Abrasion Resistant Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431665 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Abrasion Resistant Steel Market Size

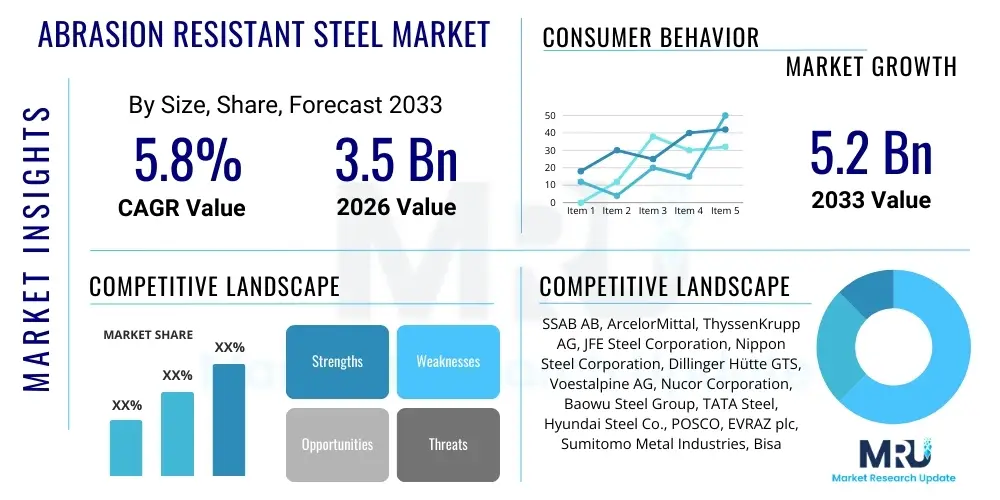

The Abrasion Resistant Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Abrasion Resistant Steel Market introduction

The Abrasion Resistant (AR) Steel Market encompasses the manufacturing and distribution of specialized steel alloys designed to withstand extreme surface wear, sliding abrasion, and impact damage typical in heavy industrial environments. These high-performance steel grades achieve their superior hardness and toughness through carefully controlled chemical compositions, primarily utilizing high carbon and manganese content, and specialized quenching and tempering processes. The primary goal of AR steel is to extend the service life of equipment components, reducing downtime and maintenance costs significantly compared to conventional structural steel. Key products within this market include specialized plates and sheets utilized across various hardness levels, such as 400 BHN (Brinell Hardness Number), 450 BHN, 500 BHN, and ultra-high-performance grades exceeding 600 BHN, tailored for specific application severity.

Major applications of abrasion resistant steel span highly demanding sectors such as mining, construction, cement production, recycling, and material handling. In mining, AR steel is indispensable for linings in dump trucks, chute liners, excavators, and crushing machinery, where continuous exposure to abrasive minerals necessitates robust material choices. The benefits derived from the adoption of AR steel are substantial, centering on increased operational efficiency and a decrease in the total cost of ownership (TCO) of capital equipment. Furthermore, the material's structural integrity under high stress allows for potential weight reduction in certain applications without compromising durability, thereby contributing to fuel efficiency in mobile machinery.

The market growth is primarily driven by global infrastructure development, rapid urbanization, and the sustained demand for mineral resources, particularly in emerging economies. The necessity for advanced, high-efficiency equipment in competitive industries forces end-users to seek materials that offer prolonged operational lifespan. Furthermore, technological advancements in steel production, leading to the development of higher quality, more weldable, and formable AR steel grades, are accelerating adoption. Strict industry regulations concerning safety and operational efficiency also encourage the replacement of legacy components with superior abrasion resistant alternatives, cementing the market's positive trajectory through the forecast period.

Abrasion Resistant Steel Market Executive Summary

The Abrasion Resistant Steel Market is characterized by robust commercial activity driven by the cyclical nature of the global heavy industries, coupled with stringent requirements for operational longevity and efficiency. Business trends indicate a pronounced shift towards customized steel solutions, where manufacturers are offering application-specific AR grades with enhanced properties like improved impact resistance at low temperatures or superior high-temperature performance, catering to specialized environments such as arctic mining or hot slag handling. Strategic alliances and mergers between raw material suppliers and steel fabricators are increasing to ensure stable supply chains and integrate expertise, optimizing production yield and quality consistency. Furthermore, sustainability is becoming a key business driver; manufacturers are investing in processes that reduce the environmental footprint associated with steel production, recognizing the growing importance of Green Steel certifications in procurement decisions by large industrial consumers.

Regionally, the Asia Pacific (APAC) stands out as the dominant and fastest-growing market segment, primarily propelled by massive infrastructure projects in China, India, and Southeast Asian nations, alongside intensive mining activities. North America and Europe, while exhibiting more mature market characteristics, show consistent demand driven by replacement cycles, technological modernization in existing fleets, and strict regulatory frameworks demanding high-quality, certified materials. The competitive landscape in these regions is heavily focused on product differentiation through superior chemical composition and processing metallurgy, enabling higher tensile strength and guaranteed through-thickness hardness. Emerging economies in Latin America and the Middle East & Africa (MEA) present significant opportunities, linked to expansions in resource extraction and the establishment of large-scale construction projects, requiring reliable, heavy-duty materials for long-term operational resilience.

Segmentation trends highlight the increasing prominence of the 450 BHN and 500 BHN grades, which offer an optimal balance between hardness, toughness, and ease of fabrication (weldability and formability), making them the preferred choice for versatile applications like truck bodies and general construction equipment. The segmentation by end-user industry demonstrates that Mining & Quarrying maintains its position as the largest consumer, reflecting the extreme abrasive wear encountered in extracting hard minerals. However, the Recycling Industry segment, driven by global waste management mandates and the increasing processing of scrap materials, is projected to register the highest Compound Annual Growth Rate (CAGR). Technology-wise, demand is growing for multi-layer AR composites and clad plates, which combine the wear resistance of high-carbon alloys with the structural integrity of conventional steel, optimizing material use and cost structure for specific wear applications.

AI Impact Analysis on Abrasion Resistant Steel Market

User queries regarding AI's influence on the Abrasion Resistant Steel Market frequently center on predictive maintenance capabilities, optimization of the steel manufacturing process, and the potential for AI-driven material discovery. Common concerns include the initial cost of integrating AI systems into legacy steel mills, data privacy in sharing operational wear data, and the need for specialized training to leverage predictive analytics effectively. Users are keen to understand how AI can minimize catastrophic failures, extend component lifespan through precise wear forecasting, and lead to the development of novel steel grades with tailored microstructures. The core themes revolve around using machine learning algorithms to enhance productivity, improve quality consistency, and transition from reactive maintenance models to highly proactive, data-informed operational strategies in harsh industrial environments.

The application of Artificial Intelligence within the abrasion resistant steel value chain is transforming both production metallurgy and end-user maintenance protocols. In manufacturing, AI algorithms analyze vast datasets encompassing smelting temperatures, alloying element dosages, and rolling parameters to predict and optimize the final microstructure and mechanical properties, ensuring consistent attainment of high Brinell hardness and uniformity across large steel plates. This level of precision minimizes off-spec production and reduces the variability inherent in traditional steelmaking, leading to higher quality and more reliable AR products. Furthermore, AI-driven simulation platforms are accelerating the R&D cycle for new steel chemistries, allowing metallurgists to virtually test thousands of potential compositions and processing routes before committing to costly physical trials.

For end-users, the integration of AI models with sensor data collected from heavy machinery (such as vibration, temperature, and throughput metrics) enables sophisticated predictive maintenance. Machine learning can detect subtle changes in operational data that indicate early stages of abrasive wear on AR steel components (e.g., bucket teeth, liner plates), allowing operators to schedule replacement or repair precisely when necessary, maximizing the component's usable life without risking equipment failure. This AI-enhanced strategy significantly reduces unscheduled downtime, a major cost factor in mining and construction, thereby enhancing the economic value proposition of high-quality abrasion resistant steel.

- AI-driven optimization of quenching and tempering processes for microstructure control.

- Predictive modeling for equipment lifespan based on real-time abrasive wear data.

- Machine learning algorithms accelerate the discovery and testing of novel high-hardness alloy compositions.

- Enhanced quality control through automated inspection of steel plate surface defects and hardness uniformity.

- AI integration in supply chain logistics to forecast demand for specific AR steel grades based on global construction and mining activity.

DRO & Impact Forces Of Abrasion Resistant Steel Market

The dynamics of the Abrasion Resistant Steel Market are profoundly shaped by three fundamental forces: the persistent need for reduced operational expenditure (OPEX) in heavy industries, the technical evolution of steel production metallurgy, and the inherent limitations related to fabrication complexities. Drivers are primarily centered on increasing industrial activity, especially the expansion of high-abrasion sectors such as mining, dredging, and earthmoving, where the replacement frequency of wear parts is a critical operational parameter. Restraints include the higher initial cost of AR steel compared to conventional alternatives, which can deter adoption by smaller contractors, along with the technical difficulties associated with welding, cutting, and forming these ultra-hard materials, requiring specialized equipment and skilled labor. Opportunities arise from the rapidly growing recycling and waste management sectors, which demand robust materials for shredders and conveyors, and the push for lightweight, high-strength solutions in mobile equipment design. These forces collectively dictate the market adoption rate and the strategic priorities of key manufacturers.

Key drivers significantly influencing market expansion include the global drive towards maximizing productivity in resource extraction. Mines are increasingly processing lower-grade ores, which often translates to higher volumes of material throughput and greater abrasive stress on equipment, necessitating the use of superior AR steel grades like 550 BHN and above. Furthermore, the longevity and reliability offered by AR steel contribute directly to reduced carbon emissions associated with frequent replacement part manufacturing and transportation, aligning with corporate sustainability goals. The mandatory shift towards more powerful and larger capacity machinery across construction and mining also demands materials capable of handling increased payload weights and dynamic stress levels without premature wear or structural failure, solidifying the demand for high-performance AR alloys.

Conversely, significant restraints hinder uniform market penetration. The specialized processing required to achieve high hardness in AR steel, such as precise quenching after hot rolling, necessitates substantial capital investment in production facilities, potentially limiting the number of competitive global suppliers. Additionally, the very properties that make AR steel desirable—its extreme hardness and tensile strength—make it challenging to work with in downstream fabrication. End-users must invest in plasma cutting, specific welding consumables, and sophisticated bending equipment, which represents a barrier to entry for smaller repair shops. Addressing these fabrication challenges through the development of AR grades with enhanced weldability characteristics, achieved through lower carbon equivalent values, remains a critical opportunity for market innovators seeking broader adoption.

Segmentation Analysis

The Abrasion Resistant Steel Market is primarily segmented based on the Brinell Hardness Number (BHN), which correlates directly with the material’s resistance to wear, followed by application and end-user industry. The BHN classification is crucial as it determines the steel's suitability for specific operating environments—ranging from moderate wear (360-400 BHN) found in certain agricultural implements to extreme wear (500-600+ BHN) typical in high-impact crushing machinery. Analyzing the market through these segments provides valuable insights into industry-specific demand patterns and the technological priorities of steel producers, ensuring that material properties align precisely with operational requirements for optimizing cost-effectiveness and performance.

The predominant segments—400 BHN, 450 BHN, and 500 BHN—represent the bulk of the market due to their versatility and optimal cost-performance ratio, balancing extreme wear resistance with manageable fabrication properties. While 500 BHN grades offer significantly longer life, the 450 BHN grade often strikes the best compromise between durability and ease of processing for high-volume applications like heavy dump truck bodies. Further detailed segmentation by product form, including plates, sheets, and structural shapes, reveals that heavy steel plate production dominates the market share, driven by its extensive use in static linings and large machinery fabrication within the mining sector. The strategic importance of understanding these segment dynamics lies in customizing supply chain strategies and allocating research and development resources toward the most commercially viable and technically demanding grades.

- By Hardness (BHN):

- 360 BHN - 400 BHN

- 450 BHN

- 500 BHN

- Above 500 BHN (550 BHN, 600+ BHN, Ultra-Hard Grades)

- By Product Form:

- Plates

- Sheets

- Structural Shapes (Bars and Tubes)

- Clad Plates/Composites

- By End-User Industry:

- Mining & Quarrying

- Construction (Earthmoving Equipment, Asphalt Plants)

- Cement & Aggregate Production

- Material Handling & Dredging

- Recycling & Waste Management (Shredders, Hoppers)

- Oil & Gas and Energy

Value Chain Analysis For Abrasion Resistant Steel Market

The value chain for the Abrasion Resistant Steel Market is intrinsically linked to the global steel industry, starting with the complex upstream extraction and processing of key raw materials. Upstream activities involve sourcing high-quality iron ore, coking coal, and critical alloying elements such as nickel, chromium, molybdenum, and manganese, which are essential for achieving the required hardness and toughness in the final AR product. The quality and stable pricing of these inputs are paramount, as variations directly influence the cost structure and final selling price of the AR steel. Key manufacturers often maintain long-term supply agreements or backward integration strategies to mitigate volatility in raw material markets, ensuring the consistency required for high-performance steel production.

The midstream process, centered on steel manufacturing, is highly technical, involving electric arc furnace (EAF) or basic oxygen furnace (BOF) melting, followed by advanced rolling techniques and critical heat treatment processes, particularly quenching and tempering (Q&T). This Q&T process is the defining factor for AR steel, imparting the necessary martensitic microstructure that provides exceptional hardness. Distribution channels are typically a mix of direct sales to large, captive end-users (like major mining corporations or global equipment manufacturers) and sales through specialized indirect channels, including dedicated steel service centers and authorized distributors. These service centers often provide value-added services such as precise cutting, machining, and fabrication, which are vital given the difficulty of working with ultra-hard steel.

Downstream activities involve the fabrication and integration of AR steel components into end-user machinery, where the material is used for liners, blades, and wear plates. This stage is dominated by Original Equipment Manufacturers (OEMs) and specialized fabrication workshops. The performance feedback from these downstream users is crucial; wear rates and failure analysis directly inform the upstream R&D efforts of steel producers. The distribution channel selection—whether direct to a major global OEM or indirect through a specialized regional service center—is strategically dependent on the order volume, required complexity of processing, and geographic reach, with indirect channels playing a vital role in reaching smaller, local maintenance and repair operations (MRO) across diverse regions.

Abrasion Resistant Steel Market Potential Customers

Potential customers for Abrasion Resistant Steel are predominantly concentrated in industries characterized by high material throughput, substantial frictional forces, and continuous operational cycles, where equipment longevity directly impacts profitability. The primary buyers are large multinational corporations operating within the mining, construction, and bulk material handling sectors. These entities prioritize materials that offer maximum Mean Time Between Failures (MTBF) and significantly reduce maintenance shutdown frequency. Procurement decisions are highly technical, often guided by materials engineers who evaluate AR steel based on guaranteed minimum Brinell hardness, guaranteed through-thickness hardness uniformity, and material certifications demonstrating compliance with international standards for chemical and mechanical properties.

The Mining & Quarrying sector represents the most critical end-user group, utilizing AR steel for high-impact applications in crushing, grinding, excavation, and material transport. Major customers include integrated mining companies (e.g., BHP, Rio Tinto) and large contractors who require AR steel plates for lining dump truck bodies, excavator buckets, dozers, and conveyor systems. The construction industry, specifically heavy civil and infrastructure contractors, constitutes another significant customer base, demanding AR steel for specialized earthmoving attachments, asphalt plant components, and concrete mixers, where mixtures of sand, gravel, and cement cause intense sliding and impact wear.

Furthermore, specialized industrial customers form a growing segment. This includes companies involved in cement production, which require AR steel for lining silos and chutes where abrasive cement clinker passes, and the burgeoning recycling industry, particularly facilities processing construction and demolition waste or scrap metal. These recycling operations rely heavily on robust AR materials for their shredder components, hammermills, and hopper linings, often demanding ultra-high hardness grades (550 BHN and above) to cope with mixed, highly variable, and often severe abrasive inputs. The need for continuous, uninterrupted operation in these environments drives consistent demand for premium AR steel replacement parts and new equipment manufacturing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SSAB AB, ArcelorMittal, ThyssenKrupp AG, JFE Steel Corporation, Nippon Steel Corporation, Dillinger Hütte GTS, Voestalpine AG, Nucor Corporation, Baowu Steel Group, TATA Steel, Hyundai Steel Co., POSCO, EVRAZ plc, Sumitomo Metal Industries, Bisalloy Steels, TimkenSteel, Gerdau S.A., Masteel, Ansteel Group Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Abrasion Resistant Steel Market Key Technology Landscape

The core technology driving the Abrasion Resistant Steel Market is the advanced heat treatment process known as Quenching and Tempering (Q&T). This specialized thermal cycle involves rapidly cooling the hot-rolled steel plate from a high temperature (quenching) to achieve a hard, martensitic microstructure, followed by controlled reheating (tempering) to restore some ductility and relieve internal stresses without significantly compromising the acquired hardness. Technological advancements focus heavily on refining the consistency and precision of this Q&T process, utilizing highly automated roller hearth furnaces and high-pressure water spray systems to ensure uniform hardness throughout the thickness of thick plates (through-hardening), which is critical for maximizing performance in severe wear conditions. Modern mills are leveraging real-time temperature monitoring and predictive control systems to tailor the microstructure for optimal balance between hardness, toughness, and weldability for diverse applications.

Beyond traditional monolithic AR plates, the market is increasingly adopting composite and clad plate technologies. Clad steel plates utilize explosive welding or hot roll bonding to combine a thin layer of extremely high-hardness AR material (often high-chromium or carbide-rich overlays) with a thicker, less expensive structural steel backing. This allows customers to leverage the superior wear properties of exotic alloys while maintaining the structural integrity and ease of attachment provided by the carbon steel base. This technology allows for cost optimization in scenarios where abrasion is confined only to the surface, mitigating the necessity of using costly high-alloy steel throughout the entire cross-section, thus expanding the economic viability of AR solutions.

Further innovation is concentrated on enhancing the metallurgy of AR grades to improve weldability and formability without sacrificing hardness, addressing a major fabrication constraint. Steel manufacturers are developing low carbon equivalent (CE) AR steels through stricter control over residual elements and reducing sulfur and phosphorus content, thereby minimizing the risk of cold cracking during welding and simplifying fabrication procedures for end-users. Furthermore, surface treatment technologies, such as plasma nitriding or laser cladding, are being explored and implemented for localized hardening or application-specific reinforcement, pushing the boundaries of material durability and offering specialized solutions for highly localized wear hotspots on complex components.

Regional Highlights

The Abrasion Resistant Steel Market exhibits distinct growth trajectories and competitive landscapes across major geographic regions, fundamentally driven by differing levels of industrial maturity, infrastructure spending, and natural resource extraction activities. Asia Pacific (APAC) currently dominates the market in terms of volume and consumption growth. This dominance is attributable to the region's massive scale of mining operations, particularly in Australia, China, and India, coupled with unprecedented investments in large-scale infrastructure and urbanization projects. The rapid industrialization necessitates vast quantities of material handling equipment and heavy machinery, generating continuous demand for high-performance AR plates. Furthermore, the presence of major, globally competitive steel producers in countries like Japan, South Korea, and China allows for localized supply and innovation, driving down procurement costs and accelerating adoption of new grades.

North America and Europe represent mature, high-value markets where demand is stable and primarily driven by replacement cycles, equipment modernization, and rigorous quality standards. In these regions, the focus is less on sheer volume and more on specialized, ultra-high-performance grades (500 BHN and above) and certified products that guarantee environmental compliance and extreme longevity. The European market, particularly Germany and Scandinavia, is known for advanced material handling and recycling technologies, demanding AR steel for highly complex shredding and processing machinery. Equipment manufacturers in North America prioritize materials that offer weight reduction alongside durability, aligning with stricter fuel efficiency regulations for heavy vehicles used in construction and logging, leading to high adoption rates of advanced, tailor-made AR steel solutions.

Latin America, rich in mineral resources, and the Middle East & Africa (MEA), characterized by rapidly developing construction sectors and oil & gas activities, are emerging as significant growth centers. Brazil, Chile, and Peru in Latin America have extensive copper, iron ore, and coal mining industries, translating into robust demand for mining wear parts. In MEA, mega construction projects and expansions in port infrastructure (requiring dredging and material handling components) fuel the need for durable AR steel. While initial adoption rates in these regions may be impacted by economic volatility, the long-term fundamentals tied to resource extraction and urbanization provide substantial underlying market potential for AR steel manufacturers willing to establish reliable regional distribution and service networks to support intensive operational requirements.

- Asia Pacific (APAC): Dominant market volume driven by China and India's infrastructure boom and major Australian mining operations; strong domestic manufacturing base.

- North America: Focus on high-value, lightweight, and ultra-high-performance grades for advanced construction and efficiency-driven mining modernization.

- Europe: Stable demand, emphasizing strict quality control, environmental certifications, and application in specialized recycling and industrial processing machinery.

- Latin America: High growth potential linked to large-scale copper, iron ore, and other commodity extraction projects requiring heavy-duty wear materials.

- Middle East and Africa (MEA): Emerging growth driven by significant construction and infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries and resource-rich African nations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Abrasion Resistant Steel Market.- SSAB AB

- ArcelorMittal

- ThyssenKrupp AG

- JFE Steel Corporation

- Nippon Steel Corporation

- Dillinger Hütte GTS

- Voestalpine AG

- Nucor Corporation

- Baowu Steel Group

- TATA Steel

- Hyundai Steel Co.

- POSCO

- EVRAZ plc

- Sumitomo Metal Industries

- Bisalloy Steels

- TimkenSteel

- Gerdau S.A.

- Masteel

- Ansteel Group Corporation

- Outokumpu Oyj

Frequently Asked Questions

Analyze common user questions about the Abrasion Resistant Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes Abrasion Resistant (AR) Steel from standard structural steel?

AR steel is distinct due to its specialized chemical composition, often containing higher levels of carbon, manganese, and alloying elements, combined with critical Quenching and Tempering (Q&T) heat treatment. This process creates a hard, martensitic microstructure, providing significantly higher Brinell Hardness Numbers (BHN) and superior resistance to surface wear, sliding abrasion, and localized impact damage compared to standard mild or high-strength low-alloy structural steels, thereby extending equipment lifespan dramatically.

Which Brinell Hardness Number (BHN) grade is most commonly used in the construction industry?

The 400 BHN and 450 BHN grades are the most commonly specified and utilized in the construction industry. The 400 BHN grade offers good wear resistance with excellent weldability and formability, suitable for moderately abrasive applications like truck bodies and general earthmoving equipment. The 450 BHN grade is often preferred for more critical components requiring a better balance between superior wear life and ease of on-site fabrication and maintenance.

How does the initial high cost of AR steel justify its adoption over conventional materials?

The initial higher procurement cost of AR steel is justified through a significantly lower total cost of ownership (TCO) over the equipment's lifecycle. AR steel drastically reduces equipment downtime associated with component failure and replacement, minimizes maintenance labor costs, and increases operational efficiency (throughput). The extended lifespan of AR components often results in an exponential return on investment compared to the marginal cost savings achieved by using cheaper, less durable alternatives that require frequent replacement.

What are the primary fabrication challenges when working with ultra-hard AR steel?

The primary fabrication challenges stem from the high hardness and low ductility of AR steel, which necessitate specialized techniques. Key challenges include increased difficulty in cutting (requiring plasma or laser cutting, not simple oxy-fuel), heightened risk of cold cracking during welding (mandating specific low-hydrogen consumables and preheating), and high resistance to cold forming or bending, often requiring specialized, high-tonnage press brakes and larger bend radii to prevent fracture.

Which end-user segment is projected to show the highest growth rate for AR steel consumption?

The Recycling and Waste Management Industry segment is projected to exhibit the highest growth rate for AR steel consumption. This accelerated demand is driven by global legislative pushes for increased recycling rates, necessitating the expansion and modernization of high-throughput shredding, crushing, and sorting facilities. These operations involve extreme, multi-directional abrasion and impact from heterogeneous waste streams, demanding the highest quality and most durable AR materials for core processing components like shredder blades and hammermills.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Abrasion Resistant Steel Plate Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Abrasion Resistant Steel Plate Market Statistics 2025 Analysis By Application (Mining Industry, Power Plants), By Type (High-carbon Alloy Steel, Low-carbon Alloy Steel), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager