Absorbable Heart Stent Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 441807 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Absorbable Heart Stent Market Size

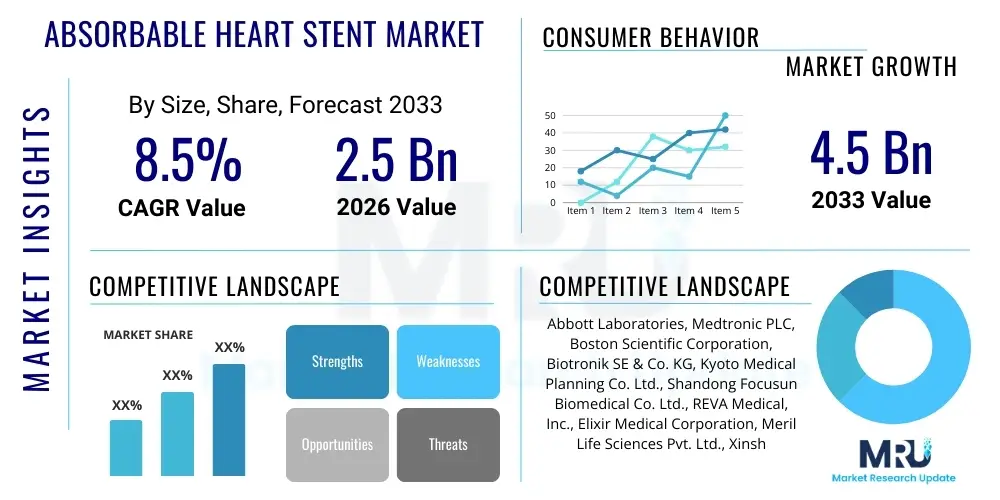

The Absorbable Heart Stent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing prevalence of cardiovascular diseases globally, coupled with a strong preference among clinicians and patients for devices that offer temporary scaffolding and eventual bioresorption, thus eliminating the long-term risks associated with permanent metallic implants. The continuous investment in research and development aimed at improving mechanical properties and dissolution kinetics of bioresorbable polymers is key to maintaining this high growth rate.

Absorbable Heart Stent Market introduction

The Absorbable Heart Stent Market encompasses the commercialization and clinical adoption of medical devices designed to treat coronary artery disease (CAD) by temporarily supporting blocked vessels and then dissolving completely within the human body over a predetermined period, typically between one to three years. Unlike traditional drug-eluting metallic stents (DES) which remain permanently, absorbable stents, also known as Bioresorbable Vascular Scaffolds (BVS), are manufactured predominantly from polymers such as PLLA (poly-L-lactic acid) or metallic alloys like magnesium, providing the necessary mechanical strength during the healing phase before hydrolyzing and metabolizing into natural compounds like water and carbon dioxide. This temporary presence is heralded as a significant advancement, restoring the vessel's natural vasomotor function and enabling future revascularization procedures without the complications of overlapping metal layers.

Major applications for absorbable heart stents center around percutaneous coronary intervention (PCI) procedures for treating symptomatic patients suffering from angina or acute coronary syndromes, particularly in non-complex lesions and younger patients where the long-term presence of metal is undesirable. The primary benefit these devices offer is the "leaving nothing behind" principle, which fundamentally changes the paradigm of CAD management by reducing the risk of late-stent thrombosis and eliminating the need for extended dual antiplatelet therapy (DAPT) in the very long term, although immediate post-implantation DAPT protocols remain stringent. Moreover, the re-establishment of a healthy vessel wall allows for non-invasive imaging techniques that are often complicated by the presence of metallic artifacts.

Driving factors propelling this market include the global aging population, which is highly susceptible to cardiovascular ailments, leading to an increasing volume of PCI procedures worldwide. Significant clinical evidence demonstrating the non-inferiority of advanced BVS iterations compared to DES in specific patient populations, combined with favorable reimbursement policies in developed economies, further stimulates adoption. Furthermore, continuous technological refinements focusing on thinner struts, improved radial strength, and tailored drug elution profiles are addressing initial concerns regarding product performance and technique sensitivity, making these advanced devices more appealing to interventional cardiologists seeking superior long-term vessel outcomes.

Absorbable Heart Stent Market Executive Summary

The Absorbable Heart Stent Market is defined by intense competition and rapid technological evolution, shifting away from first-generation polymer scaffolds towards second and third-generation devices that leverage refined materials like magnesium alloys and proprietary polymer blends offering better handling and faster resorption rates. Key business trends include strategic collaborations between large medical device corporations and specialized biotechnology firms focused on material science, aiming to accelerate regulatory approval in major markets like the U.S. and Europe. Furthermore, companies are concentrating on extensive post-market clinical trials to solidify long-term efficacy and safety data, crucial for winning physician confidence and securing broader clinical adoption amidst rigorous scrutiny from regulatory bodies regarding long-term device performance.

Regionally, North America and Europe remain the dominant revenue contributors, driven by established healthcare infrastructure, high awareness regarding advanced cardiovascular treatments, and substantial research funding. However, the Asia Pacific region, particularly China and India, is emerging as the fastest-growing market segment, attributed to the massive untapped patient pool suffering from increasing rates of lifestyle-related cardiovascular diseases, coupled with improving healthcare access and rising disposable incomes that favor premium medical solutions. Local manufacturing capabilities in these emerging economies are also beginning to exert influence, focusing on cost-effective alternatives tailored to regional needs.

In terms of segments, the Polymer-based Stents segment currently holds the largest market share due to the early commercial success and extensive clinical investigation of PLLA-based devices, despite ongoing challenges related to delayed healing and inflammatory responses observed in some initial studies. However, the Metal-based Bioresorbable Stents segment, particularly those utilizing magnesium, is poised for accelerated growth, driven by their superior radial strength and faster, more predictable degradation profiles, which offer a compelling balance between mechanical support and restoration of native vessel function, positioning them favorably for complex procedures where immediate vessel integrity is paramount.

AI Impact Analysis on Absorbable Heart Stent Market

User queries regarding AI's influence on the Absorbable Heart Stent market predominantly focus on how artificial intelligence can enhance diagnostic accuracy, optimize stent deployment techniques, and improve patient selection for BVS procedures, thereby mitigating the known challenges associated with polymer scaffold outcomes. Users are keen to understand if AI can reliably predict scaffold failure or guide personalized DAPT strategies based on individual patient characteristics and lesion morphology, given that procedural technique and patient variability significantly impact BVS success rates. Furthermore, common questions revolve around AI’s role in accelerating the discovery of new bioresorbable materials, simulating degradation kinetics, and analyzing vast quantities of clinical trial data to identify long-term safety signals and optimal patient subgroups for absorbable stents.

The integration of AI and machine learning (ML) holds transformative potential across the entire lifecycle of absorbable heart stents, from pre-clinical development to post-market surveillance. In the developmental phase, AI algorithms can simulate the mechanical and chemical degradation processes of novel bioresorbable materials, significantly cutting down the time and cost associated with traditional iterative testing by predicting long-term material performance and biocompatibility. This predictive modeling capability allows manufacturers to rapidly iterate on stent designs, optimizing strut thickness, coating uniformity, and drug release kinetics specific to different clinical applications, accelerating the pipeline for next-generation BVS products with enhanced structural integrity.

Clinically, AI applications are emerging as critical tools for procedural planning and execution. Advanced image analysis powered by deep learning can accurately characterize complex coronary lesions, identify vulnerable plaque features invisible to the naked eye, and guide interventionalists on optimal sizing and deployment pressure for the absorbable stent, which is crucial due to the lower radial strength of BVS compared to metal stents. Moreover, AI-driven predictive analytics can leverage electronic health records, genomic data, and imaging data to create personalized risk models for target lesion failure and guide the selection of patients who are most likely to benefit from the unique properties of bioresorbable devices, thus maximizing clinical effectiveness and addressing historical concerns about procedural complexity.

- AI-Enhanced Diagnostic Imaging: Using deep learning models to analyze IVUS and OCT images for precise lesion morphology classification, aiding in optimal BVS sizing and placement.

- Predictive Material Science: Utilizing ML to simulate and accelerate the discovery and testing of novel bioresorbable polymers and alloys with optimized strength and degradation profiles.

- Personalized Patient Selection: Employing AI algorithms to identify patient subgroups most suitable for BVS based on risk factors, age, and lesion characteristics, minimizing adverse event rates.

- Procedural Guidance Systems: Real-time AI feedback during PCI to optimize stent expansion and wall apposition, mitigating operator variability associated with BVS implantation.

- Clinical Data Analysis: Machine learning processing of large-scale clinical trial data to identify long-term trends, safety signals, and ideal DAPT durations post-BVS implantation.

- Supply Chain Optimization: Using AI to forecast demand, manage inventory of high-value stents, and optimize global distribution logistics.

DRO & Impact Forces Of Absorbable Heart Stent Market

The Absorbable Heart Stent Market is primarily driven by the compelling clinical rationale of restoring natural vessel function after temporary scaffolding, appealing strongly to both patients and healthcare providers aiming for better long-term outcomes and reduced reliance on permanent foreign materials. However, the market faces significant restraints, chiefly stemming from the high upfront cost of these specialized devices compared to mature metallic stents and the technical challenges associated with precise BVS implantation, which demands higher operator skill and longer procedure times. Opportunities abound in the development of next-generation devices with improved handling characteristics, expansion into non-coronary applications such as peripheral artery disease, and capitalizing on unmet needs in emerging Asian markets where cardiovascular disease incidence is skyrocketing.

Impact forces currently shaping the market dynamics include strong regulatory scrutiny, particularly following initial mixed clinical outcomes, which has slowed the pace of widespread adoption. The intense competitive landscape among device manufacturers, who are constantly striving for superior material composition and thin-strut designs, pushes innovation forward but also drives up the cost of research and development. Furthermore, pricing pressures exerted by centralized procurement agencies and evolving reimbursement structures in major economies dictate the commercial viability and market penetration strategies for high-cost devices like BVS. The persistent need for long-term safety and efficacy data, specifically comparing BVS performance against contemporary best-in-class metallic DES over a five-to-ten-year horizon, is perhaps the most significant long-term impact force influencing physician trust and market growth.

The technological impact force is powerful, with major players investing heavily in developing scaffolds made from materials like fast-resorbing magnesium and iron, aiming to overcome the material limitations of early PLLA stents, such as lower radial strength and prolonged degradation. This focus on material innovation directly addresses historical restraints. Opportunities also arise from expanding the clinical scope beyond simple lesions to complex indications such as bifurcations and small vessels, leveraging advanced imaging modalities like Optical Coherence Tomography (OCT) and Intravascular Ultrasound (IVUS) to guide procedures. The global shift towards preventative and less invasive cardiac care further solidifies the long-term opportunity for absorbable solutions that promise physiological recovery rather than permanent implantation.

Segmentation Analysis

The Absorbable Heart Stent Market is comprehensively segmented based on material type, product form, application, and end-user, offering granular insights into demand patterns and technological preferences across the global healthcare landscape. Material composition is the primary differentiator, determining the device’s mechanical properties, degradation timeline, and long-term biological response, leading to distinct market segments for polymer and metallic alloys. The application segment reflects the diverse settings where these devices are used, although coronary artery disease dominates, research is increasingly focusing on extending their use to peripheral vascular diseases, which represents a significant future growth area. Understanding these segment dynamics is crucial for manufacturers to tailor their R&D investments and commercial strategies, ensuring that product characteristics align with specific clinical requirements and evolving regulatory standards across different geographical regions.

The segmentation by end-user, primarily hospitals and specialized cardiac centers, highlights the specialized nature of BVS procedures, which typically require highly skilled interventional cardiologists and advanced cath lab infrastructure for optimal outcomes. Hospitals, given their high volume of PCI procedures and established procurement relationships, constitute the largest segment. However, specialized cardiac centers, often serving as pioneers for new and complex procedures, are critical for early adoption and establishing best practices for these innovative devices. Product form segmentation distinguishes between traditional balloon-expandable scaffolds and potentially self-expanding designs currently under development, though balloon-expandable variants dominate due to established procedural protocols.

The strategic segmentation around material type—polymer vs. metal—is central to competitive positioning. Polymer scaffolds benefit from established clinical history and biocompatibility but are challenged by radial strength. Metal scaffolds (magnesium, iron) offer superior initial mechanical support but require meticulous control over corrosion and metal ion release rates. The future success of market players will depend heavily on their ability to launch third-generation hybrid scaffolds that combine the biodegradability and drug delivery capabilities of polymers with the robust mechanical support offered by advanced metallic structures, achieving a balance that overcomes the limitations inherent in first and second-generation technologies.

- By Material Type:

- Polymer-based Stents (e.g., Poly-L-Lactic Acid (PLLA), Polycaprolactone (PCL))

- Metal-based Stents (e.g., Magnesium Alloys, Iron Alloys)

- Hybrid/Composite Stents (Next Generation)

- By Application:

- Coronary Artery Disease (CAD)

- Peripheral Artery Disease (PAD) (Emerging)

- By Product Form:

- Balloon-Expandable Stents (Dominant)

- Self-Expanding Stents (Limited/Developmental)

- By End User:

- Hospitals (High Volume Procedures)

- Ambulatory Surgical Centers (ASCs)

- Specialized Cardiac Catheterization Laboratories

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Absorbable Heart Stent Market

The value chain for the Absorbable Heart Stent Market is complex, starting with highly specialized upstream activities involving raw material synthesis and purification, particularly for medical-grade PLLA polymers or proprietary magnesium alloys. Given the sensitivity and high performance requirements of BVS materials, the upstream segment is characterized by a limited number of specialized suppliers adhering to stringent quality control standards, resulting in high raw material costs which directly impact the final product price. Key considerations at this stage include achieving the desired molecular weight distribution, controlling crystallinity, and ensuring the absence of impurities that could trigger adverse inflammatory responses upon degradation in the body, driving substantial R&D expenditure to secure high-quality, reproducible material batches.

Midstream activities involve sophisticated manufacturing processes, including extrusion or molding to create the stent scaffold, followed by laser cutting and surface finishing, which must be performed with extreme precision, often leveraging advanced micro-fabrication techniques due to the typically thin strut thickness required for BVS. This is immediately followed by the application of drug-eluting coatings, often using proprietary spray or dipping methods, and rigorous sterilization protocols. The downstream segment focuses on distribution and logistics, necessitating specialized cold chain management for certain polymer-based products and detailed procedural training for interventional cardiologists to ensure optimal implantation technique, which is a critical success factor for BVS. Direct sales channels are often favored, allowing manufacturers to maintain close contact with key opinion leaders and provide immediate technical support.

Distribution channels primarily rely on a mix of direct sales forces that target specialized cardiac cath labs and specialized medical device distributors who handle broader geographic coverage, especially in emerging markets. Direct channels allow for better margin control and effective dissemination of training and clinical updates, crucial for a high-tech device like an absorbable stent. Indirect channels through established distributors help penetrate regions where market access or regulatory hurdles are higher. Furthermore, the role of key opinion leaders (KOLs) and medical societies is paramount in the distribution chain, influencing adoption patterns through clinical guidelines and educational initiatives, thereby bridging the gap between manufacturer innovation and widespread clinical practice.

Absorbable Heart Stent Market Potential Customers

The primary potential customers and end-users of Absorbable Heart Stents are healthcare institutions specializing in cardiovascular care, most notably large academic hospitals and specialized cardiac centers with high procedural volumes for percutaneous coronary intervention (PCI). These institutions serve populations with high incidences of coronary artery disease and possess the requisite advanced catheterization laboratory infrastructure, specialized imaging equipment (IVUS/OCT), and skilled interventional cardiologists trained in the complex techniques required for optimal BVS deployment. Procurement decisions in this segment are highly influenced by clinical outcome data, device cost-effectiveness over the long term, and adherence to established clinical guidelines issued by major cardiology bodies.

A growing secondary segment includes high-volume private cardiology clinics and ambulatory surgical centers (ASCs), particularly in North America and Europe, which are increasingly offering complex cardiac interventions to meet patient demand for faster, specialized care. While ASCs may handle less complex cases, their purchasing decisions are often driven by patient preference for novel technologies and competitive positioning within their local healthcare ecosystem. These customers are highly sensitive to the perceived long-term benefits of "leaving nothing behind" and the potential reduction in future reintervention risk, making the clinical narrative of BVS highly appealing.

Geographically, potential customers in emerging markets, especially large governmental and private hospitals in China, India, and Brazil, represent significant untapped demand. As the middle class grows and healthcare infrastructure improves in these regions, there is a substantial shift towards adopting advanced Western medical technologies. Although cost remains a significant barrier, the vast patient population and the increasing adoption of aggressive treatment strategies for CAD position these large hospitals as crucial long-term customers, particularly as local manufacturing and cost-optimized BVS options become available, making the technology accessible to a wider demographic.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.0 Billion |

| Growth Rate | 13.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Boston Scientific Corporation, Biotronik SE & Co. KG, Terumo Corporation, Elixir Medical Corporation, SMT (Sahajanand Medical Technologies), MicroPort Scientific Corporation, B. Braun Melsungen AG, Amaranth Medical Inc., Kyoto Medical Planning Co., Ltd., Reva Medical, Inc., Medtronic PLC, Cook Medical, Xinsheng Medical Technology, Zhejiang Jisheng Medical Technology Co., Ltd., CeloNova BioSciences Inc., Relisys Medical Devices, Shandong Weigao Group Medical Polymer Co., Ltd., Lepu Medical Technology, OrbusNeich. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Absorbable Heart Stent Market Key Technology Landscape

The technological landscape of the Absorbable Heart Stent market is characterized by intense innovation focused on overcoming the inherent trade-offs between mechanical strength and degradation kinetics. The dominant technology revolves around utilizing bioresorbable polymers, primarily poly-L-lactic acid (PLLA), due to its proven biocompatibility and mechanical characteristics suitable for medical devices, although recent research is heavily exploring polymers with faster degradation profiles like polycaprolactone (PCL) and polyglycolic acid (PGA). Manufacturers are increasingly deploying advanced polymer processing techniques, such as biaxial orientation during manufacturing, to enhance the radial strength and reduce the strut thickness of PLLA scaffolds, aiming to mimic the performance profile of metallic stents while retaining the "resorbable" benefit, thus addressing one of the primary historical criticisms of first-generation BVS.

A parallel and rapidly evolving technological frontier involves the utilization of bioresorbable metallic alloys, predominantly based on magnesium and, increasingly, iron. Magnesium alloys offer superior radial strength immediately post-implantation and degrade much faster than polymers, often completing the process within 12 to 18 months, which aligns better with the typical time frame for complete vessel healing and minimizes the risk window associated with inflammation and thrombosis. Challenges remain in precisely controlling the corrosion rate to prevent premature loss of mechanical integrity and managing the physiological release of metal ions. Iron-based stents are also under investigation, offering extremely high initial strength but facing the hurdle of very slow degradation times, requiring innovative surface coatings or alloying strategies to accelerate the resorption process to a clinically relevant timeline.

Furthermore, drug elution technology within the BVS framework is highly critical, ensuring that the antiproliferative drugs (like everolimus or sirolimus) are released consistently during the initial phase of vessel healing, similar to metallic drug-eluting stents (DES). Novel coating technologies, including layered polymer coatings, drug-loaded matrices integrated into the stent material itself, and specialized reservoir designs, are being developed to optimize drug release kinetics. These technological advancements are often coupled with mandatory advanced imaging techniques, such as intravascular ultrasound (IVUS) and optical coherence tomography (OCT), which are integral components of the technology landscape, providing the high-resolution visualization required for accurate BVS sizing, deployment, and crucial assessment of acute and long-term scaffold performance in vivo.

Regional Highlights

- North America: This region holds a leading position in the market due to the high incidence of coronary artery disease, sophisticated healthcare infrastructure, and favorable reimbursement policies for advanced cardiac procedures. The U.S. remains the largest consumer, characterized by aggressive adoption of innovative cardiovascular devices and substantial investment in large-scale clinical trials that support the long-term safety profiles of new BVS products. Early and rapid adoption of second and third-generation BVS technologies is a key driver, alongside the significant presence of major global market players who drive R&D locally.

- Europe: Europe is a mature market driven by public awareness of temporary scaffolding benefits and strong clinical acceptance in countries like Germany, the UK, and France. Regulatory pathways, particularly CE Mark approval, often precede U.S. FDA clearance, allowing earlier market entry for innovative devices. However, regional market dynamics are characterized by strict cost-containment measures and centralized health technology assessments (HTAs) that place pressure on the pricing of premium devices like absorbable stents, influencing volume growth despite high quality of care.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is fueled by rising prevalence of cardiovascular risk factors linked to urbanization, increasing healthcare expenditure, and substantial government initiatives to improve access to advanced medical treatment in populous nations like China and India. The market is increasingly segmented, with Japan adopting high-cost, high-tech BVS rapidly, while China and India focus on developing domestic, cost-effective alternatives to address the massive patient volume.

- Latin America (LATAM): The LATAM market, while smaller, offers substantial potential, driven primarily by Brazil and Mexico. Growth is constrained by economic volatility and unequal access to advanced healthcare, but increasing private healthcare investment and the need to address a growing burden of heart disease are driving the demand for high-quality intervention devices, including BVS, particularly in major metropolitan centers and private hospital chains.

- Middle East and Africa (MEA): This region shows stable growth concentrated primarily in the GCC countries (Saudi Arabia, UAE), which benefit from high oil revenues, advanced medical tourism sectors, and government investment in modernizing healthcare facilities. Demand is focused on premium, clinically proven BVS devices, although market penetration remains low in the broader African continent due to infrastructure limitations and economic constraints, presenting a significant long-term opportunity as infrastructure develops.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Absorbable Heart Stent Market.- Abbott Laboratories

- Boston Scientific Corporation

- Biotronik SE & Co. KG

- Terumo Corporation

- Elixir Medical Corporation

- SMT (Sahajanand Medical Technologies)

- MicroPort Scientific Corporation

- B. Braun Melsungen AG

- Amaranth Medical Inc.

- Kyoto Medical Planning Co., Ltd.

- Reva Medical, Inc.

- Medtronic PLC

- Cook Medical

- Xinsheng Medical Technology

- Zhejiang Jisheng Medical Technology Co., Ltd.

- CeloNova BioSciences Inc.

- Relisys Medical Devices

- Shandong Weigao Group Medical Polymer Co., Ltd.

- Lepu Medical Technology

- OrbusNeich

Frequently Asked Questions

Analyze common user questions about the Absorbable Heart Stent market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of Absorbable Heart Stents compared to traditional metallic stents?

Absorbable heart stents, or Bioresorbable Vascular Scaffolds (BVS), offer the unique advantage of temporary scaffolding, supporting the vessel during healing before dissolving completely. This process restores the vessel’s natural flexibility and vasomotor function, eliminates the risk of late-stent thrombosis associated with permanent metal implants, and allows for future revascularization procedures without obstruction.

Which materials are most commonly used in the manufacture of Absorbable Heart Stents?

The most commonly used materials are bioresorbable polymers, primarily Poly-L-Lactic Acid (PLLA), known for its biocompatibility and established degradation pathway. Increasingly, advanced metallic alloys such as magnesium and, in developmental stages, iron are being utilized due to their superior initial radial strength and faster, more predictable resorption timelines.

What is the typical degradation time for an Absorbable Heart Stent?

The degradation time varies significantly depending on the material used. Polymer-based stents (PLLA) typically require 1 to 3 years for complete physical integrity loss and eventual absorption. Magnesium-based metallic stents generally resorb much faster, often within 12 to 18 months, aligning with the critical period needed for vessel healing.

What are the main factors currently restraining the widespread adoption of BVS technology?

Key restraints include the significantly higher upfront cost of BVS compared to mature drug-eluting metallic stents, the technical complexity and precision required for optimal implantation (operator dependence), and the historical clinical scrutiny regarding scaffold performance and early thrombosis rates observed with first-generation polymer devices.

How is Artificial Intelligence (AI) influencing the future development of Absorbable Heart Stents?

AI is transforming BVS development by simulating material performance and degradation kinetics, accelerating the discovery of novel polymers and alloys. Clinically, AI enhances diagnostic imaging (IVUS/OCT) for precise procedural guidance and aids in personalized patient selection, ensuring BVS deployment is optimized for the best long-term vessel outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager