Aircraft Carbon Brakes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432510 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Aircraft Carbon Brakes Market Size

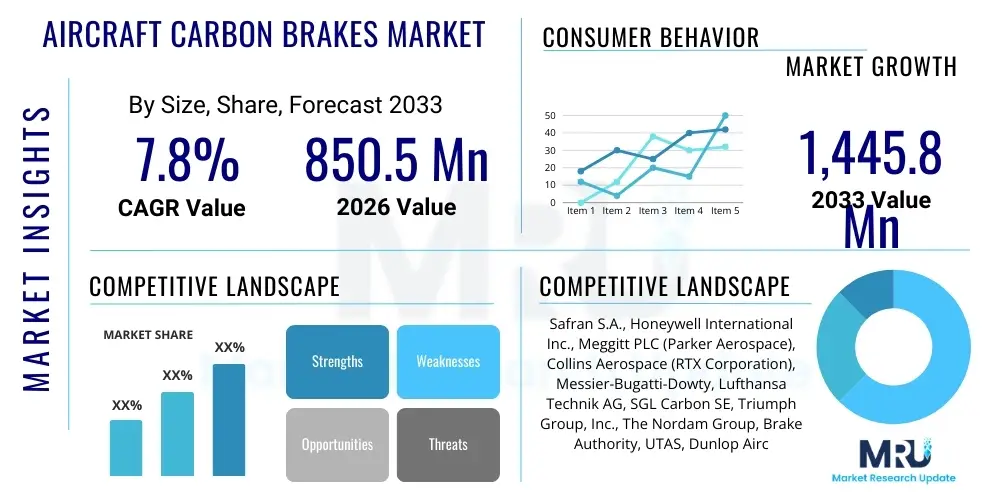

The Aircraft Carbon Brakes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,445.8 Million by the end of the forecast period in 2033.

Aircraft Carbon Brakes Market introduction

The Aircraft Carbon Brakes Market encompasses the manufacturing, distribution, and maintenance of braking systems utilizing carbon composite materials for various types of aircraft. Carbon brakes have emerged as the standard for modern commercial and military aviation due to their superior thermal stability, significantly reduced weight compared to traditional steel brakes, and enhanced wear resistance. These factors contribute directly to improved operational efficiency, lower fuel consumption, and extended maintenance intervals, making them critical components in advanced aerospace engineering. The inherent capability of carbon material to dissipate massive amounts of kinetic energy during high-speed landings without degradation is a core driver of their adoption across wide-body and narrow-body fleets.

Carbon brakes are primarily composed of carbon fiber reinforced carbon (CFRC) materials, known for their high specific heat capacity and excellent friction performance across a wide temperature spectrum. The primary applications include main wheel braking systems in large commercial airliners (such as the Boeing 787 and Airbus A350), regional jets, and high-performance military fighter jets. The transition away from steel brakes is nearly complete in new aircraft production, shifting market focus towards material refinement, regenerative braking integration, and the robust aftermarket for MRO (Maintenance, Repair, and Overhaul) services, which accounts for the largest share of market revenue.

Key benefits driving market growth include the substantial weight savings, which can be several hundred pounds per aircraft, translating directly into reduced operating costs and lower carbon emissions. Furthermore, carbon brakes offer a significantly longer lifespan than steel equivalents, sometimes lasting four to five times longer under similar operating conditions. This extended life minimizes aircraft downtime and MRO expenditures. Regulatory mandates focusing on aircraft efficiency and noise reduction, coupled with increasing global air traffic and corresponding demand for new aircraft deliveries, solidify the robust growth trajectory for this specialized aerospace component segment.

Aircraft Carbon Brakes Market Executive Summary

The Aircraft Carbon Brakes Market is characterized by high barriers to entry, dominated by a few established Tier 1 suppliers who maintain long-term contractual relationships with major aircraft OEMs like Boeing and Airbus. Business trends indicate a strong focus on securing lucrative aftermarket contracts, as the replacement and refurbishment cycles generate stable, high-margin revenue streams. Technological advancements center on developing lighter, more durable carbon-ceramic matrix (CCM) composites and enhancing braking system intelligence through integrated sensors and predictive maintenance algorithms. The recent consolidation within the aerospace supply chain, notably the merger activity involving major component manufacturers, is reshaping competitive dynamics, focusing R&D efforts on reducing production costs and increasing operational temperature tolerance.

Regionally, North America and Europe remain the principal revenue generators, driven by the presence of major aircraft manufacturers, extensive commercial airline fleets, and sophisticated MRO infrastructure. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by the explosive growth in air passenger traffic, massive fleet expansion initiatives in China and India, and corresponding investment in localized MRO capabilities. Governments in emerging economies are also prioritizing modernization of military fleets, further stimulating demand for high-performance carbon braking systems, particularly in regions facing geopolitical tensions requiring rapid fleet readiness.

Segment trends reveal that the Aftermarket segment (MRO) holds a dominant share, primarily due to the mandated routine replacement of worn carbon discs over the lifetime of the aircraft, which vastly outweighs the initial OEM installations. Within the application segment, commercial aircraft—specifically narrow-body jets, which constitute the backbone of global air travel—are the largest consumers of carbon brakes. The industry is witnessing a shift towards Carbon/Carbon (C/C) materials optimized for specific environments, alongside nascent interest in advanced composites offering even greater wear resistance and thermal endurance for next-generation aircraft programs emphasizing weight reduction.

AI Impact Analysis on Aircraft Carbon Brakes Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Aircraft Carbon Brakes Market predominantly revolve around improving maintenance predictability, optimizing brake usage during taxiing and landing, and enhancing material quality control. Key concerns focus on the integration cost of AI-driven sensor systems into existing fleet infrastructure and the reliability of machine learning algorithms in predicting critical wear limits under varying operational stress. Users anticipate that AI will fundamentally transform MRO efficiency, moving the industry away from time-based or cycle-based maintenance schedules towards true condition-based monitoring, thereby maximizing the lifespan of expensive carbon components and minimizing unexpected component failure, which is paramount for flight safety.

The primary benefit of AI integration lies in its ability to process vast quantities of data generated by onboard sensors—such as temperature, pressure, and displacement—during thousands of braking cycles. This data, when analyzed by specialized machine learning models, allows MRO providers and airlines to generate highly accurate predictions regarding the remaining useful life (RUL) of individual brake components. This predictive capability enables just-in-time inventory management for carbon discs, reduces unnecessary replacements, and ensures that maintenance actions are performed exactly when required, optimizing operational expenditures and significantly improving dispatch reliability.

Furthermore, AI algorithms are being deployed in the manufacturing phase to monitor and control the complex carbonization and graphitization processes required for producing high-quality carbon-carbon composites. AI-driven vision systems and process parameter optimization engines ensure consistency in material density and structural integrity, crucial for aerospace safety standards. While the physical material itself remains carbon composite, the lifecycle management and quality assurance are increasingly becoming digital processes powered by advanced analytics and AI frameworks, enhancing product reliability from production through retirement.

- AI-driven Predictive Maintenance (PdM) optimizes brake replacement schedules based on real-time wear data.

- Machine learning models enhance Quality Control (QC) during the composite manufacturing processes, ensuring structural integrity.

- AI assists in optimizing landing and taxi procedures (Brake-to-Vacate strategies) to minimize unnecessary brake wear.

- Sensor data fusion and analysis improve the accuracy of Remaining Useful Life (RUL) estimation for carbon discs.

- Automated inspection systems utilizing computer vision speed up MRO procedures and reduce human error.

DRO & Impact Forces Of Aircraft Carbon Brakes Market

The Aircraft Carbon Brakes Market is primarily driven by rigorous safety standards, the continuous push for lightweighting in aerospace engineering to achieve fuel efficiency targets, and the high replacement demand within the MRO segment. Restraints include the extremely high capital expenditure required for carbon brake manufacturing facilities, the long qualification cycles mandated by regulatory bodies like the FAA and EASA, and the fluctuating global prices of raw materials such as specialized carbon fibers and precursors. Opportunities are abundant in the development of advanced carbon-ceramic matrix (CCM) materials for next-generation narrow-body aircraft and the expansion of specialized MRO facilities in high-growth regions like Southeast Asia and the Middle East, catering to local fleet demands and avoiding long logistics chains.

The key impact forces shaping this market include the bargaining power of major OEMs, who dictate initial installation contracts and specifications, and the intense competitive rivalry among the few established Tier 1 suppliers (Safran, Collins, Honeywell). Supplier bargaining power for raw materials is moderate, as specialized carbon fiber suppliers are few, but high volume purchasing by brake manufacturers provides some leverage. The threat of substitutes is low; while electric taxiing systems and advanced landing gear systems are being explored, no current technology offers a viable, direct, certified replacement for high-performance carbon friction material in emergency and routine braking scenarios, maintaining the necessity of carbon composites.

Economic and technological factors exert significant force. Economic downturns directly impact airline procurement of new aircraft, slowing OEM segment growth, while geopolitical instability influences military aircraft spending. Technologically, the pressure is constant to develop materials that can withstand even higher kinetic energy loads while maintaining minimal weight, ensuring that innovation remains a competitive imperative. Environmental regulations concerning noise and emissions also favor carbon brakes, as their efficiency supports overall aircraft performance improvements, thus strengthening their market position against older, heavier alternatives.

Segmentation Analysis

The Aircraft Carbon Brakes Market is comprehensively segmented based on Type, End-User, and Material, providing deep insights into demand patterns across different aerospace sectors and product lifecycle stages. The Type segmentation differentiates demand based on aircraft category, recognizing the varying operational stresses and specifications required for commercial versus military applications. The End-User segmentation critically separates the initial equipment installation (OEM) phase from the long-term maintenance and replacement cycles (Aftermarket), reflecting the distinct market dynamics and purchasing power within each segment. Finally, Material segmentation highlights the technological evolution of carbon composites, focusing on performance enhancements and cost optimization across Carbon/Carbon (C/C) and advanced Carbon-Ceramic Matrix (CCM) formulations.

Commercial aircraft represent the largest segment by Type, driven by massive global fleet sizes and consistent replacement demands for high-cycle components. Within the End-User category, the Aftermarket segment dominates revenue share, consistently providing stable growth due to the non-negotiable requirement for brake replacement after defined usage cycles or wear limits. The competitive landscape is heavily influenced by OEM contracts, which typically lock airlines into long-term MRO service agreements with the original brake manufacturer, securing the flow of aftermarket revenue. This dual structure—high volume OEM contracts establishing dominance and high margin Aftermarket contracts sustaining profitability—defines the industry's economic model.

As the aviation industry pushes towards greener technology and higher operational efficiency, the segment analysis guides strategic investment in material science. Manufacturers are increasingly optimizing standard Carbon/Carbon brakes for enhanced longevity in high-frequency operations, while simultaneously researching and deploying advanced Carbon-Ceramic Matrix (CCM) brakes, especially in large-platform military aircraft and new wide-body commercial jets where weight savings yield maximum ROI. Understanding these segment dynamics is crucial for suppliers to tailor product offerings, manage inventory efficiently, and align R&D efforts with future airframe requirements.

- Type

- Commercial Aircraft (Narrow-Body, Wide-Body)

- Regional Jets

- Military Aircraft (Fighter Jets, Transport Aircraft)

- General Aviation and Business Jets

- End-User

- OEM (Original Equipment Manufacturer)

- Aftermarket (MRO, Airlines, Independent Repair Stations)

- Material

- Carbon/Carbon (C/C) Composites

- Carbon-Ceramic Matrix (CCM) Composites

- Sales Channel

- Direct Sales

- Distributor Sales

Value Chain Analysis For Aircraft Carbon Brakes Market

The value chain for the Aircraft Carbon Brakes Market is highly specialized and tightly integrated, beginning with the complex manufacturing of precursor materials and culminating in specialized MRO services. The upstream activities involve the production of high-modulus carbon fibers, which are then processed into pre-forms before undergoing demanding chemical vapor infiltration (CVI) or other high-temperature treatment processes to create the rigid, friction-ready carbon-carbon composite disks. This phase requires significant proprietary technology and quality control, leading to high capital costs and concentration among few specialized material suppliers and brake manufacturers who often integrate backward to control material quality.

Midstream activities center on the brake assembly, where the carbon discs are integrated with the braking system hardware, including actuators, hydraulic systems, and anti-skid controls. This stage is dominated by Tier 1 aerospace suppliers who hold the OEM contracts and possess the necessary certification and system integration expertise. Distribution channels are predominantly direct; for OEM sales, manufacturers ship directly to aircraft assembly lines (Boeing, Airbus). For the Aftermarket, distribution is either direct from the brake manufacturer to the airline/MRO subsidiary or through exclusive, certified distribution networks specializing in aerospace spares.

Downstream analysis focuses heavily on the MRO cycle. Unlike general aviation components, carbon brake refurbishment (re-carbonization) and replacement are services often mandated by OEM agreements and performed only by certified facilities. This creates a strong dependence of end-users (airlines) on the brake manufacturer for genuine parts and certified repair services, sustaining the high profitability of the Aftermarket segment. The direct distribution channel maintains quality control and traceability, which is paramount for flight safety, while indirect channels (certified distributors) primarily handle logistical support for smaller MRO centers globally.

Aircraft Carbon Brakes Market Potential Customers

The primary customers and end-users of aircraft carbon brakes fall into distinct categories defined by the product lifecycle stage and operational requirements. The initial purchasers (OEM segment) are the major global airframe manufacturers, including The Boeing Company, Airbus SE, Embraer, Bombardier, and military aircraft producers. These entities require large volumes of braking systems integrated into their new aircraft platforms and drive the initial design specifications and technological adoption trends. Securing an OEM contract is crucial as it guarantees future aftermarket revenue from the operational life of the platform, which can span several decades.

The largest and most consistent segment of potential customers, however, resides within the Aftermarket. This includes major international airlines (e.g., Delta, Emirates, Lufthansa, Air China), regional carriers, and dedicated cargo operators who are continuously replacing worn brake discs as part of routine maintenance schedules. The high wear rate relative to the aircraft's lifespan ensures continuous demand. Additionally, specialized Maintenance, Repair, and Overhaul (MRO) service providers—both independent entities and airline captive MRO divisions (e.g., Lufthansa Technik, Air France Industries KLM Engineering & Maintenance)—are crucial customers, procuring refurbished materials and spare parts for their diverse client fleets.

A third significant customer segment includes governmental and defense organizations globally. Military air forces require carbon brakes for high-performance fighter jets and heavy transport aircraft, where rapid braking capabilities and resilience to extreme thermal loads are non-negotiable safety requirements. These procurement decisions are driven by strategic defense budgets and fleet modernization cycles, often necessitating specialized, military-grade variants of the standard commercial product, purchased either directly through defense contracts or via governmental procurement agencies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,445.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Safran S.A., Honeywell International Inc., Meggitt PLC (Parker Aerospace), Collins Aerospace (RTX Corporation), Messier-Bugatti-Dowty, Lufthansa Technik AG, SGL Carbon SE, Triumph Group, Inc., The Nordam Group, Brake Authority, UTAS, Dunlop Aircraft Tyres, Eaton Corporation, Revima Group, Kratos Defense & Security Solutions, UTC Aerospace Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aircraft Carbon Brakes Market Key Technology Landscape

The technological landscape of the Aircraft Carbon Brakes Market is defined by continuous material science innovation aimed at improving friction performance, increasing component lifespan, and reducing overall system weight. The core technology remains the production of Carbon/Carbon (C/C) composites, utilizing techniques like Chemical Vapor Infiltration (CVI) or liquid phase infiltration (LPI) to impregnate carbon preforms with carbon matrix, yielding a highly resilient material. Current advancements focus on optimizing the texture and composition of the carbon matrix, often through specialized coatings or doping, to minimize oxidation, which is a major factor in premature wear, particularly at high operational temperatures and friction energy levels.

A crucial emerging technology is the increasing adoption and refinement of Carbon-Ceramic Matrix (CCM) composites. While traditional C/C is superior to steel, CCMs incorporate ceramic materials (such as silicon carbide) into the matrix, offering even greater thermal stability, superior oxidation resistance, and marginal further weight reduction. Although CCM production is generally more complex and costly, its enhanced durability justifies the investment for certain high-performance military platforms and next-generation large commercial aircraft where minimizing MRO costs and maximizing brake life are key performance indicators. The integration of advanced non-destructive testing (NDT) methodologies, such as ultrasonic evaluation and infrared thermography, is also becoming standard for ensuring manufacturing quality.

Beyond material composition, the industry is witnessing significant technological integration at the system level. This includes sophisticated Brake-by-Wire systems replacing traditional hydraulic controls, allowing for precise electronic modulation of braking force, which reduces mechanical complexity and improves system responsiveness. Furthermore, the incorporation of embedded smart sensors (Internet of Things or IoT integration) allows for real-time monitoring of temperature profiles, wear depth, and vibration characteristics. These intelligent braking systems feed critical data into AI-driven predictive maintenance platforms, maximizing the component's utilization and enhancing overall safety and efficiency, representing the future direction of the aircraft braking technology.

Regional Highlights

- North America: North America holds the largest market share, driven by the presence of major OEMs (Boeing, Lockheed Martin), significant military expenditure, and a highly established MRO ecosystem. The U.S. commercial fleet is one of the world's largest, ensuring constant demand for aftermarket services. Technological leadership in composite manufacturing and adherence to stringent FAA standards further solidify the region's dominance.

- Europe: Europe represents the second-largest market, primarily due to the operations of Airbus and key component manufacturers like Safran and Meggitt. The region benefits from a high volume of intra-European flights (narrow-body focused) and substantial MRO capabilities provided by major flag carriers and independent providers. Strict EASA regulations mandate high maintenance standards, fueling reliable aftermarket growth.

- Asia Pacific (APAC): APAC is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This explosive growth is attributed to surging air passenger traffic, unprecedented fleet expansion by Chinese and Indian carriers, and increasing government investments in military modernization programs, particularly in Japan, South Korea, and India. The increasing establishment of localized MRO centers is crucial for supporting this rapid expansion.

- Middle East and Africa (MEA): The MEA region shows strong growth, primarily concentrated in the Gulf Cooperation Council (GCC) states. This growth is driven by significant investments in major airline hubs (Emirates, Qatar Airways) operating large fleets of wide-body aircraft, which are heavy users of carbon brakes. Infrastructure development and strategic geographic positioning as a global transit hub ensure sustained demand for high-quality MRO services.

- Latin America (LATAM): LATAM’s market development is moderate, driven by localized regional jet production (Embraer) and fleet replacement cycles across major carriers in Brazil and Mexico. Economic volatility can occasionally dampen new aircraft procurement, but the underlying demand for reliable MRO services for existing fleets ensures steady replacement volumes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aircraft Carbon Brakes Market, analyzing their product portfolios, technological capabilities, geographical reach, and strategic initiatives, which include mergers, acquisitions, and long-term supply agreements. These players largely control both the OEM and the high-margin aftermarket segments.- Safran S.A. (via Messier-Bugatti-Dowty)

- Honeywell International Inc.

- Meggitt PLC (now part of Parker Aerospace)

- Collins Aerospace (A division of RTX Corporation)

- SGL Carbon SE

- Brake Authority

- Triumph Group, Inc.

- The Nordam Group

- Lufthansa Technik AG (MRO Focus)

- Eaton Corporation

- Kratos Defense & Security Solutions

- UTC Aerospace Systems (Legacy Entity)

- Dunlop Aircraft Tyres

- Revima Group

- Aerosystems (A subsidiary of leading aerospace groups)

- Chambard-Braking Systems

- Turbomeca (SME specialized supplier)

- B/E Aerospace (Now part of Collins Aerospace)

- Airbus MRO Services

- Boeing Global Services

Frequently Asked Questions

Analyze common user questions about the Aircraft Carbon Brakes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of carbon brakes over traditional steel brakes in aviation?

The primary advantage is significant weight reduction, typically several hundred kilograms per aircraft, leading to substantial fuel savings. Additionally, carbon composites offer superior thermal energy absorption and dissipation capacity, greatly improving braking performance and wear life under high stress.

Which end-user segment generates the highest revenue in the Aircraft Carbon Brakes Market?

The Aftermarket (MRO) segment generates the highest revenue. Carbon brake discs are life-limited components requiring periodic replacement due to wear, creating consistent, high-volume demand and stable profit margins for manufacturers throughout the life of the aircraft.

How do Carbon-Ceramic Matrix (CCM) brakes differ from standard Carbon/Carbon (C/C) brakes?

CCM brakes integrate ceramic materials, such as silicon carbide, into the carbon matrix. This modification provides enhanced resistance to oxidation and superior thermal stability compared to traditional C/C brakes, leading to longer service life, particularly in demanding operational environments.

What role does Artificial Intelligence (AI) play in the future of aircraft braking systems?

AI is crucial for predictive maintenance (PdM). It analyzes real-time sensor data on brake performance and wear to accurately predict the remaining useful life of components, optimizing maintenance scheduling, reducing operational costs, and preventing premature replacement.

Which geographical region is expected to show the fastest growth in carbon brake adoption?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This is driven by massive fleet expansions, rising air travel demand, and increasing investments in localized MRO capabilities across countries like China, India, and Southeast Asia.

Are carbon brakes used on all types of commercial aircraft?

Carbon brakes are standard equipment on most modern commercial aircraft, especially wide-body and narrow-body mainline jets (A320neo, B737 MAX, B787, A350). While some older or smaller regional and general aviation aircraft may still use steel, new designs overwhelmingly favor carbon due to the efficiency benefits.

What is the primary constraint impacting the market growth of new carbon brake manufacturers?

The primary constraint is the extremely high barrier to entry, specifically the capital required for specialized manufacturing facilities (like CVI reactors) and the lengthy, rigorous certification processes (FAA/EASA qualification), which creates a near-oligopoly dominated by established aerospace component suppliers.

How does the shift towards electric aircraft influence the carbon brake market?

While fully electric aircraft (e.g., eVTOLs) might employ different braking strategies, larger hybrid or conventional aircraft are incorporating electric taxi systems. These systems reduce the wear incurred during ground operations but maintain the essential requirement for reliable, high-energy carbon braking during landing and emergency stops, thus sustaining core demand.

What is the typical lifespan of a carbon brake assembly?

The lifespan is measured in landings or cycles, not time, and varies significantly based on aircraft type and operational severity. Modern carbon brake packs typically last between 2,500 and 3,500 landings, which is substantially longer than the 500-1,000 landings typically achieved by steel brakes.

Who are the key suppliers for raw carbon fiber used in aerospace brakes?

Key suppliers are generally specialized chemical and materials companies, often collaborating closely with the brake manufacturers. Companies like SGL Carbon SE and Toray Industries are important upstream providers, supplying the highly engineered precursors necessary for the aerospace-grade carbon-carbon composites.

What safety regulations govern the use and maintenance of carbon braking systems?

Carbon braking systems are governed by strict regulations from aviation authorities such as the Federal Aviation Administration (FAA) in the US and the European Union Aviation Safety Agency (EASA). These regulations cover design standards, manufacturing quality assurance, authorized maintenance procedures, and required component traceability to ensure maximum flight safety.

What defines the OEM segment's significance in this market?

The OEM segment, though smaller in immediate revenue compared to the Aftermarket, is strategically critical. Winning an OEM contract secures the supplier's position for the entire operational life of that aircraft model, guaranteeing decades of high-margin aftermarket revenue through proprietary replacement parts and certified MRO services.

How does brake refurbishment (re-carbonization) work?

Re-carbonization is a specialized process where worn carbon discs are treated to restore their structural integrity and friction capabilities. This typically involves placing the used disks back into a furnace environment and applying specialized CVI techniques to replenish the carbon matrix that has been oxidized or worn away during use, extending the usable life of the expensive component.

What influence do fuel price fluctuations have on carbon brake demand?

High fuel prices directly incentivize airlines to seek maximum efficiency. Since carbon brakes offer significant weight savings compared to steel, high fuel costs accelerate the replacement of legacy steel systems and drive demand for newer, lighter carbon-ceramic variants, strengthening the market position of carbon technology.

Are independent MRO providers allowed to service carbon brake systems?

Yes, but only if they are certified by the component manufacturer (OEM) and the relevant aviation authority (e.g., FAA Part 145 certified). Because carbon brake servicing often involves proprietary processes and specialized equipment for re-carbonization and inspection, many OEMs prefer to keep this lucrative work in-house or with closely controlled, authorized partners.

What is the current trend regarding the carbon brake adoption in military transport aircraft?

Military transport aircraft, which frequently operate from austere or short runways and carry heavy loads, are increasingly adopting carbon brakes. The superior heat dissipation and reduced maintenance requirements of carbon are essential for rapid turnaround times and reliability in demanding operational scenarios, driving steady demand for high-strength military specifications.

How are environmental concerns addressing the disposal of worn-out carbon brakes?

The industry is actively researching recycling methods for spent carbon composite material, given the high energy and resource input required for their initial manufacture. While direct material reuse is challenging, efforts focus on reclaiming valuable elements or safely disposing of materials according to strict environmental regulations, minimizing the overall ecological footprint of MRO processes.

Which geographical region is showing increased localized manufacturing investments?

Asia Pacific, particularly China and India, is seeing increased localized investment in MRO and, to a lesser extent, component manufacturing facilities. This trend is driven by government policies aimed at self-sufficiency in aerospace supply chains and the need to reduce the high logistics costs and lead times associated with sending components back to North America or Europe for servicing.

What is the significance of the anti-skid control unit in modern carbon braking?

The anti-skid control unit (ASC) is vital for maximizing braking efficiency and safety. It continuously monitors wheel rotation and hydraulic pressure to prevent skidding, ensuring optimal friction is maintained. In modern systems, the ASC works synergistically with electric braking controls to extend the life of the carbon discs by preventing excessive localized wear.

How does consolidation among major aerospace suppliers affect the carbon brake market?

Consolidation, such as the acquisition of Meggitt or the formation of large entities like Collins Aerospace, reduces the number of primary competitors. This typically results in increased market power for the remaining few suppliers, potentially leading to higher pricing power in the aftermarket segment and fewer options for OEMs seeking new technology partnerships.

What are the typical operating temperatures experienced by carbon brake discs during landing?

During a high-speed, heavy-weight landing, the temperature of carbon brake discs can momentarily spike well above 1,000 degrees Celsius (1,800+ degrees Fahrenheit). The exceptional thermal stability of carbon composite materials is what allows the brakes to absorb this massive kinetic energy without catastrophic failure or significant loss of friction coefficient (fade).

What are the major challenges in the supply chain for carbon brake manufacturing?

Challenges include maintaining the supply of high-purity, specialized carbon fibers, managing the energy-intensive CVI process which has high utility costs, and navigating complex logistics for the global distribution of highly regulated aerospace components, particularly concerning proprietary materials and intellectual property security.

Is there a noticeable price difference between carbon and steel brake systems at the point of installation?

Yes, carbon brake systems typically have a much higher initial purchase price than steel systems. However, this higher upfront cost is justified over the aircraft's operational life due to the carbon brakes' vastly superior longevity, leading to reduced total life-cycle maintenance costs (TCMC) and significant fuel savings.

How do fleet retirement schedules influence long-term market forecasts?

Fleet retirement schedules pose a long-term risk to specific aftermarket segments. When an older aircraft type (e.g., Boeing 747 Classics) is phased out, the demand for its specific, specialized carbon brake components ceases. However, this is usually offset by new aircraft orders, which guarantee new long-term aftermarket revenue streams for manufacturers.

What is the role of sensor integration in optimizing carbon brake performance?

Sensors are integrated to monitor key parameters like brake temperature, hydraulic pressure, and physical wear distance. This data is essential for real-time monitoring by the pilot, triggering automated anti-skid responses, and feeding data to ground systems for predictive maintenance planning, ensuring the brakes operate within their safest and most efficient envelope.

Which key parameters define the quality and performance of a carbon brake disc?

Key parameters include density uniformity (crucial for strength), specific heat capacity (for energy absorption), friction coefficient stability across the operational temperature range, and resistance to thermal oxidation. Manufacturing consistency in the CVI process is paramount to achieving these quality metrics and ensuring certification compliance.

Is the market for carbon brakes susceptible to counterfeit parts?

Yes, due to the high cost and constant demand, the aftermarket is susceptible to non-certified or counterfeit parts. However, rigorous industry regulations, mandatory traceability of components, and the necessity of specialized OEM tooling and expertise for servicing mitigate this threat, forcing airlines to rely primarily on authorized channels for safety compliance.

How do regional jet fleets impact the demand for carbon brakes?

Modern regional jets (RJ's) increasingly utilize carbon brakes to maximize efficiency and reduce weight, especially those designed for high-frequency short-haul routes. RJs often have higher cycles per flight hour than long-haul aircraft, leading to relatively high annual brake wear rates and robust aftermarket demand proportional to fleet utilization.

What technological advancements are expected in carbon braking systems by 2033?

By 2033, the market expects wider adoption of fully integrated smart braking systems incorporating AI for real-time diagnostic health checks, standardization of advanced Carbon-Ceramic Matrix materials for mainstream commercial platforms, and further development of regenerative braking compatibility to minimize friction material wear.

How does geopolitical instability influence military segment demand for carbon brakes?

Geopolitical instability often leads to accelerated fleet modernization and increased operational readiness among nations, directly boosting defense spending on high-performance military aircraft. This heightens the demand for specialized, high-spec carbon braking systems required for fighter and transport platforms designed for rapid deployment and high G-force operations.

Why is the material processing phase considered the bottleneck in carbon brake manufacturing?

The carbonization and graphitization stages, particularly those using Chemical Vapor Infiltration (CVI), are extremely time-consuming, energy-intensive, and require precise temperature and pressure control over long cycles (sometimes weeks). This inherent slowness of the material growth process limits throughput capacity and creates a critical bottleneck in the overall supply chain.

What is the impact of reduced aircraft utilization (e.g., during pandemics) on the MRO market?

Reduced aircraft utilization temporarily decreases the demand for brake replacements, as wear is cycle-dependent (landing/takeoff). However, as utilization normalizes, demand rapidly rebounds. Furthermore, during ground storage, airlines may use the downtime for scheduled heavy maintenance, including brake refurbishment, stabilizing MRO activity.

What is the current market focus regarding material research—cost reduction or performance enhancement?

The current market focus is balanced, but performance enhancement remains paramount, as safety is non-negotiable. Manufacturers are primarily focused on enhancing lifespan (wear resistance) and thermal limits (performance) while simultaneously employing process optimization and vertical integration to achieve incremental cost reductions necessary to maintain competitive pricing against rivals.

How important are exclusive supply agreements in securing market share?

Exclusive, long-term supply agreements between brake manufacturers and major OEMs (Airbus/Boeing) are fundamental. They not only guarantee initial installation revenue but, more importantly, lock in the entire aftermarket revenue stream for the duration of the airframe's life, effectively securing market share for decades and limiting competition.

Does general aviation (private jets) significantly contribute to the carbon brake market size?

While general and business aviation contributes to market revenue, its share is smaller compared to commercial and military segments. However, modern, high-performance business jets increasingly adopt carbon brakes for weight savings and superior stopping power, representing a growing, niche segment with specialized requirements and high-value components.

What measures are taken to prevent oxidation in carbon brakes?

Oxidation, which accelerates wear, is often mitigated through the application of specialized anti-oxidative coatings (e.g., silicon carbide or boron compounds) on the surface of the carbon discs. Furthermore, optimizing the internal microstructure and density of the carbon matrix during manufacturing provides intrinsic protection against atmospheric oxygen penetration at high operating temperatures.

What influence do environmental regulations have on braking system design?

Environmental regulations, particularly those concerning CO2 emissions and noise, indirectly influence braking system design. Lighter carbon brakes contribute to lower aircraft weight, directly supporting fuel efficiency targets and reducing emissions. While brakes themselves are not major noise sources, overall system efficiency aligns with broader regulatory pushes for sustainable aviation.

How do brake-by-wire systems improve carbon brake utilization?

Brake-by-wire systems replace heavy hydraulic lines with electronic signals, enabling highly precise and rapid control over braking actuation. This electronic modulation ensures equal and optimal force distribution across all wheels, minimizing localized wear spots and maximizing the effective lifespan of the expensive carbon brake components.

What is the relationship between the tire market and the carbon brake market?

The two markets are complementary and interlinked through MRO cycles. Both tires and brakes are high-wear components requiring frequent replacement and servicing, often performed concurrently during routine maintenance checks. Manufacturers frequently coordinate product development, ensuring compatibility between the tire's load rating and the brake's kinetic energy absorption capacity.

How does the complexity of carbon brake repair affect MRO costs?

The complexity of carbon brake repair (re-carbonization) requires specialized, high-cost equipment, highly trained technicians, and stringent quality control, driving up MRO costs compared to simple component replacement. This complexity reinforces the high value captured by certified repair centers and the original component manufacturer.

What is the current market trend regarding weight reduction in braking systems?

The unrelenting pressure to reduce aircraft weight continues to drive demand for the lightest possible braking solutions. This trend favors advanced, low-density carbon composites (C/C and CCM) and lightweight component housings (e.g., aluminum alloy calipers), contributing significantly to the overall market value proposition of carbon brake technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager