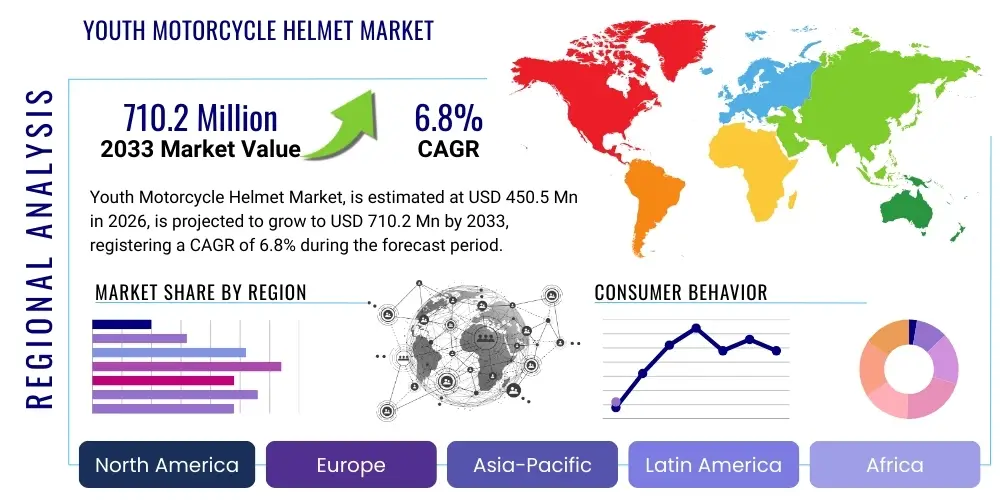

Youth Motorcycle Helmet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436591 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Youth Motorcycle Helmet Market Size

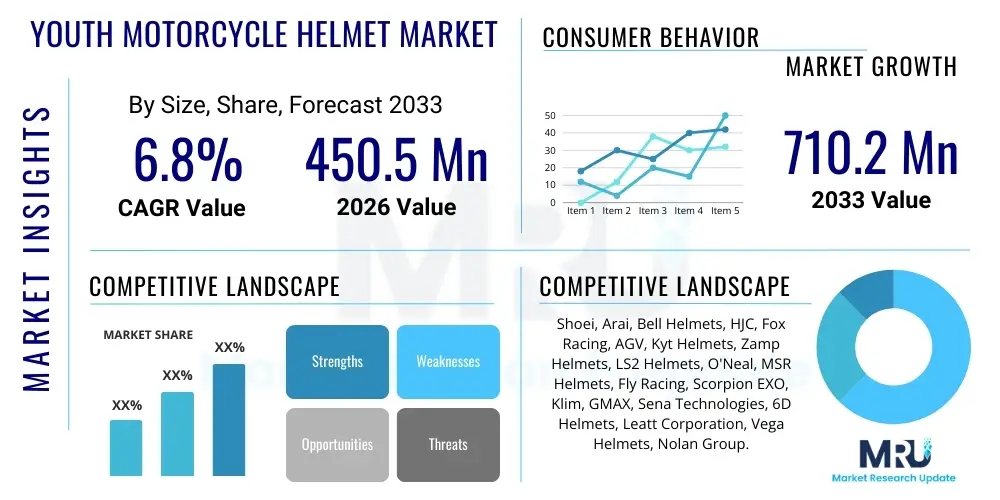

The Youth Motorcycle Helmet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This growth trajectory is strongly influenced by increasing parental awareness regarding mandatory safety regulations and the rising popularity of recreational motorsports involving minors, such as dirt biking and ATV riding. The integration of advanced materials offering higher impact absorption at reduced weight is a critical factor driving consumer acceptance and market expansion across developed and emerging economies.

The market is estimated at USD 450.5 Million in 2026, bolstered by continuous innovation in helmet technology, particularly concerning ventilation systems, customizable sizing features, and aesthetic designs tailored specifically for younger riders. Demand is also sustained by regulatory bodies globally enforcing stringent standards for protective headgear use among all age groups engaged in motorized vehicle operation, including off-road activities.

The Youth Motorcycle Helmet Market is projected to reach USD 710.2 Million by the end of the forecast period in 2033. This substantial growth reflects sustained investment by manufacturers in meeting diverse certification requirements (such as DOT, ECE, and Snell Youth standards) and leveraging robust e-commerce channels for direct consumer outreach. The focus on lightweight, durable, and highly protective helmets that appeal to both safety-conscious parents and style-aware youth will continue to shape market valuation over the next seven years.

Youth Motorcycle Helmet Market introduction

The Youth Motorcycle Helmet Market encompasses the sale and distribution of protective headgear designed specifically for individuals typically under the age of 18 engaging in motorized two-wheeler or off-road vehicle activities. These products are mandated to meet specialized safety standards that account for the physiological differences of youth, including neck strength and head size relative to body mass, necessitating lighter shells and optimized padding systems. The product description centers on high-impact resistant shells, multi-density EPS liners, secure retention systems, and effective ventilation mechanisms, all scaled down and engineered for young riders participating in competitive or recreational events like motocross, dirt biking, and street scooter use.

Major applications of youth helmets span various motorized activities, predominantly dirt biking and recreational ATV use, driven by the increasing accessibility of smaller, youth-specific vehicles. A core benefit these helmets provide is critical head protection against severe trauma during accidents, significantly reducing the risk of concussion and long-term brain injury, thereby fulfilling the primary requirement of rider safety. Furthermore, modern youth helmets integrate features such as washable liners and advanced moisture-wicking fabrics, improving comfort and hygiene, which encourages consistent usage among younger populations.

The market is primarily driven by stringent global safety regulations making helmet usage compulsory, coupled with rising disposable incomes in emerging markets allowing parents to invest in premium safety gear. Other significant driving factors include the proliferation of youth-focused motorsport academies and programs globally, cultivating interest in riding from an early age, and continuous technological advancements by manufacturers to improve ergonomics, safety standards, and aesthetic appeal, directly influencing purchasing decisions made by parents prioritizing the welfare of their children.

Youth Motorcycle Helmet Market Executive Summary

The Youth Motorcycle Helmet Market demonstrates robust growth underpinned by strong governmental regulation and increasing penetration of organized youth motorsports. Current business trends show a significant shift towards premium segment helmets incorporating composite materials like fiberglass and carbon fiber, offering superior protection and reduced weight compared to traditional thermoplastic options. Manufacturers are focusing heavily on developing helmets with advanced safety features such as integrated MIPS (Multi-directional Impact Protection System) technology and emergency quick-release cheek pads, positioning safety as the core differentiator in a competitive landscape. The market structure is characterized by high fragmentation, with several specialized helmet companies competing alongside established global protective gear brands, leading to intense product innovation cycles and aggressive marketing strategies targeted at parental concerns regarding safety and compliance.

Regional trends indicate North America and Europe maintain dominance, primarily due to well-established safety cultures, high participation rates in motocross and off-road riding, and strict enforcement of certification standards (DOT, ECE, Snell). However, the Asia Pacific region, particularly India and China, is projected to exhibit the fastest growth rate. This rapid expansion is driven by burgeoning middle-class populations, increasing urbanization leading to greater two-wheeler usage, and a nascent but rapidly developing interest in recreational off-roading, coupled with governmental initiatives promoting road safety awareness across these large, populous countries. Investment in regional manufacturing hubs and localized product designs catering to specific climatic conditions are becoming essential regional strategies for market players.

Segment trends highlight the dominance of the Off-Road/Motocross helmet type, reflecting the high accident potential and protective requirement of dirt biking, which is a popular youth activity. In terms of material, thermoplastic helmets remain popular due to their cost-effectiveness, appealing to budget-conscious families. Nevertheless, the Carbon Fiber segment is gaining traction rapidly among competitive riders and high-income consumers willing to pay a premium for maximized lightness and structural integrity. Distribution channel analysis reveals that online sales platforms are experiencing accelerated growth, offering convenience, competitive pricing, and vast product choices, although specialized offline stores remain crucial for expert fitting and safety consultation, which are particularly vital when selecting protective gear for children.

AI Impact Analysis on Youth Motorcycle Helmet Market

User queries regarding the impact of AI on the Youth Motorcycle Helmet Market frequently revolve around three main themes: enhancing helmet safety and diagnostic capabilities, optimizing manufacturing processes, and personalizing the fit and design experience. Consumers and industry stakeholders are keen to understand how AI can move helmets beyond passive protection to active safety devices. Key concerns include the feasibility and cost of integrating sensors for real-time impact detection, concussive monitoring, and emergency response notification systems, especially given the weight and size constraints specific to youth helmets. There is also significant interest in how AI-driven analytics can streamline design processes, ensuring helmets meet complex safety certifications efficiently, and how machine learning can be utilized to analyze vast datasets of accident scenarios to inform future ergonomic and impact-absorption material improvements specifically tailored for the developing skeletal structure of young riders.

The integration of Artificial Intelligence primarily affects the design, manufacturing, and post-sale service phases of the youth helmet lifecycle. AI is poised to revolutionize helmet safety by enabling predictive modeling during the research and development phase, simulating millions of impact scenarios under varying environmental conditions and speeds faster than traditional physical testing allows. This enables manufacturers to optimize the structural geometry and multi-density layering of the EPS foam liner, ensuring maximum protection for delicate young brains while minimizing helmet mass. Furthermore, AI-powered quality control systems using computer vision can meticulously inspect manufacturing output, detecting micro-cracks or material inconsistencies that could compromise safety standards, thereby drastically reducing the risk of defective products reaching the market.

Looking ahead, the expectations are that AI will drive personalization. Machine learning algorithms can analyze 3D scans of a child’s head shape and size, recommending or even generating custom-fit liners, addressing the critical issue of improper helmet fit which significantly diminishes protection effectiveness. In the retail sector, AI-driven recommendation engines will assist parents by filtering products based on mandatory regional safety certifications, specific riding applications (motocross vs. street), and budget constraints, thereby simplifying the often-overwhelming purchasing decision process related to essential safety equipment for their children.

- AI-driven optimization of EPS liner density and structure for superior impact absorption.

- Integration of machine learning algorithms for predictive crash modeling and simulation during R&D.

- Deployment of AI vision systems for automated, high-precision quality control in manufacturing.

- Development of smart helmets using integrated sensors for real-time impact detection and emergency notification (E-Call functionality).

- Utilization of generative AI for designing aesthetically appealing yet structurally compliant helmet shells and graphics.

- Personalization of helmet fit through 3D scanning and AI-recommended custom interior padding specifications.

DRO & Impact Forces Of Youth Motorcycle Helmet Market

The Youth Motorcycle Helmet Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Primary drivers include increasingly stringent mandatory safety regulations imposed by global transportation and safety authorities (such as DOT, ECE R22.06, and Snell M2020Y), coupled with growing parental concern over rider safety, leading to a willingness to invest in certified, high-quality protective gear. Opportunities arise from technological advancements, particularly in developing ultra-lightweight, high-strength composite materials and integrating smart features like connectivity and health monitoring, which appeal to a modern consumer base. However, the market faces significant restraints, chiefly high manufacturing costs associated with specialized certifications and advanced materials, which can limit affordability, particularly in price-sensitive markets, and the challenge of ensuring correct helmet sizing and fit over a child's rapidly growing years.

Key impact forces shaping this market involve intense regulatory pressure and the critical role of consumer education. The regulatory landscape constantly evolves, demanding manufacturers continually re-certify and innovate, acting as both a driver for quality and a constraint due to compliance costs. Furthermore, consumer behavior is heavily influenced by safety advocacy groups and peer recommendations, pushing demand toward reputable brands known for exceeding minimum safety standards. The competitive environment is also a powerful force, compelling continuous product diversification in design, features, and price points to capture market share across different socio-economic segments.

The potential for market expansion is tied closely to addressing the restraint of improper fit. Designing helmets that can adjust safely and comfortably as a child grows (through interchangeable padding or adjustable sizing systems) presents a significant opportunity. Moreover, leveraging digital marketing and social media channels to educate parents on the necessity of specialized youth helmets versus scaled-down adult versions is crucial for converting awareness into sales, particularly in regions where off-road riding is gaining traction but standardized safety practices are still developing.

Segmentation Analysis

The Youth Motorcycle Helmet Market is comprehensively segmented based on product Type, Material Composition, Application, and Distribution Channel. This multi-faceted segmentation allows manufacturers to tailor product development and marketing efforts precisely to the needs and safety requirements of different youth riding demographics. The analysis highlights the structural demand differences between competitive riders requiring high-end, lightweight composite helmets and recreational riders seeking durable, budget-friendly thermoplastic options. Understanding these segments is vital for effective inventory management, pricing strategy, and geographic market penetration, ensuring that safety standards are consistently met across all product lines designed for the younger population.

The type segmentation clearly distinguishes between the high level of protection provided by full-face and off-road helmets, which dominate segments associated with higher speeds or rugged terrain, and the more generalized use cases for open-face and modular helmets. Material segmentation reflects the ongoing trade-off between cost, weight, and protective capabilities, with advanced materials increasingly being adopted by parents prioritizing maximum safety regardless of price. Application segmentation confirms that off-road activities remain the largest segment, driving demand for specialized features like extended visors and robust ventilation suitable for demanding environments. Finally, the distribution channel segmentation reveals a dynamic retail shift, with e-commerce platforms offering significant convenience, while specialty stores retain relevance due to the requirement for expert fitting advice crucial for youth safety gear.

Strategic success within this market requires an approach that integrates material innovation with application-specific design. For instance, developing a lightweight composite motocross helmet that meets Snell Youth standards and features youth-specific emergency release systems targets the high-value application segment effectively. Simultaneously, providing well-certified, attractively designed thermoplastic full-face helmets through mass retail channels addresses the growing demand from parents introducing their children to lower-speed street or scooter riding, ensuring market coverage across the economic spectrum and regulatory compliance in diverse scenarios.

- By Type:

- Full Face

- Open Face

- Modular

- Off-Road/Motocross

- By Material:

- Thermoplastic (Polycarbonate/ABS)

- Fiberglass Composite

- Carbon Fiber

- By Application:

- Dirt Biking/Motocross

- Street Riding (Scooters/Small Motorcycles)

- ATV/UTV Use

- Recreational Use

- By Distribution Channel:

- Offline (Specialty Stores, Department Stores)

- Online (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Youth Motorcycle Helmet Market

The value chain for the Youth Motorcycle Helmet Market commences with upstream activities centered on the procurement and processing of specialized raw materials, including high-grade resins, fibers (carbon and glass), multi-density expanded polystyrene (EPS) foam, and advanced textile materials for liners and retention straps. Manufacturers maintain stringent control over material sourcing due to the critical safety implications, often requiring certified suppliers capable of providing consistent quality materials essential for meeting rigorous regulatory standards like ECE 22.06 and DOT. This upstream segment is characterized by high capital investment in mold production, advanced polymer mixing, and fiber weaving technologies, ensuring the structural integrity and lightweight properties necessary for youth-specific protective gear, often necessitating partnerships with specialized chemical and material science firms.

The midstream stage involves complex manufacturing processes, including shell formation (injection molding for thermoplastics or laying up composites), application of protective coatings, precise manufacturing of multi-density EPS liners, assembly of retention systems, and integration of specialized features such as ventilation ports and visor mechanisms. Quality assurance and safety certification testing dominate this stage, often accounting for a significant portion of the production timeline and cost. The downstream segment focuses on distribution, which is bifurcated into direct and indirect channels. Direct channels involve sales through proprietary brand websites or factory outlets, allowing for greater control over pricing and customer relationship management. Indirect channels, which form the bulk of the market, rely on a network of specialized motorcycle gear retailers, general sporting goods stores, and increasingly, major global e-commerce platforms and regional online marketplaces.

Distribution channel effectiveness is heavily dependent on product segmentation. High-end, specialty helmets (e.g., carbon fiber motocross models) often move through specialized power sports dealerships or certified gear retailers where expert fitting services are available, addressing parental concerns about fit crucial for safety. Conversely, mid-range thermoplastic models are often sold through broader retail networks and high-volume e-commerce platforms, optimizing reach and inventory efficiency. Effective management of this distribution network, ensuring product availability and compliance documentation reaches all touchpoints, is essential for maximizing market share and maintaining brand reputation in a safety-critical industry.

Youth Motorcycle Helmet Market Potential Customers

The primary end-users and buyers in the Youth Motorcycle Helmet Market are predominantly safety-conscious parents and guardians making purchasing decisions for children and adolescents aged typically between 5 and 16 years who engage in motorized activities. While the youth are the wearers, the purchasing power and final selection authority rest with the adults, who prioritize quantifiable safety certifications (Snell M2020Y, ECE, DOT) above all other features. These customers require extensive, verifiable information regarding impact ratings, structural integrity, and ergonomic design suitable for a child's developing neck and head, focusing on lightweight construction and effective visibility features such as clear or tinted visors and wide peripheral vision.

A secondary but rapidly growing customer segment includes youth sports organizations, competitive racing teams, and motorsport academies that purchase protective gear in bulk to equip their participants. These institutional buyers focus on durability, standardization of safety features across the cohort, and volume pricing, often selecting mid-to-high-range helmets that can withstand frequent and rigorous use across training sessions and races. Their decisions are heavily influenced by regulatory bodies governing youth motorsport, often mandating specific safety certifications that exceed general road requirements, such as the highest Snell standards for motocross events.

Furthermore, recreational users constitute a massive segment, including families who own ATVs or small dirt bikes for weekend leisure activities. These customers seek a balance between safety, comfort, and affordability, often opting for well-certified, medium-cost thermoplastic full-face or off-road helmets available through easily accessible online or mass retail channels. Marketing efforts targeting this group must emphasize ease of cleaning, adjustability for growing heads, and visual appeal to the youth, while simultaneously reassuring parents about the protective efficacy of the product in diverse recreational settings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.2 Million |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shoei, Arai, Bell Helmets, HJC, Fox Racing, AGV, Kyt Helmets, Zamp Helmets, LS2 Helmets, O'Neal, MSR Helmets, Fly Racing, Scorpion EXO, Klim, GMAX, Sena Technologies, 6D Helmets, Leatt Corporation, Vega Helmets, Nolan Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Youth Motorcycle Helmet Market Key Technology Landscape

The technological landscape of the Youth Motorcycle Helmet Market is rapidly evolving, driven primarily by the need to achieve higher safety ratings at reduced weights and size scales appropriate for young riders. A core technological trend is the widespread adoption of MIPS (Multi-directional Impact Protection System) or similar slip-plane technologies. MIPS is designed to mitigate rotational forces transmitted to the brain during oblique impacts, a common mechanism of concussion, offering a crucial layer of protection beyond standard vertical impact testing. Manufacturers are also heavily investing in advanced energy-absorbing materials, moving beyond standard single-density EPS to multi-density or cone-shaped EPS liners that strategically manage impact energy across different layers, providing optimized protection tailored to the impact intensity and location, which is particularly relevant given the varied types of accidents young riders face in recreational and competitive settings.

Material science innovation is another critical pillar of the market's technology landscape. The transition from heavy, standard thermoplastics to lightweight composite shells, utilizing advanced fiberglass blends, Kevlar reinforcements, and pure carbon fiber, is key to reducing the overall helmet mass. Minimizing weight is paramount for youth helmets as it reduces strain on a child's developing neck muscles while maintaining structural integrity required for high-energy absorption. Furthermore, aerodynamic design using Computational Fluid Dynamics (CFD) is becoming standard practice, ensuring stability and reducing drag and buffeting, which contributes to rider fatigue and potential distraction, improving overall safety and comfort, especially at higher speeds often seen in youth motocross.

Emerging technologies focus on connectivity and user experience. Integrated communication systems, often Bluetooth-enabled, are being adapted for youth models, allowing riders and guardians/coaches to maintain communication in off-road environments. Crucially, the introduction of smart helmet features, including embedded sensors for impact detection (accelerometers and gyroscopes) linked to GPS and automatic emergency notification systems (E-Call), represents the cutting edge. While currently a niche segment due to cost, these technologies promise to revolutionize post-crash response times, offering significant peace of mind to parents and enhancing the overall protective value proposition of the youth helmet.

Regional Highlights

Regional dynamics heavily dictate market maturity, regulatory compliance, and consumer purchasing behavior in the Youth Motorcycle Helmet Market. North America and Europe currently represent the most established markets, characterized by stringent enforcement of safety standards (DOT and ECE respectively) and a high consumer expectation for advanced safety features like MIPS and composite materials. High disposable incomes and a pervasive culture of organized motorsports, particularly motocross and off-road ATV riding, drive strong demand for premium, certified helmets. In these regions, the primary focus is on innovation, design aesthetics appealing to the youth, and maximizing lightweight protection, often resulting in higher Average Selling Prices (ASPs).

Asia Pacific (APAC) is projected to be the fastest-growing region, driven primarily by population density, increasing rates of two-wheeler adoption for commuter and recreational purposes, and rising safety awareness fueled by government campaigns. While price sensitivity remains a factor in developing APAC economies like India and Indonesia, the burgeoning middle class is increasingly willing to invest in higher quality imported or locally manufactured helmets that meet international standards. The major challenge in APAC is navigating disparate regional safety certifications and combating the prevalence of counterfeit or uncertified low-cost helmets, necessitating strong regulatory enforcement and consumer education by market leaders.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging opportunities. LATAM’s growth is spurred by the high reliance on motorcycles and scooters for transportation, increasing the need for compliant street helmets across all age groups. In MEA, specifically the Gulf Cooperation Council (GCC) nations, high spending on recreational off-roading (dune buggies and dirt bikes) drives the niche demand for high-end off-road youth helmets. However, both regions face challenges related to supply chain logistics, reliance on imports, and the need for standardized safety protocols, making market entry strategic and often requiring partnerships with local distributors who possess deep regional knowledge.

- North America: Dominant market share fueled by high motocross participation, stringent DOT/Snell standards, and high adoption of premium technologies (MIPS, carbon fiber).

- Europe: Mature market characterized by strict ECE R22.06 regulations, strong emphasis on quality and ergonomic design, and a highly competitive landscape featuring global and regional specialty brands.

- Asia Pacific (APAC): Highest CAGR, driven by rising disposable incomes, rapid urbanization, increasing two-wheeler ownership, and growing government initiatives promoting youth road safety in countries like China and India.

- Latin America (LATAM): Growing market due to high utilization of two-wheelers for daily transport; increasing demand for certified, entry-to-mid-level youth full-face helmets.

- Middle East & Africa (MEA): Niche market growth supported by recreational off-road activities; focus on durable, highly ventilated helmets suitable for extreme climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Youth Motorcycle Helmet Market. These companies drive innovation through material science, safety compliance, and targeted marketing focused on parental trust and youth appeal.- Shoei Co., Ltd.

- Arai Helmet, Ltd.

- Bell Helmets, Inc. (A Vista Outdoor Company)

- HJC Helmets

- Fox Racing, Inc.

- AGV S.p.A. (Part of Dainese Group)

- Kyt Helmets

- Zamp Helmets

- LS2 Helmets (Tech Design Team SL)

- O'Neal USA

- MSR Helmets

- Fly Racing (Western Power Sports)

- Scorpion EXO

- Klim Technical Riding Gear

- GMAX Helmets

- Sena Technologies, Inc. (Focus on integrated communication systems)

- 6D Helmets, LLC (Known for ODS Technology)

- Leatt Corporation

- Vega Helmets

- Nolan Group (N-Com)

Frequently Asked Questions

Analyze common user questions about the Youth Motorcycle Helmet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific safety certifications are required for youth motorcycle helmets?

The most critical safety certifications are the U.S. Department of Transportation (DOT), the European standard ECE R22.06, and specialized standards such as the Snell M2020Y (Youth). Parents must ensure the chosen helmet carries the specific certification required for their region and intended use (e.g., Snell for competitive off-roading).

How often should a youth motorcycle helmet be replaced?

Youth helmets should be replaced immediately after any significant impact, as internal structural damage may not be visible. Even without impact, manufacturers recommend replacement every five to seven years due to material degradation (especially the EPS liner and resins) and evolving safety standards, or sooner if the child outgrows the helmet size.

What is the primary difference between an adult helmet and a youth-specific helmet?

Youth-specific helmets are designed not just to be smaller but to be significantly lighter, accounting for the lower strength and mass of a child's neck and head. They often feature proprietary sizing systems and energy management liners optimized for lower-mass impacts, ensuring safety without excessive weight strain.

Are smart features, like integrated communications, available and safe for youth helmets?

Yes, integrated smart features, such as Bluetooth communication systems, are increasingly available. They are generally deemed safe, provided they do not add excessive weight or compromise the helmet’s structural integrity. These features primarily aid parental/coach supervision and communication rather than high-level in-helmet entertainment.

Which material segment offers the best balance of safety and lightweight performance for youth riders?

Fiberglass composite materials often provide the optimal balance. While carbon fiber is the lightest and strongest, fiberglass composite offers excellent impact resistance and substantial weight reduction compared to standard thermoplastics, usually at a more accessible price point for the average safety-conscious consumer.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager