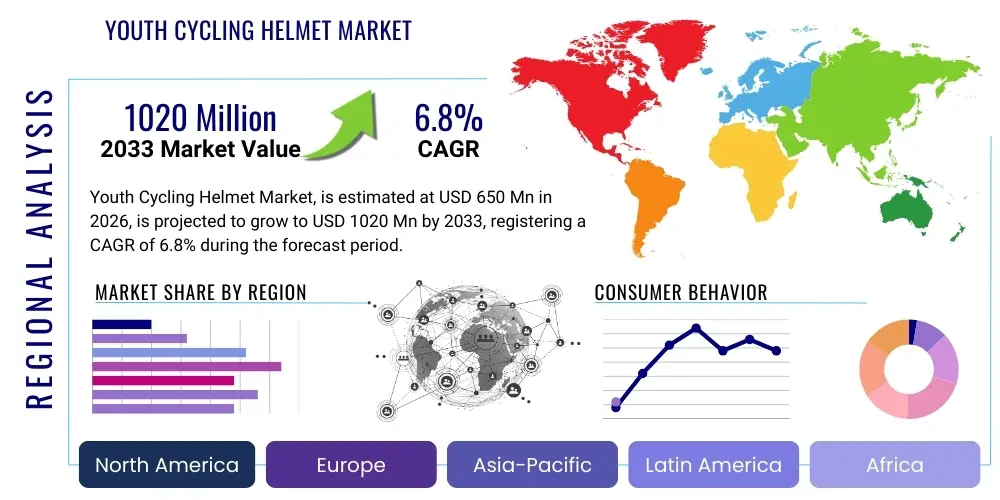

Youth Cycling Helmet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436856 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Youth Cycling Helmet Market Size

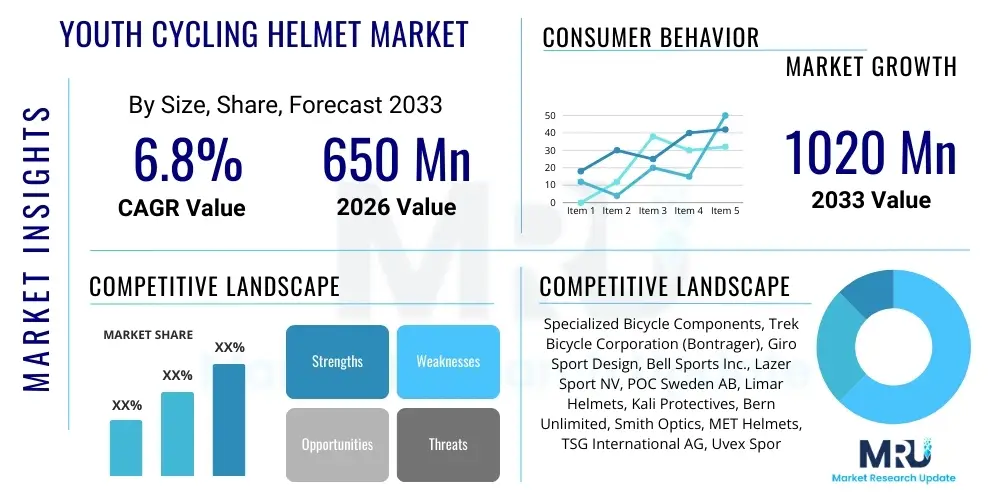

The Youth Cycling Helmet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1020 Million by the end of the forecast period in 2033. This consistent expansion is primarily fueled by heightened parental awareness regarding cycling safety, coupled with increasing governmental mandates and initiatives promoting helmet usage among minors. The market dynamics are also heavily influenced by continuous technological advancements in safety materials, such as MIPS integration, which provide superior impact protection tailored specifically for the developing skeletal structures of youth.

The valuation reflects robust demand across developed economies, particularly North America and Europe, where cycling is integrated into recreational and commuter activities for children and adolescents. Furthermore, emerging markets in the Asia Pacific are experiencing rapid urbanization and a growing middle class, leading to higher disposable incomes that allow for investment in quality protective gear. This shift towards premium, certified safety equipment, rather than basic models, significantly contributes to the overall market valuation increase projected over the next seven years.

Specific market growth vectors include the rising popularity of competitive youth cycling sports and mountain biking, which necessitate high-performance, specialized helmets. Regulatory bodies worldwide are continuously updating safety standards (e.g., CPSC, EN 1078), prompting manufacturers to frequently innovate and replace older inventory with newer, compliant, and feature-rich models. The focus remains on optimizing fit, ventilation, and lightweight design to ensure comfort and compliance among young riders, thereby sustaining continuous demand in this specialized segment.

Youth Cycling Helmet Market introduction

The Youth Cycling Helmet Market encompasses the design, manufacturing, distribution, and sale of protective headgear specifically engineered for children and adolescents engaging in cycling activities. These products are distinct from adult helmets, featuring specialized sizing matrices, often greater adjustability systems, lighter weight construction, and enhanced graphic designs appealing to younger demographics. The primary objective of these helmets is to mitigate the risk of traumatic brain injury (TBI) resulting from falls or collisions, making them an essential component of cycling safety equipment across recreational, commuter, and sports cycling segments.

The products utilize various construction methodologies, predominantly in-mold technology, which fuses the polycarbonate outer shell with the EPS (Expanded Polystyrene) foam liner, optimizing strength while minimizing weight. Major applications span casual biking, BMX riding, mountain biking (MTB), and road cycling, each requiring helmets designed to meet specific impact protection requirements and ventilation needs. Key benefits driving market adoption include adherence to mandatory safety standards (such as CPSC 1203 in the US or relevant European standards), improved ergonomic fit for prolonged wear, and the incorporation of advanced safety features like rotational energy management systems (e.g., MIPS, WaveCel) to address oblique impacts.

Driving factors for sustained market growth include mandatory helmet laws implemented in various jurisdictions globally, the proliferation of family-oriented outdoor activities, and comprehensive public health campaigns emphasizing injury prevention. Furthermore, continuous material science improvements enhancing energy absorption capabilities without compromising helmet aesthetics or comfort are crucial catalysts. The market is highly sensitive to seasonal changes, safety recalls, and consumer confidence in certified protective equipment, ensuring continuous focus on quality control and transparent safety reporting by manufacturers.

Youth Cycling Helmet Market Executive Summary

The Youth Cycling Helmet Market is characterized by robust growth, driven primarily by stringent global safety regulations and increasing parental investment in child safety gear. Business trends indicate a strong move towards premiumization, where consumers increasingly prefer helmets incorporating advanced rotational safety technologies, superior ventilation systems, and enhanced adjustability features, shifting the focus from price to protective efficacy. This premium segment growth is highly beneficial for specialized manufacturers focusing on innovation and intellectual property surrounding impact protection mechanisms. Competitive strategies often center on strategic retail partnerships, direct-to-consumer digital channels, and collaborations with youth sporting organizations to build brand loyalty early in the consumer lifecycle. Sustainability in manufacturing materials, while nascent, is also emerging as a factor influencing procurement decisions, particularly in European markets.

Regional trends highlight North America and Europe as established leaders, commanding the largest market shares due to high cycling participation rates and well-established legal frameworks mandating helmet use. However, the Asia Pacific region (APAC) is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), fueled by increasing urbanization, rising disposable incomes in countries like China and India, and government investments in cycling infrastructure and school safety programs. Latin America and the Middle East and Africa (MEA) represent high-potential, yet underpenetrated markets, where growth will be heavily dependent on regulatory adoption of standardized safety protocols and the expansion of organized retail channels capable of distributing certified products effectively.

Segmentation trends reveal that the In-Mold Technology segment maintains dominance due to its optimal balance of weight, protection, and cost efficiency in mass production. However, Specialized Helmets (e.g., BMX full-face, high-end MTB helmets) are growing rapidly, reflecting the increasing specialization of youth cycling disciplines. By application, the Recreational/Casual segment holds the largest volume share, but the Sports/Competitive segment drives innovation and higher Average Selling Prices (ASPs). Furthermore, distribution channel analysis shows that online retail platforms are gaining significant traction, offering consumers extensive product comparisons and access to niche, international brands, challenging the traditional dominance of specialty sporting goods stores.

AI Impact Analysis on Youth Cycling Helmet Market

User queries regarding AI’s influence on the Youth Cycling Helmet Market typically revolve around three core themes: enhancing safety standards through predictive modeling, optimizing manufacturing processes for personalized fit, and leveraging AI for consumer engagement and design forecasting. Common concerns include how AI can identify high-risk impact zones to better inform helmet design, whether machine learning (ML) algorithms can be used to analyze large datasets of real-world accident scenarios to validate safety certifications, and the potential for AI-driven customization to deliver safer, better-fitting products for diverse head shapes of children and teenagers. Users anticipate that AI could lead to ‘smart helmets’ capable of monitoring impact forces in real- time or even predicting potential hazards.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally shifting product development methodologies within the youth protective gear sector. AI-driven simulation tools allow engineers to conduct thousands of virtual impact tests, optimizing EPS foam density, shell geometry, and ventilation port placement far more efficiently than traditional physical prototyping. This reduces the time-to-market for safer, lighter helmets. Furthermore, ML is being applied in supply chain management to forecast demand with greater accuracy, especially concerning seasonal and demographic fluctuations unique to the youth market, thereby preventing stockouts of popular sizes or colors. AI is also powering sophisticated digital fitting guides, using image recognition to recommend the perfect helmet size, crucial for safety as improper fit is a major contributor to helmet failure during an accident.

- AI-Enhanced Safety Simulation: Utilizing ML algorithms to model and predict complex rotational and linear impact forces, optimizing EPS liner thickness and multi-density foam applications.

- Generative Design Optimization: Employing AI to create lightweight internal lattice structures (e.g., using 3D printing) that absorb energy more effectively than standard foam liners, particularly beneficial for reducing weight in youth models.

- Personalized Fit Recommendation Engines: Deployment of computer vision and ML in e-commerce platforms to ensure accurate sizing based on user-submitted photos or measurements, improving safety compliance.

- Supply Chain and Inventory Management: AI-driven predictive analytics to forecast demand for specific sizes and regional color preferences, optimizing production schedules and reducing waste.

- Smart Helmet Integration (Nascent): Incorporation of micro-sensors monitored by AI to detect severe impacts, trigger emergency alerts, and provide data logging for post-accident analysis and future design refinement.

DRO & Impact Forces Of Youth Cycling Helmet Market

The Youth Cycling Helmet Market is governed by a dynamic interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful Impact Forces. Key drivers include mandatory helmet legislation, increasing consumer income leading to higher safety spending, and the exponential growth of organized youth cycling events, all of which mandate certified protective equipment. Restraints primarily involve the high cost associated with advanced safety technologies (like MIPS), which can limit adoption in price-sensitive emerging markets, alongside challenges related to achieving consistent fit across diverse international head anthropometries. Opportunities are significant, focusing on innovation in smart helmet technology (integrated sensors) and expanding market penetration in underserved geographies through lower-cost, yet certified, alternatives. These factors collectively create a competitive landscape where regulatory compliance and material innovation are paramount for sustained growth.

Specific drivers include public health campaigns promoted by organizations like the World Health Organization (WHO) and regional traffic safety boards, which successfully link helmet use to reduced mortality and severe injury rates, influencing parental behavior directly. Furthermore, the continuous introduction of updated safety standards, often requiring more rigorous testing against oblique impacts, compels consumers to upgrade older, non-compliant helmets, thus stimulating replacement cycles. The increasing awareness among parents about the specific differences between standard helmets and those offering rotational protection serves as a substantial demand catalyst in mature markets, driving the preference for premium, high-ASP products.

Conversely, significant restraints hinder growth. Counterfeit or non-certified helmets pose a severe threat, particularly in markets with weak enforcement mechanisms, offering low-cost alternatives that compromise safety. Another key challenge is consumer reluctance due to perception issues—specifically, that helmets are uncomfortable, hot, or cumbersome, leading to non-compliance, particularly among older adolescents. The supply chain is subject to volatility in raw material costs, especially for petroleum-derived components like EPS foam and polycarbonate shells, which impacts manufacturing profitability and retail pricing structures. Managing the delicate balance between maximum protection, minimum weight, and optimal ventilation remains a persistent engineering challenge.

Opportunities for market expansion include integrating new materials, such as bio-based or recycled polymers, appealing to environmentally conscious consumers and meeting evolving corporate social responsibility goals. The digitalization of the retail experience, particularly customized fitting applications using 3D scanning or augmented reality (AR), offers a pathway to solve the chronic issue of improper fit. Moreover, establishing strategic partnerships with schools, cycling clubs, and pediatric healthcare providers offers direct access to the target demographic, promoting educational content alongside product sales, thereby embedding the necessity of helmet use into early youth culture. The push for multi-sport helmets certified for both biking and skateboarding offers diversification opportunities.

Segmentation Analysis

The Youth Cycling Helmet Market is meticulously segmented based on several critical factors, including product type, the material used in the internal liner, application, and distribution channel. This segmentation allows manufacturers and marketers to precisely target distinct consumer needs, ranging from the casual neighborhood rider requiring basic protection to the competitive athlete demanding high-performance, lightweight gear. Understanding these segment dynamics is crucial for strategic pricing, product development lifecycle management, and optimizing supply chain distribution flows. The primary segmentation criterion, technology, determines the level of protection offered and often correlates directly with the product’s price point and competitive positioning within the market landscape.

The market analysis distinguishes between In-Mold construction, which dominates due to its widespread applicability and cost-efficiency, and Hard Shell construction, primarily used for BMX or aggressive trail riding where greater puncture resistance is needed. Furthermore, the introduction of advanced safety segments, specifically those utilizing MIPS (Multi-directional Impact Protection System) or proprietary rotational safety mechanisms, represents the fastest-growing segment, driven by scientific evidence supporting their superior efficacy in reducing rotational forces impacting the brain during angled falls. Segmentation by application ensures that the helmet design, including coverage area, visor integration, and ventilation intensity, aligns perfectly with the intended cycling activity, maximizing both safety and user satisfaction.

- By Technology:

- In-Mold Technology

- Hard Shell Technology (Hardshell)

- Hybrid/Fusion Technology

- By Safety Feature:

- Standard EPS Liner

- Rotational Energy Management Systems (e.g., MIPS, WaveCel, SPIN)

- By Application:

- Recreational and Casual Cycling (Urban/Path Riding)

- Sports and Competitive Cycling (Road, MTB, BMX)

- Commuter Cycling (School travel)

- By Distribution Channel:

- Specialty Sports Stores

- Departmental and Hypermarkets

- Online Retail (E-commerce)

- Mass Merchandisers

- By Size/Age Group:

- Toddler/Small Child (Ages 1-5)

- Child (Ages 5-10)

- Youth/Adolescent (Ages 10-16)

Value Chain Analysis For Youth Cycling Helmet Market

The value chain for the Youth Cycling Helmet Market begins with upstream activities focused on sourcing specialized raw materials, primarily petrochemical derivatives such as Expanded Polystyrene (EPS) beads, Polycarbonate (PC) sheets for the shell, and various polymers for retention systems (straps, buckles). This upstream segment is highly sensitive to global commodity price fluctuations and relies heavily on key chemical and plastic suppliers. Manufacturers must maintain strict quality control over these inputs, particularly the EPS density, as it directly determines the helmet's shock-absorbing capacity. Key activities include material innovation, research into eco-friendly or recycled materials, and securing long-term supply contracts with stable pricing structures to ensure cost predictability.

Midstream activities involve core manufacturing, including design, prototyping, mold fabrication, injection molding of shells, EPS foaming (in-mold process), assembly of fit systems and liners, and rigorous testing for certification (CPSC, EN 1078). This phase is capital-intensive and requires high levels of automation and precision engineering. Differentiation at this stage is achieved through proprietary safety technologies (e.g., patented rotational systems) and ergonomic design tailored specifically to the varying head shapes and physiological needs of the youth demographic. Effective quality management and efficient production scaling are essential for competitiveness, especially in balancing the requirement for low unit costs with the need for premium safety features.

Downstream analysis focuses on distribution and sales. The market utilizes both direct and indirect channels. Direct sales are increasingly prevalent through branded e-commerce sites, allowing companies to control brand messaging, manage personalized customer experiences, and gather direct consumer feedback. Indirect channels include specialty sports retailers (offering expert fitting advice), mass merchandisers (providing high volume sales of entry-level models), and large online marketplaces (offering vast selection and price competition). Distribution logistics must handle seasonal spikes in demand (spring/summer) efficiently, ensuring compliant, certified products reach consumers globally. Marketing efforts are heavily concentrated on educating parents about safety standards and utilizing digital media channels frequently accessed by both parents and youth to influence purchase decisions.

Youth Cycling Helmet Market Potential Customers

The primary end-users and potential customers of Youth Cycling Helmets are parents and guardians making procurement decisions for children and adolescents ranging from toddlers (aged 1) up to young adults (aged 16 or 17). This purchasing demographic is highly motivated by safety standards, recommendations from pediatricians or cycling organizations, and regional legal requirements for helmet usage. They prioritize certified protection (e.g., CPSC compliance), adjustable fit systems to accommodate growing heads, and durability. Secondary customers include institutional buyers such as schools, summer camps, municipal cycling programs, and youth sports leagues (BMX, mountain biking clubs) that purchase helmets in bulk to ensure compliance and safety for participants, often preferring models that offer a balance between high safety ratings and cost-effectiveness.

Within the consumer segment, a key distinction exists between buyers of casual/recreational helmets and buyers of specialized/competitive helmets. Parents buying for casual use (riding in the park or neighborhood) often seek versatile, brightly colored, and aesthetically pleasing options that encourage compliance, typically opting for mid-range pricing. Conversely, parents purchasing for competitive youth cyclists (MTB or road racing) are highly educated about safety technologies like MIPS, prioritize low weight, enhanced ventilation, and aerodynamic performance, and are willing to invest significantly more in premium products that mirror professional-grade equipment but scaled for youth dimensions.

The evolving customer base also includes tech-savvy young riders and their parents interested in "smart" safety features. Although these products are still niche, customers are emerging who seek integrated technology, such as LED lights for visibility, NFC chips for medical information storage, or even nascent crash detection sensors. Furthermore, as sustainability becomes a growing purchasing criterion, customers who prioritize environmentally conscious materials and ethical manufacturing practices form a high-value, albeit smaller, segment, particularly in Western European and North American markets, influencing product development toward eco-friendly alternatives.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1020 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation (Bontrager), Giro Sport Design, Bell Sports Inc., Lazer Sport NV, POC Sweden AB, Limar Helmets, Kali Protectives, Bern Unlimited, Smith Optics, MET Helmets, TSG International AG, Uvex Sports Group, Schwinn, Fox Racing, Seven iDP, Catlike, KASK S.p.A., Nutcase Inc., Mongoose. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Youth Cycling Helmet Market Key Technology Landscape

The technology landscape of the Youth Cycling Helmet Market is rapidly evolving, driven primarily by the need to manage complex impact forces, especially rotational energy, which is widely recognized as a major contributor to concussions and other serious brain injuries. The core technology remains the Expanded Polystyrene (EPS) foam liner, but innovation is centered on enhancing its energy dissipation capabilities. The most significant technological adoption is the Rotational Energy Management System (REMS), exemplified by Multi-directional Impact Protection System (MIPS). MIPS utilizes a low-friction layer positioned between the head and the helmet’s shell, allowing a controlled sliding motion upon angled impact, thereby redirecting rotational forces away from the brain. This technology is increasingly becoming a standard expectation rather than a premium feature across all quality youth helmet segments.

Beyond rotational systems, advanced structural integrity is achieved through In-Mold construction techniques, which chemically and physically bond the external polycarbonate shell to the EPS foam during the molding process. This process results in a helmet that is simultaneously lighter, stronger, and better ventilated than older hardshell designs. Furthermore, significant research and development efforts are focused on material science, specifically the use of alternative shock-absorbing materials like Koroyd (a welded tube structure) or WaveCel (a collapsible cellular material). These innovations aim to offer superior linear and rotational protection while maintaining extreme breathability, crucial for comfort and compliance during extended youth activities.

The integration of ‘Smart Helmet’ features represents the future technological frontier. While still nascent, this includes embedded micro-sensors (accelerometers and gyroscopes) designed to detect severe impacts and automatically trigger emergency notifications to pre-set contacts via connected smartphone applications. Other smart features include integrated rechargeable LED lights for enhanced visibility, particularly relevant for young commuters, and Near Field Communication (NFC) chips for storing emergency medical information. These technological enhancements are aimed not only at improving protection during a crash but also proactively reducing the likelihood of an accident through better visibility and responsiveness.

Regional Highlights

- North America (USA and Canada): North America maintains a leading position, characterized by stringent consumer product safety standards (CPSC 1203) and high per capita expenditure on youth sports and recreation. The market benefits from strong cycling culture and widespread mandatory helmet laws, particularly in state and provincial jurisdictions for minors. The region is a key adopter of premium safety features like MIPS, driving higher average selling prices. The US market is highly competitive, with established domestic and international brands vying for retail shelf space and digital market share.

- Europe (Germany, UK, France, Scandinavia): Europe is a mature and highly regulated market, primarily governed by the EN 1078 safety standard. Scandinavian countries, the UK, and Germany show particularly high compliance rates and a strong preference for sustainably produced and technically advanced helmets. The growth is fueled by government initiatives promoting cycling as a form of transportation and recreation, coupled with a focus on high-quality, lightweight designs that prioritize ventilation and ergonomic fit, essential for prolonged wear during active commuting or sports training.

- Asia Pacific (APAC) (China, India, Japan, Australia): APAC is the fastest-growing region, driven by rapid urbanization, increasing middle-class income, and subsequent growth in cycling infrastructure and recreational spending. While safety standards compliance varies, countries like Australia and Japan have well-established regulatory environments promoting helmet use. China and India represent massive volume opportunities, although price sensitivity remains a key factor. Market penetration is accelerating as global brands establish local manufacturing and distribution partnerships, often introducing budget-friendly certified models tailored for regional aesthetics.

- Latin America (Brazil, Mexico, Argentina): The market in Latin America is developing, with growth constrained by inconsistent regulatory enforcement and economic volatility. However, large urban centers, especially in Brazil and Mexico, show significant potential due to traffic congestion leading to increased bicycle commuting. Market expansion relies heavily on local governments implementing infrastructure improvements and safety awareness campaigns, boosting demand for entry-level certified helmets distributed through mass market channels.

- Middle East and Africa (MEA): MEA represents a nascent market, primarily focused on urban recreational cycling. Market size is relatively small but exhibits potential, particularly in affluent Gulf Cooperation Council (GCC) countries, where premium protective gear is purchased for high-end recreational activities. Growth is linked to climate considerations, necessitating highly ventilated helmets, and the region requires significant investment in consumer education regarding international safety certifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Youth Cycling Helmet Market.- Specialized Bicycle Components

- Trek Bicycle Corporation (Bontrager)

- Giro Sport Design

- Bell Sports Inc.

- Lazer Sport NV

- POC Sweden AB

- Limar Helmets

- Kali Protectives

- Bern Unlimited

- Smith Optics

- MET Helmets

- TSG International AG

- Uvex Sports Group

- Schwinn

- Fox Racing

- Seven iDP

- Catlike

- KASK S.p.A.

- Nutcase Inc.

- Mongoose

Frequently Asked Questions

Analyze common user questions about the Youth Cycling Helmet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most crucial safety feature to look for in a youth cycling helmet?

The most crucial feature is adherence to recognized safety standards (e.g., CPSC 1203, EN 1078) combined with a rotational energy management system, such as MIPS. These systems are proven to reduce the rotational forces transmitted to the brain during common angled impacts, significantly lowering the risk of concussion compared to standard EPS helmets.

How often should a youth cycling helmet be replaced, even without a visible crash?

Helmets should be replaced immediately after any significant impact, as the EPS foam is designed for single-impact use. Even without a crash, manufacturers typically recommend replacement every 3 to 5 years. UV exposure, heat, and normal wear degrade the plastic components and EPS liner, compromising the helmet’s structural integrity and protective capability over time.

Are youth cycling helmet regulations the same globally?

No, youth cycling helmet regulations vary significantly by region. North America adheres to the CPSC standard, while Europe primarily uses EN 1078. Parents must ensure the purchased helmet meets the specific safety certification mandated or recognized in their country, as these certifications dictate the minimum impact absorption and coverage requirements.

What is the main driver behind the increasing market size for youth cycling helmets?

The primary driver is the widespread implementation of mandatory safety legislation for minors and the corresponding surge in parental safety awareness. Heightened public education campaigns about the long-term consequences of head injuries are compelling parents to invest in higher quality, certified, and technologically advanced protective gear for their children.

What is the difference between In-Mold and Hard Shell construction for youth helmets?

In-Mold construction fuses the outer shell directly to the protective EPS foam, resulting in a lightweight, well-ventilated helmet ideal for recreational and road cycling. Hard Shell construction involves a separate, tougher plastic shell glued to the foam, offering superior durability against scrapes and punctures, making it preferred for BMX, skate, or aggressive mountain biking.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager