Yellow Phosphorus Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431705 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Yellow Phosphorus Market Size

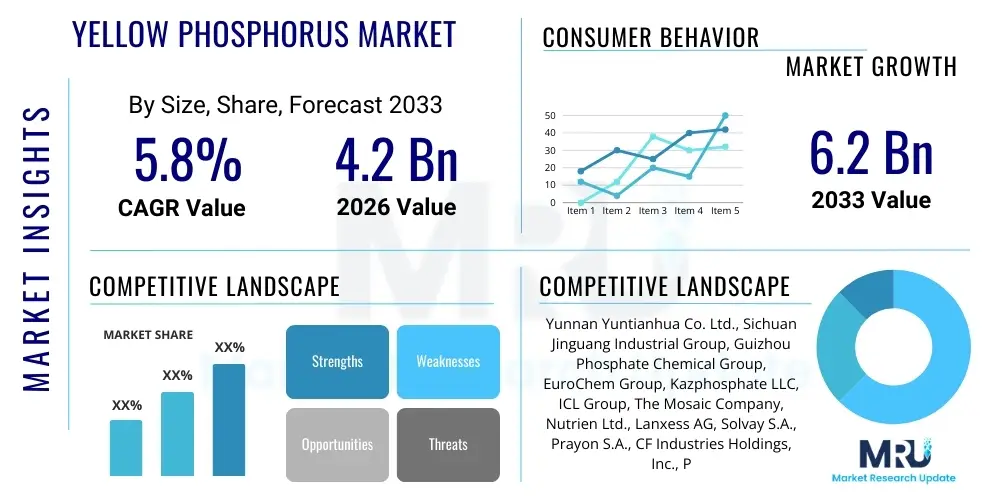

The Yellow Phosphorus Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Yellow Phosphorus Market introduction

Yellow phosphorus, also known as elemental phosphorus or white phosphorus, is a highly reactive allotrope of phosphorus produced primarily through the thermal reduction of phosphate rock in electric arc furnaces. This vital industrial intermediate is the precursor for almost all phosphorus-containing chemicals, making it indispensable across several core sectors of the global economy. Its high purity and reactive nature dictate its crucial role in synthesizing phosphoric acid, phosphorus pentoxide, phosphorus trichloride, and various organic phosphorus derivatives, which are foundation materials for modern technology and food production. The market’s resilience is rooted in the continuous demand from the agricultural sector for fertilizers and from the burgeoning electronics and pharmaceutical industries requiring high-purity phosphorus compounds.

The primary applications of yellow phosphorus span agriculture, where its derivatives are essential for creating phosphate fertilizers critical for global food security, and industrial applications, including the manufacturing of detergents, water treatment chemicals, and specialized fire retardants. Furthermore, the growth in advanced battery technology, particularly lithium iron phosphate (LFP) batteries used in electric vehicles and energy storage systems, is providing a substantial new demand vector for high-quality phosphorus compounds derived from yellow phosphorus. This expanding application base, coupled with increasing population and declining arable land, underscores the non-cyclical importance of this commodity.

Driving factors for the yellow phosphorus market include the relentless global demand for food, necessitating increased fertilizer use, and the rapid industrialization in emerging economies, particularly in the Asia Pacific region. Regulatory shifts focusing on cleaner water treatment and fire safety standards also boost the demand for specific phosphorus derivatives. The benefits of using yellow phosphorus as an industrial feedstock include its capacity to yield highly purified derivatives essential for sophisticated chemical synthesis, although its production process remains highly energy-intensive and subject to stringent environmental regulations due to its hazardous nature.

Yellow Phosphorus Market Executive Summary

The Yellow Phosphorus market is characterized by robust growth, primarily driven by surging demand from the agricultural and electronics sectors, yet simultaneously constrained by high production energy costs and complex environmental compliance issues. Business trends indicate a consolidation among major producers focused on optimizing energy efficiency and securing stable phosphate rock supply chains, particularly as geopolitical factors influence feedstock availability. The market structure remains highly dependent on captive consumption, where major producers utilize yellow phosphorus internally to create downstream derivatives like phosphoric acid and purified phosphate salts, leading to pricing volatility dependent on both raw material costs and end-product demand fluctuations. Strategic investments are increasingly channeled toward developing cleaner, less energy-intensive production methodologies, although the dominance of the electric furnace process persists due to economies of scale and established infrastructure.

Regional trends highlight the undeniable dominance of the Asia Pacific (APAC) region, specifically China, which acts as both the largest producer and consumer globally, largely due to its extensive phosphate mining capabilities and massive downstream industries (fertilizers and specialty chemicals). Growth in APAC is further catalyzed by rapid industrial expansion and growing domestic food consumption requirements. Conversely, established markets in North America and Europe are witnessing steady, albeit slower, growth, focusing on high-value, niche applications like advanced electronics, pharmaceuticals, and sophisticated industrial coatings, where regulatory frameworks emphasize safety and sustainability in product formulation.

Segment trends reveal that the Agrochemicals segment maintains the largest market share owing to high volume fertilizer requirements, while the Specialty Chemicals segment, driven by applications in high-performance materials and advanced battery electrolytes, is projected to register the fastest growth CAGR during the forecast period. The focus on high-purity yellow phosphorus derivatives for the lithium-ion battery supply chain represents a significant technological and market shift, diversifying demand away from traditional bulk applications. Furthermore, the grade segmentation shows increasing demand for higher purity grades (Electronic Grade and Food Grade) as quality standards tighten across sensitive end-user industries.

AI Impact Analysis on Yellow Phosphorus Market

User inquiries regarding AI's impact on the Yellow Phosphorus Market primarily center around enhancing operational efficiency, mitigating environmental risks associated with production, and optimizing the highly energy-intensive thermal reduction process. Key themes revolve around how AI can facilitate predictive maintenance for expensive electric arc furnaces, improve resource allocation for energy management (given electricity is a primary cost factor), and refine quality control for high-purity derivatives required by the electronics industry. Concerns often include the substantial initial investment required for digitalization and the expertise needed to integrate AI platforms into legacy industrial control systems. Users expect AI to stabilize production costs, increase yield from finite phosphate rock reserves, and help meet increasingly strict regulatory requirements for emissions and waste management, ultimately aiming for more sustainable and cost-effective elemental phosphorus production.

- AI-driven optimization of electric arc furnace operations, reducing specific energy consumption per ton of yellow phosphorus produced.

- Predictive maintenance analytics for critical production equipment, minimizing unplanned downtime and extending equipment lifespan.

- Enhanced supply chain visibility and risk management using machine learning to forecast fluctuations in phosphate rock prices and electricity costs.

- Improved process control systems utilizing AI algorithms for real-time monitoring of chemical reactions, ensuring higher purity yields for electronic and food grades.

- Application of computational chemistry and AI for accelerating the discovery and development of novel, greener phosphorus derivatives and alternative production methods.

- Optimization of waste heat recovery and pollution control systems (e.g., sludge management) to improve environmental compliance and reduce operational footprint.

DRO & Impact Forces Of Yellow Phosphorus Market

The Yellow Phosphorus market dynamics are fundamentally shaped by the crucial balance between persistent global agricultural demand (a core driver) and significant structural restraints, notably the extreme energy consumption and the environmental footprint of the production process. Opportunities arise from technological advancements aimed at sustainable production and the burgeoning requirements of high-tech industries, particularly in energy storage. Key drivers include the necessity for increased food production globally, which fuels demand for phosphate fertilizers, and the rapid expansion of the electronics and electric vehicle sectors, which rely on phosphorus derivatives for high-performance components. These drivers create a compelling force for market expansion, ensuring steady demand irrespective of typical economic cycles.

Restraints are primarily economic and regulatory. The production of yellow phosphorus via the thermal reduction method is one of the most energy-intensive processes in the chemical industry, making producers highly susceptible to electricity price volatility and carbon taxation policies. Furthermore, the increasing scarcity of high-quality phosphate rock reserves, coupled with the need for stricter pollution control mechanisms for managing toxic byproducts, imposes significant capital expenditure and operational restraints. These factors pressure profit margins and concentrate production geographically in regions with access to cheap, stable electricity and abundant phosphate rock.

Opportunities center on innovation in sustainability and application diversification. The shift toward green chemistry and circular economy principles is driving research into alternative, less energy-intensive methods (e.g., biological or solar-powered reduction) for phosphorus recovery. Moreover, the specialized demand for ultra-pure phosphorus compounds in cutting-edge technologies, such as advanced semiconductors, fire suppressants, and the cathodes of LFP batteries, offers high-margin growth avenues, allowing producers to shift focus from bulk commodity sales to value-added specialties. These impact forces collectively dictate the market’s direction, favoring integrated companies capable of managing both upstream resource security and downstream technological complexity.

Segmentation Analysis

The Yellow Phosphorus Market is comprehensively segmented based on its grade, application, and geographical distribution, reflecting the diverse industrial requirements and end-use priorities globally. Segmentation by grade is crucial as it differentiates the product based on purity levels required for specific downstream processes, ranging from technical grade (used primarily for bulk chemical synthesis and metallurgy) to high-purity electronic and food grades, which command significant price premiums due to stringent quality control requirements. The market analysis across these segments provides essential insights into value migration and technological investment patterns within the industry, where demand for higher purity products is growing disproportionately faster than bulk grades.

Application-wise, the market is traditionally dominated by the Agrochemicals sector, consuming yellow phosphorus derivatives for the production of fertilizers such as diammonium phosphate (DAP) and monoammonium phosphate (MAP), essential inputs for modern farming practices. However, secondary applications in detergents, water treatment (through phosphates), food and beverage additives, and specialty chemicals (including fire retardants and plasticizers) provide significant market depth and diversification. The rapid expansion of the electronics sector, particularly in Asia, is creating a high-growth niche for high-purity phosphoric acid and related compounds used in etching and cleaning processes for semiconductor manufacturing.

- By Grade: Technical Grade, Food Grade, Electronic Grade, Others (e.g., Industrial Grade).

- By Application: Agrochemicals (Fertilizers, Pesticides), Food & Beverages (Additives, Preservatives), Detergents & Cleaning Agents, Specialty Chemicals (Fire Retardants, Plasticizers, Water Treatment), Electronics & Semiconductors, Pharmaceuticals.

- By Region: North America, Europe, Asia Pacific (APAC), Latin America (LATAM), Middle East and Africa (MEA).

Value Chain Analysis For Yellow Phosphorus Market

The value chain for the Yellow Phosphorus market is vertically integrated and starts with the highly concentrated upstream process of phosphate rock mining and beneficiation, which is crucial as the quality and accessibility of phosphate rock directly impact the efficiency and cost structure of phosphorus production. Upstream activities involve significant capital expenditure for mining infrastructure and energy-intensive processes to refine the rock concentrate. Major producers often possess captive phosphate rock mines to ensure feedstock security and cost stability, which provides a substantial competitive advantage. The subsequent thermal reduction of phosphate rock in large, specialized electric furnaces, powered by substantial electricity input, marks the critical, most energy-intensive step in generating elemental yellow phosphorus.

Midstream activities involve the storage, handling, and transportation of yellow phosphorus, which requires stringent safety protocols due to its high reactivity and toxicity. Immediately following production, the majority of yellow phosphorus is channeled into further chemical synthesis to produce key derivatives. These derivatives, such as purified phosphoric acid (PPA), phosphorus pentoxide, phosphorus chlorides, and various phosphate salts, constitute the core trade products. The midstream processing complexity, particularly for high-purity derivatives required by the food and electronics sectors, adds significant value and intellectual property to the chain.

Downstream activities focus on incorporating these derivatives into final consumer and industrial products. Direct distribution primarily supplies large industrial consumers like major fertilizer manufacturers (agrochemicals), detergent formulators, and specialized chemical companies. Indirect distribution channels utilize established networks of specialty chemical distributors and traders to reach smaller end-users in pharmaceuticals, electronics component manufacturing, and niche industrial coatings markets. The close relationship between integrated producers and downstream consumers is vital, especially given the just-in-time nature of agricultural and electronic manufacturing supply chains, highlighting the strategic importance of stable logistics and reliable product quality.

Yellow Phosphorus Market Potential Customers

Potential customers for yellow phosphorus derivatives are broadly diversified across essential economic sectors, with the largest volume consumption originating from companies involved in the large-scale production of agricultural inputs. Agrochemical manufacturers constitute the primary customer base, utilizing high volumes of technical-grade derivatives, particularly wet-process phosphoric acid derived from yellow phosphorus, to formulate fertilizers like superphosphates and ammonium phosphates essential for global crop yields. These customers require reliable, high-volume supply contracts and are sensitive to price volatility due to the commodity nature of their end products, making feedstock cost efficiency a critical factor in purchasing decisions.

A rapidly expanding customer segment comprises manufacturers in the electronics and semiconductor industry. These companies require ultra-high purity grades of phosphoric acid for critical cleaning, etching, and processing steps in silicon wafer and microchip manufacturing. Given the exacting standards of the electronics sector, these customers prioritize consistency, low metallic impurity levels (Electronic Grade), and guaranteed traceability, often leading to long-term partnerships with specialized phosphorus derivative producers who can meet these rigorous specifications. This segment represents a high-value, fast-growing market niche.

Other significant end-users include manufacturers of specialty chemicals, where phosphorus derivatives are integrated into niche applications such as high-performance fire retardants (used in plastics, textiles, and construction materials), water treatment chemicals (preventing corrosion and scale build-up), and food and beverage processing companies. In the food sector, customers rely on food-grade phosphates for leavening agents, preservatives, and pH control. These diverse customer groups demonstrate varied procurement priorities, ranging from bulk volume and competitive pricing (Agrochemicals) to specialized purity and technological partnership (Electronics and Pharmaceuticals).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Yunnan Yuntianhua Co. Ltd., Sichuan Jinguang Industrial Group, Guizhou Phosphate Chemical Group, EuroChem Group, Kazphosphate LLC, ICL Group, The Mosaic Company, Nutrien Ltd., Lanxess AG, Solvay S.A., Prayon S.A., CF Industries Holdings, Inc., PhosAgro, Wengfu Group Co. Ltd., Hubei Xingfa Chemicals Group, China National Chemical Corporation (ChemChina), FMC Corporation, Merck KGaA, OCP Group, and Innophos Holdings, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Yellow Phosphorus Market Key Technology Landscape

The fundamental technology governing yellow phosphorus production remains the thermal reduction process using electric arc furnaces (EAF), a capital-intensive method that requires large quantities of high-purity phosphate rock, coke (as a reductant), and silica (as a flux). This technology, although mature and highly scalable, is inherently energy-intensive, consuming vast amounts of electricity, which is the single largest operating cost component. Technological innovation in this traditional landscape is focused less on radical process change and more on optimization, aiming to improve furnace design for better heat distribution, enhance energy efficiency ratios, and integrate advanced automation systems to maintain stable operating conditions and reduce electrode consumption, thereby lowering overall production costs and mitigating reliance on volatile energy markets.

Beyond process optimization, a crucial area of technological development involves managing the environmental impact, particularly sludge disposal and fluorine recovery. Producers are investing in technologies for cleaner production, including efficient gas scrubbing systems to capture hazardous fluoride and phosphorus oxide emissions, and implementing techniques to safely utilize or dispose of phosphogypsum and furnace slag. A nascent, but strategically important, technological trend is the exploration of ‘green phosphorus’ production methods. These emerging technologies investigate routes such as chemical reduction using renewable energy sources or bio-based processes, aiming to decouple phosphorus manufacturing from high-carbon electricity grids, offering a long-term solution to environmental sustainability and regulatory compliance pressures, although these methods are generally not yet commercially viable at scale compared to EAFs.

Furthermore, the technology landscape is being shaped by the increasing demand for ultra-high purity yellow phosphorus derivatives, particularly for the electronics and LFP battery markets. This requires sophisticated purification and synthesis technologies downstream, such as solvent extraction, crystallization, and membrane separation techniques. Producers are adopting advanced analytical methods, including Inductively Coupled Plasma Mass Spectrometry (ICP-MS), to ensure purity levels meet parts-per-billion specifications, reflecting the market’s technological shift from bulk commodity chemicals to precision-engineered specialty materials essential for modern high-tech manufacturing processes.

- Electric Arc Furnace (EAF) Optimization: Focus on improving energy efficiency, reducing specific energy consumption, and implementing automated control systems for stable high-temperature operations.

- Flotation and Beneficiation: Advanced techniques used upstream to upgrade low-grade phosphate rock into high-quality feedstock suitable for EAF processing, maximizing resource utilization.

- Wet-Process Phosphoric Acid Purification: Development of advanced solvent extraction and crystallization methods to produce purified phosphoric acid (PPA) for food and electronic applications.

- Environmental Control Systems: Implementation of advanced scrubbing and recovery technologies for fluoride, sulfur dioxide, and other gaseous emissions, coupled with improved methods for phosphogypsum management.

- Emerging Green Chemistry: Research into low-temperature chemical or electro-chemical reduction methods utilizing renewable energy to bypass the highly energy-intensive thermal process.

- Derivative Synthesis Automation: High-precision reaction technologies for manufacturing specialized phosphorus derivatives like phosphonates, organophosphorus compounds, and electronic-grade precursors.

Regional Highlights

The Asia Pacific (APAC) region commands the dominant share of the global Yellow Phosphorus market, primarily due to the overwhelming presence of China, which controls the largest proven phosphate rock reserves and possesses substantial installed capacity for yellow phosphorus production. The regional dominance is further amplified by significant domestic demand fueled by the immense agricultural sector requiring phosphate fertilizers, coupled with the rapid expansion of downstream industries, including electronics manufacturing (especially semiconductors in Taiwan, South Korea, and China) and the booming lithium-ion battery sector. Favorable government policies in key producing countries, alongside access to relatively stable and affordable electricity (though prices are rising), solidify APAC’s position as the global manufacturing hub, driving international trade and setting price benchmarks.

North America and Europe represent mature markets characterized by stringent environmental regulations and a focus on high-value, specialized derivatives rather than bulk yellow phosphorus production. In North America, the market is characterized by a high degree of integration, with key players utilizing yellow phosphorus for captive consumption to produce advanced specialty chemicals, high-purity phosphoric acid, and value-added agricultural products. Demand growth here is moderate and stable, linked largely to the pharmaceutical, food additive, and non-agricultural chemical sectors. European production, similarly, is focused on high-specification products and advanced manufacturing, with consumption being highly sophisticated but often constrained by high energy costs and limitations on domestic phosphate rock mining.

The Middle East and Africa (MEA) and Latin America (LATAM) are emerging regions exhibiting considerable growth potential, largely driven by the availability of phosphate rock reserves (e.g., Morocco in MEA, Brazil in LATAM) and increasing domestic agricultural requirements. Morocco, through OCP Group, is a global powerhouse in phosphate mining and fertilizer production, influencing the entire value chain. Investment in these regions is focused on establishing integrated production facilities to leverage local raw material advantages and serve rapidly growing internal agricultural markets, reducing reliance on expensive imports. However, establishing complex, energy-intensive yellow phosphorus facilities in these regions is challenged by infrastructure deficits and fluctuating energy supply stability.

- Asia Pacific (APAC): Market leader, driven by massive agricultural demand, robust electronic manufacturing growth, and primary production capacity concentrated in China, India, and Vietnam.

- North America: Mature market characterized by captive consumption, focus on specialty chemicals, pharmaceuticals, and stable, moderate growth driven by technological upgrades in agriculture.

- Europe: High-value market focused on stringent regulatory compliance, advanced derivatives, and limited domestic production due to high energy costs and environmental constraints.

- Latin America (LATAM): Emerging growth market driven by expanding agricultural land use and significant phosphate rock resources, particularly in Brazil and Peru.

- Middle East & Africa (MEA): Strategic region due to massive phosphate reserves (especially Morocco), increasing investment in downstream processing to serve regional and global fertilizer markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Yellow Phosphorus Market.- Yunnan Yuntianhua Co. Ltd.

- Sichuan Jinguang Industrial Group

- Guizhou Phosphate Chemical Group

- EuroChem Group

- Kazphosphate LLC

- ICL Group

- The Mosaic Company

- Nutrien Ltd.

- Lanxess AG

- Solvay S.A.

- Prayon S.A.

- CF Industries Holdings, Inc.

- PhosAgro

- Wengfu Group Co. Ltd.

- Hubei Xingfa Chemicals Group

- China National Chemical Corporation (ChemChina)

- FMC Corporation

- Merck KGaA

- OCP Group

- Innophos Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Yellow Phosphorus market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers of demand in the Yellow Phosphorus market?

The market is primarily driven by persistent global demand for phosphate fertilizers necessary for agriculture and increasing requirements for high-purity phosphorus derivatives used in the rapidly growing electronics and lithium iron phosphate (LFP) battery manufacturing sectors.

Which geographical region dominates the global production and consumption of Yellow Phosphorus?

The Asia Pacific (APAC) region, specifically China, dominates the market due to its abundant phosphate rock reserves, massive production capacity leveraging the electric furnace process, and robust downstream demand from agricultural and electronic industries.

What key restraint affects the profitability and expansion of Yellow Phosphorus production?

The major restraint is the extremely high energy intensity of the thermal reduction process using electric arc furnaces, making production highly susceptible to volatility in electricity prices and increasing pressure from carbon taxation policies and environmental regulations.

How does the Yellow Phosphorus market contribute to the electric vehicle (EV) supply chain?

Yellow phosphorus is a critical precursor for manufacturing high-purity phosphoric acid derivatives essential for producing lithium iron phosphate (LFP) cathode materials, which are increasingly utilized in EV batteries due to their safety and cost-effectiveness.

What is the difference between Technical Grade and Electronic Grade Yellow Phosphorus derivatives?

Technical Grade is used for high-volume bulk applications like fertilizers and basic chemicals, while Electronic Grade derivatives undergo extensive purification to meet ultra-low impurity levels required for semiconductor etching and cleaning processes, commanding a significantly higher market price.

What are the main feedstocks required for Yellow Phosphorus production?

The main feedstocks include phosphate rock, which serves as the phosphorus source; coke or carbonaceous materials, which act as the reducing agent; and silica, which functions as a fluxing agent in the electric arc furnace to facilitate slag separation.

How are environmental concerns impacting the future technological direction of the industry?

Environmental concerns drive technological focus toward optimizing existing EAFs for better energy efficiency and developing alternative, less energy-intensive 'green phosphorus' production methods to mitigate high carbon emissions and manage hazardous byproducts like phosphogypsum sludge safely.

What role do phosphorus derivatives play in the water treatment industry?

Phosphorus derivatives, such as phosphonates and specific phosphate salts, are extensively used in water treatment as sequestering agents to control corrosion, prevent scale formation, and stabilize water quality in industrial cooling systems and municipal water networks.

Why is the Yellow Phosphorus value chain often characterized by vertical integration?

Vertical integration, particularly backward integration into phosphate rock mining, is crucial for producers to secure a stable, cost-effective supply of the primary raw material, reducing exposure to volatile input pricing and ensuring the quality needed for downstream specialization.

Does the price of Yellow Phosphorus directly correlate with fertilizer prices?

While highly correlated, especially for technical grade derivatives, the correlation is not always direct. Yellow phosphorus pricing is influenced by both downstream fertilizer demand and upstream factors like electricity costs and phosphate rock availability, which can introduce independent price fluctuations.

How significant is the role of AI in Yellow Phosphorus manufacturing?

AI is becoming increasingly significant, primarily in optimizing the energy-intensive EAF processes through real-time predictive analytics, enhancing resource management, improving predictive maintenance schedules, and refining quality control systems for high-purity product yields.

What key market opportunity is expected to generate the highest growth rate in the near future?

The Specialty Chemicals segment, particularly those derivatives utilized in the growing electric vehicle battery (LFP technology) and advanced semiconductor manufacturing industries, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to specialized demand.

What is the typical shelf life and storage requirement for Yellow Phosphorus?

Yellow phosphorus must be stored under water, protective oil, or an inert gas to prevent contact with oxygen, as it is pyrophoric and ignites spontaneously in the air. While chemically stable when stored properly, its storage requires specialized, highly controlled, and secure facilities.

What are the major phosphorus derivatives produced from Yellow Phosphorus?

Major derivatives include Purified Phosphoric Acid (PPA), Phosphorus Pentoxide (P2O5), Phosphorus Trichloride (PCl3), Phosphorus Oxychloride (POCl3), and various phosphate salts like Sodium Tripolyphosphate (STPP) and specialized organophosphorus compounds.

How are geopolitical events influencing the stability of the Yellow Phosphorus supply chain?

Geopolitical events impact the supply chain by affecting the trade routes and export policies of major phosphate rock producers (like Morocco, China, and Russia) and influencing regional energy prices, leading to price volatility and potential supply disruptions for producers globally.

What is the role of Technical Grade Yellow Phosphorus in the metallurgy industry?

In metallurgy, technical grade phosphorus compounds are used primarily in the production of certain ferroalloys, such as ferrophosphorus, where phosphorus acts as an alloying element to improve specific properties of steel and other metal castings, such as hardness and corrosion resistance.

Why is the recovery of valuable byproducts an area of focus for producers?

Focusing on byproduct recovery, such as utilizing furnace slag for construction materials or recovering fluorine compounds, is essential for improving the overall economic viability of the operation and reducing the volume of hazardous waste requiring costly disposal.

What differentiates White Phosphorus from Yellow Phosphorus?

Yellow phosphorus is the commercial form of white phosphorus, often appearing yellowish due to impurities or exposure to sunlight. Chemically, they are the same allotrope (P4), but the terms are sometimes used to reflect the purity level or processing history of the product.

How is the pharmaceutical industry utilizing Yellow Phosphorus derivatives?

The pharmaceutical industry uses high-purity phosphorus derivatives as key intermediates in the synthesis of various drugs, including specific antibiotics, antivirals, and therapeutic agents, where phosphorus compounds are vital building blocks.

What challenges do new entrants face when trying to enter the Yellow Phosphorus production market?

New entrants face significant barriers including extremely high capital requirements for establishing EAF facilities, the need for secure, long-term sourcing contracts for phosphate rock, and navigating complex, strict environmental and safety regulations associated with handling this hazardous substance.

How do tariffs and trade agreements affect the movement of Yellow Phosphorus across regions?

Tariffs, especially those imposed on key producing nations like China, can significantly disrupt international trade flows, leading to localized price increases in importing regions and prompting major chemical users to seek diversified or more regionalized supply chains for stability.

What is the expected long-term impact of phosphate rock scarcity on the market?

The long-term scarcity of high-quality phosphate rock will increase feedstock costs, incentivize miners to process lower-grade ores, and accelerate research into phosphorus recycling technologies (e.g., from sewage sludge) to ensure resource security and sustainability for the industry.

Which sub-segment within Agrochemicals is the largest consumer of phosphorus derivatives?

Within Agrochemicals, the fertilizer manufacturing sub-segment, which includes the production of common compounds like DAP (Diammonium Phosphate) and MAP (Monoammonium Phosphate), constitutes the overwhelming majority of Yellow Phosphorus derivative consumption.

How does the demand for fire retardants influence the Yellow Phosphorus market?

Stringent fire safety standards globally, particularly in the construction and transportation sectors, drive consistent demand for organophosphorus fire retardants, which are synthesized using yellow phosphorus derivatives, ensuring a stable market contribution from this application segment.

What measures are taken by companies to mitigate the high energy cost associated with production?

Companies mitigate high energy costs by locating facilities near sources of low-cost, stable electricity (often hydro or coal power), implementing advanced process controls for energy efficiency, and engaging in hedging or long-term energy contracts to stabilize operational expenditures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager