Zirconium Target Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438079 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Zirconium Target Market Size

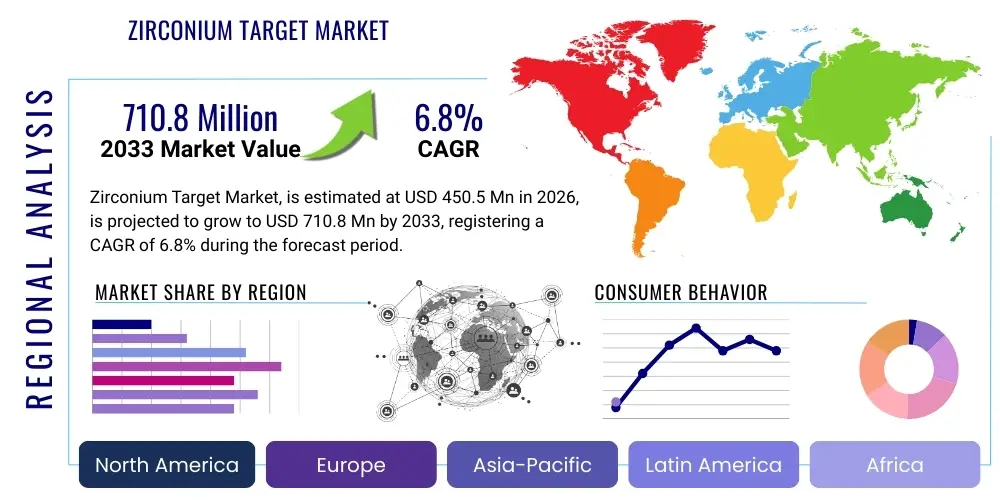

The Zirconium Target Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 710.8 Million by the end of the forecast period in 2033.

Zirconium Target Market introduction

The Zirconium Target Market encompasses the production and distribution of high-purity zirconium materials specifically fabricated into targets used primarily in physical vapor deposition (PVD) processes, such as magnetron sputtering. These targets are critical raw materials utilized for depositing thin films of zirconium and its compounds (like zirconium dioxide) onto various substrates. Zirconium, known for its exceptional corrosion resistance, high melting point, and excellent mechanical properties, makes these films indispensable in high-performance applications, including semiconductor manufacturing, optical coatings, and protective layers in harsh environments. The stringent purity requirements, particularly 4N (99.99%) and higher, dictate the complexity and cost structure of this specialized market.

The major applications driving demand for zirconium targets are concentrated in the electronics and specialized industrial sectors. In semiconductor fabrication, thin zirconium films act as diffusion barriers, gate oxides (especially Zirconium Dioxide, ZrO2), and highly reliable insulating layers, crucial for advancing miniaturization and performance in memory chips and advanced logic circuits. Furthermore, the aerospace and defense sectors utilize zirconium coatings for structural components requiring high heat and corrosion resistance. The market is also bolstered by demand in display technologies (OLED/LCD) and the growing field of advanced energy systems, particularly solid oxide fuel cells (SOFCs) and specialized protective coatings for nuclear infrastructure, where the material’s low neutron absorption cross-section is highly valued.

Key driving factors include the continuous expansion of the global semiconductor industry, particularly in Asia Pacific (APAC), which is investing heavily in new fabrication plants (fabs). The push for higher efficiency and durability in electronic components necessitates the adoption of advanced material thin films like zirconium. Additionally, the increasing complexity of optical and protective coatings required in high-stress industrial machinery and medical devices further stimulates market growth. Benefits derived from using zirconium targets include superior film adhesion, enhanced thermal stability, and robust protective performance, ensuring product longevity and reliability across critical technological domains.

Zirconium Target Market Executive Summary

The Zirconium Target Market is exhibiting robust growth, propelled by sustained global investment in high-tech manufacturing, especially semiconductors and advanced displays. Business trends indicate a strong focus on enhancing target purity levels (moving towards 5N and 6N grades) and adopting advanced manufacturing techniques, such as hot isostatic pressing (HIP) and vacuum melting, to meet the stringent demands of modern PVD processes. Strategic alliances between raw material suppliers and thin-film deposition equipment manufacturers are becoming commonplace to optimize material utilization and deposition efficiency. Price volatility of primary zirconium metal remains a key challenge, but long-term supply agreements and forward contracts are being utilized by major players to mitigate this risk, ensuring stability in the supply chain necessary for high-volume production cycles.

Regionally, Asia Pacific (APAC) dominates the market share due to its entrenched position as the global hub for electronics manufacturing, encompassing Taiwan, South Korea, China, and Japan. These countries house the world’s largest semiconductor foundries and advanced display panel producers, creating massive localized demand. North America and Europe, while smaller in volume, represent significant markets characterized by high-value applications in aerospace, defense, and specialized R&D, focusing heavily on cutting-edge materials science and nuclear technologies. These regions are also witnessing a resurgence in domestic semiconductor manufacturing capacity (e.g., US CHIPS Act funding), promising increased local consumption of high-purity targets in the forecast period.

Segment trends highlight the dominance of the high-purity segment (99.99% and above) driven entirely by semiconductor industry requirements for defect reduction and film performance. Application-wise, the Semiconductor/Electronics segment holds the largest share and is projected to experience the fastest growth, underpinned by the transition to advanced nodes and the need for new material stacks (High-K dielectric materials). Furthermore, rotating targets are gradually gaining preference over planar targets, especially in large-area deposition applications (like display panels), due to their enhanced material utilization, longer lifespan, and superior film thickness uniformity, improving overall cost-efficiency for large-scale operations.

AI Impact Analysis on Zirconium Target Market

User inquiries regarding AI's impact on the Zirconium Target Market predominantly center on how artificial intelligence and machine learning (ML) can optimize the complex manufacturing processes of these high-purity materials, especially concerning quality control and yield optimization. Users are keen to understand if AI can predict material defects during ingot casting, hot pressing, or sputtering target bonding, thereby reducing waste and enhancing the costly purity verification stages. Another significant theme revolves around predictive maintenance for sputtering equipment—AI models analyzing deposition parameters (plasma intensity, gas flow, power) to predict when target erosion will require replacement, maximizing target life and minimizing unscheduled downtime in crucial fabrication lines. Finally, strategic users seek AI insights for demand forecasting, linking global semiconductor cycles and defense spending patterns to target raw material procurement, moving beyond traditional statistical models to incorporate real-time, global supply chain data for better inventory management.

- AI-driven optimization of Zirconium purification and refining processes, reducing impurities and enhancing target uniformity.

- Machine learning algorithms applied to PVD equipment data for predictive modeling of target erosion and lifespan, maximizing utilization.

- Automated visual inspection using AI for detecting surface flaws and internal microstructure defects in finished targets, ensuring ultra-high purity compliance.

- Enhanced supply chain logistics and demand forecasting using AI to align zirconium sourcing with volatile semiconductor manufacturing schedules.

- Development of digital twins for sputtering chambers, simulated using AI to test new target geometries and deposition recipes virtually, accelerating R&D cycles.

DRO & Impact Forces Of Zirconium Target Market

The dynamics of the Zirconium Target Market are shaped by powerful Drivers, inherent Restraints, and evolving Opportunities, which collectively constitute the core Impact Forces. The primary driver is the relentless technological advancement and capacity expansion within the global semiconductor industry, particularly the transition to advanced nodes (below 10nm), which mandates the use of ultra-high-purity materials like zirconium for crucial dielectric layers and interconnects. This demand is further amplified by government initiatives globally aimed at strengthening domestic chip supply chains, guaranteeing long-term consumption growth. Simultaneously, the material's unparalleled resistance to corrosion and high temperatures ensures sustained demand from specialized industrial sectors, including nuclear and chemical processing equipment, where substitutes are scarce. The combined effect of these factors creates a strong upward trajectory for market growth and material complexity.

Conversely, the market faces significant restraints, chief among them being the extremely high cost and complexity associated with manufacturing ultra-high-purity zirconium metal (typically 99.99% to 99.999% purity). The purification processes are energy-intensive and time-consuming, leading to high production costs that are passed down to the end-users. Furthermore, the supply chain for primary zirconium metal is susceptible to geopolitical instability, as mining and primary processing are concentrated in specific regions. A substantial technical restraint is the material's intrinsic brittleness and sensitivity to oxygen contamination during fabrication (sputtering target bonding and machining), which can lead to target cracking or premature failure in high-power sputtering applications, demanding specialized, high-vacuum manufacturing environments that few suppliers can master consistently.

Opportunities for market players lie predominantly in technological innovation focusing on enhancing target performance and sustainability. Developing novel manufacturing techniques, such as additive manufacturing or specialized powder metallurgy, could potentially lower the cost of complex target geometries and improve material utilization rates (MU%). Expanding applications in emerging technologies, notably in solid-state batteries where zirconium-based electrolytes are being researched, represents a significant future growth avenue. The development of advanced recycling programs for spent targets to recover and re-purify expensive zirconium material would also improve supply security and environmental sustainability. These drivers, restraints, and opportunities converge to create market forces compelling manufacturers to invest heavily in both purification technology and application-specific product customization to maintain competitive advantage.

Segmentation Analysis

The Zirconium Target Market is segmented primarily based on material purity, physical type, and key end-use application sectors. This segmentation is crucial as the performance and pricing of zirconium targets are directly proportional to their purity level, which determines their suitability for different technological requirements, particularly in demanding fields like microelectronics. The types of targets (planar versus rotating) delineate differences in manufacturing scale and process efficiency, while the application segmentation clearly identifies the main demand drivers and growth pockets within the global industrial landscape. Analyzing these segments provides a clear framework for understanding market structure and identifying niche opportunities for specialized suppliers.

- By Purity:

- 99.9% (3N)

- 99.95% (3N5)

- 99.99% (4N)

- 99.995% (4N5)

- 99.999% (5N and Above)

- By Type (Geometry):

- Planar Targets

- Rotating (Rotary) Targets

- By Application:

- Semiconductor/Electronics

- Optical Coatings

- Flat Panel Displays (FPD)

- Aerospace and Defense

- Solar Cells and Renewable Energy

- Nuclear Reactors and Chemical Processing

- Others (e.g., Medical Devices, Decorative Coatings)

Value Chain Analysis For Zirconium Target Market

The value chain for Zirconium Targets is characterized by complexity and high specialization, beginning with upstream raw material sourcing. The chain initiates with the mining and initial processing of zircon sand (ZrSiO4). This primary input undergoes rigorous chemical separation and refinement processes, often involving the costly Kroll process or electrolytic refinement, to produce reactor-grade or commercial-grade zirconium sponge. The reactor-grade purity is particularly critical for nuclear applications, while high-purity electronic-grade sponge (usually 4N or 5N) is essential for sputtering targets. A specialized group of metal processors and advanced material manufacturers then take the purified sponge, performing multiple stages of melting, alloying (if necessary), casting, and forging under high vacuum to create the dense, high-purity target material ingots, requiring immense technological expertise and quality control.

The midstream stage involves the highly technical target fabrication process, where the ingots are machined, hot isostatically pressed (HIP), or sintered to achieve the desired density and microstructure. This fabrication includes bonding the zirconium target material to a backing plate (usually copper or aluminum) necessary for efficient cooling during the PVD process. Distribution channels are largely direct due to the bespoke nature and high value of the product. Direct sales teams manage customized orders for major semiconductor foundries (TSMC, Samsung, Intel), display manufacturers (LG Display, BOE), and large PVD equipment OEMs (Applied Materials, Tokyo Electron). This direct model ensures that precise specifications regarding purity, size, and backing material are met, often requiring Non-Disclosure Agreements (NDAs) due to the proprietary nature of thin-film recipes.

Indirect distribution plays a smaller role, mainly for smaller R&D institutions or niche industrial coaters, often utilizing specialized material distributors or agents who can handle smaller, less frequent orders. Downstream analysis reveals the end-users: the PVD departments within fabrication facilities. The performance of the zirconium target directly impacts the yield, efficiency, and quality of the final electronic device or coated product. Therefore, seamless communication and quality assurance throughout the entire value chain—from mining to final sputter—are paramount. The high capital expenditure associated with purification and fabrication acts as a significant barrier to entry, ensuring the market remains dominated by established, high-tech material specialists.

Zirconium Target Market Potential Customers

The primary customers for Zirconium Targets are large, integrated manufacturing entities that utilize physical vapor deposition (PVD) techniques on an industrial scale. The most dominant segment consists of multinational semiconductor manufacturers (foundries and integrated device manufacturers - IDMs) who use zirconium targets to deposit critical thin films for logic chips, DRAM, and NAND flash memory. These customers demand the highest purity levels (5N and above) and are focused on minimizing defects and maximizing deposition uniformity to achieve high yields in their multi-billion-dollar fabrication plants. Their purchasing decisions are driven by target reliability, material microstructure consistency, and the supplier's ability to maintain a robust, certified quality management system compliant with industry standards.

Another crucial customer group includes manufacturers of Flat Panel Displays (FPDs), encompassing LCD, OLED, and MicroLED technologies. These companies, particularly in East Asia, rely on large-format planar and, increasingly, rotating zirconium targets for depositing transparent conductive oxides (TCOs) or protective layers on large glass substrates. While purity requirements are marginally less demanding than the semiconductor sector, the emphasis here is on target size, longevity, and maximizing the throughput of the large sputtering systems. The aerospace and defense contractors constitute a high-value, albeit lower volume, customer base, purchasing targets for specialized, high-performance protective coatings on turbine blades, missile components, and specialized sensors that must withstand extreme operational environments.

Finally, emerging customer segments include specialized coating services providers for the medical device industry (e.g., biocompatible coatings), energy sector researchers focused on solid oxide fuel cells (SOFCs) and specialized solar cell manufacturing, and general industrial coaters focused on enhancing tool wear resistance. These diverse applications collectively drive the requirement for specialized target geometries and compound variations (e.g., Zr-Si alloys or stabilized Zirconium Oxide) tailored to unique process parameters. Understanding the diverse technical specifications required by these distinct customer profiles is essential for targeted product development and market penetration strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 710.8 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lesker Company, Furuya Metal Co. Ltd., Praxair Surface Technologies (now Linde), Materion Corporation, Honeywell International Inc., ALB Materials Inc., E-light target Co. Ltd., Ningbo Guangqian Advanced Materials Co., Ltd., Advanced Engineering Materials Limited (AEM), Sputtering Components Inc., SCI Engineered Materials, Kurt J. Lesker Company, XI'AN FUNCTION MATERIAL GROUP, Japan New Metals Co., Ltd., China Rare Metal Material Co., Ltd., Umicore, H.C. Starck Solutions, PAM-XIAMEN |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Zirconium Target Market Key Technology Landscape

The manufacturing technology landscape for Zirconium Targets is heavily focused on achieving and maintaining ultra-high purity while ensuring optimal microstructure for efficient sputtering performance. Key technologies deployed upstream include advanced vacuum melting techniques, such as electron beam melting (EBM) and vacuum induction melting (VIM), which are essential for removing trace metallic and gaseous impurities (oxygen, nitrogen) that severely degrade target performance. Subsequent stages involve specialized powder metallurgy and pressing techniques. Hot Isostatic Pressing (HIP) is frequently utilized to achieve near-theoretical density and fine grain structure, minimizing internal voids and defects, which is critical for mitigating arcing and enhancing deposition rate stability during high-power sputtering processes. The complexity of these processes necessitates rigorous material handling in controlled, cleanroom environments to prevent external contamination.

Midstream technological advancements center around target bonding and non-destructive testing. Zirconium targets must be bonded to copper backing plates using high-reliability methods, such as soldering or diffusion bonding, to ensure maximum thermal and electrical conductivity, effectively dissipating the intense heat generated during sputtering. Failure in bonding leads to overheating and cracking, resulting in costly downtime. Non-destructive evaluation techniques, including ultrasonic testing and eddy current analysis, are critical for verifying the integrity of the internal structure and the bond interface before the target is shipped to the end-user. Furthermore, the shift towards rotating targets necessitates precision machining and balancing technologies to ensure smooth, uniform rotation and deposition across large substrates, dramatically improving target utilization rates compared to traditional planar geometries.

In terms of application technology, the rise of Atomic Layer Deposition (ALD) as a complementary or alternative deposition method poses a long-term challenge to PVD, but sputtering remains dominant for high-throughput, large-area applications. Therefore, innovation is focused on enhancing magnetron sputtering technology itself—specifically, improving magnet array designs and power delivery systems to handle advanced zirconium alloy targets or zirconium compound targets (like ZrO2). Research is ongoing into plasma control systems and dynamic deposition rate monitoring using in-situ sensors, often integrated with the aforementioned AI systems, to ensure the deposited zirconium films meet extremely tight thickness and composition tolerances required by next-generation microelectronic devices.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the global Zirconium Target market, accounting for the largest share due to its dominance in semiconductor fabrication (e.g., Taiwan, South Korea, China) and Flat Panel Display (FPD) manufacturing (e.g., China, Japan). The region hosts the vast majority of new semiconductor capacity additions, driving unparalleled demand for high-purity targets (4N and 5N). China, specifically, is seeing accelerated growth driven by national self-sufficiency goals in the electronics sector, positioning it as both a major consumer and an increasingly important, though highly competitive, supplier base.

- North America: This region is characterized by high-value, specialized demand from the aerospace, defense, and advanced R&D sectors, particularly in specialized nuclear applications where zirconium's properties are indispensable. Furthermore, renewed emphasis on domestic chip manufacturing (e.g., Arizona, New York) is expected to significantly increase the consumption of ultra-high-purity targets, supported by government incentives aimed at supply chain localization and geopolitical risk mitigation.

- Europe: The European market demonstrates steady demand, primarily driven by high-tech industrial coating applications, advanced automotive electronics, and specialized materials research institutions. Countries like Germany and France are significant consumers due to their strong presence in precision engineering and high-performance industrial machinery, requiring zirconium coatings for wear resistance and thermal barriers. The focus here is often on robust material performance rather than sheer volume required by Asian fabs.

- Latin America (LATAM): Currently represents a smaller market share, primarily serving basic industrial coating needs and limited local electronics assembly operations. Growth is steady but moderate, lacking the massive infrastructure investments seen in APAC or the highly specialized demands of North America and Europe.

- Middle East and Africa (MEA): This region is the smallest segment but holds strategic potential, particularly due to investments in energy infrastructure and specialized petrochemical processing facilities. Zirconium targets are utilized for highly corrosion-resistant coatings in these harsh environments. Future growth will be tied to diversification efforts away from oil and gas, prompting localized R&D in specialized materials technology.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Zirconium Target Market.- Lesker Company

- Furuya Metal Co. Ltd.

- Praxair Surface Technologies (now Linde)

- Materion Corporation

- Honeywell International Inc.

- ALB Materials Inc.

- E-light target Co. Ltd.

- Ningbo Guangqian Advanced Materials Co., Ltd.

- Advanced Engineering Materials Limited (AEM)

- Sputtering Components Inc.

- SCI Engineered Materials

- Kurt J. Lesker Company

- XI'AN FUNCTION MATERIAL GROUP

- Japan New Metals Co., Ltd.

- China Rare Metal Material Co., Ltd.

- Umicore

- H.C. Starck Solutions

- PAM-XIAMEN

- Mitsubishi Materials Corporation

- Goodfellow Corporation

Frequently Asked Questions

Analyze common user questions about the Zirconium Target market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for ultra-high purity Zirconium Targets?

The primary driver is the ongoing expansion and technological advancement within the global semiconductor industry, particularly the transition to sub-10nm fabrication nodes, which requires 4N (99.99%) and 5N (99.999%) purity Zirconium targets for depositing critical high-K dielectric thin films and reliable diffusion barriers in advanced memory and logic devices.

How do rotating targets compare to planar targets in terms of performance and market share?

Rotating (rotary) targets offer significantly higher material utilization, longer operational life, and superior film uniformity compared to traditional planar targets. While planar targets still dominate in R&D and specialized, smaller applications, rotating targets are rapidly increasing their market share, especially in high-volume, large-area deposition sectors like Flat Panel Display manufacturing and high-throughput industrial coating.

Which geographical region dominates the Zirconium Target Market consumption?

Asia Pacific (APAC) holds the dominant market share for Zirconium Target consumption. This is attributed to the presence of the world’s largest fabrication hubs for semiconductors (Taiwan, South Korea) and display panels (China, South Korea), generating immense localized demand for sputtering materials.

What are the key technical challenges in Zirconium Target manufacturing?

Major technical challenges include achieving and maintaining ultra-high purity during the refining and vacuum melting stages, ensuring optimal microstructure and high density via Hot Isostatic Pressing (HIP), and reliably bonding the zirconium material to the copper backing plate to prevent thermal failures and cracking during the high-power sputtering process.

Beyond electronics, what critical high-value applications utilize Zirconium Target coatings?

High-value applications outside of electronics include specialized protective coatings for aerospace and defense components (enhancing heat and corrosion resistance), cladding materials and components in nuclear reactors (due to Zirconium's low neutron absorption cross-section), and highly durable coatings in demanding chemical processing environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager