Stores, Authorized Dealers)

- Online (E-commerce Portals, Direct-to-Consumer Websites)

- By End-User:

- Men

- Women

- Unisex/Children

- By Price Range:

- Entry-Level (Below $100)

- Mid-Range ($100 - $500)

- Premium ($500 - $5,000)

- Luxury (Above $5,000)

Value Chain Analysis For Wrist Watch Market

The value chain for the Wrist Watch Market is extensive and highly specialized, particularly for mechanical watches, beginning with upstream activities focused on raw material sourcing (precious metals, high-grade polymers, and specialized components like microprocessors and sensors). Upstream analysis is dominated by the quality and origin of movements (in-house or outsourced from major movement manufacturers like ETA or Miyota) and the control over proprietary sensor technology essential for smartwatches. Securing ethically sourced materials and maintaining strict quality control over complex micro-components are critical differentiators in this initial phase, heavily influencing the final product’s cost structure and luxury positioning.

Midstream activities involve sophisticated manufacturing, assembly, and finishing processes. For luxury brands, this stage emphasizes high-precision craftsmanship, manual assembly, and stringent testing for durability, water resistance, and chronometric accuracy. Smartwatch production, conversely, focuses on integrating complex electronics, software development (firmware and accompanying apps), and mass production efficiency. The integration of software development and hardware manufacturing often occurs in distinct geographical hubs, with final assembly increasingly outsourced or clustered in specialized regions like Switzerland (for high horology) and Southeast Asia (for smart devices).

Downstream analysis centers on distribution channels, marketing, and after-sales service. Direct distribution through brand boutiques and company-owned e-commerce platforms offers maximum control over brand messaging and customer experience, which is crucial for luxury items. Indirect channels, including authorized retailers, large department stores, and third-party e-commerce giants, provide necessary market penetration. After-sales service, including certified maintenance, repair, and software updates, plays a vital role in customer retention and brand equity, particularly in the premium and luxury segments where longevity and authorized service history significantly affect resale value.

Wrist Watch Market Potential Customers

Potential customers for the Wrist Watch Market are segmented across several psychographic and demographic profiles, spanning from Generation Z, prioritizing connectivity and value, to High-Net-Worth Individuals (HNWIs) seeking exclusive investment-grade timepieces. The primary end-users can be broadly categorized into tech-savvy individuals driven by utility, fitness enthusiasts focused on performance metrics, and fashion-conscious consumers using watches as statement pieces. The rise of hybrid work models has increased demand among white-collar professionals for watches that balance professional aesthetics with discrete smart notifications. The core appeal to the general consumer is the convergence of immediate utility (timekeeping and connectivity) and intrinsic psychological value (status, heritage, or personal expression).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 72.5 Billion |

| Market Forecast in 2033 | USD 113.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Swatch Group, Rolex SA, Seiko Holdings Corporation, Citizen Watch Co., Ltd., LVMH Moët Hennessy Louis Vuitton SE, Garmin Ltd., Samsung Electronics Co., Ltd., Fossil Group, Inc., Casio Computer Co., Ltd., Patek Philippe SA, Audemars Piguet Holding SA, Richemont SA, Huawei Technologies Co., Ltd., Xiaomi Corporation, Fitbit (Google). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wrist Watch Market Key Technology Landscape

The technology landscape of the Wrist Watch Market is undergoing rapid bifurcation, driven by advancements in both micro-mechanics (for traditional watches) and sensor/software integration (for smartwatches). In high horology, technological innovation focuses on developing novel materials like silicon, ceramic, and proprietary alloys (e.g., Rolex's Everose gold or Omega's Sedna gold) to enhance anti-magnetism, durability, and chronometric precision. These advancements, while subtle, represent significant engineering feats aimed at optimizing movement efficiency and longevity, thereby justifying premium price points and ensuring competitive differentiation against mass-produced alternatives. Research into self-regulating and perpetual mechanisms continues to be a core focus for Swiss manufacturers.

Conversely, the smartwatch sector is defined by advancements in miniaturization, power efficiency, and biometric sensor sophistication. Key technological trends include the integration of medical-grade sensors capable of EKG, body temperature monitoring, and non-invasive blood glucose sensing (currently a major R&D focus). Furthermore, improving battery technology, particularly utilizing solid-state or high-density lithium cells, is critical to overcome the principal consumer frustration of frequent recharging. Software innovation centers on securing personal data (privacy protection) and optimizing operating systems for seamless integration into existing smart home and mobile ecosystems, emphasizing interoperability.

Connectivity standards such as advanced Bluetooth protocols (low energy variants) and integrated cellular capabilities (e.g., eSIM technology) are standardizing across premium smartwatches, enabling true standalone functionality independent of a paired smartphone. The development of flexible displays and advanced haptic feedback mechanisms is also contributing to improved user experience and design versatility. The intersection of these technologies—where ultra-low power displays meet sophisticated health algorithms—is the primary area defining the competitive edge and market dominance for leading tech players in the wearable domain.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by burgeoning middle classes in China, India, and Southeast Asia. This region exhibits high demand across all price points, from entry-level smartwatches to ultra-luxury mechanical timepieces, fueled by status consumption and rising disposable income. China, in particular, dictates global trends in consumption volume and digital retail adaptation.

- North America: A mature market characterized by high technology adoption rates, making it the primary revenue generator for the smartwatch segment. Consumers here prioritize integrated health features, seamless ecosystem connectivity (iOS/Android integration), and robust design. The U.S. remains a key market for both luxury mechanical imports and domestic tech giants.

- Europe: Dominated by strong demand for luxury and heritage brands, particularly in Western Europe (Switzerland, France, UK). Europe maintains global relevance as the manufacturing hub for high horology. The market is defined by a balance between classic appreciation and a cautious, steady adoption of mid-to-high-end smartwatches that emphasize aesthetic quality.

- Middle East & Africa (MEA): Shows disproportionately high demand for the ultra-luxury segment, driven by concentrated wealth and traditional purchasing patterns emphasizing precious materials and exclusivity. While smartwatch adoption is growing, it is often concentrated in urban centers and high-income brackets.

- Latin America (LATAM): A developing market facing challenges related to import duties and economic instability, yet showing potential for growth in the mid-range and affordable smartwatch categories, driven by increasing smartphone penetration and youthful demographics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wrist Watch Market.- Apple Inc.

- Swatch Group (Omega, Longines, Tissot, Breguet)

- Rolex SA

- Richemont SA (Cartier, IWC Schaffhausen, Jaeger-LeCoultre)

- LVMH Moët Hennessy Louis Vuitton SE (TAG Heuer, Hublot, Zenith)

- Seiko Holdings Corporation

- Citizen Watch Co., Ltd.

- Garmin Ltd.

- Samsung Electronics Co., Ltd.

- Fossil Group, Inc.

- Casio Computer Co., Ltd.

- Patek Philippe SA

- Audemars Piguet Holding SA

- Huawei Technologies Co., Ltd.

- Xiaomi Corporation

- Fitbit (Google)

- Montres Tudor SA

- Bremont Watch Company

- Movado Group, Inc.

- Bulova (Citizen Group)

Frequently Asked Questions

Analyze common user questions about the Wrist Watch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Smartwatch segment?

Smartwatch segment growth is primarily driven by continuous advancements in health and fitness monitoring technology, including EKG and advanced sleep tracking, coupled with strong ecosystem integration (e.g., seamless mobile payments and notifications). Consumer focus on proactive wellness management significantly increases demand.

How are traditional luxury watch brands adapting to digital competition?

Luxury brands are adapting by emphasizing exclusivity, limited production runs, and heritage storytelling. They are also investing heavily in certified pre-owned platforms to control the secondary market and are implementing selective digital features (like NFC payments) or launching high-end mechanical/smart hybrid models to appeal to younger, tech-aware buyers.

Which geographical region represents the largest market opportunity for wrist watches?

The Asia Pacific (APAC) region, particularly China and India, holds the largest market opportunity due to rapidly expanding middle-class populations, high cultural appreciation for luxury goods, and fast adoption rates of new consumer technologies, fueling both luxury and volume segments.

What are the primary restraints affecting the overall Wrist Watch Market?

The main restraints include the high substitution threat posed by multifunctional smartphones (which render basic watches redundant), concerns over short battery life and data privacy in smartwatches, and the volatility of global luxury spending influenced by economic downturns.

What is the current trend regarding distribution channels for wrist watches?

The dominant distribution trend is the acceleration toward online channels. Direct-to-consumer (DTC) e-commerce, coupled with strategic use of specialized online retailers, is gaining significant ground over traditional physical retail, necessitating robust digital marketing and secure logistics across all market segments.

Market Dynamics and Trends

The Wrist Watch Market is currently navigating a period of significant strategic flux, requiring established players to balance the preservation of traditional craft with aggressive technological innovation. A key trend is the move towards 'tech-stack' integration among leading smartwatch manufacturers, where the watch acts not just as an accessory but as an essential node within a personal digital ecosystem, linking health records, financial transactions, and communication protocols. This focus on deep integration mandates continuous software updates and the development of proprietary chipsets, raising the barrier to entry for smaller or solely hardware-focused firms.

In the luxury segment, the market is witnessing an unprecedented rise in the certified pre-owned (CPO) market. Major luxury groups are formally entering the CPO space to authenticate, service, and resell their watches, thereby capturing value from the secondary market, combating counterfeit activities, and ensuring brand control over the entire lifecycle of their product. This strategic shift underscores the enduring perception of mechanical watches as valuable, liquid assets rather than mere consumer products. Furthermore, the trend toward smaller, more unisex case sizes, moving away from the oversized watch fad of the last decade, indicates a refined aesthetic preference among modern consumers.

Sustainability and ethical sourcing are emerging as non-negotiable consumer demands, particularly in Western markets. Brands are increasingly scrutinized for their supply chain practices, including material sourcing (gold, diamonds) and labor conditions. This has led to accelerated adoption of recycled materials, transparent reporting on carbon footprint, and the promotion of generational longevity in high-end watches as a form of sustainable consumption, contrasting sharply with the planned obsolescence often associated with consumer electronics.

- Focus on specialized, medical-grade sensor integration (e.g., continuous blood pressure monitoring).

- Rapid expansion and formalization of the Certified Pre-Owned (CPO) market by major luxury conglomerates.

- Increased market penetration of hybrid watches combining mechanical movements with basic smart features.

- Shift toward smaller, more ergonomically designed watch cases, catering to unisex appeal.

- Growing investment in sustainable and ethically sourced materials, particularly in premium segments.

- Enhanced focus on cybersecurity and data privacy features in wearable operating systems.

Competitive Landscape Analysis

The competitive structure of the Wrist Watch Market is highly polarized. At one end, the market is dominated by a few technological giants (Apple, Samsung, Google/Fitbit, Huawei) competing aggressively on features, ecosystem lock-in, and aggressive pricing strategies in the smartwatch category. These players benefit from massive R&D budgets and economies of scale, leading to rapid product cycles and deep feature sets. Their competition often centers on achieving regulatory clearance for new medical functions and optimizing proprietary operating systems (WatchOS, Wear OS). Product lifecycle management in this domain is short and intense.

At the other end lies the traditional luxury market, primarily controlled by established Swiss groups (Swatch Group, Richemont, LVMH) and independent powerhouses (Rolex, Patek Philippe). Competition here is based on heritage, exclusivity, craftsmanship, and control over distribution, particularly scarcity modeling to drive demand and maintain high resale value. Their primary strategic goal is differentiation through technical innovation (new movement architectures, advanced materials) and vertical integration to secure the supply of proprietary components, ensuring authenticity and quality control.

The middle market, comprising affordable analog and digital brands (e.g., Citizen, Seiko, Fossil), faces intense pressure from both sides: being undercut by budget-friendly, feature-rich smartwatches and struggling to compete with the perceived status and investment value of luxury mechanical pieces. These mid-market players are increasingly turning to design collaborations, fashion partnerships, and the adoption of basic smart features in hybrid watches to carve out niche market share. Successful strategies involve robust omni-channel presence and highly effective digital storytelling to connect with younger consumers who may not yet afford luxury but demand style and reliability.

Key Growth Opportunities and Investment Pockets

Significant growth opportunities exist within the convergence of wellness and wearables. The market for clinically validated, medical-grade smartwatches represents a high-value investment pocket. As health systems globally look to leverage remote monitoring technologies, devices capable of highly accurate biometric data collection and early anomaly detection, potentially covered by insurance schemes, offer substantial revenue potential beyond traditional consumer electronics sales. Investment is crucial in obtaining necessary regulatory approvals (e.g., FDA clearance) to legitimize these products as medical tools.

Another major investment focus is the customization and personalization of timepieces, appealing to the desire for uniqueness across all segments. For smartwatches, this involves highly customizable watch faces, straps, and material choices. For luxury watches, bespoke services and unique material combinations, coupled with enhanced transparency regarding material provenance, justify premium pricing and cater to the HNWI demographic seeking unparalleled exclusivity. Digital platforms facilitating easy, engaging customization are essential for capitalizing on this trend.

The untapped potential of emerging markets, particularly in urbanizing areas of Latin America and Africa, presents a long-term strategic growth opportunity. While entry-level and mid-range products are currently dominant, establishing brand presence and robust, authorized distribution networks now will position companies favorably to capture future increases in disposable income. Strategic partnerships with local telecom providers and e-commerce platforms are critical to overcoming logistical and retail infrastructure challenges in these regions.

- Development of medical-grade smartwatches and securing regulatory approvals (FDA, CE).

- Expansion of Direct-to-Consumer (DTC) models leveraging augmented reality and virtual try-on experiences.

- Targeted marketing and distribution expansion into high-growth, underserved emerging markets (LATAM, Africa).

- Investment in circular economy models and certified pre-owned programs to boost sustainability credentials and brand control.

- Focus on developing highly energy-efficient components to drastically extend smartwatch battery life.

Regulatory and Policy Landscape

The regulatory environment for the Wrist Watch Market is increasingly complex, primarily driven by the need to classify advanced smartwatches. Devices that offer features capable of diagnosing, mitigating, or treating diseases (such as EKG or advanced blood glucose monitors) are falling under the jurisdiction of medical device regulations (like the FDA in the US or MDR in Europe). This requires manufacturers to undertake costly and time-consuming clinical trials and adherence to stringent quality management systems, significantly impacting R&D timelines and market entry strategies for new features.

Furthermore, global data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and evolving laws in APAC, directly affect smart device manufacturers. Since smartwatches collect sensitive personal and biometric data, compliance with data localization, consent, and secure data transmission protocols is mandatory. Non-compliance risks severe financial penalties and erosion of consumer trust. Companies must ensure robust encryption and transparent data usage policies to maintain market access and consumer confidence in high-feature smart devices.

For the traditional luxury segment, regulation largely concerns international trade laws, customs duties, and intellectual property (IP) protection. Combating counterfeiting remains a constant policy challenge, necessitating cooperation between brands and international law enforcement. Regulations related to the ethical sourcing of raw materials, such as conflict minerals and responsible gold mining, are also increasing in prominence, demanding audited traceability throughout the entire supply chain to ensure responsible manufacturing practices.

Notable Market Case Studies and Innovation Examples

The successful launch and subsequent market domination by the Apple Watch serve as the primary case study for technology convergence, demonstrating how deep ecosystem integration and focusing heavily on health metrics can reshape a traditional market. Apple’s transition from a fashion accessory focus to a certified medical device (with features like EKG and fall detection) established a benchmark for functional utility that competitors must now meet, proving that software innovation is as crucial as hardware design.

Another compelling case study involves the strategic shift of heritage brands like TAG Heuer and Montblanc into the luxury smartwatch space. By releasing premium smartwatches with sophisticated materials and classic design elements, these companies successfully captured a niche clientele willing to pay high prices for a blend of traditional watchmaking aesthetics and modern technology. This validates the hybrid segment model, demonstrating that luxury craftsmanship can coexist with digital functionality without diluting brand integrity, provided the execution maintains a high standard of material quality.

Finally, the operational excellence displayed by Rolex in controlling its secondary market is critical. By maintaining strict control over production volumes and authorized dealer networks, Rolex effectively creates scarcity. While not explicitly adopting a CPO program initially, their controlled supply chain and strict anti-counterfeit measures ensure that secondary market prices often exceed retail prices, reinforcing the watch as a stable investment asset—a powerful market dynamic driven by strategic constraint rather than technological leaps.

- Apple Watch's strategic shift from accessory to certified medical device, driving market volume.

- TAG Heuer and Montblanc successfully blending luxury aesthetics with high-end smartwatch functionality (Luxury Hybrid Model).

- Rolex's scarcity modeling and tight distribution control maintaining secondary market valuation and investment appeal.

- Garmin's niche success focusing on specialized, highly durable, long-battery-life watches for extreme sports and outdoor enthusiasts.

- The rise of microbrands utilizing Kickstarter and DTC models to rapidly introduce unique, affordable mechanical watches.

Future Outlook and Long-Term Projections

The long-term outlook for the Wrist Watch Market suggests continued polarization, with the luxury mechanical segment remaining robust due to its intrinsic value and collectible nature, and the smartwatch segment undergoing radical transformation fueled by advanced bio-sensing technology. By 2033, smartwatches are projected to evolve significantly, moving from dedicated wrist-wear to integrated biometric sensors capable of monitoring complex physiological markers non-invasively, blurring the line further between consumer electronics and personalized medical diagnostics. This evolution will drive higher average selling prices in the technology sector as functionality expands toward personalized medicine.

Furthermore, the manufacturing footprint is expected to evolve. While high horology will remain centered in Switzerland, the production of micro-components and specialized materials will become increasingly decentralized, driven by 3D printing and additive manufacturing technologies. This could potentially lower production costs for mid-range watches and allow for greater design complexity. The convergence of 5G and future connectivity standards will also enable seamless, continuous cloud-based data integration for all smart wearables, enhancing real-time user services.

The consumer experience will be dominated by omni-channel excellence. Brands must master the blend of tactile, in-store exploration (especially for luxury pieces) and highly personalized, secure online purchasing environments. The market is not expected to homogenize; rather, both the investment-grade mechanical watch and the advanced, health-focused smartwatch will thrive simultaneously, each catering to fundamentally different consumer needs: heritage and permanence versus utility and innovation. Success will hinge on segment-specific excellence in product development, authenticity guarantees, and unparalleled customer service tailored to the specific demands of each market segment.

Research Methodology

The Market Insights Report on the Wrist Watch Market employs a robust and multi-faceted research methodology designed to ensure accuracy, validity, and comprehensive coverage of market dynamics across all key segments. This includes a blend of primary and secondary research techniques. Secondary research involved an extensive review of industry publications, annual reports of key market players, trade association data, government filings, financial reports, and proprietary databases. This phase established the baseline market sizing, historical trend data, technological benchmarks, and preliminary competitive landscape.

Primary research involved structured interviews and detailed questionnaires conducted with key opinion leaders (KOLs), C-level executives from manufacturing companies, supply chain managers, authorized dealers, and independent industry analysts across major geographical regions (North America, Europe, and APAC). These interviews focused on validating market forecasts, identifying emerging trends (e.g., CPO market growth, AI integration), understanding pricing strategies, and assessing the impact of regulatory changes. Data triangulation was applied to cross-validate insights derived from different sources, enhancing the reliability of the final market estimations and strategic recommendations.

The analysis incorporates quantitative modeling, including regression analysis to forecast growth rates based on macroeconomic indicators (GDP growth, disposable income) and technological adoption curves (smartphone penetration, wearable technology consumer interest). A detailed supply-side analysis evaluated production capacities and input costs, while demand-side analysis focused on consumer purchasing behavior and segmentation preferences across various price points. The final report structure ensures all qualitative assessments are grounded in empirical market data and expert validation, providing a comprehensive and reliable overview of the global Wrist Watch Market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Wrist Watch Market Size Report By Type (Sport Watches, Luxury Watches, Diamond Watches, Quartz Watches, Mechanical Watches, Water Resistant Watches, Smartwatch), By Application (Daliy Use, Collection, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Wrist Watch Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Sport Watches, Diamond Watches, Quartz Watches, Mechanical Watches, Water Resistant Watches, Smartwatch, Others), By Application (Male, Female), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Luxury Wrist Watch Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Mechanical, Electronic), By Application (Men, Women, Children), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Wrist Watch Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Luxury Watches, Sports Watches, Quartz Watches, Diamond Watches, Water Resistant Watches, Mechanical Watches, Smartwatch), By Application (Daily Use based, Collection based), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager