Aluminum Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432911 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Aluminum Tube Market Size

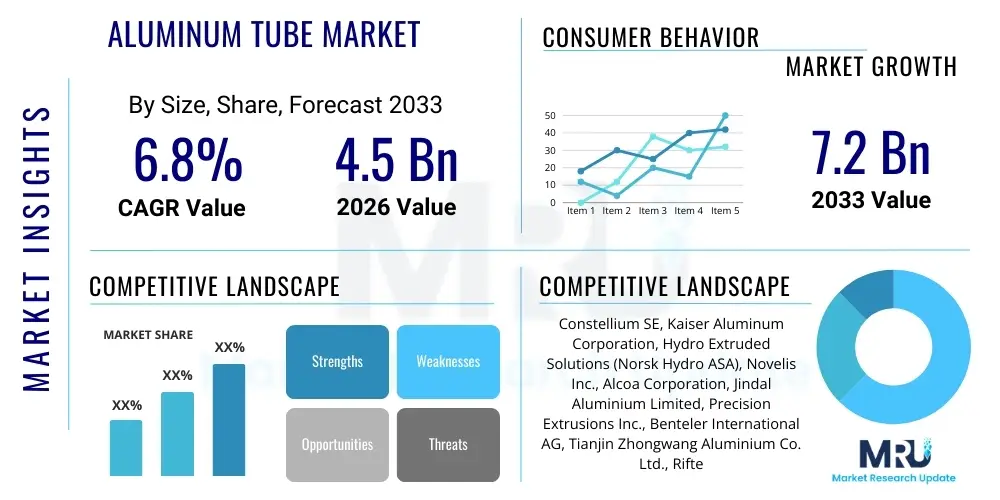

The Aluminum Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the increasing global emphasis on lightweighting solutions across key industries, particularly in the automotive sector for electric vehicle (EV) manufacturing and in the heating, ventilation, and air conditioning (HVAC) industry due to the shift toward environmentally friendly refrigerants requiring high-pressure resistance.

Aluminum Tube Market introduction

The Aluminum Tube Market encompasses the production and distribution of various tubular products manufactured from aluminum and its alloys. These tubes are highly valued across industrial applications due to aluminum's inherent benefits, including low density, high strength-to-weight ratio, excellent corrosion resistance, superior thermal conductivity, and ease of recycling. Products range from seamless drawn tubes, preferred for high-pressure systems like heat exchangers and fluid transfer lines, to extruded tubes, widely used in structural and less critical fluid conveyance applications.

Major applications of aluminum tubes span several high-growth sectors. The automotive industry utilizes them extensively for structural components, chassis parts, brake lines, and thermal management systems, especially within the rapidly expanding electric vehicle segment where weight reduction is paramount for battery efficiency. Furthermore, the construction sector leverages aluminum tubes for window frames, scaffolding, and architectural elements, while the HVAC and refrigeration industries depend on them for condensers, evaporators, and line sets, driven by regulatory changes mandating high-efficiency cooling technologies.

The core benefits driving market demand include improved fuel efficiency in transport applications due to lightweighting, extended product lifespan resulting from corrosion resistance, and alignment with global sustainability goals through high recyclability. Key driving factors include stringent emission standards compelling automotive OEMs to reduce vehicle weight, robust infrastructure development in emerging economies, and technological advancements in aluminum alloys enabling higher performance characteristics under extreme conditions, thus solidifying aluminum tubes as a critical material across modern manufacturing supply chains.

Aluminum Tube Market Executive Summary

The Aluminum Tube Market is characterized by robust business trends centered on sustainability, technological specialization, and supply chain resilience. Key business trends include the increasing adoption of specialized aluminum alloys, such as the 6xxx series, which offer superior formability and strength required for complex automotive parts, and a greater focus on automation in extrusion and drawing processes to enhance production efficiency and maintain tight tolerances. Geographically, Asia Pacific remains the dominant manufacturing and consuming region, propelled by massive industrial output and infrastructural investments in countries like China and India. Simultaneously, North America and Europe demonstrate rapid growth driven by high-value applications, stringent environmental regulations, and the aggressive electrification of their vehicle fleets, prioritizing tubes optimized for thermal management systems in EVs.

Segment trends reveal a strong preference for extruded tubes due to their cost-effectiveness and versatility, although the demand for seamless tubes, essential for high-pressure fluid conveyance systems, is expanding significantly, especially within industrial hydraulics and aerospace. Application-wise, the automotive segment dominates, with its growth trajectory inextricably linked to the production volumes of EVs and plug-in hybrid electric vehicles (PHEVs). Furthermore, the industrial machinery segment shows consistent demand, benefiting from the need for lightweight and robust pneumatic and hydraulic lines. The competitive landscape is moderately fragmented, with large integrated aluminum producers focusing on vertical integration and niche players specializing in ultra-precise or custom alloy tubing solutions.

The market trajectory is heavily influenced by fluctuating raw material prices (LME aluminum prices) and the industry’s capacity to adopt advanced manufacturing technologies, such as Friction Stir Welding (FSW) for complex assemblies. Long-term profitability hinges on manufacturers' ability to secure stable, sustainable primary or secondary (recycled) aluminum sources and to continuously invest in R&D to meet the evolving technical specifications of demanding end-users, particularly concerning miniaturization and increased pressure ratings in heat exchanger applications. The overall outlook remains highly positive, supported by foundational shifts toward energy efficiency and lightweight construction globally.

AI Impact Analysis on Aluminum Tube Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Aluminum Tube Market primarily focus on operational efficiency, quality assurance, and predictive supply chain management. Common themes include how AI can optimize the highly energy-intensive extrusion process, whether machine learning models can predict and prevent defects in real-time during drawing and forming, and how AI-driven analytics can mitigate the risks associated with volatile aluminum feedstock pricing and complex global logistics. Users anticipate AI will fundamentally shift quality control from manual inspection to automated, highly precise scanning, ensuring tighter material specifications for critical applications like aircraft components or EV battery cooling lines. There is also significant interest in using AI for optimizing energy consumption within production facilities, aligning with the industry's sustainability commitments, and improving overall equipment effectiveness (OEE) by predicting maintenance needs well in advance of failure.

- AI-driven Predictive Maintenance: Utilizing sensor data from extrusion presses and drawing machines to forecast equipment failure, minimizing downtime, and extending asset lifespan.

- Enhanced Quality Control (QC): Employing computer vision and machine learning algorithms for real-time defect detection (cracks, wall thickness variation) during manufacturing, significantly reducing waste.

- Process Optimization: AI models adjusting parameters (temperature, pressure, speed) during the extrusion process to maximize throughput, optimize material yield, and reduce energy consumption.

- Supply Chain and Price Forecasting: Utilizing complex algorithms to analyze global commodity markets and logistics data, enabling better procurement strategies for raw aluminum and minimizing exposure to price volatility.

- Automation in Handling and Sorting: Implementing intelligent robotic systems for precise handling, cutting, and sorting of finished tubes based on complex order specifications, improving labor efficiency.

- Product Design Simulation: Using generative design and AI simulation tools to optimize tube geometry and alloy composition for specific end-use requirements (e.g., maximum heat transfer or structural rigidity) before physical prototyping.

- Energy Consumption Management: Deploying AI to manage and optimize power distribution and consumption across high-energy processes like melting, alloying, and heat treating.

DRO & Impact Forces Of Aluminum Tube Market

The dynamics of the Aluminum Tube Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal/external Impact Forces. A primary driver is the accelerating shift towards electric vehicles globally, demanding lightweight aluminum tubes for battery enclosures, thermal management systems, and structural safety components. Concurrently, increasing infrastructure spending and the recovering construction sector globally continue to generate steady demand. However, the market faces significant restraints, most notably the high volatility and periodic sharp increases in primary aluminum prices, which directly affect manufacturing costs and profitability, alongside the considerable energy intensity required for aluminum production, leading to higher operational expenditure and environmental scrutiny. These forces necessitate strategic raw material sourcing and ongoing investment in energy-efficient technology to maintain competitive pricing structures.

Significant opportunities exist in the burgeoning demand for specialized, high-performance alloys, particularly those tailored for extreme temperature and pressure applications in the aerospace and advanced industrial sectors. Furthermore, the push for circular economy models provides an opportunity for increased adoption of recycled aluminum (secondary aluminum), which significantly reduces the carbon footprint associated with production, appealing strongly to environmentally conscious OEMs. Technological advancements in precise fabrication techniques, such as hydroforming and advanced welding, also open new markets for complex, high-tolerance tube assemblies, allowing aluminum tubes to replace traditional heavier materials in sophisticated applications.

The impact forces are driven by regulatory changes, such as stricter global emission standards (mandating lightweighting) and evolving refrigerant regulations (driving demand for specialized HVAC tubing), alongside macroeconomic factors like industrial output growth and geopolitical stability affecting trade routes and commodity supply. Competition from substitute materials, such as high-strength plastics, composites, and specialized steels, acts as a perpetual external force compelling aluminum tube manufacturers to continuously innovate on strength, cost, and weight efficiency. The collective impact of these forces suggests a market trajectory favoring manufacturers capable of delivering high-precision, sustainably sourced, and cost-effective tubular solutions tailored to specific, demanding end-user requirements across the automotive and industrial sectors.

Segmentation Analysis

The Aluminum Tube Market is highly diversified and segmented based on various technical and functional characteristics, allowing manufacturers to cater to the specific demands of a broad range of industries. Segmentation by product type (seamless vs. extruded) is critical, as seamless tubes offer superior integrity and pressure capabilities necessary for heat exchangers and demanding fluid lines, while extruded tubes provide cost efficiency and design flexibility for structural applications. Further segmentation by alloy type, particularly between the 1xxx (pure aluminum for conductivity), 3xxx (manganese alloys for moderate strength and corrosion resistance), and 6xxx series (magnesium and silicon alloys for structural strength and weldability), determines the suitability for end-use environments, profoundly impacting market strategies and R&D efforts. This granular segmentation enables precise market positioning and competitive analysis based on specialized product offerings and target vertical applications.

- Product Type:

- Seamless Tubes

- Extruded Tubes

- Drawn Tubes

- Alloy Type:

- 1xxx Series (e.g., 1050, 1100)

- 3xxx Series (e.g., 3003)

- 5xxx Series (e.g., 5052)

- 6xxx Series (e.g., 6061, 6063)

- 7xxx Series (e.g., 7075)

- Application:

- Automotive (Heat Exchangers, Brake Lines, Structural Components)

- HVAC and Refrigeration (Condenser Coils, Line Sets, Evaporators)

- Construction and Infrastructure (Window Frames, Scaffolding)

- Industrial Machinery and Equipment (Hydraulic/Pneumatic Lines)

- Aerospace and Defense

- Consumer Goods and Packaging

- Diameter/Size:

- Small Diameter (Micro-port tubes, capillary tubes)

- Medium Diameter

- Large Diameter

- End-Use Industry:

- OEMs (Original Equipment Manufacturers)

- Tier 1 and Tier 2 Suppliers

- Aftermarket/Replacement

Value Chain Analysis For Aluminum Tube Market

The value chain for the Aluminum Tube Market begins with the upstream segment involving the sourcing of raw materials, primarily bauxite mining, followed by the complex and energy-intensive smelting and refining of primary aluminum, or the collection and processing of secondary (recycled) aluminum scrap. Key activities at this stage include alloying, where specific elements like magnesium, silicon, or manganese are added to molten aluminum to achieve the desired mechanical and thermal properties for tubular applications. Manufacturers often procure standard billets or specialized ingots from integrated aluminum producers. Cost control and sustainability initiatives are heavily concentrated in this upstream phase, particularly regarding energy input and carbon footprint reduction, which directly influence the final cost structure of the tube product.

The midstream phase, which encompasses the core manufacturing process, involves converting aluminum billets into tubes using specialized techniques such as hot or cold extrusion, drawing, or welding/forming. Extrusion is highly prevalent for high-volume structural tubes, while drawing is reserved for producing seamless tubes with high precision and tight tolerances required for critical fluid handling. Value is added through secondary processing steps like cutting, bending, heat treatment (T4, T6), surface finishing, and custom fabrication (e.g., flaring or end forming). Investment in advanced machinery, automation, and quality control systems is essential in this phase to maintain product quality and operational efficiency.

The downstream analysis focuses on distribution channels and end-user engagement. Distribution is generally managed through a mix of direct sales to large Original Equipment Manufacturers (OEMs) in the automotive and HVAC sectors, and indirect channels utilizing large industrial distributors or metal service centers that handle inventory, cutting, and just-in-time delivery for smaller fabricators and maintenance, repair, and operations (MRO) clients. The proximity to key manufacturing hubs (e.g., automotive clusters) significantly influences logistical efficiency. The effectiveness of the distribution channel is measured by speed, inventory management efficiency, and the ability to provide value-added services such as kitting or pre-assembly, crucial factors in competitive tender processes within the industrial purchasing landscape.

Aluminum Tube Market Potential Customers

Potential customers for aluminum tubes are diverse and span multiple high-volume and high-specification industrial sectors, driven by the need for lightweight, durable, and corrosion-resistant components. The most significant customer base resides within the automotive sector, encompassing major global vehicle manufacturers (OEMs) and their Tier 1 suppliers who purchase large volumes for heat exchange systems (radiators, condensers), brake and fuel lines, and increasingly for structural battery cooling plates and chassis components in electric vehicles. These customers demand strict adherence to alloy specifications, dimensional accuracy, and certification standards (e.g., IATF 16949).

Another critical customer segment is the HVAC and refrigeration industry, including manufacturers of residential, commercial, and industrial cooling equipment. These buyers require specific alloy tubes optimized for heat transfer efficiency and resistance to new, higher-pressure, and often corrosive refrigerants (like R-32 or CO2). Furthermore, major construction contractors and architectural material suppliers constitute a steady demand source, seeking aluminum tubes for their structural integrity, aesthetic appeal, and minimal maintenance requirements in modern building designs and infrastructure projects, particularly in curtain wall systems and highly specialized scaffolding.

The industrial machinery and equipment sector, including manufacturers of hydraulic, pneumatic, and fluid power systems, represents a high-value customer base that prioritizes seamless tubes with exceptional pressure bearing capacity and fatigue resistance for critical applications. Finally, the aerospace and defense industries are niche but highly lucrative customers, requiring tubes made from high-strength alloys (e.g., 7xxx series) with aerospace certifications, where weight savings and reliability are paramount, often procured directly or through highly specialized metal service centers capable of handling small-batch, high-specification orders, emphasizing long-term contractual relationships and rigorous quality audits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Constellium SE, Kaiser Aluminum Corporation, Hydro Extruded Solutions (Norsk Hydro ASA), Novelis Inc., Alcoa Corporation, Jindal Aluminium Limited, Precision Extrusions Inc., Benteler International AG, Tianjin Zhongwang Aluminium Co. Ltd., Riftek, Kromet International Inc., AMETEK Specialty Metal Products, Vitkovice Cylinders a.s., Service Steel Aerospace Corp., Nippon Light Metal Company, Granges AB, Luvata, Wieland-Werke AG, Zhongfu Aluminium Co. Ltd., Custom Aluminum Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Aluminum Tube Market Key Technology Landscape

The manufacturing of high-quality aluminum tubes relies heavily on advanced forming and processing technologies designed to achieve tight dimensional tolerances, superior surface finish, and enhanced mechanical properties. The core technologies utilized include direct and indirect extrusion, which efficiently produces long lengths of tubes with complex internal geometries, particularly critical for multi-port flat tubes used in automotive heat exchangers. Continuous advancements in extrusion die design, combined with automated process control systems, are essential for minimizing scrap rates and maximizing production speed. Furthermore, the specialized technology of cold drawing is utilized to produce seamless tubing that exhibits significantly higher strength, better surface quality, and thinner walls than standard extruded products, making them indispensable for high-pressure fluid transfer systems and aerospace applications where fatigue resistance is paramount.

A secondary but increasingly critical technological focus involves fabrication and joining techniques. Technologies such as Friction Stir Welding (FSW) are being adopted for joining aluminum components, offering high-strength, defect-free welds necessary for critical assemblies like battery cooling plates, surpassing traditional welding methods which can compromise material strength. Furthermore, Hydroforming technology is increasingly applied to produce tubular components with complex, tailored shapes while maintaining structural integrity and reducing the need for multiple welded joints. This allows automotive OEMs to create optimized structural parts that contribute significantly to vehicle safety and lightweighting mandates.

Material science and surface treatment technologies also form a vital part of the market landscape. The development of advanced aluminum alloys, such as specific 6xxx and 7xxx series variants, engineered for enhanced corrosion resistance and high yield strength after heat treatment, is continuous. Surface technologies like specialized anodizing or internal coating processes are employed to protect tubes used in harsh environments or those conveying corrosive fluids, thus extending product lifespan and maintaining system efficiency. The integration of sensors and digital twinning within the production line is also emerging as a key technology for enhancing process visibility, predictive quality assurance, and achieving industry 4.0 standards across tube manufacturing facilities globally.

Regional Highlights

- Asia Pacific (APAC) stands as the largest and fastest-growing market for aluminum tubes, driven primarily by the colossal manufacturing bases in China and India. This dominance is rooted in massive industrial output across the automotive, construction, and electronics sectors. China, in particular, acts as both the world's largest consumer and producer of primary aluminum and aluminum products. The region's growth is fueled by rapid urbanization, substantial government investment in infrastructure (rail, housing), and the explosive local demand for two-wheelers and compact electric vehicles, which rely heavily on lightweight aluminum components. The competitive environment is characterized by large local players offering cost-competitive products, driving down global average manufacturing costs while simultaneously improving quality to meet export standards.

- North America is a high-value market characterized by high consumption of specialized aluminum tubes, particularly in the premium automotive, aerospace, and advanced HVAC sectors. The demand is heavily influenced by stringent fuel efficiency standards (CAFE standards) and the massive investment by OEMs into the regional production of electric vehicles. Manufacturers in this region focus on high-precision seamless and drawn tubes, leveraging advanced domestic recycling infrastructure (secondary aluminum) to meet sustainability targets. The US and Canada are significant consumers of specialized structural tubing for drilling, industrial machinery, and defense applications, prioritizing reliability and certifications.

- Europe represents a mature yet dynamic market, propelled by stringent environmental regulations and the leading role the European Union plays in automotive electrification. Demand is high for high-strength 6xxx series alloys for structural vehicle components and complex multi-port tubes for thermal management systems in EVs. European manufacturers are leaders in advanced manufacturing techniques, focusing heavily on reducing the environmental impact of production (low-carbon aluminum). The HVAC segment in Europe is shifting rapidly towards high-pressure tubes necessary for CO2 and R-290 refrigerants, providing a critical growth niche. Germany, France, and Italy are key consuming nations due to their strong automotive and industrial machinery sectors.

- Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions experiencing accelerated growth. In LATAM, growth is tied to recovering automotive production (especially in Brazil and Mexico) and essential infrastructure projects. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, showcases demand driven by large-scale construction projects, expansion of the oil and gas industry requiring specialized corrosion-resistant piping, and significant investments in renewable energy infrastructure (solar farms). While currently smaller in market size, these regions are critical for long-term expansion strategies due to ongoing industrial diversification and urbanization trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Aluminum Tube Market.- Hydro Extruded Solutions (Norsk Hydro ASA)

- Constellium SE

- Novelis Inc. (A subsidiary of Hindalco Industries)

- Kaiser Aluminum Corporation

- Alcoa Corporation

- Jindal Aluminium Limited

- Benteler International AG

- Precision Extrusions Inc.

- Tianjin Zhongwang Aluminium Co. Ltd.

- Granges AB

- AMETEK Specialty Metal Products

- Nippon Light Metal Company, Ltd.

- Luvata

- Wieland-Werke AG

- Service Steel Aerospace Corp.

- Vitkovice Cylinders a.s.

- Custom Aluminum Products Inc.

- China Zhongwang Holdings Limited

- Sapa Extrusions (now integrated into Norsk Hydro)

- Tubacex S.A. (Aluminum Division)

Frequently Asked Questions

Analyze common user questions about the Aluminum Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Aluminum Tube Market?

The market growth is primarily driven by the mandatory requirements for vehicle lightweighting, intensified by the global push for electric vehicles (EVs), the increasing adoption of aluminum in advanced HVAC systems requiring high-pressure resistance, and substantial infrastructure development across emerging economies.

How does the type of aluminum alloy impact tube performance in end-use applications?

Different alloys are chosen based on specific needs. 6xxx series alloys (containing magnesium and silicon) are preferred for structural components due to their superior strength and weldability after heat treatment, while 3xxx series alloys offer excellent corrosion resistance and formability, commonly used in general heat exchangers.

What is the difference between seamless and extruded aluminum tubes, and which applications use which type?

Seamless tubes are manufactured without a weld joint, offering superior integrity, pressure rating, and tighter tolerances, making them essential for critical fluid conveyance, aerospace hydraulics, and high-pressure HVAC systems. Extruded tubes are generally more cost-effective, versatile, and suitable for structural parts, general piping, and less demanding heat transfer applications.

Which region dominates the aluminum tube market in terms of production and consumption?

The Asia Pacific (APAC) region dominates the global market, led by China, due to its massive scale of industrial manufacturing, high rates of infrastructure investment, and large domestic demand across the automotive and construction sectors.

What are the major restraints affecting the profitability of aluminum tube manufacturers?

The two main restraints are the significant volatility in the price of primary aluminum (raw material cost) on global commodity exchanges, and the high energy consumption associated with smelting and extrusion processes, which impacts operational costs and necessitates ongoing efficiency investments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Collapsible Aluminum Tube Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aluminum Tube OPGW Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Aluminum Tube Filling and Sealing Machine Market Statistics 2025 Analysis By Application (Food Industry, Pharma, Cosmetics, Others), By Type (Full-automatic, Semi-automatic), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cold-drawn Aluminum Tube Market Statistics 2025 Analysis By Application (Aerospace, Transportation), By Type (Round Aluminum Tube, Square Aluminum Tube), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager