After Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432441 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

After Market Size

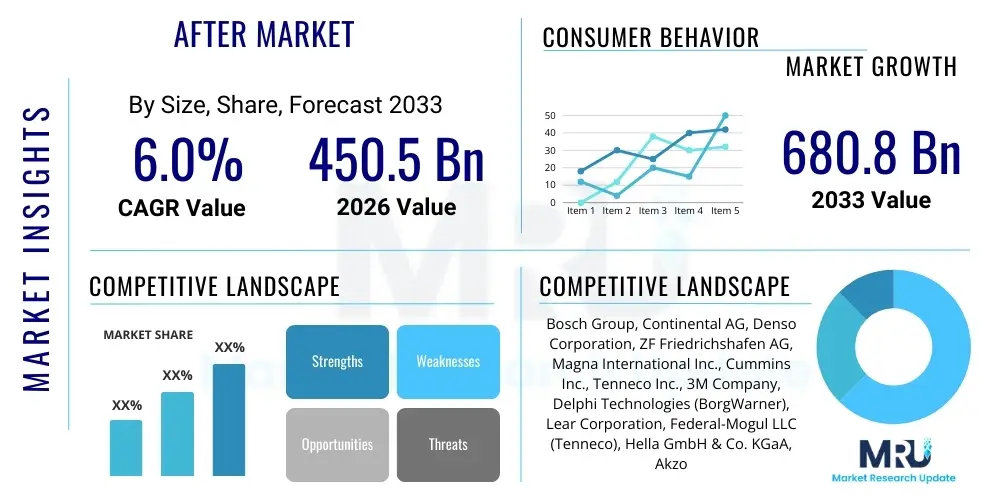

The After Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. This robust expansion is primarily fueled by the increasing lifespan of existing assets, coupled with the rising demand for sophisticated maintenance, repair, and overhaul (MRO) services across various industrial and consumer sectors. The continuous integration of digital diagnostic tools and predictive maintenance platforms is also playing a crucial role, allowing service providers to offer more efficient and less invasive repair solutions, thereby optimizing asset uptime and reducing long-term operational costs for end-users globally. The proliferation of connected devices and the transition towards subscription-based maintenance models further solidify this growth trajectory.

The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 680.8 Billion by the end of the forecast period in 2033. This significant valuation reflects the essential nature of aftermarket services, particularly in mature economies where infrastructure age demands consistent upkeep, and in rapidly industrializing regions where new equipment adoption necessitates strong localized service networks. Key drivers include stringent regulatory requirements for operational safety and environmental compliance, which mandate the use of certified components and specialized servicing techniques, thereby increasing the value proposition of authorized service centers and high-quality parts manufacturers. The shift from reactive repairs to proactive asset management forms the core of this financial expansion, ensuring sustained revenue streams for market participants.

After Market introduction

The After Market encompasses all activities, products, and services related to the repair, maintenance, customization, and enhancement of durable goods or capital assets after their initial sale by the original equipment manufacturer (OEM). This broad ecosystem includes replacement parts, consumable supplies, specialized tools, diagnostic software, and various service contracts such as warranties and extended service agreements. Products within the aftermarket range from standard replacement components (e.g., filters, batteries, brake systems) to high-technology modules requiring specialized calibration and installation, particularly in complex sectors like aerospace, automotive, and industrial machinery. The sustained performance and operational longevity of globally deployed assets are heavily reliant on the efficiency and availability of the After Market supply chain, which often operates independently of, or in close collaboration with, OEMs.

Major applications of the After Market span commercial and consumer segments, ensuring the continuity of vital transportation networks, manufacturing operations, energy production, and household utility systems. The primary benefits include maximizing asset utilization, enhancing safety through compliant repairs, improving operational efficiency, and providing cost-effective alternatives to outright replacement of equipment. This market serves as a crucial economic stabilizer, enabling businesses and consumers to extend the useful life of expensive investments. Driving factors behind its growth include the increasing average age of assets worldwide, the complexity introduced by digitalization (requiring software updates and diagnostics), favorable governmental regulations promoting sustainability and reuse, and the consumer preference for high-quality, long-lasting repair solutions that are often more accessible and competitively priced than original dealer services.

The convergence of advanced analytics, Internet of Things (IoT) sensors, and sophisticated logistics management has transformed the After Market from a reactive service industry into a proactive, predictive domain. This evolution mandates continuous innovation in parts manufacturing, inventory management, and technical training. Furthermore, the rising awareness regarding environmental impact is driving demand for remanufactured and recycled components, creating new revenue streams and supporting circular economy objectives. The ability of market players to rapidly adapt to technological advancements in primary assets, such as electric powertrains or smart manufacturing systems, is critical for maintaining competitive relevance and capitalizing on future growth opportunities within this essential sector.

After Market Executive Summary

The After Market is undergoing a rapid technological transformation characterized by strong digital integration and shifting consumer expectations. Business trends indicate a movement towards highly consolidated service networks, where major parts distributors and large independent service organizations are leveraging economies of scale and advanced inventory systems to capture market share. The proliferation of e-commerce platforms has fundamentally altered the distribution landscape, offering direct-to-consumer and business-to-business options that bypass traditional intermediaries, leading to enhanced price transparency but also increasing competitive pressure. Key strategic initiatives include investments in predictive maintenance technology and developing proprietary diagnostic tools to secure service contracts, moving the industry focus from simple component replacement to comprehensive lifecycle management and customized service delivery.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the highest growth rate, driven by massive increases in industrial output, infrastructure development, and vehicle ownership, particularly in emerging economies like India and Southeast Asia. North America and Europe, while mature, remain dominant in terms of market value, characterized by high adoption rates of advanced diagnostic technologies and stringent quality control standards favoring certified original equipment (OE) or equivalent parts. Regional divergence is apparent in distribution channels; while Europe favors established wholesaler networks, North America sees stronger growth in large retail chains and online platforms. The Middle East and Africa (MEA) present niche opportunities, particularly in energy and heavy equipment maintenance, requiring specialized, rugged components and localized supply chain solutions to navigate unique logistical challenges.

Segment trends reveal a pronounced shift toward the service and repair segment, overshadowing the traditional parts replacement market in terms of growth velocity. Within component types, electronics and advanced sensor systems are experiencing accelerated demand due to the increasing sophistication of modern equipment. Distribution is fragmenting, with online and direct service channels gaining prominence, though independent workshops (IWS) remain the backbone of installation and complex repair services globally. Furthermore, the emergence of dedicated software and subscription services for remote monitoring and firmware updates signifies a growing high-value segment. These trends collectively underscore an increasingly complex, digitally interconnected aftermarket ecosystem requiring nuanced strategic planning across all geographical and product segments to ensure competitive advantage and sustained profitability in the forthcoming decade.

AI Impact Analysis on After Market

Common user questions regarding AI's impact on the After Market revolve primarily around predictive capabilities, job displacement, and supply chain optimization. Users are highly interested in how AI-driven predictive maintenance (PdM) can reduce unexpected failures and minimize downtime, seeking quantified evidence of return on investment (ROI) from these systems. Concerns frequently surface regarding the need for specialized training to manage AI-generated insights and the security implications of utilizing vast amounts of operational data. Furthermore, stakeholders are keen to understand AI’s role in automating complex diagnostics, optimizing dynamic pricing strategies for parts and services, and revolutionizing inventory management by forecasting demand with unprecedented accuracy, ensuring the right part is available at the right time and location across extensive global service networks, ultimately enhancing service delivery efficiency and customer satisfaction.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data from equipment, forecasting component failure before it occurs, dramatically reducing unplanned downtime and lowering emergency repair costs.

- Automated Diagnostics: Implementing AI systems that quickly interpret fault codes, historical repair data, and operational parameters to recommend precise repair actions, improving first-time fix rates and technician efficiency.

- Optimized Inventory Management: Employing AI for highly accurate demand forecasting, inventory placement optimization, and dynamic stocking levels, minimizing obsolescence risk and enhancing spare parts availability.

- Intelligent Pricing Strategies: Using AI to analyze market conditions, competitive pricing, part availability, and historical sales data to set optimal, dynamic prices for services and replacement components, maximizing profit margins.

- Chatbots and Customer Support: Deploying AI-driven conversational interfaces to handle routine customer service inquiries, scheduling, and basic technical troubleshooting, freeing up human experts for complex issues.

- Service Route Optimization: Using AI to dynamically plan and adjust technician service routes, considering real-time traffic, job complexity, and parts availability, leading to faster service delivery and reduced fuel consumption.

- Quality Control and Counterfeit Detection: Implementing AI image recognition and data analysis to verify the authenticity and quality of aftermarket parts, mitigating risks associated with using substandard or counterfeit components in sensitive equipment repairs.

- Personalized Service Recommendations: Leveraging AI to analyze individual asset usage patterns and maintenance history to offer tailored service packages and component upgrade recommendations to end-users, fostering customer loyalty.

DRO & Impact Forces Of After Market

The After Market is fundamentally driven by the expanding global installed base of durable assets and increasing operational complexity, which necessitates expert maintenance and high-quality replacement parts, ensuring sustained demand regardless of new equipment sales fluctuations. Key drivers include the aging fleet of transportation and industrial machinery, regulatory mandates favoring maintenance over replacement for environmental reasons, and the rapid advancements in digital tools enabling predictive services. Conversely, the market faces restraints such as significant supply chain volatility, which impacts part availability and cost, the growing threat of sophisticated counterfeit products, and the persistent challenge of skilled labor shortages, particularly technicians proficient in complex modern diagnostics and repair procedures. Opportunities abound in the expansion of remanufacturing processes, leveraging the circular economy trend, developing customized service agreements integrated with OEM data platforms, and expanding presence in high-growth emerging economies where service infrastructure is rapidly developing, offering significant long-term growth potential and revenue diversification for established market players and innovative startups.

Segmentation Analysis

The After Market is comprehensively segmented across component type, distribution channel, end-user sector, and service category, reflecting the diverse and specialized nature of maintenance and repair needs globally. Analyzing these segments provides critical insights into market dynamics, identifying areas of rapid growth, technological disruption, and competitive intensity, allowing stakeholders to strategically allocate resources and tailor their product offerings. The granularity of segmentation helps differentiate between the high-volume, low-margin segments (like consumables) and the high-value, high-margin areas (like specialized diagnostics and software services), which are becoming increasingly crucial with the adoption of smart assets. The interdependencies between these segments, particularly the shift towards integrated service offerings that bundle parts, labor, and digital tools, are key to understanding future market evolution.

- By Component Type:

- Consumables (Filters, Fluids, Lubricants)

- Wear and Tear Parts (Brakes, Batteries, Tires)

- Engine & Drivetrain Components

- Electrical & Electronic Components (Sensors, ECUs, Wiring Harnesses)

- Body & Chassis Components

- By Distribution Channel:

- Original Equipment Manufacturers (OEM) & Authorized Dealers

- Independent Aftermarket (IAM) Distributors/Wholesalers

- Retail Chains & E-commerce Platforms

- Independent Workshops & Service Garages

- By End-User:

- Commercial Fleet Operators

- Individual Vehicle Owners/Consumers

- Industrial & Manufacturing Sector

- Aerospace & Defense

- Energy & Utilities

- By Service Category:

- Repair & Maintenance Services

- Remanufacturing & Refurbishing

- Software Upgrades & Diagnostic Services

- Warranty & Service Contracts

Value Chain Analysis For After Market

The After Market value chain begins upstream with raw material suppliers and component manufacturers, including both OEMs and independent parts producers (IPP). Upstream analysis is critical, focusing on the sourcing of high-quality materials (metals, polymers, electronics) and establishing robust manufacturing capabilities, often governed by stringent quality certifications (e.g., ISO, TS standards) to ensure performance equivalent to original equipment. This stage is marked by fierce competition between OEMs, who control proprietary specifications, and IPPs, who leverage cost efficiencies and reverse engineering capabilities to offer viable alternatives. Key challenges upstream include managing intellectual property rights and securing reliable, cost-effective supply lines against global logistical bottlenecks. Success in the upstream segment relies heavily on precise forecasting and strategic inventory building to mitigate delays and maintain price stability across the fluctuating market demand cycles.

The midstream involves intricate logistics, warehousing, and distribution, serving as the bridge between component production and the point of service. This network includes large master distributors, regional wholesalers, and specialized parts providers, which manage vast catalogs, often exceeding hundreds of thousands of SKUs. Distribution channels are diversifying rapidly, moving from traditional multi-tier distribution to omni-channel models that integrate physical retail footprints with highly efficient e-commerce platforms. Direct and indirect channels both play vital roles; OEM dealers represent the direct channel, offering guaranteed quality and factory-certified labor, while the Independent Aftermarket (IAM) operates indirectly through various intermediaries, prioritizing speed, competitive pricing, and broad accessibility. The efficiency of this midstream logistics network, utilizing advanced warehouse management systems and regional stocking points, is paramount to reducing repair turnaround times and boosting overall customer satisfaction across all service sectors.

Downstream activities center on service delivery and end-user engagement, primarily involving independent workshops, specialized repair facilities, fleet maintenance centers, and Do-It-Yourself (DIY) consumers. This stage is highly labor-intensive and relies on skilled technicians and specialized diagnostic equipment. Customer loyalty is built through service quality, speed of repair, and transparent pricing. The increasing complexity of modern assets requires constant investment in technical training and digital diagnostic subscriptions, placing pressure on smaller independent service providers. The ultimate success of the downstream segment is measured by asset uptime and total cost of ownership (TCO) reduction for the end-user, often secured through long-term service contracts that embed the parts provider and service operator deep into the customer’s operational planning and maintenance scheduling ecosystem.

After Market Potential Customers

Potential customers for the After Market are diverse, spanning high-volume commercial entities and individual consumers who require reliable operation and long lifespan from their assets. Commercial End-Users represent the highest value segment, including large fleet operators (logistics, transportation, public transit), industrial manufacturers utilizing heavy machinery and production lines, construction companies, and utility providers (energy generation, telecommunications infrastructure). These buyers prioritize minimization of downtime, compliance with safety regulations, and long-term cost efficiencies, often opting for comprehensive fleet maintenance contracts and OE-equivalent certified parts to maintain optimal operational continuity. Their procurement decisions are driven by sophisticated TCO models and often involve formalized bidding processes for high-volume parts and labor contracts.

The consumer segment, primarily composed of individual asset owners (e.g., private vehicle owners, appliance owners), constitutes a high-frequency, fragmented market driven by convenience, proximity, and competitive pricing. These customers utilize independent repair shops, quick-lube facilities, and increasingly, direct-to-consumer e-commerce channels for DIY repairs and routine maintenance. While price sensitivity is generally higher in the consumer segment, there is a growing willingness to pay a premium for specialized or high-tech components that promise enhanced performance or longevity, particularly as assets become increasingly sophisticated and repairs move beyond basic mechanical skills. Targeted marketing and digital engagement are essential for capturing and retaining this highly variable customer base.

Furthermore, specialized institutional buyers, such as governmental agencies, military branches, and large infrastructure operators, constitute a crucial potential customer base, particularly for high-specification, ruggedized, and proprietary components. These buyers are typically bound by strict procurement rules, demanding parts traceability, adherence to military or federal standards, and long-term supply agreements. Addressing the needs of this varied customer landscape requires manufacturers and service providers to maintain a flexible inventory strategy, offer a wide range of product quality tiers (from economy to premium OE-certified), and invest heavily in distribution infrastructure capable of meeting both immediate retail demands and large-scale contractual obligations across diverse geographical and logistical environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 680.8 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch Group, Continental AG, Denso Corporation, ZF Friedrichshafen AG, Magna International Inc., Cummins Inc., Tenneco Inc., 3M Company, Delphi Technologies (BorgWarner), Lear Corporation, Federal-Mogul LLC (Tenneco), Hella GmbH & Co. KGaA, Akzo Nobel N.V., LKQ Corporation, Genuine Parts Company, Dorman Products, Inc., Aisin Seiki Co., Ltd., Valeo SA, Mahle GmbH, Schaeffler AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

After Market Key Technology Landscape

The technological landscape of the After Market is rapidly evolving, driven by the need for increased efficiency, precision, and connectivity in service delivery. One dominant trend is the pervasive adoption of advanced diagnostic tools based on cloud computing and IoT connectivity. These tools enable remote monitoring of asset performance, allowing service providers to identify and troubleshoot issues without physical interaction in many cases. The integration of augmented reality (AR) and virtual reality (VR) is transforming technician training and complex repair procedures, providing overlaid digital instructions and remote expert guidance directly onto the equipment being serviced, significantly reducing error rates and the time required for specialized repairs, which is crucial given the complexity of modern mechatronic systems across all industrial sectors.

Another crucial area is the development of advanced materials and manufacturing processes for replacement parts. This includes the increasing use of 3D printing (Additive Manufacturing) for on-demand production of specialized, low-volume, or obsolete parts, reducing inventory costs and supply chain lead times, particularly in niche industrial or classic equipment segments. Furthermore, advancements in sensor technology and data analytics platforms are enabling highly effective predictive maintenance solutions. These systems utilize sophisticated AI models to process massive datasets generated by connected assets, optimizing maintenance schedules and ensuring components are replaced only when scientifically necessary, shifting expenditure from reactive fixes to planned, preventative interventions, thereby maximizing asset lifespan and operational efficiency for high-value machinery.

The digital backbone of the After Market is being strengthened by robust Enterprise Resource Planning (ERP) and specialized parts management software. These systems integrate inventory, logistics, service scheduling, and customer relationship management (CRM) functions, providing a holistic view of the service operation. E-commerce platforms are no longer just transaction portals; they are sophisticated marketplaces featuring advanced search algorithms, VIN/part compatibility checkers, and streamlined returns processing, catering to both professional buyers and DIY customers. The technology push is centered on creating a seamless, interconnected service ecosystem where data flows instantly from the asset to the service provider and back, fundamentally reshaping the competitive landscape and raising the operational bar for all participants in the global maintenance and repair economy.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth Velocity: APAC represents the fastest-growing region, driven by explosive industrialization, infrastructure projects, and the largest concentration of newly manufactured assets, particularly in China and India. This growth is amplified by a massive, aging two-wheeler and commercial vehicle fleet requiring constant maintenance, alongside strong OEM investment in localized parts distribution and manufacturing facilities to cater to the immense scale of demand and evolving regulatory standards within the region.

- North America (NA) Technological Maturity and E-commerce Penetration: North America holds a substantial share of the market value, characterized by early and high adoption of advanced diagnostic tools, telematics, and predictive maintenance solutions, especially within commercial fleets. The distribution system is mature, with major retail chains and e-commerce platforms commanding significant power, placing emphasis on rapid logistics (often next-day delivery) and streamlined customer experience for both professional mechanics and DIY consumers across the diverse geographical landscape.

- Europe (EU) Regulatory Focus and Remanufacturing Excellence: European markets are defined by stringent environmental and safety regulations, fostering high demand for OE-quality and certified parts, significantly boosting the remanufacturing segment as a means of promoting sustainability and controlling costs. The distribution network remains highly structured, often relying on established wholesaler-led independent aftermarket channels and emphasizing technical precision and training to service complex, high-end automotive and industrial equipment common throughout the Eurozone.

- Latin America (LATAM) Economic Sensitivity and Infrastructure Gaps: LATAM exhibits growth potential tempered by economic volatility and logistical challenges. The market relies heavily on affordable, general-purpose components, and the lifespan of assets is often prolonged due to cost constraints, leading to high demand for repair services. The informal repair sector is prominent, and market success requires navigating complex customs and import duties while establishing reliable local distribution partnerships to ensure consistent parts availability.

- Middle East and Africa (MEA) Specialized Requirements and Infrastructure Investment: MEA features a dual market structure: high-end demand for specialized components for oil, gas, and aerospace industries (Middle East), and basic, robust parts for older transport fleets (Africa). Significant government investment in infrastructure and urbanization is fueling demand for heavy machinery maintenance, requiring market players to offer highly specialized service capabilities adapted to extreme operating conditions and logistical complexities unique to the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the After Market.- Bosch Group

- Continental AG

- Denso Corporation

- ZF Friedrichshafen AG

- Magna International Inc.

- Cummins Inc.

- Tenneco Inc.

- 3M Company

- Delphi Technologies (BorgWarner)

- Lear Corporation

- Federal-Mogul LLC (Tenneco)

- Hella GmbH & Co. KGaA

- Akzo Nobel N.V.

- LKQ Corporation

- Genuine Parts Company

- Dorman Products, Inc.

- Aisin Seiki Co., Ltd.

- Valeo SA

- Mahle GmbH

- Schaeffler AG

Frequently Asked Questions

Analyze common user questions about the After market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the global After Market?

The primary driver is the significant and sustained increase in the average age and operational lifespan of the global installed base of durable assets, combined with increasing technological complexity that mandates specialized, high-value repair and maintenance services rather than full equipment replacement.

How is digital transformation impacting traditional aftermarket distribution channels?

Digital transformation is accelerating the shift from traditional wholesaler models to omni-channel distribution, characterized by robust e-commerce platforms offering direct purchasing, enhanced inventory visibility, and sophisticated predictive analytics for demand forecasting and highly efficient supply chain management.

What role does remanufacturing play in the modern After Market economy?

Remanufacturing is a critical high-growth segment supporting the circular economy by restoring used components to original specifications, reducing raw material usage, meeting sustainability regulations, and offering cost-effective, high-quality alternatives to new parts, especially within mature European and North American markets.

Which geographical region is expected to demonstrate the highest CAGR for aftermarket services?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rapid industrial growth, massive fleet expansion, significant infrastructure development, and increasing consumer spending power across key emerging economies like India and Southeast Asia.

What are the main restraints affecting the long-term profitability and stability of the After Market?

Key restraints include the global shortage of skilled technical labor capable of servicing complex modern equipment, persistent volatility and logistical disruptions within the global parts supply chain, and the increasing market presence and subsequent competitive pressure from counterfeit or substandard component manufacturers.

The sustained complexity introduced by rapid technological integration, such as advanced driver-assistance systems (ADAS) in vehicles or complex robotics in industrial settings, continues to mandate specialized service knowledge, thereby raising the barrier to entry for smaller independent workshops and consolidating service expertise within certified or OEM-aligned networks. This concentration of knowledge also drives the development of proprietary diagnostic tools and subscription services, making continuous technological investment a non-negotiable requirement for competitive market participation across all major geographical areas.

Furthermore, regulatory shifts are increasingly influencing the After Market. Governments worldwide are enacting ‘Right to Repair’ legislation aimed at granting independent service providers and consumers greater access to diagnostic data, repair tools, and proprietary software interfaces previously exclusive to OEMs. While this creates market opportunities for independent entities and reduces repair costs for consumers, it simultaneously forces OEMs to redefine their parts pricing strategies and digital service offerings, necessitating complex legal and technological compliance adjustments throughout the entire supply chain. Managing the delicate balance between protecting intellectual property and ensuring consumer accessibility remains a core strategic challenge for all major market players navigating this evolving regulatory environment.

In terms of distribution channel optimization, the integration of physical and digital inventory management systems is paramount. Major distributors are investing heavily in advanced robotics and automation within their warehousing operations to minimize picking errors and enhance order fulfillment speed, a crucial competitive differentiator in time-sensitive repair scenarios. The adoption of localized micro-fulfillment centers, particularly in dense urban areas, ensures that high-demand parts can be delivered to service locations within hours, supporting the imperative of maximizing asset uptime for commercial clients. This logistical efficiency is directly linked to customer satisfaction and the securing of long-term service contracts, thus solidifying its importance as an ongoing investment priority for market leaders aiming for sustained growth.

The segmentation by end-user remains pivotal, as the needs of a large commercial fleet operator differ fundamentally from those of an individual vehicle owner. Commercial customers demand detailed service history tracking, predictable maintenance budgeting, and guarantees on part lifespan, often requiring dedicated account management and specialized logistical support tailored to minimizing disruption to their core business operations. Conversely, the individual consumer market requires ease of access, transparent communication regarding repair status, and flexible payment options. Market success increasingly relies on customized digital engagement strategies that accurately target these distinct behavioral and procurement requirements, leveraging data analytics to personalize service offerings and marketing efforts effectively across diverse customer groups.

The impact of electric vehicle (EV) technology and alternative powertrains, while still nascent in the broader aftermarket, represents a significant long-term structural shift. EVs require fewer traditional consumable parts (e.g., filters, oil) but introduce high-voltage battery maintenance, complex thermal management systems, and specialized electronic control units. This necessitates a fundamental retraining of the existing technician workforce and the establishment of new, specialized service centers equipped with safety protocols and proprietary diagnostic equipment specific to high-voltage systems. Market participants who proactively invest in EV parts supply chains and technician certification are strategically positioning themselves to dominate the next generation of aftermarket revenue streams, mitigating risks associated with the decline of traditional internal combustion engine (ICE) repair segments over the coming decades.

Within the component segment, the growth of connectivity components—such as advanced sensors, telematics hardware, and firmware update modules—is outpacing traditional mechanical parts growth. These components are essential for enabling AI-driven predictive maintenance and remote diagnostics, ensuring the seamless flow of operational data from the asset to the cloud-based management systems. This convergence of hardware and software components means that parts manufacturers must increasingly adopt capabilities in electronics, embedded systems, and software development, moving beyond purely mechanical engineering expertise. The value derived from these electronic components is often tied to the associated software license or data subscription, creating high-margin annuity revenue streams for key technology providers within the aftermarket ecosystem.

The financial health of the After Market is also deeply influenced by macroeconomic factors, including global commodity prices, inflation rates, and currency fluctuations, which directly affect the cost of raw materials and imported components. Companies relying on global sourcing must employ sophisticated hedging strategies and maintain diversified supply bases to mitigate cost volatility and ensure predictable pricing for their end-users. Furthermore, mergers and acquisitions (M&A) activities are consolidating market power, particularly as large parts distributors and service chains acquire smaller regional players to expand their geographical footprint and service capabilities, seeking synergies in logistics, procurement, and talent acquisition to enhance their overall competitive position against large multinational rivals.

The imperative for sustainability is generating new segment opportunities centered on lifecycle management. Beyond remanufacturing, the repair and reuse of complex, high-value components are becoming standardized practices, often supported by regulatory incentives and corporate sustainability goals. This shift demands investment in specialized cleaning, testing, and certification equipment to ensure the repaired components meet the requisite quality standards. Service providers that can offer comprehensive, verified sustainable repair options are gaining favor among large commercial and institutional clients who are committed to reducing their carbon footprint and maximizing resource efficiency throughout their entire operational life cycles.

Looking at the competitive landscape, technology licensing and strategic partnerships between independent parts manufacturers and diagnostic software developers are key to accessing proprietary data streams. OEMs historically leverage their control over diagnostic tools to maintain market share, but independent players are overcoming this barrier through collaborations that pool resources for reverse engineering and developing compliant, multi-brand diagnostic solutions. This collaborative approach enhances the technical capabilities of the independent aftermarket, offering workshops and customers robust, versatile tools that cover a wider range of equipment models than often provided by a single OEM, thereby expanding the competitive options available in the service sector.

The influence of customer experience (CX) platforms and digital self-service tools cannot be overstated in the downstream segment. Modern end-users, both commercial and individual, expect real-time updates on repair status, transparent service quotes, and convenient digital scheduling options. Investing in user-friendly mobile applications and online service portals that integrate seamlessly with ERP systems is essential for reducing administrative overhead and enhancing customer trust. A superior digital customer experience is increasingly acting as a powerful non-price differentiator, driving repeat business and positive brand reputation in a crowded and highly competitive service landscape, ensuring that operational excellence is matched by digital accessibility.

Finally, the security aspect of connected assets is becoming a critical concern in the After Market. As diagnostic and maintenance processes become remotely connected, the risk of cyberattacks targeting operational data or vehicle/machine control systems increases. Service providers must implement robust cybersecurity protocols, secure data transmission channels, and ensure that remote access tools comply with the highest industry standards. Protecting customer data and ensuring the integrity of firmware updates and diagnostic procedures are non-negotiable requirements that will increasingly influence vendor selection and regulatory compliance mandates in the forecast period.

The complexity of securing reliable, high-quality labor is driving innovation in training methods. Traditional apprenticeship models are being augmented by simulation-based training, virtual reality environments, and modular online certification programs tailored to the rapid pace of technological change. Companies are partnering with vocational schools and technical universities to pipeline talent, focusing on mechatronics, data analytics, and software diagnostics expertise rather than purely mechanical skills. Addressing this talent gap through advanced pedagogical techniques is paramount to ensuring the After Market has the necessary human capital to support the sophisticated demands of the modern connected asset ecosystem globally.

In summary, the After Market is a dynamic intersection of traditional manufacturing, complex logistics, and advanced digital services. Its growth hinges on adaptability to EV technology, successful implementation of AI for predictive services, efficient navigation of global supply chain challenges, and continuous investment in human capital and regulatory compliance. The market structure, while historically fragmented, is rapidly consolidating, emphasizing the strategic importance of scale, technological depth, and comprehensive service offerings for stakeholders seeking leadership in this essential, high-value global industry, ensuring asset longevity and operational efficiency for consumers and businesses alike.

The integration of predictive analytics is transforming how capital expenditure is viewed by major fleet operators and industrial clients. Instead of budgeting for unscheduled major repairs, companies are shifting towards predictable operational expenditure on proactive maintenance subscriptions. This move is facilitated by aftermarket service providers who guarantee uptime SLAs (Service Level Agreements) backed by real-time data feeds and AI monitoring. The financial models underpinning these service contracts are highly complex, factoring in component lifespan probability, operational intensity, and regional availability risk, demonstrating a maturation of the aftermarket offering from simple parts sales to sophisticated risk management partnerships that embed the service provider deep within the customer’s long-term business strategy and asset management planning.

Furthermore, government and institutional procurement in the After Market is increasingly prioritizing vendors who demonstrate environmental, social, and governance (ESG) compliance. This includes mandates for transparent sourcing, responsible waste disposal protocols related to fluids and components, and adherence to labor standards. For global market players, achieving high ESG ratings is becoming a competitive necessity, particularly when bidding for large-scale public transportation or utility maintenance contracts. This pressure necessitates deep supply chain audits and investment in green technologies, such as advanced fluid recycling processes and low-emission logistical fleets, pushing the entire aftermarket toward greater operational sustainability.

The role of specialized software in diagnostics cannot be overstated. Modern assets contain multiple complex electronic control units (ECUs) and interconnected systems. Proprietary software is often required not just to read fault codes, but to recalibrate sensors, update firmware, and authorize component replacements, particularly for safety-critical systems. Independent aftermarket players are heavily invested in developing sophisticated ‘multi-tool’ diagnostic solutions that can communicate across various OEM protocols, providing technicians with the necessary digital keys to perform complex repairs without relying solely on expensive, single-brand OEM tools, thus lowering the cost of repair and increasing the versatility of independent workshops worldwide.

Finally, emerging market entry strategies often involve localizing manufacturing and distribution to overcome trade barriers and logistical hurdles. For regions like Latin America and certain parts of Africa, importing heavy components can be prohibitively expensive or slow. Successful market penetration therefore requires joint ventures with local partners, investment in local assembly or light manufacturing operations, and the establishment of robust regional service hubs staffed by locally trained personnel. This localization ensures component availability, fosters local economic development, and provides the necessary service responsiveness that is crucial for building trust and securing long-term contracts in fast-growing, yet infrastructure-constrained, operating environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- HVAC After Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Lawn and Garden Equipment After Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Manufacturing After Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- E-commerce Automotive After Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

- Automotive After Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager