Yacht Charter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432045 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Yacht Charter Market Size

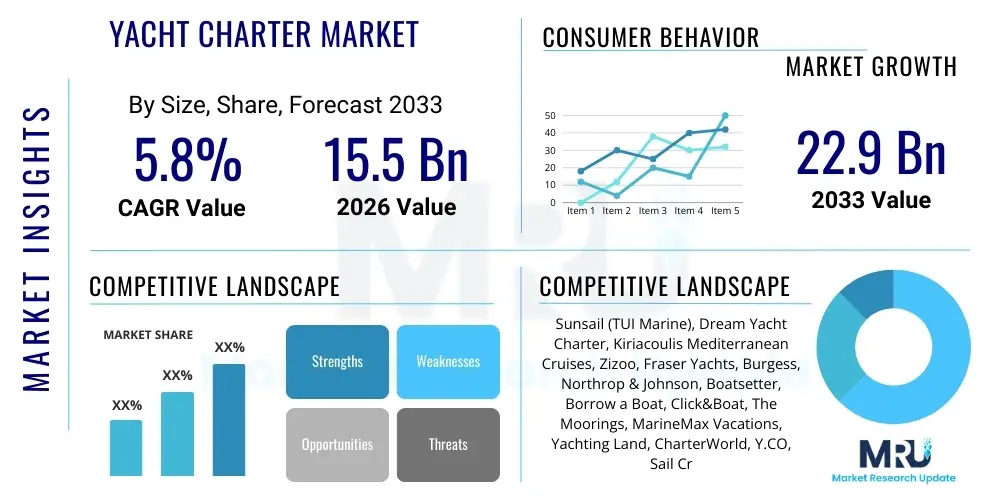

The Yacht Charter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 22.9 Billion by the end of the forecast period in 2033.

Yacht Charter Market introduction

The Yacht Charter Market encompasses the rental of yachts, ranging from small sailing boats to superyachts, for recreational or business purposes, typically for a specified duration. This industry provides access to luxury maritime experiences without the extensive financial outlay associated with yacht ownership, making high-end seafaring increasingly accessible to affluent consumers and specialized corporate groups. The product offerings are highly diversified, catering to various customer preferences, including type of vessel (motor, sail, catamaran), charter style (crewed or bareboat), and application (leisure holidays, corporate events, or specialized deep-sea exploration). The fundamental value proposition lies in delivering personalized, exclusive, and flexible travel experiences across premier coastal and oceanic destinations globally.

Major applications of yacht charter services are primarily segmented into leisure travel, which includes family vacations, romantic getaways, and adventure tourism, and corporate applications, often referred to as Meetings, Incentives, Conferences, and Exhibitions (MICE). The benefits associated with chartering are numerous, including unparalleled privacy, highly customized itineraries, onboard fine dining, and access to remote or secluded locations inaccessible by traditional tourism methods. Furthermore, the operational complexities and costs associated with maintaining a private yacht are entirely managed by the charter operator, providing a seamless, stress-free luxury experience for the end-user, thereby significantly driving market demand.

Driving factors for sustained market growth include the rising disposable income among high-net-worth individuals (HNWIs) in emerging economies, the burgeoning demand for experiential and personalized travel, and the ongoing expansion of digital booking platforms that simplify the charter process. The increasing global interest in sustainable tourism and eco-friendly boating is also subtly influencing the market, pushing operators towards incorporating more fuel-efficient and hybrid vessels into their fleets. This strategic adaptation ensures the market remains robust and appeals to a new generation of environmentally conscious luxury consumers seeking exclusive yet responsible vacation options.

Yacht Charter Market Executive Summary

The Yacht Charter Market is experiencing robust expansion, fundamentally driven by shifts in global business trends emphasizing experiential luxury and the democratization of booking processes through digital platforms. Key business trends highlight a move toward fractional ownership models and enhanced services focused on personalization, where charter companies are leveraging sophisticated data analytics to tailor itineraries, onboard amenities, and crew profiles to precise client specifications. Regional trends underscore Europe's enduring dominance, particularly the Mediterranean basin (France, Italy, Greece, Croatia), remaining the epicenter of superyacht activity, while emerging markets in Southeast Asia and the Caribbean are seeing accelerated growth due to infrastructural improvements and increased visibility. Technological advancements, particularly in fleet management software and virtual reality tours for pre-booking inspection, are streamlining operations and boosting consumer confidence across all geographical regions.

Segmentation trends indicate significant momentum in the crewed charter segment, especially for motor yachts, reflecting the high preference among HNWIs for all-inclusive, worry-free voyages that include professional staff, chefs, and dedicated itinerary planners. Conversely, the bareboat segment, dominated by sailing yachts and catamarans, continues to appeal strongly to experienced sailors and smaller, budget-conscious groups seeking autonomy and adventure. This dual growth highlights the market's successful strategy of catering to both ultra-luxury and niche adventure tourism markets simultaneously. Investment is rapidly increasing in larger catamaran fleets, recognized for their stability, spaciousness, and fuel efficiency, positioning them as a major growth segment challenging traditional monohull dominance in the leisure charter space.

Overall, the market trajectory is highly positive, bolstered by macroeconomic recovery and a renewed global appetite for premium travel post-pandemic, characterized by seclusion and safety. The industry’s focus on integrating environmental sustainability measures, such as adopting cleaner propulsion systems and promoting ethical maritime practices, is crucial for long-term viability and brand appeal. Strategic partnerships between charter operators, luxury hospitality providers, and high-end brokerage houses are creating comprehensive lifestyle packages, cementing the yacht charter experience as an integral part of the global luxury travel ecosystem, ensuring sustained expansion toward the projected market valuation by 2033.

AI Impact Analysis on Yacht Charter Market

User inquiries regarding Artificial Intelligence (AI) integration in the Yacht Charter Market predominantly center on how AI can enhance the customer experience, optimize operational efficiency, and fundamentally alter the brokerage landscape. Common questions involve the use of AI for dynamic pricing models, predicting customer preferences for personalized itinerary creation, automating predictive maintenance schedules for fleets, and improving cybersecurity protocols for sensitive client data. A significant concern revolves around the balance between automation and maintaining the highly personalized, human-centric nature of luxury service delivery, often questioning if AI systems can adequately replace experienced yacht brokers or dedicated crew members. The general expectation is that AI will revolutionize the backend operations and initial booking phases, leading to faster, more transparent transactions, while the onboard experience remains high-touch and expertly managed by human professionals.

The key theme emerging from user analysis is the desire for 'Intelligent Chartering,' where booking platforms utilize Machine Learning (ML) algorithms to match clients not only with suitable vessels but also with compatible crews based on psycho-graphic profiles and previous charter histories. Users are particularly interested in how AI can optimize route planning, factoring in real-time weather data, local regulations, and potential congestion points to ensure maximum safety and enjoyment. Furthermore, concerns about pricing transparency are addressed by AI-driven dynamic pricing tools that provide justifiable, real-time quotes based on market supply, demand, and vessel availability, reducing information asymmetry inherent in traditional high-value transactions. This integration marks a significant pivot towards data-driven decision-making across the entire value chain.

Ultimately, the impact of AI is summarized as a force multiplier for efficiency and personalization. While it may not replace the human element of luxury service, it significantly empowers charter companies to scale their operations, reduce response times, and offer hyper-customized services that were previously manual and time-intensive. The shift towards predictive maintenance using sensors and AI diagnostics is expected to drastically reduce downtime and ensure fleet reliability, directly enhancing customer satisfaction and operational profitability. AI integration is thus viewed less as a disruption and more as an essential upgrade for maintaining competitiveness and meeting the evolving standards of the modern luxury traveler who demands speed, customization, and reliability.

- AI-driven Predictive Maintenance: Utilizing sensor data and ML algorithms to forecast equipment failures and schedule preemptive repairs, minimizing vessel downtime and maximizing operational availability.

- Dynamic Pricing and Revenue Management: Implementation of sophisticated AI models to adjust charter rates in real-time based on demand, seasonality, competitive pricing, and specific vessel features, optimizing yield management.

- Personalized Recommendation Engines: Using client data, past preferences, and behavioral analysis to recommend customized vessels, destinations, activities, and crew members, enhancing the bespoke luxury experience.

- Automated Customer Service (Chatbots/Virtual Assistants): Deploying AI-powered tools for initial inquiry handling, FAQ resolution, and preliminary booking assistance, providing 24/7 service access.

- Enhanced Cybersecurity and Data Protection: AI deployment to monitor network traffic, detect anomalies, and protect sensitive financial and personal data of high-profile clients and operational systems.

- Optimized Route Planning and Navigation: Integrating real-time weather and maritime data into AI systems to generate the safest and most fuel-efficient cruising routes, factoring in regulatory compliance.

DRO & Impact Forces Of Yacht Charter Market

The Yacht Charter Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the fundamental Impact Forces guiding its trajectory. Key drivers include the global expansion of luxury tourism, characterized by consumers preferring highly exclusive and secluded experiences, especially in a post-pandemic environment where privacy is paramount. Concurrently, the increasing wealth concentration among Ultra-High-Net-Worth Individuals (UHNWIs) and the rise of experiential spending among the affluent middle class provide a massive demographic base willing to invest in premium maritime leisure. Opportunities lie in developing niche markets, such as eco-friendly charters, adventure tourism charters focused on remote destinations, and specialized wellness/health retreats aboard luxury vessels, allowing operators to diversify revenue streams beyond traditional Mediterranean and Caribbean routes. These opportunities are often realized through strategic fleet modernization and digital transformation efforts that enhance market reach and operational efficiency.

Restraints, however, pose significant challenges to sustained growth. The primary constraints involve high operational costs, including fuel, crew salaries, insurance, and maintenance, which translate into high charter prices, limiting broad consumer access. Furthermore, the inherent seasonality of the market, heavily reliant on predictable weather patterns in key geographical areas, creates periods of intense utilization followed by extended periods of low activity, impacting year-round revenue stability. Regulatory hurdles, complex international maritime laws, and stringent environmental compliance requirements for emissions and waste disposal also introduce operational complexity and potential legal risks for charter companies. These restraints necessitate robust risk management strategies and substantial initial capital investment to enter and compete effectively in the high-end segments.

The impact forces driving change are multifaceted. The technological force emphasizes digitalization, requiring companies to invest heavily in robust booking software, client relationship management (CRM) systems, and virtual reality visualization tools to streamline the customer journey from inquiry to disembarkation. The socio-economic force dictates the consumer preference shift towards sustainability and ethical tourism, pressuring operators to adopt hybrid propulsion and reduce the environmental footprint of their fleets. Lastly, the competitive landscape force is driving consolidation, with larger global operators acquiring smaller regional fleets to achieve economies of scale and expand their global footprint, intensifying competition particularly in the most desirable charter destinations like the Amalfi Coast and the Greek Isles, thereby continuously pushing the boundaries of service excellence and value delivery.

Segmentation Analysis

The Yacht Charter Market is comprehensively segmented based on several critical parameters including the type of yacht, the charter contract structure, and the primary application of the service. This granular segmentation allows market participants to tailor their fleets and service offerings to precise demand patterns within the luxury travel ecosystem. The dominance of motor yachts reflects the preference for speed and ultra-luxury amenities, while the sustained growth of sailing yachts and catamarans speaks to the specialized demand for adventure, eco-friendliness, and stability. Contract types differentiate between those seeking full management (crewed charter) and those desiring autonomy (bareboat charter), directly influencing the required level of expertise and service provided by the charter operator. Understanding these segments is vital for accurate forecasting and strategic investment in fleet acquisition and geographic expansion.

The Application segmentation clearly delineates the market utility between leisure and corporate purposes. Leisure remains the cornerstone segment, driven by family vacations, holiday travel, and specialized celebratory events, capitalizing on the inherent privacy and exclusivity yachts offer. Conversely, the corporate segment, encompassing MICE activities, executive retreats, and high-level negotiations conducted in a secure, discrete environment, is gaining traction due to the unique high-impact branding opportunities and the ability to combine business with bespoke luxury travel. These segments are interconnected; for instance, corporate clients often transition to high-end leisure charter clients, demonstrating the market's high customer lifetime value potential.

Strategic analysis of these segments reveals that the catamaran sub-segment is poised for accelerated growth due to its superior efficiency, stability, and growing appeal in regions like the Caribbean and Southeast Asia. Furthermore, the crewed charter segment, despite being the most expensive, exhibits inelastic demand among the highest tiers of HNWIs, indicating a strong willingness to pay for comprehensive, professional, and personalized service. Future growth strategies will likely involve capitalizing on the overlap between these segments, such as offering semi-crewed or luxury bareboat packages that blend autonomy with limited professional support, addressing the evolving needs of sophisticated travelers.

- By Yacht Type:

- Motor Yacht (Superyacht, Mega Yacht, Standard Motor Yacht)

- Sailing Yacht (Monohull, Schooner, Ketch)

- Catamaran (Power Catamaran, Sailing Catamaran)

- By Contract Type:

- Bareboat Charter (Client operates vessel)

- Crewed Charter (Includes professional crew, chef, and staff)

- Cabin Charter (Booking individual cabins on a shared vessel)

- By Application:

- Leisure (Vacations, Holidays, Events)

- Corporate/MICE (Business meetings, Incentives, Executive Retreats)

- By Region:

- North America

- Europe (Mediterranean, Northern Europe)

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Yacht Charter Market

The Value Chain for the Yacht Charter Market is complex, beginning with the upstream activities centered on yacht construction, financing, and ownership. Upstream analysis involves shipyard operations where yachts are built or refitted, often customized to meet the rigorous specifications required for high-end commercial chartering. Key players in this phase include naval architects, specialized equipment suppliers, and financing institutions that fund the acquisition of multi-million dollar vessels. Efficiency in this stage relies heavily on timely delivery, build quality, and adherence to international classification standards (e.g., Lloyd’s Register, RINA). The quality of the vessel dictates its marketability and potential charter rate, making this a critical phase for overall value generation.

Midstream activities encompass the core service delivery functions: centralized reservation systems, marketing, brokerage, and operational management. The distribution channel is bifurcated into direct and indirect methods. Direct channels involve proprietary booking websites and in-house sales teams managing the operator's fleet, offering higher margin control. Indirect channels rely heavily on yacht brokers and online travel agencies (OTAs) specializing in marine tourism, acting as intermediaries to connect charterers with available vessels globally. Successful midstream management requires robust CRM systems, aggressive digital marketing tailored to affluent demographics, and skilled brokerage expertise to negotiate complex charter agreements and legal contracts, ensuring compliance with flag state regulations and maritime law.

Downstream analysis focuses on the execution of the charter experience, involving provisioning, crew management, technical support, and post-charter follow-up. Potential customers, the end-users, are the final recipients of the value. Logistics are crucial, ensuring the yacht is impeccably maintained, fully provisioned to the client’s specifications, and crewed by highly trained professionals. The post-charter feedback mechanism, including detailed client surveys and loyalty programs, closes the loop, informing future marketing strategies and service enhancements. The interplay between these stages—from the high capital expenditure in yacht acquisition (upstream) to the high service delivery standards (downstream)—determines the profitability and reputation of the charter company in the highly competitive luxury sector.

Yacht Charter Market Potential Customers

Potential customers for the Yacht Charter Market are highly stratified, ranging from experienced sailors seeking economical bareboat rentals to Ultra-High-Net-Worth Individuals (UHNWIs) demanding fully crewed superyachts for extended periods. The primary end-user segment is the affluent leisure traveler, typically comprising families, groups of friends, or couples celebrating significant life events who prioritize privacy, luxury amenities, and exclusive access to sought-after destinations. These buyers are often repeat customers who charter annually or biannually, seeking highly personalized service and vessels equipped with the latest technology, water toys, and high-spec interiors, placing immense value on the discretion and professionalism of the crew.

A rapidly expanding customer base includes corporate entities and business travelers utilizing yachts for MICE (Meetings, Incentives, Conventions, and Exhibitions) purposes. These buyers value the exclusivity and unique environment a yacht provides for high-level meetings, team-building retreats, or client entertainment, seeking venues that project prestige and offer maximum security and confidentiality away from public view. For this segment, the charter decision is heavily influenced by the yacht's capacity for formal dining, meeting facilities, and high-speed satellite connectivity, prioritizing practical business requirements alongside luxury accommodations, often leading to charters during shoulder seasons.

Furthermore, an emerging segment consists of younger, tech-savvy millennials and Gen Z travelers who, while perhaps not UHNWIs, are interested in smaller, more economical vessels like bareboat catamarans or cabin charters, often facilitated through peer-to-peer (P2P) platforms. These buyers are motivated by the desire for authentic, experience-driven travel and value flexibility and digital booking ease. The market is thus balancing the high-ticket demands of traditional luxury patrons with the volume-based needs of a younger demographic seeking affordable access to the maritime lifestyle, demonstrating a broadening spectrum of potential buyers across various price points and experience levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 22.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunsail (TUI Marine), Dream Yacht Charter, Kiriacoulis Mediterranean Cruises, Zizoo, Fraser Yachts, Burgess, Northrop & Johnson, Boatsetter, Borrow a Boat, Click&Boat, The Moorings, MarineMax Vacations, Yachting Land, CharterWorld, Y.CO, Sail Croatia, Camper & Nicholsons, Blue Cruise, Moorings, IYC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Yacht Charter Market Key Technology Landscape

The Yacht Charter Market is rapidly integrating advanced technologies to enhance operational efficiency, safety, and the overall client experience. Central to this transformation is the widespread adoption of sophisticated online booking and fleet management systems. These platforms utilize cloud computing and API integration to provide real-time inventory updates, dynamic pricing capabilities, and streamlined payment processing, effectively reducing friction in the high-value transaction cycle. Furthermore, the integration of specialized Vessel Monitoring Systems (VMS) allows operators to track yacht performance, fuel consumption, and maintenance requirements proactively, moving from reactive repairs to predictive maintenance schedules, which significantly minimizes unexpected technical delays and maximizes fleet utilization throughout the busy charter season.

Another pivotal technological shift involves the enhancement of the customer interface using immersive and interactive digital tools. Virtual Reality (VR) and Augmented Reality (AR) tours are increasingly being deployed, allowing potential clients to virtually step aboard and fully explore a yacht's interior and deck spaces from anywhere in the world before committing to a booking. This innovation not only builds confidence but also reduces the necessity for pre-charter physical inspections. Simultaneously, high-speed satellite communication systems (like Starlink or similar LEO satellite networks) are becoming standard on luxury vessels, meeting the client expectation of uninterrupted connectivity, essential for both corporate operations and seamless personal media consumption while at sea, thereby significantly influencing charter preferences.

Beyond customer-facing technologies, sustainable technological innovations are reshaping fleet composition. The focus on reducing environmental impact is driving the adoption of hybrid and electric propulsion systems, particularly in smaller and mid-sized motor yachts and catamarans, driven by tightening maritime emission regulations (IMO standards) and consumer demand for eco-conscious travel options. Coupled with advanced weather routing software that optimizes course efficiency based on meteorological data and hydrodynamics, these technologies ensure that the charter industry can offer both luxury and responsibility, future-proofing operational models against escalating fuel costs and global climate scrutiny, making sustainable technology a core competitive differentiator.

Regional Highlights

- Europe (Dominance and Mediterranean Hub): Europe retains its undisputed position as the largest and most influential market for yacht chartering, primarily centered around the Mediterranean Sea. Destinations such as the French Riviera, the Italian Amalfi Coast, the Greek Islands (Cyclades, Ionian), and the Croatian Dalmatian Coast account for the vast majority of superyacht charter activity globally. This dominance is supported by a robust infrastructure of world-class marinas, highly experienced charter brokers, favorable seasonal weather, and proximity to a large pool of HNWIs. Recent growth is significant in Eastern Mediterranean regions (e.g., Turkey and Montenegro), offering high-value alternatives to established Western European ports, driven by favorable taxation and expanding luxury amenities, ensuring Europe’s continued leadership throughout the forecast period.

- North America (Caribbean and Domestic Growth): North America is a critical secondary market, characterized by two distinct demands: outbound luxury charters primarily targeting the Caribbean (Bahamas, BVI) during the winter season and domestic charters focused on the New England coast, Florida, and the Pacific Northwest during the summer. The region exhibits high demand for large, crewed motor yachts. The American market is characterized by a high propensity for technologically integrated vessels and a strong reliance on established international brokerage houses. The increasing availability of high-quality bareboat options, particularly in the Virgin Islands, also caters to the mid-tier leisure segment, further bolstering overall regional market expansion.

- Asia Pacific (Emerging Luxury Destination): APAC represents the fastest-growing market, albeit from a smaller base, driven by the rapid creation of new wealth, especially in China, Southeast Asia, and Australia. Key growth regions include Thailand (Phuket), Indonesia (Bali, Komodo), and the Philippines, which offer unique, exotic cruising grounds largely untouched by traditional European charter seasonality. Challenges remain regarding marina infrastructure development and local regulatory frameworks, but sustained investment in luxury resorts and related tourism infrastructure is rapidly positioning APAC as a major contender for high-end winter charter circuits, particularly appealing to younger HNWIs seeking adventure and novelty.

- Middle East and Africa (MEA - Niche and High-End): The MEA region is characterized by niche, ultra-luxury demand, primarily centered in the UAE (Dubai, Abu Dhabi) and increasingly Saudi Arabia (Red Sea Project). This market segment focuses almost exclusively on highly customized superyachts, often utilized for high-profile corporate events and extended private stays, often chartering for shorter durations but at extremely high daily rates. Growth is intrinsically linked to government investment in coastal tourism mega-projects and the establishment of new, high-specification marinas designed to attract the largest superyacht fleets, positioning the region as a year-round destination alternative to the traditional European seasonality.

- Latin America (Developing Charter Scene): Latin America remains a developing market, with sporadic but increasing activity focused around the Brazilian coast, Mexico, and certain Caribbean access points. The market is still nascent regarding extensive dedicated charter infrastructure compared to Europe, but domestic wealth growth and interest in local coastal tourism suggest strong long-term potential. Growth is currently slow but steady, focusing on attracting regional clientele interested in smaller to mid-sized vessels for local excursions and eco-tourism, indicating potential for bareboat and specialized adventure charters in the long term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Yacht Charter Market.- Sunsail (TUI Marine)

- Dream Yacht Charter

- Kiriacoulis Mediterranean Cruises

- Zizoo

- Fraser Yachts

- Burgess

- Northrop & Johnson

- Boatsetter

- Borrow a Boat

- Click&Boat

- The Moorings

- MarineMax Vacations

- Yachting Land

- CharterWorld

- Y.CO

- Camper & Nicholsons

- IYC (International Yacht Collection)

- Nautal

- FYLY Yachting

- Horizon Yacht Charters

Frequently Asked Questions

Analyze common user questions about the Yacht Charter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Yacht Charter Market?

The primary driver is the rising global wealth among HNWIs and UHNWIs coupled with a strong shift in consumer preference toward private, experiential, and highly personalized luxury travel and leisure activities that offer maximum seclusion and customization.

Which yacht type segment holds the largest market share globally?

The Motor Yacht segment currently holds the largest market share in terms of revenue, specifically within the crewed charter category, reflecting the high demand for large, technologically advanced superyachts offering speed and extensive luxury amenities.

How is technology, specifically AI, influencing the yacht charter booking process?

AI is streamlining the booking process through dynamic pricing, personalized vessel recommendations based on customer profiles, and optimizing operational efficiency via predictive maintenance systems, ensuring greater fleet reliability and improved transparency for clients.

Which geographical region is considered the most dominant in the yacht charter industry?

Europe, specifically the Mediterranean basin encompassing Greece, Italy, France, and Croatia, is the most dominant region, owing to its mature infrastructure, historical significance, favorable climate, and concentration of key brokerage houses and luxury clientele.

What is the difference between a Bareboat Charter and a Crewed Charter?

A Bareboat Charter involves renting the vessel without professional crew or provisions, requiring the client to possess relevant sailing qualifications. A Crewed Charter includes the captain, professional staff, and chef, offering an all-inclusive, fully serviced luxury experience.

What are the major challenges facing market expansion in the APAC region?

The main challenges in the Asia Pacific region include underdeveloped marina infrastructure, complexity in local maritime regulations and customs procedures, and the need for greater standardization in service quality across emerging destinations.

Are sustainability initiatives impacting yacht charter services?

Yes, sustainability is a growing concern. Market operators are responding by incorporating more hybrid and electric propulsion vessels (especially catamarans), implementing stricter waste management protocols, and offering "green" itinerary options to appeal to environmentally conscious luxury travelers.

How does the MICE segment contribute to the overall Yacht Charter Market?

The MICE (Meetings, Incentives, Conferences, and Exhibitions) segment contributes significantly by generating demand for high-value, short-duration charters used for executive retreats, corporate entertainment, and confidential business meetings, valuing the privacy and unique branding environment offered by luxury yachts.

What is the projected Compound Annual Growth Rate (CAGR) for the forecast period?

The Yacht Charter Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 5.8% between the years 2026 and 2033, driven by sustained global interest in maritime luxury tourism and digitalization.

What key strategic trends are observed among leading yacht charter companies?

Key trends include consolidation through mergers and acquisitions (M&A) to expand fleet size and geographic reach, heavy investment in digital booking platforms, and a strong focus on enhancing client loyalty through hyper-personalized, bespoke itinerary planning and service delivery.

What impact does seasonality have on the Yacht Charter Market?

Seasonality creates major operational volatility, with peak demand concentrated in the Mediterranean summer and Caribbean winter, leading to high utilization and premium pricing during these windows, followed by periods of necessary maintenance and lower revenue generation during shoulder seasons.

How do yacht charter services handle compliance with international maritime regulations?

Professional charter companies operate under stringent compliance frameworks, adhering to specific flag state regulations, international safety standards (SOLAS), crew licensing requirements (STCW), and environmental protection laws, ensuring all chartered vessels are legally and safely operable worldwide.

What is the role of brokerage houses in the superyacht charter sector?

Brokerage houses are essential intermediaries, providing expertise in legal contracts, liaising between owners and charterers, marketing vessels globally, and managing complex financial transactions, thereby facilitating the majority of high-value crewed superyacht charters.

Why are Catamarans becoming increasingly popular in the charter market?

Catamarans offer increased stability, greater spaciousness compared to monohulls of similar length, superior fuel efficiency (for power cats), and shallower drafts, making them ideal for exploring secluded bays in tropical destinations like the Caribbean and Southeast Asia, appealing to both bareboat and crewed segments.

How are emerging technologies like VR being used by charter companies?

Virtual Reality (VR) is utilized to create immersive virtual tours of chartered vessels, allowing potential clients to experience the layout, amenities, and interior finishes remotely, which significantly aids in the decision-making process and builds booking confidence prior to commitment.

What defines a Superyacht or Megayacht in the context of chartering?

While definitions vary, a Superyacht is typically defined as a luxury vessel over 24 meters (78 feet) in length, and a Megayacht often refers to those exceeding 60 meters (200 feet). These vessels invariably require a full professional crew and command the highest charter rates.

What financial metrics are crucial for evaluating the Yacht Charter Market?

Key financial metrics include average charter rate per day/week (influenced by yacht size and age), Occupancy Rate (or utilization rate), Customer Acquisition Cost (CAC), and Customer Lifetime Value (CLV), particularly high in the repeat luxury charter segment.

How does the peer-to-peer (P2P) model affect the traditional charter market?

The P2P model, exemplified by platforms like Boatsetter and Click&Boat, democratizes boat access by allowing private owners to list their vessels. This model primarily impacts the bareboat and smaller yacht segments, introducing competitive pricing and expanding accessibility to a broader consumer base.

What are the typical risks associated with bareboat chartering for consumers?

The risks primarily include liability for damage to the vessel, the necessity for the charterer to possess adequate navigational skills and certification, and exposure to unforeseen weather conditions, necessitating comprehensive insurance and experienced preparation.

Which factors contribute to the high cost of crewed yacht charters?

High costs are driven by significant operational overheads, including professional crew salaries, gourmet provisioning, premium insurance, high-grade fuel consumption, and the amortization of the multi-million dollar capital investment required to purchase and maintain a large luxury yacht to exacting standards.

What role do global economic conditions play in the market?

The market is highly sensitive to global economic health; periods of robust economic growth and high stock market valuations typically translate directly into increased spending by HNWIs on luxury assets and experiences, including high-end yacht charters, demonstrating a strong correlation with macroeconomic cycles.

How is the concept of fractional ownership influencing charter market participation?

Fractional ownership programs lower the barrier to entry for prospective yacht owners, often guaranteeing owners a certain number of weeks for personal use while dedicating the rest of the time to chartering. This model increases the supply of high-quality vessels available for chartering without requiring full capital commitment.

What is 'yacht provisioning' and why is it important in luxury charters?

Yacht provisioning is the process of stocking the vessel with all necessary supplies, including fuel, gourmet foods, beverages, specialized dietary items, and luxury goods, customized exactly to the client's pre-charter requests, forming a crucial element of the bespoke service offering.

How are environmental, social, and governance (ESG) factors affecting fleet investment?

ESG factors are pressuring operators to invest in cleaner technologies (e.g., IMO Tier III compliant engines, hybrid systems) and adopt ethical labor practices for crew members. Compliance with evolving environmental standards is becoming mandatory for maintaining brand reputation and accessing desirable charter grounds.

What are the emerging trends in crewed charter itinerary planning?

Emerging trends prioritize highly customized and often adventurous itineraries, moving beyond traditional hotspots to secluded or 'off-the-beaten-path' locations, incorporating themes like wellness retreats, historical exploration, or active water sports, ensuring the voyage is a unique, tailored experience.

Which type of yacht, sailing or motor, is preferred for the corporate charter segment?

Motor yachts are overwhelmingly preferred for corporate charters due to their stability, larger onboard meeting spaces, greater capacity for formal dining, and higher speed, which allows for adherence to tight executive schedules and faster transit between business locations.

How crucial is crew professionalism and training in the ultra-luxury segment?

Crew professionalism is arguably the single most critical factor in the ultra-luxury segment. The crew embodies the service quality, ensuring safety, privacy, and impeccable hospitality; extensive training (STCW certification, hospitality expertise) is non-negotiable for competitive advantage.

What is the current growth outlook for the Yacht Charter Market in the Middle East and Africa (MEA)?

The MEA region, particularly the Gulf States, has a strong growth outlook, fueled by massive government investment in luxury coastal infrastructure and tourism projects (like Saudi Arabia's Red Sea Project), attracting the global superyacht fleet and ultra-high-net-worth clientele.

How do online platforms like Zizoo and Click&Boat impact traditional brokerage?

These digital platforms have increased market transparency, standardized booking procedures, and significantly expanded the supply of smaller and mid-sized yachts, primarily impacting the bareboat and standard leisure charter segments, complementing, rather than replacing, the high-touch superyacht brokerage model.

What considerations are vital when chartering a yacht for an extended period (more than two weeks)?

Extended charters require meticulous planning regarding crew rotation, complex provisioning logistics, intermediate port clearances and refueling, comprehensive technical support plans, and careful management of legal paperwork to comply with international cruising permits and taxation rules across multiple jurisdictions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager