Zirconia Dental Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436302 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Zirconia Dental Product Market Size

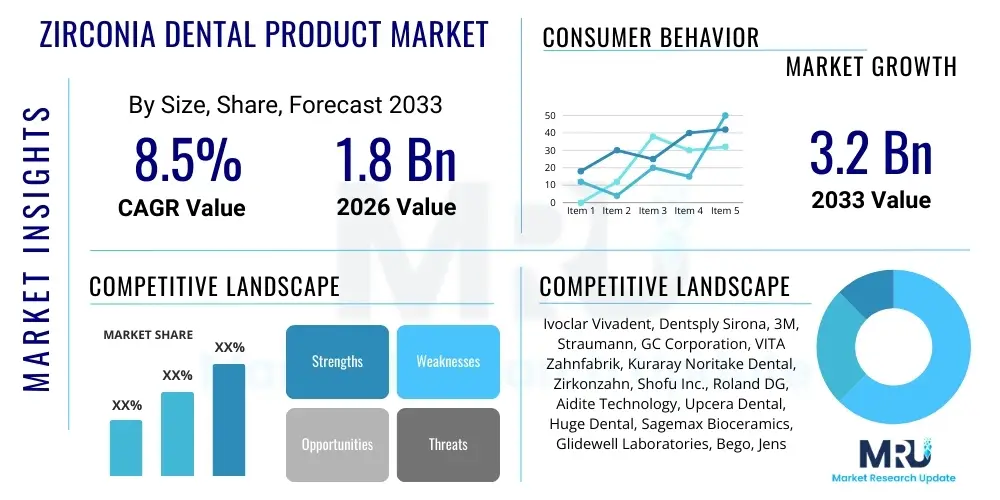

The Zirconia Dental Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Zirconia Dental Product Market introduction

The Zirconia Dental Product Market encompasses the global trade of materials and devices utilizing zirconium dioxide (zirconia) for restorative and prosthetic dentistry. Zirconia is highly favored due to its exceptional mechanical properties, including high flexural strength and fracture toughness, coupled with superior biocompatibility and aesthetic qualities that closely mimic natural tooth structure. This material has largely replaced conventional metal alloys and porcelain-fused-to-metal (PFM) restorations, becoming the gold standard for various dental applications such as crowns, bridges, implants, and dentures. The market is driven by increasing patient demand for durable, metal-free, and highly aesthetic dental solutions.

Key products within this market include pre-sintered zirconia blocks and discs, specialized milling machines (CAD/CAM systems) designed to process these materials, and coloring liquids used to achieve natural shading. The robust adoption of digital dentistry workflows, which integrate intraoral scanners and computer-aided design, has significantly accelerated the demand for zirconia products, as they are perfectly suited for precise milling and rapid production cycles. Furthermore, the rising global prevalence of dental diseases and the expanding geriatric population requiring restorative interventions contribute significantly to market expansion.

The primary applications of zirconia span across prosthodontics and implantology, offering patients solutions that are both functional and visually pleasing. The inherent benefits, such as reduced risk of allergic reactions (due to metal elimination) and longevity in the oral environment, solidify zirconia’s position as a leading material. Major driving factors include technological advancements in material science, leading to multi-layered and highly translucent zirconia variants, and the increasing disposable income in emerging economies, enabling greater access to advanced dental care.

Zirconia Dental Product Market Executive Summary

The Zirconia Dental Product Market is experiencing robust growth driven primarily by the transition from traditional restorative materials to highly aesthetic and durable ceramic alternatives. Business trends indicate a significant investment in CAD/CAM technology integration by dental laboratories and clinics worldwide, optimizing the fabrication process for zirconia restorations and boosting efficiency. Strategic partnerships between zirconia material manufacturers and digital equipment providers are commonplace, aiming to offer end-to-end digital solutions that streamline workflows, reduce material waste, and improve clinical outcomes. Furthermore, the market is characterized by intense R&D focusing on enhancing the translucency and reducing the brittleness of zirconia formulations, catering directly to the increasing patient focus on anterior aesthetics.

Regionally, North America and Europe maintain dominance, attributed to high healthcare expenditure, established dental infrastructure, and early adoption of advanced dental technologies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth trajectory, fueled by rapidly expanding dental tourism, rising awareness of oral hygiene, and government initiatives aimed at improving dental access, particularly in countries like China, India, and South Korea. This demographic shift towards advanced dental care in APAC presents lucrative growth opportunities, compelling global vendors to expand their distribution and manufacturing footprint in the region.

Segment trends reveal that the Zirconia Blocks and Discs segment maintains the largest market share, serving as the fundamental raw material for CAD/CAM milling centers. The application segment is dominated by Crowns and Bridges, reflecting the most common usage of zirconia in restorative dentistry. Conversely, the Zirconia Implants sub-segment is demonstrating the highest CAGR, propelled by the growing demand for metal-free dental implants that minimize gingival discoloration and provide excellent long-term stability. End-user trends show that large commercial dental laboratories, equipped with sophisticated CAD/CAM systems, remain the primary consumers, although point-of-care milling adoption in specialized dental clinics is steadily increasing.

AI Impact Analysis on Zirconia Dental Product Market

Common user questions regarding AI's influence on the Zirconia Dental Product Market center on how artificial intelligence can optimize the design and fabrication phases, specifically querying AI's role in improving milling precision, predicting material performance, and automating quality control. Users often express concerns about whether AI-driven design tools could standardize restorations too much or whether initial investment costs in advanced AI-integrated CAD/CAM systems are justifiable. The consensus expectation is that AI will primarily enhance diagnostic accuracy, streamline the complex design of anatomical contours for crowns and bridges, and significantly reduce the turnaround time for prosthetics, thereby increasing the overall adoption rate of zirconia by making the process more efficient and error-free.

- AI integration optimizes CAD software for designing highly accurate, personalized zirconia restorations based on patient occlusion data.

- Predictive analytics driven by AI models helps dental labs select the optimal type of zirconia material (e.g., high strength vs. high translucency) for specific clinical cases, minimizing failure rates.

- AI-powered quality control systems inspect milled zirconia units for microfractures or dimensional inaccuracies before sintering, significantly improving manufacturing standards.

- Automated segmentation and labeling using machine learning enhances the efficiency of intraoral scanning and preparation margin identification, crucial steps before CAD/CAM processing.

- AI algorithms assist in optimizing milling paths within CAD/CAM machines, reducing milling time and improving the longevity of the milling tools, thereby lowering operational costs for zirconia production.

DRO & Impact Forces Of Zirconia Dental Product Market

The market dynamics for zirconia dental products are predominantly shaped by powerful drivers, moderated by specific technological restraints, and fueled by significant technological opportunities, creating a complex impact force landscape. The primary driver is the overwhelming preference for metal-free dentistry driven by aesthetic consciousness and heightened awareness of material biocompatibility. Simultaneously, the proliferation of advanced CAD/CAM technology has created an ecosystem where zirconia restoration fabrication is precise, fast, and scalable, reducing reliance on labor-intensive, conventional techniques. These factors collectively exert a strong upward force on market growth, pushing dental professionals toward high-performance ceramic solutions for both routine and complex restorative cases.

Conversely, significant restraints hinder wider adoption, notably the inherently higher material cost compared to PFM restorations and certain concerns related to the long-term wear resistance against opposing natural dentition, although modern multi-layered zirconia formulations are mitigating this issue. Another technical restraint involves the complexity of handling ultra-translucent zirconia, which requires specialized sintering protocols and highly precise bonding agents. These challenges act as moderate drag forces, particularly in price-sensitive markets or smaller clinics lacking the necessary infrastructure.

Opportunities center around the digitalization of dental practices and the development of next-generation materials. The integration of 3D printing techniques combined with zirconia technology (e.g., hybrid structures) promises enhanced customization and reduced waste. Furthermore, expanding penetration into emerging economies, coupled with favorable regulatory frameworks supporting dental implantology, opens vast untapped potential. The overall impact force is strongly positive, driven by consumer preference for aesthetics and technology adoption, significantly outweighing the friction caused by material costs and technical handling nuances.

Segmentation Analysis

The Zirconia Dental Product Market is comprehensively segmented based on the physical form of the product, the final clinical application, and the type of end-user facility utilizing the material. This segmentation is crucial for understanding specific market dynamics, technological adoption rates, and targeting specific procurement chains. The market structure reflects the entire digital workflow, starting from the raw material blocks and discs used in specialized labs, through to the final placement of crowns, bridges, and implants in clinics. Detailed analysis of these segments reveals that technological shifts, such as the increasing demand for ultra-translucent materials, disproportionately affect the Product Type category, while demographic shifts mainly influence the Application category, particularly the demand for aesthetic full-arch restorations.

- By Product Type:

- Zirconia Blocks

- Zirconia Discs

- Zirconia Liquid (Coloring and Glazing agents)

- By Application:

- Crowns and Bridges

- Dentures (Full and Partial)

- Dental Implants

- Inlays and Onlays

- By End-User:

- Dental Laboratories

- Dental Clinics

- Hospitals

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Zirconia Dental Product Market

The value chain for the Zirconia Dental Product Market begins with upstream activities involving the extraction and purification of zirconium oxide, primarily undertaken by specialized chemical companies and ceramic material providers. This raw material is then processed into high-purity, pre-sintered ceramic blanks (blocks and discs) by core material manufacturers such as Kuraray Noritake or VITA. The efficiency of this upstream phase dictates the consistency and quality of the final product, focusing heavily on minimizing impurities and controlling crystallographic structures to enhance translucency and strength. Technological advancements in powder processing and standardization are critical elements at this stage.

The midstream phase involves the key transformation process: the utilization of CAD/CAM systems within dental laboratories. Here, zirconia blanks are milled according to digital designs obtained from intraoral scanners, followed by specialized high-temperature sintering in dedicated furnaces to achieve full density and mechanical strength. The distribution channel is bifurcated: direct channels involve large material manufacturers supplying directly to major regional laboratories, often accompanied by technical training and maintenance services. Indirect channels involve authorized regional distributors and dealers who manage inventory and provide localized sales support to smaller clinics and labs.

Downstream analysis focuses on the end-users—dental clinics, hospitals, and specialty dental practices—where the final restoration is cemented or fixed. Success at this stage relies heavily on clinical expertise, proper handling protocols, and the use of compatible bonding agents. The increasing trend toward vertically integrated companies, which control material production, CAD/CAM hardware, and software, is reshaping the value chain, aiming to optimize material cost and quality control from raw material to patient placement. This push for vertical integration is a direct response to the demand for guaranteed performance metrics and simplified procurement.

Zirconia Dental Product Market Potential Customers

The primary customers and end-users of zirconia dental products are broadly categorized into institutions and private entities involved in restorative and prosthetic dentistry. Dental laboratories represent the single largest segment of buyers. These facilities invest heavily in high-volume CAD/CAM systems, sintering furnaces, and raw zirconia materials (blocks and discs) to produce customized restorations for a vast network of clinical practices. Their purchasing decisions are driven by material cost-efficiency, processing speed, material compatibility with milling equipment, and the aesthetic quality (translucency and shade matching) of the finished product, requiring reliable, certified suppliers.

Dental clinics, especially those adopting chairside CAD/CAM technology (point-of-care dentistry), are rapidly growing as potential customers. These clinics purchase smaller volumes of zirconia blocks and aim for rapid, single-visit restoration capabilities. Their focus is on ease of use, material durability, and swift processing times that minimize patient chair time. Hospitals, particularly those with specialized maxillofacial and prosthodontics departments, also constitute significant buyers, typically requiring high-strength zirconia for complex rehabilitation cases, trauma treatment, and implant-supported prosthetics. Furthermore, academic and research institutions purchase zirconia materials for material science studies and clinical training purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ivoclar Vivadent, Dentsply Sirona, 3M, Straumann, GC Corporation, VITA Zahnfabrik, Kuraray Noritake Dental, Zirkonzahn, Shofu Inc., Roland DG, Aidite Technology, Upcera Dental, Huge Dental, Sagemax Bioceramics, Glidewell Laboratories, Bego, Jensen Dental, Dental Direkt, Amann Girrbach, Zimmer Biomet. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zirconia Dental Product Market Key Technology Landscape

The Zirconia Dental Product market is fundamentally reliant on advanced material science and digital fabrication technologies. The central technology is Computer-Aided Design and Computer-Aided Manufacturing (CAD/CAM), which allows for the precise milling of zirconia blanks into complex anatomical shapes. Modern CAD/CAM systems integrate high-resolution scanners (intraoral or laboratory scanners) and sophisticated software capable of processing patient data and designing optimal restorations, maximizing the mechanical integrity and marginal fit of the final zirconia unit. Continuous innovation in milling technology, particularly the use of highly precise 5-axis milling machines, is crucial for handling the hardness and brittleness of zirconia effectively, ensuring high quality and minimizing tool wear.

Material technology forms the second critical pillar. Earlier generations of zirconia were highly opaque, limiting aesthetic use; however, advancements have led to the widespread adoption of High Translucency (HT) and Ultra Translucency (UT) zirconia, often combined in multi-layered discs that mimic the natural gradient of dentin and enamel. This stratification technology involves sophisticated powder preparation and pressing techniques. Furthermore, rapid sintering furnaces, which can significantly cut down the sintering time from several hours to under an hour while maintaining material properties, are becoming standard equipment, boosting laboratory productivity and enabling chairside restorations.

Another emerging technology influencing the landscape is the integration of Artificial Intelligence (AI) and Machine Learning (ML) into CAD software. AI assists in automated design proposals, occlusion analysis, and quality assurance checks, significantly reducing the human error associated with complex restoration design. Moreover, research is ongoing into hybrid materials and surface treatments for zirconia, such as plasma spraying and specialized layering techniques, aimed at improving bonding strength to dental cements and reducing potential opposing enamel wear. This continuous technological evolution ensures zirconia remains at the forefront of restorative dental materials.

Regional Highlights

The global Zirconia Dental Product Market exhibits distinct growth patterns across key geographic regions, driven by variations in healthcare infrastructure, dental expenditure, and technological adoption rates.

- North America: This region maintains market leadership due to high per capita dental expenditure, robust presence of major market players, and early, widespread adoption of advanced CAD/CAM systems in both corporate and private dental practices. The focus is increasingly on premium, aesthetic, multi-layered zirconia solutions.

- Europe: Characterized by mature healthcare systems and strong regulatory support for high-quality medical devices, Europe is a major consumer. Germany, Italy, and the UK are critical markets, emphasizing standardized training and precision manufacturing, driving demand for high-strength, durable zirconia for complex implantology.

- Asia Pacific (APAC): Expected to register the highest CAGR, APAC growth is fueled by massive untapped patient populations, increasing dental tourism in nations like Thailand and India, and rising disposable incomes leading to higher investment in aesthetic dentistry. Local manufacturing capabilities are also rapidly expanding, presenting a competitive challenge.

- Latin America (LATAM): Growth in LATAM is driven by improving access to dental care and rising awareness of advanced restorative options in urban centers like Brazil and Mexico. The market is moderately price-sensitive, balancing demand for quality zirconia with cost-effective production techniques.

- Middle East and Africa (MEA): This region is characterized by significant infrastructure investment in high-income Gulf countries (UAE, Saudi Arabia), leading to modern dental facilities that readily adopt advanced zirconia technology, particularly for cosmetic dentistry. Growth in Africa is more measured, focusing primarily on essential restorative needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zirconia Dental Product Market.- Ivoclar Vivadent AG

- Dentsply Sirona Inc.

- 3M Company

- Straumann Group

- GC Corporation

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- Kuraray Noritake Dental Inc.

- Zirkonzahn GmbH

- Shofu Inc.

- Roland DG Corporation

- Aidite Technology Co., Ltd.

- Upcera Dental Technology Co., Ltd.

- Huge Dental Material Co., Ltd.

- Sagemax Bioceramics, Inc.

- Glidewell Laboratories

- Bego Group

- Jensen Dental

- Dental Direkt GmbH

- Amann Girrbach AG

- Zimmer Biomet Holdings, Inc.

Frequently Asked Questions

Analyze common user questions about the Zirconia Dental Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Zirconia Dental Product Market?

The primary driver is the rising global demand for highly aesthetic, biocompatible, and durable metal-free restorations, coupled with the rapid adoption of digital CAD/CAM technology that makes zirconia fabrication efficient and precise.

How does the cost of zirconia restorations compare to traditional PFM (Porcelain-Fused-to-Metal) restorations?

While the initial material cost of high-quality zirconia blocks or discs is generally higher than traditional PFM components, the long-term cost efficiency is often better due to superior longevity, reduced chair time via CAD/CAM, and simplified clinical procedures.

What are the main application segments for zirconia in dentistry?

Zirconia is predominantly used in the fabrication of dental crowns and bridges, which represents the largest application segment. It is also increasingly utilized for dental implants, fixed dentures, and complex full-mouth rehabilitation cases requiring high strength.

Which geographical region is expected to show the fastest growth rate in the market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), driven by improving healthcare infrastructure, substantial government investment in dental health, and growing consumer demand for cosmetic dental treatments.

What technological advancements are currently enhancing the aesthetic appeal of zirconia?

Key advancements include the development of multi-layered zirconia discs that mimic the natural color gradient and translucency of natural teeth, along with specialized high-translucency (HT/UT) formulations that allow for all-zirconia restorations without porcelain layering.

Detailed Segmentation Insights: Product Type and Application

Zirconia Product Type Analysis

The segmentation by Product Type provides insight into the purchasing habits of dental laboratories and the technological trajectory of material development. Zirconia Blocks and Discs constitute the foundation of the market, serving as the raw material input for all CAD/CAM-driven processes. Discs typically command a larger market share due to their compatibility with most high-throughput milling systems, allowing for the creation of multiple units from a single blank, thus maximizing material utilization and reducing waste. The shift towards larger, multi-layered discs reflects the industry's focus on achieving highly aesthetic, monolithic restorations that eliminate the risk of porcelain chipping associated with layered materials. Manufacturers are continually refining the grain size and purity of these blanks to enhance mechanical performance and optical properties, addressing the critical balance between strength and translucency required for modern dental aesthetics.

Zirconia Blocks, while smaller, are often preferred in chairside CAD/CAM settings (dental clinics) where rapid, single-unit production is prioritized. The adoption rate of blocks is closely tied to the sales of proprietary chairside milling machines. As dental clinics increasingly adopt point-of-care solutions to enhance patient convenience and streamline operations, the demand for pre-colored, pre-sintered (or partially sintered) blocks optimized for immediate use is witnessing steady growth. This segment is characterized by faster turnaround times but typically involves a higher per-unit cost compared to large-scale laboratory production using discs.

Zirconia Liquids, encompassing coloring and glazing agents, are essential for the final aesthetic outcome. These specialized liquids are applied to the pre-sintered (green stage) material to achieve precise vita shades before the final high-temperature sintering. The market for these liquids is highly specialized, driven by the need for exact shade matching and long-term color stability. Advanced layering and internal coloring techniques using these liquids allow dental technicians to create highly customized, life-like restorations, cementing the importance of this ancillary segment within the overall value chain, especially as high-translucency zirconia demands more nuanced coloring protocols.

- Zirconia Discs: Dominant raw material format, preferred by large dental laboratories for multi-unit milling and optimal material economy.

- Zirconia Blocks: Key component for chairside (point-of-care) dentistry, valuing rapid processing and simplicity.

- Zirconia Liquid: Specialized agents crucial for achieving professional aesthetic outcomes through precise shade matching and internal colorization before final sintering.

Zirconia Application Segment Analysis

The application segment delineates where zirconia products find their primary utility within the mouth, revealing trends in clinical needs and patient demographics. Crowns and Bridges remain the cornerstone application, consuming the majority of zirconia material globally. Zirconia has become the material of choice for single crowns and multi-unit fixed partial dentures due to its superior strength, which allows for minimal preparation of the natural tooth structure, and its aesthetically pleasing opacity that effectively masks discolored or underlying metal posts. The growing prevalence of dental trauma, caries, and the natural aging of the population continually drives demand in this restorative category.

The Dental Implants segment is witnessing the most rapid expansion. Traditional titanium implants are robust but can cause grey discoloration visible through thin gingiva, prompting a surge in demand for metal-free, all-zirconia implants (often referred to as ceramic implants). Zirconia implants offer exceptional soft tissue response and reduced plaque accumulation, contributing to better long-term peri-implant health. While zirconia implants currently represent a smaller portion of the total implant market, increasing clinical evidence supporting their osseointegration capabilities and heightened patient preference for holistic, metal-free options are fueling aggressive growth projections.

Furthermore, Zirconia is increasingly utilized in the fabrication of Dentures, particularly in the construction of full-arch implant-supported fixed prostheses. Its high durability ensures the structural integrity of these complex frameworks, resisting the substantial occlusal forces exerted during mastication. Inlays and Onlays, which require precise marginal adaptation and high wear resistance, also utilize monolithic zirconia when high strength is needed, though this remains a niche application compared to the major restorative categories. The diversity of applications underscores zirconia’s versatility as the primary high-performance ceramic in modern dentistry.

- Crowns and Bridges: Largest segment, driven by high aesthetic requirements and need for long-term functional stability in single and multi-unit restorations.

- Dental Implants: Fastest-growing segment, propelled by the shift towards metal-free, biocompatible ceramic implants for enhanced aesthetics and improved soft tissue health.

- Dentures: Focuses on durable, implant-supported frameworks for fixed prostheses, leveraging zirconia's high flexural strength.

- Inlays and Onlays: Smaller segment utilizing zirconia where high strength is necessary in areas of concentrated occlusal load.

Regional Deep Dive and Market Dynamics

North American Market Landscape

The North American Zirconia Dental Product Market, encompassing the United States and Canada, is the most mature and dominant market globally, characterized by high adoption rates of advanced dental technology and substantial consumer willingness to pay for premium aesthetic dental procedures. The United States, in particular, drives innovation through large integrated dental service organizations (DSOs) and substantial research funding allocated to dental materials science. The regulatory environment, managed by bodies like the FDA, ensures high standards for material quality and clinical efficacy, further solidifying confidence in zirconia products. Demand here is strongly skewed towards multi-layered, ultra-translucent zirconia formulations that simplify the workflow for dental technicians while meeting demanding patient expectations for natural appearance.

Key drivers include the high penetration of insurance coverage facilitating expensive procedures and the robust presence of leading global manufacturers who prioritize new product launches and educational initiatives in this region. The increasing integration of high-definition intraoral scanners and sophisticated CAD software systems is creating a seamless digital workflow from diagnosis to restoration fabrication, which fundamentally favors the use of zirconia due to its milling properties. Competitive strategies in North America often revolve around comprehensive solution packages, bundling raw materials, milling equipment, and maintenance contracts to secure long-term loyalty from large dental laboratory chains and DSO networks. The market shows a pronounced trend toward consolidation among laboratories, which further amplifies the purchasing power for high-volume zirconia materials.

- Dominance attributed to high per capita dental spending and advanced clinical infrastructure.

- Strong trend towards fully digital dentistry (scanners and CAD/CAM) driving rapid consumption of specialized zirconia blanks.

- Focus on premium, aesthetic zirconia types (HT/UT) for high-end cosmetic procedures.

European Market Landscape

Europe represents the second-largest market, with significant contributions from Western European nations, notably Germany, France, and Italy. The European dental market is characterized by a strong emphasis on precision engineering, resulting in high standards for zirconia quality and strict adherence to ISO certification. Germany stands out as a critical hub, both for material consumption and manufacturing innovation, being home to several influential CAD/CAM hardware and zirconia material producers. The stringent quality control expected by European dental associations and regulatory bodies ensures a steady demand for certified, high-performance zirconia.

Market growth in Europe is sustained by an aging population requiring extensive restorative work and government-supported healthcare systems that often cover basic restorative procedures, increasing the volume of treatments performed. However, the market is also influenced by varying reimbursement policies across different nations, which sometimes restrain the adoption of the most expensive, specialized zirconia types. Competitive dynamics involve establishing strong distribution networks and offering robust clinical training and technical support to dental professionals, focusing on the longevity and proven track record of the restorative solutions. The integration of zirconia into standardized implant protocols also drives consistent demand across the continent.

- High quality standards and reliance on precision manufacturing, particularly in Germany and Scandinavian countries.

- Sustained demand driven by an aging demographic requiring extensive prosthetic solutions.

- Market size influenced by national reimbursement policies, affecting the price sensitivity of the end-users.

Asia Pacific (APAC) Market Dynamics

The Asia Pacific region is forecast to be the fastest-growing market globally, projected to surpass European volumes within the next decade. This exponential growth is primarily fueled by two major factors: rapid economic development leading to increased disposable incomes and vast, underserved populations demanding better access to sophisticated dental care. Countries like China, India, South Korea, and Japan are at the forefront of this expansion. China, with its substantial population and aggressive investment in healthcare infrastructure, presents immense growth potential, driving demand for locally produced and imported zirconia materials.

In South Korea and Japan, the focus is on technological sophistication, with high adoption rates of advanced materials and digital workflows, mirroring trends seen in North America. Meanwhile, emerging economies like India and Southeast Asia are witnessing explosive growth in dental tourism, where international patients seek high-quality zirconia restorations at competitive prices, necessitating large-scale procurement of materials by high-volume dental chains. The competitive landscape in APAC is intensifying, with local manufacturers gaining technological ground, offering price-competitive alternatives to global brands. Challenges include fragmented distribution channels and the necessity for extensive clinical education to standardize the handling and placement protocols for zirconia among a rapidly growing pool of dental practitioners.

- Highest CAGR globally, driven by improved healthcare access and rising middle-class disposable income.

- Key growth contributors: China (infrastructure expansion) and South Korea/Japan (technological sophistication).

- Significant presence of dental tourism driving demand for high-volume, cost-effective, quality restorations.

Latin America and MEA Market Dynamics

The Latin American (LATAM) market, led by Brazil and Mexico, is growing steadily, propelled by increasing urbanization and greater availability of private dental clinics offering advanced services. Zirconia adoption is strong in aesthetic restorative applications, but the market often demonstrates higher price sensitivity compared to North America or Western Europe. Vendors frequently enter this market through local partnerships and distribution agreements, providing essential technical support and materials tailored to specific regional economic conditions. The focus is often on balancing high strength needed for complex oral conditions with cost-effective material options.

The Middle East and Africa (MEA) region shows bipolar growth. Highly concentrated demand exists in the Gulf Cooperation Council (GCC) states (UAE, Qatar, Saudi Arabia), where high government spending on healthcare infrastructure and a high influx of expatriates demanding premium services lead to rapid adoption of the latest zirconia technologies, often imported directly from leading global suppliers. In contrast, the African segment is nascent, focusing mainly on essential dental care, though South Africa acts as a regional leader in adopting advanced restorative materials. Growth in MEA is highly reliant on sustained investment in modern dental facilities and the development of specialized clinical training centers.

- LATAM: Steady growth, price-conscious adoption, strong demand for aesthetic treatments in urban centers (Brazil and Mexico).

- MEA: Driven by luxury dental services and infrastructure investment in GCC nations; high reliance on imported premium zirconia products.

Impact of Digital Dentistry on Zirconia Market

The market trajectory of zirconia is inextricably linked to the pervasive influence of digital dentistry, which encompasses intraoral scanning, CAD/CAM systems, and sophisticated material processing protocols. The shift from manual wax-ups and investment casting to fully digital design and milling has significantly reduced the variables associated with traditional prosthetic fabrication, resulting in more predictable and accurate zirconia restorations. Digital workflows minimize the risk of human error during crucial stages like margin trimming and anatomical contouring, which is vital for maximizing the longevity of a restoration. This precision capability is what enables the use of monolithic zirconia restorations, as the milling machine can produce the required high level of fit and surface smoothness, negating the need for highly skilled manual layering of porcelain.

The efficiency gained through digital processes directly impacts the viability of zirconia, particularly for high-volume dental laboratories. Automation allows labs to process a greater number of cases per day with fewer technicians, offsetting the higher initial cost of the raw material and equipment. Furthermore, the interoperability between different digital components—scanners, design software, and milling machines—is continuously improving, reducing system complexity and broadening the market appeal to smaller dental clinics. This interoperability ensures that zirconia products, regardless of the brand, can be seamlessly integrated into diverse clinical environments, accelerating global adoption.

Technological advancement in scanners and software, including cloud-based data storage and AI-assisted design, further solidifies zirconia's market position. Remote communication between clinics and labs utilizing digital files ensures faster feedback loops and reduces the necessity for repeated adjustments, enhancing patient satisfaction. Ultimately, digital dentistry has transformed zirconia from a specialist material into a standard restorative option by making its fabrication reliable, scalable, and economically sustainable for large-scale production. This convergence of material science and digital technology is the single most powerful driver determining the future market size and penetration of zirconia dental products worldwide.

- Digital workflow integration minimizes fabrication errors and ensures high marginal fit for zirconia prosthetics.

- CAD/CAM automation enhances laboratory efficiency, allowing for high-volume, predictable production.

- Chairside milling technology enables single-visit zirconia restorations, increasing convenience and market adoption by clinics.

Market Challenges and Future Outlook

Key Market Restraints and Mitigation Strategies

Despite its advantages, the Zirconia Dental Product Market faces inherent challenges primarily related to cost, processing difficulty, and specific technical limitations. The high initial capital investment required for dedicated CAD/CAM milling centers and high-temperature sintering furnaces remains a substantial barrier to entry, particularly for smaller independent dental laboratories and clinics in developing regions. Furthermore, the raw material cost of high-quality, multi-layered zirconia blanks is significantly greater than traditional alternatives. To mitigate this, manufacturers are focusing on creating more affordable, simplified systems (e.g., desktop mills) and optimizing material processing to reduce waste, thereby lowering the effective cost per unit.

Another technical restraint involves the material's potential brittleness and sensitivity during the sintering and post-milling stages, demanding extremely precise handling and strict adherence to manufacturing protocols. Improper sintering can result in reduced strength or undesirable aesthetics. The industry is countering this through "smart" sintering furnaces equipped with automatic calibration and advanced control systems, ensuring optimal material transformation. Concerns regarding the wear of opposing dentition by high-density, polished zirconia are being addressed through next-generation materials and mandatory stringent polishing and glazing protocols, which aim to replicate the smoothness of natural enamel, demonstrating a continuous commitment to material safety and long-term performance.

Looking forward, the market outlook remains exceptionally positive. The future of zirconia rests on achieving even higher levels of translucency without compromising strength, effectively closing the aesthetic gap between zirconia and pure glass ceramics. The integration of 3D printing techniques for temporary restorations and complex framework structures is anticipated to complement zirconia milling, offering hybrid solutions that further optimize cost and complexity. Furthermore, the expansion of clinical applications beyond crowns and bridges into orthodontics and advanced maxillofacial prosthetics is expected to open new revenue streams. Sustained growth will be heavily reliant on continuous clinical education and the successful penetration of digital workflows into large, rapidly emerging Asian economies.

- High initial investment costs in CAD/CAM infrastructure impede smaller clinic adoption.

- Material processing sensitivity during sintering requires strict, specialized protocols.

- Future outlook: Increased focus on ultra-high translucency and integration with additive manufacturing (3D printing) technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager