Zeolite Separation Membrane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433480 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Zeolite Separation Membrane Market Size

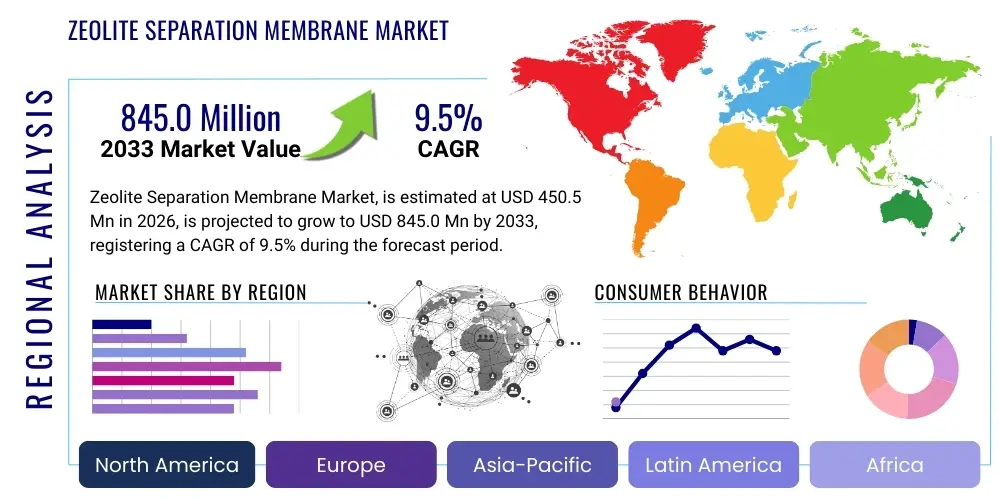

The Zeolite Separation Membrane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 845.0 Million by the end of the forecast period in 2033.

Zeolite Separation Membrane Market introduction

The Zeolite Separation Membrane Market encompasses advanced material technologies designed for highly efficient separation processes, primarily focusing on gas separation, pervaporation, and vapor separation. Zeolites are crystalline aluminosilicates characterized by uniform micropores, offering exceptional molecular sieving capabilities and chemical stability. Unlike conventional polymeric membranes, zeolite membranes exhibit superior thermal and chemical resistance, making them ideal for harsh operating conditions prevalent in industrial applications such as petrochemical processing and natural gas purification. The inherent structural rigidity and selective adsorption properties of zeolite frameworks allow for precise separation based on molecular size, shape, and polarity.

Major applications driving market adoption include CO2 capture and sequestration (CCS) from flue gases, hydrogen purification, nitrogen/oxygen separation, and the dehydration of organic solvents through pervaporation. The unique benefits of these membranes—such as reduced energy consumption compared to traditional cryogenic distillation or adsorption techniques, high flux, and prolonged operational lifespan—position them as crucial enabling technologies for sustainable industrial operations. Furthermore, the ability to operate at high temperatures simplifies process integration in many chemical plants, contributing significantly to overall process intensification and efficiency gains.

Key driving factors propelling market expansion include increasingly stringent environmental regulations mandating lower carbon emissions and enhanced purity standards in industrial outputs. The global push toward energy efficiency and the rising demand for cleaner energy sources necessitate advanced separation solutions that zeolite membranes provide. Continuous research in synthesizing cost-effective, defect-free, and scalable membrane modules, along with growing investment in pilot projects across the chemical and petrochemical industries, further solidifies the market trajectory.

Zeolite Separation Membrane Market Executive Summary

The Zeolite Separation Membrane Market is experiencing robust growth fueled by transformative business trends focusing on sustainability and operational efficiency. The market shift is characterized by the transition from lab-scale synthesis to commercialized, large-area membrane modules, particularly for high-volume applications like CO2 removal and solvent dehydration in the chemical sector. Strategic partnerships between academic research institutions and membrane manufacturers are accelerating the commercial readiness of next-generation zeolite materials, emphasizing thin-film composite membranes to maximize permeability and selectivity while minimizing material usage and associated costs. Furthermore, the integration of smart monitoring systems and predictive maintenance is emerging as a critical business trend, enhancing membrane longevity and reducing unexpected downtime in critical separation processes.

Regionally, Asia Pacific (APAC) stands out due to rapid industrialization, high energy demand, and increased focus on mitigating industrial pollution, particularly in China and India. North America and Europe maintain technological leadership, driven by substantial R&D expenditure on hydrogen generation purification and advanced petrochemical separations, complemented by strict governmental mandates favoring cleaner industrial processes. Specifically, Europe’s robust focus on circular economy initiatives heavily supports the adoption of pervaporation membranes for solvent recovery and dehydration. Latin America and the Middle East & Africa (MEA) are poised for future growth, primarily driven by investments in refining capacity expansion and nascent carbon capture projects.

Segment trends indicate that Gas Separation, particularly for CO2/N2 and H2/CO2 systems, dominates the application segment due to the immediate industrial need for carbon abatement and high-purity gas streams. Within the product type segment, small-pore zeolites (like ZSM-5 and Chabazite-type) are gaining traction for highly selective molecular sieving applications, while synthesis innovations focus heavily on developing ceramic-supported membranes that offer optimal mechanical strength and thermal stability. The market is also seeing increased investment in modules designed for harsh, high-temperature vapor separation, targeting volatile organic compound (VOC) removal in the pharmaceutical and fine chemical industries, showcasing a diversified growth profile across multiple separation modes.

AI Impact Analysis on Zeolite Separation Membrane Market

Common user questions regarding AI's influence in the Zeolite Separation Membrane Market typically revolve around whether AI can accelerate the discovery of novel zeolite structures, optimize membrane manufacturing processes for zero-defect production, and enhance the real-time operational efficiency of installed separation units. Users are primarily concerned with how machine learning can shorten the lengthy synthesis optimization cycles currently required to achieve high-quality membranes and whether predictive modeling can drastically improve maintenance scheduling and lifespan predictions, thereby lowering total ownership costs. The core expectation is that AI will move the market past incremental improvements into a phase of rapid, data-driven material and process innovation.

Based on this analysis, the key themes summarize into three main areas: accelerated material discovery, process optimization, and predictive performance management. AI algorithms, specifically machine learning and deep learning, are increasingly employed to screen vast theoretical libraries of porous materials, identifying optimal zeolite topologies and chemical compositions tailored for specific separation tasks (e.g., C3/C2 separation or targeted isomer separation). This computational approach drastically reduces the time and cost associated with traditional trial-and-error synthesis, enabling manufacturers to bring high-performance membranes to market faster and with better predictability regarding performance metrics such as flux and separation factor. Furthermore, AI tools are vital for understanding the complex interaction between synthesis parameters (temperature, pH, concentration, aging time) and the resulting membrane morphology, ensuring defect-free layer growth.

The second significant impact lies in optimizing the industrial scaling of membrane production, transitioning from batch processing to continuous, quality-controlled manufacturing lines. AI-driven quality control systems use real-time data from in-situ sensors (thermal imaging, pressure monitoring) during crystallization and calcination steps to detect and correct process deviations immediately, thereby maximizing yield and reducing module failure rates. Operationally, AI is instrumental in utilizing sensor data from operating industrial separation units to monitor membrane fouling, predict performance decline, and automatically adjust operating conditions (e.g., feed flow rate, temperature gradient) to maximize efficiency and extend the service interval. This shift toward intelligent, self-optimizing separation systems significantly enhances the economic viability of zeolite membranes in high-stakes industrial environments.

- AI accelerates the identification of ideal zeolite frameworks for challenging separations using high-throughput virtual screening.

- Machine learning optimizes synthesis parameters (temperature, precursor ratio) to minimize structural defects in large-scale membrane production.

- Predictive maintenance schedules are generated using AI to anticipate membrane fouling and performance degradation in real-time operation.

- Computational Fluid Dynamics (CFD) integrated with AI optimizes module design for improved flow distribution and mass transfer efficiency.

- AI models correlate synthesis data with long-term separation performance, establishing robust quality assurance protocols.

DRO & Impact Forces Of Zeolite Separation Membrane Market

The market dynamics are defined by powerful Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory, forming the core Impact Forces. The primary driver is the accelerating necessity for highly energy-efficient separation processes in response to global climate goals and high energy costs, positioning zeolite membranes as superior alternatives to energy-intensive separation methods like distillation and cryogenics. However, significant restraints, particularly the high initial capital investment required for module fabrication and the persistent challenge of achieving perfect, defect-free synthesis across large surface areas, hinder widespread commercial adoption, particularly among small and medium-sized enterprises (SMEs). Opportunities emerge from the niche applications requiring exceptional thermal and chemical stability, such as hydrogen purification and the separation of highly aggressive chemical mixtures, areas where traditional polymer membranes fail.

The impact forces influencing this sector are primarily technological and regulatory. Technological maturity acts as a strong pull factor; as researchers develop more scalable, reproducible synthesis techniques—like vapor-phase transport or specialized seeding layers—the cost barriers diminish, driving acceptance. Simultaneously, the regulatory landscape, especially the stringent air quality and greenhouse gas emission standards set forth by international bodies, provides a powerful external push, forcing industries like petrochemicals, cement, and power generation to invest in advanced carbon capture and separation technologies, where zeolite membranes offer superior performance compared to conventional amine scrubbing.

Furthermore, the environmental imperative constitutes a sustained impact force. The increasing global focus on solvent recovery in the pharmaceutical and fine chemical sectors, aiming for zero-liquid discharge, strongly favors pervaporation using zeolite membranes. This focus on resource efficiency creates a robust market opportunity, moving zeolite technology beyond traditional large-scale gas separation into high-value, niche separation markets. Addressing the challenge of long-term membrane stability and developing standardized testing protocols are crucial steps in mitigating current restraints and unlocking the full commercial potential derived from these inherent market opportunities.

Segmentation Analysis

The Zeolite Separation Membrane market segmentation provides a detailed view of the diverse material types, application areas, and support structures that define product offerings and market demand. Segmentation is crucial for understanding where innovation investment is most concentrated and identifying the fastest-growing end-use sectors. The market is broadly segmented based on Zeolite Type (pore size and crystal structure), Application (the industrial separation task), and Configuration (the physical form and support structure of the membrane module). This granular analysis enables businesses to tailor their R&D efforts toward segments demonstrating the highest growth potential, such as CO2 capture utilizing small-pore zeolites or high-temperature vapor separation using thermally stable supports.

The application segmentation is particularly dynamic, reflecting global industrial trends. While established applications like natural gas dehydration and H2 recovery remain core revenue streams, emerging applications such as bioethanol dehydration and flue gas cleanup are projected to exhibit superior growth rates, driven by sustainability goals and biofuel mandates. The structure segmentation, differentiating between tubular, hollow fiber, and plate-and-frame modules, highlights the ongoing efforts to increase the membrane surface area per unit volume (packing density), essential for economical large-scale industrial deployment.

The core material segmentation—small-pore vs. large-pore zeolites—dictates the selectivity mechanism. Small-pore zeolites (e.g., ZSM-5, T-type) excel in precise molecular sieving (e.g., separating water from ethanol or CO2 from CH4), benefiting from their ultra-uniform channels, while large-pore zeolites (e.g., Faujasite) are often explored for bulk gas separations and catalytic membrane reactors. Successfully overcoming the manufacturing hurdle of producing flawless, thin, and highly permeable separating layers on robust supports (typically alumina or stainless steel) is the underlying technological challenge across all these segments.

- By Zeolite Type:

- Small-Pore Zeolite Membranes (e.g., ZSM-5, T-type, Chabazite)

- Large-Pore Zeolite Membranes (e.g., Faujasite, Beta)

- Hydrophilic Zeolites

- Hydrophobic Zeolites

- By Application:

- Gas Separation

- Natural Gas Processing (CO2/CH4, H2S removal)

- Air Separation (N2/O2)

- Hydrogen Recovery and Purification (H2/CO2, H2/N2)

- CO2 Capture and Sequestration (CCS)

- Pervaporation (Liquid Separation)

- Organic Solvent Dehydration (e.g., Ethanol/Water)

- Azeotropic Mixture Separation

- Vapor Separation

- Volatile Organic Compound (VOC) Removal

- Hydrocarbon Separation

- By Configuration:

- Tubular Membranes

- Hollow Fiber Modules (Emerging)

- Plate-and-Frame Modules

- By End-Use Industry:

- Chemical and Petrochemical

- Oil & Gas

- Pharmaceutical and Fine Chemicals

- Environmental (Air and Water Treatment)

- Biofuel and Food Processing

Value Chain Analysis For Zeolite Separation Membrane Market

The value chain for the Zeolite Separation Membrane Market is structured into four primary phases: upstream raw material supply and synthesis, midstream membrane fabrication and module assembly, downstream distribution and integration, and finally, end-user application and maintenance. The upstream phase is critical, involving the sourcing of high-purity precursors such as aluminum sources (aluminum hydroxide or alkoxides), silica sources (silica sol or tetraethyl orthosilicate), and structured templates (organic amines) necessary for hydrothermal synthesis. Innovations in this stage focus on developing cheaper, more accessible raw materials and optimizing the seeding process crucial for defect-free membrane growth. A key challenge is maintaining consistent quality and purity of these raw materials, which directly impacts the structural integrity and separation performance of the final membrane layer.

The midstream fabrication process represents the highest value-addition step, encompassing the complex synthesis of the zeolite layer onto porous supports (typically ceramic or metal) using techniques like hydrothermal synthesis, chemical vapor deposition (CVD), or secondary growth. Following synthesis, the membranes are integrated into robust modules (e.g., tubular or plate-and-frame), which require specialized engineering to ensure high packing density, minimal pressure drop, and exceptional sealing integrity for industrial use. Distribution channels in the downstream segment are predominantly direct for large-scale industrial projects, involving specialized engineering, procurement, and construction (EPC) firms that integrate the membrane units into existing or new industrial plants. Indirect distribution occasionally occurs through specialized technology distributors catering to R&D labs or smaller industrial pilot projects.

The end-user phase includes the installation, system operation, and ongoing maintenance of the membrane separation systems. Due to the nascent stage and high technical complexity of zeolite membrane technology, significant post-sale support, training, and performance monitoring are essential, often involving direct engagement with the membrane manufacturer. The market heavily relies on system integrators and specialized engineering firms to bridge the gap between membrane science and industrial application. Efficiency in the value chain is increasingly measured by the ability to mass-produce defect-free membranes consistently, thereby reducing manufacturing costs and improving the economic attractiveness of the technology relative to traditional separation methods.

Zeolite Separation Membrane Market Potential Customers

Potential customers for Zeolite Separation Membranes are typically large-scale industrial operators requiring high-selectivity separation under extreme thermal or chemical stress where traditional membrane materials fail. The primary customer base resides within the Chemical and Petrochemical sectors. These industries frequently require separation of challenging mixtures, such as C3/C2 hydrocarbons in olefin plants, or the purification of reaction intermediates, where high temperatures preclude the use of polymeric membranes. Furthermore, the urgent need for cost-effective hydrogen purification and highly selective CO2 removal from process streams makes integrated refining and ammonia production facilities prime targets. The value proposition for these customers lies in reduced energy consumption and improved product purity, directly translating into better profitability and regulatory compliance.

A secondary, rapidly expanding customer segment is the Environmental industry, focused specifically on industrial flue gas treatment and solvent recovery. Customers involved in waste management, specialized industrial cleaning, and pharmaceutical manufacturing are increasingly adopting zeolite pervaporation membranes for efficient solvent dehydration and recovery, moving toward sustainable, closed-loop systems. For pharmaceutical and fine chemical manufacturers, the ability of zeolite membranes to selectively remove water from heat-sensitive organic solvents at low temperatures is a significant differentiator, protecting valuable products and improving process yields, making them crucial buyers of high-purity, small-scale membrane systems.

Finally, the Oil & Gas sector, particularly natural gas processing and LNG production, represents significant potential demand. These customers require robust systems for natural gas sweetening (removal of H2S and CO2) and dehydration. Zeolite membranes offer operational advantages over traditional absorption columns in remote or offshore locations due to their compact footprint and relative simplicity. As the energy sector pivots toward blue hydrogen production, the demand for high-throughput, stable membranes capable of purifying hydrogen from steam methane reforming processes (H2/CO2 separation) will solidify major energy companies as foundational long-term customers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 845.0 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MTR, UOP Honeywell, Total Zeolites, Hyflux Ltd., Evonik Industries, Alfa Laval, Nippon Shokubai, Pervatech, TNO, Applied Membranes Inc., Zeochem, Novamem Ltd., Sinocleansky, Sumitomo Chemical, Nano-Purification Solutions, Air Products and Chemicals, Kawasaki Heavy Industries, CEMEX, LiqTech International, NGK Insulators Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zeolite Separation Membrane Market Key Technology Landscape

The technological landscape of the Zeolite Separation Membrane market is defined by continuous innovation across three main areas: synthesis techniques, membrane material engineering (focusing on thinness and defect elimination), and module design for industrial scalability. The predominant synthesis method remains hydrothermal crystallization, where a precursor gel is heated to grow the zeolite layer on a porous support. However, research is heavily focused on refining secondary growth methods and seed layer techniques, aiming to create highly oriented, ultra-thin zeolite layers (often less than 1 micrometer thick) with near-zero defects. The integrity of this separation layer is paramount, as even minuscule defects can severely compromise selectivity, necessitating rigorous quality control during and after the fabrication process.

Advanced synthesis approaches like Chemical Vapor Deposition (CVD) are gaining traction, particularly for hydrophobic zeolites, as CVD allows for better control over crystal orientation and morphology under dry conditions, which can be advantageous for highly aggressive organic vapor separations. Furthermore, the development of Mixed Matrix Membranes (MMMs), where zeolite crystals are embedded into a polymer matrix, is a parallel technology trend. While MMMs offer easier scalability and lower cost due to the use of polymers, pure inorganic zeolite membranes retain the advantage in high-temperature, harsh chemical environments, pushing manufacturers to continuously improve the mechanical bonding between the inorganic zeolite layer and the underlying ceramic or metallic support to enhance durability.

Module engineering represents the final technological bottleneck for industrial adoption. Current research emphasizes optimizing flow dynamics within the module to reduce concentration polarization—a phenomenon where the separated component accumulates near the membrane surface, hindering performance. Innovations include the design of novel tubular membrane bundles and the exploration of hollow fiber configurations for maximizing the membrane area per volume, thereby reducing the system footprint and capital costs. Success in this market hinges not only on creating a highly selective material but also on packaging that material into a durable, scalable, and economically viable industrial module that can withstand years of operation in real-world conditions.

Regional Highlights

- North America: This region is characterized by substantial investment in advanced separation R&D, particularly focused on hydrogen purification technologies and natural gas processing. Driven by environmental regulations and the shale gas revolution, there is high demand for robust, energy-efficient solutions for CO2 and H2S removal. The US Department of Energy (DOE) funding for carbon capture initiatives further stimulates market growth. North America also leads in the adoption of pilot-scale zeolite systems for unique applications like isotope separation and advanced petroleum refining.

- Europe: Europe is a pivotal region, largely due to stringent environmental policies supporting the circular economy and solvent recovery. The European Union's focus on reducing VOC emissions and enhancing chemical manufacturing sustainability makes it a key market for pervaporation and vapor separation zeolite membranes. Germany and the Netherlands are technological hubs, featuring strong collaboration between leading chemical companies, equipment manufacturers, and specialized research institutes focused on industrial process intensification and membrane reactor development.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market owing to rapid industrial expansion, high reliance on fossil fuels, and urgent need for industrial pollution control. China and India are major consumers, driving demand for zeolite membranes in coal-fired power plant flue gas treatment (CO2 capture) and large-scale petrochemical separations. The region benefits from lower manufacturing costs, fostering local production and quicker adoption of established membrane technologies, although quality control in large-scale synthesis remains a strategic focus.

- Latin America (LATAM): Growth in LATAM is driven primarily by the expansion of the oil & gas and biofuel sectors. Countries like Brazil, with significant bioethanol production, utilize zeolite pervaporation membranes extensively for cost-effective ethanol dehydration, avoiding energy-intensive distillation. Market penetration here is closely tied to commodity prices and government investment in infrastructure, focusing mainly on established, cost-effective membrane designs.

- Middle East and Africa (MEA): The MEA region's market is intrinsically linked to the massive investments in refining, petrochemical complexes, and LNG production. Zeolite membranes are highly sought after for challenging, high-temperature separations inherent in deep refining processes and for large-scale gas sweetening operations. Adoption is driven by the necessity for operational reliability in extreme desert climates, where the thermal stability of inorganic membranes offers a significant advantage over polymeric alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zeolite Separation Membrane Market.- MTR (Membrane Technology and Research)

- UOP Honeywell

- Total Zeolites

- Hyflux Ltd. (Hydrochem)

- Evonik Industries

- Alfa Laval

- Nippon Shokubai

- Pervatech

- TNO (Netherlands Organisation for Applied Scientific Research)

- Applied Membranes Inc.

- Zeochem

- Novamem Ltd.

- Sinocleansky

- Sumitomo Chemical

- Nano-Purification Solutions

- Air Products and Chemicals

- Kawasaki Heavy Industries

- CEMEX

- LiqTech International

- NGK Insulators Ltd.

Frequently Asked Questions

Analyze common user questions about the Zeolite Separation Membrane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What makes zeolite membranes superior to conventional polymeric membranes for industrial use?

Zeolite membranes offer significantly higher thermal and chemical stability (up to 400°C), superior mechanical strength, and more precise molecular sieving capabilities due to their crystalline, uniform pore structures. This enables efficient separation in harsh environments such as high-temperature gas streams or corrosive organic solvents, where polymer membranes rapidly degrade.

In which industrial applications are zeolite separation membranes most economically viable?

They are highly viable in applications requiring high purity or operating under conditions where energy consumption for alternative methods (like distillation) is prohibitive. Key areas include high-temperature hydrogen recovery, ethanol and solvent dehydration via pervaporation, and selective removal of CO2 or H2S from natural gas streams, offering substantial operational cost savings.

What are the primary technological challenges hindering the mass adoption of zeolite membranes?

The main challenges involve achieving repeatable, defect-free synthesis across large membrane surface areas, which is essential for industrial scale-up. High production costs associated with complex synthesis techniques (such as secondary hydrothermal growth) and ensuring long-term module durability and sealing integrity in harsh industrial settings also remain significant hurdles.

How does the type of zeolite (small-pore vs. large-pore) affect separation performance?

Small-pore zeolites (e.g., ZSM-5, T-type) are used for highly selective molecular sieving, separating molecules with very similar sizes (e.g., water/ethanol separation), relying on size exclusion and adsorption differences. Large-pore zeolites (e.g., Faujasite) are generally used for bulkier separations or catalytic membrane reactors, offering higher flux but typically lower intrinsic selectivity based purely on size exclusion.

Which regions are expected to drive future growth in the Zeolite Separation Membrane Market?

The Asia Pacific (APAC) region, led by China and India, is expected to exhibit the fastest growth due to rapid industrialization, increasing energy demand, and growing regulatory pressure for CO2 capture and environmental remediation. North America and Europe will continue to lead in high-value, high-tech applications like advanced hydrogen and chemical separation R&D.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager