Absorbable Heart Stent Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436028 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Absorbable Heart Stent Market Size

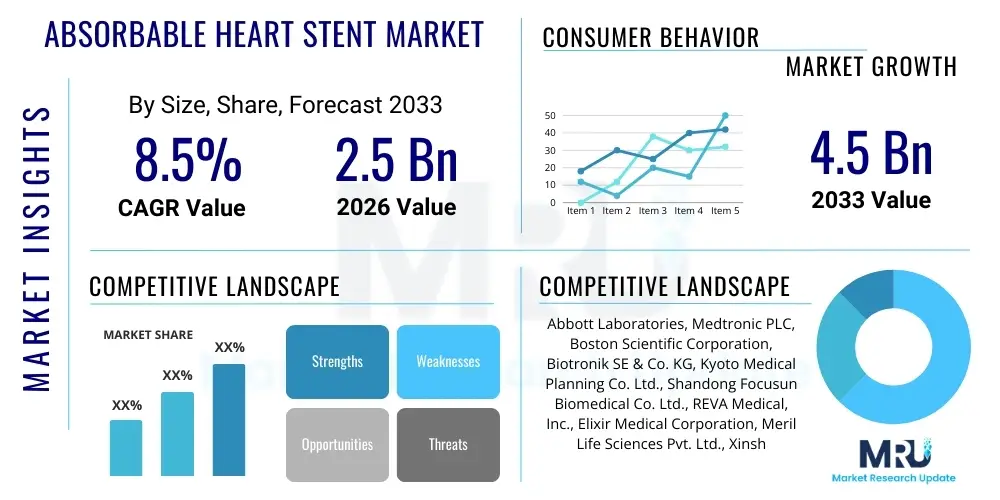

The Absorbable Heart Stent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 4.5 Billion by the end of the forecast period in 2033.

Absorbable Heart Stent Market introduction

The Absorbable Heart Stent Market encompasses the development, manufacturing, and commercialization of bioresorbable scaffolds (BRS) designed to temporarily support coronary arteries following percutaneous coronary intervention (PCI). Unlike traditional metallic stents, which remain permanently implanted, BRS provide transient mechanical support, ensuring vessel patency during the healing phase, and then gradually dissolve, typically over 18 to 36 months, allowing the treated vessel to restore its natural structure and physiological function. This innovation fundamentally shifts the paradigm from permanent metallic caging to temporary vascular restoration therapy, mitigating the long-term risks associated with permanent implants such as late-stent thrombosis and hindering future surgical interventions.

Major applications of absorbable heart stents include the treatment of stable angina, unstable angina, and acute myocardial infarction, particularly in patients with single, relatively uncomplicated lesions. The product description emphasizes materials like PLLA (Poly-L-Lactic Acid) and specific copolymers, engineered for optimal radial strength, controlled degradation kinetics, and effective drug elution (drug-eluting bioresorbable scaffolds). Key benefits include the restoration of vasomotion, elimination of permanent metallic artifacts for improved diagnostic imaging (MRI/CT), and improved compliance, which are crucial for long-term patient health and quality of life.

The primary driving factors propelling this market forward are the rising global prevalence of cardiovascular diseases (CVDs), particularly coronary artery disease (CAD), coupled with advancements in material science and polymer engineering that enhance the safety and efficacy profiles of BRS. Furthermore, growing clinical evidence supporting the non-inferiority or superiority of BRS in specific patient subgroups, combined with increased physician and patient awareness regarding the limitations of permanent metallic stents, significantly fuel adoption rates across developed and emerging economies. Stringent regulatory scrutiny and requirements for long-term follow-up data, while posing temporary hurdles, ultimately drive innovation towards safer, second- and third-generation devices.

Absorbable Heart Stent Market Executive Summary

The Absorbable Heart Stent Market is experiencing robust growth driven by significant advancements in biodegradable polymer technology and strong clinical momentum towards vascular restoration therapies. Key business trends include increasing strategic collaborations between medical device manufacturers and research institutions to accelerate clinical trials, focusing on developing thinner strut designs and faster absorption rates to optimize patient outcomes. Furthermore, market competition is intensifying, leading to competitive pricing strategies and diversified product portfolios, particularly in regions where regulatory approval processes are streamlined. The transition from first-generation bulky scaffolds to optimized, second-generation devices with improved radial strength and reduced inflammatory response defines the current technological trajectory.

Regional trends indicate that North America and Europe currently dominate the market due to well-established healthcare infrastructures, high adoption of advanced interventional cardiology procedures, and favorable reimbursement policies. However, the Asia Pacific region is poised for the fastest growth, propelled by rapidly increasing prevalence of CAD, improving access to advanced medical treatments, and massive unmet needs in large population centers like China and India. Government initiatives aimed at modernizing healthcare facilities and increasing investment in research and development (R&D) concerning bioresorbable technology are significant catalysts for APAC market expansion, making it a critical focus area for global manufacturers seeking sustained long-term growth.

Segmentation trends highlight that the Polymeric Stents sub-segment, primarily based on PLLA, continues to hold the largest market share owing to its established clinical history and widespread regulatory approvals, despite ongoing material science exploration into novel polymers. In terms of end-users, hospitals remain the largest consumer segment due to the high volume of PCI procedures performed, requiring substantial procurement of these specialized devices. The market is also seeing increasing penetration of drug-eluting absorbable stents, which combine the structural benefits of BRS with localized drug delivery to inhibit restenosis, positioning them as the standard of care for complex lesions, thereby driving segment value and utilization.

AI Impact Analysis on Absorbable Heart Stent Market

User queries regarding AI's influence in the Absorbable Heart Stent market predominantly center on improving diagnostic accuracy, optimizing stent deployment, and predicting long-term bioresorption performance. Users are keen to understand how AI-driven image analysis (e.g., Optical Coherence Tomography (OCT) and Intravascular Ultrasound (IVUS)) can enhance the precision of lesion assessment, crucial for selecting the appropriate size and ensuring optimal apposition of BRS. Furthermore, significant interest revolves around AI's role in refining material science by simulating polymer degradation kinetics, which minimizes costly and time-consuming physical experimentation. The key themes are enhanced procedural safety, personalization of treatment, and accelerated R&D timelines for next-generation scaffolds.

AI algorithms are fundamentally transforming pre-procedural planning by analyzing complex patient anatomical data and calculating optimal stent dimensions and deployment pressures, thereby reducing the risk of procedural complications such as malapposition or edge dissection, which are particularly sensitive issues with BRS due to their lower intrinsic radial strength compared to metals. Machine learning models trained on vast datasets of patient demographics, lesion characteristics, and long-term follow-up data can accurately predict which patients are most likely to benefit from an absorbable stent versus a traditional metallic stent, thus enabling precision cardiology and optimizing resource allocation within cath labs. This predictive capacity is critical for ensuring the economic viability and clinical success of BRS technology.

Beyond clinical deployment, AI is impacting manufacturing efficiency and quality control. Deep learning models are utilized in the manufacturing process to monitor and adjust the polymer extrusion and laser cutting stages, ensuring dimensional consistency and structural integrity of the delicate scaffolds, which directly correlates to their radial strength and predictable absorption profiles. In the post-market surveillance phase, natural language processing (NLP) and machine learning are deployed to sift through massive amounts of clinical trial and real-world evidence data to rapidly identify potential safety signals or performance deviations, accelerating the feedback loop necessary for regulatory compliance and continuous product improvement in this highly specialized segment.

- AI optimizes BRS sizing and placement through advanced coronary artery morphology analysis (OCT/IVUS).

- Predictive modeling using machine learning identifies ideal patient cohorts for BRS implantation, enhancing personalized medicine.

- Deep learning algorithms accelerate material science R&D by simulating polymer degradation and mechanical performance.

- AI systems enhance quality control in manufacturing, ensuring uniform strut thickness and optimal radial strength.

- Natural Language Processing aids in rapid analysis of post-market clinical data for enhanced safety monitoring and regulatory reporting.

DRO & Impact Forces Of Absorbable Heart Stent Market

The Absorbable Heart Stent Market is primarily driven by the persistent clinical need for temporary vascular support, the high prevalence of Coronary Artery Disease (CAD), and ongoing innovation in material science, which are powerful foundational factors. Restraints include the higher cost of BRS compared to established drug-eluting metallic stents, technical challenges related to strut thickness impacting deliverability and restenosis rates, and extended mandatory dual antiplatelet therapy (DAPT) duration required by early generation products. Opportunities arise from expanding applications into peripheral artery disease and complex lesion subsets, coupled with the development of next-generation scaffolds featuring magnesium and zinc alloys offering superior radial strength and faster bioresorption kinetics. These dynamics collectively shape the market's trajectory.

Key drivers include the demonstrable benefit of vascular restoration—allowing the vessel to recapture its native mechanics—and the expanding aging population globally, which requires frequent interventional cardiac procedures. The persistent long-term complications associated with permanent metallic structures, such as very late stent thrombosis (VLST) and chronic inflammation, strongly push clinicians and researchers toward bioresorbable alternatives. Regulatory bodies are increasingly supportive of innovative cardiovascular devices that demonstrate clear long-term patient benefits, fostering an environment conducive to product commercialization and clinical adoption across major geographies.

The impact forces influencing the market are multifaceted, encompassing technological sophistication, clinical trial outcomes, and pricing pressure. The failure of early first-generation BRS devices (like Abbott’s Absorb) initially exerted a dampening effect, highlighting the critical need for robust, long-term safety data, forcing manufacturers to refine material composition and design parameters. Currently, the market is characterized by medium-to-high competitive intensity, where sustained clinical validation (Level 1 evidence) is the primary determinant of market success, ensuring that only clinically superior and economically viable products achieve substantial penetration and sustained growth.

Segmentation Analysis

The Absorbable Heart Stent Market is comprehensively segmented based on material type, product type, end-user, and regional geography, reflecting the diversity in clinical needs and technological solutions available. Material segmentation is crucial, differentiating between polymeric scaffolds, which constitute the largest segment due to their established biodegradability and versatility, and metallic scaffolds (e.g., magnesium or zinc-based alloys), which are gaining traction owing to their superior radial strength and faster, more predictable degradation profiles. The product type dictates whether the scaffold is designed purely for support or incorporates localized drug delivery (drug-eluting vs. bare-metal absorbable stents), with drug-eluting variants dominating due to superior efficacy in preventing restenosis.

End-user segmentation clearly indicates that hospitals, particularly tertiary care centers equipped with advanced cath labs and interventional expertise, remain the primary consumer base for these high-value medical devices, driven by the sheer volume of percutaneous coronary interventions (PCI) performed annually. Ambulatory Surgical Centers (ASCs) are emerging as a growth sector, especially in developed markets like the US, as procedural shift moves towards outpatient settings for less complex cases, offering patients convenience and cost benefits. Geographic segmentation reveals a mature market presence in North America and Europe, juxtaposed against high-growth potential in Asia Pacific, necessitating tailored marketing and distribution strategies focusing on regulatory compliance and localized clinical education programs.

The interaction between material science and drug delivery defines the market's innovation curve. For instance, polymeric scaffolds are further segmented by the type of polymer used (PLLA, PLGA, etc.), where PLLA remains the gold standard but is continuously being improved upon to address issues of chronic inflammation and strut dimensions. Furthermore, the segmentation by indication—single-vessel disease versus multi-vessel disease—is critical for market forecasting, as current clinical guidelines often restrict the use of BRS to less complex lesions, though ongoing trials aim to expand their therapeutic window to more challenging anatomical scenarios, promising future market expansion.

- Material Type:

- Polymeric Scaffolds (PLLA, PCL, PLGA)

- Metallic Scaffolds (Magnesium Alloys, Zinc Alloys)

- Product Type:

- Drug-Eluting Bioresorbable Stents (DE-BRS)

- Bare-Metal Bioresorbable Stents (BM-BRS)

- End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Cardiac Catheterization Laboratories (Cath Labs)

- Application:

- Coronary Artery Disease (CAD)

- Peripheral Artery Disease (PAD)

Value Chain Analysis For Absorbable Heart Stent Market

The value chain for the Absorbable Heart Stent Market begins with upstream activities focused heavily on specialized material procurement and research. Upstream analysis involves sourcing high-purity, medical-grade bioresorbable polymers (like PLLA or specialized metallic alloys) and pharmaceutical agents (for drug elution). This stage is characterized by intense R&D investment, focusing on polymer synthesis, formulation stability, and biomechanical testing to achieve the requisite radial strength and controlled degradation kinetics. Key players in this phase include specialized chemical manufacturers and polymer science research laboratories that adhere to rigorous quality and regulatory standards for implantable medical devices. Vertical integration into material manufacturing offers significant competitive advantages by ensuring supply consistency and cost control.

Midstream activities involve the complex manufacturing and assembly process, including extrusion or molding of the scaffold, precise laser cutting of the strut pattern, drug loading/coating, and sterilization procedures. Due to the delicate nature and critical tolerances required for BRS, manufacturing requires highly advanced, often proprietary, cleanroom technologies and automated quality assurance systems. The value is significantly added here through intellectual property (IP) related to scaffold design (e.g., strut geometry, expansion ratio) and drug delivery systems. Regulatory approval (e.g., FDA PMA, CE Mark) is obtained at this stage, representing a major valuation milestone and a barrier to entry for new competitors.

Downstream analysis focuses on distribution channels and end-user penetration. Direct channels involve manufacturers selling directly to large hospital systems or Group Purchasing Organizations (GPOs), requiring specialized clinical sales teams who can educate interventional cardiologists on complex deployment techniques and long-term data. Indirect channels utilize specialized medical device distributors, particularly in fragmented or emerging markets, who handle logistics, inventory management, and localized customer support. Effective distribution relies on a temperature-controlled supply chain and close collaboration with hospital inventory management systems to ensure immediate availability in cath labs. The ultimate value delivery is through the interventional cardiologist, whose procedural expertise dictates the successful deployment and long-term clinical outcome of the BRS.

Absorbable Heart Stent Market Potential Customers

Potential customers for Absorbable Heart Stents are primarily healthcare institutions and specialized medical practitioners who perform percutaneous coronary intervention (PCI) procedures. The largest and most influential buyers are major tertiary and quaternary care hospitals that maintain large-volume cardiac catheterization laboratories (cath labs). These institutions prioritize devices that offer superior long-term patient outcomes, reduced readmission rates, and fit within established clinical protocols. Procurement decisions in large hospitals are typically centralized through value analysis committees, weighing clinical effectiveness, cost-per-procedure, and long-term total cost of ownership against metallic stent alternatives.

A secondary, yet rapidly expanding, customer segment includes specialized cardiovascular clinics and Ambulatory Surgical Centers (ASCs) focusing on high-volume, less complex cardiac interventions. These centers are highly sensitive to product efficiency and streamlined workflow processes. The appeal of BRS to these buyers stems from the increasing patient demand for less invasive, temporary implant solutions. Furthermore, government health programs and private insurance providers, acting as indirect buyers through reimbursement mechanisms, significantly influence market demand by defining which BRS procedures are covered and at what rate, ultimately driving adoption rates across the healthcare spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Medtronic PLC, Boston Scientific Corporation, Biotronik SE & Co. KG, Kyoto Medical Planning Co. Ltd., Shandong Focusun Biomedical Co. Ltd., REVA Medical, Inc., Elixir Medical Corporation, Meril Life Sciences Pvt. Ltd., Xinsheng Medical Technology, SMT (Sahajanand Medical Technologies), Arterial Remodeling Technologies (ART), Amaranth Medical, Inc., MicroPort Scientific Corporation, Lepu Medical Technology, OrbusNeich Medical, Terumo Corporation, Bluegrass Vascular Technologies, Essential Medical, Inc., B. Braun Melsungen AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Absorbable Heart Stent Market Key Technology Landscape

The technology landscape of the Absorbable Heart Stent Market is defined by continuous innovation in material science, scaffold design, and drug delivery systems, aiming to overcome the challenges encountered with first-generation products, specifically focusing on achieving the delicate balance between radial strength and rapid absorption. Currently, the predominant material technology involves high molecular weight Poly-L-Lactic Acid (PLLA), which offers predictable degradation over two to three years. However, newer technologies are emerging, including bioresorbable metallic stents based on magnesium and zinc alloys. Magnesium stents, like those developed by Biotronik, offer superior radial support and faster degradation (typically 12-18 months), positioning them as highly competitive alternatives, despite requiring sophisticated manufacturing techniques to prevent premature corrosion.

Advancements in scaffold design represent a critical technological frontier. Newer generation stents feature significantly thinner struts (approaching 100 microns or less), which drastically improves deliverability, reduces localized inflammation, and potentially lowers the rate of acute thrombosis and restenosis—key factors previously limiting BRS adoption. Furthermore, manufacturing technologies such as micro-extrusion and advanced laser cutting are being optimized to ensure high geometric precision and uniformity, vital for scaffolds that must maintain structural integrity while dissolving. Sophisticated surface modification techniques are also employed to control the elution kinetics of anti-proliferative drugs (like everolimus or sirolimus), ensuring sustained delivery without compromising the structural stability of the underlying polymer matrix.

Crucially, ancillary imaging and assessment technologies drive procedural success for BRS. Intravascular imaging modalities, particularly Optical Coherence Tomography (OCT) and Intravascular Ultrasound (IVUS), are indispensable, as they allow interventional cardiologists to meticulously assess lesion characteristics and confirm optimal stent expansion and apposition post-deployment, a requirement often more stringent for BRS than metallic stents. The integration of AI tools with these imaging platforms (as discussed previously) provides real-time guidance and quantitative assessment, standardizing deployment techniques and improving long-term outcomes, making these imaging systems essential components of the modern BRS technological ecosystem. Research into novel, non-toxic polymer compositions that elicit minimal chronic inflammation upon degradation also remains a high-priority area.

Regional Highlights

The Absorbable Heart Stent Market exhibits significant regional disparities, driven by variations in healthcare spending, regulatory environments, and the prevalence of cardiovascular disease. North America, particularly the United States, commands a significant share due to high awareness among cardiologists, robust reimbursement frameworks that support advanced cardiovascular procedures, and the presence of major industry players engaging in large-scale clinical trials. The regulatory clarity provided by the FDA, following the initial phases of BRS introduction, has stabilized the market, fostering the adoption of second-generation devices. High adoption rates are sustained by aggressive R&D investments focused on improving material science and optimizing deployment strategies, particularly within large academic medical centers.

Europe represents another mature market segment, characterized by high-quality healthcare systems and favorable government support for medical innovation. Countries such as Germany, the UK, and France are key contributors, driven by a high volume of PCI procedures and rapid uptake of clinically validated technologies. The implementation of the Medical Device Regulation (MDR) has standardized market access but also increased the requirement for clinical evidence, pushing manufacturers to ensure long-term data robustness. European cardiologists are generally proactive in adopting technologies that promise improved long-term quality of life, aligning well with the restorative benefits offered by BRS.

Asia Pacific (APAC) is projected to be the fastest-growing market region over the forecast period. This rapid expansion is fueled by rising disposable incomes, significant improvements in healthcare infrastructure, and the alarming increase in the incidence of coronary artery disease across populous nations like China and India. Local manufacturers are emerging as strong competitors, focusing on cost-effective BRS solutions tailored to regional clinical practices. Regulatory pathways are becoming more harmonized, attracting substantial investment from global companies seeking to capitalize on the enormous patient base. Latin America and the Middle East & Africa (MEA) currently represent smaller markets but offer substantial long-term potential as healthcare access expands and specialized cardiac centers are established.

- North America: Market leader driven by high prevalence of CAD, robust reimbursement structures, and early adoption of second-generation BRS technologies.

- Europe: High adoption rates in Western Europe fueled by strong clinical evidence, advanced healthcare infrastructure, and stringent quality standards (MDR compliance).

- Asia Pacific (APAC): Expected fastest growth due to rising CVD incidence, modernization of healthcare facilities, and increasing access to advanced interventional procedures in China and India.

- Latin America: Emerging market with growth potential linked to increasing healthcare expenditure and expansion of specialized cardiac care centers.

- Middle East & Africa (MEA): Growth driven by medical tourism, significant investments in high-end medical technologies in GCC countries, and addressing severe gaps in cardiovascular care infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Absorbable Heart Stent Market.- Abbott Laboratories

- Medtronic PLC

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- Kyoto Medical Planning Co. Ltd.

- Shandong Focusun Biomedical Co. Ltd.

- REVA Medical, Inc.

- Elixir Medical Corporation

- Meril Life Sciences Pvt. Ltd.

- Xinsheng Medical Technology

- SMT (Sahajanand Medical Technologies)

- Arterial Remodeling Technologies (ART)

- Amaranth Medical, Inc.

- MicroPort Scientific Corporation

- Lepu Medical Technology

- OrbusNeich Medical

- Terumo Corporation

- Bluegrass Vascular Technologies

- Essential Medical, Inc.

- B. Braun Melsungen AG

Frequently Asked Questions

What is the primary clinical advantage of an Absorbable Heart Stent over a traditional metallic stent?

The primary clinical advantage is vascular restoration. Absorbable Heart Stents (BRS) provide temporary mechanical support and then dissolve completely, allowing the coronary vessel to regain its natural function, vasomotion, and structural integrity, thereby eliminating the long-term risk of late-stent thrombosis and enabling potential future revascularization options.

Which materials are most commonly used in the manufacturing of Bioresorbable Scaffolds (BRS)?

The most commonly used material is Poly-L-Lactic Acid (PLLA), a biocompatible polymer known for its predictable degradation kinetics over 2-3 years. However, new metallic alloys, primarily based on magnesium and zinc, are gaining traction due to their superior radial strength and faster absorption profile, typically completing degradation within 12 to 18 months.

What impact did the withdrawal of first-generation BRS devices have on the current market?

The commercial withdrawal of first-generation devices, such as Abbott’s Absorb, significantly impacted market adoption by highlighting crucial clinical limitations related to strut thickness and high thrombosis rates. This event spurred manufacturers to focus intensely on developing second-generation scaffolds with thinner struts, improved radial strength, and robust long-term clinical trial data to re-establish physician confidence and ensure patient safety.

How is Artificial Intelligence (AI) enhancing the deployment and efficacy of Absorbable Heart Stents?

AI is used to optimize BRS procedural outcomes through sophisticated pre-procedural planning, analyzing intravascular imaging (OCT/IVUS) to determine optimal stent sizing and expansion parameters. This minimizes the risk of malapposition and inadequate sizing, which are critical for the long-term success of bioresorbable scaffolds due to their lower intrinsic radial force.

Which geographical region is expected to demonstrate the highest growth rate for the Absorbable Heart Stent Market?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by the rapidly increasing burden of coronary artery disease, major governmental investments in modernizing cardiovascular healthcare infrastructure, and improved patient access to advanced interventional cardiology devices in key markets like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager