Air Spring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435022 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Air Spring Market Size

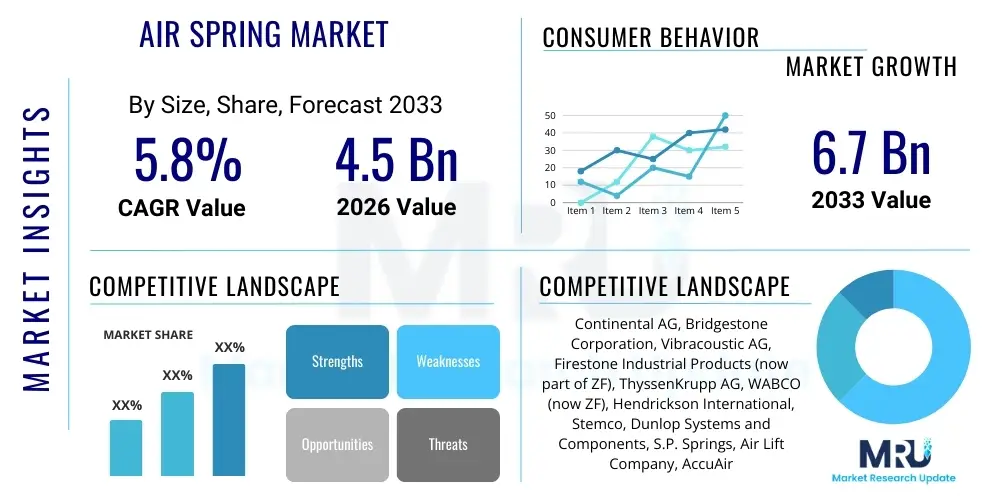

The Air Spring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Air Spring Market introduction

The Air Spring Market encompasses the global production and distribution of flexible elements used in vehicle suspension systems and industrial machinery to provide load support, vibration isolation, and ride height control. An air spring, fundamentally a bellows or bladder made of reinforced rubber or synthetic materials, utilizes compressed air to adjust its load-carrying capacity and stiffness. This technological sophistication allows for superior isolation compared to conventional steel springs, making them indispensable in applications where cargo protection, passenger comfort, and vehicle stability are paramount. The design variation, including convoluted, sleeve, and rolling lobe types, caters to diverse functional requirements across different vehicle classes and industrial installations.

Major applications of air springs span across the transportation sector, predominantly heavy-duty commercial vehicles such as trucks, buses, and trailers, where they mitigate road shock and ensure consistent axle load distribution regardless of the load profile. Furthermore, the rail industry heavily relies on air springs for primary and secondary suspension systems in high-speed trains and commuter rail cars, drastically improving passenger ride quality and reducing track wear. In the industrial segment, air springs function as actuators or vibration isolators for sensitive equipment, stamping presses, and foundation mounts, providing precise control and dampening harmful low-frequency vibrations that could damage machinery or disrupt operational accuracy. The increasing complexity and weight of modern road freight and rail transport necessitate advanced suspension solutions, positioning air springs as a core component of future mobility and infrastructure maintenance.

The principal benefits driving market adoption include enhanced vehicle handling, prolonged tire and component life due to reduced road input forces, and the ability to maintain a constant vehicle height irrespective of payload variability. Key driving factors accelerating market expansion involve rapid global expansion of logistics and e-commerce requiring high-capacity freight transport, stringent government regulations emphasizing passenger safety and comfort in public transportation, and the ongoing modernization of global railway networks. Moreover, technological advancements leading to lighter, more durable materials and integrated electronic control systems are making air springs increasingly attractive across previously underserved vehicle segments, solidifying their market relevance in sophisticated suspension design.

Air Spring Market Executive Summary

The Air Spring Market is undergoing significant transformations driven by macro-economic factors such as the growth of global trade and rapid urbanization, which necessitate more robust and efficient transportation infrastructure. Current business trends indicate a strong pivot towards active and semi-active suspension systems, incorporating advanced sensors and Electronic Control Units (ECUs) to optimize performance in real-time. Original Equipment Manufacturers (OEMs) are increasingly integrating air springs as standard features, particularly in electric buses and heavy-duty trucks, anticipating future demands for reduced energy consumption and superior ride characteristics. Furthermore, the aftermarket segment remains robust, fueled by the replacement cycle of aging fleet vehicles and the trend among conventional vehicle owners to upgrade their suspension systems for better performance and payload management, often utilizing durable composite materials to replace traditional rubber elements.

Regionally, the Asia Pacific (APAC) market dominates the consumption and production landscape, primarily attributed to the massive manufacturing base in China and India, coupled with substantial investments in public infrastructure and logistics networks. This region exhibits the highest growth potential due to expanding vehicle fleets and rapid industrialization, driving demand for both commercial and rail applications. Conversely, North America and Europe maintain high market maturity, focusing on technological innovation, stringent emission standards, and the adoption of lightweight materials. European growth is primarily stimulated by rigorous safety regulations and the sustained modernization of high-speed rail networks, while North America continues to see strong demand from the long-haul trucking sector and off-road specialty vehicles, increasingly integrating smart suspension features to enhance operational efficiency.

Segment trends highlight the dominance of the commercial vehicle segment, especially heavy-duty trucks, which utilize multiple air spring units per vehicle. However, the fastest-growing segment is anticipated to be passenger rail applications, reflecting global commitments to sustainable mass transit and the expansion of urban metro systems worldwide. In terms of technology, the shift from traditional convoluted air springs to more compact rolling lobe and sleeve designs is evident, catering to the limited space constraints and higher load requirements of modern vehicle designs. Furthermore, the rising demand for lightweight chassis components is accelerating the research and development of polymer and composite-reinforced air spring bellows, promising extended product lifecycles and improved fuel efficiency across all application segments.

AI Impact Analysis on Air Spring Market

Common user questions regarding AI's impact on the Air Spring Market primarily revolve around predictive maintenance capabilities, the integration of smart, adaptive suspension control systems, and optimizing the air spring manufacturing process itself. Users are keenly interested in how Artificial Intelligence can utilize real-time sensor data—such as pressure, temperature, and acceleration—to forecast potential failures, thereby minimizing unexpected downtime for commercial fleet operators. There is significant anticipation that AI-driven algorithms will move beyond reactive adjustments to deliver truly proactive suspension management, dynamically adapting air pressure and damping characteristics based on road conditions, load fluctuations, and driver behavior, optimizing both ride comfort and energy efficiency. Furthermore, inquiries frequently touch upon how AI can streamline supply chains and enhance quality control in the production of complex rubber and composite air spring components, ultimately leading to higher durability and lower production costs across the industry.

- AI enables advanced predictive maintenance by analyzing pressure, temperature, and vibration data patterns to estimate the remaining useful life (RUL) of the air spring system.

- Implementation of deep learning algorithms facilitates the development of next-generation active suspension control systems, optimizing ride comfort and stability dynamically.

- AI-driven simulation tools accelerate the design and testing phases, leading to faster prototyping of new materials and bellows geometries that meet stringent load requirements.

- Automated quality inspection systems using machine vision and AI reduce manufacturing defects in complex composite and rubber components, improving overall product reliability.

- Optimized logistics and supply chain management powered by AI reduce inventory costs for manufacturers and improve the timely availability of aftermarket replacement parts globally.

- Smart fleet management solutions utilize AI to correlate air spring performance data with vehicle operational metrics, informing fleet operators on best practices for route optimization and load management.

DRO & Impact Forces Of Air Spring Market

The Air Spring Market is primarily driven by the escalating global demand for efficient and safe freight transport, necessitated by the burgeoning e-commerce sector and increasingly complex supply chains. The need to protect high-value, sensitive cargo during transit mandates superior vibration isolation, a core capability of air suspension systems. Additionally, regulatory mandates focusing on enhanced passenger safety, especially in urban buses and rail systems, coupled with growing customer expectations for premium ride comfort, push OEMs to adopt sophisticated air spring technology over traditional mechanical suspensions. These drivers are further amplified by the rapid modernization of global railway networks and the increasing production of heavy-duty commercial vehicles in emerging economies, establishing a strong foundation for sustained market growth throughout the forecast period.

However, market expansion faces notable restraints, chiefly the relatively high initial cost associated with air suspension systems compared to conventional leaf or coil springs. This cost premium includes not only the spring itself but also necessary components like air compressors, reservoirs, and complex electronic control systems, posing a barrier to entry in price-sensitive vehicle segments, particularly in certain light commercial vehicle markets. Furthermore, the complexity of the maintenance and repair procedures for air suspension systems, requiring specialized tools and training, acts as a deterrent for smaller fleet operators and independent maintenance shops. The volatility in raw material prices, specifically synthetic rubber and various polymers derived from petroleum, also presents an ongoing challenge to maintaining stable manufacturing costs and competitive pricing strategies within the market.

Significant opportunities are emerging from the shift towards electric and autonomous vehicles, which require highly stable and precise suspension systems to accommodate heavy battery packs and ensure the accuracy of integrated sensor suites. Air springs are ideally suited for these requirements, offering precise height and leveling control essential for maximizing aerodynamic efficiency and sensor performance. The development of lighter, more robust composite materials and the integration of smart, electronically controlled air spring modules represent key innovation opportunities. These technological advances aim to overcome current restraints by reducing system weight, simplifying installation, and providing enhanced functionality, thus broadening the applicability of air springs into new segments such as high-performance passenger cars and specialized industrial machinery, while the impact forces demonstrate a high degree of correlation between commercial vehicle output and overall air spring demand, indicating a strong positive feedback loop driven by global economic activity and infrastructure development.

Segmentation Analysis

The Air Spring Market is comprehensively segmented based on product type, application, end-user, and distribution channel, providing a granular view of market dynamics. Segmentation by product type typically differentiates between convoluted, rolling lobe, sleeve, and diaphragm air springs, each tailored for specific load and deflection requirements. The application segment focuses heavily on the transportation industry, dividing demand among Commercial Vehicles (trucks, buses), Passenger Cars, Rail Vehicles, and Industrial/Non-Vehicular uses. Understanding these segmentations is critical for manufacturers to align their product portfolios with high-growth sectors and target specific needs, such as high-frequency vibration isolation in rail applications versus robust load leveling in heavy-duty trucks. The trend towards higher payload capacity and advanced electronic integration is continuously reshaping the proportional contribution of these segments to the total market revenue.

- By Product Type:

- Convoluted

- Rolling Lobe

- Sleeve

- Diaphragm

- By Application:

- Commercial Vehicles

- Heavy-Duty Trucks

- Medium-Duty Trucks

- Buses and Coaches

- Trailers

- Passenger Cars

- Rail Vehicles

- Industrial & Non-Vehicular

- Vibration Isolators

- Actuators

- Seat Suspension

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Air Spring Market

The value chain for the Air Spring Market begins with the upstream procurement of specialized raw materials, primarily synthetic rubber (such as Neoprene and Butyl rubber) for the bellows, reinforcing fabric (typically nylon or aramid fibers), and metallic components (steel, aluminum) for the bead plates and pistons. Material sourcing and quality control at this stage are crucial, as the performance and durability of the air spring system are highly dependent on the resilience of these basic components against extreme temperature fluctuations, chemical exposure, and high fatigue cycles. Strategic partnerships with rubber and polymer manufacturers are essential for securing competitive pricing and access to advanced compound formulations that improve product lifespan and reduce overall weight, which is a key competitive differentiator in the modern suspension market.

The subsequent midstream manufacturing phase involves sophisticated processes including compounding, molding, vulcanization, and assembly. Manufacturers often employ high-precision automated machinery for bellows production and stringent quality checks to ensure airtight seals and structural integrity. Major players invest heavily in R&D to integrate advanced sensor technology and electronic damping components directly into the spring assembly, moving beyond simple mechanical components to complex mechatronic systems. The production process also includes the manufacturing of associated ancillary components like air reservoirs, height control valves, and air compressors, which are critical for the complete functionality of an air suspension system, requiring specialized engineering expertise and adherence to strict automotive quality standards (e.g., IATF 16949).

The downstream distribution channels are bifurcated into Original Equipment Manufacturers (OEMs) and the Aftermarket. The OEM channel involves direct sales to truck, bus, trailer, and rail car manufacturers for factory installation, demanding just-in-time delivery and adherence to customized specifications. The aftermarket channel, servicing replacement demand, is handled through a network of independent distributors, authorized service centers, and specialized suspension component retailers. Direct sales routes are becoming increasingly important for high-end industrial and specialized rail applications, while the aftermarket relies heavily on strong, geographically dispersed distribution networks to ensure rapid availability of replacement units, driving overall revenue stability for market participants.

Air Spring Market Potential Customers

The primary segment of potential customers for air springs is the Original Equipment Manufacturers (OEMs) across the heavy commercial vehicle (HCV) and passenger rail sectors. Truck and bus OEMs represent the largest volume buyers, integrating air springs into their chassis designs to meet regulatory requirements for safety and stability, and marketing their vehicles based on enhanced driver comfort and reduced cargo damage claims. Their purchasing decisions are driven by factors such as system reliability, compatibility with sophisticated electronic vehicle architectures (ECU integration), manufacturing scale capabilities of the supplier, and the ability to reduce overall system weight for fuel efficiency gains. Long-term contractual agreements and continuous supplier qualification processes define this high-value customer relationship.

Another crucial customer segment comprises large commercial fleet operators and logistics companies who purchase air springs for fleet upgrades and maintenance. While often procuring through the aftermarket, these end-users prioritize product durability, ease of installation, and total cost of ownership (TCO). For fleet operators managing hundreds or thousands of vehicles, extended component lifespan directly translates into reduced maintenance costs and minimized vehicle downtime, making high-quality, reliable aftermarket air springs highly attractive. Increasingly, these customers are also demanding smart air springs capable of providing diagnostic feedback, aiding in preemptive maintenance scheduling and improving operational efficiency across their entire asset base.

Specialized industrial machinery builders and rail maintenance authorities form the third key customer segment. Industrial buyers utilize air springs as vibration isolators for precision manufacturing equipment (e.g., semiconductor fabrication, measurement instruments) or as powerful linear actuators. These customers require highly specific load ratings and precise deflection characteristics, often necessitating customized spring designs. Rail maintenance organizations, focusing on longevity and resistance to extreme environmental conditions, purchase air springs designed to rigorous railway standards for use in bogie suspension, demanding proven performance records and compliance with stringent national rail safety certifications across their rolling stock modernization programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Continental AG, Bridgestone Corporation, Vibracoustic AG, Firestone Industrial Products (now part of ZF), ThyssenKrupp AG, WABCO (now ZF), Hendrickson International, Stemco, Dunlop Systems and Components, S.P. Springs, Air Lift Company, AccuAir Suspension, Ride-Rite, Airmax Suspension, VDL Bus & Coach, Trelleborg AB, Meritor (now part of Cummins), SAF-Holland, Knorr-Bremse, Reyco Granning. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Air Spring Market Key Technology Landscape

The key technological advancements in the Air Spring Market center on developing smarter, lighter, and more durable components. Material science innovation is paramount, moving beyond standard rubber compounds to incorporate high-performance elastomers, thermoplastics, and fiber-reinforced composites. These advanced materials offer superior resistance to abrasion, ozone, and chemical degradation, significantly extending the lifespan of the bellows component, crucial for heavy-duty operational cycles. The adoption of lighter materials directly contributes to overall vehicle weight reduction, supporting fuel efficiency goals and aligning with environmental sustainability mandates. Furthermore, new manufacturing techniques, such as precision injection molding and advanced vulcanization processes, ensure higher consistency and tighter tolerance control in high-volume production, enhancing overall system reliability and minimizing premature failure rates across the installed base.

Another pivotal technological shift involves the integration of electronic control systems, transforming passive air springs into semi-active and active suspension systems. These systems utilize Electronic Control Units (ECUs), sophisticated sensors (including pressure transducers, accelerometers, and height sensors), and specialized air supply units (compressors and valves) to manage air pressure and damping force in real-time. Active suspension allows the vehicle to react instantaneously to changes in road surface, load, and speed, providing optimal stability and ride quality under diverse conditions. This integration is particularly vital in new autonomous vehicle platforms, where consistent vehicle posture and sensor alignment are non-negotiable prerequisites for safe and reliable operation, driving substantial R&D investment by market leaders into software and hardware optimization.

The rise of integrated system modules is also defining the technology landscape. Modern air spring assemblies are increasingly being designed as modular units that include the spring, shock absorber, and control components in a single, compact package, simplifying installation for OEMs and streamlining replacement procedures in the aftermarket. Furthermore, connectivity technologies, facilitated by the Internet of Things (IoT), allow air spring performance data to be transmitted wirelessly for remote diagnostics and predictive maintenance scheduling. This focus on digital connectivity not only extends component life but also provides valuable operational insights to fleet managers, enabling the transition towards condition-based monitoring rather than traditional time-based maintenance schedules, thus enhancing the overall economic value proposition of air suspension technology in commercial fleets globally.

Regional Highlights

The global Air Spring Market exhibits distinct dynamics across key geographical regions, influenced by varying regulatory landscapes, economic development paces, and transportation infrastructure maturity. The market structure, growth rates, and dominant application segments differ significantly across North America, Europe, and the Asia Pacific region, necessitating tailored market strategies for manufacturers seeking global leadership. Understanding these regional nuances—from the high technological adoption rate in Europe to the volume-driven growth in APAC—is essential for accurate forecasting and strategic resource allocation in areas such as R&D, manufacturing capacity expansion, and supply chain logistics, ensuring robust market penetration and profitability across diverse consumer bases.

North America and Europe represent mature markets characterized by stringent safety and environmental regulations, leading to a high penetration rate of air suspension in heavy-duty commercial vehicles and high-speed rail. In North America, the emphasis is placed heavily on the long-haul trucking segment, where durability, load stability, and driver comfort are top priorities, driving demand for high-performance, complex air spring systems. European market growth is propelled by rigorous EU standards for passenger safety in coaches and rail, alongside the early adoption of advanced, electronically controlled active suspension systems in premium passenger vehicles and electric buses, focusing on energy efficiency and system integration within sophisticated vehicle platforms.

Asia Pacific (APAC) stands out as the fastest-growing region, dominated by the immense manufacturing and demand centers in China, India, and Southeast Asia. The region benefits from rapidly expanding logistics networks, government investments in modernizing public transportation (including extensive metro and high-speed rail projects), and increasing production volumes of commercial vehicles. While pricing sensitivity remains a factor in certain segments, the sheer volume of vehicle production and infrastructure development creates overwhelming demand. This region is moving swiftly from basic mechanical suspensions to advanced air spring systems, representing the most significant opportunity for volume manufacturers, often necessitating localized production facilities to manage costs and meet regional regulatory and logistical demands effectively.

- Asia Pacific (APAC): Dominant in terms of volume growth due to rapid infrastructure spending, increasing commercial vehicle production (especially in China and India), and expanding rail networks. Focus is shifting towards adopting European-style technology for safety and comfort in buses and trains.

- North America: Mature market characterized by high demand from the heavy-duty long-haul trucking sector and a strong aftermarket. Driven by mandates for driver comfort and optimized cargo protection, leading to high adoption of complex, electronically managed suspension systems.

- Europe: High adoption rate spurred by strict regulatory requirements concerning vehicle stability, passenger comfort, and safety standards (Euro 6 norms impact vehicle design). Strong focus on semi-active suspension and integration in electric public transit fleets and premium passenger cars.

- Latin America (LATAM): Emerging market experiencing steady growth, linked to investments in mining, agriculture, and cross-border logistics infrastructure. Price sensitivity is higher, but growing fleet modernization drives gradual uptake of reliable air suspension systems.

- Middle East and Africa (MEA): Growth driven by infrastructure projects, expanding oil and gas logistics, and urbanization leading to increased demand for buses and heavy transport. Climatic challenges necessitate highly durable air spring materials resistant to extreme heat and dust.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Air Spring Market.- Continental AG

- Bridgestone Corporation

- Vibracoustic AG

- Firestone Industrial Products (now part of ZF)

- ThyssenKrupp AG

- WABCO (now ZF)

- Hendrickson International

- Stemco

- Dunlop Systems and Components

- S.P. Springs

- Air Lift Company

- AccuAir Suspension

- Ride-Rite

- Airmax Suspension

- VDL Bus & Coach

- Trelleborg AB

- Meritor (now part of Cummins)

- SAF-Holland

- Knorr-Bremse

- Reyco Granning

Frequently Asked Questions

Analyze common user questions about the Air Spring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the growth of the Air Spring Market?

The primary drivers are the massive global expansion of commercial vehicle production, particularly heavy-duty trucks and buses, coupled with increasingly stringent regulatory requirements for driver and passenger safety and comfort. Growth in rail infrastructure modernization and the rising demand for sophisticated cargo protection in logistics also fuel market expansion.

How does the integration of AI impact air spring system maintenance and performance?

AI significantly impacts performance by enabling predictive maintenance through real-time sensor data analysis, minimizing vehicle downtime and maintenance costs. For performance, AI allows for dynamic and instantaneous adjustment of suspension characteristics (active suspension) based on road and load conditions, optimizing stability and ride quality far beyond passive systems.

Which application segment holds the largest share in the Air Spring Market?

The Commercial Vehicles segment, specifically heavy-duty trucks and buses, currently holds the largest market share due to the necessity of air suspension for load leveling, axle protection, and compliance with payload distribution standards in high-capacity freight and public transport operations globally.

What are the primary restraints challenging the Air Spring Market expansion?

Key restraints include the relatively higher initial system cost compared to traditional mechanical suspensions, which incorporates the compressor, valves, and ECUs. Additionally, the specialized technical knowledge required for the maintenance and repair of complex air suspension systems presents a barrier for smaller or less specialized fleet operators.

How are electric vehicles (EVs) influencing the demand for air springs?

EVs are positively influencing demand as their heavy battery packs necessitate robust, precise suspension systems to maintain stability and constant vehicle height. Air springs are vital for optimizing the center of gravity, controlling ride height for improved aerodynamics, and ensuring the accuracy of integrated sensor suites critical for autonomous operation, making them a preferred solution for electric platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Railway Air Spring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Air Spring for Railroad Market Statistics 2025 Analysis By Application (Urban Rail, Passenger Rail), By Type (Rolling Lobe Air Spring, Convoluted Air Springs), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Air Spring Systems Market Statistics 2025 Analysis By Application (Vehicles, Railway, Industrial Applications), By Type (Convoluted Air Spring Systems, Sleeve Air Spring Systems), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager