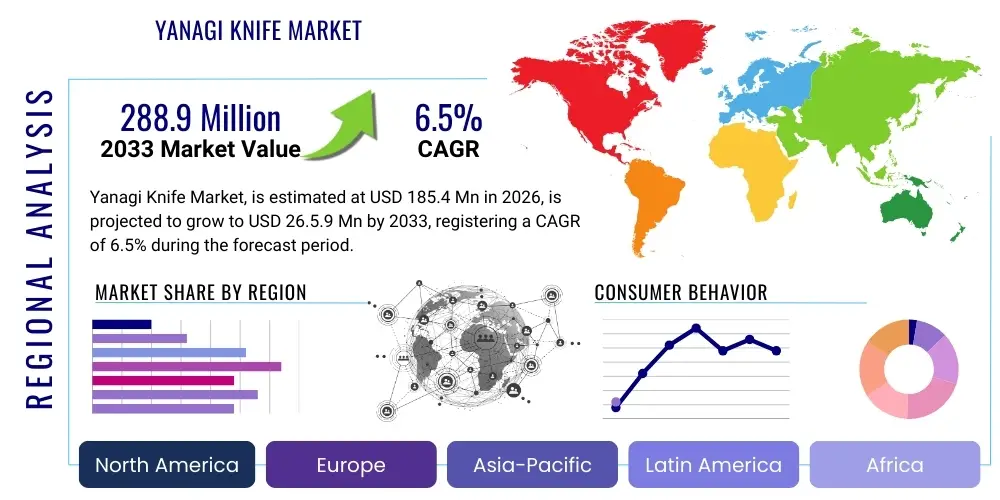

Yanagi Knife Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437657 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Yanagi Knife Market Size

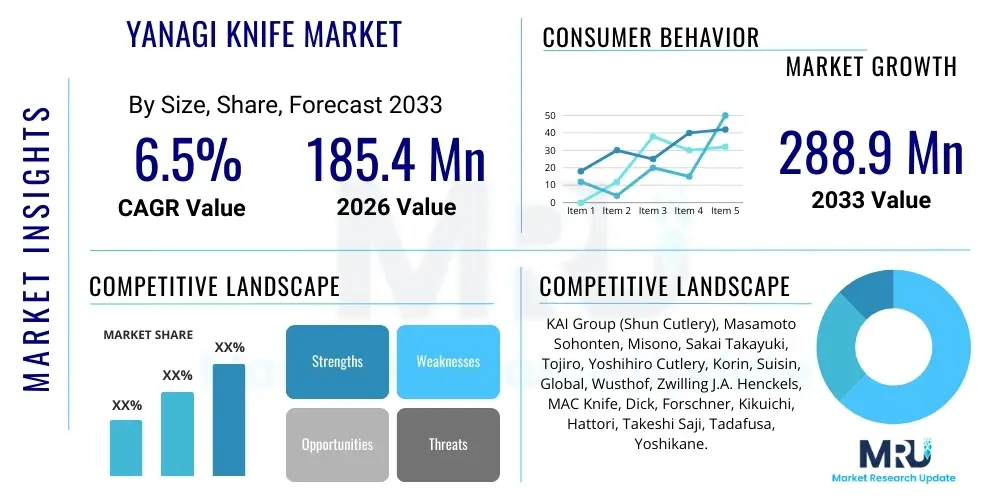

The Yanagi Knife Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $185.4 Million in 2026 and is projected to reach $288.9 Million by the end of the forecast period in 2033.

Yanagi Knife Market introduction

The Yanagi Knife Market encompasses the manufacturing, distribution, and sale of traditional Japanese slicing knives, primarily recognized for their long, thin, and supremely sharp single-beveled blades. Originating from Japan, the Yanagi (often called Yanagiba or "willow leaf blade") is the quintessential tool for preparing sashimi and nigiri sushi, designed to slice delicate proteins in one smooth, uninterrupted motion, thereby preserving the ingredient's cellular structure and enhancing flavor and presentation. The meticulous craftsmanship involved, often leveraging high-carbon steels like Aogami (Blue Steel) and Shirogami (White Steel), positions these knives firmly within the premium segment of the global cutlery market, attracting both professional sushi chefs and affluent culinary enthusiasts seeking authentic tools.

The primary driving forces for the sustained growth of this specialized market segment include the explosive global expansion of Japanese cuisine, particularly sushi and sashimi, which necessitates the use of specialized, high-performance slicing tools. Furthermore, increasing consumer appreciation for artisanal quality, coupled with a willingness among serious home cooks to invest in specialized culinary equipment, fuels demand. Major applications span high-end gastronomy, hospitality services, and professional culinary training institutions globally. The intrinsic benefit of the Yanagi knife lies in its single-bevel design, which allows for extremely fine, razor-sharp edges essential for precision slicing, resulting in superior food aesthetics and texture.

Product standardization varies significantly based on regional manufacturing origin, with those forged in traditional centers like Sakai or Seki commanding premium pricing due to superior heat treatment and forging techniques (e.g., Honyaki versus Kasumi construction). Key market players are focused on enhancing corrosion resistance in high-carbon variants and improving ergonomic handles to appeal to Western culinary professionals accustomed to double-bevel knives. The market's foundational stability is rooted in the continuous demand generated by global culinary diversification and the prestige associated with owning and using traditional Japanese specialized tools.

Yanagi Knife Market Executive Summary

The Yanagi Knife Market is characterized by robust growth underpinned by strong global business trends favoring specialized, high-quality culinary tools and the increasing globalization of Japanese food culture. Key business trends include the shift toward direct-to-consumer (DTC) models by Japanese master smiths leveraging e-commerce platforms, enabling them to bypass traditional import channels and maintain greater control over brand presentation and pricing. Furthermore, sustained investment in hybrid steel technologies—aiming to combine the edge retention of carbon steel with the corrosion resistance of stainless steel—is a significant strategic area for leading manufacturers, appealing directly to the professional segment operating in high-volume, humid kitchen environments.

Regional trends highlight Asia Pacific, specifically Japan, as the established leader in both production and consumption, though North America and Europe demonstrate the fastest growth rates. This rapid expansion in Western markets is driven by the proliferation of specialized Japanese restaurants and the growing trend of professional Western chefs incorporating authentic Japanese techniques into their repertoire. Distribution trends show a movement away from general cutlery shops towards specialized, high-service retail environments and dedicated online platforms that can offer expert advice on the unique maintenance requirements of single-bevel knives. The market structure remains highly fragmented at the manufacturing level, dominated by numerous small, artisanal workshops, yet consolidated at the distribution level by a few major international cutlery brands that market traditional Japanese knives under their umbrella.

Segment trends indicate that the Professional Chefs segment remains the primary revenue generator due to the high frequency of replacement and demand for premium materials like Blue Steel No. 1 or Shirogami No. 2. However, the Home Cooks/Enthusiasts segment is expanding rapidly, favoring mid-range, easier-to-maintain stainless clad (Kasumi style) Yanagis, offering a balance between performance and practicality. Material segmentation shows that high-performance, complex carbon steels are growing in value, while utility-focused, high-grade stainless steels are growing in volume, demonstrating a clear segmentation based on end-user skill level and maintenance tolerance. Continuous innovation in handle materials, moving towards stabilized wood and composite resins for improved hygiene and longevity, also shapes current segment trajectories.

AI Impact Analysis on Yanagi Knife Market

User inquiries regarding AI's impact on the Yanagi Knife Market predominantly center on three themes: how AI can revolutionize traditional craftsmanship, whether AI can improve supply chain transparency regarding genuine Japanese materials, and if AI-driven recommendation engines will influence consumer purchasing decisions for specialized, high-cost tools. Users express concerns about the potential erosion of traditional skills if automation replaces master smiths, yet they also seek assurances that technology could improve quality consistency and reduce defects inherent in manual production processes. The key expectations revolve around leveraging AI for advanced quality control (e.g., micro-analysis of edge geometry and steel microstructure), optimizing inventory management for niche steel types, and generating highly personalized content to educate consumers on knife selection and maintenance, particularly for the unique demands of single-bevel tools.

- AI-Powered Quality Control: Utilization of machine vision and deep learning algorithms to analyze grinding patterns and edge sharpness, ensuring stringent adherence to master standards during mass production or semi-automated finishing processes.

- Supply Chain Transparency: Implementation of blockchain technology, managed by AI systems, to track the provenance of exotic steel blanks (e.g., Aogami steel sourcing) from the mill to the finished knife, combating counterfeiting and assuring authenticity for premium buyers.

- Predictive Maintenance Recommendations: AI analytics predicting optimal sharpening schedules based on usage patterns tracked via smart kitchen systems or professional kitchen inventory software, reducing premature wear and improper care.

- Automated Design Optimization: Generative design tools assisting manufacturers in refining handle ergonomics or blade profiles (length, spine thickness) to optimize balance and comfort for specific regional cooking styles, without replacing the final forging process.

- Enhanced E-commerce Personalization: AI-driven recommendation engines using sophisticated user profiling to match specific steel types (e.g., corrosion-prone carbon vs. stainless-clad) and forging styles (Kasumi vs. Honyaki) to the user's intended application, maintenance tolerance, and budget.

DRO & Impact Forces Of Yanagi Knife Market

The market is fundamentally driven by the escalating global appreciation and adoption of Japanese culinary arts, necessitating specialized, high-precision tools like the Yanagi knife for authentic preparation methods, particularly sushi and sashimi. However, significant restraints exist, primarily stemming from the intensive maintenance requirements—such as professional-level whetstone sharpening and stringent corrosion prevention—which deter amateur users accustomed to lower-maintenance Western cutlery. Opportunities for expansion lie in penetrating emerging Asian markets outside Japan where disposable incomes are rising, and in developing technologically advanced material compositions (like sintered steel or advanced cladding methods) that offer the performance benefits of traditional high-carbon steel with reduced maintenance burdens, thereby broadening the consumer base and mitigating the primary restraint.

Key drivers include the dramatic rise in high-end culinary tourism and the influence of media showcasing professional Japanese techniques, creating a aspirational demand for tools associated with mastery. The prestige attached to owning traditionally crafted tools further enhances market viability. Conversely, the market faces strong restraint from the relatively high cost of entry, both for the initial purchase of a master-forged Yanagi and the necessity of acquiring specialized skills and equipment (high-quality Japanese whetstones) for proper upkeep. Furthermore, the limited availability of highly skilled traditional blacksmiths capable of crafting true single-bevel Honyaki blades represents a long-term supply constraint impacting the premium segment.

The primary impact forces shaping the Yanagi Knife Market are the rapid shifts in consumer dining habits globally and stringent quality expectations. Economic prosperity in developing economies creates new pockets of demand, while the prevailing cultural force of authenticity drives preference toward traditionally made Japanese products over mass-produced alternatives. Technological impact focuses mainly on advanced metallurgy and surface treatments, impacting price and performance trade-offs across different market segments. Successfully leveraging opportunities like collaborations with international culinary schools to standardize Yanagi training and establishing certification programs for quality assurance will be crucial for sustainable market expansion against the backdrop of supply chain limitations and high consumer education requirements.

Segmentation Analysis

The Yanagi Knife Market is segmented primarily based on Material Composition, End-User application, and Distribution Channel, reflecting the diverse requirements of professional versus enthusiast users and the varying costs associated with raw material and manufacturing complexity. Material segmentation is crucial as it determines the knife's performance characteristics, requiring different levels of skill for both use and maintenance. End-User segmentation provides insight into the primary revenue drivers, with professional culinary environments placing emphasis on durability, precise balance, and edge retention, while home users prioritize ease of maintenance and accessibility.

The material segment dominated by High Carbon Steel variants, specifically Aogami (Blue Steel) and Shirogami (White Steel), captures the premium price points due to their superior edge sharpness and retention capabilities, despite their susceptibility to corrosion. The Stainless Steel segment, utilizing alloys such as VG-10 or Molybdenum Vanadium, caters to the broader market, offering good performance with significantly lower maintenance. Distribution channels reveal a continuing migration towards specialized online retail and direct sales by manufacturers (DTC), which allows for better customer education and ensures product authenticity in a market frequently affected by imitation products.

- By Material:

- High Carbon Steel (Shirogami, Aogami)

- Stainless Steel (Molybdenum Vanadium, VG-10, AUS-8)

- Clad Steel (Kasumi construction, combining soft stainless cladding with hard carbon core)

- Powdered/Sintered Steel (e.g., R2/SG2)

- By End-User:

- Professional Chefs (Sushi Restaurants, High-end Hospitality)

- Home Cooks/Enthusiasts

- Culinary Schools and Training Academies

- By Blade Length:

- Short Yanagi (210mm - 240mm)

- Standard Yanagi (270mm - 300mm)

- Long Yanagi (330mm and above)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Knife Stores and Cutlery Shops

- Direct Sales (Artisan Workshops)

- Supermarkets and Hypermarkets (Primarily lower-end stainless variants)

Value Chain Analysis For Yanagi Knife Market

The value chain for the Yanagi Knife Market is unique due to its dependence on highly specialized upstream processes, particularly the production of esoteric Japanese steels. Upstream activities involve sourcing high-purity iron sand and metallurgical expertise required to produce steels like Hitachi Metals' Shirogami and Aogami. This segment is characterized by limited suppliers, high barriers to entry, and complex intellectual property surrounding alloying formulas. The subsequent manufacturing phase, encompassing forging, heat treatment, grinding, and sharpening, is the most critical value-adding step, often executed by specialized small to medium-sized workshops (traditional blacksmiths) utilizing generational knowledge and proprietary techniques (Honyaki forging being the pinnacle of this expertise). Quality control at this stage dictates the final price and performance of the blade.

The downstream segment focuses on distribution and retail. Historically, this involved long supply chains moving from Japanese manufacturers through dedicated international importers and finally to specialized cutlery retailers. However, the rise of e-commerce has significantly altered this, facilitating more direct routes. Direct distribution involves manufacturers selling through their own branded websites, offering customization and personalized advice, which significantly enhances profit margins and customer engagement. Indirect distribution relies on established retail networks, including large international houseware brands (which often co-brand or private label), and professional kitchen supply companies. Specialty stores still play a vital role as they provide the essential service of demonstrating proper usage and providing initial professional sharpening services, which is key for first-time buyers of single-bevel knives.

The channel preference is increasingly favoring direct sales and specialty stores because the product complexity necessitates expert guidance regarding bevel angles, maintenance, and steel selection. Direct marketing strategies emphasize the heritage and precision of the craftsmanship, capitalizing on the prestige associated with authenticity. The flow of value is significantly higher in the manufacturing stage due to the manual skill involved. Profit margins tend to be maximized when manufacturers manage to capture the direct sales channel, bypassing the multiple layers of traditional importers and distributors. Efficiency gains in the value chain are primarily sought through optimizing the logistics of transporting delicate, high-value goods globally, and ensuring rigorous quality checks before shipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.4 Million |

| Market Forecast in 2033 | $288.9 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KAI Group (Shun Cutlery), Masamoto Sohonten, Misono, Sakai Takayuki, Tojiro, Yoshihiro Cutlery, Korin, Suisin, Global, Wusthof, Zwilling J.A. Henckels, MAC Knife, Dick, Forschner, Kikuichi, Hattori, Takeshi Saji, Tadafusa, Yoshikane. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Yanagi Knife Market Potential Customers

Potential customers for the Yanagi Knife Market are segmented across professional and private domains, with a primary focus on individuals and establishments dedicated to high-precision food preparation, especially Japanese cuisine. The largest revenue segment comprises professional sushi and sashimi chefs working in established restaurants, hotel chains, and catering services globally. These customers require multiple Yanagi knives of varying lengths and demand the highest-grade materials (Honyaki or high-end Kasumi constructions using Aogami steel) that offer superior edge retention and balance to withstand continuous daily use. Their purchasing decisions are driven purely by performance, reputation of the smith, and longevity, often resulting in recurring high-value purchases.

The secondary, but fastest-growing, customer base consists of serious culinary enthusiasts, affluent home cooks, and gastronomes who are dedicated to mastering specialized cooking techniques, often requiring premium, single-purpose tools. This segment generally opts for high-quality Stainless Clad Yanagis (VG-10 core) or mid-range Shirogami Kasumi knives, valuing performance over absolute edge retention, but prioritizing easier maintenance compared to pure carbon steel. These buyers are heavily influenced by online reviews, culinary influencers, and brand heritage. They are typically found in high-income urban centers across North America and Europe, driving significant growth in the specialized online retail channel.

A third crucial segment includes culinary schools, professional training academies, and specialized vocational institutions focusing on authentic Japanese cuisine. These entities purchase Yanagi knives in bulk for student kits, often selecting durable, mid-range options (e.g., Molybdenum Vanadium stainless steel Yanagis) that balance cost-effectiveness with the necessary geometry for learning single-bevel sharpening and slicing techniques. Establishing long-term supply agreements with these institutions represents a stable, foundational revenue stream and helps foster the next generation of professional users, ensuring future market demand. Targeted marketing towards this educational segment is key for long-term brand building.

Yanagi Knife Market Key Technology Landscape

The technology landscape of the Yanagi Knife Market is a fascinating blend of ancient, proprietary forging techniques and cutting-edge metallurgical innovation, primarily focused on enhancing blade performance and mitigating the inherent limitations of high-carbon steel. Traditional technology revolves around the meticulous process of 'Honyaki' (true forged) and 'Kasumi' (mist or laminated) construction, where the former uses a single piece of high-carbon steel, requiring differential heat treatment and water quenching, while the latter involves cladding a hard core steel with softer iron or stainless steel. Technological advancement in this domain involves refining the heat treatment processes, often using precision temperature control via induction heating or salt baths, to achieve optimal hardness (60-65 HRC) and structural stability without sacrificing toughness.

Modern material technology constitutes the most significant area of research and development. This includes the widespread adoption of Powdered Metallurgy (PM) steels, such as R2 (SG2), which offer ultra-fine carbide structures, resulting in exceptionally high edge retention and improved corrosion resistance compared to traditional carbon steels. Manufacturers are also heavily investing in advanced cladding technologies to produce "stainless-clad carbon core" blades, offering the benefit of a highly reactive and sharp carbon edge while providing stainless protection to the majority of the blade surface, thereby easing maintenance for the professional user working in moisture-rich environments. The application of sophisticated cryogenic treatments post-quenching (sub-zero treatment) is another key technological element utilized to enhance steel microstructure, converting retained austenite to hard martensite, further boosting hardness and durability.

Beyond the blade itself, handle technology is evolving rapidly, moving beyond traditional wooden handles (Ho Wood and Water Buffalo horn) to utilize advanced composites, stabilized woods, and food-safe resins. These technological upgrades enhance hygiene, moisture resistance, and provide superior ergonomic profiles tailored for international users, which is crucial for AEO considerations focused on global customers. Furthermore, the technology of grinding and finishing is increasingly incorporating highly precise CNC grinding machines for the initial bevel creation, allowing for perfect consistency, though the final, critical sharpening and polishing steps remain largely a domain of master artisans using traditional whetstones, preserving the inherent value and craftsmanship of the premium product.

Regional Highlights

-

Asia Pacific (APAC): Dominance in Production and Traditional Consumption

APAC remains the undisputed center for Yanagi knife production, driven primarily by manufacturing hubs in Japan (Sakai, Seki, Takefu). Japan not only supplies the global market but also represents the most mature and discerning consumer base, where the Yanagi knife is a mandatory tool in professional kitchens. Demand is steady, characterized by high-value purchases of artisanal, often custom-made, Honyaki blades. Regional growth outside Japan is accelerating, particularly in South Korea, China, and Southeast Asian nations (Singapore, Thailand) due to rising disposable income and the rapid expansion of international sushi chains and high-end dining experiences. Market penetration in these emerging economies is often led by mid-range, stainless-steel Yanagis that offer a performance upgrade without the intensive maintenance associated with traditional Japanese carbon steel.

The market dynamics in APAC are heavily influenced by cultural factors, where the perceived quality and historical lineage of the smith significantly impact purchasing decisions. Traditional distribution channels (specialty tool shops and direct master sales) still hold considerable sway, though e-commerce is rapidly gaining ground, providing international exposure to smaller, highly specialized Japanese workshops. The stability of steel sourcing, largely dependent on domestic Japanese metallurgical companies like Hitachi Metals, is a critical regional factor influencing pricing and lead times globally.

-

North America: Rapid Growth and Enthusiast Adoption

North America is characterized by the fastest rate of market growth, fueled by a significant cultural shift towards high-quality, specialized culinary tools among both professional chefs and wealthy home enthusiasts. The professional segment—spanning major metropolitan culinary centers like New York, Los Angeles, and Vancouver—drives demand for high-end, longer-bladed Yanagis (270mm to 330mm) used in premium Japanese and fusion restaurants. This region exhibits a strong preference for brands that effectively marry Japanese authenticity with robust Western distribution and customer service.

The rapid adoption by the enthusiast segment is key to volumetric growth. American consumers often gravitate toward hybrid or stainless-clad Yanagis, which reduce maintenance complexity while retaining the aesthetic and slicing efficiency of a single-bevel knife. E-commerce and specialized online retailers are the dominant distribution channels, often providing comprehensive tutorials and educational content tailored to Western users unfamiliar with single-bevel sharpening techniques. Marketing strategies in North America emphasize performance benefits, steel science, and the artisanal heritage of the tools.

-

Europe: Specialization and High-End Hospitality Demand

The European market, particularly in Western Europe (UK, Germany, France), shows robust, concentrated demand driven by its highly developed hospitality sector and high concentration of Michelin-starred restaurants. Professional chefs in Europe increasingly seek Yanagi knives to execute advanced techniques learned through global culinary training. Demand is sophisticated, prioritizing high-performance carbon steels (Aogami Super) for precision slicing of premium proteins.

Market growth in Europe is steady, supported by strong import channels and established distribution networks that cater specifically to professional kitchen suppliers. Unlike North America, European consumers often prioritize high durability and certification standards. Eastern Europe represents an emerging sub-segment with lower initial adoption but strong potential as Japanese cuisine continues its spread. Regulatory compliance regarding imported specialty steels and handle materials is a significant operational consideration for suppliers in this region.

-

Latin America and MEA: Emerging Markets with Niche Demand

Latin America and the Middle East & Africa (MEA) currently represent smaller market shares but offer high potential. In Latin America, demand is concentrated in rapidly growing urban centers (e.g., São Paulo, Mexico City) with burgeoning fine dining scenes. Adoption is slow due to high import duties and lower general consumer awareness, but the professional segment is gradually recognizing the necessity of specialized tools.

In MEA, demand is heavily concentrated within the luxury hospitality sector, particularly in major hubs like Dubai, Abu Dhabi, and Doha, where high-end international hotel chains employ specialized chefs. Purchasing decisions are often centralized by procurement divisions within large hotel groups, focusing on bulk quality and robust maintenance contracts. Growth is dependent on the continued expansion of high-end tourism and international culinary presence in these regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Yanagi Knife Market.- KAI Group (Shun Cutlery)

- Masamoto Sohonten

- Misono

- Sakai Takayuki

- Tojiro

- Yoshihiro Cutlery

- Korin

- Suisin

- Global

- Wusthof

- Zwilling J.A. Henckels

- MAC Knife

- Dick

- Forschner (Victorinox)

- Kikuichi Cutlery

- Takeshi Saji

- Tadafusa

- Yoshikane Hamono

- Hitachi Metals (Upstream Steel Supplier Influence)

- Aritsugu

Frequently Asked Questions

Analyze common user questions about the Yanagi Knife market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a Yanagi knife and how does its single bevel impact slicing performance?

The Yanagi knife, or Yanagiba, is a traditional Japanese slicing knife characterized by its long, thin blade (240mm to 330mm) and crucial single-bevel edge (kataba). This asymmetry creates a hollow ground (uraoshi) on the flat side and a polished bevel on the front, allowing the chef to slice delicate proteins like raw fish in one smooth, pull-cut motion, minimizing friction and cellular damage for superior texture and gloss.

Which type of steel is recommended for professional Yanagi users, high-carbon or stainless steel?

Professional users typically prefer high-carbon steel, specifically Aogami (Blue Steel) or Shirogami (White Steel), due to their capacity to achieve unparalleled sharpness and edge retention. While high-carbon steel requires meticulous maintenance (immediate cleaning and oiling to prevent rust), its superior performance in precision slicing tasks outweighs the maintenance burden for dedicated culinary professionals.

What is the difference between Honyaki and Kasumi construction in Yanagi knives?

Honyaki represents the highest quality, forged from a single, homogenous piece of high-carbon steel using differential heat treatment, offering exceptional edge retention but demanding high skill to forge and sharpen. Kasumi knives are laminated, featuring a core of hard carbon steel clad in softer iron or stainless steel, making them easier to sharpen, more durable against chipping, and generally more affordable, thus suitable for high-volume use and advanced enthusiasts.

Where is the primary growth market for Yanagi knives outside of Japan?

North America currently serves as the primary growth market for Yanagi knives outside of Japan. This growth is driven by the expansion of specialized Japanese cuisine, increasing consumer disposable income, and the high demand among professional and serious home cooks for specialized, premium kitchen tools, predominantly distributed through specialized e-commerce channels.

What are the key maintenance requirements unique to the Yanagi knife?

The unique maintenance requirements center on the single-bevel geometry, necessitating dedicated sharpening on high-quality Japanese whetstones (typically 1000 grit and higher) to maintain the correct angle and polish the back (uraoshi). Additionally, if made from high-carbon steel, the blade requires immediate cleaning and drying after use, often followed by light oiling, to prevent oxidation and staining.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager