Zirconium Silicate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434762 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Zirconium Silicate Market Size

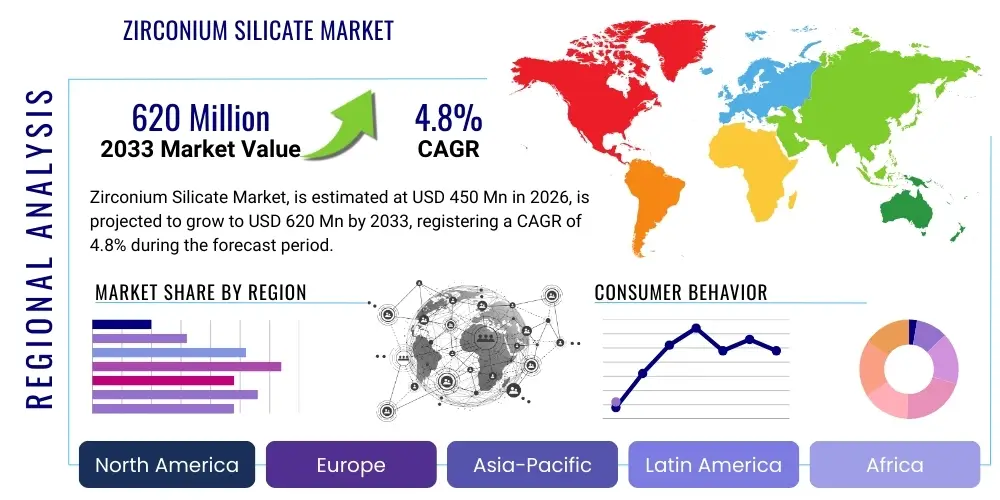

The Zirconium Silicate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 620 Million by the end of the forecast period in 2033.

Zirconium Silicate Market introduction

Zirconium silicate (ZrSiO4) is a highly valued industrial mineral derived primarily from the mineral zircon. It is characterized by its exceptional properties, including high hardness, chemical inertness, low thermal expansion, and a high refractive index. These attributes make it indispensable across several high-performance industrial sectors. The material is typically processed into fine powders, flours, and sands, which dictates its ultimate application suitability, ranging from opacifiers in ceramics to foundry sands and specialty refractory materials. Global market expansion is intrinsically linked to the sustained growth of the housing and construction industries, particularly in emerging economies, where demand for superior ceramic tiles and sanitaryware drives consumption.

The primary application of zirconium silicate revolves around its role as an opacifying agent in the production of ceramic glazes and frits. Its ability to impart whiteness, opacity, and superior surface finish to ceramic products makes it a cornerstone material in the tile, porcelain, and sanitaryware manufacturing processes. Beyond ceramics, it is crucial in refractories, utilized in high-temperature environments such as furnace linings and crucibles, owing to its excellent thermal stability and resistance to chemical attack. Furthermore, the material finds significant use in precision casting, acting as a foundry sand due to its minimal expansion upon heating, ensuring dimensional accuracy of complex metal parts.

The overarching benefits of utilizing zirconium silicate include enhanced material performance, reduced production costs in specific applications due to its efficiency as an opacifier, and improved environmental profiles compared to some alternative materials. Key driving factors underpinning the market growth involve the rapid urbanization globally, particularly in Asia Pacific, stimulating residential and commercial construction activities. Additionally, technological advancements in processing techniques are leading to finer particle sizes and higher purity grades of zirconium silicate, expanding its applicability in niche, high-value sectors such as advanced structural ceramics and specialized coatings, thereby securing its continuous relevance in industrial material science.

Zirconium Silicate Market Executive Summary

The Zirconium Silicate Market demonstrates resilient growth driven by infrastructural spending and sustained demand from the ceramics and refractory sectors. Current business trends indicate a shift towards ultra-fine and stabilized grades, demanded by advanced ceramic manufacturers seeking improved thermal shock resistance and higher mechanical strength in end products. Strategic acquisitions and vertical integration among key suppliers, particularly those controlling zircon mineral sourcing, characterize the competitive landscape, aiming to stabilize supply chain volatility and ensure raw material access. Furthermore, stringent environmental regulations regarding dust emissions and worker safety are influencing processing technology adoption, favoring closed-loop systems and sustainable milling practices, impacting operational expenditures across the value chain.

Regional trends highlight the Asia Pacific (APAC) region as the dominant consumer and producer, primarily fueled by massive construction booms in China, India, and Southeast Asian nations. This demand is closely tied to the regional dominance in ceramic tile manufacturing, which consumes the largest share of global zirconium silicate output. North America and Europe, while representing mature markets, show steady growth primarily driven by specialty applications, including high-performance refractories required by the glass and steel industries, and ongoing demand for specialized dental ceramics and precision investment casting shells. The reliance on imported raw zircon material remains a key geopolitical and logistical factor influencing regional market dynamics, compelling manufacturers in these regions to focus on value-added processing rather than basic material production.

Segmentation trends reveal that the 'Ceramics & Tiles' application segment continues to command the largest market share due to universal demand for architectural ceramics. However, the 'Refractories' segment is anticipated to exhibit a higher growth rate, benefiting from renewed investments in metallurgical and glass manufacturing infrastructure requiring extremely high-purity, thermally stable materials. In terms of grade, standard milling grades dominate volume, but the high-purity, ultra-fine grades are gaining traction and contributing disproportionately to revenue growth, signaling premiumization within the market structure. Innovation is concentrated on surface modification techniques and developing composite materials that leverage zirconium silicate's properties while minimizing overall consumption.

AI Impact Analysis on Zirconium Silicate Market

Common user questions regarding AI's impact on the Zirconium Silicate Market frequently center on predictive material optimization, automated quality control in processing, and demand forecasting reliability. Users are keen to understand how machine learning (ML) algorithms can refine the milling process to achieve tighter particle size distribution curves, crucial for high-opacity ceramic glazes. Another major concern involves optimizing complex supply chain logistics, given the global sourcing of raw zircon and the dispersed manufacturing base of end-products. Users expect AI to mitigate risks associated with fluctuating raw material prices and geopolitical disruptions, thereby enhancing production efficiency and predictive maintenance schedules for critical processing equipment like jet mills and kilns, translating into tangible operational savings.

- AI-driven optimization of raw zircon beneficiation processes, enhancing yield and purity levels.

- Predictive maintenance analytics for heavy milling and grinding equipment, minimizing unplanned downtime in production facilities.

- Machine learning integration into automated ceramic glazing lines, ensuring consistent opacity and color matching using real-time spectral data.

- Enhanced supply chain visibility and risk management through AI modeling of geopolitical factors affecting zircon sourcing.

- Optimization of energy consumption in high-temperature calcination and melting processes using predictive control systems.

- Automated quality control systems utilizing computer vision for defect detection in finished ceramic products and refractory linings.

- Improved R&D efficiency by simulating material properties and testing new formulations of zirconium silicate composites digitally.

DRO & Impact Forces Of Zirconium Silicate Market

The Zirconium Silicate Market is primarily driven by expanding global infrastructure and robust demand from the ceramics industry, particularly in developing Asian nations undergoing rapid urbanization. Counterbalancing these growth factors are restraints such as volatility in the price and supply of raw zircon mineral, which is geographically concentrated and subject to export restrictions and mining policy changes. Opportunities lie in developing specialized, nano-sized zirconium silicate powders for use in advanced electronics and biomedical applications, capitalizing on the material's unique physical properties. The collective impact forces show that macroeconomic stability and regulatory shifts concerning construction standards significantly influence overall market trajectory, making the market moderately sensitive to global economic cycles.

Major market drivers include the irreversible trend of global urbanization, which necessitates vast amounts of residential and commercial construction, consequently boosting demand for high-quality ceramic tiles and sanitaryware where zirconium silicate is essential. Furthermore, the increasing adoption of continuous casting technology in the steel industry requires high-performance refractory materials capable of withstanding extreme temperatures and chemical abrasion, solidifying demand for zirconium silicate-based refractories. Innovations in processing, leading to the commercial availability of ultra-fine grades, are opening up new application avenues in paints, coatings, and composite materials, thereby diversifying the market's demand base beyond traditional sectors and sustaining overall growth momentum.

Restraints largely revolve around supply chain vulnerability; raw zircon mineral production is highly concentrated in countries like Australia and South Africa. Any disruption, whether mining-related labor issues, political instability, or logistical bottlenecks, can significantly inflate raw material costs and constrain supply to processing facilities worldwide. Additionally, the availability of substitutes, particularly in lower-end ceramic applications, such as alternative opacifiers (e.g., certain titanium compounds), poses a moderate threat, although zirconium silicate generally offers superior performance. Opportunities are abundant in green technology applications, such as high-efficiency furnace linings and catalysts, where the chemical stability and high-temperature resistance of zirconium silicate are invaluable for sustainable industrial processes.

Segmentation Analysis

The Zirconium Silicate Market is segmented based on Grade Type, Application, and geographic Region. The Grade Type segmentation differentiates between standard grades (used mainly as foundry sand and basic refractories) and premium grades (characterized by high purity, fine particle size, and specialized surface treatments, utilized predominantly in high-end ceramic glazes, electronics, and technical ceramics). The Application analysis demonstrates the market’s reliance on the construction sector, with ceramics and tiles holding the dominant share, followed by vital industrial uses in refractories, foundry processes, and pigment manufacturing. Regional segmentation underscores the strategic importance of the Asia Pacific region due to its expansive manufacturing and construction base.

- By Grade Type:

- Standard Grade Zirconium Silicate

- Premium/High-Purity Grade Zirconium Silicate

- Ultra-Fine Powder Zirconium Silicate

- By Application:

- Ceramics and Tiles (Opacifiers, Glazes)

- Refractories (Furnace Linings, Insulators)

- Foundry and Casting (Molds, Cores, Washes)

- Paints and Coatings (Pigments, Fillers)

- Others (Specialty Chemicals, Cosmetics, Electronics)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA) (South Africa, GCC Countries)

Value Chain Analysis For Zirconium Silicate Market

The Zirconium Silicate value chain begins with the upstream mining and beneficiation of raw zircon sand, a process highly concentrated geographically. This primary material is then processed through high-temperature smelting, milling, and fine grinding to produce zirconium silicate flours and opacifiers of varying purity and particle sizes. The intermediate processors add value through purification techniques, ensuring the material meets stringent industrial specifications, especially for high-end ceramic and refractory applications. Logistics and distribution channels, spanning global shipping networks, connect processors to end-use manufacturers, often involving specialized chemical distributors capable of handling bulk industrial minerals.

Downstream analysis focuses on the large-scale industrial consumers, primarily ceramic tile manufacturers, who integrate zirconium silicate as a functional additive into their glaze formulations to achieve desired opacity and aesthetic properties. Refractory producers utilize the high thermal stability of the material to create furnace linings crucial for the glass, steel, and cement industries. The distribution channel is characterized by both direct sales, particularly for large, multinational end-users who contract volumes directly from major processors, and indirect sales through regional specialized distributors who manage inventory and provide smaller, technical batch deliveries to localized manufacturing clusters. The shift towards higher purity grades necessitates more rigorous quality control throughout the entire supply chain.

The efficiency of the value chain is significantly influenced by the energy costs associated with high-temperature processing (calcination and fusion) and the complexity of achieving ultra-fine particle size distributions via sophisticated milling technologies. Direct sales channels are preferred by manufacturers seeking supply security and favorable pricing, typical in the massive APAC construction markets. Conversely, indirect channels play a crucial role in serving diverse, smaller markets and providing technical support for specialized applications in North America and Europe. The key challenge remains the geographical disparity between raw material extraction, processing centers (often in China, India), and major consumption hubs, requiring robust global logistics management.

Zirconium Silicate Market Potential Customers

The primary end-users and buyers of zirconium silicate are companies operating within heavy industry and construction-related manufacturing sectors. Ceramic tile and sanitaryware manufacturers represent the largest customer segment, relying on zirconium silicate as the most effective opacifying agent to enhance the quality and aesthetics of their finished products. Their demand is highly correlated with residential construction activity and consumer discretionary spending on home improvements globally. These customers prioritize consistency in particle size and purity, as variations directly impact the final product quality and manufacturing efficiency.

Another major segment of potential customers includes companies specializing in high-temperature materials, such as refractory manufacturers for the steel, cement, and glass industries. These buyers demand high-purity, chemically stable forms of zirconium silicate that can withstand extreme thermal cycling and chemical corrosion in demanding industrial furnaces and kilns. Precision investment casting foundries are also significant buyers, utilizing zirconium silicate in mold washes and core production to achieve superior surface finishes and dimensional stability in high-value metal components for the aerospace and automotive sectors.

Emerging customer bases are found in advanced materials and niche chemical applications, including pigment manufacturers requiring stable, non-toxic white colorants, and specialized coating producers for high-performance protective layers. Furthermore, the dental and medical industries are increasingly utilizing high-purity zirconium compounds derived from zirconium silicate for biocompatible components, representing a smaller but rapidly growing high-margin customer base that places exceptional emphasis on regulatory compliance and ultra-high purity levels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 620 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tronox Holdings plc, Iluka Resources Limited, Chemours Company, The Zircoa, Doral Mineral Industries, Eramet Group, RBM (Richards Bay Minerals), I-Minerals Inc., Shandong Dongli Zirconium Industry Co. Ltd., Ningxia Dadi Zirconium Industry Co. Ltd., China National Building Material Group Co., Ltd., Orient Zirconic Ind. Sci. & Tech. Co., Ltd., Alkane Resources Ltd., Kenmare Resources plc, Mineração Caraíba SA, Lomon Billions Group Co., Ltd., Malabar Minerals, Gujarat Foils Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zirconium Silicate Market Key Technology Landscape

The Zirconium Silicate Market relies on sophisticated mineral processing and high-temperature fusion technologies to convert raw zircon sand into marketable products. Key processes include gravity separation and magnetic separation during the initial beneficiation of raw zircon, followed by wet or dry milling processes to achieve specific particle size distributions. The primary technological focus is on ultra-fine grinding, employing advanced equipment like jet mills and ball mills to produce micronized and sub-micron grades essential for high-opacity glazes and specialized composite materials. Controlling particle size distribution (PSD) with extreme precision is a critical technological capability that differentiates premium suppliers and allows them to serve high-value niche markets effectively.

A significant area of technological innovation involves high-purity production techniques, such as chemical processing and electrofusion methods, designed to reduce trace impurities (like iron and titanium oxides) that can negatively affect whiteness and thermal stability in the final application. Electrofusion yields fused zirconium silicate, which is often used in high-performance refractories due to its superior chemical resistance. Furthermore, surface modification technologies are increasingly being utilized to enhance the dispersion characteristics of zirconium silicate powder in complex matrices like glazes, coatings, and specialized polymers, improving performance without increasing material load.

Digitalization and automation are also transforming the manufacturing landscape. Manufacturers are implementing sophisticated process control systems and sensors to monitor parameters like milling temperature, slurry density, and flow rates in real-time, ensuring batch-to-batch consistency and minimizing energy waste. Advanced analytical techniques, including X-ray fluorescence (XRF) and particle size analyzers, are integral to quality assurance. These technological investments focus on improving resource utilization, reducing waste, and meeting the increasingly demanding purity specifications required by modern industrial applications, moving the industry towards highly efficient, precision material production.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Zirconium Silicate Market, driven by exponential growth in construction and manufacturing, particularly in China and India. The region's dominance is underpinned by its position as the largest global hub for ceramic tile production and consumption. Investments in infrastructure and urbanization projects ensure sustained, high-volume demand.

- North America: This region represents a mature, high-value market focused less on volume and more on specialty applications. Demand is stable, primarily stemming from high-performance refractory materials for the energy and metallurgical sectors, and specialized uses in precision casting and technical ceramics. Strict quality standards favor premium, high-purity grades.

- Europe: Characterized by a strong presence in high-quality architectural ceramics and advanced refractories, Europe maintains steady demand. The market here is highly regulated, driving technological adoption toward energy-efficient processing and sustainable sourcing practices. Germany and Italy remain key consumers due to their strong manufacturing bases.

- Middle East and Africa (MEA): Growth in the MEA region is accelerating due to massive construction and Vision 2030 type infrastructure projects in GCC countries. South Africa also plays a dual role as a significant raw zircon supplier and an emerging consumer in regional heavy industries.

- Latin America: This region shows promising potential, particularly Brazil, owing to its large domestic ceramic industry and growing refractory needs in the mining and steel sectors. Market growth is sensitive to local economic stability and governmental investment in housing projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zirconium Silicate Market.- Tronox Holdings plc

- Iluka Resources Limited

- The Chemours Company

- The Zircoa

- Doral Mineral Industries

- Eramet Group

- RBM (Richards Bay Minerals)

- I-Minerals Inc.

- Shandong Dongli Zirconium Industry Co. Ltd.

- Ningxia Dadi Zirconium Industry Co. Ltd.

- China National Building Material Group Co., Ltd. (CNBM)

- Orient Zirconic Ind. Sci. & Tech. Co., Ltd.

- Alkane Resources Ltd.

- Kenmare Resources plc

- Mineração Caraíba SA

- Lomon Billions Group Co., Ltd.

- Malabar Minerals

- Gujarat Foils Limited

- Tricon Energy Ltd.

- TOR Minerals International, Inc.

Frequently Asked Questions

Analyze common user questions about the Zirconium Silicate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of zirconium silicate in the ceramics industry?

The primary function of zirconium silicate in the ceramics industry is to act as a highly effective opacifier and whitening agent in glazes and frits. It imparts superior opacity, whiteness, and chemical resistance to ceramic tiles, sanitaryware, and porcelain products, significantly improving their aesthetic and functional quality.

Which geographical region dominates the consumption of zirconium silicate?

The Asia Pacific (APAC) region currently dominates the global consumption of zirconium silicate. This dominance is directly attributable to the high volume of manufacturing, especially in the construction-dependent ceramic tile industry, driven by rapid urbanization and infrastructure development in countries like China and India.

What are the main substitutes for zirconium silicate in industrial applications?

While zirconium silicate is often preferred for high-performance applications, key substitutes include titanium dioxide (TiO2), tin oxide, and certain calcined aluminum silicates. Titanium dioxide is commonly used as an alternative opacifier in some lower-grade ceramics and coatings, though it often sacrifices the extreme thermal stability offered by zirconium silicate.

How does the supply chain vulnerability of raw zircon affect the market?

The raw zircon supply chain is highly vulnerable because mining is geographically concentrated (e.g., Australia, South Africa). Disruptions, export policies, or geopolitical instability in these regions can lead to significant price volatility and supply constraints for zirconium silicate processors globally, impacting profitability and production schedules.

What distinguishes high-purity grade zirconium silicate from standard grades?

High-purity grade zirconium silicate is distinguished by significantly lower levels of trace contaminants, especially iron and titanium oxides, and a finer, tightly controlled particle size distribution (micronized or sub-micron). This grade is essential for applications demanding maximum whiteness, superior thermal shock resistance, such as advanced glazes, dental ceramics, and high-end refractories.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Zirconium Silicate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Zirconium Silicate Market Size Report By Type (High-grade Zirconium Silicate, Common Zirconium Silicate), By Application (Ceramics, Wear-resistant Materials, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager