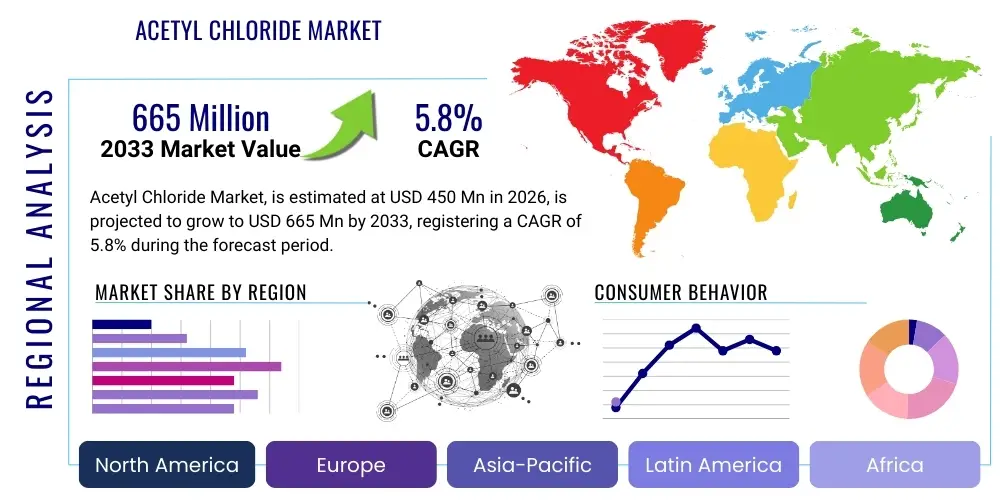

Acetyl Chloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436873 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Acetyl Chloride Market Size

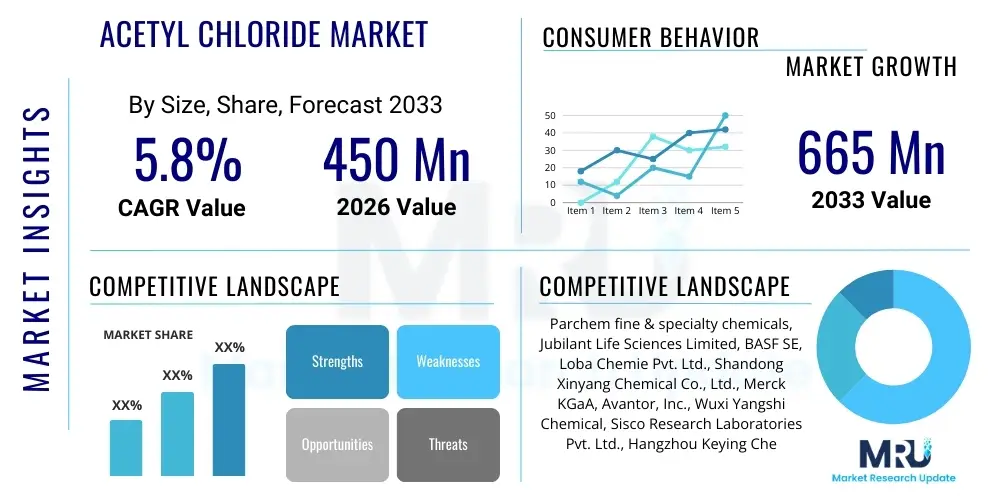

The Acetyl Chloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 665 Million by the end of the forecast period in 2033.

Acetyl Chloride Market introduction

Acetyl chloride (CH3COCl) is a foundational organic reagent, characterized by its high reactivity and strong acylating properties, making it indispensable across various chemical synthesis processes. It is produced primarily by reacting acetic acid or acetic anhydride with chlorinating agents such as phosphorus trichloride, thionyl chloride, or sulfuryl chloride. Its colorless, fuming liquid form and pungent odor necessitate careful handling, but its chemical efficiency in introducing the acetyl group (CH3CO) into alcohols, amines, and other organic molecules drives its pervasive use in highly regulated industries. The high demand stems from its purity requirements, especially when utilized as a critical intermediate in the production of complex pharmaceutical active ingredients (APIs) and high-performance agrochemicals.

Major applications of acetyl chloride span the synthesis of dyes, perfumes, herbicides, and pharmaceuticals, particularly in the manufacturing of aspirin (acetylsalicylic acid) and various vitamin intermediates. Its ability to create esters and amides swiftly and with high yield is a key benefit, streamlining industrial chemical production. Furthermore, acetyl chloride plays a crucial role in the Friedel–Crafts acylation reaction, forming ketones, which are central building blocks in the fine chemical industry. The inherent efficiency of the reaction and the high purity standards achievable with commercially available acetyl chloride grades underscore its value in modern synthetic chemistry.

The market growth is fundamentally driven by the escalating global pharmaceutical sector, which continuously requires acetyl chloride for the synthesis of new generic and patented drugs. The expanding agricultural industry, particularly in developing economies, also contributes significantly due to the increasing need for effective and targeted agrochemicals, including pesticides and herbicides, which often rely on acetyl chloride intermediates. Technological advancements focused on optimizing the manufacturing process, reducing impurity levels, and ensuring safer handling and transportation procedures further propel market expansion, positioning acetyl chloride as a stable yet dynamic segment within the broader industrial chemicals landscape.

Acetyl Chloride Market Executive Summary

The Acetyl Chloride Market is characterized by robust expansion driven primarily by the stringent demands of the pharmaceutical and agrochemical industries for high-purity reagents. Business trends indicate a strong focus on capacity expansion and vertical integration among leading manufacturers to secure raw material supply (acetic acid/anhydride) and maintain competitive pricing power. The market witnesses continuous investment in advanced purification technologies, aiming to meet the exacting specifications required for sensitive applications, particularly in Asia Pacific, which is rapidly emerging as the global manufacturing hub for generic drugs and fine chemicals. Furthermore, strategic partnerships between primary producers and specialized downstream contract manufacturing organizations (CMOs) are becoming increasingly common, streamlining the supply chain and accelerating product innovation cycles.

Regional trends highlight the significant dominance of the Asia Pacific (APAC) region, largely fueled by rapid industrialization, lower manufacturing costs, and burgeoning demand from China and India's expansive domestic pharmaceutical markets. North America and Europe, while growing at a slower pace, remain critical markets due to established regulatory frameworks demanding premium quality acetyl chloride and sustained demand from legacy chemical synthesis sectors. Environmental regulations, particularly those governing the by-products of acetyl chloride production, are influencing operational decisions in Western markets, prompting producers to invest in closed-loop systems and sustainable manufacturing techniques to ensure long-term viability and compliance.

Segmentation trends reveal that the pharmaceutical application segment holds the largest market share, driven by the indispensable nature of acetyl chloride in synthesizing critical APIs like analgesics, anti-inflammatories, and sedatives. The high-purity grade (above 99.5%) segment is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), reflecting the increasing sophistication and stringent quality control standards mandated by regulated end-users. Conversely, while smaller in volume, the segment catering to specialized chemical synthesis, including specialty polymers and advanced materials, provides significant opportunities for market participants focusing on niche high-margin products, suggesting a trend toward diversification away from purely bulk chemical supply.

AI Impact Analysis on Acetyl Chloride Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Acetyl Chloride market typically revolve around three core themes: enhancing process safety and efficiency, optimizing complex chemical synthesis pathways, and revolutionizing supply chain resilience. Users are keen to understand how machine learning models can predict and prevent hazardous exothermic reactions intrinsic to acetyl chloride production, thereby drastically improving worker safety and reducing operational downtime. They also frequently ask about AI's role in accelerating the discovery of novel agrochemical or pharmaceutical intermediates that utilize acetyl chloride as a precursor, potentially shrinking R&D timelines and lowering costs associated with experimental trials.

The integration of AI and machine learning platforms promises a transformative shift from traditional empirical methods to data-driven synthesis strategies within the acetyl chloride ecosystem. Predictive modeling is already being utilized to optimize catalyst performance, control purity levels with greater precision, and forecast equipment failure in continuous flow reactors, ensuring maximum yield and minimizing waste generation. This analytical capability translates directly into higher production efficiency and reduced energy consumption, addressing both economic pressures and growing environmental concerns from regulatory bodies and end-users alike.

Furthermore, AI-driven solutions are crucial for optimizing the complex global supply chain for acetyl chloride, which is often subject to volatile raw material prices and demanding storage conditions. Generative models can process vast amounts of real-time market data, meteorological patterns, and logistics constraints to recommend optimal inventory levels and distribution routes, effectively mitigating the risks associated with transporting highly reactive chemicals. This focus on enhanced risk management and operational predictability through AI implementation is expected to reinforce the stability and reliability of the acetyl chloride supply, fostering confidence among high-volume buyers in regulated industries.

- AI-driven predictive maintenance optimizes reactor uptime and reduces the risk of equipment failure in high-pressure synthesis environments.

- Machine learning algorithms enhance safety protocols by analyzing process parameters in real-time to prevent runaway or hazardous chemical reactions.

- Generative AI accelerates pharmaceutical R&D by simulating millions of potential acetyl chloride-mediated synthesis routes for novel drug candidates.

- AI optimizes supply chain logistics, inventory management, and route planning for the transportation of highly corrosive acetyl chloride, ensuring regulatory compliance.

- Data analytics platforms improve product quality control by correlating input variables (raw material purity, temperature, pressure) with final acetyl chloride grade output.

DRO & Impact Forces Of Acetyl Chloride Market

The Acetyl Chloride Market is fundamentally influenced by a complex interplay of drivers (D), restraints (R), and opportunities (O), which dictate its trajectory and profitability. The primary drivers are the expanding global pharmaceutical industry, particularly the demand for acetylsalicylic acid (aspirin) and related pain management drugs, and the consistent growth of the agricultural chemicals sector requiring robust intermediates for herbicides and insecticides. Simultaneously, rapid industrialization and the expansion of fine chemicals manufacturing in the Asia Pacific region provide strong market momentum. The inherent versatility and reactivity of acetyl chloride in organic synthesis ensure its continued dominance over potential alternative acylating agents in many industrial processes.

However, the market faces significant restraints primarily centered on the inherent hazards associated with handling, storage, and transportation of acetyl chloride. Being highly corrosive, reactive with water, and generating toxic hydrogen chloride gas upon hydrolysis, it mandates strict adherence to complex safety regulations, imposing substantial operational and capital costs on manufacturers and logistics providers. Furthermore, the volatility in raw material pricing, particularly acetic acid and chlorinating agents, exerts pressure on profit margins, while the emergence of stricter environmental protection laws regarding emissions and waste disposal, particularly in developed economies, complicates manufacturing scalability and compliance.

Despite these challenges, substantial opportunities exist, driven by innovation in downstream applications. The rise of specialty chemicals utilized in advanced polymers, electronic materials, and high-performance coatings presents new, high-margin avenues for acetyl chloride application. The development of advanced, safer synthesis technologies, such as continuous flow chemistry methods, offers an opportunity to overcome traditional safety and scalability constraints, potentially lowering the cost of production and enhancing market penetration. Furthermore, strategic opportunities arise from focusing on high-purity grades required for niche applications like personalized medicine and high-end electronics, where quality premiums justify higher production costs.

Segmentation Analysis

The Acetyl Chloride Market is structurally segmented based on crucial factors including purity grade, primary application, and geographical region, allowing for granular analysis of demand patterns and competitive landscapes. Segmentation by purity grade reflects the varying requirements of end-user industries, where pharmaceutical and electronic applications necessitate ultra-high purity (>99.5%), while bulk chemical synthesis can often utilize commercial grade (99% purity). Application segmentation highlights the dominance of pharmaceuticals and agrochemicals, though the fine chemicals synthesis segment offers substantial future growth due to the development of novel specialty products.

- By Purity Grade:

- Greater than 99%

- Greater than 99.5% (High Purity)

- By Application:

- Pharmaceuticals (e.g., Acetylsalicylic Acid, Vitamins, Sedatives)

- Agrochemicals (e.g., Herbicides, Insecticides)

- Dyes and Pigments

- Chemical Synthesis (Fine & Specialty Chemicals)

- Others (e.g., Polymers, Catalysts, Electronic Materials)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Acetyl Chloride Market

The value chain of the Acetyl Chloride market begins with the upstream sourcing of crucial raw materials, primarily acetic acid (or acetic anhydride) and various chlorinating agents such as phosphorus trichloride (PCl3), thionyl chloride (SOCl2), or sulfuryl chloride (SO2Cl2). Upstream analysis reveals that raw material costs constitute a significant portion of the total production expenditure, making suppliers of acetic acid and chlorination chemicals powerful entities in the chain. Integration with large-scale chemical producers that can guarantee a stable supply of these precursors is critical for mitigating price volatility and ensuring continuous manufacturing operations, particularly given the aggressive and demanding nature of the synthesis process itself.

The midstream stage involves the highly specialized manufacturing of acetyl chloride, requiring significant capital investment in corrosion-resistant equipment, advanced process control systems, and stringent safety infrastructure due to the hazardous nature of the compound. Key manufacturers focus heavily on optimizing reaction yields and implementing rigorous purification steps—such as distillation—to achieve the high purity grades demanded by pharmaceutical customers. Efficiency in this stage, driven by technological adoption and economies of scale, is the primary source of competitive advantage. Distribution channels are highly specialized; due to acetyl chloride’s corrosive and reactive nature, its transportation relies on specialized tankers, corrosion-resistant packaging, and adherence to complex international Dangerous Goods (DG) regulations.

The downstream segment encompasses the utilization of acetyl chloride by various end-user industries. Direct sales typically involve large bulk orders to major pharmaceutical and agrochemical manufacturers who operate dedicated synthesis facilities. Indirect distribution channels, often involving specialized chemical distributors and regional agents, service smaller fine chemical companies or R&D labs requiring smaller, specialized volumes. The strongest leverage in the downstream market is held by the pharmaceutical industry, which dictates high quality and regulatory compliance standards. Value addition in the downstream is concentrated on complex derivatization and synthesis of high-value products, where the quality and timely supply of acetyl chloride directly influence the success and cost-efficiency of the final product manufacturing cycle.

Acetyl Chloride Market Potential Customers

The primary potential customers for acetyl chloride are entrenched within the highly regulated chemical processing sectors, predominantly the pharmaceutical and agrochemical industries, which require high volumes of reactive intermediates for the synthesis of complex organic compounds. Pharmaceutical manufacturers represent the largest and most critical customer base, relying on acetyl chloride for acetylation reactions vital to produce a wide range of Active Pharmaceutical Ingredients (APIs), including pain relievers like aspirin, various sedatives, and intermediates for complex biological drugs. These customers demand the highest purity grades, meticulous quality assurance documentation, and a reliable supply chain, leading to long-term contractual relationships with certified acetyl chloride producers.

The agrochemical sector constitutes the second major customer segment, using acetyl chloride as a foundational building block in the synthesis of specialized pesticides, herbicides (such as 2,4-D and related derivatives), and insecticides. The continuous global pressure on enhancing crop yield and protection, particularly in rapidly agriculturalizing regions like APAC and Latin America, ensures sustained demand from this segment. Agrochemical manufacturers generally seek competitive pricing and consistent bulk supply, though quality standards remain high to ensure product efficacy and regulatory acceptance in food-related applications.

Beyond these two giants, potential customers include manufacturers of dyes, pigments, and specialty chemicals. Companies producing complex polymers, resins, and advanced materials for niche applications such as electronics or automotive coatings also frequently use acetyl chloride for various acetylation or chlorination processes. These fine chemical customers often require smaller, highly customized batches but are typically willing to pay a premium for exceptional purity and specialized technical support, representing lucrative, albeit smaller, market segments that producers target for diversification and stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 665 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Parchem fine & specialty chemicals, Jubilant Life Sciences Limited, BASF SE, Loba Chemie Pvt. Ltd., Shandong Xinyang Chemical Co., Ltd., Merck KGaA, Avantor, Inc., Wuxi Yangshi Chemical, Sisco Research Laboratories Pvt. Ltd., Hangzhou Keying Chemical Co., Ltd., China National Chemical Corporation (ChemChina), Tokyo Chemical Industry Co., Ltd. (TCI), Alfa Aesar (Thermo Fisher Scientific), Central Drug House (CDH), and Otto Chemie Pvt. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Acetyl Chloride Market Key Technology Landscape

The manufacturing technology for acetyl chloride is relatively mature, but ongoing innovation focuses heavily on enhancing process safety, maximizing yield, and achieving ultra-high purity grades efficiently. The predominant method involves reacting acetic acid or acetic anhydride with a chlorinating agent, commonly phosphorus trichloride (PCl3) or thionyl chloride (SOCl2). While batch processing has historically been standard, modern advancements are increasingly favoring continuous flow chemistry (CFC) techniques. CFC reactors offer precise control over reaction parameters, temperature, and stoichiometry, significantly improving safety by managing the heat generated from the highly exothermic reaction, minimizing the risk of thermal runaway, and allowing for faster throughput and smaller equipment footprint.

Another crucial technological development involves the continuous refinement of purification and separation processes. Achieving the stringent purity levels (e.g., >99.5%) required by the pharmaceutical industry necessitates highly sophisticated fractional distillation under controlled conditions to remove residual acetic acid, chlorinating agents, and metallic impurities. Companies are investing in advanced analytical technologies, such as gas chromatography coupled with mass spectrometry (GC-MS), to ensure real-time monitoring of product quality during distillation, minimizing batch variations and compliance issues. The focus is shifting towards integrated systems that automate these purification steps to reduce human exposure and enhance overall process reliability.

Furthermore, sustainability concerns are driving research into alternative, greener synthesis routes that minimize the generation of hazardous by-products, such as hydrogen chloride gas. While wet scrubbing systems are standard for HCl management, some research efforts explore catalytic methods or milder chlorination agents that improve atom economy and reduce corrosive effluent. The technological landscape is thus characterized by evolutionary rather than revolutionary change, concentrating efforts on safety automation, continuous production scalability, and environmental stewardship, all critical factors for securing supply contracts in regulated global markets.

Regional Highlights

- Asia Pacific (APAC): Dominance and Manufacturing Hub

The APAC region currently dominates the global Acetyl Chloride Market, driven by the massive expansion of the fine chemical and pharmaceutical industries in China and India. These countries benefit from lower operational costs, abundant availability of raw material precursors (acetic acid), and less stringent, though evolving, environmental regulations compared to Western counterparts. APAC is not only the largest consumer but also the primary global exporter of acetyl chloride, especially commercial grades used in bulk synthesis and agrochemical formulations. The rapid growth of the domestic healthcare sector and the increasing production of generic drugs further solidify APAC's position as the fastest-growing market.

The investment influx into chemical infrastructure and the government support for domestic manufacturing (such as "Make in India" initiatives) are crucial factors driving capacity expansion. However, increasing environmental scrutiny in China, leading to periodic plant closures and production shifts, introduces volatility. Southeast Asian countries, including Thailand and Vietnam, are also emerging as key manufacturing locations, attracting new investments due to diversified supply chain strategies.

- North America: High-Value, Specialized Demand

North America represents a mature yet robust market for acetyl chloride, characterized by high demand for specialized, ultra-high purity grades primarily used in the synthesis of innovative pharmaceuticals, advanced materials, and R&D activities. The United States maintains strict regulatory standards enforced by bodies like the FDA and EPA, which dictates high quality control throughout the manufacturing and distribution process. The market growth here is stable, driven by continuous innovation in proprietary drug development and the persistent need for effective agrochemicals, though bulk production capacity is often lower compared to APAC due to higher operational and environmental compliance costs.

- Europe: Focus on Compliance and Sustainability

The European market is defined by stringent safety and environmental regulations (e.g., REACH), making compliance a significant barrier to entry and a constant challenge for existing manufacturers. European demand is stable, concentrated on pharmaceuticals and specialty chemicals, with a strong emphasis on sustainable and ethical sourcing. Manufacturers in countries like Germany and Switzerland focus on producing high-value, niche acetyl chloride derivatives and intermediates, prioritizing technological investment in advanced, safer continuous production methods and robust waste management systems to meet rigorous EU standards. The market growth in Europe is moderate, centered on quality premiums rather than volume expansion.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets

LATAM and MEA currently hold smaller shares but present significant growth potential, driven primarily by expanding agricultural sectors requiring agrochemical inputs (LATAM) and planned petrochemical capacity expansions (MEA). Brazil and Mexico are key consumers in LATAM due to their vast agricultural lands. MEA’s growth is nascent, tied to diversification efforts away from oil economies and investment into localized specialty chemical manufacturing, though infrastructural and logistical challenges remain persistent hurdles for bulk acetyl chloride handling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Acetyl Chloride Market.- Parchem fine & specialty chemicals

- Jubilant Life Sciences Limited

- BASF SE

- Loba Chemie Pvt. Ltd.

- Shandong Xinyang Chemical Co., Ltd.

- Merck KGaA

- Avantor, Inc.

- Wuxi Yangshi Chemical

- Sisco Research Laboratories Pvt. Ltd.

- Hangzhou Keying Chemical Co., Ltd.

- China National Chemical Corporation (ChemChina)

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Alfa Aesar (Thermo Fisher Scientific)

- Central Drug House (CDH)

- Otto Chemie Pvt. Ltd.

- Shandong Jinyimeng Chemical Co., Ltd.

- Gansu Dalong Chemical Co., Ltd.

- Dow Chemical Company

- Spectrum Chemical Mfg. Corp.

- Santa Cruz Biotechnology, Inc.

Frequently Asked Questions

Analyze common user questions about the Acetyl Chloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the growth of the Acetyl Chloride Market?

The primary drivers are the escalating global demand from the pharmaceutical industry for intermediates like acetylsalicylic acid (aspirin) and specialized APIs, coupled with the rising consumption of agrochemicals (herbicides and pesticides) in emerging economies, particularly across the Asia Pacific region.

Which purity grade of Acetyl Chloride is expected to see the fastest market growth?

The high-purity grade (Greater than 99.5%) segment is projected to exhibit the fastest CAGR. This growth is driven by the stringent quality requirements of the pharmaceutical, electronics, and advanced specialty chemicals industries, which require extremely low impurity levels for safety and efficacy.

What are the major restraints affecting the production and distribution of Acetyl Chloride?

Major restraints include the inherent hazards associated with the compound, such as its high corrosivity and reactivity with moisture, which mandate costly specialized handling, storage infrastructure, and strict adherence to complex international Dangerous Goods (DG) transportation and safety regulations.

How is the Asia Pacific region dominating the Acetyl Chloride Market?

APAC dominates the market both in production and consumption volume. This is due to the presence of large-scale, cost-effective manufacturing centers in China and India, catering to their domestic and international pharmaceutical and fine chemical industries, establishing the region as the global manufacturing hub.

What technological advancements are influencing Acetyl Chloride manufacturing?

Technological advancements are centered on enhancing safety and efficiency. This includes the increased adoption of continuous flow chemistry (CFC) techniques to manage exothermic reactions, and advanced analytical methods like GC-MS for real-time quality control and achieving ultra-high purity levels efficiently.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Chloroacetyl Chloride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Acetyl Chloride Market Statistics 2025 Analysis By Application (Pharmaceutical Industry, Agriculture Industry, Dye Industry, Liquid Crystal Material), By Type (High Purity, Low Purity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager