Zinc Nickel Alloy Plating Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435735 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Zinc Nickel Alloy Plating Market Size

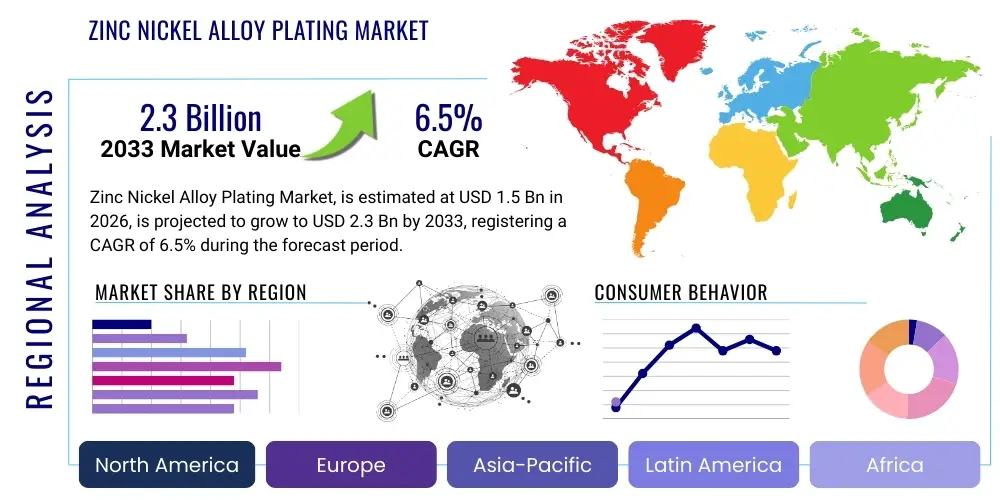

The Zinc Nickel Alloy Plating Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Zinc Nickel Alloy Plating Market introduction

The Zinc Nickel (Zn-Ni) Alloy Plating Market encompasses the production and application of electrodeposited coatings that offer superior corrosion protection compared to traditional zinc coatings. This alloy system, typically containing 5% to 8% nickel content, is widely recognized for its ability to provide exceptional resistance to red rust and white corrosion, particularly in harsh environments involving high temperatures or exposure to road salts and industrial chemicals. The primary product is the deposited metallic layer applied to ferrous substrates, enhancing their durability and extending the lifespan of critical components across various heavy-duty industries. The fundamental shift driving this market is the stringent regulatory requirement for enhanced component longevity and the phasing out of hazardous plating substances like cadmium.

Major applications of Zn-Ni plating span across the automotive, aerospace, industrial machinery, and construction sectors. In the automotive industry, it is essential for brake systems, chassis components, fasteners, and engine parts, where component reliability is paramount. Its low hydrogen embrittlement properties make it particularly suitable for high-strength steel fasteners, mitigating the risk of premature failure. This technical advantage has positioned Zn-Ni as the preferred surface treatment over traditional zinc and even some cadmium alternatives, especially as vehicle manufacturers increase warranty periods and demand parts that can withstand severe climatic conditions. The market introduction phase was characterized by adopting alkaline non-cyanide baths, which offer better distribution and lower environmental impact than acidic or cyanide-based systems.

The primary benefits driving market expansion include unparalleled galvanic corrosion resistance, enhanced thermal stability, and compliance with key environmental directives such as RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). The driving factors include the rapid electrification of the automotive fleet, which necessitates corrosion-resistant coatings for high-voltage connectors and battery casings, and the increasing global demand for high-performance industrial equipment requiring minimal maintenance. Furthermore, the robust growth in infrastructure development globally, particularly in harsh coastal or highly polluted industrial zones, continuously fuels the need for resilient metallic coatings like zinc-nickel alloys.

Zinc Nickel Alloy Plating Market Executive Summary

The Zinc Nickel Alloy Plating Market is experiencing robust expansion driven primarily by critical shifts in the automotive and aerospace manufacturing paradigms. Business trends indicate a strong move towards environmentally compliant plating processes, with key players investing heavily in alkaline Zn-Ni baths to meet global regulatory standards while optimizing process efficiency and throughput. Consolidation activity, particularly through strategic mergers and acquisitions among major chemical and plating service providers, is characterizing the competitive landscape, aiming to achieve economies of scale and expand geographical service coverage. Furthermore, the rising cost volatility of key raw materials, specifically nickel, is prompting innovation in lower-nickel-content formulations that still meet strict performance specifications, signaling a trend toward material optimization and supply chain resilience.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, is dominating growth, fueled by massive domestic automotive production and rapid industrialization demanding advanced corrosion control solutions. North America and Europe maintain significant market shares due to stringent regulatory frameworks mandating the use of high-performance, non-toxic alternatives to legacy coatings, pushing the adoption rate in critical applications such as military and aerospace components. The European market, in particular, is witnessing intense technological uptake concerning trivalent chromium passivation, which complements Zn-Ni deposits, ensuring maximum long-term protection and aesthetic appeal, thereby solidifying its position in the premium segment of the market.

Segment trends reveal that the Automotive segment remains the largest end-user, but the industrial machinery and construction segments are demonstrating the fastest growth rates, driven by global capital investment cycles. Based on type, the alkaline plating bath segment holds prominence due to its superior throwing power and reduced hazard profile compared to acidic systems. The emphasis on sustainability and energy efficiency in plating operations is also fueling the demand for continuous reel-to-reel plating lines that utilize Zn-Ni alloys, offering high volume and consistent quality crucial for electronic component manufacturing and specialized fasteners, thus reinforcing the overall market segmentation dynamics.

AI Impact Analysis on Zinc Nickel Alloy Plating Market

Common user questions regarding AI's impact on the Zinc Nickel Alloy Plating Market frequently revolve around optimizing plating bath chemistry, predicting coating thickness consistency, and automating quality control processes to reduce waste and human error. Users are concerned about how AI-driven predictive maintenance could affect the required frequency of chemical analysis and adjustments, seeking quantification of efficiency gains. Key themes include the implementation of machine learning for real-time process control, leveraging large datasets from plating rectifiers and bath analyzers to preemptively address variations in alloy composition or current density. Expectations are high that AI will lead to a new generation of smart plating lines capable of self-correction, significantly reducing operational costs, minimizing reject rates, and ensuring the complex specifications required by high-reliability sectors like aerospace are consistently met, potentially transforming the labor-intensive quality assurance protocols currently in place.

- Real-time process optimization: AI algorithms monitor bath temperature, pH, metal concentration, and current density to maintain optimal plating parameters, minimizing variation in nickel content and thickness.

- Predictive maintenance: Machine learning models forecast equipment failure (e.g., pump degradation, rectifier anomalies) and predict the optimal time for bath replenishment or filtration, maximizing uptime.

- Automated quality control (AQC): Integration of vision systems and deep learning to inspect plated parts for cosmetic defects, pitting, or thickness deviations faster and more accurately than human operators.

- Supply chain resilience: AI analyzes raw material price fluctuations and sourcing risks (especially nickel) to provide procurement strategies and optimize inventory levels for plating chemicals.

- Digital twin simulation: Creation of virtual representations of plating lines to test different operational scenarios, optimize rack design, and improve current distribution without disrupting physical production.

- Energy consumption optimization: Use of neural networks to modulate rectifier output based on load patterns, minimizing energy consumption while maintaining required deposition rates and quality.

DRO & Impact Forces Of Zinc Nickel Alloy Plating Market

The Zinc Nickel Alloy Plating Market is fundamentally shaped by powerful driving forces centered on regulatory adherence and technical performance superiority, counterbalanced by significant restraints related to capital intensity and raw material pricing. The primary drivers include the mandatory shift away from carcinogenic coatings like cadmium and hexavalent chromium, propelled by global legislations like ELV, RoHS, and REACH, compelling industries, particularly automotive OEMs, to adopt Zn-Ni. Opportunities lie prominently in the burgeoning Electric Vehicle (EV) sector, where the critical demand for durable, thermally stable, and corrosion-resistant coatings for battery components and high-power connectors presents a major market avenue. However, the high initial investment required for sophisticated plating equipment and chemical management systems acts as a formidable restraint, especially for smaller market players, alongside the volatile pricing and supply chain risks associated with nickel, which directly impacts operational costs and long-term financial planning, creating a complex risk-reward profile for market expansion.

The impact forces influencing this market are predominantly high on the demand side and moderate on the supply side. Increased consumer expectations for product longevity and the subsequent extended warranty periods offered by manufacturers exert strong upward pressure on the demand for premium coatings like Zn-Ni. Technological substitution remains a latent threat, as advancements in ceramic coatings or high-performance polymers could potentially challenge Zn-Ni in specific low-friction or extreme temperature applications, though currently, Zn-Ni maintains a cost-performance advantage in galvanic protection. The bargaining power of major buyers (Tier 1 automotive suppliers and major aerospace companies) is substantial, driving down pricing and demanding continuous process improvement, while the environmental regulatory framework acts as a critical external force dictating technology adoption pathways and accelerating the obsolescence of older, non-compliant plating lines across the globe.

The market’s intrinsic opportunity profile is further enhanced by geographical expansion into developing economies that are rapidly adopting Western manufacturing standards and quality control protocols. The growing industrial base in Southeast Asia and Latin America represents untapped potential for specialized plating service providers offering Zn-Ni solutions. Conversely, the market must navigate the inherent technical challenge of maintaining tight nickel percentage consistency (typically 5-8%) across complex parts, which requires stringent chemical analysis and sophisticated process monitoring, thus limiting the ease of entry for new plating shops. This dynamic interplay of high performance-driven demand and high regulatory compliance costs defines the competitive environment and investment landscape for the forecast period.

Segmentation Analysis

The Zinc Nickel Alloy Plating Market is meticulously segmented based on end-use industry, plating process type (bath chemistry), and component material, reflecting the diversity of applications and technical requirements globally. The end-use segmentation is crucial, differentiating high-volume, cost-sensitive sectors like Automotive from high-specification, low-volume sectors such as Aerospace and Defense. The process type segmentation, focusing on alkaline versus acidic baths, highlights the technological choices made by plating companies, with alkaline systems generally preferred for their superior metal distribution and environmental characteristics. This segmentation analysis provides stakeholders with a clear framework to assess market penetration strategies, identify high-growth niches, and tailor their chemical formulations and service offerings to meet precise industry standards and geographical regulatory requirements.

- By Plating Bath Type:

- Alkaline Zinc Nickel Plating

- Acidic Zinc Nickel Plating

- By End-Use Industry:

- Automotive (Fasteners, Brakes, Chassis, Powertrain)

- Aerospace and Defense (Actuators, Landing Gear Components)

- Construction and Infrastructure (Structural Fasteners, Pipe Connectors)

- Industrial Machinery (Hydraulic components, Pumps, Valves)

- Electrical and Electronics (Connectors, Housings)

- By Plating Method:

- Rack Plating

- Barrel Plating

- Continuous (Reel-to-Reel) Plating

- By Component Material:

- Steel Alloys (High-Strength Steel)

- Cast Iron

- Other Ferrous Metals

Value Chain Analysis For Zinc Nickel Alloy Plating Market

The value chain for the Zinc Nickel Alloy Plating Market commences with upstream raw material suppliers, predominantly chemical manufacturers providing zinc anodes, nickel salts (sulfates, chlorides), complexing agents, brighteners, and additives essential for maintaining bath stability and performance. This upstream phase is characterized by intense focus on purity and consistent supply, as any variation in chemical quality directly impacts the corrosion resistance and appearance of the final plating. Key suppliers often have specialized chemical expertise and proprietary formulations, creating barriers to entry. The pricing power in the upstream segment is moderate, heavily influenced by global commodity markets for zinc and nickel, making supply chain resilience a critical competitive factor for subsequent market players.

The midstream segment involves the plating solution providers and chemical formulators (Tier 2 suppliers) who develop, sell, and service the proprietary plating processes (e.g., specific alkaline or acidic bath chemistries). These companies also offer technical support and analytical services to plating job shops. Following this, the core activity is the plating process itself, performed by captive plating facilities (owned by OEMs) or, more commonly, specialized independent job shop platers. These job shops operate sophisticated machinery, including automated plating lines, rectifiers, and waste treatment systems, managing highly regulated processes. Their success depends on process control (ensuring precise alloy composition and thickness), capacity utilization, and adherence to complex customer specifications (e.g., salt spray hours, friction coefficients).

Downstream distribution channels primarily involve direct sales and service agreements between the job shop platers and the final end-users (OEMs or Tier 1 suppliers in automotive, aerospace, etc.). Due to the technical nature and high quality assurance requirements of the plated parts, especially in automotive, indirect distribution through generalized chemical distributors is less common for the finished components. Direct relationships allow for rigorous quality auditing and immediate feedback loops regarding component performance and compliance. Potential customers often dictate the choice of plating process and chemistry, ensuring that the entire value chain is focused on delivering a high-reliability coating that minimizes the risk of component failure in the field.

Zinc Nickel Alloy Plating Market Potential Customers

The primary potential customers and end-users of Zinc Nickel Alloy Plating are large-scale manufacturers and their critical Tier 1 suppliers operating in environments where component failure due to corrosion or hydrogen embrittlement is unacceptable. The most significant buying segment is the Automotive industry, encompassing Original Equipment Manufacturers (OEMs) and their network of component suppliers responsible for manufacturing safety-critical parts such as braking systems, steering assemblies, fuel lines, chassis fasteners, and, increasingly, battery enclosures and electrical connectors for Electric Vehicles (EVs). These customers require high-volume, consistently high-quality plating services that meet specific corrosion standards (e.g., ISO 9227) and environmental mandates.

Another crucial customer segment is the Aerospace and Defense industry, where performance specifications are significantly more stringent, focusing on coatings for hydraulic components, structural fasteners, and landing gear assemblies. In this sector, the low hydrogen embrittlement characteristics of Zn-Ni are highly valued, making it a critical replacement for legacy cadmium coatings. These buyers prioritize reliability and traceability, often demanding multi-year performance guarantees and detailed process documentation. The buying process in this segment is highly regulated and necessitates approvals for specific plating vendors and proprietary chemistries.

Beyond these primary sectors, heavy industrial machinery manufacturers (for earthmoving equipment, agricultural machinery, and mining equipment) constitute substantial buyers, seeking robust coatings that can withstand extreme wear and environmental exposure, including moisture, dirt, and chemical attack. Finally, infrastructure and construction end-users, including suppliers of structural steel fasteners, pipe clamps, and hardware used in bridges and public works, represent a continuously growing demand pool, driven by the global need for infrastructure longevity and reduced maintenance costs in corrosive atmospheres like marine and coastal environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atotech (MKS Instruments), Coventya (Element Solutions Inc), Enthone (MacDermid), Columbia Chemical, Technic Inc., Ronatec, JCU Corporation, Sarrel Group, Asterion LLC, EPI Electrochemical Products, Aalberts Surface Treatment, Plating Specialties, Inc., ZINQ Galvanizing, C. Uyemura & Co., Ltd., Chemetall (BASF), Dipsol Chemicals Co., Ltd., Jettec Technologies, Keystone Plating, Apex Plating, KC Jones Plating Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Nickel Alloy Plating Market Key Technology Landscape

The core technology in the Zinc Nickel Alloy Plating market revolves around advanced electrochemical processes designed to control the codeposition of zinc and nickel metals with high precision, typically targeting a nickel content of 5-8% for optimal performance. Key innovations are centered on moving away from hazardous cyanide and hexavalent chromium processes, leading to the dominance of alkaline non-cyanide Zn-Ni baths. Alkaline technology offers superior throwing power, ensuring uniform coating thickness even on complex geometries and deep recesses, which is crucial for fasteners and intricate hydraulic components. Furthermore, the development of sophisticated rectifier controls and pulsed current technologies allows platers to fine-tune the metallurgical structure of the alloy, enhancing both corrosion resistance and aesthetic finish, thus supporting the stringent quality requirements of major OEMs globally.

A significant area of technological focus is the development of post-treatment passivation layers, specifically trivalent chromium passivation (TCP). Zn-Ni deposits require a supplementary passivation layer to further enhance resistance to white rust and red rust, and the adoption of TCP systems is nearly universal due to the regulatory phase-out of hexavalent chromium. Manufacturers are concentrating on developing TCP layers that are thin, highly durable, and compatible with various topcoats or sealers, providing extended salt spray performance (often exceeding 1,000 hours to red rust) as demanded by automotive specifications. Advanced analytical tools, such as X-ray fluorescence (XRF) spectroscopy, are integral to the process landscape, enabling rapid, non-destructive measurement of coating thickness and alloy composition to ensure consistent quality throughout high-volume production runs.

Furthermore, technology related to environmental sustainability and process efficiency is gaining traction. This includes sophisticated filtration and ion exchange systems for efficient bath maintenance and minimizing the discharge of heavy metals. Plating equipment manufacturers are innovating automated, closed-loop systems that reduce chemical consumption and labor inputs. Continuous reel-to-reel plating technology is also evolving rapidly, particularly for small electronic components and high-volume fasteners, maximizing throughput while ensuring uniformity. The integration of sensors and process control software, often leveraging AI and IoT platforms, represents the next frontier, enabling predictive process adjustments and further reducing the total cost of ownership for plating facilities worldwide.

Regional Highlights

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily driven by massive automotive manufacturing hubs in China, India, Japan, and South Korea. Rapid industrialization and heavy investment in infrastructure, combined with increasing adoption of global environmental standards, accelerate the demand for high-performance Zn-Ni plating, especially in high-volume, cost-competitive sectors.

- North America: This region holds a mature market characterized by stringent regulatory oversight, particularly in the Aerospace, Defense, and high-end automotive segments. The demand is focused on high-specification Zn-Ni applications, including low hydrogen embrittlement coatings for critical fasteners, driving innovation in process control and quality assurance to meet military and aerospace procurement specifications.

- Europe: Europe is a key market defined by strict environmental regulations (REACH, RoHS, ELV), making the transition to Zn-Ni and trivalent chromium passivation mandatory across the automotive supply chain. Germany, France, and Italy are major consumption centers, emphasizing technological leadership in bath chemistry and plating equipment efficiency, particularly in providing certified, high-end corrosion solutions.

- Latin America (LATAM): Growth in LATAM is closely linked to fluctuating automotive production levels in Brazil and Mexico. The region serves as a crucial manufacturing base supplying North American markets, necessitating compliance with international corrosion protection standards, leading to steady adoption of Zn-Ni for exported components and local infrastructure projects.

- Middle East and Africa (MEA): This region is characterized by high demand for corrosion resistance due to extremely harsh operating environments (high salinity, desert conditions). The market growth is nascent but promising, driven by large oil and gas sector investments and infrastructure development, which require robust protective coatings for pipes, valves, and structural elements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Nickel Alloy Plating Market.- Atotech (MKS Instruments)

- Coventya (Element Solutions Inc)

- Enthone (MacDermid)

- Columbia Chemical

- Technic Inc.

- Ronatec

- JCU Corporation

- Sarrel Group

- Asterion LLC

- EPI Electrochemical Products

- Aalberts Surface Treatment

- Plating Specialties, Inc.

- ZINQ Galvanizing

- C. Uyemura & Co., Ltd.

- Chemetall (BASF)

- Dipsol Chemicals Co., Ltd.

- Jettec Technologies

- Keystone Plating

- Apex Plating

- KC Jones Plating Company

Frequently Asked Questions

Analyze common user questions about the Zinc Nickel Alloy Plating market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Zinc Nickel Alloy Plating over conventional Zinc Plating?

The primary advantage is vastly superior corrosion resistance, particularly against red rust. Zn-Ni coatings, especially when complemented by trivalent chromium passivation, can achieve salt spray endurance exceeding 1,000 hours, significantly longer than standard zinc coatings, crucial for mission-critical automotive and aerospace components.

Why is the Automotive industry the largest end-user segment for Zn-Ni plating?

The automotive industry is the largest consumer because Zn-Ni meets strict OEM requirements for component longevity, resistance to road salts and high temperatures, and, most importantly, its inherent low hydrogen embrittlement characteristic, which is vital for high-strength steel fasteners used in vehicle safety systems.

What are the key differences between Alkaline and Acidic Zinc Nickel plating baths?

Alkaline baths offer superior throwing power, resulting in more uniform plating thickness on complex components and requiring simpler waste treatment. Acidic baths generally offer higher current efficiency and brighter deposits but possess poorer throwing power and require more complex chemical maintenance for consistent alloy composition.

How do global regulations like REACH and RoHS influence the Zn-Ni market growth?

These regulations act as major market drivers by mandating the phase-out of hazardous legacy coatings, such as cadmium and hexavalent chromium. Zn-Ni, when used with trivalent chromium passivation, is a compliant and high-performance replacement, accelerating its adoption across Europe and other globally regulated markets.

What challenges does the volatility of nickel prices pose to the market?

The fluctuating global price of nickel, a key alloying element (typically 5-8% of the deposit), directly impacts the operational cost and profit margins of plating service providers. This volatility prompts ongoing research into cost-effective bath chemistries or optimization strategies to maintain competitiveness without compromising coating performance standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager