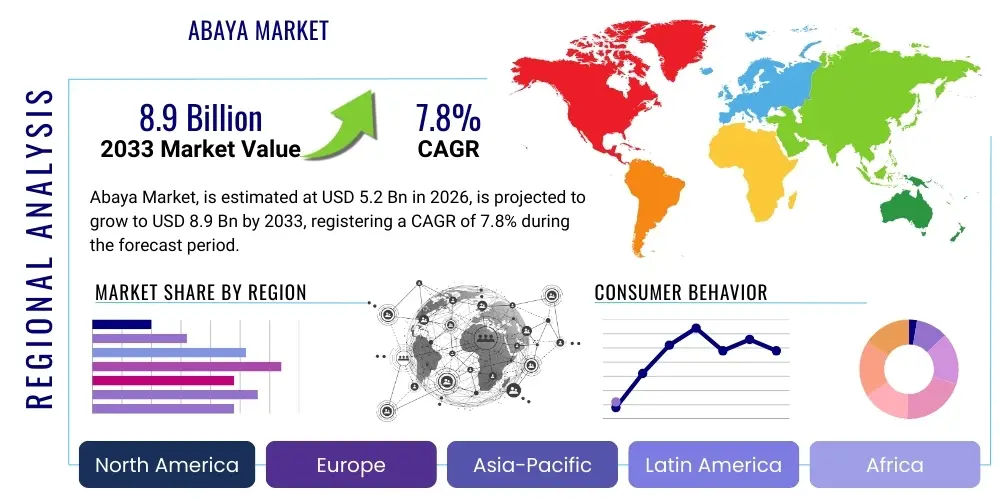

Abaya Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437525 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Abaya Market Size

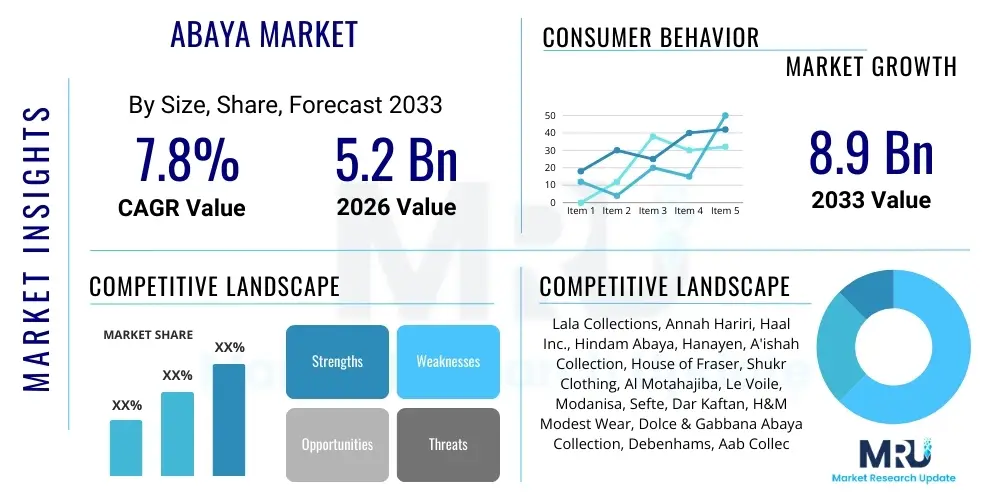

The Abaya Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $5.2 Billion USD in 2026 and is projected to reach $8.9 Billion USD by the end of the forecast period in 2033.

Abaya Market introduction

The Abaya Market, a pivotal segment within the global modest fashion industry, encompasses the manufacturing, distribution, and sale of traditional Islamic outer garments worn primarily by women in Middle Eastern and select Asian countries. Historically, the abaya served purely as a religious and cultural requirement for covering the body in public; however, the contemporary market has witnessed a significant evolution, transforming the abaya into a high-fashion statement reflecting modern aesthetic sensibilities while maintaining core principles of modesty. Product descriptions now range from traditional black, heavy crepe designs to lightweight, brightly colored, heavily embellished garments utilizing advanced textile technologies such as smart fabrics and performance materials.

Major applications for abayas extend beyond daily wear, including specialized designs for formal events, corporate settings, and bridal attire. The rising disposable incomes across the Gulf Cooperation Council (GCC) nations, coupled with increasing globalization and the influence of social media fashion influencers, are key benefits driving market expansion. Furthermore, designers are incorporating complex embroideries, digital prints, and sustainable materials, appealing to a broader consumer base that values both cultural heritage and global fashion trends. This convergence of tradition and modernity sustains robust market growth, particularly among younger, affluent consumers.

Key driving factors include the high population density of Muslims globally, especially in regions with economic growth potential, and the shift in consumer preference towards premiumization and customization. The market benefits significantly from cultural tourism and the increased participation of women in the workforce in GCC countries, necessitating comfortable, practical, yet stylish modesty wear. Moreover, dedicated marketing campaigns during key religious periods like Ramadan boost seasonal sales, cementing the abaya’s position not just as an essential garment but as a fashion category ripe for innovation and luxury positioning.

Abaya Market Executive Summary

The Abaya Market Executive Summary highlights a dynamic transition driven by shifting consumer demographics and sophisticated retail strategies. Business trends indicate a strong move towards omni-channel retailing, where luxury boutiques maintain their prestige while e-commerce platforms capture the burgeoning market for accessible, designer collaborations and fast-fashion modesty wear. There is a pronounced trend towards product diversification, moving beyond the traditional black abaya to include customized fits, innovative cuts, and varied textile applications, addressing the needs of both the conservative and fashion-forward segments of the population. Strategic acquisitions and vertical integration among key manufacturers are stabilizing supply chains and enhancing quality control, positioning major players to capitalize on international expansion.

Regional trends demonstrate the Middle East, particularly Saudi Arabia and the UAE, remaining the revenue hub due to cultural mandates and high purchasing power. However, rapid expansion is noted in the Asia Pacific (APAC) region, specifically in Indonesia and Malaysia, fueled by large Muslim populations and increasing government support for the modest fashion industry. Europe and North America are emerging as significant consumer markets, driven by Muslim diaspora communities and the growing acceptance of modest aesthetics among non-Muslim consumers, translating modest wear into universal fashion statements. This globalization necessitates tailored marketing strategies addressing regional variances in interpretation of modesty and color palettes.

Segment trends underscore the dominance of the ready-to-wear (RTW) segment due to convenience, though bespoke and customized abayas are experiencing high growth rates, reflecting consumer desire for personalization and unique craftsmanship. Material segmentation shows increased uptake of luxurious fabrics like silk and premium synthetic blends that offer wrinkle resistance and breathability, crucial in hot climates. Furthermore, the ‘occasion wear’ segment—focused on highly embellished and intricate designs for weddings and major festivals—commands significant price premiums, contributing disproportionately to overall market valuation, indicating a consumer willingness to invest heavily in specialized, high-quality garments.

AI Impact Analysis on Abaya Market

User inquiries regarding AI's impact on the Abaya market frequently center on three primary themes: enhanced personalization, optimized supply chain efficiency, and ethical considerations surrounding cultural appropriation in design. Consumers are keen to know how AI can facilitate truly bespoke fitting using virtual try-on and 3D scanning technologies, addressing the traditional challenge of achieving a perfect fit for a flowing garment. Brands, conversely, focus on AI's ability to predict hyper-local fashion trends within diverse religious and cultural parameters, ensuring inventory alignment with fast-changing modesty standards and seasonal demand spikes, particularly during Ramadan. The overall expectation is that AI will streamline the custom design process, reduce material waste through precise demand forecasting, and create highly engaging digital shopping experiences, thereby modernizing a traditionally conservative retail sector.

- AI-Powered Trend Forecasting: Utilizing big data analytics of social media, regional sales patterns, and geopolitical events to predict shifts in preferred abaya styles, lengths, colors, and embellishments, enabling just-in-time design cycles.

- Personalized Design and Customization: Implementing algorithms that allow customers to input body measurements and style preferences (fabric type, sleeve cut, embroidery density) to instantly render a unique abaya design, improving conversion rates for high-value custom orders.

- Virtual Try-On (VTO) Technology: Deploying Augmented Reality (AR) and AI to allow consumers to virtually drape abayas onto their digital avatars, significantly reducing returns related to fit and appearance, a critical function for e-commerce.

- Supply Chain Optimization: Using machine learning to optimize inventory management, predict raw material sourcing needs (e.g., specific textile grades), and manage logistics across complex international distribution networks, minimizing holding costs and lead times.

- Quality Control and Defect Detection: Implementing visual recognition AI systems in manufacturing plants to rapidly identify and flag flaws in embroidery, stitching, or fabric integrity, ensuring the high quality expected in luxury and premium abaya segments.

DRO & Impact Forces Of Abaya Market

The Abaya Market is profoundly shaped by a unique blend of internal growth drivers (D), external constraints (R), emerging opportunities (O), and pervasive impact forces (I). Key drivers include soaring consumer expenditure on modest fashion, fueled by rising female employment rates and discretionary income in the GCC and Southeast Asia, coupled with the effective marketing of abayas as culturally rich, premium fashion items. The cultural imperative associated with the garment ensures a foundational demand that is insulated from global fashion cycles to a significant extent. Furthermore, technological improvements in textile manufacturing, specifically the development of lighter, heat-resistant, and aesthetically versatile fabrics, directly enhance the product's appeal and wearer comfort, driving market volume and value.

Restraints primarily revolve around the high volatility of raw material costs, particularly luxury fabrics like high-grade crepe and silk, which can significantly affect production margins. Counterfeit products and unauthorized replicas pose a serious challenge to established designer brands, diluting brand equity and undercutting price points, particularly in competitive regional markets. Furthermore, the inherent conservatism in certain market segments may resist rapid innovation in design or material, slowing the adoption of unconventional styles. Regulatory frameworks concerning import tariffs and quality certifications in diverse geographical regions add layers of complexity and cost to cross-border trade, requiring substantial compliance expenditure.

Opportunities are abundant in the ethical and sustainable fashion movement, where brands can differentiate themselves by using certified organic textiles and ensuring transparent labor practices, appealing strongly to socially conscious young buyers. Geographic expansion into untapped Western markets, achieved through collaboration with mainstream retailers and leveraging the modest fashion trend internationally, presents substantial revenue potential. The development of specialized abayas—such as sports abayas, maternity wear, or highly functional travel abayas—opens niche, high-margin product categories. Impact forces are dominated by socio-cultural shifts, including the gradual relaxation of dress codes in specific countries, which forces manufacturers to innovate and make the abaya an aspirational choice rather than a mandatory one. Geopolitical stability in the core MENA region also exerts a strong influence on consumer confidence and purchasing power, acting as an unpredictable external variable on market growth trajectories.

Segmentation Analysis

The Abaya market segmentation is critical for understanding divergent consumer needs and targeted product development, primarily categorized by material, application, distribution channel, and type. Material analysis shows a complex interplay between high-end natural fibers (silk, pure wool) used in luxury lines and synthetic/blended fabrics (polyester, crepe, chiffon) dominating the everyday wear and mass-market segments, offering durability and cost-effectiveness. Application segmentation differentiates between daily casual wear, formal/occasional wear (which commands higher price points), and specialty functional wear (e.g., travel or sports abayas). Distribution channels are increasingly bifurcated between traditional brick-and-mortar boutiques and high-growth e-commerce platforms, while the segmentation by type reflects the stylistic evolution from traditional closed abayas to open front, coat-style, and kimono-style variations, catering to varied regional and personal preferences.

- By Type:

- Traditional (Classic, Closed) Abayas

- Modern (Open, Kimono, Coat-style) Abayas

- Caftan/Farasha Abayas

- By Material:

- Synthetic Fabrics (Polyester, Crepe, Chiffon)

- Natural Fabrics (Silk, Cotton, Linen)

- Blended/Performance Fabrics

- By Application/End-Use:

- Casual Wear

- Formal/Occasion Wear

- Travel/Functional Wear

- By Distribution Channel:

- Offline (Boutiques, Department Stores, Exclusive Brand Outlets)

- Online (E-commerce Platforms, Brand Websites)

- By Price Point:

- Economy

- Mid-Range

- Premium/Luxury

Value Chain Analysis For Abaya Market

The value chain for the Abaya market begins with the upstream activities centered on raw material procurement and textile processing. This phase is highly globalized, sourcing high-quality synthetic fibers (crepe, polyester) often from East Asia (China, Korea) and luxury natural fabrics (silk, high-grade linen) from countries like India and Italy. Key challenges in the upstream segment include ensuring ethical sourcing and maintaining consistent quality standards across diverse suppliers, crucial for brands positioning themselves in the premium segment. Efficiency in this stage significantly determines the final product cost and sustainability credentials of the finished garment. Specialized design houses often integrate backward, investing in fabric technology research to develop proprietary materials that offer superior drape, breathability, or wrinkle resistance, providing a competitive edge.

Midstream activities encompass design, production, and manufacturing. While high-volume, cost-effective manufacturing often takes place in countries with lower labor costs (e.g., Turkey, Pakistan, parts of South Asia), high-end, bespoke abayas are typically crafted in ateliers within the GCC or fashion centers like Dubai and Paris, leveraging highly skilled artisans for intricate embroidery and hand-finishing. The adoption of computer-aided design (CAD) and advanced cutting technologies has streamlined pattern making and reduced material wastage. Quality control is paramount during the stitching and embellishment phase, especially for formal wear that features delicate beadwork and complex digital printing. Marketing and branding efforts, which emphasize cultural resonance and modern aesthetics, become critical value-adding activities here.

Downstream analysis focuses on distribution channels, which are rapidly evolving. The channel mix involves direct sales through flagship stores and designer boutiques, indirect sales via multi-brand retailers and department stores, and increasingly dominant digital platforms. Direct-to-consumer (D2C) e-commerce channels offer greater control over branding and customer data, proving highly effective for personalized recommendations and loyalty programs, especially for younger, digitally native consumers. Traditional marketplaces and souqs remain important in core Middle Eastern regions for the mass-market segment. The final customer engagement, including post-sale services and alterations, concludes the value chain, heavily influencing brand loyalty and repeat purchasing behavior, which is particularly strong in the Abaya market due to the necessity of fit and personal taste.

Abaya Market Potential Customers

The primary consumer base for the Abaya market traditionally comprises Muslim women residing in the Middle East and North Africa (MENA) region, specifically targeting the high-net-worth individuals and middle-class populations within the GCC countries, such as Saudi Arabia, the UAE, Kuwait, and Qatar. These consumers purchase abayas not just out of cultural obligation but as a significant investment in their daily and occasional wardrobe, seeking luxury materials, custom tailoring, and designs that reflect the latest regional fashion narratives. Demographic shifts, including increased urbanization and higher educational attainment, mean this core group is highly discerning, valuing brands that successfully fuse tradition with contemporary design concepts and superior textile performance.

The second major segment consists of the extensive global Muslim diaspora residing in North America, Europe, and Australia. These consumers often utilize the abaya or related modest wear styles for religious observances and cultural occasions, driving demand for more versatile, travel-friendly, and slightly adapted designs that fit into Western fashion environments. This group heavily relies on international e-commerce platforms and specialized modest fashion retailers, placing a high value on ease of wear and global shipping logistics. They often seek products that are stylish and align with modern global trends while adhering to modesty requirements, prioritizing flexibility in styling.

The emerging potential customer base includes younger Muslim women globally (Gen Z and Millennials) who treat the abaya as a fashion accessory subject to fast fashion cycles, driving demand for innovative, budget-friendly options and collaborations with global influencers. Furthermore, non-Muslim women are increasingly engaging with modest fashion globally, viewing open abayas, kimonos, and flowing cover-ups as chic, versatile outerwear, particularly in climates requiring light layering. Marketing towards this group necessitates positioning the abaya as a universal modest outerwear garment rather than exclusively a cultural or religious item, focusing on textile quality, unique design elements, and global accessibility.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion USD |

| Market Forecast in 2033 | $8.9 Billion USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lala Collections, Annah Hariri, Haal Inc., Hindam Abaya, Hanayen, A'ishah Collection, House of Fraser, Shukr Clothing, Al Motahajiba, Le Voile, Modanisa, Sefte, Dar Kaftan, H&M Modest Wear, Dolce & Gabbana Abaya Collection, Debenhams, Aab Collection, Islamic Design House, Al Madina, Saudi Fashion Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Abaya Market Key Technology Landscape

The Abaya market is increasingly adopting advanced textile and manufacturing technologies to enhance product quality, comfort, and aesthetic versatility. A critical technological focus is on material science, particularly the development and application of performance fabrics. This includes proprietary blends of synthetic and natural fibers designed to offer superior characteristics such as UV protection, moisture-wicking properties, anti-microbial treatments, and enhanced durability without compromising the drape and flow essential to the abaya’s design. Brands are investing heavily in research to create 'smart abayas' incorporating subtle technological elements like temperature regulation for extreme climatic conditions found across the GCC region, moving the garment beyond mere covering to functional clothing.

In the design and production phase, digital technology plays an instrumental role. High-resolution digital printing allows for intricate, colorful, and unique patterns to be applied directly onto fabrics with exceptional color fastness and precision, reducing the cost and complexity associated with traditional embroidery and embellishment techniques. Furthermore, 3D body scanning and virtual fit technology are transforming the custom tailoring segment. These technologies enable precise measurement capture and pattern generation, drastically reducing the need for multiple physical fittings, a major value proposition for affluent customers seeking bespoke services delivered rapidly and remotely. This integration of CAD/CAM systems ensures greater standardization and efficiency in the manufacturing workflow.

Retail and supply chain technologies are also reshaping the market landscape. Enterprise Resource Planning (ERP) systems, specifically tailored for apparel retail, are employed to manage complex inventories across multiple international distribution channels, from raw material stock to finished goods at various price points. Crucially, the deployment of advanced e-commerce platforms featuring AI-driven recommendation engines and robust digital showrooms facilitates global reach. Blockchain technology is beginning to be explored by premium brands to ensure authenticity, tracing the supply chain from the raw silk yarn to the finished garment, countering the persistent issue of counterfeit products and assuring consumers of ethical sourcing and genuine quality.

Regional Highlights

- Middle East and Africa (MEA): This region remains the undisputed cornerstone of the global Abaya market, driven by deep cultural and religious significance. Saudi Arabia dominates market share due to its large population and continued adherence to traditional dress codes. The UAE, particularly Dubai, acts as the luxury and innovation hub, showcasing designer and high-fashion abayas and serving as a major re-export center. High per capita income and robust consumer spending on premium fashion ensure continuous market growth.

- Asia Pacific (APAC): APAC is the fastest-growing region, powered by highly populous Muslim nations like Indonesia, Malaysia, and Brunei. Market demand here is characterized by a preference for colorful, lighter-weight fabrics and modern, modest silhouettes that integrate traditional local textiles and patterns. E-commerce penetration is exceptionally high in Southeast Asia, facilitating brand access to dispersed populations and driving competitive pricing.

- Europe: The European market, though smaller, is significant due to large Muslim diaspora communities in countries like France, the UK, and Germany. Demand focuses on versatile, practical, and sophisticated designs suitable for cooler climates and integration into the professional workplace. European consumption is highly influenced by global modest fashion trends and designer collaborations that bridge cultural and contemporary aesthetics.

- North America: Driven by a substantial and increasingly affluent Muslim population, the North American market exhibits strong demand for high-quality, modest fashion. Consumption patterns favor ethically sourced and subtly branded abayas. Retail in this region is largely dominated by online specialty retailers and collaborations with major department stores recognizing the purchasing power of this demographic.

- Latin America (LATAM): While a smaller market, LATAM shows nascent growth primarily in countries with smaller but established Muslim communities. The growth trajectory is focused on accessible price points and foundational modesty wear, relying heavily on international imports and regional trade agreements to fulfill demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Abaya Market.- Lala Collections

- Annah Hariri

- Haal Inc.

- Hindam Abaya

- Hanayen

- A'ishah Collection

- Al Motahajiba

- Le Voile

- Modanisa

- Sefte

- Dar Kaftan

- Shukr Clothing

- Islamic Design House

- Aab Collection

- Al Madina

- Saudi Fashion Co.

- Desert Rose Abayas

- Mashael Al Mutawa

- The Modist (now defunct but influential in market trend setting)

- Dolce & Gabbana (Abaya Line)

Frequently Asked Questions

Analyze common user questions about the Abaya market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Abaya market?

Market growth is primarily driven by rising disposable incomes, high consumption rates in GCC countries, the increasing influence of modest fashion trends globally, and technological advancements leading to comfortable, innovative, and aesthetically diverse abaya designs. E-commerce penetration also significantly expands market reach.

Which segmentation dominates the Abaya market?

In terms of revenue contribution, the Ready-to-Wear (RTW) segment, particularly within the Premium/Luxury price point and Formal/Occasion Wear application, dominates due to high ticket sizes and consistent demand for quality, designer garments for special events throughout the year.

How does sustainability affect Abaya manufacturing?

Sustainability is becoming a crucial differentiating factor. Consumers, especially younger generations, are increasingly demanding ethically sourced and environmentally friendly fabrics. Brands are responding by investing in organic cotton, recycled synthetic materials, and transparent supply chain practices to meet this growing ethical consumer preference.

What role does technology play in Abaya market retailing?

Technology enhances retailing through AI-driven personalization, offering virtual try-on experiences that reduce returns. Advanced digital printing allows for intricate customization and pattern variation, while sophisticated ERP systems optimize inventory management for complex, global supply chains, improving overall customer satisfaction and operational efficiency.

Which region presents the most significant opportunity for Abaya market expansion?

While the Middle East remains the core revenue generator, the Asia Pacific (APAC) region, specifically Southeast Asia (Indonesia, Malaysia), presents the most significant long-term expansion opportunity due to its vast, digitally connected Muslim population base and increasing integration into the global modest fashion ecosystem.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager