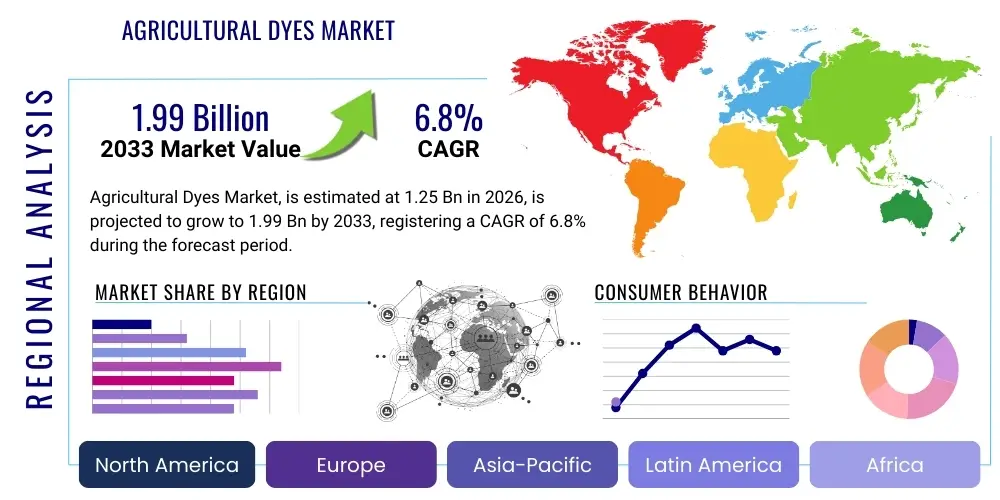

Agricultural Dyes Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440291 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Agricultural Dyes Market Size

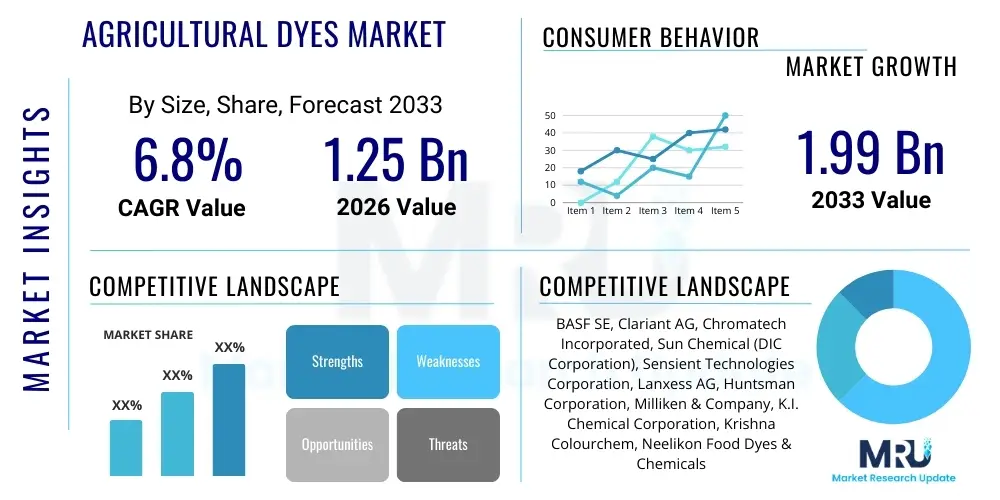

The Agricultural Dyes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 1.99 billion by the end of the forecast period in 2033.

Agricultural Dyes Market introduction

The agricultural dyes market encompasses a specialized segment within the broader chemical industry, dedicated to developing and supplying colorants specifically formulated for various agricultural applications. These dyes are critical for enhancing the visibility, safety, and efficacy of numerous agricultural products, ranging from seed coatings and fertilizers to crop protection agents and irrigation water tracers. The primary product description highlights their function in visual identification, aiding farmers and agricultural professionals in precise application, differentiation of treated areas, and adherence to regulatory standards. Major applications span seed treatment, where dyes mark treated seeds for safety and easy identification, thereby preventing accidental consumption and indicating proper application; fertilizer coloration, making granular or liquid fertilizers more distinct and preventing misuse; and pesticide/herbicide formulations, where dyes serve as drift indicators, ensuring even spray coverage and minimizing environmental impact by making spray patterns visible. Furthermore, they are employed in animal health products, pond and lake management for aquatic weed control, and as markers in agricultural research. The myriad benefits derived from the adoption of agricultural dyes include improved operational efficiency through enhanced visibility during application, reduced wastage of expensive agricultural inputs, increased safety for both human handlers and livestock by clearly distinguishing treated products, and better compliance with stringent agricultural regulations. The market's growth is fundamentally driven by the escalating global demand for food, which necessitates optimized agricultural practices; the continuous innovation in seed technology and crop protection chemicals; and the increasing awareness among farmers regarding the advantages of precision agriculture. Moreover, strict regulatory frameworks mandating the clear identification of certain agricultural chemicals contribute significantly to the sustained demand for these specialized colorants.

Agricultural Dyes Market Executive Summary

The agricultural dyes market is experiencing robust expansion, fueled by advancements in agricultural practices and a heightened focus on product safety and efficiency across the global food production landscape. Business trends reveal a pronounced shift towards sustainable and eco-friendly dye formulations, with market participants investing heavily in research and development to produce biodegradable and low-toxicity options that align with evolving environmental regulations and consumer preferences. Consolidation through mergers and acquisitions is also a noticeable trend, as larger chemical corporations seek to integrate specialized dye manufacturers to expand their product portfolios and geographical reach. Regional trends indicate that Asia Pacific, particularly countries like China and India, represents a pivotal growth hub due to extensive agricultural land, increasing adoption of modern farming techniques, and government initiatives promoting agricultural productivity. North America and Europe continue to be significant markets, driven by stringent regulatory environments mandating product differentiation and a strong emphasis on precision agriculture, even though their growth rates may be more mature. Latin America is emerging as a high-potential market, propelled by expanding agribusiness sectors and the increasing mechanization of farming. Segment trends demonstrate a strong demand for dyes used in seed treatment applications, as treated seeds offer enhanced protection and yield, making their identification crucial. The liquid dye segment is witnessing significant traction due to ease of application and homogeneous dispersion, especially in large-scale farming operations, while powder dyes retain their importance for cost-effectiveness and stability. Furthermore, the market is observing an increased preference for high-visibility and long-lasting dyes that can withstand various environmental conditions, reflecting the end-users' need for durable and reliable marking solutions. Overall, the market's trajectory is characterized by innovation, strategic regional focus, and an unwavering commitment to safety and operational excellence in agriculture.

AI Impact Analysis on Agricultural Dyes Market

User questions regarding AI's impact on the agricultural dyes market often center on how artificial intelligence can optimize the application and formulation of these colorants, enhance precision farming techniques, and contribute to the development of smarter, more responsive agricultural inputs. Key themes revolve around the potential for AI-driven systems to predict optimal dye concentrations based on environmental conditions and crop types, leading to more efficient resource utilization. Concerns also emerge about the integration challenges of AI with existing agricultural machinery and the need for standardized data protocols. Users frequently express expectations that AI will enable real-time monitoring of dye efficacy, facilitate the development of novel smart dyes that change color based on plant health or pathogen detection, and improve supply chain logistics for agricultural dye distribution, ultimately making farming more sustainable and data-driven.

- AI-powered precision sprayers could use computer vision to identify specific crop areas requiring treatment, optimizing dye usage in crop protection products.

- Predictive analytics driven by AI could forecast the optimal dye formulation and concentration based on weather patterns, soil conditions, and crop growth stages.

- AI-enabled drones equipped with multispectral cameras could monitor the efficacy of dyed fertilizers or seed treatments post-application, identifying inconsistencies or areas needing re-application.

- Machine learning algorithms could accelerate the research and development of novel smart dyes, identifying chemical structures that offer specific visual cues or responses to environmental stimuli.

- AI could enhance quality control in dye manufacturing by analyzing production data in real-time, ensuring consistent color strength and stability.

- Supply chain optimization through AI can improve inventory management and distribution of agricultural dyes, reducing lead times and waste.

- Autonomous agricultural vehicles could be programmed with AI to apply dyed inputs with unprecedented accuracy, minimizing drift and maximizing coverage.

- AI-driven sensors could detect the presence of dyed seeds or residues in environmental samples, aiding in regulatory compliance and environmental impact assessments.

DRO & Impact Forces Of Agricultural Dyes Market

The agricultural dyes market is influenced by a complex interplay of drivers, restraints, opportunities, and internal and external impact forces that collectively shape its growth trajectory and competitive landscape. One of the primary drivers is the increasing global demand for food, which propels the need for enhanced agricultural productivity and efficiency. This, in turn, necessitates the widespread adoption of advanced farming techniques, including precision agriculture, high-quality seed treatments, and effective crop protection, all of which benefit significantly from the use of specialized dyes for identification, safety, and efficacy. The stringent regulatory environment in many developed and developing nations also acts as a significant driver, as regulatory bodies increasingly mandate the clear coloration of seeds treated with pesticides, fertilizers, and other agricultural chemicals to prevent accidental ingestion and ensure traceability. Furthermore, the rising awareness among farmers and agricultural enterprises about the benefits of visual aids in optimizing resource utilization, minimizing waste, and improving operational safety contributes substantially to market expansion. The continuous innovation in agricultural chemical formulations, requiring compatible and stable dye systems, also provides a consistent demand impetus. However, the market faces several notable restraints that could temper its growth. Environmental concerns surrounding the potential ecological impact of synthetic dyes, even at low concentrations, drive a cautious approach to their usage and push for more eco-friendly alternatives. The fluctuating prices of raw materials, which are often petrochemical-derived, can significantly impact manufacturing costs and profitability for dye producers. Additionally, the limited awareness and slower adoption of advanced agricultural practices, particularly in less developed regions, can hinder market penetration. Strict regulatory hurdles in new markets, requiring extensive testing and approval for novel dye formulations, also pose a challenge. Opportunities within the agricultural dyes market are abundant, particularly in the realm of sustainable and biodegradable dye development. The growing consumer preference for organic and sustainably produced food creates a niche for natural and bio-based colorants derived from plant extracts or microbial fermentation, offering manufacturers a pathway to differentiate their products and tap into premium markets. The expansion of precision agriculture technologies, such as drone-based spraying and sensor-driven application systems, presents opportunities for the integration of smart dyes that can interact with these technologies for advanced monitoring and control. Furthermore, emerging economies with large agricultural sectors and increasing investments in modern farming present untapped growth potential for market players. The development of multi-functional dyes that not only provide color but also possess additional properties, such as UV protection, pathogen indication, or nutrient release tracking, represents a significant innovation avenue. The impact forces affecting this market are multifaceted. Technological advancements in chemical synthesis and formulation science continuously influence the development of more stable, vibrant, and environmentally benign dyes. Economic shifts, including global commodity prices and agricultural subsidies, directly affect farmers' purchasing power and their investment in agricultural inputs like dyes. Sociodemographic factors, such as population growth and dietary changes, dictate the overall demand for agricultural produce and, consequently, the demand for efficiency-enhancing products. Environmental pressures, including climate change and water scarcity, necessitate more efficient and sustainable agricultural practices, reinforcing the value proposition of dyes in optimized input application. Finally, political and regulatory landscapes, with their evolving standards for chemical safety and environmental protection, dictate permissible dye types and application guidelines, thereby profoundly shaping market dynamics and product development strategies.

Segmentation Analysis

The agricultural dyes market is comprehensively segmented to address the diverse needs of the agricultural sector, offering tailored solutions based on various characteristics. This segmentation allows for a granular understanding of market dynamics, enabling manufacturers to focus on specific product development and marketing strategies. The primary segmentation criteria typically include type, application, form, and end-user, each providing unique insights into consumer preferences and industry demands. Analyzing these segments helps stakeholders identify high-growth areas, understand competitive landscapes, and formulate strategies that resonate with the distinct requirements of different agricultural practices and geographical regions. The evolving nature of agriculture, driven by technological advancements and environmental considerations, continually influences the redefinition and emergence of new sub-segments within this market, highlighting its dynamic character.

- By Type:

- Synthetic Dyes (e.g., Azo Dyes, Phthalocyanine Dyes, Anthraquinone Dyes)

- Natural Dyes (e.g., Carmine, Annatto, Turmeric, Chlorophyll, Spirulina Extract)

- Fluorescent Dyes

- Pigments (though technically not dyes, often used for similar coloring purposes in agriculture)

- By Application:

- Seed Treatment

- Fertilizer Coloration

- Crop Protection (Pesticides, Herbicides, Fungicides)

- Adjuvants and Tank Mixes

- Irrigation Water Tracers

- Animal Health Products

- Aquaculture and Pond Management

- Agricultural Research and Development

- By Form:

- Liquid Dyes

- Powder Dyes

- Granular Dyes

- Paste Dyes

- By End-User:

- Seed Companies

- Fertilizer Manufacturers

- Pesticide & Herbicide Manufacturers

- Agricultural Cooperatives

- Farmers (Direct Application)

- Research Institutions

- Aquaculture Farms

Value Chain Analysis For Agricultural Dyes Market

The value chain for the agricultural dyes market is intricate, encompassing several sequential stages from raw material sourcing to final product consumption, each adding value and involving distinct sets of stakeholders. Upstream analysis reveals that the initial phase involves the procurement of diverse raw materials, which typically include basic chemical intermediates, petrochemical derivatives for synthetic dyes, and natural extracts or microbial cultures for bio-based colorants. Key suppliers in this segment are chemical manufacturers specializing in precursors, solvent producers, and natural resource extractors. The quality and availability of these raw materials directly impact the cost and characteristics of the final dye product. The manufacturing segment transforms these raw materials into finished agricultural dyes through complex chemical synthesis, purification, and formulation processes. This stage demands significant capital investment in infrastructure, specialized equipment, and skilled technical personnel to ensure the production of dyes that meet stringent performance and safety standards. Downstream analysis focuses on the distribution and end-use of agricultural dyes. Once manufactured, dyes are typically distributed through a multi-channel network. Direct distribution involves manufacturers selling directly to large agricultural chemical companies, seed treatment providers, or major fertilizer producers who incorporate the dyes into their end products. Indirect distribution leverages a network of wholesalers, distributors, and specialized agricultural chemical retailers who then supply the dyes to smaller agricultural enterprises, cooperatives, and individual farmers. This multi-tiered approach ensures broad market reach. The final stage involves the end-users, primarily seed companies, fertilizer and pesticide manufacturers, and increasingly, individual large-scale farms and agricultural research institutions, who apply these dyes in their respective processes to enhance product visibility, ensure safety, and improve operational efficiency. Each stage of this value chain is critical, and collaboration across these segments is essential for innovation, cost-efficiency, and market responsiveness.

Agricultural Dyes Market Potential Customers

The potential customers for agricultural dyes are diverse and span across various sub-sectors of the agricultural industry, all seeking to enhance the visibility, safety, and efficacy of their products and operations. The primary end-users or buyers of agricultural dyes include large multinational seed companies that utilize these colorants extensively to mark treated seeds, differentiating them from untreated seeds and ensuring clear identification of chemical treatments for safety and regulatory compliance. Similarly, major fertilizer manufacturers are significant customers, incorporating dyes into granular or liquid fertilizers to provide visual cues for even application, product differentiation, and to prevent accidental ingestion. Crop protection chemical producers, encompassing manufacturers of pesticides, herbicides, and fungicides, consistently integrate dyes into their formulations; these dyes serve as spray pattern indicators, helping farmers achieve uniform coverage, minimize drift, and easily identify treated areas, thereby optimizing chemical usage and reducing environmental impact. Agricultural cooperatives and large-scale farming operations that conduct in-house seed treatment or chemical mixing also represent a growing customer base, as they require bulk quantities of dyes for their localized applications. Furthermore, companies involved in aquaculture and pond management utilize specific dyes to trace water flow, indicate the presence of treatments for algae or aquatic weeds, or simply to enhance aesthetic appeal. Research institutions and universities engaged in agricultural science frequently employ dyes as tracers in experiments, for cell staining, or to mark various biological samples. Even certain animal health product manufacturers use dyes for visual differentiation of medicated feeds or topical treatments. The common thread among all these potential customers is the need for reliable, safe, and effective visual markers that contribute to improved operational efficiency, adherence to safety protocols, and compliance with increasingly stringent agricultural regulations, underscoring the indispensable role of agricultural dyes in modern farming ecosystems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 billion |

| Market Forecast in 2033 | USD 1.99 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, Chromatech Incorporated, Sun Chemical (DIC Corporation), Sensient Technologies Corporation, Lanxess AG, Huntsman Corporation, Milliken & Company, K.I. Chemical Corporation, Krishna Colourchem, Neelikon Food Dyes & Chemicals Ltd., Organic Dyes and Pigments (ORCO), R.S.P. Dyes & Chemicals Pvt. Ltd., Synose Dyes & Chemicals, Kolorjet Chemical Pvt. Ltd., Spectra Colors Corp., DyStar Group, Archroma, Atul Ltd., Kemira Oyj |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Agricultural Dyes Market Key Technology Landscape

The agricultural dyes market is continually shaped by advancements in various technological domains, which not only enhance the performance characteristics of these colorants but also drive their sustainable development and efficient application. A prominent technological area involves the innovation in chemical synthesis and formulation techniques, focusing on developing dyes with improved stability against UV radiation, pH variations, and microbial degradation, ensuring their efficacy and visibility throughout the agricultural cycle. This includes the creation of encapsulated dye formulations that provide controlled release, minimizing environmental leaching and extending the longevity of the visual marker. Another critical technology is the development of biodegradable and eco-friendly dye alternatives. This trend is fueled by increasing environmental regulations and consumer demand for sustainable agricultural inputs. Researchers are exploring natural pigments derived from plant extracts, algae, and microbial fermentation, as well as designing synthetic dyes with specific chemical structures that allow for faster and safer environmental degradation, reducing their ecological footprint. Furthermore, advancements in nano-encapsulation technologies are enabling the production of dyes with superior color strength, reduced particle size for better dispersion, and enhanced compatibility with various agrochemical formulations, leading to more uniform and effective application. The integration of "smart dye" technologies represents an emerging frontier, where dyes are engineered to exhibit dynamic properties. These intelligent colorants could potentially change color in response to specific environmental stimuli, such as changes in soil pH, nutrient deficiencies in plants, or the presence of pathogens, offering real-time diagnostic capabilities. Application technologies also play a crucial role, with innovations in precision spraying equipment, including drone-based systems and robotic applicators, demanding dyes that are highly soluble, non-clogging, and capable of forming uniform, visible patterns under various field conditions. Spectroscopic and colorimetric analysis techniques are also integral, providing manufacturers with robust quality control methods to ensure color consistency and purity, which are vital for meeting regulatory standards and end-user expectations. These intertwined technological developments collectively contribute to a more efficient, sustainable, and intelligent future for agricultural practices, with dyes serving as indispensable tools.

Regional Highlights

- North America: A mature market characterized by advanced agricultural practices, high adoption of precision farming, and strict regulatory frameworks for chemical safety. Key growth is driven by demand for high-performance dyes in seed treatment and crop protection.

- Europe: Driven by stringent environmental regulations, pushing for the development and adoption of eco-friendly and biodegradable dyes. Emphasis on sustainable agriculture and organic farming practices influences product innovation.

- Asia Pacific (APAC): The largest and fastest-growing market, propelled by vast agricultural lands, increasing population, rising food demand, and the modernization of farming techniques in countries like China, India, and Southeast Asia. Significant investments in agribusiness fuel demand.

- Latin America: An emerging market with substantial growth potential due to expanding arable land, increasing mechanization of agriculture, and growing investments in key crops like soybeans, corn, and sugarcane. Brazil and Argentina are prominent contributors.

- Middle East and Africa (MEA): A developing market with increasing focus on improving food security and modernizing agricultural practices. Demand is gradually increasing, particularly in regions investing in large-scale farming and water management solutions where dyes serve as essential tracers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Agricultural Dyes Market.- BASF SE

- Clariant AG

- Chromatech Incorporated

- Sun Chemical (DIC Corporation)

- Sensient Technologies Corporation

- Lanxess AG

- Huntsman Corporation

- Milliken & Company

- K.I. Chemical Corporation

- Krishna Colourchem

- Neelikon Food Dyes & Chemicals Ltd.

- Organic Dyes and Pigments (ORCO)

- R.S.P. Dyes & Chemicals Pvt. Ltd.

- Synose Dyes & Chemicals

- Kolorjet Chemical Pvt. Ltd.

- Spectra Colors Corp.

- DyStar Group

- Archroma

- Atul Ltd.

- Kemira Oyj

Frequently Asked Questions

What are the primary applications of agricultural dyes?

Agricultural dyes are primarily used for seed treatment coloration, making treated seeds identifiable and safe; for coloring fertilizers to ensure even application; and as drift indicators in crop protection sprays (pesticides, herbicides) to optimize coverage and minimize environmental impact. They also find use in irrigation water tracing and animal health products.

Why are agricultural dyes important for modern farming?

Agricultural dyes are crucial for modern farming as they enhance operational efficiency by providing visual cues for precise application, reduce waste of expensive inputs, improve safety for handlers and livestock by clearly identifying treated products, and help farmers comply with strict regulatory requirements for agricultural chemical identification and traceability.

What types of dyes are commonly used in agriculture?

Common types include synthetic dyes like azo dyes, phthalocyanine dyes, and anthraquinone dyes, which offer vibrant colors and stability. There's also a growing trend towards natural dyes derived from plants (e.g., annatto, turmeric) and fluorescent dyes for enhanced visibility under specific conditions.

What are the key drivers for the growth of the agricultural dyes market?

Key drivers include the increasing global demand for food, necessitating enhanced agricultural productivity; the widespread adoption of precision agriculture techniques; stringent regulatory mandates for the identification of agricultural chemicals; and growing awareness among farmers about the benefits of visual aids in optimizing resource utilization and safety.

How do environmental regulations impact the agricultural dyes market?

Environmental regulations significantly influence the market by driving demand for biodegradable, low-toxicity, and eco-friendly dye formulations. They also impose strict guidelines on the types of dyes that can be used, their concentrations, and application methods, encouraging innovation towards sustainable and compliant solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager