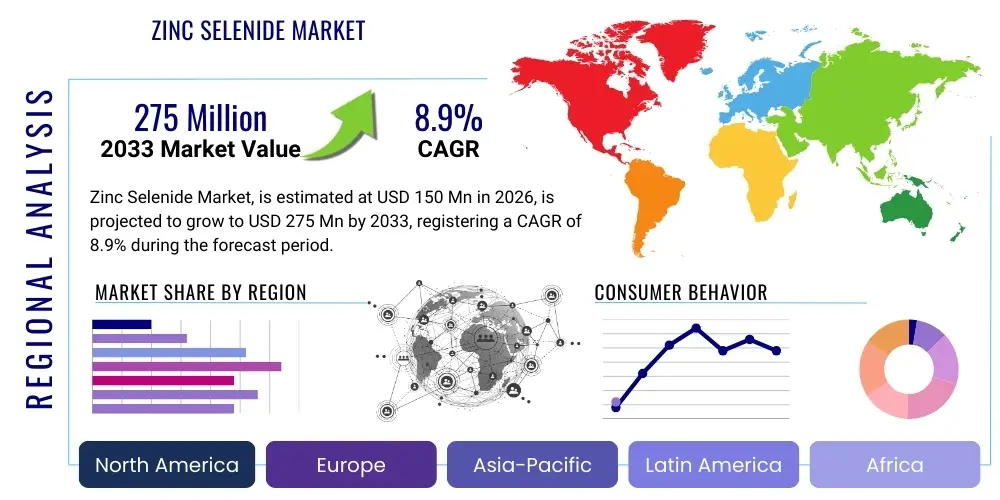

Zinc Selenide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434647 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Zinc Selenide Market Size

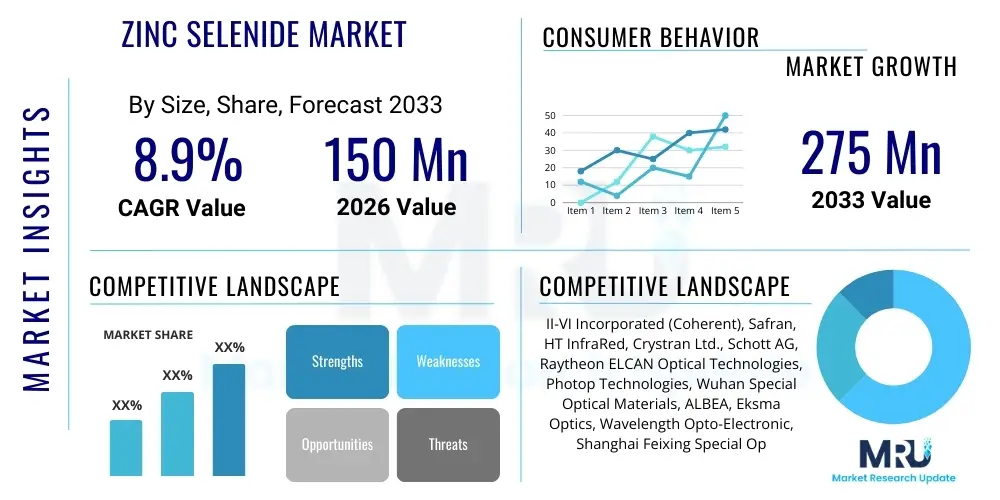

The Zinc Selenide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at USD 150 Million in 2026 and is projected to reach USD 275 Million by the end of the forecast period in 2033.

Zinc Selenide Market introduction

Zinc Selenide (ZnSe) is a highly specialized compound semiconductor material, categorized by its exceptional transparency across a wide optical spectrum, particularly in the mid-infrared to far-infrared region (0.6 μm to 20 μm). This unique property makes it the material of choice for high-power carbon dioxide (CO2) laser optics, thermal imaging windows, and infrared optical components requiring low absorption and high durability. The product is typically synthesized through chemical vapor deposition (CVD), ensuring high purity and superior optical homogeneity, which is essential for precision applications in defense, aerospace, and advanced manufacturing sectors. The quality of ZnSe material directly influences the performance and lifespan of infrared systems, driving continuous innovation in manufacturing processes to reduce scattering and bulk absorption losses.

Major applications of Zinc Selenide are primarily concentrated in high-performance infrared systems. In the industrial segment, ZnSe components, such as lenses, output couplers, and windows, are critical for CO2 laser cutting and welding machinery utilized across automotive and electronics manufacturing. The defense sector relies heavily on ZnSe for missile guidance systems, surveillance equipment, and thermal cameras due to its robust performance in harsh environmental conditions and its capacity to transmit long-wavelength infrared radiation. Furthermore, its potential in solid-state lighting (LEDs) and blue-green laser diodes, though secondary to IR optics, represents emerging growth avenues predicated on its wide bandgap characteristics.

The market growth is fundamentally driven by the escalating demand for high-resolution thermal imaging systems in security and surveillance, coupled with the global proliferation of industrial laser processing equipment. Benefits associated with ZnSe include its high transmission efficiency, excellent mechanical strength compared to other IR materials (like Germanium), and suitability for anti-reflective coatings. These factors collectively contribute to the material's indispensability in systems requiring precision optical performance and extended operational lifetimes, solidifying its position as a critical enabling technology across advanced optical engineering domains.

Zinc Selenide Market Executive Summary

The Zinc Selenide market is undergoing robust expansion, characterized by significant technological advancements aimed at improving material homogeneity and reducing production costs through scaled-up Chemical Vapor Deposition (CVD) processes. Key business trends indicate a shift towards vertically integrated supply chains, where leading manufacturers are increasingly controlling raw material sourcing (high-purity zinc and selenium) and component fabrication, ensuring quality control and protecting intellectual property related to proprietary crystal growth techniques. Furthermore, strategic partnerships between ZnSe component suppliers and defense contractors or industrial laser system integrators are becoming prevalent, fostering co-development of optimized optical solutions specifically designed for next-generation high-power laser systems and advanced thermal sensing devices.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth trajectory, primarily fueled by massive industrialization, rapid adoption of advanced laser processing technologies in China and South Korea, and burgeoning defense expenditures, particularly concerning surveillance and targeting systems. North America and Europe, while mature markets, maintain dominance in terms of value, driven by established defense industries, stringent quality requirements for aerospace applications, and ongoing research and development in quantum and infrared spectroscopy. The strategic importance of ZnSe components in military technology also subjects this market to geopolitical trade dynamics and export controls, influencing regional manufacturing strategies and inventory levels.

Segment trends highlight the critical dominance of the IR Optics segment, particularly applications involving high-power CO2 lasers, which demand ultra-low absorption ZnSe windows and lenses. Within the product type, Multi-Spectral Grade ZnSe is gaining traction over Standard Grade, although it commands a higher price, owing to its enhanced performance across multiple wavelengths essential for complex military or scientific instrumentation. The application shift is toward smaller, more lightweight, and robust optical elements required for Unmanned Aerial Vehicles (UAVs) and portable thermal imaging devices, pushing manufacturers to innovate in thin-film coating and component miniaturization without compromising optical integrity.

AI Impact Analysis on Zinc Selenide Market

Common user questions regarding AI's impact on the Zinc Selenide market often center on how Artificial Intelligence can optimize the expensive and intricate manufacturing process, particularly CVD growth, and whether AI-enhanced sensors will increase or decrease the demand for traditional IR optics. Users are keen to understand if AI-driven analysis of thermal data will require higher precision ZnSe components for better input resolution, or if computational compensation will lower the required material quality. The core themes revolve around process optimization, predictive maintenance of optical systems, and the integration of AI with advanced sensing technologies that rely on ZnSe optics.

AI's primary influence is currently being realized in optimizing the chemical vapor deposition (CVD) process used to synthesize high-purity ZnSe crystals. Machine learning algorithms can analyze real-time data collected during the synthesis process—such as temperature gradients, gas flow rates, and precursor concentrations—to predict material defects, homogeneity, and stress distribution. This predictive modeling capability significantly reduces waste, shortens cycle times, and ensures consistent quality control, which is vital for high-specification defense and industrial laser optics. By utilizing AI for anomaly detection and process parameter tuning, manufacturers can achieve greater throughput of high-quality, optical-grade ZnSe material, thereby mitigating the material's historically high production cost and complexity.

Furthermore, AI-driven image processing and target recognition in thermal imaging systems, which utilize ZnSe windows, indirectly stimulate the demand for superior optical quality. While AI algorithms can enhance poorly resolved images, the performance ceiling of the entire system remains limited by the input data quality. Consequently, the push for clearer, higher-resolution thermal data necessary for sophisticated AI analysis (e.g., precise autonomous navigation, detailed industrial inspection) necessitates extremely low-absorption, high-transmission ZnSe optics. AI also plays a role in the predictive maintenance of laser systems; by monitoring the performance decay of ZnSe components (due to absorption or surface degradation), AI can alert operators, reducing unexpected downtime and extending the useful life of industrial laser machinery.

- AI optimizes CVD manufacturing parameters, enhancing material homogeneity and reducing defect rates.

- Predictive maintenance driven by AI extends the lifespan of ZnSe optical components in high-power laser systems.

- Increased sophistication of AI-based thermal imaging requires higher resolution and superior optical quality ZnSe components for reliable data input.

- AI algorithms assist in non-destructive testing and quality assurance of finished ZnSe optical elements.

- Computational photography driven by AI may partially compensate for minor optical aberrations but fundamentally increases the need for high-fidelity input sensors requiring premium ZnSe optics.

DRO & Impact Forces Of Zinc Selenide Market

The Zinc Selenide market dynamics are shaped by a delicate balance between escalating technological requirements (Drivers), high production complexity and material constraints (Restraints), and expanding application areas in defense and specialized commercial sectors (Opportunities). The primary impact forces driving the market expansion include the exponential growth in industrial laser applications, where ZnSe remains indispensable for CO2 laser systems, and heightened global security concerns propelling demand for advanced thermal surveillance and targeting systems. Conversely, the market faces significant inertia from the high cost associated with manufacturing ultra-pure, optical-grade ZnSe using energy-intensive CVD processes, creating a barrier to entry and limiting widespread adoption in cost-sensitive commercial applications.

Key drivers include the global expansion of industrial manufacturing, which relies heavily on high-precision laser cutting, welding, and marking processes, requiring durable ZnSe optics. Furthermore, increasing investments in defense and military modernization, particularly in long-wave and mid-wave infrared (LWIR/MWIR) technology used in ground, air, and naval platforms, mandates the use of ZnSe due to its superior transmission properties compared to alternatives like Germanium or Sapphire in specific IR bands. The opportunity landscape is further broadened by emerging niche applications, such as specialized medical lasers and advanced spectroscopic instruments used in environmental monitoring and analytical chemistry, which demand the unique spectral properties offered by ZnSe.

However, major restraints impacting the market include the inherent toxicity of raw materials (selenium compounds) and the high capital expenditure required for CVD reactors, which necessitates compliance with strict environmental and safety regulations. The potential threat of substitution, primarily from alternative IR materials like Zinc Sulfide (ZnS), especially in non-critical or lower-power applications, or the development of alternative laser technologies that bypass CO2 systems entirely, poses a long-term challenge. To capitalize on opportunities, manufacturers are focused on enhancing material purity to minimize scattering and absorption, developing robust anti-reflection coatings tailored for extreme environments, and exploring novel, cost-effective synthesis methods to maintain competitive advantage.

Segmentation Analysis

The Zinc Selenide market is predominantly segmented based on the product grade (influencing purity and application suitability), the manufacturing method (which dictates cost and scale), and the diverse end-use industries. The segmentation reflects the specialized nature of the material, where even minor variations in purity or structural homogeneity profoundly affect performance, especially in high-power laser applications. The market structure emphasizes the dominance of the Optical Grade segment, which includes high-transmission windows, lenses, and prisms designed specifically for use in sophisticated infrared optical trains. Understanding these segments is crucial for strategic market positioning, as the requirements for defense-grade thermal imagers differ significantly from those for general industrial laser machines.

The segmentation by end-user illustrates the primary revenue drivers: Defense & Aerospace, which demands the highest performance specifications and accounts for a significant portion of the market value, followed closely by Industrial Applications, driven by volume demand from laser machining systems. A growing, albeit smaller, segment includes Healthcare and Scientific Research, where ZnSe components are employed in Fourier Transform Infrared (FTIR) spectroscopy and highly precise medical laser delivery systems. Manufacturers strategically focus on tailoring their production capabilities, such as advanced polishing and coating services, to meet the stringent technical requirements of these diverse, high-value segments, ensuring components withstand both high thermal load and mechanical stress.

- By Product Grade:

- Standard Grade ZnSe

- Optical Grade ZnSe

- Multi-Spectral Grade ZnSe

- By Application:

- CO2 Laser Optics

- Thermal Imaging Windows/Domes

- Spectroscopy Components (FTIR)

- Infrared Filters and Prisms

- Semiconductor Applications (LEDs/Lasers)

- By End-User Industry:

- Defense and Aerospace

- Industrial Manufacturing (Laser Processing)

- Medical and Healthcare

- Research and Development

- By Manufacturing Process:

- Chemical Vapor Deposition (CVD)

- High-Pressure Melting

Value Chain Analysis For Zinc Selenide Market

The Zinc Selenide value chain is highly integrated and commences with the upstream extraction and purification of ultra-high purity elemental zinc and selenium, which are critical precursors. Achieving the required 5N or 6N purity level is resource-intensive and expensive, setting the foundational cost structure of the final product. Specialized chemical companies manage this initial phase. Following precursor refinement, the midstream involves the complex synthesis phase, primarily utilizing the energy-intensive Chemical Vapor Deposition (CVD) technique. This step, executed by specialized crystal growth manufacturers, transforms the raw materials into large ZnSe blanks or boules. Quality control and proprietary CVD techniques employed here are major sources of competitive differentiation and material cost.

The downstream stage involves the fabrication and finishing of the optical components. This process includes precise diamond turning, grinding, polishing, and the application of anti-reflection (AR) coatings, often using proprietary thin-film deposition methods optimized for specific infrared wavelengths (e.g., 10.6 μm for CO2 lasers). Component manufacturers, who are often different from the CVD raw material producers, must adhere to extremely tight geometrical tolerances and surface quality specifications. The direct distribution channel primarily involves selling these finished components directly to Original Equipment Manufacturers (OEMs) in the defense sector or industrial laser system integrators, facilitating close collaboration on design and specification compliance.

The indirect distribution channel involves specialized optical distributors and resellers who stock standard ZnSe windows and lenses, serving smaller R&D laboratories, academic institutions, and maintenance markets. This channel offers accessibility and rapid deployment for standard components but typically handles lower volumes and less customized products compared to the direct OEM sales. The efficiency of the distribution network is crucial, as optical components require careful handling and specialized packaging to prevent damage, emphasizing the need for robust logistics and inventory management across the entire value chain.

Zinc Selenide Market Potential Customers

Potential customers for Zinc Selenide are concentrated in sectors requiring highly reliable and efficient transmission of infrared radiation, particularly those operating with high-power CO2 lasers or advanced thermal sensing devices. The most lucrative and demanding end-users are defense contractors and national military organizations that purchase components for mission-critical applications such as Forward Looking Infrared (FLIR) systems, missile heat shields, targeting pods, and surveillance equipment. These customers prioritize Multi-Spectral Grade and Optical Grade ZnSe, placing stringent demands on mechanical resilience, transmission uniformity, and reliability under extreme thermal and mechanical stress, making procurement a highly specialized process often involving long-term contracts.

The industrial manufacturing sector represents the highest volume buyer, predominantly comprising global industrial laser system manufacturers (OEMs). Companies specializing in automotive, electronics, heavy machinery, and metal fabrication utilize ZnSe lenses and output couplers within their high-power CO2 laser systems for cutting, marking, and welding. These customers value component consistency, long operational life, and competitive pricing, often requiring large batch orders of standardized ZnSe components with specific anti-reflection coatings optimized for 10.6 μm wavelength performance. The purchase cycle here is aligned with capital equipment upgrade and maintenance schedules.

Additionally, research and development institutions, university laboratories, and specialized medical device manufacturers constitute crucial niche markets. These entities purchase ZnSe components for use in highly sensitive analytical instruments like FTIR spectrometers, specialized imaging systems, and medical CO2 laser delivery systems for surgical applications. These customers often require unique component geometries, complex coatings, and smaller volumes, driving demand for custom fabrication services rather than mass-produced standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 150 Million |

| Market Forecast in 2033 | USD 275 Million |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | II-VI Incorporated (Coherent), Safran, HT InfraRed, Crystran Ltd., Schott AG, Raytheon ELCAN Optical Technologies, Photop Technologies, Wuhan Special Optical Materials, ALBEA, Eksma Optics, Wavelength Opto-Electronic, Shanghai Feixing Special Optical Glass, Joint-Stock Company "Krasnoe Znamya", Guizhou Materials and Technologies, Shanghai Kingstone Optical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zinc Selenide Market Key Technology Landscape

The technological landscape of the Zinc Selenide market is dominated by the sophisticated Chemical Vapor Deposition (CVD) technique, which is essential for producing large-area, highly homogeneous, polycrystalline ZnSe material necessary for optical applications. CVD involves reacting gaseous zinc and selenium precursors at high temperatures (typically above 800°C) onto a substrate, resulting in a dense, transparent, and structurally uniform material. Advances in CVD technology focus on optimizing precursor stoichiometry and temperature profiles to control grain size, reduce internal scatter, and minimize impurities, thereby achieving the ultra-low absorption coefficients required for high-power CO2 laser systems without thermal lensing effects.

Beyond the synthesis, the finishing technologies are equally critical. Precision machining techniques, particularly Single Point Diamond Turning (SPDT), are standard for shaping ZnSe components into complex geometries, such as aspheric lenses and diffractive optics, with nanometer-scale surface accuracy. Coupled with SPDT, advanced metrology systems ensure that the finished optics meet stringent wave-front distortion specifications. The continuous evolution of Anti-Reflection (AR) and Protective coatings represents another technological frontier. Manufacturers are developing multi-layer thin-film coatings, often based on proprietary processes, to enhance transmission efficiency across specific IR bands and provide superior abrasion resistance and durability, especially for external windows used in harsh defense and aerospace environments.

A notable emerging technology involves the development of Multi-Spectral Zinc Selenide, often synthesized by doping or varying the CVD process parameters to create a material that is transparent from the visible spectrum through the far-infrared. This innovation aims to provide a single optical window solution for systems requiring simultaneous visual, mid-wave, and long-wave infrared capabilities, simplifying system architecture and reducing overall weight. Furthermore, research into novel growth methods, potentially reducing the energy dependency and complexity associated with traditional high-temperature CVD, could revolutionize production scalability and material cost in the coming decade, although CVD remains the commercial standard for high-volume, high-quality production.

Regional Highlights

The global Zinc Selenide market exhibits distinct regional dynamics driven by varying levels of industrialization, defense expenditure, and technological maturity across key geographic areas.

- North America: This region maintains market leadership in terms of value, primarily due to the substantial presence of major defense contractors and advanced aerospace manufacturing hubs in the United States. Demand is characterized by extremely high quality and performance specifications for military thermal imaging systems, missile guidance, and high-power directed energy research. The region benefits from established research infrastructure and significant governmental funding for advanced optical materials development, particularly related to export-controlled military technologies.

- Europe: Europe is a key market, driven by the robust industrial automation sector in Germany, Italy, and France, which are heavy users of industrial CO2 laser systems. The region also hosts major defense and surveillance technology firms. Strict environmental regulations surrounding hazardous material handling (selenium) necessitate advanced waste management and purification standards, influencing operational costs for European manufacturers.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region, fueled by rapid industrial expansion in China, South Korea, and Japan, leading to massive uptake of high-speed laser processing equipment. Furthermore, escalating geopolitical tensions and resulting increases in defense budgets across India and China are accelerating the deployment of domestic thermal imaging and military surveillance systems, creating substantial localized demand for high-quality ZnSe components.

- Latin America: This region represents a smaller but expanding market, primarily focusing on general industrial applications and maintenance for imported machinery. Growth is moderate and largely dependent on regional investment in manufacturing infrastructure and security modernization efforts, often sourcing components via international distributors rather than local manufacturing.

- Middle East and Africa (MEA): The MEA market is largely centered on defense and security applications, driven by large-scale military procurement and infrastructure protection projects in the Gulf Cooperation Council (GCC) countries. Demand is often project-based and highly sensitive to international political and economic factors, focusing on high-durability ZnSe optics for extreme desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zinc Selenide Market.- II-VI Incorporated (Coherent)

- Safran

- HT InfraRed

- Crystran Ltd.

- Schott AG

- Raytheon ELCAN Optical Technologies

- Photop Technologies

- Wuhan Special Optical Materials

- ALBEA

- Eksma Optics

- Wavelength Opto-Electronic

- Shanghai Feixing Special Optical Glass

- Joint-Stock Company "Krasnoe Znamya"

- Guizhou Materials and Technologies

- Shanghai Kingstone Optical Co., Ltd.

- Janos Technology LLC

- ISP Optics (Infrasil)

- AC&T (Advanced Ceramics and Technology)

- Rocky Mountain Instrument Co. (RMI)

- CVI Laser Optics (A Toptica Company)

Frequently Asked Questions

Analyze common user questions about the Zinc Selenide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Zinc Selenide?

Zinc Selenide is primarily utilized in high-performance infrared optics, serving as windows, lenses, and prisms for high-power industrial CO2 lasers (at 10.6 μm wavelength) and in advanced thermal imaging systems and surveillance equipment used extensively across defense and aerospace sectors due to its superior transmission characteristics in the mid- to far-infrared spectrum.

Why is Chemical Vapor Deposition (CVD) the preferred method for producing ZnSe?

CVD is the preferred synthesis method because it yields high-purity, large-area, polycrystalline Zinc Selenide blanks with excellent optical homogeneity and minimal internal absorption and scattering. This precision is essential to meet the stringent quality requirements for high-power laser applications where material defects can cause thermal distortion and component failure.

How does Multi-Spectral Grade Zinc Selenide differ from standard Optical Grade?

Multi-Spectral Grade ZnSe is specially manufactured to maintain high transparency across a broader range of the electromagnetic spectrum, often spanning the visible light region through the infrared. This contrasts with standard Optical Grade, which is typically optimized only for the infrared band, enabling Multi-Spectral Grade to be used in advanced systems requiring combined day-vision and thermal imaging capabilities.

What major factors restrain the growth of the Zinc Selenide market?

The primary restraints include the high production cost associated with the energy-intensive CVD process, the necessity of using costly, ultra-high purity raw materials (zinc and selenium), and the inherent toxicity of selenium precursors, which requires compliance with stringent environmental health and safety regulations, increasing operational overheads.

Which geographic region dominates the demand for high-value Zinc Selenide components?

North America currently dominates the market in terms of value, driven by the massive requirement for mission-critical, high-specification ZnSe optics for the defense and aerospace industries, supported by robust governmental R&D investments and established manufacturing capabilities for highly specialized infrared systems.

What is the role of ZnSe in Fourier Transform Infrared (FTIR) Spectroscopy?

In FTIR spectroscopy, ZnSe is frequently used for the internal reflection elements (IREs) in Attenuated Total Reflectance (ATR) accessories. Its chemical inertness and transparency in the relevant mid-infrared range make it ideal for analyzing liquid, semi-solid, and solid samples efficiently, without introducing spectral interference.

Are there any substitutes for Zinc Selenide in CO2 laser applications?

While other materials exist, such as Germanium (Ge) and Zinc Sulfide (ZnS), ZnSe remains the material of choice for high-power industrial CO2 lasers (10.6 μm) due to its extremely low absorption coefficient at that specific wavelength and its superior mechanical strength compared to Germanium, which is susceptible to thermal runaway at high temperatures.

How is the industrial laser market impacting ZnSe demand?

The industrial laser market is a critical volume driver for standard and optical grade ZnSe. As manufacturing processes worldwide increase adoption of precision laser cutting, welding, and marking, the constant wear and tear of laser optics necessitate regular replacement and maintenance, ensuring consistent, high-volume demand for ZnSe lenses and windows.

What are the technical challenges in machining Zinc Selenide optics?

ZnSe is relatively soft and brittle, requiring specialized handling and machining techniques like Single Point Diamond Turning (SPDT). Achieving nanometer-scale surface finishes without chipping or subsurface damage is challenging. Moreover, the subsequent application of durable anti-reflection coatings must be done carefully to maintain the high optical fidelity of the polished surface.

How does AI contribute to quality control in ZnSe manufacturing?

AI algorithms are increasingly used in non-destructive testing and quality assurance by analyzing images and spectroscopic data of the grown ZnSe blanks. AI can quickly identify subtle internal defects, stress points, and crystalline inhomogeneities that are difficult for human inspection to detect, thereby improving yield rates of the highest-grade optical material.

What is the typical operational wavelength range for Zinc Selenide optics?

Zinc Selenide is transparent from approximately 0.6 μm (visible orange/red) up to 20 μm (far-infrared). However, its primary operational window for commercial and defense applications is typically the 8–12 μm band (LWIR) for thermal imaging and the 10.6 μm wavelength specific to CO2 lasers.

What role does Asia Pacific play in the future market growth of ZnSe?

Asia Pacific is forecasted to be the region with the highest CAGR, propelled by rapid expansion in industrial automation and manufacturing across economies like China and South Korea, coupled with significant increases in regional defense spending and the localization of advanced optical component manufacturing capabilities.

How are environmental regulations affecting ZnSe production costs?

Since selenium precursors are toxic, manufacturers must invest heavily in advanced pollution control systems, specialized ventilation, worker safety protocols, and waste treatment facilities to comply with stringent global environmental and occupational safety regulations. These mandatory investments contribute significantly to the overall manufacturing cost structure.

What specialized coatings are applied to ZnSe optical components?

Specialized coatings typically include Anti-Reflection (AR) coatings, often based on proprietary compounds like ThF4 (Thorium Fluoride) or ZnS/Ge multilayers, optimized for specific IR wavelengths (e.g., 10.6 μm or 8-12 μm). Hard Carbon (Diamond-Like Carbon, DLC) coatings are also used for external windows to enhance durability and abrasion resistance in harsh environments.

Is Zinc Selenide used in semiconductor devices?

Yes, while IR optics is the dominant application, high-purity ZnSe is used as a semiconductor material in specialized applications, particularly for manufacturing blue and blue-green laser diodes and Light Emitting Diodes (LEDs) due to its wide direct bandgap. However, this remains a niche market compared to its use in industrial and military optics.

How does the defense sector influence the demand for Multi-Spectral ZnSe?

The defense sector drives demand for Multi-Spectral ZnSe because modern military platforms require integrated sensor systems that can operate effectively across visible, near-IR, and long-wave IR bands simultaneously. Using Multi-Spectral ZnSe simplifies the optical train, reduces weight, and improves system alignment reliability in complex targeting and surveillance pods.

What is the significance of the 10.6 μm wavelength for ZnSe?

The 10.6 μm wavelength corresponds precisely to the primary output of high-power industrial CO2 lasers. ZnSe exhibits extremely low optical absorption at this specific wavelength, making it essential for transmitting the laser beam efficiently without generating excessive heat, which would otherwise distort the beam (thermal lensing) or damage the optics.

What kind of structural defects are manufacturers trying to minimize in ZnSe?

Manufacturers actively work to minimize internal structural defects such as voids, non-uniform grain boundaries, crystalline strain, and inclusion scattering centers. These defects, if present, lead to energy absorption and scattering, significantly reducing the material's power handling capability and image quality in thermal systems.

How does the high cost of raw materials impact the market competitiveness?

The requirement for 5N (99.999%) or higher purity zinc and selenium precursors elevates the base material cost substantially. This high cost limits the number of manufacturers capable of entering the market and places significant pressure on established players to maximize yield and minimize scrap during the synthesis and fabrication stages to remain competitive.

What is the impact of UAV proliferation on ZnSe market trends?

The rapid proliferation of Unmanned Aerial Vehicles (UAVs) in both military and commercial sectors drives demand for miniaturized, lightweight, yet highly robust IR optics. ZnSe is favored for small thermal camera windows and gimbals on UAVs due to its excellent optical performance and relatively good mechanical resilience compared to other IR materials like Germanium.

What are the typical quality assurance metrics for ZnSe optics?

Key quality assurance metrics include transmission percentage across the specified IR band, surface figure accuracy (measured in fractions of a wavelength), scratch/dig specifications (per military standards), bulk absorption coefficient (especially critical for laser optics), and the adhesion and durability of the anti-reflection coatings under environmental stress.

How do trade restrictions affect the global supply chain of Zinc Selenide?

Due to its critical role in military technology, high-performance ZnSe components are often classified as dual-use goods and are subject to strict export control regulations (e.g., ITAR, Wassenaar Arrangement). These restrictions complicate the global supply chain, often necessitating production redundancy and local manufacturing capabilities within key geographic regions.

What is the difference between ZnSe and ZnS in terms of optical performance?

Zinc Selenide (ZnSe) generally offers superior transmission characteristics, particularly in the longer wavelength IR region (up to 20 μm) and exhibits lower absorption at 10.6 μm. Zinc Sulfide (ZnS), especially Cleartran grade, has a slightly lower refractive index, better durability, and is often preferred for applications requiring moderate IR transmission but greater mechanical robustness, such as rugged domes.

What role does the automotive industry play in ZnSe demand?

The automotive industry primarily drives demand indirectly through its extensive use of industrial CO2 lasers for cutting high-strength steel, tailored blank welding, and precision component marking. While the volume is high, the requirements are often for standard-grade ZnSe optics used in high-throughput manufacturing lines.

How is the lifespan of a ZnSe laser lens typically determined?

The lifespan is primarily determined by the power density of the laser, the cleanliness of the operating environment (contaminants cause absorption and thermal damage), and the inherent quality (low absorption coefficient) of the ZnSe material itself. Regular cleaning and proper maintenance are essential to achieving the expected component life.

What are the challenges of coating ZnSe surfaces?

Challenges include achieving excellent adhesion between the soft ZnSe substrate and the thin-film coating layers, ensuring minimal stress induced by the coating process that could distort the delicate surface figure, and maximizing the durability of the coating while maintaining precise optical thickness for optimal anti-reflection performance.

In which medical applications is ZnSe commonly found?

ZnSe is commonly used in medical CO2 laser delivery systems for surgical procedures, particularly dermatology and ophthalmology. It acts as the output window or focusing lens, delivering precise, high-power laser energy to target tissues due to its efficiency at the 10.6 μm wavelength.

How does the trend toward system miniaturization affect ZnSe component design?

Miniaturization requires ZnSe components to be smaller, lighter, and more complex in geometry (e.g., highly curved or aspheric) to maintain equivalent focal length and optical performance within confined system volumes. This necessitates increased reliance on high-precision fabrication techniques like SPDT and advanced mounting solutions.

What is the role of polishing in ZnSe optical manufacturing?

Polishing is critical as it determines the final surface quality, minimizing roughness and sub-surface damage. A high-quality polish is essential to reduce scattering losses, particularly important for high-resolution thermal imaging where surface imperfections can significantly degrade image clarity and system sensitivity.

Which countries in APAC are key drivers of ZnSe demand?

China is the single largest consumer in APAC, driven by its massive manufacturing sector and growing defense industry. South Korea and Japan are also significant contributors, focused on high-end industrial automation and advanced optoelectronics research and development, requiring premium-grade ZnSe optics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Zinc Selenide Market Statistics 2025 Analysis By Application (Laser Optical Element, Medical Field, Thermal Imaging System), By Type (Below 50 mm, 50-150 mm, 150-250 mm, Above 250 mm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Zinc Selenide Crystal Market Statistics 2025 Analysis By Application (Laser Optical Element, Medical Field, Thermal Imaging System), By Type (250 mm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager