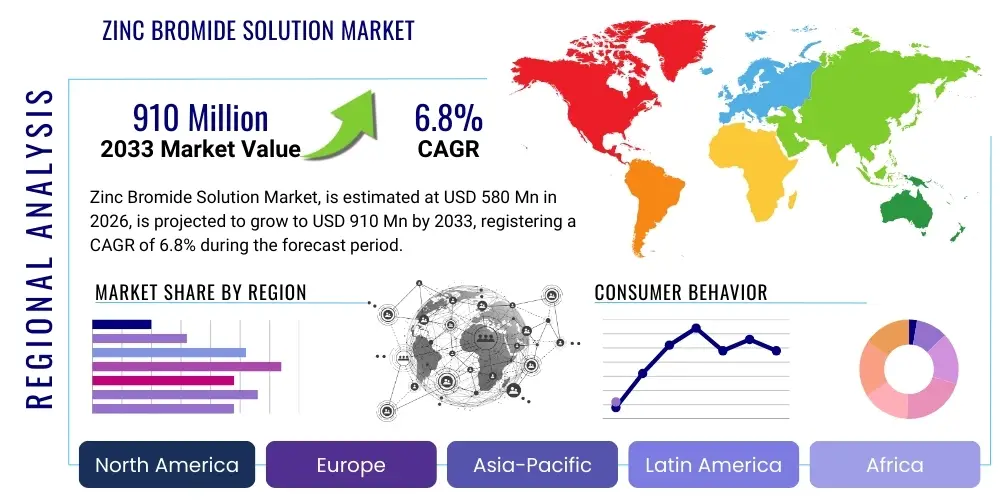

Zinc Bromide Solution Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435856 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Zinc Bromide Solution Market Size

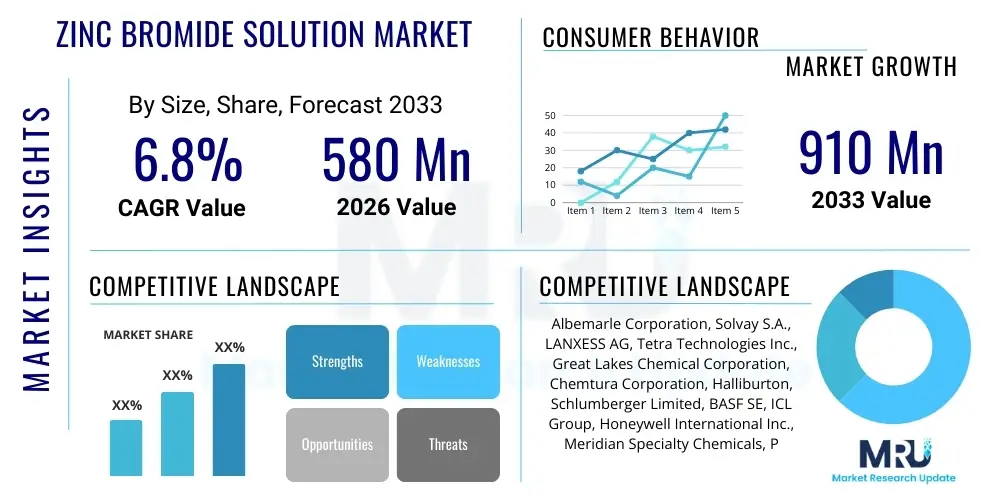

The Zinc Bromide Solution Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 910 Million by the end of the forecast period in 2033.

Zinc Bromide Solution Market introduction

The Zinc Bromide Solution Market encompasses the production and deployment of concentrated zinc bromide in aqueous solutions, primarily utilized across diverse industrial applications requiring high density, excellent thermal stability, and effective electrochemical properties. This colorless, highly dense brine is fundamentally crucial in the oil and gas sector, serving as a key component in clear brine fluids (CBFs) for well completion, workover, and drilling operations, where its high density helps counterbalance formation pressures, preventing blowouts and maintaining wellbore stability without causing formation damage. The compound’s increasing relevance in contemporary energy solutions, particularly in flow battery systems, is driving significant expansion, repositioning the market from a specialized chemical commodity primarily serving upstream petroleum activities toward a critical material for sustainable energy infrastructure development.

The product is commercially available in various concentrations, most commonly 50% and 75% by weight, catering to specific density requirements across applications. Key applications extend beyond conventional oilfield usage to include high-performance windows, specialized pharmaceutical syntheses, and increasingly, large-scale stationary energy storage. The inherent benefits of zinc bromide solutions—such as their non-flammability, relatively low toxicity profile compared to other heavy brines, and high electrochemical activity—make them superior choices for demanding industrial environments. The density benefit in oilfield services ensures optimal hydrostatic pressure control, minimizing risk during complex drilling operations in deep-water or high-pressure, high-temperature (HPHT) reservoirs, thereby enhancing overall operational safety and efficiency.

Driving factors for the market expansion are multifaceted, anchored significantly by the sustained, though volatile, global demand for oil and gas, particularly for deep-sea drilling projects which necessitate premium CBFs. Concurrently, the accelerating global transition towards renewable energy necessitates robust, grid-scale energy storage solutions, where zinc bromide flow batteries (ZBBs) offer compelling advantages in scalability, longevity, and cost-effectiveness compared to traditional lithium-ion systems for long-duration storage. Furthermore, continuous technological advancements aimed at improving recovery and purity of the brine, alongside efforts to enhance the cyclability and energy density of ZBBs, are expected to catalyze future demand and solidify the market’s growth trajectory over the forecast period.

Zinc Bromide Solution Market Executive Summary

The Zinc Bromide Solution Market is characterized by robust growth driven by synergistic demand from the traditional oil and gas sector and the rapidly expanding energy storage industry, creating distinct business opportunities for specialized chemical suppliers. Business trends indicate a strong focus on backward integration among key players to secure reliable bromine feedstock supply, coupled with strategic partnerships targeting flow battery manufacturers to capitalize on the clean energy transition. Regional trends highlight North America's dominance due to extensive oilfield activity and significant investment in grid modernization, while Asia Pacific is emerging as the fastest-growing region, fueled by massive utility-scale energy storage projects, particularly in China and India, alongside burgeoning deep-water exploration in Southeast Asia. Segment trends confirm that clear brine fluids remain the primary revenue driver, but the energy storage application segment is experiencing the highest proportional growth, signaling a fundamental shift in future market dynamics towards long-duration battery technologies.

AI Impact Analysis on Zinc Bromide Solution Market

Users frequently inquire how Artificial Intelligence (AI) can optimize the production processes, logistics, and end-use application efficiency of zinc bromide solutions, specifically focusing on supply chain resilience, predictive maintenance of brine fluid systems in oilfields, and enhancing the performance characteristics of zinc bromide flow batteries (ZBBs). Key themes revolve around leveraging machine learning models to forecast demand volatility accurately, especially concerning the highly cyclical nature of oil and gas exploration and the rapidly evolving regulatory landscape of energy storage. Concerns often center on the computational requirements for modeling complex electrochemical reactions within ZBBs and the integration challenges of AI-driven optimization tools within legacy oilfield infrastructure. Expectations are high that AI will significantly reduce operational expenditures (OpEx) for both chemical production and large-scale battery deployment, thereby improving profitability and promoting wider adoption of ZBB technology as a viable alternative for grid stabilization.

- AI optimizes chemical manufacturing processes, ensuring precise concentration control and reducing waste generation during zinc bromide synthesis.

- Machine learning algorithms enhance supply chain efficiency by predicting feedstock price fluctuations and optimizing inventory levels for global distribution.

- Predictive maintenance in oilfield applications uses AI to monitor brine fluid density, temperature, and contamination levels in real-time, preventing wellbore instability issues.

- AI-driven battery management systems (BMS) maximize the cycle life and efficiency of Zinc Bromide Flow Batteries (ZBBs) by optimizing charge/discharge cycles based on real-time grid data.

- Natural Language Processing (NLP) aids in rapidly analyzing complex environmental and safety regulations globally, ensuring compliance for the handling and disposal of dense brines.

- Advanced analytics support R&D efforts by simulating new electrolyte formulations, accelerating the discovery of higher energy density zinc bromide solutions.

DRO & Impact Forces Of Zinc Bromide Solution Market

The market dynamics are shaped by a strong reliance on global crude oil prices, which directly influence exploration and production (E&P) budgets, alongside the transformative push from renewable energy mandates demanding effective grid-scale storage. Drivers include increasing deep-water drilling activities requiring high-density clear brine fluids (CBFs) and the accelerating adoption of long-duration zinc bromide flow batteries (ZBBs) driven by policy support for decarbonization. Restraints primarily involve the high upfront cost and logistical complexity associated with handling high-density brines, potential environmental concerns regarding zinc discharge, and intense competition from alternative brines (like calcium bromide) and established battery technologies (like lithium-ion and vanadium redox). Opportunities are significant in developing specialized, non-corrosive formulations for ZBBs and expanding market penetration in regions focusing heavily on renewable integration, such as Southeast Asia and Sub-Saharan Africa. The major impact forces are the cyclical nature of the upstream oil and gas sector and the regulatory environment governing utility-scale energy storage, both of which introduce significant volatility and opportunities for technological innovation to mitigate risk.

Segmentation Analysis

The Zinc Bromide Solution market segmentation provides a comprehensive breakdown of market structure based on concentration type, functional application, and target end-user industry, enabling targeted analysis of growth hot spots. The concentration segmentation highlights the technical preference differences, with 75% solutions dominating high-pressure oilfield applications due to superior density capabilities, while lower concentrations suffice for standard industrial or emerging battery uses. Application segmentation clearly delineates the market’s dual engine: the mature Clear Brine Fluids (CBF) sector and the high-growth Energy Storage (Flow Batteries) sector. Understanding these segments is crucial for manufacturers to align their R&D and capacity expansion strategies, focusing either on maintaining dominance in the stable O&G market or rapidly capturing share in the dynamic utility sector.

- By Concentration Type:

- 50% Solution

- 75% Solution

- Other Concentrations (e.g., lower grades for specific chemical processes)

- By Application:

- Clear Brine Fluids (CBF) for Oil & Gas

- Flow Batteries (Energy Storage Systems)

- High-Performance Window Manufacturing

- Pharmaceutical Intermediates

- Chemical Synthesis and Others

- By End-User Industry:

- Oil & Gas Exploration and Production (E&P)

- Utilities and Energy Storage Providers

- Chemical and Manufacturing Industry

- Construction (High-Performance Glass)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Zinc Bromide Solution Market

The value chain for zinc bromide solution begins with upstream sourcing of raw materials, primarily bromine (often sourced from naturally occurring brines or geothermal sources) and high-purity metallic zinc, alongside necessary reagents for synthesizing the final solution. The upstream segment is characterized by relatively few key global bromine producers, leading to potential supply bottlenecks and price volatility, making robust supply agreements critical for manufacturers. Midstream operations involve complex chemical synthesis, purification, and formulation, where major specialty chemical companies convert these raw inputs into high-density, low-contaminant zinc bromide solutions (e.g., 75% concentration), requiring stringent quality control, especially for sensitive applications like flow batteries.

Downstream activities involve specialized logistics for transporting and distributing the dense, sometimes corrosive, liquid product, predominantly through bulk tankers or specialized Intermediate Bulk Containers (IBCs). The distribution channel varies significantly; direct sales are common for large volume buyers like major Oilfield Service (OFS) companies or utility-scale battery integrators, allowing for customized formulations and technical support. Indirect channels involve distributors and regional agents who manage smaller orders and inventories for local chemical buyers or smaller E&P operators, particularly in geographically dispersed markets, requiring expertise in handling hazardous materials.

The crucial difference between the direct and indirect channels is the level of technical involvement. Direct sales usually incorporate comprehensive technical service packages, helping oilfield operators design specific brine fluid mixtures for complex well scenarios, or assisting battery manufacturers in integrating the electrolyte optimally into their systems. Conversely, indirect distribution focuses on efficient, localized delivery and storage, maximizing market reach and speed of response. The flow battery segment is increasingly favoring direct, long-term supply partnerships to ensure electrolyte quality and stability over the projected 20+ year lifespan of the storage units.

Zinc Bromide Solution Market Potential Customers

The primary consumers of zinc bromide solutions are major players within the Oil & Gas Exploration and Production (E&P) sector and specialized utility companies investing heavily in grid modernization and renewable energy integration. E&P companies, particularly those engaged in deep-water or high-pressure drilling environments, are high-volume buyers, utilizing the solution as clear brine fluids for crucial well completion and workover processes. These customers demand extremely high purity, consistent density, and minimal contamination to protect expensive downhole equipment and reservoir formation integrity.

A rapidly growing segment of potential customers includes large utility providers, independent power producers (IPPs), and energy storage system integrators who deploy zinc bromide flow batteries (ZBBs) for grid stabilization, peak shaving, and load shifting. These customers prioritize solutions that offer long cycle life, high energy efficiency, non-flammability, and competitive levelized cost of storage (LCOS). Furthermore, niche markets include specialized glass manufacturers requiring high refractive index fluids for non-destructive testing or high-performance window production, and pharmaceutical companies utilizing zinc compounds as reagents or catalysts in specialized chemical synthesis.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 910 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Albemarle Corporation, Solvay S.A., LANXESS AG, Tetra Technologies Inc., Great Lakes Chemical Corporation, Chemtura Corporation, Halliburton, Schlumberger Limited, BASF SE, ICL Group, Honeywell International Inc., Meridian Specialty Chemicals, PVS Chemicals Inc., Shandong Tianxin Chemical Co. Ltd., Jordan Bromine Company, Compass Minerals, Kemira Oyj, SNF Floerger, Baker Hughes Company, Dow Chemical Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Bromide Solution Market Key Technology Landscape

The technology landscape for the Zinc Bromide Solution market is dual-focused, encompassing advancements in chemical synthesis and purification for optimal product quality, and innovations in its core applications, particularly flow battery systems. In chemical manufacturing, key technological efforts are directed toward producing ultra-high purity zinc bromide solutions with minimal heavy metal contamination, a necessity for enhancing the longevity and performance of flow batteries where impurities can cause side reactions and degrade cell efficiency. Advanced crystallization and filtration techniques, often coupled with continuous process monitoring, are employed to meet these demanding specifications. Furthermore, research is ongoing to develop more sustainable methods for raw material extraction, minimizing the environmental footprint associated with bromine sourcing.

In the oil and gas sector, technological focus revolves around optimizing the density and corrosion inhibition properties of Clear Brine Fluids (CBFs). Manufacturers utilize advanced corrosion inhibitors and specialized polymer additives to ensure the high-density zinc bromide brine remains chemically stable and non-damaging to downhole tools and reservoir rock under extreme temperature and pressure conditions (HPHT). The development of sophisticated fluid monitoring and recycling technologies is also critical, enabling operators to reuse expensive brine solutions, thereby significantly reducing operational costs and material waste, aligning with stricter environmental regulations and efficiency mandates.

The most significant technological shift is occurring within the energy storage application. Innovations in Zinc Bromide Flow Battery (ZBB) technology center on improving the efficiency and design of the battery stack and addressing the challenge of dendrite formation, which historically limited battery lifespan. Researchers are developing novel membrane materials (e.g., polymer-based ion-exchange membranes) that selectively transport ions while mitigating zinc plating issues. Additionally, advancements in electrolyte management systems, including tailored circulation protocols and formulation enhancements (such as the inclusion of complexing agents), are paramount to achieving the necessary long-duration, multi-cycle performance required for utility-scale grid storage integration, ultimately positioning zinc bromide as a competitive long-term storage medium.

Regional Highlights

- North America: North America holds the largest market share, predominantly driven by extensive oil and gas exploration activities, especially in the Gulf of Mexico and other deep-water basins, necessitating large volumes of high-density clear brine fluids. The region benefits from established infrastructure for specialty chemical production and a strong presence of major oilfield service companies. Additionally, significant federal and state incentives for renewable energy and grid modernization in the U.S. and Canada are accelerating the deployment of zinc bromide flow batteries for utility-scale projects, establishing North America as a dual-growth engine market where both traditional and new applications thrive.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid growth is fueled by massive government investments in renewable energy infrastructure, particularly in China, India, and Australia, leading to an explosive demand for long-duration energy storage solutions like ZBBs. While traditional oilfield demand is moderate compared to North America, the sheer scale of the energy transition, coupled with burgeoning deep-water drilling in Southeast Asia, positions APAC as the epicenter for future market expansion, requiring localized manufacturing capacity for cost efficiency.

- Europe: The European market demonstrates mature demand for specialty chemicals but shows a relatively slower growth rate in traditional oilfield applications due to declining North Sea output. However, Europe is a major innovator in environmental technologies and circular economy practices. Strict decarbonization policies and high energy costs are driving strong interest in ZBBs for industrial microgrids and grid balancing, with a focus on sustainable sourcing and lifecycle management of the bromine compounds, pushing manufacturers towards advanced recycling and low-carbon production methods.

- Middle East and Africa (MEA): MEA represents a significant market, dominated almost entirely by the high demand for clear brine fluids driven by large-scale, complex oil and gas projects in the Arabian Peninsula and offshore Africa. National Oil Companies (NOCs) are major purchasers, prioritizing product reliability and technical service support. While energy storage adoption is nascent, rapidly growing utility demand in regional economic hubs, particularly the UAE and Saudi Arabia, indicates a potential future shift toward ZBB deployment for managing large solar power installations.

- Latin America (LATAM): The LATAM market growth is closely tied to fluctuating oil prices and the pace of deep-water exploration off the coasts of Brazil and Mexico. The need for robust, high-performance CBFs in these complex geological environments sustains a steady demand. Economic stabilization and government policy shifts toward renewable energy in countries like Chile and Brazil suggest an emerging opportunity for energy storage applications, though the O&G sector remains the primary consumer in the near term.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Bromide Solution Market.- Albemarle Corporation

- Solvay S.A.

- LANXESS AG

- Tetra Technologies Inc.

- Great Lakes Chemical Corporation (part of Lanxess)

- Chemtura Corporation (part of Lanxess)

- Halliburton

- Schlumberger Limited

- BASF SE

- ICL Group

- Honeywell International Inc.

- Meridian Specialty Chemicals

- PVS Chemicals Inc.

- Shandong Tianxin Chemical Co. Ltd.

- Jordan Bromine Company

- Compass Minerals

- Kemira Oyj

- SNF Floerger

- Baker Hughes Company

- Dow Chemical Company

Frequently Asked Questions

Analyze common user questions about the Zinc Bromide Solution market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary application driving the demand for high-density zinc bromide solution?

The primary driver is the Oil and Gas sector, where high-density zinc bromide is utilized as Clear Brine Fluid (CBF) during well completion and workover operations to control formation pressure and maintain wellbore stability in deep or high-pressure, high-temperature (HPHT) environments.

How is the adoption of Zinc Bromide Flow Batteries (ZBBs) impacting market growth?

ZBBs are significantly boosting market growth by providing a highly scalable, long-duration energy storage solution suitable for utility-scale grid integration. This application is creating high-volume, long-term demand for zinc bromide electrolyte, diversifying the market beyond the traditional oil and gas reliance.

What are the key differences between zinc bromide and calcium bromide brines?

Zinc bromide solutions offer superior density capabilities (up to 20.0 lb/gal) compared to calcium bromide (maximum 14.2 lb/gal), making zinc bromide necessary for extremely high-pressure wells. However, zinc bromide is generally more expensive and requires specialized handling due to corrosion potential.

Which region is expected to show the fastest growth rate for zinc bromide solutions?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth, primarily due to large-scale government commitments and massive investments in renewable energy infrastructure and grid-scale energy storage projects, particularly in countries like China and India.

What are the main restraints affecting the Zinc Bromide Solution Market?

Major restraints include the inherent volatility and cyclical downturns in the global crude oil and gas market, the high upfront cost of premium-grade zinc bromide solutions, and technological competition from alternative battery storage chemistries and cheaper drilling brines.

This report presents a thorough analysis of the Zinc Bromide Solution Market, detailing the fundamental dynamics, technological shifts, and strategic positioning of key market participants across critical global regions. The expansion is structurally supported by indispensable demands from the deep-water petroleum industry and the pivotal requirements of the rapidly evolving long-duration energy storage sector, particularly driven by global decarbonization mandates. The forecasted CAGR of 6.8% reflects a balanced trajectory, acknowledging both the established revenue streams from oilfield services and the high-potential, disruptive growth expected from flow battery applications. Furthermore, the market landscape is continually being reshaped by stringent environmental regulations and advancements in purification technologies aimed at reducing life-cycle costs and enhancing product performance in electro-chemical systems. Strategic investments in supply chain resilience, focusing on sustainable sourcing of bromine and zinc, are becoming crucial competitive differentiators among leading chemical producers who aim to secure long-term contracts with energy storage system integrators.

Technological innovation remains central to overcoming market restraints. Efforts to engineer non-corrosive, highly stable zinc bromide formulations are paramount for maximizing the operational lifespan of flow batteries, thereby improving the economic viability of utility-scale deployments. Concurrently, in the oil and gas segment, the continuous development of environmentally sound and recyclable clear brine fluid systems is essential for meeting both regulatory compliance and cost efficiency objectives of major international and national oil companies. The competitive ecosystem is characterized by established specialty chemical giants maintaining strong control over supply and quality, increasingly being challenged by specialized energy technology firms focused solely on the electrolyte needs of the burgeoning battery market. This strategic interplay necessitates diversified product portfolios capable of serving technically demanding sectors simultaneously.

The segmentation analysis confirms that while Clear Brine Fluids represent the current revenue mainstay, the Flow Battery segment’s trajectory is poised to become the most influential growth factor toward the latter half of the forecast period. Regional analysis underscores North America’s current revenue leadership, driven by its complex deep-water drilling activities, while identifying Asia Pacific as the pivotal future growth hub, particularly due to its aggressive investment in utility-scale energy storage necessary to support vast renewable energy projects. Effective penetration of the APAC market requires localized production facilities, optimized logistics, and strategic partnerships with local battery integrators and governmental agencies. Ultimately, the future success in the Zinc Bromide Solution Market will depend on the ability of manufacturers to navigate commodity price volatility, maintain superior product purity, and strategically align their offerings with the accelerating transition towards long-duration, reliable energy storage solutions globally.

The impact forces within this market are strongly dictated by macroeconomic factors, specifically the global price per barrel of crude oil, which directly influences the capital expenditure of the upstream oil and gas industry, thus affecting demand for premium brines like zinc bromide. When oil prices are robust, deep-water projects—which inherently require zinc bromide—are prioritized, stimulating demand. Conversely, downturns lead to reduced drilling and workover activity, pressuring chemical suppliers. Simultaneously, governmental policy initiatives related to carbon neutrality and renewable portfolio standards exert a powerful force, creating mandatory demand for grid-scale energy storage solutions, thereby stabilizing and accelerating the growth of the ZBB application segment, which acts as a crucial counter-cyclical stabilizer against the volatility inherent in the fossil fuel industry.

Regulatory frameworks also play a substantial role, particularly concerning the transportation, handling, and environmental disposal of high-density brines. Given that zinc bromide is classified as a hazardous material, adherence to international maritime regulations (IMO) and local environmental protection agency guidelines is non-negotiable, adding complexity and cost to the supply chain. Companies demonstrating superior environmental safety records and offering solutions for brine recycling and reclamation gain a competitive edge. This necessity for compliance further drives technological investment in closed-loop systems and advanced purification techniques, ensuring sustainability while mitigating risks associated with environmental liabilities, strengthening the market position of vertically integrated suppliers capable of managing the full life cycle of the chemical solution from sourcing to end-of-life reclamation.

The evolving technological landscape is creating distinct opportunities for specialization. In the energy sector, the integration of smart monitoring and AI-driven control systems into ZBB operations allows for minute-by-minute optimization of electrolyte usage and battery performance, extending the lifespan and overall efficiency of storage assets. This reliance on digital integration positions chemical manufacturers who can offer high-fidelity data on their product’s electrochemical properties at an advantage. Similarly, within the oilfield chemical sector, the development of integrated fluid management software, utilizing cloud-based analytics, helps operators predict fluid needs more accurately, reducing waste and associated logistical costs, thereby cementing zinc bromide’s role as the preferred fluid for technically challenging well applications due to its reliability and operational superiority over lighter brines.

Furthermore, the competitive dynamic is heavily influenced by intellectual property surrounding flow battery technology. Chemical suppliers who collaborate closely with ZBB developers or hold proprietary licenses for advanced electrolyte additives are better positioned to capture long-term supply contracts. As major utilities commit billions to multi-gigawatt-hour storage projects, the stability, purity, and guaranteed supply chain of the electrolyte become critical contractual terms. This shifts the focus from simple commodity supply to a specialized, performance-driven chemical partnership, raising barriers to entry for smaller or less technologically sophisticated producers and driving consolidation among market leaders to secure essential raw material access and technical expertise.

The market faces ongoing challenges related to raw material sourcing. Bromine production is concentrated geographically, primarily centered around the Dead Sea region and specific brine deposits in the U.S. and China. Geopolitical instability or regulatory changes in these key regions can severely impact global supply chains and increase feedstock costs, directly affecting the final pricing of zinc bromide solutions. Manufacturers must employ robust hedging strategies and diversify their sourcing geographically or through innovative recycling programs to mitigate these risks. Zinc, while more widely available, also sees price fluctuations influenced by global industrial demand and metal refining capacity, necessitating careful contract negotiation and inventory management to maintain profitability margins, especially when serving high-volume, cost-sensitive oilfield contracts.

Customer segmentation confirms the divergence in market demands. Oilfield customers prioritize density, stability, and compatibility with other drilling mud additives, often purchasing in large, immediate batches dictated by project timelines. Conversely, utility and energy storage customers prioritize ultra-high purity, long-term stability (20+ years), and guaranteed high-volume supply over the life of the battery installation, favoring customized long-term supply agreements and requiring extensive technical documentation on electrochemical performance. Addressing both customer profiles requires distinct sales channels, technical support teams, and manufacturing quality control protocols, compelling major players to structure their business units to cater separately to the cyclical demands of upstream oil and gas and the steady, growth-oriented requirements of grid storage infrastructure.

The ongoing trend towards regional self-sufficiency, particularly accelerated by recent global supply disruptions, is forcing manufacturers to evaluate and invest in localized production hubs. While global trade remains essential, the establishment of manufacturing and distribution centers within key consuming regions, such as the U.S. Gulf Coast, the Middle East, and key industrial zones in China, reduces lead times, minimizes transportation costs associated with shipping dense liquids, and enhances responsiveness to regional quality specifications. This localization strategy, while capital intensive initially, acts as a crucial element of risk mitigation and market access, especially within the highly regulated utility and oilfield sectors where local presence is often a prerequisite for major contract eligibility. This shift underscores the increasing importance of decentralized operations for sustaining market growth and customer retention across diverse global markets.

In summary, the Zinc Bromide Solution Market is positioned at an intersection of mature industrial reliance and emerging clean energy innovation. Success in this evolving environment necessitates a strategic balance between maintaining high standards for the traditional, profitability-driven oil and gas sector, and aggressively investing in technological advancements, purity control, and long-term supply agreements crucial for dominating the rapidly scaling flow battery market. The ultimate market size realization depends heavily on overcoming logistical complexities, managing feedstock price volatility, and adapting swiftly to accelerating global regulatory shifts favoring sustainable energy storage deployment over the next decade.

The value chain integrity is increasingly dependent on ethical and sustainable sourcing of bromine, given the growing environmental scrutiny on chemical production. Upstream integration or long-term partnerships with certified bromine suppliers who adhere to strict environmental, social, and governance (ESG) standards are crucial for ensuring the market longevity of the solution, particularly when supplying environmentally conscious European or North American energy companies. Downstream, the specialized handling of zinc bromide requires advanced health, safety, and environment (HSE) protocols during transportation, distribution, and on-site use, necessitating highly trained personnel and dedicated logistical infrastructure, adding another layer of specialization to the distribution process.

Furthermore, the high barrier to entry related to the capital expenditure required for ultra-high purity production facilities and the complex regulatory approval process limits new market entrants, consolidating market power among established global chemical manufacturers. These incumbent players leverage their existing global distribution networks, technical expertise in fluid engineering, and deep relationships within the oil and gas sector to maintain competitive dominance. However, the emergence of niche, innovative startups focusing exclusively on high-performance electrolytes for flow batteries, often backed by venture capital focused on clean energy technology, presents a disruptive force by introducing novel synthesis methods and battery integrations that challenge traditional market incumbents on quality and electrochemical performance, particularly in the energy storage application segment.

The role of regulatory standardization, particularly within the energy storage application, is vital for mass market adoption. As ZBBs gain traction, the need for standardized purity metrics, performance testing protocols, and certification processes for the electrolyte becomes essential to ensure interoperability and reliability across various battery manufacturers and utility grids. Industry collaboration involving chemical suppliers, battery manufacturers, and standards organizations (such as IEC and IEEE) is actively working to define these benchmarks. Compliance with these emerging standards will differentiate premium zinc bromide suppliers, enabling them to command higher pricing and secure larger, standardized supply contracts necessary for utility-scale deployments globally, reinforcing quality as a primary purchasing criterion over mere price competition.

Geopolitical stability directly impacts the flow battery segment's growth potential. Unlike lithium-ion batteries, which rely heavily on geographically concentrated and politically volatile lithium and cobalt supplies, zinc and bromine offer relatively diversified sourcing options, which is a major selling point for national energy security planning. However, concentrated bromine sourcing still poses risks. Therefore, technology and R&D efforts are increasingly focused on developing highly efficient, closed-loop recycling processes for the electrolyte, aiming for near-zero material loss over the battery's lifespan. Successful demonstration of true circular economy principles in electrolyte management will significantly de-risk ZBB deployment for governments and utilities, further accelerating market penetration and solidifying zinc bromide's position as a sustainable long-duration storage chemical.

The analysis of the potential customer base underscores a market requiring dual capabilities: responsiveness to the immediate, project-based demands of drilling operators and the strategic, long-term partnership approach required by utility companies. Serving the Oil & Gas market requires deep operational expertise and quick logistical response times, often providing customized blending services on-site. Serving the Utilities sector demands financial stability, guaranteed decades-long supply commitments, and strict quality assurance protocols related to purity and consistency. This dual requirement dictates that successful market players must either be vertically integrated giants or highly specialized niche providers focusing exclusively on one segment, though the trend favors those capable of cross-segment servicing due to scale and hedging advantages against sectoral cyclicality.

Finally, the long-term characterization of the market trajectory suggests a gradual decoupling from the absolute volatility of the oil and gas sector. While O&G will remain a foundational revenue stream, the increasing financial weight and technological maturity of the energy storage application segment will provide a stable, growing counterbalance. This shift ensures a more resilient and sustained growth curve for the Zinc Bromide Solution Market overall, moving it toward recognition as a critical component in global infrastructure development—both for maximizing hydrocarbon extraction efficiency and for enabling the global energy transition toward renewable sources. Strategic foresight and early investment in high-purity production capabilities are the determining factors for competitive leadership over the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager