Zirconium Metal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433204 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Zirconium Metal Market Size

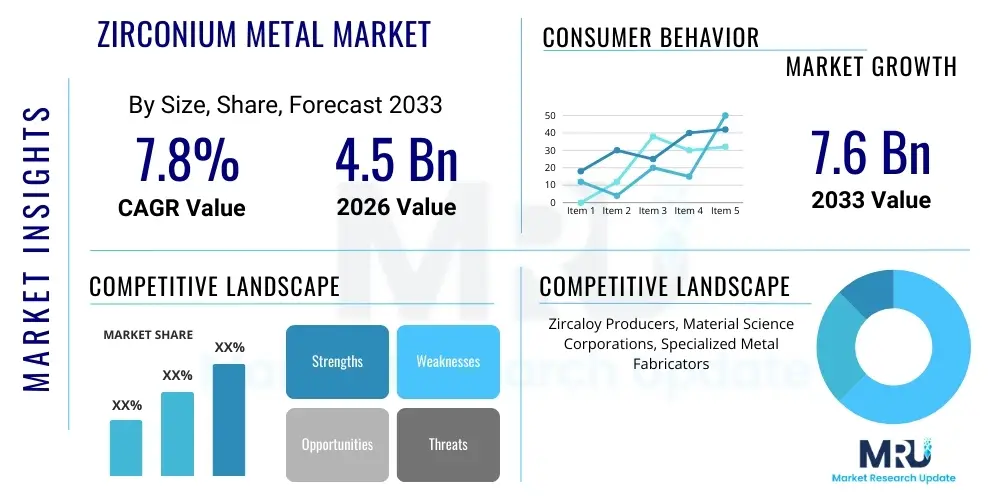

The Zirconium Metal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033.

Zirconium Metal Market introduction

The Zirconium Metal Market encompasses the production, processing, and application of zirconium, a transition metal renowned for its exceptional corrosion resistance, high melting point, and low neutron capture cross-section. Zirconium metal, particularly in the form of Zircaloy alloys, is strategically critical, primarily serving the nuclear energy sector where its properties are indispensable for cladding fuel rods in light-water reactors (LWRs). Beyond nuclear applications, zirconium finds substantial utility in the chemical processing industry (CPI) due to its superior resistance to harsh acidic and alkaline environments, making it ideal for heat exchangers, pumps, and specialized piping systems. The increasing global focus on clean energy generation and heightened industrial safety standards are fundamentally driving the demand trajectory for this specialized material.

Zirconium is derived primarily from the mineral zircon (zirconium silicate), requiring complex extractive metallurgy processes, such as the Kroll process or plasma melting, to produce high-purity, reactor-grade metal. Product forms range from zirconium sponge and powder to mill products like tubes, plates, and bars. The benefits of using zirconium metal are multifaceted, including enhanced operational longevity of equipment, minimized maintenance costs in corrosive environments, and crucial safety advantages in nuclear power generation. Its biocompatibility also positions it for niche growth within the medical device and orthopedic sectors, although this remains a secondary application compared to the industrial and energy spheres.

Major applications dictating market dynamics include nuclear reactor construction and maintenance, chemical processing, high-performance aerospace components requiring thermal stability, and specialized electronics. The primary driving factor remains the global renaissance in nuclear power construction and life extension projects, particularly in Asia Pacific and Eastern Europe, seeking stable, low-carbon baseload electricity. Furthermore, the stringent requirements for materials in highly corrosive chemical operations, particularly in the production of acetic acid and hydrochloric acid, solidify zirconium's commercial relevance and sustained market growth across the forecast period.

Zirconium Metal Market Executive Summary

The Zirconium Metal Market demonstrates robust growth driven predominantly by non-discretionary demand from the nuclear power industry and critical infrastructure replacement cycles in chemical processing plants. Key business trends indicate a strategic push towards enhancing production efficiency and quality control measures, specifically focusing on ultra-high-purity, reactor-grade zirconium (Zr). The market structure is highly consolidated, with a few integrated producers dominating the supply chain, emphasizing long-term procurement contracts with utilities and government entities. Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, propelled by massive investments in new nuclear capacity, particularly in China and India, alongside significant expansion in regional chemical manufacturing sectors. North America and Europe remain mature but vital markets, characterized by reactor life extension projects and maintenance requirements.

AI Impact Analysis on Zirconium Metal Market

Common user questions regarding AI's impact on the Zirconium Metal Market center on optimizing the complex, energy-intensive extractive processes (like Kroll reduction), predicting material performance under extreme operating conditions, and enhancing quality assurance for reactor-grade materials. Users frequently inquire about how predictive maintenance facilitated by AI could extend the operational life of Zircaloy cladding and how machine learning algorithms might accelerate the discovery of new, advanced zirconium alloys with even better corrosion resistance or neutron economy. There is also significant interest in using AI for supply chain resilience, forecasting geopolitical risks affecting key mineral sources (zircon sand), and optimizing inventory management for specialized mill products with long lead times. These inquiries reveal an expectation that AI will be transformative not only in manufacturing efficiency but critically in ensuring the safety, reliability, and economic viability of nuclear and heavy industrial applications.

The implementation of Artificial Intelligence and machine learning models in the Zirconium Metal sector is strategically focused on enhancing efficiency and maintaining stringent quality standards required for mission-critical applications. AI is already being deployed in real-time monitoring of reactor coolant chemistry and corrosion rates, allowing operators to make micro-adjustments that maximize fuel life and reactor safety. Furthermore, in the manufacturing phase, AI-powered image processing and spectral analysis are drastically improving the detection of micro-defects and impurities in Zirconium sponge and billets, ensuring that materials meet the precise, sub-ppm purity thresholds mandated for reactor usage, thereby reducing waste and reprocessing costs.

Future implications suggest AI will be central to predictive maintenance schedules for nuclear facilities, specifically by modeling neutron flux damage accumulation in Zircaloy components over decades. This data-driven approach moves maintenance from time-based schedules to condition-based, optimizing operational uptime and minimizing the risk of unplanned shutdowns. The adoption of AI is critical for maintaining market growth, especially as the industry faces pressure to lower the overall levelized cost of energy (LCOE) from nuclear sources while simultaneously addressing increasingly complex material science challenges associated with higher burnup fuels and advanced reactor designs.

- AI optimizes complex extractive metallurgy processes, reducing energy consumption and operational variability.

- Machine learning improves real-time quality control for reactor-grade zirconium purity testing.

- Predictive modeling enhances Zircaloy cladding performance and extends reactor fuel life cycles.

- AI supports advanced material discovery for next-generation zirconium alloys with superior properties.

- Demand forecasting and supply chain resilience are improved using AI to manage geopolitical sourcing risks.

DRO & Impact Forces Of Zirconium Metal Market

The Zirconium Metal Market operates under a distinct set of drivers, restraints, and opportunities (DRO), which collectively shape its trajectory and are influenced by significant impact forces predominantly rooted in regulatory frameworks and global energy policy. The primary driver is the renewed commitment to nuclear energy expansion worldwide, particularly the deployment of Small Modular Reactors (SMRs) and the extension of operational licenses for existing Light Water Reactors (LWRs, which rely heavily on Zircaloy alloys. Simultaneously, the material's unparalleled resistance to corrosive agents ensures sustained demand from chemical manufacturing, especially for handling high-temperature, highly concentrated acids. These market drivers ensure a baseline level of resilient demand that is less susceptible to general economic downturns than many other commodity markets.

Conversely, significant restraints hinder more explosive growth. The high initial capital expenditure required for setting up high-purity production facilities, coupled with the complex and energy-intensive manufacturing process (e.g., Kroll reduction), limits the entry of new players and maintains high product costs. Furthermore, the market faces regulatory pressure; reactor-grade materials are subject to stringent, slow, and expensive certification processes imposed by national nuclear regulatory bodies (such as the NRC in the US or similar bodies globally), which can delay commercial deployment. Geopolitical supply chain risks associated with zircon sand sourcing, primarily from Australia, South Africa, and Indonesia, also pose structural constraints on feedstock availability and price stability.

Opportunities for growth are concentrated in material science innovation and new application penetration. The development of advanced, accident-tolerant fuels (ATF), often involving modified zirconium alloys or coatings, presents a major opportunity for vendors to capture premium value in the nuclear sector. Beyond nuclear, the emerging use of zirconium components in specialized high-frequency electronic devices and fuel cell technology opens new avenues for diversification. Impact forces, driven heavily by international treaties and national energy security mandates, exert powerful control. Environmental compliance standards and safety regulations compel end-users to rely exclusively on high-quality, certified zirconium products, fundamentally insulating established, reliable suppliers and reinforcing the barriers to entry for unproven competitors. These forces create a high-stakes, high-reward environment where quality and certification are paramount.

Segmentation Analysis

The Zirconium Metal Market is structurally segmented across various dimensions, including grade type, application, and end-user industry, reflecting the specialized nature and diverse purity requirements of the product. Grade segmentation is critical, separating the highly regulated and technically demanding nuclear-grade zirconium from the commercially focused industrial-grade. Application segmentation highlights the material's use across cladding, structural components, and piping/tubing. This detailed segmentation allows market participants to tailor their production capabilities and marketing strategies to specific, high-value niches, maximizing profitability within this consolidated supply landscape.

- By Grade Type:

- Nuclear Grade Zirconium (Reactor Grade)

- Industrial Grade Zirconium (Commercial Grade)

- By Product Form:

- Zirconium Sponge

- Zirconium Powder

- Zirconium Ingots and Billets

- Mill Products (Tubes, Rods, Plates, Sheets)

- By Application:

- Nuclear Fuel Cladding and Structural Components

- Chemical Processing Equipment (Heat Exchangers, Pumps)

- Aerospace Components

- Medical Devices and Implants

- Others (Electronics, Specialized Ceramics)

- By End-User Industry:

- Nuclear Power

- Chemical Processing

- Aerospace and Defense

- Electronics and Semiconductors

Value Chain Analysis For Zirconium Metal Market

The Zirconium Metal value chain is characterized by high integration and rigorous quality checkpoints spanning from mineral extraction to final installation in critical applications. Upstream analysis begins with the mining and processing of zircon sand, the primary raw material. This stage involves significant concentration and purification to produce purified zirconium oxide. The transition to zirconium metal (sponge) is highly concentrated, involving complex and proprietary technology like the chlorination-reduction (Kroll) process, a bottleneck that significantly dictates global supply dynamics and pricing stability. Few companies possess the technical expertise and regulatory approvals necessary to consistently produce high-purity, nuclear-grade sponge, leading to a vertically integrated structure among major players.

The midstream involves the transformation of zirconium sponge into usable forms. This includes melting and alloying to create ingots (e.g., Zircaloy alloys), followed by fabrication into mill products such as tubes, sheets, and rods. Precision engineering and stringent quality testing are non-negotiable at this stage, particularly for components destined for nuclear reactors, where microscopic defects can compromise safety and performance. Fabrication typically requires highly specialized equipment and controlled environments, adding significantly to the capital intensity of this segment. This specialized fabrication often dictates the direct distribution channels, focusing on a business-to-business model with deep technical integration between the material supplier and the component manufacturer.

Downstream analysis focuses on distribution and end-user consumption. Direct distribution channels dominate the nuclear sector, involving long-term supply agreements between the fabricator and nuclear utility operators or governmental agencies responsible for fuel manufacturing. Indirect distribution, involving specialized industrial distributors or engineering, procurement, and construction (EPC) firms, is more prevalent in the industrial-grade market (chemical processing, aerospace), offering small-to-medium enterprises access to required products. The entire value chain is heavily monitored by regulatory bodies, ensuring traceability and compliance from the mine to the reactor core, reinforcing the high-entry barriers characteristic of this specialized metals market.

Zirconium Metal Market Potential Customers

The primary and most lucrative end-users of high-purity Zirconium Metal are organizations operating within the energy and high-pressure chemical sectors, where material failure is catastrophic. Nuclear power generation companies and fuel assembly manufacturers represent the most critical customer segment, requiring Zircaloy tubing for fuel cladding, structural grids, and guide tubes within reactor cores. These buyers prioritize quality, certification history, and secure, long-term supply reliability over minor price fluctuations, positioning them as highly demanding yet essential patrons of the market.

Another major customer group comprises chemical processing industries (CPI), specifically companies involved in the production of highly corrosive substances such as concentrated mineral acids (sulfuric, nitric, hydrochloric) and organic acids (acetic acid). These end-users acquire zirconium components (heat exchangers, distillation columns, vessel linings) to ensure process integrity and extend the lifespan of capital equipment under severe operating conditions. The drive for operational efficiency and mandatory regulatory compliance regarding environmental releases makes high-performance materials like zirconium crucial purchasing criteria for these industrial buyers.

Beyond these core sectors, potential customers include defense contractors and aerospace manufacturers utilizing zirconium for its strength, lightness, and heat resistance in missile components and specialized airframe parts. Furthermore, medical device manufacturers use zirconium alloys for orthopedic implants and surgical instruments due to their biocompatibility and low rejection rates. While smaller in volume compared to the nuclear sector, these niche applications command premium pricing and require distinct, traceable quality assurance procedures, broadening the overall customer portfolio for diversified zirconium producers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zircaloy Producers, Material Science Corporations, Specialized Metal Fabricators |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zirconium Metal Market Key Technology Landscape

The technology landscape governing the Zirconium Metal Market is dominated by sophisticated metallurgical processes required to achieve the extreme purity levels demanded by the nuclear industry. The Kroll process remains the foundational technology for reducing zirconium tetrachloride to zirconium metal sponge, although modern adaptations focus intensely on process optimization to minimize energy consumption and eliminate critical impurities such as hafnium, which must be strictly controlled due to its high neutron absorption characteristics. Continuous innovation in solvent extraction and ion exchange purification technologies is essential in the upstream mineral processing phase to ensure cost-effective separation of zirconium from hafnium, a co-occurrence that poses the greatest technical challenge to commercial viability.

Midstream technological advancements center on specialized melting and fabrication techniques. Plasma melting and electron beam melting are increasingly utilized to produce defect-free zirconium ingots with superior homogeneity, crucial for subsequent hot and cold working stages. Furthermore, the fabrication of Zircaloy fuel cladding tubes requires highly specialized drawing and extrusion technologies, often performed under vacuum or inert atmosphere conditions to prevent contamination. Innovations in non-destructive testing (NDT), particularly advanced ultrasonic and eddy current techniques, are pivotal, ensuring that fabricated mill products meet the zero-defect tolerance required for reactor operation.

A burgeoning technological focus lies in developing Accident-Tolerant Fuel (ATF) cladding materials, which represent the future of nuclear material science. This involves researching and implementing advanced surface modification techniques, such as applying protective coatings (e.g., Chromium or specialized ceramic layers) to standard Zircaloy or developing entirely new zirconium-based alloys designed to significantly slow steam oxidation at high temperatures, offering enhanced safety margins during postulated accident scenarios. These research efforts, often government-funded, dictate the long-term technological trajectory and material procurement strategies within the nuclear segment.

Regional Highlights

The global Zirconium Metal market exhibits significant regional variations in demand intensity, regulatory maturity, and strategic focus, primarily driven by regional energy policies. Asia Pacific (APAC) stands out as the highest-growth region, attributed to the aggressive expansion of nuclear power infrastructure in nations like China, India, and South Korea, which are investing heavily in new reactor builds and establishing indigenous fuel fabrication capabilities. This rapid industrialization, combined with robust chemical processing growth, necessitates substantial imports or domestic production scaling of high-purity zirconium.

North America (NA) and Europe represent highly mature markets where demand is largely inelastic and sustained by reactor life extension projects, defueling operations, and rigorous maintenance cycles for both nuclear and aging industrial infrastructure. These regions are characterized by stringent quality requirements and established regulatory frameworks, making them crucial for suppliers who specialize in certified, long-lifecycle products. North America, in particular, is a hub for research and development into next-generation Accident-Tolerant Fuel technologies, ensuring continuous demand for specialized, R&D-grade zirconium materials.

The Middle East and Africa (MEA) and Latin America (LATAM) currently account for smaller shares but present compelling long-term growth opportunities. Nations in the MEA region, notably the UAE and others exploring civil nuclear power programs, are initiating major infrastructure projects requiring initial core loadings of zirconium materials. LATAM markets are driven more by growth in chemical processing and mining infrastructure, demanding industrial-grade zirconium for corrosion resistance rather than large-scale nuclear power requirements, indicating diverse purchasing profiles across these emerging regions.

- Asia Pacific (APAC): Dominates market growth due to vast new nuclear reactor construction projects (China, India) and massive expansion in the chemical manufacturing sector.

- North America: Stable market driven by nuclear reactor life extension programs, high-value specialized aerospace applications, and extensive R&D into advanced fuel cladding.

- Europe: Demand sustained by maintenance and decommissioning activities in established nuclear fleets, coupled with strong regulatory demand for industrial-grade materials in CPI.

- Middle East and Africa (MEA): Emerging market primarily driven by new civilian nuclear energy programs (e.g., UAE) focusing on energy diversification.

- Latin America (LATAM): Growth fueled by localized demands from the petrochemical and heavy chemical industries seeking corrosion-resistant materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zirconium Metal Market.- Westinghouse Electric Company (Nuclear Fuel Business)

- Framatome (an EDF Group Company)

- China National Nuclear Corporation (CNNC)

- KAMAN Nuclear (formerly Zircaloy Products Division)

- ATI (Allegheny Technologies Incorporated)

- Tricor Metals

- Aperam S.A.

- VSMPO-AVISMA Corporation

- Heraeus Group

- Orano (Material activities)

- Western Zirconium (WZI)

- Chepetsky Mechanical Plant (CMP)

- Mepura - Metallpulver GmbH

- Baoji Titanium Industry Co., Ltd. (BAOTI)

- Advanced Metallurgical Group (AMG)

- Roshydromet (part of Rosatom)

- Global Advanced Metals (GAM)

- Toho Titanium Co., Ltd.

- Axel Johnson Inc. (through subsidiaries)

- Neo-Pure Materials Corporation

Frequently Asked Questions

Analyze common user questions about the Zirconium Metal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current demand for Nuclear Grade Zirconium?

The primary driver is the global commitment to nuclear energy expansion and the extension of operational licenses for existing Light Water Reactors (LWRs). Zirconium alloys (Zircaloy) are non-substitutable for fuel rod cladding due to their optimal combination of mechanical strength, high corrosion resistance, and extremely low thermal neutron capture cross-section, ensuring reactor efficiency and safety.

How does the production of Zirconium Metal compare to other industrial metals in terms of cost and complexity?

Zirconium metal production is significantly more complex and costly than base metals due to the necessity of separating zirconium from hafnium, a chemically similar element. This separation requires complex processes like liquid-liquid extraction, followed by the highly energy-intensive Kroll reduction process to produce high-purity sponge, resulting in elevated capital expenditure and operating costs.

What is Accident-Tolerant Fuel (ATF) and how is it impacting Zirconium Metal demand?

Accident-Tolerant Fuel (ATF) represents a critical nuclear safety upgrade designed to better withstand high-temperature conditions during accidents. ATF often involves advanced zirconium alloys or standard Zircaloy tubes enhanced with protective coatings (e.g., Chromium). This research and deployment effort is driving R&D spending and creating new, premium market opportunities for specialized zirconium materials and surface modification technologies.

Which end-user segment accounts for the highest volume consumption of Zirconium Metal?

The Nuclear Power industry accounts for the highest volume consumption of high-purity zirconium metal. This demand is concentrated in the continuous replacement of fuel assemblies, which necessitates large quantities of precisely fabricated Zircaloy tubing for fuel cladding and structural components within the reactor core.

What regional market is projected to exhibit the fastest growth for Zirconium Metal through 2033?

The Asia Pacific (APAC) region is projected to demonstrate the fastest market growth. This acceleration is predominantly fueled by aggressive national energy strategies in China, India, and other regional economies that prioritize the construction of new nuclear power plants and corresponding growth in domestic nuclear fuel fabrication capabilities, alongside strong industrial sector expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Zirconia Powders Market Statistics 2025 Analysis By Application (Medical, Paints & Coatings, Electronics, Zirconium Metal Production, Other), By Type (Purity: 99%, Purity: 99.9%, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Zirconium Metal Market Statistics 2025 Analysis By Application (Chemical Processing, Nuclear Reactor, Military Industry, Others), By Type (Nuclear Grade, Industrial Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Zirconium Metal Market Statistics 2025 Analysis By Application (Chemical Processing, Nuclear Reactor, Military Industry), By Type (Nuclear Grade, Industrial Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager