Active Magnetic Bearing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434140 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Active Magnetic Bearing Market Size

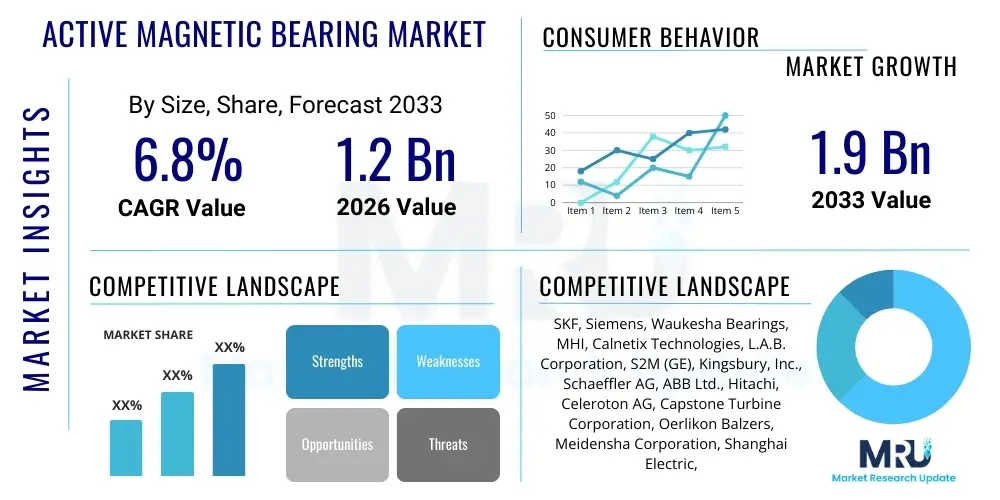

The Active Magnetic Bearing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.9 Billion by the end of the forecast period in 2033.

Active Magnetic Bearing Market introduction

Active Magnetic Bearings (AMBs) represent a critical innovation in rotating machinery, fundamentally redefining the standards for efficiency, speed, and reliability by utilizing magnetic levitation to suspend moving parts without any mechanical contact. This frictionless operation is the core differentiator, eliminating mechanical wear and tear, and thereby drastically reducing the need for maintenance, lubrication systems, and associated operational downtime compared to conventional rolling element or fluid film bearings. AMBs achieve contactless rotation through a complex system of electromagnets integrated into the stator, precise position sensors, and sophisticated digital control systems that continuously adjust the magnetic forces in real-time. This active control capability allows the rotor position to be dynamically managed, offering unparalleled precision in handling vibrational forces and ensuring stability even at extremely high rotational speeds, which is crucial for maximizing performance in high-power density applications. The implementation of AMBs directly contributes to the operational excellence and cost efficiency of mission-critical industrial assets, solidifying their position as a premium technology solution for advanced industrial environments globally. Their ability to operate effectively in vacuum environments or extreme temperature ranges further broadens their suitability across specialized scientific and industrial niches.

The product's application portfolio spans highly demanding sectors where performance stability and inherent system reliability are non-negotiable prerequisites. Major deployments of Active Magnetic Bearings are concentrated in natural gas compressors and expanders within the global oil and gas infrastructure, high-speed turbogenerators in power generation facilities, and specialized vacuum pumps essential for semiconductor manufacturing processes. The intrinsic benefits associated with AMBs, such as the complete removal of lubricating oil systems, not only simplifies machinery design but also ensures zero contamination risk, making them indispensable in contamination-sensitive industries like aerospace, advanced material processing, medical device manufacturing (e.g., hermetically sealed pumps), and specialized cryogenic applications. Furthermore, the inherent capability of AMB systems to integrate sophisticated, built-in condition monitoring and diagnostics, coupled with remote adjustment capabilities, aligns perfectly with the evolving demands of Industry 4.0 paradigms focused on maximizing asset utilization, enabling true predictive maintenance regimes, and optimizing overall system productivity and responsiveness across diverse operational demands.

A host of powerful driving factors are propelling the growth and accelerated market penetration of the Active Magnetic Bearing sector. Foremost among these is the pervasive global push toward energy efficiency, spurred by mounting regulatory pressure and corporate sustainability goals. AMBs inherently offer lower parasitic losses than conventional bearings, translating directly into reduced energy consumption for the host machinery, a crucial metric in the increasingly competitive energy and industrial sectors. Secondly, the rapidly expanding market for high-speed, high-power-density turbomachinery, necessitated by modern liquefied natural gas (LNG) processing and enhanced gas recovery techniques, mandates rotational speeds and reliability levels that only magnetic levitation technology can reliably accommodate. Concurrently, the continuous technological refinement in control electronics, specifically the deployment of high-speed digital signal processors (DSPs) and high-efficiency Silicon Carbide (SiC) power amplifiers, has resulted in AMB systems that are more compact, substantially more cost-effective to produce, and significantly easier to seamlessly integrate into both new equipment designs and existing industrial retrofit projects. This combination of superior technical performance, economic efficiency over the lifecycle, and simplified integration is rapidly overcoming initial adoption hurdles and driving sustained market expansion across key geographies and industrial verticals.

Active Magnetic Bearing Market Executive Summary

The Active Magnetic Bearing (AMB) market is currently undergoing a dynamic phase of strategic evolution, underpinned by transformative business trends focused on service digitalization and system integration. A primary business trend observed is the shift from providing standalone AMB components to offering holistic, integrated rotating machine solutions, often sold with long-term predictive maintenance and performance optimization contracts. This model relies heavily on advanced data analytics and cloud connectivity for continuous performance monitoring, positioning AMB manufacturers as critical service providers rather than just component suppliers. Furthermore, market competition is intensifying, driven by strategic maneuvering, including specialized technology acquisitions and joint ventures between established industrial giants and nimble, magnetic bearing technology specialists. This consolidation aims to capture integrated supply chain value, reduce manufacturing lead times, and leverage shared expertise in complex control software and sophisticated power electronics necessary for the next generation of high-load, high-speed bearing systems. Strategic focus is being placed on developing modular and scalable AMB solutions that can be rapidly deployed across various machinery sizes, standardizing interfaces, and reducing the bespoke engineering required for each installation, thus lowering costs and broadening market accessibility to medium-sized industrial equipment manufacturers globally.

Regionally, the market exhibits a clear bifurcation between mature adoption in developed economies and explosive growth potential in emerging industrial hubs. North America and Western Europe, characterized by mature, highly regulated industrial sectors, maintain their dominance through persistent demand in upgrading existing infrastructure, particularly in high-pressure gas compression stations and critical defense applications. Adoption in these regions is driven by lifecycle cost minimization and adherence to stringent safety and emissions standards. European countries, in particular, lead in integrating AMBs into specialized machine tools and renewable energy storage systems (flywheels). Conversely, the Asia Pacific (APAC) region, spearheaded by accelerated industrial capacity expansion in nations like China, India, and South Korea, is emerging as the undisputed locus of future growth. This is fueled by colossal investments in new petrochemical plants, LNG terminals, and domestic high-tech manufacturing ecosystems, all demanding advanced, reliable, high-speed rotating equipment. These burgeoning markets are often leapfrogging older technologies and adopting advanced AMBs directly, thus stimulating disproportionately rapid market penetration and revenue growth within the forecast period and demanding localized supply chain and service support.

Analysis of market segmentation reveals structural reliance on a few critical industrial sectors while simultaneously highlighting promising diversification opportunities. The Compressor application segment remains the largest revenue contributor globally, reflecting its indispensable role in the energy value chain, specifically pipeline transport and gas processing. Technologically, Heteropolar magnetic bearings, often valued for their high force density and compactness, continue to hold significant share, although Homopolar designs are gaining traction in ultra-high-speed scenarios due to reduced eddy current losses. The most pivotal trend in end-use industries is the burgeoning uptake within the Power Generation segment, particularly for decentralized power generation units, geothermal turbines, and the deployment of advanced kinetic energy storage systems (flywheels). This diversification away from the traditional, cyclical dependence on the Oil & Gas sector demonstrates the expanding relevance of AMB technology across the broader industrial and sustainable energy landscape, assuring resilience against sector-specific downturns and presenting substantial long-term growth runways for specialized market players focusing on energy transition solutions and high-precision applications like advanced manufacturing spindles and critical medical devices.

AI Impact Analysis on Active Magnetic Bearing Market

The convergence of Artificial Intelligence and Active Magnetic Bearing technology is poised to fundamentally redefine operational performance, moving beyond traditional automation into cognitive industrial systems. User discussions and industry inquiries frequently center on the transformative potential of AI in enabling true predictive maintenance. Specifically, stakeholders are keen to understand how advanced machine learning models can process heterogeneous data—including high-frequency vibration spectrums, thermal profiles, instantaneous control current measurements, and historical load data—to detect subtle, pre-failure signatures that are imperceptible to human operators or conventional threshold-based systems. This capability is expected to maximize asset availability by shifting maintenance scheduling from reactive or fixed-interval approaches to proactive, need-based interventions, potentially adding significant cumulative operational hours and reducing unexpected outages in critical applications like deep-sea compression. The integration of edge computing facilitates localized AI processing, enabling near-instantaneous anomaly detection before data is transmitted to the cloud, enhancing system response time and reliability in remote installations.

A second critical area of AI impact, attracting substantial user interest, involves optimizing the dynamic control loop of the AMB system itself. Conventional AMB controllers utilize static or fixed-gain control strategies, which are adequate but not optimal across the full spectrum of operating conditions (from light load/low speed to heavy load/high speed). AI-driven adaptive control systems, often leveraging reinforcement learning or sophisticated neural networks, are being researched and deployed to learn the non-linear dynamics of the specific rotor-bearing system in real-time. This allows the controller to autonomously adjust damping and stiffness parameters, ensuring absolute rotor stability, minimizing levitation power consumption, and significantly extending the stable operating envelope (e.g., surpassing previous speed limitations or handling greater levels of unbalance). The goal is to achieve self-tuning, high-performance bearing systems that can react instantaneously and optimally to environmental perturbations without human intervention or pre-programmed lookup tables, thereby ensuring superior efficiency and expanding the viable applications of AMB technology into highly dynamic industrial processes.

Furthermore, AI is rapidly changing the product development lifecycle and enhancing operational safety. Generative AI and advanced simulation tools are utilized in the design phase to rapidly simulate millions of operational scenarios and optimize the electromagnetic design, sensor placement, and control parameter settings, substantially reducing the time and cost associated with physical prototyping and empirical testing. This accelerates time-to-market for highly specialized AMB solutions tailored for unique client requirements. On the safety front, AI-enhanced diagnostic systems improve the efficacy of auxiliary bearing protection mechanisms by ensuring quicker, more accurate detection of sudden control failures, allowing for optimally controlled rundown sequences. This comprehensive integration of AI transforms the AMB from a high-tech component into an intelligent, self-monitoring, and self-optimizing industrial asset, thereby increasing its overall value proposition and justifying the premium pricing within the highly competitive industrial machinery market. This continuous feedback loop enabled by AI ensures that system performance continually improves throughout its operational lifespan.

- AI enhances predictive maintenance accuracy by analyzing multivariate sensor data streams, identifying subtle fault patterns beyond human capacity and traditional threshold systems.

- Machine learning optimizes real-time control algorithms for enhanced rotor stability, ensuring optimal performance across dynamic load and speed variations and extending the operational envelope.

- Deep learning aids in classifying complex operational anomalies, providing early warnings and preventing sudden catastrophic system failures, especially in high-speed turbomachinery.

- AI-driven digital twins simulate long-term performance variability and component degradation, accelerating custom design cycles and deployment strategies while minimizing reliance on expensive physical prototypes.

- Reinforcement learning enables self-optimizing AMB systems that adapt automatically to environmental and internal mechanical changes, ensuring peak efficiency and reducing human calibration effort.

- Automated data processing and fault diagnosis protocols reduce reliance on human expertise for troubleshooting and system calibration, lowering operational expenditure.

- Natural Language Processing (NLP) is used in developing sophisticated human-machine interfaces (HMIs) for remote diagnostics and reporting, streamlining operator interaction and improving maintenance workflows.

- AI contributes to energy savings by continuously minimizing power consumption required for stable magnetic levitation under different operational loads and environmental conditions.

DRO & Impact Forces Of Active Magnetic Bearing Market

The trajectory of the Active Magnetic Bearing market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, defining its growth potential and inherent risks. The primary market driver is the undeniable shift towards high-efficiency, high-speed industrial machinery across global sectors. Environmental regulations and the economic pressure to reduce carbon footprints necessitate equipment with minimal energy losses, a condition where the frictionless nature of AMBs provides a distinct and immediate advantage over mechanical counterparts, often translating to significant operational savings over decades. Furthermore, the inherent superior reliability of AMBs, offering operational lifecycles often measured in decades without major mechanical intervention, is highly attractive to industries where operational continuity is paramount, such as nuclear power, defense, and long-distance pipeline transmission, thus significantly driving procurement decisions toward these advanced solutions. This technological superiority is augmented by the capability of AMBs to seamlessly integrate advanced health monitoring systems, contributing to a substantial reduction in the total lifecycle cost, despite the elevated initial capital outlay, compelling major industrial players to view them as a strategic long-term investment.

Restraints impeding faster and broader adoption predominantly revolve around the financial and technical complexities inherent to the technology. The significantly higher upfront capital cost of an AMB system, including the sophisticated control unit, high-power electronics, and mandatory auxiliary bearings, remains the most formidable barrier compared to relatively inexpensive conventional bearing assemblies. This cost hurdle particularly affects small-to-medium enterprises (SMEs) or budget-constrained projects where long-term TCO savings cannot immediately overcome initial budget limitations. Additionally, the system complexity necessitates highly specialized expertise for design, installation, calibration, and routine diagnostics. The global shortage of engineers and technicians specifically trained in rotor dynamics, magnetic control systems, and associated power electronics poses a logistical constraint on deployment and maintenance, particularly in rapidly industrializing regions lacking established technical support infrastructure. Moreover, potential risks associated with control system failure and the necessity of robust backup systems (auxiliary bearings) introduce an additional layer of design complexity and cost that requires continuous management and certification, creating a restraint on rapid, broad-based adoption across non-critical applications.

Despite these challenges, vast opportunities are emerging, significantly bolstering the market’s long-term growth forecast. One of the most significant opportunities lies in the integration of AMBs into Flywheel Energy Storage Systems (FESS). AMBs enable flywheels to spin at ultra-high speeds in a vacuum with virtually zero friction, maximizing energy storage efficiency and making FESS a viable technology for grid stabilization and renewable energy integration, representing a massive potential market as global energy grids decentralize. Another high-growth sector is the burgeoning demand for ultra-clean, high-speed operation in semiconductor and flat-panel display manufacturing, where the lubrication-free nature of AMBs is essential for preventing atmospheric contamination in vacuum processes, capitalizing on the high-value nature of these industries. Moreover, continuous technological advancements focusing on reducing system footprint and cost, such as modular control architectures and the application of new magnetic materials, are making AMBs increasingly viable for mid-range industrial compressors and commercial HVAC turbo-chillers, segments previously dominated by conventional bearing technologies, thereby opening up substantial new market avenues and promising long-term revenue growth.

Segmentation Analysis

The comprehensive segmentation analysis of the Active Magnetic Bearing market is fundamental to understanding market penetration patterns and identifying highly specialized growth pockets. The classification across Type, Application, and End-Use Industry helps illuminate where technological complexity meets specific industrial needs. The differentiation based on bearing type—Homopolar versus Heteropolar—is critical, as each configuration offers distinct performance characteristics: Heteropolar bearings generally provide higher static load capacity and compactness, suitable for moderate speeds and high-force applications, whereas Homopolar designs are often favored for extreme high-speed applications where minimizing eddy current losses is paramount, leading to superior efficiency in high RPM turbomachinery. Furthermore, the segmentation into Radial and Axial bearings reflects the fundamental force requirements of the application, with most systems utilizing a combination of both to manage both lateral (radial) and thrust (axial) loads effectively. This granular view ensures that market strategies are aligned with specific technical constraints and performance demands across various machinery designs and speeds, enabling manufacturers to tailor their R&D investments effectively.

The segmentation by application clearly indicates the market’s heavy reliance on high-power rotating machinery. Compressors, pivotal components in the Oil & Gas, chemical processing, and industrial refrigeration sectors, consistently dominate the application segment due to the stringent requirements for reliability and efficiency over long operational periods in often remote and harsh environments. Following compressors, Turbines and Pumps represent significant market shares, reflecting their use in power generation (e.g., gas turbines, microturbines) and specialized fluid handling, often involving highly corrosive or high-temperature media. Crucially, the growth rate in non-traditional applications like Machine Tools (high-speed spindles) and Flywheels is significantly outpacing the mature segments. This shift reflects a widening recognition of AMBs’ unique ability to enhance precision (in machining, enabling nanometer-scale accuracy) and energy retention (in storage systems, minimizing energy bleed-off), signaling a healthy market diversification away from solely energy-intensive core industries and toward advanced manufacturing and sustainable energy solutions that demand extreme performance metrics and superior long-term stability.

The End-Use Industry segmentation highlights the cyclical yet critical role of the Oil & Gas sector as the primary revenue generator, driven by high capital expenditure on gas processing and transport infrastructure worldwide, particularly in new LNG projects. However, future growth is structurally supported by robust expansion in the Power Generation sector, especially concerning utility-scale turbine upgrades and decentralized power solutions, driven by global decarbonization efforts. The fastest-growing segments, Aerospace & Defense and Medical & Life Sciences, although currently smaller in volume, demand specialized, highly reliable, miniaturized AMB solutions that command premium pricing due to stringent certification requirements. The Aerospace sector utilizes AMBs for high-performance APUs and turbo-pumps where weight reduction and reliability are paramount under extreme g-loads, while the Medical sector, focusing on devices like ventricular assist devices, values the non-contact, lubrication-free nature for biocompatibility and reliability over long durations. Understanding these industry-specific regulatory compliance requirements and performance tolerances is essential for competitive positioning and sustained market success across the entire value spectrum of the Active Magnetic Bearing technology.

- Type: Homopolar, Heteropolar, Radial Bearing, Axial Bearing

- Application: Compressors, Turbines, Pumps, Machine Tools, Power Generation, Flywheels, Specialized Scientific Equipment, Turbo-expanders, Electric Vehicle Motors (Emerging)

- End-Use Industry: Oil & Gas (Midstream and Upstream), Power Generation (Utility and Distributed), Industrial Machinery (Compressors, Blowers, Pumps), Aerospace & Defense (APUs, Turbo-pumps), Medical & Life Sciences (VADs, High-speed Centrifuges), Semiconductor Manufacturing (Ultra-high Vacuum Pumps)

Value Chain Analysis For Active Magnetic Bearing Market

The Active Magnetic Bearing value chain commences with the highly specialized Upstream segment, dominated by the procurement and production of critical enabling technologies and advanced materials. Essential raw materials include custom-grade soft magnetic materials (like high-silicon electrical steel laminations) optimized for high-frequency magnetic fields, high-purity copper windings for the electromagnets, and advanced, robust structural materials for the bearing housings designed to manage high rotational stresses and thermal loads. However, the most value-intensive upstream components are the sophisticated electronics: high-speed digital signal processors (DSPs or FPGAs) for control computation, and state-of-the-art power semiconductors, specifically SiC and GaN modules, which are crucial for the efficient and high-frequency switching required by the power amplifiers. Strong intellectual property surrounding proprietary sensor design (e.g., eddy current proximity sensors) and control algorithm architecture ensures that specialized component suppliers exert significant influence over the total system cost and performance envelope, demanding rigorous quality control and tight supply chain collaboration, often leading to deep integration with core AMB manufacturers.

The Midstream phase involves the core manufacturing and integration processes, which require exceptionally high precision engineering and specialized assembly facilities. This segment includes the meticulous winding of the electromagnetic coils, high-precision machining and balancing of the rotor assembly (often utilizing specialized composite materials for weight reduction), and the integration of the complex control cabinet where the power electronics and control systems reside. Crucially, proprietary knowledge related to magnetic field modeling, advanced rotor dynamics simulation, and the development of customized, robust control software represents the highest value-add activity in this stage. Fabrication processes must adhere to extremely tight mechanical and electrical tolerances to ensure proper operation, especially when operating above critical speeds (supercritical operation). Rigorous testing protocols, including high-speed run-down tests, load capacity validation, and thermal cycling assessments, are mandatory before system deployment. This manufacturing segment is characterized by relatively high overhead costs, long development cycles, and substantial barriers to entry, reinforcing the dominance of a few highly specialized global players with decades of accumulated expertise in complex rotating machinery dynamics and active control systems.

The Downstream phase focuses on market access, installation, and long-term service provision, often representing the most stable and high-margin revenue streams for AMB suppliers. Given the technical complexity and mission-critical nature of AMB applications (e.g., in LNG compression), direct distribution to large Original Equipment Manufacturers (OEMs) and major industrial end-users (Oil & Gas, Power Utilities) is the prevailing model. This direct relationship ensures technical fidelity during complex installation and commissioning phases, requiring on-site engineering teams. Post-sales service is a pivotal differentiator; suppliers must offer comprehensive global support, remote diagnostic capabilities (often AI-enhanced), predictive maintenance contracts, and rapid response service. The ability to monitor bearing health remotely, provide immediate expert guidance, and stock specialized replacement parts globally forms a substantial competitive advantage. Indirect channels are selectively used through certified system integrators to reach regional markets or specialized applications (e.g., high-speed pumps), ensuring that all installation work is executed to the manufacturer’s stringent standards, thereby maintaining operational reliability and securing recurring revenue streams through service agreements throughout the system’s operational lifespan.

Active Magnetic Bearing Market Potential Customers

Potential customers for Active Magnetic Bearings are high-value industrial entities characterized by their dependence on continuous, high-speed, and reliable machinery operation where the cost of system failure far outweighs the investment in advanced technology. The quintessential buyer profile is a large, multinational OEM of turbomachinery (e.g., compressor manufacturers) or an industrial asset owner specializing in complex process industries. These customers are deeply motivated by factors beyond initial price, prioritizing superior reliability, drastically reduced maintenance overheads, and maximizing energy efficiency over the long operational lifecycle. Their procurement decisions are often influenced by detailed technical reviews, requiring extensive documented evidence of system performance, proven Mean Time Between Failures (MTBF) data, and proof of concept in similar challenging operating environments, such as high-temperature or high-pressure gas streams, ensuring operational continuity in critical infrastructure projects. Long-term warranty and service commitments are key non-price procurement criteria for this sophisticated customer base.

Key segments of the customer base are concentrated within the global energy infrastructure. Major buyers include international oil and gas supermajors, midstream pipeline operators, and LNG producers who purchase large-scale, high-pressure gas compressors integrated with AMBs for critical applications, including Liquefied Natural Gas (LNG) liquefaction and high-volume natural gas transmission lines. The reliability and efficiency gains offered by AMBs in these continuous duty applications provide compelling economic returns. Within the power sector, potential customers are utility-scale power plant operators, independent power producers (IPPs) focused on optimizing plant efficiency, and specialized manufacturers of microturbines and large-scale kinetic energy storage flywheels, all requiring the low-friction, high-speed capability inherent to AMB technology. These customers often procure AMB systems as part of a complete turbomachinery package, requiring close collaboration between the bearing manufacturer and the machinery OEM to ensure seamless integration and optimized rotor dynamics for the entire system during the design phase.

Furthermore, specialized high-technology sectors constitute a rapidly expanding and strategically important customer segment. Leading semiconductor manufacturers are primary buyers, utilizing AMBs in ultra-high vacuum pumps critical for clean-room fabrication processes (wafer etching, deposition), leveraging the lubrication-free design to eliminate hydrocarbon contamination risks entirely, a non-negotiable requirement for high-yield manufacturing. The Aerospace and Defense industry represents another high-value customer group, purchasing AMB components for aircraft auxiliary power units (APUs), specialized military turbomachinery, and advanced missile systems where low weight, high reliability, and guaranteed operation in extreme environmental conditions (e.g., high vacuum, extreme temperatures) are mandatory. These buyers often require custom-engineered solutions adhering to rigorous military or civil aviation certification standards, establishing a highly profitable niche market for manufacturers capable of meeting the highest safety and performance compliance thresholds, thereby broadening the market reach beyond conventional heavy industrial applications and securing long-term developmental contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SKF, Siemens, Waukesha Bearings, MHI, Calnetix Technologies, L.A.B. Corporation, S2M (GE), Kingsbury, Inc., Schaeffler AG, ABB Ltd., Hitachi, Celeroton AG, Capstone Turbine Corporation, Oerlikon Balzers, Meidensha Corporation, Shanghai Electric, Beijing Dadi Yunchuan Technology, Advanced Magnetic Bearing Technology, Kaman Corporation, New Way Air Bearings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Active Magnetic Bearing Market Key Technology Landscape

The Active Magnetic Bearing market's technological evolution is rapidly advancing, primarily driven by breakthroughs in digital control architecture and the power electronics that govern the bearing system. The current state-of-the-art involves highly sophisticated, multi-core Digital Signal Processors (DSPs) and high-density Field-Programmable Gate Arrays (FPGAs) capable of executing complex multi-variable control algorithms at loop closure rates often exceeding 20 kHz. These advanced controllers are essential for real-time calculation of magnetic forces required to maintain rotor stability, especially when operating above critical speeds or handling high levels of rotational unbalance. The migration towards robust control theory, including state-space modeling and adaptive filtering (often incorporating AI/ML elements), allows modern AMB systems to dynamically counteract disturbances, suppress vibration harmonics, and maintain tight positional accuracy, thereby significantly enhancing the overall performance and expanding the operational limits of high-performance turbomachinery across critical sectors while ensuring minimal power consumption during stable levitation.

A secondary, but equally transformative, technological shift is centered on the adoption of wide-bandgap (WBG) semiconductors, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN), within the power amplifiers. These materials fundamentally enable significantly higher switching frequencies (up to hundreds of kHz) and substantially lower conduction losses compared to traditional silicon-based insulated-gate bipolar transistors (IGBTs). The benefits are two-fold: improved system efficiency, leading to less heat generation and lower operating costs; and critical miniaturization. Higher switching rates allow for the use of much smaller inductors and capacitors in the filtering stages, resulting in dramatically smaller, lighter, and more compact control cabinets. This size and weight reduction is essential for integrating AMBs into space-constrained applications, such as microturbines, aerospace Auxiliary Power Units (APUs), and decentralized industrial pumps, effectively lowering the integration complexity and expanding the total addressable market for AMB suppliers globally by making them suitable for mobile and size-sensitive installations.

Furthermore, innovations in magnetics and material science are crucial for sustained performance improvements. Efforts are focused on developing high-saturation flux density electrical steels and thinner laminations to minimize core losses (eddy current and hysteresis losses), especially at ultra-high rotational frequencies characteristic of vacuum pumps and high-speed spindles. Simultaneously, sensor technology is evolving, with fiber-optic displacement sensors being integrated alongside traditional eddy current probes to provide enhanced measurement robustness in harsh electromagnetic environments and high-temperature operating conditions. Finally, the passive component reliability is addressed through continuous refinement of the auxiliary (touchdown) bearings, often utilizing advanced ceramics (e.g., silicon nitride) or specialized hybrid compositions. These components, critical for surviving system run-down following power failure, are being designed for higher impact load capacity, reduced frictional torque, and extended life under emergency contact, ensuring the long-term safety and mechanical integrity of the entire rotor system under all operational and failure conditions, a key selling point for reliability-conscious customers in the energy and defense sectors globally.

Regional Highlights

Regional market concentration highlights distinct adoption maturity and growth drivers across major global economies. North America retains its position as a technological and market leader, driven by mature infrastructure and high capital availability. The region’s deep reliance on the oil and gas sector, particularly the extensive network of gas transmission pipelines and major LNG export facilities, necessitates continuous investment in high-reliability, long-life compression equipment integrated with AMBs. Furthermore, substantial expenditure in the defense and aerospace industries, particularly in the U.S., demands specialized, high-performance AMB systems for propulsion and auxiliary power applications where component weight and reliability are non-negotiable. The strong presence of leading research institutions and key market innovators in the U.S. ensures that technological standards remain high, with strong demand for AI-integrated predictive maintenance solutions that maximize asset uptime and minimize operational risk across critical national infrastructure and industrial assets.

Europe represents a highly specialized and technically sophisticated market for Active Magnetic Bearings, defined by its pioneering role in advanced manufacturing (Industry 4.0) and rigorous environmental mandates. European demand is heavily influenced by the principles of precision, automation, and energy efficiency, particularly in machine tools (high-speed spindles achieving sub-micron accuracy) and advanced material processing equipment. Countries like Germany, Switzerland, and the UK are key users, driven by stringent EU directives that favor high-efficiency machinery, providing a structural advantage for AMB adoption in power generation and specialized industrial compressor applications where reducing carbon footprint is paramount. The strong presence of major global bearing and industrial companies within Europe also fosters a robust ecosystem for research, development, and strategic partnerships focused on adapting AMB technology for smaller, more modular industrial applications and accelerating the deployment of high-efficiency energy storage flywheels critical for grid modernization efforts across the continent.

The Asia Pacific (APAC) region is forecasted to be the engine of future market growth, distinguished by unparalleled rates of industrial expansion and rapid urbanization. China, South Korea, and Japan lead the charge, driven by massive investments across three fronts: energy infrastructure (new LNG terminals and pipeline construction), petrochemical expansion, and the explosive growth of the semiconductor manufacturing industry. The demand for ultra-clean, oil-free vacuum pumps, crucial for advanced wafer fabrication in South Korea and Taiwan, is a particularly powerful catalyst for AMB market penetration due to zero contamination requirements. Governments across APAC are actively promoting domestic development of high-tech industrial machinery, often specifying advanced components like magnetic bearings to achieve global competitive parity and reduce reliance on imported technology. This convergence of large-scale infrastructure spending and indigenous technological capability positions APAC as the dominant market for new installations and large-scale project deployments, characterized by fierce competition among global suppliers seeking to establish strong local manufacturing and service footprints to cater to rapidly escalating regional demand.

- North America: Dominant market share fueled by Oil & Gas infrastructure modernization, stringent environmental requirements for efficiency, and significant investment in aerospace and defense high-performance systems. Demand centers on lifecycle cost reduction and predictive health monitoring integration for critical assets.

- Europe: Strong adoption driven by Industry 4.0, stringent efficiency regulations (EU mandates), high investment in precision machine tools, and accelerating deployment of flywheel energy storage systems (FESS) for grid stability and sustainable energy management.

- Asia Pacific (APAC): Fastest growing region, powered by rapid industrialization, colossal investments in petrochemical and LNG infrastructure, and burgeoning demand from the high-growth semiconductor sector requiring ultra-clean, high-speed vacuum pump technology for high-yield fabrication.

- Middle East & Africa (MEA): Growth strongly correlated with expansion in oil and gas upstream and midstream compression capacity. Demand is acutely focused on system reliability and performance robustness in high-temperature, remote desert environments where maintenance access is difficult and costly.

- Latin America: Moderate but steady growth, focusing on modernizing aging industrial infrastructure in mining, petrochemicals, and power generation, seeking rugged, reliable, heavy-duty bearing solutions to reduce maintenance dependency in remote operational sites and improve energy efficiency across aging plant assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Active Magnetic Bearing Market.- SKF

- Siemens

- Waukesha Bearings

- MHI (Mitsubishi Heavy Industries)

- Calnetix Technologies

- L.A.B. Corporation

- S2M (Société de Mécanique Magnétique - GE Company)

- Kingsbury, Inc.

- Schaeffler AG

- ABB Ltd.

- Hitachi

- Celeroton AG

- Capstone Turbine Corporation

- Oerlikon Balzers

- Meidensha Corporation

- Shanghai Electric

- Beijing Dadi Yunchuan Technology

- Advanced Magnetic Bearing Technology

- Kaman Corporation

- New Way Air Bearings

Frequently Asked Questions

Analyze common user questions about the Active Magnetic Bearing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary operational advantages of Active Magnetic Bearings (AMBs) over traditional bearings?

AMBs offer critical advantages including frictionless operation, which eliminates mechanical wear, reduces energy consumption by removing parasitic losses, and negates the need for lubrication systems. they also provide active control over rotor dynamics, allowing for precise vibration suppression and stable operation across critical speeds, significantly enhancing machine reliability and extending service life in demanding industrial environments.

How does the high initial cost of an AMB system justify its implementation?

The justification for the high initial investment in AMBs lies in the drastically reduced Total Cost of Ownership (TCO) over the asset lifecycle. This reduction is achieved through minimal maintenance requirements, elimination of lubrication system expenses, improved energy efficiency (critical in large turbomachinery), and dramatically lowered downtime due to superior reliability and advanced predictive diagnostics capabilities integrated into the control system architecture.

Which industry vertical is currently the largest consumer of Active Magnetic Bearings?

The Oil & Gas industry remains the largest consumer of Active Magnetic Bearings globally. This dominance is driven by the necessity for highly reliable, long-life compressors and turbines used in gas pipeline transport, petrochemical processing, and LNG facilities, where the non-contact operation and high efficiency of AMBs are critical for continuous, safe operation in often hazardous or remote locations where maintenance access is difficult.

What role does Artificial Intelligence (AI) play in modern AMB systems?

AI is increasingly vital for enhancing AMB performance through predictive maintenance and advanced control optimization. AI algorithms analyze real-time sensor data to accurately predict system failures by identifying complex fault patterns, while machine learning is used to dynamically adjust control parameters for optimal rotor stability, leading to minimal power consumption and extended operational windows across all load conditions.

What key technological advancements are driving the miniaturization of AMB systems?

Miniaturization in AMBs is primarily driven by advancements in high-power-density electronics. Specifically, the adoption of Silicon Carbide (SiC) and Gallium Nitride (GaN) semiconductors in power amplifiers allows for much higher switching frequencies, resulting in significantly smaller, lighter, and more compact control cabinets, making AMBs feasible for smaller applications like high-speed microturbines and specialized aerospace components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Active Magnetic Bearing Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Active Magnetic Bearing Market Statistics 2025 Analysis By Application (Motors, Blowers, Compressors, Pumps, Generators, Turbines, Turboexpanders), By Type (Analog Control, Digital Control), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager