Zinc Flake Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436540 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Zinc Flake Market Size

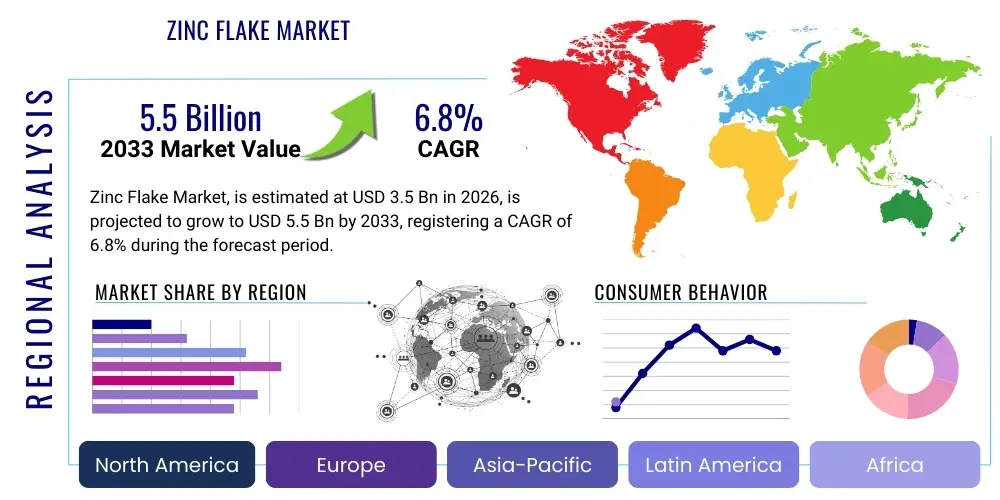

The Zinc Flake Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.5 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by increasing global demand for high-performance anti-corrosion solutions across critical industrial sectors.

Zinc Flake Market introduction

The Zinc Flake Market encompasses the production, distribution, and utilization of finely processed zinc particles characterized by a laminar or platelet-like structure, optimized for use in coating formulations. These specialized pigments are fundamental components in high-performance anti-corrosion systems, most notably in inorganic zinc-rich primers and proprietary chromate-free zinc flake coatings. Their unique geometry allows for efficient electrical contact within the dry coating film, maximizing cathodic protection against aggressive corrosive environments encountered in automotive, construction, and heavy infrastructure applications. The shift away from traditional hot-dip galvanizing towards sustainable, thin-layer anti-corrosion treatments further catalyzes the demand for high-purity zinc flakes.

Zinc flake products are engineered to deliver superior barrier properties and self-healing corrosion resistance. Major applications span the automotive sector, particularly for fastening elements, brake components, and chassis parts, where longevity and resistance to road salts are paramount. Furthermore, they are extensively utilized in construction materials, wind energy infrastructure, and marine environments due to their exceptional durability and compliance with stringent environmental regulations regarding volatile organic compounds (VOCs). The primary benefits derived from using zinc flakes include significantly extended service life of metallic components, reduced maintenance costs, and an environmentally favorable application process compared to electroplating or traditional galvanizing techniques.

Key driving factors propelling market expansion include rapid urbanization and associated infrastructure development in emerging economies, necessitating robust anti-corrosion protection for new bridges, pipelines, and industrial facilities. Moreover, the stringent global standards imposed on corrosion protection in the automotive industry, coupled with the mandatory phase-out of hexavalent chromium in many regions, have created a definitive preference for zinc flake technologies. Continuous innovation in flake morphology and surface treatment, enhancing compatibility with various resin systems, further solidifies the market's growth potential.

Zinc Flake Market Executive Summary

The global Zinc Flake Market exhibits strong growth driven by robust regulatory mandates emphasizing corrosion control and the industrial shift toward chrome-free coating systems. Current business trends indicate a rising focus on ultra-thin coating technologies that utilize optimized flake geometries to maintain protective efficacy while minimizing material usage. Key industry players are heavily investing in R&D to develop finer, higher aspect ratio flakes that improve coating uniformity and overall cathodic efficiency. Furthermore, strategic partnerships between zinc flake manufacturers and major coating formulators are defining the competitive landscape, aiming to integrate material science advancements directly into end-user application processes, thereby streamlining the supply chain and ensuring product customization based on specific substrate and environment requirements.

Regional trends reveal Asia Pacific (APAC) as the fastest-growing market segment, primarily propelled by massive infrastructure investment in China, India, and Southeast Asian nations, alongside the booming automotive manufacturing base in these regions. North America and Europe maintain leading positions in terms of technological adoption and demand for premium, high-specification zinc flake coatings, driven by strict environmental compliance and the need for durable protection in critical infrastructure assets. The Middle East and Africa (MEA) are also emerging as significant markets due to extensive oil and gas exploration activities and corresponding requirements for specialized, anti-corrosion coating solutions capable of withstanding harsh desert and coastal conditions. The regulatory landscape in Europe, particularly concerning REACH compliance, continues to steer product innovation towards safer and more sustainable formulations.

Segmentation analysis highlights the superior performance of coatings based on material type, with powder coatings and waterborne systems gaining prominence over solvent-borne variants, aligning with VOC reduction goals. In terms of application, the automotive segment dominates market share, primarily due to the widespread adoption of zinc flake coatings for ensuring the integrity of critical fasteners and components. However, the construction and industrial machinery segments are poised for rapid acceleration, fueled by the demand for long-lasting protective finishes on exposed structural steel and heavy equipment. The trend toward customized flake sizes tailored for specific deposition techniques (e.g., dip-spin versus spray application) represents a significant segmentation trend, optimizing performance characteristics such as coverage rate and adhesion strength across diverse industrial processes.

AI Impact Analysis on Zinc Flake Market

Common user questions regarding the impact of AI on the Zinc Flake Market frequently center on themes such as predictive maintenance of coating performance, optimization of manufacturing processes, and AI-driven quality control of flake morphology. Users are concerned about how AI can enhance the consistency of particle size distribution, which is critical for coating efficiency. There is also significant interest in leveraging machine learning to predict the long-term corrosion performance of zinc flake coatings under varying environmental stressors, thereby reducing the need for costly and time-consuming physical accelerated weathering tests. The overall expectation is that AI will dramatically increase production efficiency, reduce waste, and accelerate the discovery of new, complex zinc alloy flake compositions tailored for extreme operating conditions. Furthermore, questions arise regarding AI’s role in optimizing logistics and supply chain management for raw zinc material and finished flakes, ensuring timely and cost-effective delivery to global coating formulators amidst fluctuating commodity prices.

- AI optimizes the synthesis process, employing predictive models to control reaction parameters, ensuring consistent flake aspect ratios and particle size distribution (PSD), leading to higher quality batches.

- Machine learning algorithms analyze coating process data (e.g., dip-spin speeds, curing temperatures) to minimize defects, resulting in improved adhesion and uniform film thickness in end-user applications.

- Predictive analytics monitors the performance of applied zinc flake coatings in real-time infrastructure, anticipating corrosion failure points and enabling proactive maintenance scheduling, extending asset life.

- AI-powered simulation tools rapidly model the efficacy of novel zinc alloy or composite flakes, drastically cutting down the time required for product development and material qualification.

- Automated visual inspection systems, powered by deep learning, perform high-throughput quality control on manufactured flakes, identifying morphological imperfections invisible to traditional methods.

- Intelligent inventory management systems use AI to forecast demand fluctuations across automotive and construction sectors, optimizing raw material procurement (zinc ingot) to mitigate price volatility risks.

DRO & Impact Forces Of Zinc Flake Market

The Zinc Flake Market is primarily driven by the imperative need for long-term corrosion protection in critical infrastructure and the automotive industry, compounded by global regulations mandating the phase-out of toxic heavy metals, particularly hexavalent chromium. Key opportunities lie in developing highly specialized, customized flake systems for niche applications like high-temperature environments (e.g., engines, exhaust systems) and composite coatings incorporating nanotechnology to further enhance barrier properties. However, the market faces significant restraints, chiefly the inherent volatility of zinc commodity prices, which directly impacts the production cost of zinc flakes and thus the final coating price. Furthermore, the stringent technical requirements for application processes—such as precise surface preparation and curing protocols—present a barrier to entry for smaller coating applicators, slightly tempering overall market expansion. Despite these challenges, the overwhelming global consensus on extending asset life and reducing maintenance costs provides a sustained impetus for market growth.

The principal impact force shaping the market is technological substitution risk; while zinc flakes currently dominate the high-performance chrome-free coating segment, continuous research into alternative metallic or ceramic-based anti-corrosion pigments poses a potential long-term threat. Conversely, the market is significantly amplified by the regulatory environment, particularly in industrialized regions like the EU and North America, where legislation like the RoHS Directive reinforces the necessity of non-toxic protective solutions, favoring zinc flake formulations. The bargaining power of buyers, especially large automotive OEMs, remains high, necessitating continuous innovation in cost-effective, high-efficiency products from zinc flake producers. This dynamic equilibrium between regulatory pull, commodity volatility, and technological innovation defines the competitive structure of the market.

Demand for infrastructure resilience in coastal and highly industrialized areas, coupled with the increasing complexity of modern vehicles, drives the need for multi-layered protection systems where zinc flakes are foundational. The opportunity to penetrate non-traditional markets, such as aerospace fasteners and medical device components requiring thin, robust anti-corrosion layers, presents avenues for specialized high-margin product development. Addressing the supply chain vulnerability related to zinc sourcing through diversification and backward integration remains a critical strategic priority for major market participants. Successfully navigating these impact forces—leveraging regulatory tailwinds while mitigating material cost risks—will determine sustainable profitability in the coming forecast period.

- Drivers: Stricter environmental regulations banning chrome-based coatings (e.g., EU ELV, RoHS), accelerating demand for chrome-free zinc flake systems.

- Drivers: Rapid growth in global automotive production and the necessity for superior corrosion resistance in vehicle components (fasteners, brakes, chassis).

- Drivers: Increasing investment in infrastructure projects (bridges, tunnels, pipelines) requiring long-life, robust anti-corrosion coatings in harsh environments.

- Restraints: High volatility and fluctuating prices of raw zinc metal, impacting manufacturing costs and profitability margins.

- Restraints: Requirement for specialized application equipment and strict process control (e.g., dip-spin technology) which limits widespread adoption by smaller firms.

- Opportunity: Development of innovative composite zinc flakes incorporating graphene or silicates to enhance electrical conductivity and barrier performance.

- Opportunity: Expansion into developing economies (APAC, Latin America) where industrialization is surging and reliable corrosion protection solutions are highly sought after.

- Impact Force - Regulatory Pressure: Extremely high, favoring non-toxic, sustainable solutions like zinc flakes over traditional plating.

- Impact Force - Raw Material Volatility: High, necessitating sophisticated risk management and supply chain contracts to buffer price swings.

- Impact Force - Substitution Threat: Moderate, as alternative materials like aluminum flakes or new polymers are continuously evaluated, though zinc remains the gold standard for cathodic protection.

Segmentation Analysis

The Zinc Flake Market segmentation is crucial for understanding specific consumer needs and technological requirements across various industries. Segmentation by material type predominantly covers pure zinc flakes and zinc alloy flakes, the latter incorporating elements like aluminum or magnesium to enhance performance characteristics such as galvanic activity and coating hardness. Segmentation by application method distinguishes between coatings designed for dip-spin processes, which are popular for mass treatment of fasteners, and those formulated for spray application, typically used for larger structural components. Furthermore, the segmentation by end-use industry highlights the critical dependence of the market on automotive, followed by general industrial and construction sectors, each demanding tailored product specifications.

The differentiation between pure zinc and zinc alloy flakes directly impacts the price and performance profile. Pure zinc flakes offer excellent basic cathodic protection, serving as sacrificial anodes to the underlying steel substrate. Conversely, zinc alloy flakes are engineered to balance corrosion resistance, especially in chloride-rich environments, with improved mechanical properties, making them suitable for high-stress applications. The increasing preference for alloy flakes reflects the industry’s need for coatings that not only prevent rust but also withstand abrasion and stone chipping, particularly relevant in modern vehicle manufacturing where components are exposed to continuous mechanical and environmental wear.

The growth dynamics within segments are heavily influenced by environmental legislation. The push towards water-based and solvent-free coating systems represents a significant shift within the formulation segment, driving innovation in dispersing agents and stabilizing additives compatible with these low-VOC carriers. While solvent-borne coatings still hold historical market share, their growth is tempered by tightening environmental regulations worldwide. The future market is expected to be increasingly dominated by optimized flake formulations that integrate seamlessly into environmentally compliant coating matrices, catering specifically to the high-volume needs of global automotive production lines.

- By Material Type:

- Pure Zinc Flakes

- Zinc Alloy Flakes (e.g., Zn-Al, Zn-Mg)

- By Coating Formulation:

- Solvent-borne Coatings

- Water-borne Coatings

- Powder Coatings

- By Application Method:

- Dip-Spin Coatings

- Spray Coatings

- Dip-Drain Coatings

- By End-Use Industry:

- Automotive (Fasteners, Brakes, Chassis)

- Construction and Infrastructure (Structural Steel, Bridges)

- Industrial Machinery and Equipment

- Oil & Gas and Marine

- Wind Energy and Power Generation

Value Chain Analysis For Zinc Flake Market

The value chain of the Zinc Flake Market begins with the upstream segment, dominated by the mining and refining of primary zinc metal, which is then processed into high-purity zinc ingots. This stage is highly capital-intensive and subject to global commodity price fluctuations. Key players in this phase include large-scale metallurgical enterprises. The subsequent critical step involves the specialized manufacturing of zinc flakes, requiring sophisticated atomization or mechanical milling processes to achieve the desired laminar morphology and tight particle size distribution. Flake manufacturers add value through proprietary surface treatments and passivation steps, ensuring the flakes are stable and chemically receptive to various coating binders, thus transitioning the product from a commodity metal to a specialized chemical pigment.

The midstream segment involves the coating formulators, who purchase the zinc flakes and blend them with resins, solvents (or water), and additives to create proprietary zinc-rich primer and topcoat systems. These formulators play a crucial role in optimizing the coating viscosity, storage stability, and application characteristics tailored for specific industrial processes like dip-spin or automated spraying. Distribution channels are bifurcated: direct distribution is common for large-volume sales to tier-one automotive suppliers or major infrastructure projects, offering personalized technical support and bulk delivery. Indirect distribution relies on specialized chemical distributors and regional agents, particularly for servicing smaller industrial painting houses and localized construction firms, providing accessible inventory and localized technical support.

The downstream segment culminates in the final application of the zinc flake coating onto metal substrates, typically carried out by certified industrial coaters or in-house facilities of Original Equipment Manufacturers (OEMs), particularly in the automotive and heavy machinery industries. The quality of this final step is paramount, as application technique profoundly influences the protective performance. End-users, such as automotive companies and civil engineering firms, determine the demand volume and technical specifications, often driving innovation back up the chain by demanding higher corrosion resistance and improved environmental profiles. The efficiency of the distribution network, ensuring timely supply of freshly formulated coatings, is essential to maintaining material performance, as some formulations have limited pot life.

Zinc Flake Market Potential Customers

The primary consumers of zinc flake products are coating formulators and specialized industrial applicators who serve various manufacturing sectors. These customers purchase zinc flakes as a critical pigment to produce proprietary anti-corrosion paints and primers, which are then applied to metallic components. The largest segment of end-users are Original Equipment Manufacturers (OEMs) in the automotive industry, who rely heavily on these coatings for crucial components such as bolts, nuts, springs, brake rotors, and exhaust systems, demanding long-term durability and compliance with strict automotive specifications like those established by globally recognized standards bodies. They are intensely focused on quality control and batch consistency, driving procurement decisions based on performance guarantees and global supply capability.

Another significant customer base exists within the construction and infrastructure sector, including structural steel fabricators, bridge builders, and pipeline operators. These entities require coatings that can endure decades of exposure to harsh weather, chemical agents, and abrasive environments, utilizing zinc flake coatings on large structural elements. Procurement decisions here are often guided by long-term cost-of-ownership analysis, prioritizing coatings that minimize maintenance cycles. Furthermore, the wind energy sector represents a rapidly expanding customer group, utilizing specialized coatings for turbine towers and foundational elements to protect against coastal corrosion and severe atmospheric exposure, requiring high film thickness and robust adhesion characteristics.

In addition to these major sectors, potential customers include manufacturers of heavy industrial machinery (e.g., agricultural equipment, mining vehicles), utilities companies (for transmission towers and switchgear), and marine engineering firms (for components exposed to saltwater). These diverse end-users emphasize customization, seeking zinc flake formulations that optimize protection based on specific operational parameters, such as high-temperature tolerance or resistance to specific chemical spills. The purchasing decision for all potential customers is increasingly influenced by the sustainability profile of the product, favoring chrome-free, low-VOC formulations that utilize advanced zinc flake technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dörken MKS-Systeme GmbH & Co. KG, NOF Metal Coatings Group, Atotech Deutschland GmbH (now MacDermid Enthone), Jinhai Zinc Flake Co., Ltd., TOYO Advanced Material Co., Ltd., Chem-Stone Technology Co., Ltd., Magni Group, Inc., Valspar Corporation (Sherwin-Williams), Henkel AG & Co. KGaA, PPG Industries, Akzo Nobel N.V., Zinga Metall AS, Nippon Paint Holdings Co., Ltd., Beckers Group, KC Cottrell Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Flake Market Key Technology Landscape

The technological landscape of the Zinc Flake Market is characterized by continuous refinement in particle engineering and formulation chemistry aimed at maximizing corrosion protection efficiency while minimizing environmental impact. Key advancements revolve around the methods used to produce the flakes, primarily the chemical vapor deposition (CVD) and mechanical pulverization techniques, which are constantly optimized to achieve a higher aspect ratio (length to thickness) and smoother surface finish. A higher aspect ratio is critical as it enables better alignment of flakes within the coating film, creating a tortuous path for corrosive agents and enhancing the cathodic protection effectiveness. Furthermore, surface treatment technologies involving proprietary passivating agents are essential to prevent premature reaction of the highly active zinc surface before application and to improve compatibility with water-borne resin systems.

A major area of innovation is the development of zinc alloy flakes, specifically incorporating elements like aluminum, magnesium, and rare earth metals. These alloys are designed to provide synergistic protection mechanisms, improving resistance in highly aggressive environments, such as those exposed to road de-icing salts or marine air. For instance, Zn-Al alloy flakes demonstrate prolonged protection lifespan compared to pure zinc in certain industrial settings. Coupled with material science advancements, application technology, particularly automated high-efficiency dip-spin systems, has evolved to ensure uniform coverage, especially for complex geometries like threaded fasteners, guaranteeing minimal waste and superior film build control, which is crucial for meeting stringent automotive industry standards regarding dimensional tolerance.

Future technological advancements are focused on creating nano-structured zinc flakes or incorporating composite materials like graphene or carbon nanotubes into the flake matrix. This integration aims to enhance electrical conductivity throughout the coating film, boosting the efficiency of sacrificial protection and increasing the mechanical robustness of the resulting layer. Furthermore, smart coating technologies, where the zinc flake system is designed to release inhibitors in response to environmental triggers, are emerging as high-value, next-generation products. These innovations ensure the Zinc Flake Market remains at the forefront of anti-corrosion technology, offering solutions that are environmentally compliant, highly effective, and economically viable for mass industrial application.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by extensive infrastructure investment in China, India, and Southeast Asian nations. The region’s explosive growth in the automotive manufacturing sector, coupled with massive expenditures on bridges, ports, and renewable energy facilities, drives exceptional demand for protective coatings. Adoption of advanced zinc flake technology is accelerating due to increasing regulatory pressure to shift away from traditional, less environmentally friendly plating methods.

- Europe: Europe is characterized by stringent environmental regulations (e.g., REACH and ELV directives) which have strongly favored the early and widespread adoption of chrome-free zinc flake systems. The region is a technological leader, housing several key R&D centers and major zinc flake manufacturers. High consumption is sustained by the sophisticated European automotive industry, requiring premium, high-performance coatings for luxury and high-end vehicle components, ensuring maximum longevity under severe weather conditions.

- North America: The North American market maintains a mature demand profile, driven by the need to maintain and rehabilitate aging infrastructure, including major highway systems and water treatment plants. The rigorous demands of the US automotive and heavy machinery manufacturing base, requiring highly durable and reliable anti-corrosion protection, anchor the market. Strict quality standards and performance specifications imposed by federal and state agencies ensure a continued reliance on certified, high-grade zinc flake products.

- Latin America (LATAM): The LATAM market is experiencing moderate growth, linked closely to fluctuations in commodity prices and industrial investment cycles in Brazil, Mexico, and Argentina. Expanding domestic vehicle production and necessary improvements in oil and gas infrastructure demand functional anti-corrosion solutions. Market expansion is contingent on regulatory harmonization and increased industrialization, providing a growing runway for zinc flake adoption as an upgrade from conventional galvanizing methods.

- Middle East and Africa (MEA): The MEA region is a specialized market focusing heavily on the Oil & Gas, petrochemical, and construction sectors. Demand is driven by the necessity for coatings capable of withstanding extremely harsh, high-temperature, and saline desert/coastal environments. Major infrastructure projects and industrial maintenance requirements in Saudi Arabia, UAE, and Qatar necessitate robust, high-specification zinc flake coatings for long-term asset protection, favoring products with enhanced barrier properties.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Flake Market.- Dörken MKS-Systeme GmbH & Co. KG

- NOF Metal Coatings Group

- Atotech Deutschland GmbH (now part of MacDermid Enthone Industrial Solutions)

- Jinhai Zinc Flake Co., Ltd.

- TOYO Advanced Material Co., Ltd.

- Chem-Stone Technology Co., Ltd.

- The Magni Group, Inc.

- Valspar Corporation (a subsidiary of Sherwin-Williams)

- Henkel AG & Co. KGaA

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Zinga Metall AS

- Nippon Paint Holdings Co., Ltd.

- Beckers Group

- KC Cottrell Co., Ltd.

- Wacker Chemie AG

- BASF SE

- Hempel A/S

- KCC Corporation

- Jotun A/S

Frequently Asked Questions

Analyze common user questions about the Zinc Flake market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of zinc flakes in industrial coatings?

The primary function of zinc flakes in industrial coatings is to provide exceptional cathodic (sacrificial) corrosion protection to the underlying steel substrate. Due to their laminar geometry and high purity, the flakes align parallel within the coating film, forming an electrically conductive network. When the coating is scratched or damaged, the zinc flakes corrode preferentially instead of the steel, effectively protecting the component and extending its service life significantly beyond that achieved by standard paints or traditional galvanizing techniques, particularly in highly corrosive environments like those found in marine or road salt exposure.

How do zinc flake coatings compare environmentally to traditional methods like electroplating?

Zinc flake coatings offer superior environmental performance compared to traditional methods such as electroplating or hot-dip galvanizing, particularly concerning hazardous substances. Most modern zinc flake systems are chrome-free, eliminating the use of toxic hexavalent chromium (Cr VI), aligning with global regulations like REACH and RoHS. Furthermore, the application processes, such as dip-spin, are often closed-loop systems, minimizing waste and avoiding the large volumes of hazardous wastewater typically associated with electroplating baths, thus making them the preferred sustainable choice for corrosion protection in the automotive and general industrial sectors seeking low-VOC and chrome-free solutions.

Which end-use industry drives the highest demand for zinc flake products globally?

The automotive industry is the dominant end-use sector driving the highest global demand for zinc flake products. Zinc flake coatings are indispensable for protecting critical safety and functional components such as fasteners, brake calipers, springs, and chassis elements. Automotive OEMs mandate the use of these specialized coatings because they provide excellent anti-corrosion properties without causing hydrogen embrittlement, a significant risk associated with traditional electroplating processes on high-strength steel parts. The stringent quality and durability requirements in vehicle manufacturing necessitate the consistent performance offered by optimized zinc flake formulations.

What are the key technical differences between pure zinc flakes and zinc alloy flakes?

The key technical difference lies in the protective performance profile achieved through composition. Pure zinc flakes offer robust standard cathodic protection. Zinc alloy flakes, typically incorporating aluminum or magnesium, are engineered to provide enhanced, synergistic protection. The inclusion of these alloying elements often leads to the formation of denser, more stable passive layers when exposed to aggressive media (like chlorides), thereby prolonging the sacrificial action and offering superior long-term corrosion resistance, especially suitable for extremely harsh environments such as marine exposure or components subject to concentrated de-icing agents.

How does the volatile price of raw zinc metal impact the zinc flake market?

The volatile price of raw zinc metal significantly impacts the zinc flake market as zinc is the primary constituent material. Since the market price of zinc is tied to global commodity exchanges, fluctuations directly influence the production costs for manufacturers and the final price of the finished coating systems. High raw material volatility necessitates sophisticated hedging and procurement strategies by major flake producers to stabilize pricing for coating formulators. While strong demand often allows price increases to be passed on to end-users, prolonged volatility can lead to margin compression or prompt end-users to seek alternative, potentially non-zinc-based corrosion protection methods, affecting long-term market stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Zinc Flake Market Size Report By Type (Particle size<15μm, 15μm≤Particle size≤20μm, Particle size>20μm), By Application (Automotive Application, Mechanical Application, Wind Electric Application, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Zinc Flake Market Statistics 2025 Analysis By Application (Automotive Application, Mechanical Application, Wind Electric Application), By Type (Particle size?15?m, 15?m?Particle size?20?m, Particle size?20?m), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager