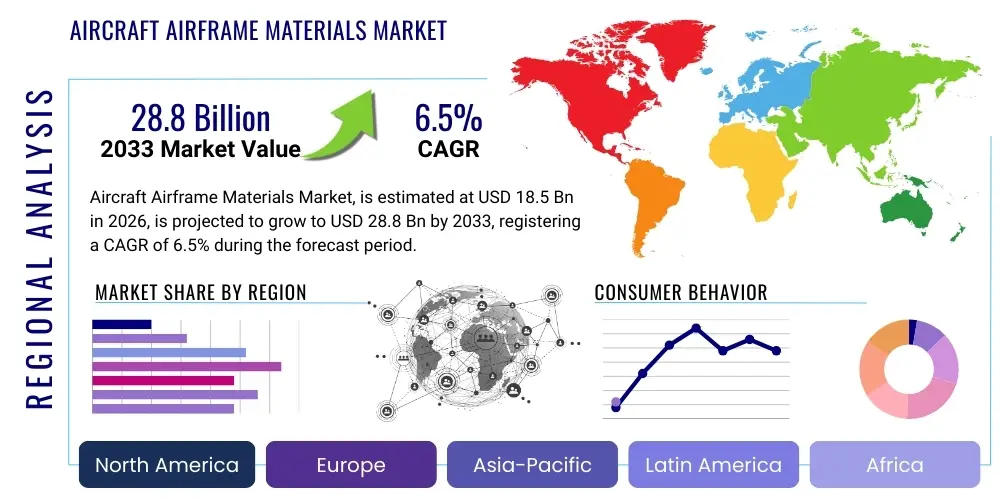

Aircraft Airframe Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436386 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Aircraft Airframe Materials Market Size

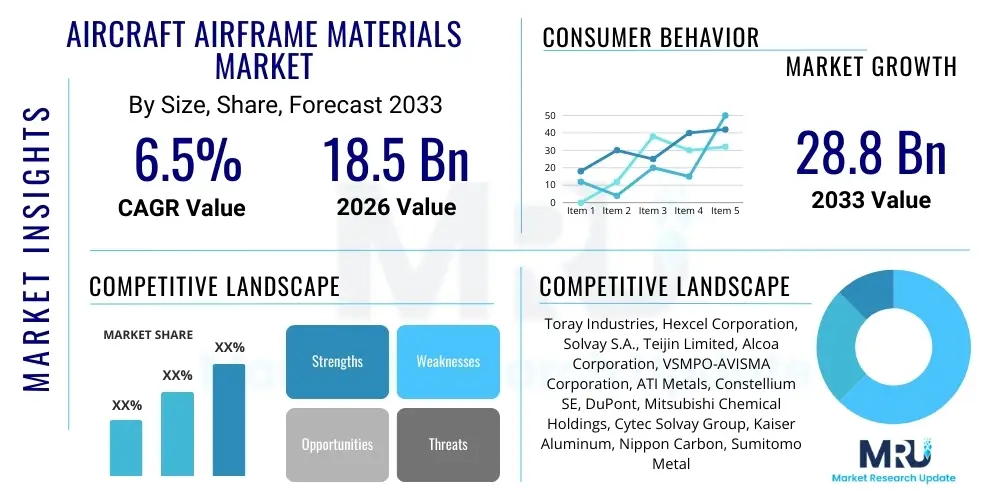

The Aircraft Airframe Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $18.5 Billion in 2026 and is projected to reach $28.8 Billion by the end of the forecast period in 2033.

Aircraft Airframe Materials Market introduction

The Aircraft Airframe Materials Market encompasses the supply and demand for high-performance structural materials essential for constructing the fuselage, wings, and empennage of commercial, military, and general aviation aircraft. These materials are selected based on stringent criteria, prioritizing high strength-to-weight ratios, exceptional fatigue resistance, corrosion resistance, and thermal stability. The primary materials dominating this landscape include advanced aluminum alloys, titanium alloys, and, increasingly, carbon fiber reinforced plastics (CFRPs) and other composite materials. The evolution of airframe design is intrinsically linked to material science breakthroughs, driving the push toward lighter, safer, and more fuel-efficient airframes, which is crucial for reducing operational costs and meeting global sustainability mandates. This continuous material transition dictates investment strategies across the aerospace supply chain.

Major applications of these specialized materials span the entirety of aircraft platforms. In commercial aviation, materials like CFRP are extensively used in new-generation wide-body and narrow-body aircraft, enabling significant weight savings compared to traditional metallic structures. Titanium is indispensable for high-stress and high-temperature areas, such as engine pylons and landing gear components. Military aircraft require materials with superior ballistic protection and stealth capabilities, often utilizing specialized composite layups and radar-absorbent materials. The inherent benefits derived from advanced airframe materials include substantial improvements in aircraft performance parameters, notably extended range, increased payload capacity, and reduced greenhouse gas emissions due to lower fuel consumption per flight cycle.

The market is primarily driven by robust aircraft order backlogs, particularly for fuel-efficient narrow-body jets, and the global trend toward replacing aging fleets with modern composite-intensive designs. Furthermore, escalating geopolitical tensions necessitate continuous investment in military aircraft modernization programs, demanding materials capable of enduring extreme operational environments and providing advanced stealth characteristics. The driving factors are further compounded by technological innovations in material manufacturing processes, such as automated fiber placement (AFP) and out-of-autoclave (OOA) curing techniques, which reduce production lead times and costs, thereby accelerating the adoption cycle of newer material systems in high-volume production lines.

Aircraft Airframe Materials Market Executive Summary

The Aircraft Airframe Materials Market is experiencing fundamental transformation driven by the aerospace industry's unwavering commitment to sustainability and operational efficiency. Business trends indicate a decisive shift away from traditional metallic structures towards advanced composites, primarily Carbon Fiber Reinforced Polymer (CFRP), which now constitute over 50% of the structural weight in modern aircraft programs like the Boeing 787 and Airbus A350. Key market participants, including major material suppliers and OEMs, are heavily investing in vertical integration and developing closed-loop recycling processes for composites to address end-of-life challenges and regulatory pressures. The growth trajectory is significantly influenced by supply chain resilience strategies, following recent global disruptions, leading to increased localized production and dual sourcing requirements for critical raw materials such as carbon fibers and specialty resins.

Regionally, North America maintains its dominance due to the presence of leading aerospace manufacturers (OEMs) and robust defense spending, serving as the epicenter for advanced material research and application development. However, the Asia Pacific region is demonstrating the highest growth velocity, propelled by massive expansion in commercial airline fleets, especially in China and India, and increasing governmental investments in developing indigenous aerospace manufacturing capabilities. Europe remains a critical hub, particularly for composite innovation, driven by major manufacturers and ambitious EU-led initiatives focused on decarbonization and achieving net-zero aviation targets, requiring the deployment of lightweight materials suitable for future hydrogen-powered or electric aircraft designs.

Segmentation trends highlight the increasing importance of the Composite Material segment, projected to outpace metallic materials in growth, although high-performance metals like titanium and specialized aluminum-lithium alloys retain crucial roles in highly stressed primary structures. The Commercial Aircraft segment is the largest revenue contributor, intrinsically linked to global passenger traffic projections and airline profitability. Within this segment, narrow-body aircraft represent the largest volume opportunity due to their high production rates and extensive replacement needs. Emerging segments include ceramic matrix composites (CMCs) and metal matrix composites (MMCs) primarily utilized in specialized military applications and high-temperature engine components, paving the way for revolutionary airframe architectures and designs in the next decade.

AI Impact Analysis on Aircraft Airframe Materials Market

Users frequently inquire about how Artificial Intelligence (AI) can optimize the material selection process, accelerate R&D cycles for novel airframe materials, and enhance the quality control during complex composite manufacturing. The primary concern revolves around AI's capability to manage the vast datasets generated during material testing and simulation, particularly for predicting the long-term fatigue life and environmental degradation of advanced composites under diverse operational conditions. Key expectations center on utilizing Machine Learning (ML) algorithms for defect detection in Automated Fiber Placement (AFP) and Automated Tape Laying (ATL) processes, moving manufacturing towards a zero-defect environment, thereby reducing waste and the extremely high cost associated with scrap materials in aerospace production. This focus on predictive modeling is crucial for certifying new material systems faster and ensuring regulatory compliance with minimal physical testing.

AI's influence extends deeply into optimizing the complex microstructure of metallic alloys and the curing cycles of thermoset composites. Researchers and manufacturers anticipate AI-driven simulations to precisely tailor material properties, such as thermal expansion coefficients or impact resistance, at the atomic level, a capability previously constrained by conventional trial-and-error methodologies. Furthermore, AI tools are expected to integrate material property databases with Finite Element Analysis (FEA) software, enabling designers to instantaneously assess the structural performance implications of material substitutions or design changes. This capability significantly lowers the barrier to entry for new, high-performance materials that require complex processing or specialized handling, facilitating their acceptance in conservative aerospace programs.

The successful deployment of AI in the airframe materials domain is intrinsically linked to developing robust digital twins of manufacturing assets and material performance profiles. These digital representations, powered by AI and ML, offer real-time insights into process variability and material state, enabling automated adjustments to parameters like temperature, pressure, and cure time in composite fabrication. This paradigm shift from reactive quality control to predictive process management is essential for sustaining the high production rates demanded by OEMs like Boeing and Airbus. Ultimately, AI serves as an accelerant for innovation, addressing the twin challenges of cost reduction and performance enhancement necessary for the next generation of lighter, more capable aircraft.

- Accelerated material R&D through ML-driven property prediction and simulation.

- Optimized composite manufacturing via AI-powered defect detection in Automated Fiber Placement (AFP).

- Enhanced quality control and reduced scrap rates through predictive process monitoring (Digital Twins).

- Intelligent material degradation modeling for accurate prediction of structural fatigue life.

- Streamlined regulatory compliance by minimizing physical testing using validated AI models.

- Automation of material selection based on mission profiles and environmental factors.

DRO & Impact Forces Of Aircraft Airframe Materials Market

The Aircraft Airframe Materials Market is governed by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively influenced by powerful macro-economic and technological impact forces. A primary driver is the pervasive industry requirement for enhanced fuel efficiency, directly translating into demand for lighter materials. This is further compounded by the aggressive replacement cycle of aging aircraft fleets, particularly in mature markets, necessitating modern designs that maximize the integration of lightweight composites. Conversely, significant restraints include the exceptionally high upfront cost of advanced materials, especially carbon fiber and titanium, and the capital-intensive nature of transitioning existing production lines from metal fabrication to composite manufacturing. Furthermore, stringent regulatory requirements, demanding extensive testing and certification for any new material system, often results in protracted adoption timelines, hindering faster market penetration.

Opportunities in this sector primarily revolve around the development of sustainable and recyclable composite materials, responding to growing environmental scrutiny and legislative pressures, particularly in Europe. The exploration and commercialization of advanced material systems, such as thermoplastic composites (TPCs) which offer faster processing cycles and easier repairability than traditional thermosets, present a substantial long-term growth avenue. Additionally, the proliferation of additive manufacturing (3D printing) for metallic and polymer components opens new doors for complex geometric designs, reducing material waste and assembly time. These technological opportunities are vital for overcoming existing cost restraints and streamlining the aerospace materials supply chain, making high-performance materials more economically viable for medium-sized aircraft platforms.

The market is subjected to intense impact forces defined by high barriers to entry (supplier specialization and certification), significant buyer power (OEMs dictating material specifications and pricing), and moderate threat of substitutes (continuous technological competition between new alloys and advanced composites). The PESTEL framework reveals that Political factors, specifically government defense spending and international trade tariffs on raw materials, heavily influence market stability. Economic forces, such as fluctuating oil prices and global GDP growth, directly impact airline profitability and, consequently, new aircraft orders. Social factors drive demand for quieter and more sustainable air travel, reinforcing the need for material innovation. Technology remains the paramount force, with breakthroughs in nanotechnology and material processing constantly redefining the performance ceiling for airframe structures.

Segmentation Analysis

The segmentation of the Aircraft Airframe Materials Market provides a granular understanding of material adoption patterns across different aircraft platforms and operational requirements. The market is broadly categorized based on the type of material used, the specific aircraft type utilizing the material, and the application area within the airframe. This multi-faceted segmentation highlights the dominance of high-performance materials essential for structural integrity and weight reduction. Aluminum alloys, despite the rise of composites, still maintain a significant market share, particularly in legacy fleets and certain secondary structures due to their lower cost and proven manufacturing ease. However, the fastest-growing segment is driven by the utilization of carbon fiber reinforced polymers (CFRP) due to their unparalleled strength-to-weight ratio and fatigue performance, essential attributes for new-generation long-range aircraft.

The aircraft type segmentation clearly delineates demand, with Commercial Aircraft currently representing the largest segment due to high production volumes of narrow-body jets (e.g., Airbus A320neo and Boeing 737 MAX series). The Military Aircraft segment demands specialized, often classified, materials focusing on survivability, high temperature tolerance, and radar cross-section reduction. The growth in the General Aviation and Business Jet segments, while smaller in volume, often drives early adoption of cutting-edge materials, especially those that offer easier repair and lower maintenance burdens. Understanding these consumption patterns is crucial for material suppliers to align their R&D portfolios with specific OEM requirements and future fleet demands.

Application-wise, the market is segmented into primary structures (wings, fuselage, tail) and secondary structures (doors, fairings, flight control surfaces). Primary structures represent the most critical and capital-intensive application, demanding the highest quality, certified materials, predominantly advanced composites and titanium alloys. Secondary structures, offering more flexibility in material choice, are increasingly seeing the use of lighter polymer materials and rapidly fabricated components through additive manufacturing techniques. The inherent link between airframe structure criticality and material choice dictates distinct supply chains and regulatory pathways for each application area.

- By Material Type:

- Advanced Composites (Carbon Fiber Reinforced Plastic - CFRP, Glass Fiber Reinforced Plastic - GFRP, Aramid Fiber Reinforced Plastic - AFRP)

- Aluminum Alloys (Aluminum-Lithium Alloys)

- Titanium Alloys

- Specialty Steels

- Other Materials (Ceramic Matrix Composites - CMC, Metal Matrix Composites - MMC)

- By Aircraft Type:

- Commercial Aircraft (Narrow-Body Aircraft, Wide-Body Aircraft, Regional Jets)

- Military Aircraft (Fighter Jets, Transport Aircraft, Helicopters)

- General Aviation and Business Jets

- Rotorcraft (Civil and Military Helicopters)

- By Application:

- Primary Structures (Fuselage, Wings, Empennage)

- Secondary Structures (Flaps, Slats, Doors, Fairings)

- Interior Structures

Value Chain Analysis For Aircraft Airframe Materials Market

The value chain for the Aircraft Airframe Materials Market is highly complex, characterized by stringent qualification processes and deep integration between tiers. The upstream segment is dominated by specialized raw material suppliers, including chemical companies providing high-grade resins (epoxy, BMI, thermoplastic), metal refineries supplying aerospace-grade titanium sponge and aluminum billets, and dedicated carbon fiber manufacturers. These suppliers operate under tight quality control standards, as minor variations in raw material quality can severely compromise the structural integrity of the final airframe components. Procurement in this stage is highly competitive and often involves long-term, strategic contracts to ensure supply stability for multi-year aircraft programs. The performance and pricing of these foundational materials heavily influence the cost and capabilities downstream.

The midstream segment involves the transformation of raw materials into ready-to-use forms, such as prepregs, sheets, billets, and forgings. Tier-2 manufacturers convert fibers and resins into composite prepregs or specialty metallic alloys into machined components. This stage utilizes highly advanced, capital-intensive machinery, including large autoclaves, sophisticated weaving machines, and precision five-axis CNC machines. Distribution channels at this level are often direct or through highly specialized distributors who possess the capability to store and manage sensitive materials, like temperature-controlled prepregs, ensuring their shelf life and integrity are maintained before delivery to the final component fabricators. Quality management systems (e.g., AS9100) are non-negotiable at every step.

The downstream segment, constituting Tier-1 suppliers and major Original Equipment Manufacturers (OEMs) like Boeing and Airbus, focuses on the final fabrication, assembly, and integration of the airframe structures. Tier-1 suppliers (e.g., Spirit AeroSystems, Premium Aerotec) utilize materials to manufacture large primary components (wings or fuselage sections). They often deal directly with OEMs, who exert significant influence over material specifications, qualification testing, and final pricing. Direct distribution to OEMs is standard for primary structures, ensuring traceability and minimizing logistical risks. Indirect distribution sometimes occurs for standard parts and repairs through authorized maintenance, repair, and overhaul (MRO) facilities, completing the value cycle by supplying materials for sustaining the operational fleet.

Aircraft Airframe Materials Market Potential Customers

Potential customers for Aircraft Airframe Materials are concentrated in a highly specialized ecosystem where performance, certification, and traceability are paramount. The largest cohort of end-users are the global Original Equipment Manufacturers (OEMs), primarily responsible for designing and assembling new commercial and military aircraft. These giants—including Boeing, Airbus, Lockheed Martin, and Embraer—are the primary decision-makers, setting the technical specifications for all airframe materials used in their platforms. Their purchasing strategy is driven by long-term production contracts, demanding materials that offer guaranteed supply stability, low defect rates, and verifiable performance data over decades of service life. OEMs require materials that enable incremental improvements in fuel efficiency and maintenance intervals.

Another crucial group comprises Tier-1 and Tier-2 component manufacturers and structural sub-assemblers (e.g., Safran, GKN Aerospace, Triumph Group). These entities act as the immediate buyers of processed materials like prepregs, specialized metallic plates, and forgings, which they transform into finished airframe parts. Their material selection is dictated by the OEM contracts they hold, focusing on processability, ease of machining, and cost-effectiveness within their specific manufacturing environment. The relationship between material suppliers and Tier manufacturers is collaborative, often involving joint development agreements to tailor material forms (e.g., custom carbon fiber weaves) for specific structural requirements.

The third significant category of end-users are Military and Defense organizations, purchasing materials directly or through prime defense contractors. This segment prioritizes materials offering exceptional performance in extreme conditions, superior stealth characteristics (low radar observability), and resistance to environmental and chemical damage. Lastly, the global ecosystem of Maintenance, Repair, and Overhaul (MRO) facilities and aftermarket suppliers represents a steady demand channel for materials used in structural repairs, retrofits, and life-extension programs for existing fleets, typically requiring certified repair materials compatible with the original airframe composition.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $18.5 Billion |

| Market Forecast in 2033 | $28.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Hexcel Corporation, Solvay S.A., Teijin Limited, Alcoa Corporation, VSMPO-AVISMA Corporation, ATI Metals, Constellium SE, DuPont, Mitsubishi Chemical Holdings, Cytec Solvay Group, Kaiser Aluminum, Nippon Carbon, Sumitomo Metal Industries, Allegheny Technologies Incorporated, Carpenter Technology Corporation, TenCate Advanced Composites, SGL Carbon SE, BASF SE, Norsk Titanium AS |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Airframe Materials Market Key Technology Landscape

The key technology landscape of the Aircraft Airframe Materials Market is fundamentally defined by the pursuit of ultra-lightweight, high-strength structural solutions, dominated by advancements in composite fabrication and specialty metal processing. The most significant technological driver is the maturation of advanced composite manufacturing techniques, specifically Automated Fiber Placement (AFP) and Automated Tape Laying (ATL). These robotic systems allow for the precise and high-speed layup of complex composite plies, drastically reducing manual labor, improving material utilization, and ensuring consistent quality, which is paramount for large airframe components like the wings and fuselage barrels. Further optimization is achieved through Out-of-Autoclave (OOA) processing technologies, which reduce energy consumption and cycle times compared to traditional, large-scale autoclave curing, making composites more cost-effective for medium-volume production.

In parallel with composite advancement, specialized metallurgy remains critical, with ongoing innovation in aluminum-lithium (Al-Li) alloys and near-net-shape titanium processing. Al-Li alloys offer a significant density reduction (up to 3%) and improved stiffness compared to older aluminum generations, making them attractive for structures where aluminum is still preferred due to cost or repairability concerns. For titanium, technologies like Electron Beam Melting (EBM) and Wire Arc Additive Manufacturing (WAAM) are revolutionizing the manufacturing of complex, large titanium components, such as bulkheads and landing gear fittings. These additive manufacturing (AM) techniques reduce the material waste associated with subtractive machining of expensive titanium billets and accelerate the production of complex geometries, reducing overall lead times and supply chain complexity.

Looking forward, the technology landscape is being shaped by the adoption of thermoplastic composites (TPCs) and the integration of smart materials. TPCs, unlike traditional thermosets, can be rapidly welded, reformed, and recycled, offering superior impact resistance and faster assembly times, potentially lowering the total cost of ownership over the aircraft life cycle. Furthermore, the burgeoning field of smart materials involves developing structures with integrated sensors for real-time structural health monitoring (SHM). This capability, often leveraging embedded fiber optics or piezoelectric materials, allows for continuous assessment of stress, temperature, and damage, shifting maintenance paradigms from scheduled checks to condition-based interventions, thus maximizing aircraft uptime and reducing MRO costs associated with airframe inspection.

Regional Highlights

Regional dynamics within the Aircraft Airframe Materials Market are heavily influenced by the concentration of major aerospace OEMs, national defense budgets, and the maturity of domestic manufacturing capabilities, leading to distinct growth profiles across continents. North America, anchored by the United States, represents the largest and most technologically advanced market. This dominance is attributable to the presence of global aviation giants (Boeing, Lockheed Martin), sustained high levels of defense expenditure necessitating advanced material procurement for fighter jets and military transporters, and a well-established ecosystem of specialized material suppliers and Tier-1 integrators. The region leads in the adoption and commercialization of new technologies, particularly in areas concerning large-scale composite fabrication and aerospace-grade additive manufacturing.

Europe constitutes the second largest market, characterized by intense innovation driven by Airbus and its extensive supply chain networks across the EU. European regional growth is significantly boosted by governmental and collaborative research programs focused on sustainable aviation, pushing the rapid integration of high-performance, recyclable materials, and next-generation composite technologies. Key countries like France, Germany, and the UK invest heavily in optimizing composite repair techniques and developing materials suitable for future propulsion technologies, including hydrogen fuel cells, which place unique thermal and structural demands on the airframe. Regulatory alignment and cross-border collaboration enhance the efficiency of material certification processes within the European aerospace sector.

The Asia Pacific (APAC) region is projected to register the fastest market expansion over the forecast period. This rapid growth is fueled by massive fleet expansion requirements from airlines in emerging economies (China, India, Southeast Asia), driven by surging middle-class travel demand. Furthermore, significant governmental initiatives in China (e.g., COMAC C919 program) and Japan aim to establish robust domestic aerospace manufacturing capabilities, necessitating substantial localized material sourcing and technology transfer. The military modernization efforts across major APAC nations also contribute significantly to the demand for advanced materials, specifically titanium and high-strength steels, used in indigenous defense programs. Latin America and the Middle East and Africa (MEA) represent nascent markets, primarily driven by maintenance and repair activities and limited indigenous aircraft assembly, relying heavily on imports for complex airframe material needs.

- North America: Market leader, driven by Boeing and defense spending; focus on large-scale composite automation (AFP/ATL) and advanced metallurgy.

- Europe: Strong second position, led by Airbus; emphasizes sustainable, recyclable composites and OOA manufacturing techniques; crucial for next-generation platforms.

- Asia Pacific (APAC): Fastest growing region; fueled by massive commercial fleet expansion and strategic government investments in domestic aerospace capabilities (China, India).

- Latin America (LATAM): Moderate growth driven mainly by maintenance demand and regional jet production (Embraer); reliance on imported specialized materials.

- Middle East & Africa (MEA): Growth tied to strategic airline hub development and military procurement; low domestic manufacturing capacity for specialized airframe materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Airframe Materials Market.- Toray Industries

- Hexcel Corporation

- Solvay S.A.

- Teijin Limited

- Alcoa Corporation

- VSMPO-AVISMA Corporation

- ATI Metals

- Constellium SE

- DuPont

- Mitsubishi Chemical Holdings

- Cytec Solvay Group

- Kaiser Aluminum

- Nippon Carbon

- Sumitomo Metal Industries

- Allegheny Technologies Incorporated

- Carpenter Technology Corporation

- TenCate Advanced Composites

- SGL Carbon SE

- BASF SE

- Norsk Titanium AS

Frequently Asked Questions

Analyze common user questions about the Aircraft Airframe Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Aircraft Airframe Materials Market?

The primary driver is the global aerospace industry's increasing demand for fuel efficiency and reduced operating costs, necessitating the widespread adoption of lightweight, high-performance materials, primarily advanced carbon fiber reinforced polymers (CFRP) in new aircraft designs.

How are advanced composites changing the airframe manufacturing process?

Advanced composites enable significant weight reduction and are manufactured using highly automated processes like Automated Fiber Placement (AFP) and Out-of-Autoclave (OOA) curing, shifting production towards precision robotic manufacturing and away from traditional metal forming.

Which aircraft segment is the largest consumer of airframe materials?

The Commercial Aircraft segment is the largest consumer, primarily driven by high-volume production of narrow-body jets, which are undergoing continuous modernization and material upgrades to enhance fuel economy and longevity.

What are the main restraints impacting the market adoption of new materials?

The main restraints are the exceptionally high cost associated with specialty raw materials (e.g., aerospace-grade titanium, carbon fiber), the capital intensity of new manufacturing infrastructure, and the stringent, time-consuming regulatory certification required for aerospace applications.

What is the role of 3D printing in the future of airframe materials?

Additive Manufacturing (3D printing), particularly for specialized metallic alloys (e.g., titanium), allows for the rapid creation of complex, near-net-shape structural parts, drastically reducing material waste, machining time, and supply chain complexity for critical components.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager