Zinc Phosphate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431983 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Zinc Phosphate Market Size

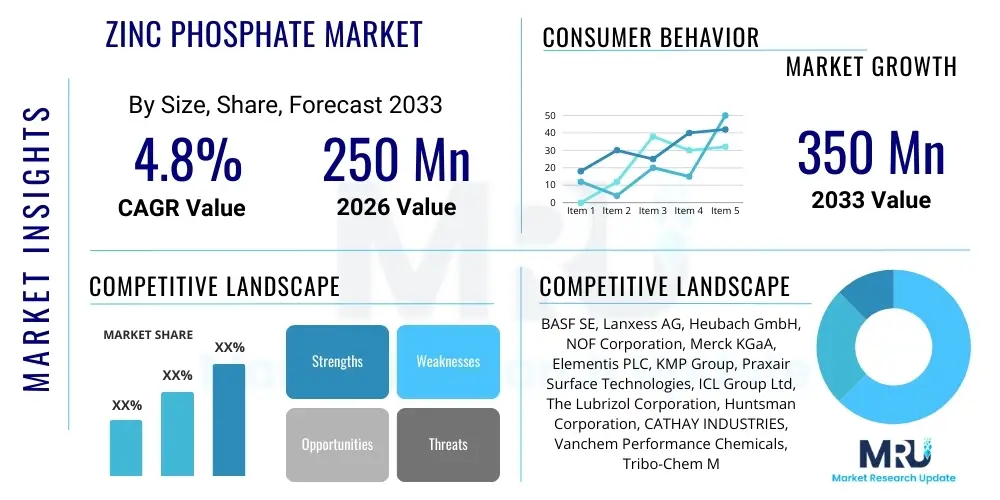

The Zinc Phosphate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 250 Million in 2026 and is projected to reach USD 350 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for high-performance anti-corrosive coatings across vital infrastructure and manufacturing sectors globally. Zinc phosphate remains a cornerstone pigment in primer formulations due to its excellent cost-to-performance ratio and compatibility with various resin systems, securing its prominent position despite the continuous emergence of alternative corrosion inhibition technologies. The steady expansion of the automotive and marine industries, coupled with extensive construction and maintenance activities in emerging economies, are key contributors sustaining this positive market momentum through the next decade.

Zinc Phosphate Market introduction

Zinc phosphate (Zn₃(PO₄)₂) is a crucial inorganic compound primarily utilized as a non-toxic corrosion-inhibiting pigment in protective coatings. This white, odorless crystalline powder functions by forming a stable, complex layer on the metal surface, effectively passivating the substrate and preventing the initiation and spread of rust. Its efficacy is particularly pronounced in protective primer formulations applied to iron, steel, and aluminum substrates. The product is valued for its low solubility in water, enabling long-term protective performance when incorporated into paints and coatings, especially those based on alkyd, epoxy, and polyurethane resin systems used extensively in industrial maintenance and fabrication.

Major applications of zinc phosphate span the metal pretreatment industry, where it is used in phosphating baths to prepare surfaces for subsequent painting, and critically, in the formulation of high-performance anti-corrosion paints used across demanding environments. Key industries utilizing zinc phosphate include automotive manufacturing, construction (structural steel), marine and shipbuilding (decks, hulls, infrastructure), and general industrial machinery and equipment production. The adoption of zinc phosphate is reinforced by global regulatory pressures aimed at phasing out traditional toxic corrosion inhibitors, such as chromates, positioning zinc phosphate as a standard, reliable, and more environmentally compliant alternative, thus broadening its scope in mainstream protective systems.

The inherent benefits of utilizing zinc phosphate—including superior adhesion promotion, effective electrochemical barrier formation, and relatively low environmental impact compared to older chemistries—drive its market expansion. Driving factors encompass rapid urbanization in the Asia Pacific region leading to massive infrastructural projects, stringent safety and durability standards in the transportation sector requiring extended coating lifecycles, and ongoing technological advancements focused on developing modified or nano-structured zinc phosphate variants that offer enhanced performance characteristics, such as lower density and improved dispersion stability within coating formulations, catering to evolving industry needs for thinner, yet more robust, protective layers.

Zinc Phosphate Market Executive Summary

The Zinc Phosphate Market demonstrates robust business trends characterized by steady demand from end-use sectors prioritizing asset protection and longevity. The overarching shift towards stricter environmental, safety, and health (ESH) regulations globally is a primary trend, compelling coating manufacturers to increase the usage of zinc phosphate as a reliable, non-chromate alternative. Furthermore, the market is experiencing moderate consolidation among major chemical suppliers who are focusing on optimizing production processes and securing raw material supply chains (primarily zinc and phosphoric acid). Innovation is focused on developing products with higher purity and specific particle morphologies, allowing for easier integration into modern, low-VOC (Volatile Organic Compound) coating systems, aligning with sustainable industrial practices and consumer demand for high-performance, green solutions.

Regional trends indicate that the Asia Pacific (APAC) region currently holds the largest market share and is projected to exhibit the highest growth rate, primarily fueled by massive infrastructure investments in countries like China, India, and Southeast Asia, alongside thriving automotive manufacturing bases. Conversely, North America and Europe, characterized by mature markets, exhibit stable demand driven largely by maintenance and replacement cycles, and are leading the transition towards high-end specialized coatings requiring specific zinc phosphate grades compatible with advanced waterborne and high-solids formulations. Regulatory mandates, such as REACH in Europe, significantly influence product development and supply dynamics within these regions, promoting the substitution of conventional materials with compliant alternatives like zinc phosphate.

Segment trends confirm that the anti-corrosion coatings application segment dominates the market due to the sheer volume used in primers for steel protection. Within the type segment, the traditional Zinc Phosphate Tetrahydrate remains the standard offering, although demand for high-purity and micro-fine Zinc Phosphate Monohydrate is increasing, particularly in specialized applications where finer particle size enhances performance and reduces sedimentation. The Automotive and Construction end-use industries represent the core demand drivers, with the marine sector contributing significant, albeit specialized, demand for high-durability coatings suitable for harsh saltwater environments. Suppliers are increasingly customizing zinc phosphate products based on particle size and surface treatment to meet the diverse technical specifications required across these various industrial applications, ensuring functional optimization for the end product.

AI Impact Analysis on Zinc Phosphate Market

User queries regarding AI's influence in the zinc phosphate market primarily revolve around three central themes: optimizing new corrosion inhibitor formulation to enhance performance and reduce material usage; increasing efficiency and predictive maintenance in zinc phosphate manufacturing processes; and using data analytics to forecast raw material price volatility and manage supply chain risks. Users are keenly interested in how machine learning algorithms can rapidly screen and validate novel coating combinations, potentially accelerating the transition away from traditional reliance on trial-and-error methods in R&D. The expectation is that AI will allow chemists to predict the efficacy of specific zinc phosphate grades when mixed with various resins and additives, leading to faster commercialization of customized protective solutions that meet stringent industry standards for environmental performance and durability.

In the realm of materials science, Artificial Intelligence is increasingly utilized to model crystal growth and surface reactions, which is crucial for optimizing the performance characteristics of zinc phosphate pigments. AI-driven simulations can predict how slight modifications to the synthesis process—such such as temperature, pH, and reactant concentration—affect the resultant particle size distribution, crystal structure, and surface activity of the zinc phosphate. This predictive capability significantly reduces the time and cost associated with laboratory testing, allowing producers to fine-tune product specifications to specific client requirements, such as enhanced compatibility with waterborne systems or improved gloss retention in the final paint film. Furthermore, AI helps in identifying optimal dispersion techniques, minimizing agglomeration, and ensuring uniform distribution within complex coating matrixes.

The impact of AI extends significantly into the operational aspects of zinc phosphate production. Machine learning algorithms are deployed for quality control, analyzing real-time sensor data from reactors to maintain precise stoichiometric ratios and crystallization parameters, thereby ensuring batch-to-batch consistency and high purity, which are critical requirements for performance-grade pigments. Predictive maintenance facilitated by AI monitors the health of manufacturing equipment, anticipating potential failures and scheduling maintenance preemptively, reducing costly downtime and enhancing overall operational efficiency. Moreover, sophisticated AI models are being used for complex logistics planning, optimizing inventory levels of precursors (zinc oxide, phosphoric acid) based on forecasted global demand and managing the complex transport of bulk chemicals, adding resilience to the global supply chain for this key corrosion inhibitor.

- AI optimizes new zinc phosphate formulations for enhanced anticorrosion performance.

- Machine learning accelerates R&D cycles by simulating pigment-resin interactions in coatings.

- Predictive maintenance minimizes manufacturing downtime and ensures batch consistency.

- AI-driven supply chain analytics forecast raw material price fluctuations (zinc, phosphorus).

- Real-time quality control systems maintain high purity and specific particle morphology.

DRO & Impact Forces Of Zinc Phosphate Market

The Zinc Phosphate Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary drivers include the accelerated global investment in infrastructure, requiring long-lasting protective coatings for bridges, ports, and public utilities, coupled with increasing production volumes in the automotive and general manufacturing sectors, particularly across Asian economies. These growth factors are strongly reinforced by stringent regulatory mandates worldwide phasing out heavy metal-based anti-corrosive pigments, such as chromates, thereby solidifying zinc phosphate's position as a preferred, compliant substitute. The necessity for protective measures against structural degradation ensures a sustained demand base, irrespective of minor economic downturns, making corrosion protection a non-negotiable expense in capital expenditure projects.

Restraints impeding market growth primarily center on the inherent toxicity concerns associated with zinc compounds, which, although less severe than chromates, still prompt regulatory scrutiny and push end-users toward developing completely heavy-metal-free alternatives (like calcium exchange silicates or organic inhibitors). Furthermore, the market faces significant volatility in the price and supply of key raw materials, specifically zinc metal and phosphoric acid, which directly impacts production costs and profit margins for manufacturers. This volatility necessitates constant hedging and inventory management challenges. Competition from high-performance, non-zinc-based corrosion inhibitors and the increasing shift towards powder coatings, which often require different types of anticorrosive additives, also present moderate restraints, forcing continuous product innovation to maintain market relevance.

Opportunities for expansion lie predominantly in technological advancements, specifically the development of nano-sized zinc phosphate particles. These nano-materials offer superior surface area coverage and dispersion characteristics, allowing for reduced loading in coating formulations while maintaining or even enhancing corrosion resistance, addressing both cost and sustainability concerns. The increasing adoption of waterborne and high-solids coating systems, driven by VOC reduction targets, presents a niche opportunity for zinc phosphate producers to develop grades optimized for these specific low-viscosity, environmentally friendly mediums. Additionally, geographical expansion into rapidly industrializing regions of Latin America and Africa, where infrastructure spending is accelerating, offers significant untapped growth potential, allowing companies to diversify their revenue streams and establish early market dominance.

Segmentation Analysis

The Zinc Phosphate Market is systematically segmented based on Type, Application, and End-Use Industry, providing a nuanced understanding of market dynamics and consumption patterns across various sectors. The segmentation by Type primarily distinguishes between the hydrates, such as Zinc Phosphate Tetrahydrate and Zinc Phosphate Monohydrate, which differ in stability, water content, and performance characteristics in specific resin systems. The Application segmentation focuses on the key areas where the product is utilized, with Anti-corrosion Coatings being the dominant segment, followed by metal pretreatment baths and, to a lesser extent, applications in pharmaceuticals and specialized lubrication. This structural categorization helps stakeholders tailor their product offerings and marketing strategies effectively.

The Type segmentation reflects technical requirements, where Zinc Phosphate Tetrahydrate, the most common industrial form, is typically used in solvent-based primers due to its favorable cost and proven performance history. In contrast, the Monohydrate and specialized anhydrous forms are often preferred for more demanding applications or for formulations requiring extremely fine particle size and low water content. This technical variance dictates the production processes and subsequent pricing structures. Analyzing these segments is critical as demand shifts towards specialized coating types (like direct-to-metal or extreme-weather protection), requiring customized phosphate structures for optimal long-term adhesion and barrier protection against aggressive corrosive agents found in coastal and industrial environments.

The End-Use Industry segmentation highlights the primary drivers of demand. The Automotive sector utilizes vast quantities of zinc phosphate for priming chassis components and bodies to ensure vehicle longevity and resistance to road salts and environmental factors. Similarly, the Construction industry relies heavily on zinc phosphate-based primers for protecting structural steel used in buildings and bridges. Other substantial end-users include the Marine industry, requiring robust protection against seawater corrosion, and the General Industry sector, encompassing machinery, appliances, and heavy equipment. Understanding the specific compliance standards and usage volumes within each end-use industry is essential for forecasting market requirements and strategically allocating manufacturing capacity across various grades of zinc phosphate pigment.

- Application:

- Anti-corrosion Coatings (Paints and Primers)

- Metal Pretreatment (Phosphating Baths)

- Lubricants and Additives

- Pharmaceuticals and Dental Applications (Minor)

- Type:

- Zinc Phosphate Tetrahydrate

- Zinc Phosphate Monohydrate

- Modified Zinc Phosphate (e.g., Nano-grade, Organic-modified)

- End-Use Industry:

- Automotive and Transportation

- Construction and Infrastructure

- Marine and Shipbuilding

- General Industrial Manufacturing

- Aerospace and Defense

Value Chain Analysis For Zinc Phosphate Market

The Zinc Phosphate market value chain commences with the upstream sourcing of raw materials, primarily high-purity zinc compounds (such as zinc oxide or metallic zinc) and phosphoric acid. The quality and stable pricing of these precursor chemicals are paramount, as they dictate the final product's purity, crystal structure, and manufacturing cost. Key suppliers in the upstream segment are large-scale chemical producers and metallurgical companies. Effective management of this initial stage, particularly concerning adherence to sustainability standards and securing long-term supply contracts, is crucial for manufacturers to maintain competitive pricing and consistent product quality in the downstream processes.

The midstream phase involves the synthesis and processing of zinc phosphate by specialty chemical manufacturers. This critical stage includes complex chemical reactions, precise control over crystallization parameters, filtration, drying, milling, and surface treatment to achieve specific particle size distributions and surface properties required by coating formulators. Manufacturers utilize sophisticated batch or continuous processes to produce various grades, such as tetrahydrate, monohydrate, or custom-modified variants. Efficiency in energy consumption and waste management during synthesis are major performance metrics for midstream players, determining operational profitability and environmental compliance in highly regulated markets like Europe and North America.

The downstream distribution channel involves specialty chemical distributors, agents, and direct sales teams connecting the manufacturers to end-users. Direct distribution is common for large-volume customers like major automotive coating suppliers or large paint manufacturers, allowing for technical support and customized product delivery. Indirect distribution through specialized chemical distributors facilitates access to smaller-volume users and provides regional logistical support. The final end-users are the paint and coating formulators who incorporate zinc phosphate into their products, which are then applied across the construction, automotive, and marine industries. The effectiveness of the value chain relies on seamless logistical coordination and high-level technical cooperation between midstream processors and downstream formulators to ensure optimal application performance.

Zinc Phosphate Market Potential Customers

The primary potential customers and end-users of zinc phosphate are specialized coating manufacturers and large-scale industrial companies that conduct their own in-house metal pretreatment and painting operations. These buyers seek high-purity zinc phosphate pigments for inclusion in protective primers, particularly those designed for solvent-based, waterborne, or high-solids epoxy and alkyd systems. Within this group, customers like major global paint corporations (e.g., AkzoNobel, PPG Industries, Sherwin-Williams) represent significant bulk purchasers who require consistent quality and substantial volumes for their global supply chains catering to diverse segments like marine, protective and maintenance, and coil coatings.

Furthermore, the automotive original equipment manufacturers (OEMs) and their Tier 1 suppliers constitute a major customer segment. These companies require zinc phosphate specifically for metal pretreatment processes (phosphating baths) that enhance the adhesion and corrosion resistance of subsequent e-coat and topcoat layers on vehicle bodies and components. The purchasing decisions in this sector are heavily influenced by stringent OEM specifications regarding salt spray resistance and chip resistance, driving demand for specialized, highly uniform zinc phosphate compositions. Long-term contractual agreements and technical collaboration are common between zinc phosphate suppliers and large automotive chemical providers to ensure just-in-time delivery of specified grades.

Other vital potential customers include specialized chemical distributors who serve the fragmented small and medium-sized enterprise (SME) coating formulators, particularly those focusing on local construction, agricultural equipment, and general fabrication markets. These distributors require a comprehensive portfolio of zinc phosphate grades, including modified and nano-grade variants, to meet the varied technical demands of their localized customer base. The marine industry, encompassing large shipbuilding yards and maintenance contractors, is another high-value customer segment, demanding premium, extremely durable zinc phosphate pigments capable of withstanding severe osmotic blistering and constant exposure to corrosive environments over decades of service life.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250 Million |

| Market Forecast in 2033 | USD 350 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Lanxess AG, Heubach GmbH, NOF Corporation, Merck KGaA, Elementis PLC, KMP Group, Praxair Surface Technologies, ICL Group Ltd, The Lubrizol Corporation, Huntsman Corporation, CATHAY INDUSTRIES, Vanchem Performance Chemicals, Tribo-Chem Manufacturing, American Elements |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Phosphate Market Key Technology Landscape

The technological landscape of the Zinc Phosphate Market is currently characterized by two major developmental pillars: optimizing crystal morphology and particle size, and enhancing compatibility with advanced coating chemistries, particularly waterborne and high-solids systems. Traditional production technology focuses on controlled precipitation to yield the desired crystal structure (tetrahydrate or monohydrate) and morphology, which is crucial for maximizing surface area and reactivity. Recent technological advancements utilize mechanical micronization and precise surface treatment techniques, such as the application of organofunctional silanes or hydrophobic agents, to modify the zinc phosphate particle surface. This modification significantly improves dispersibility in various polymer matrices and reduces the settling rate, leading to more uniform and effective corrosion inhibition in the applied film.

A significant area of innovation involves the synthesis of nano-structured zinc phosphates. Utilizing advanced crystallization control techniques, manufacturers are producing particles in the nanometer range (typically below 100 nm). These nano-particles offer an exponential increase in reactive surface area compared to conventional micrometer-sized pigments. The enhanced surface activity allows coating formulators to achieve comparable or superior corrosion resistance with a lower pigment loading, which in turn reduces the overall density and cost of the final coating product, aligning with industry demands for resource efficiency and weight reduction, particularly in the automotive and aerospace sectors. However, the commercial scale-up of nano-zinc phosphate synthesis remains challenging due to difficulties in aggregation control and ensuring long-term dispersion stability in liquid formulations.

Furthermore, technology is focused on creating composite or modified zinc phosphate pigments. These hybrid materials often incorporate other corrosion-inhibiting ions, such as aluminum, calcium, or strontium, within the zinc phosphate structure to create synergistic effects, broadening the scope of pH stability and improving performance under varied environmental conditions. For instance, incorporating specific ions can stabilize the phosphate layer formed on the metal surface, offering superior long-term barrier properties. The development of specialized grades designed specifically for high-performance coil coatings and direct-to-metal (DTM) applications, which require rapid curing and exceptional adhesion, represents the cutting edge of technological innovation within the zinc phosphate market, ensuring the material remains competitive against emerging environmentally friendly alternatives.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: APAC is the leading regional market and is projected to register the fastest growth during the forecast period. This dominance is attributable to the explosive growth in manufacturing output, massive infrastructural development projects, and the large-scale automotive production base, particularly in China, India, Japan, and South Korea. High consumption of zinc phosphate is driven by its extensive use in protective coatings for new construction, pipelines, and industrial machinery, coupled with less stringent, or evolving, environmental regulations compared to Western markets, allowing for broader application scope.

- North America (NA) Regulatory Compliance: The North American market is mature, characterized by stable demand driven by maintenance cycles and rigorous performance standards in the oil and gas, marine, and aerospace industries. The primary focus here is on utilizing high-ppurity, specialized zinc phosphate grades that comply strictly with VOC limitations and stringent health and safety mandates. Innovation is concentrated on integrating zinc phosphate into advanced solvent-free and high-solids systems, reflecting a premium pricing structure compared to Asia.

- Europe (EU) Sustainability Focus: Europe represents a significant, yet highly regulated, market. The enforcement of regulations like REACH significantly influences market behavior, reinforcing the substitution of chromates with zinc phosphate. European demand is driven by the automotive refinish market and high-specification industrial maintenance, but competition from advanced chrome-free alternatives is strong. Manufacturers emphasize developing highly sustainable, non-hazardous zinc phosphate formulations compatible with waterborne systems to meet EU green directives and consumer preferences.

- Latin America (LATAM) Infrastructure Growth: LATAM is an emerging market for zinc phosphate, driven by increasing government investment in public infrastructure, particularly in Brazil and Mexico, and expanding oil and gas exploration requiring protective pipe coatings. The market growth rate is accelerating, but it is currently hampered by economic volatility and reliance on imported products. Potential lies in localizing manufacturing and distribution networks to reduce supply chain costs and lead times.

- Middle East and Africa (MEA) Oil and Gas Demand: The MEA region shows consistent demand, primarily concentrated in the Gulf Cooperation Council (GCC) countries. Consumption is dominated by the needs of the critical oil and gas sector (pipelines, refineries, storage tanks), which mandates exceptionally high levels of corrosion protection due to severe desert and marine environments. The demand is highly focused on specialty, high-performance zinc phosphate grades used in severe service coating specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Phosphate Market.- BASF SE

- Lanxess AG

- Heubach GmbH

- NOF Corporation

- Merck KGaA

- Elementis PLC

- KMP Group

- Praxair Surface Technologies

- ICL Group Ltd

- The Lubrizol Corporation

- Huntsman Corporation

- CATHAY INDUSTRIES

- Vanchem Performance Chemicals

- Tribo-Chem Manufacturing

- American Elements

- Jost Chemical Co.

- Troy Corporation

- Wuxing Chemical Co., Ltd.

- Jiangsu Sanmu Group

- Shanghai Huilin Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Zinc Phosphate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of zinc phosphate in industrial applications?

The primary function of zinc phosphate is to act as a highly effective, non-toxic corrosion-inhibiting pigment, predominantly used in primer coatings and metal phosphating baths to protect ferrous metals and aluminum from rust and chemical degradation. It forms a stable, protective layer on the metal surface, passivating the substrate.

How do regulatory changes, such as REACH, impact the demand for zinc phosphate?

Regulatory changes, particularly the phasing out of traditional toxic inhibitors like chromates under initiatives such as REACH, significantly boost the demand for zinc phosphate. Zinc phosphate serves as a preferred, compliant, and reliable substitute, driving its increased adoption in environmentally conscious coating formulations across Europe and North America.

Which end-use industry is the largest consumer of zinc phosphate, and why?

The Automotive and Transportation industry is the largest consumer due to the critical requirement for long-term corrosion protection on vehicle bodies, chassis, and components. Zinc phosphate is essential both in pretreatment phosphating processes and in subsequent primer coatings to guarantee vehicle durability against harsh environmental factors like road salts.

What technological advancements are shaping the future of the zinc phosphate market?

Key technological advancements include the development of nano-structured zinc phosphate pigments, which offer enhanced performance at lower loading levels, and the modification of standard grades to improve compatibility with modern, low-VOC coating systems, such as waterborne and high-solids formulations, ensuring ecological compliance and superior dispersion stability.

Is zinc phosphate usage affected by raw material price fluctuations?

Yes, the market is highly sensitive to the price volatility of key upstream raw materials, primarily zinc metal and phosphoric acid. Fluctuations in commodity prices directly impact the production costs and overall pricing strategy for zinc phosphate manufacturers, necessitating robust supply chain risk management and long-term procurement contracts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager