Amber Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432989 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Amber Glass Market Size

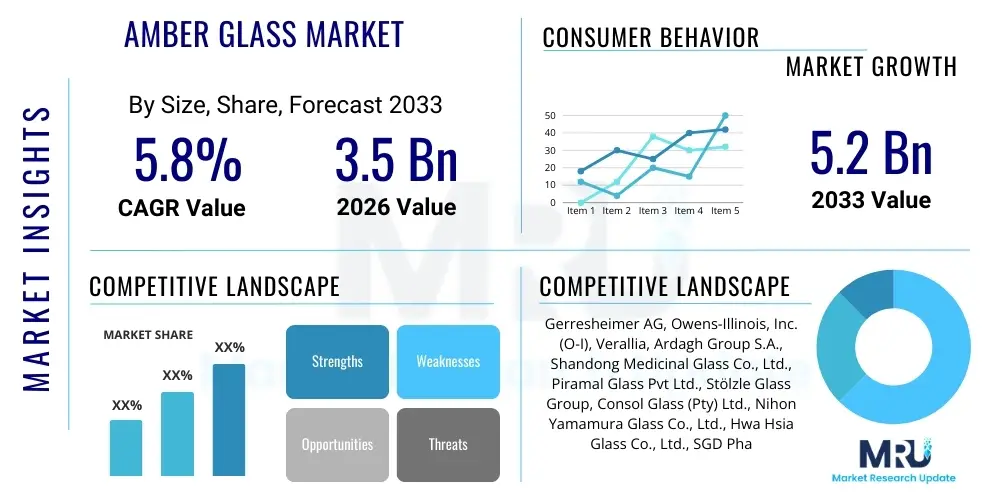

The Amber Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.2 Billion by the end of the forecast period in 2033. This consistent expansion is largely attributed to the increasing demand from the pharmaceutical and cosmetic industries, where the UV protection properties of amber glass are highly valued for preserving product integrity and shelf life. The stringent regulatory requirements concerning drug and perishable product packaging globally further cement the essential role of amber glass packaging solutions.

The resilience of the amber glass market is also fueled by growing consumer preference for sustainable packaging materials. As glass is infinitely recyclable, it aligns with global corporate environmental responsibility initiatives, positioning it favorably against plastic alternatives. Regional market growth dynamics show significant momentum in the Asia Pacific region, driven by rapid industrialization, expanding healthcare infrastructure, and rising disposable incomes leading to increased consumption of packaged goods and pharmaceuticals. The inherent barrier properties against moisture, oxygen, and UV radiation make amber glass a premium choice, sustaining high market valuation despite potential cost pressures compared to alternative materials.

Amber Glass Market introduction

The Amber Glass Market encompasses the global production, distribution, and utilization of glass materials treated with specific additives (typically sulfur, iron, and carbon) to achieve a deep brown, light-filtering hue. This type of glass is fundamentally characterized by its exceptional ability to block ultraviolet (UV) and short-wavelength blue light, which can degrade sensitive contents such such as essential oils, vitamins, pharmaceuticals, and certain food products. The manufacturing process involves precise control over raw material composition and furnace temperatures, resulting in a chemically stable and inert container that ensures product efficacy over extended periods.

Major applications of amber glass span across critical sectors including pharmaceuticals, where it is used for vials, bottles, and syringes for light-sensitive medications; beverages, particularly for craft beers and certain spirits to prevent skunking; and cosmetics, providing protective packaging for serums and essential oils. The primary benefits driving its market adoption include unparalleled product stability, regulatory compliance across major global markets, and its superior recyclability profile. Furthermore, the perceived premium quality associated with amber glass packaging contributes to brand differentiation and consumer trust, particularly in the high-end retail segments.

Key driving factors accelerating market expansion include stringent government regulations mandating protective packaging for light-sensitive drug formulations, robust growth in the global pharmaceutical industry, and the ongoing shift in consumer behavior toward natural and organic products that require maximum protection from light degradation. The expanding craft beverage industry worldwide, characterized by unique brewing processes that necessitate UV protection, also serves as a substantial demand catalyst for various amber glass bottle formats, ensuring continued market strength through the forecast period.

Amber Glass Market Executive Summary

The global Amber Glass Market exhibits strong business trends defined by capacity expansion, vertical integration among key players, and strategic focus on lightweight glass production to enhance supply chain efficiency. Market stakeholders are increasingly investing in sophisticated furnace technologies and digital printing capabilities to meet diverse customer demands for customized packaging designs while maintaining high-volume production efficiency. Mergers and acquisitions are common strategies deployed by larger entities seeking to consolidate market share, secure raw material supplies, and expand geographic reach, particularly in emerging economies where packaging demand growth rates are highest. Furthermore, the persistent demand for single-dose and specialty pharmaceutical containers is driving innovation in smaller vial and ampoule formats.

Regionally, the market presents varied dynamics. Asia Pacific (APAC) stands out as the fastest-growing region, fueled by massive investments in domestic pharmaceutical manufacturing and the proliferation of the cosmetics and personal care sector in countries like China and India. North America and Europe maintain leading market shares owing to established healthcare regulations, high consumption of packaged premium beverages, and advanced recycling infrastructures that support glass usage. Regulatory harmonization efforts across the EU and North America regarding packaging standards significantly influence product development and compliance requirements for market entry and sustained operation.

Segment trends indicate a robust dominance by the pharmaceutical segment, driven by an expanding pipeline of complex, light-sensitive biological drugs. By product type, bottles and jars constitute the largest segment, catering extensively to both the beverage and food preservation industries. However, vials and ampoules are projected to register a higher CAGR, reflecting the critical need for safe, sterile, and protective packaging solutions in injectable drug delivery systems. The convergence of sustainability goals with consumer preference is also driving growth in recycled content usage within the amber glass manufacturing process, altering raw material sourcing strategies across the industry value chain.

AI Impact Analysis on Amber Glass Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Amber Glass Market primarily focus on optimization across the complex manufacturing process, quality control, and supply chain predictability. Key themes center around how AI-driven predictive maintenance can reduce costly furnace downtime, how machine learning algorithms can enhance the consistency and quality of the amber coloration (essential for UV protection compliance), and the use of sophisticated demand forecasting to optimize inventory and reduce warehousing costs. Users are keenly interested in whether AI integration will lead to a significant reduction in operational expenditure (OPEX) and how generative design algorithms might streamline the development of new, lightweight, and customized glass container shapes without compromising structural integrity or barrier properties.

- AI-powered predictive maintenance reduces furnace downtime and optimizes energy consumption in melting processes.

- Machine learning algorithms enhance quality control by identifying microscopic defects and ensuring consistent amber color saturation for superior UV filtration.

- AI-driven supply chain optimization improves inventory management and logistics planning, particularly for fragile products like glass.

- Generative AI assists in rapid prototyping and design of customized, structurally optimized amber glass containers.

- Implementation of smart sensors and AI analytics increases operational efficiency, potentially lowering manufacturing costs per unit.

DRO & Impact Forces Of Amber Glass Market

The dynamics of the Amber Glass Market are significantly shaped by a confluence of influential factors: key drivers include the non-negotiable need for UV protection in pharmaceutical and natural cosmetic products, while restraints encompass the high initial capital investment required for furnace establishment and the volatility of energy prices crucial for glass melting. Opportunities arise from technological advancements leading to lightweighting and the increasing global emphasis on glass recycling infrastructure. These factors interact within a competitive landscape where regulatory compliance and supply chain reliability exert substantial impact forces on market participants, dictating pricing strategies and geographic market penetration.

Primary drivers sustaining market growth include the expansion of regulatory frameworks, such as the requirements set by the U.S. Pharmacopeia (USP) and European Pharmacopoeia (EP), which often necessitate light-resistant packaging for drug stability. The substantial growth in the global nutraceutical and essential oils markets, where product degradation is a major concern, also mandates the use of highly protective containers like amber glass. Furthermore, consumer perception increasingly favors glass over plastics due to environmental concerns, contributing to robust demand in the premium food and beverage sectors. The intrinsic inertness of glass ensures no leaching of harmful chemicals into the contents, which is a critical selling point in sensitive applications.

Restraints primarily revolve around the inherent limitations of glass manufacturing, particularly the energy-intensive nature of the melting process, which ties operational costs directly to volatile natural gas and electricity prices. The relatively high weight of glass compared to alternatives like PET poses logistical challenges and increases transportation costs, especially across long distances. Opportunities are abundant in adopting advanced manufacturing techniques, such as the narrow-neck press and blow (NNPB) process, which significantly reduces the weight of bottles without sacrificing strength. Additionally, penetrating emerging markets with lower existing penetration rates and expanding the use of bio-based materials in coloration processes offer new avenues for sustainable growth and differentiation.

Segmentation Analysis

The Amber Glass Market is meticulously segmented based on end-use industry, product type, and capacity, providing a granular view of demand distribution and growth potential across various applications. The segmentation analysis highlights the dominant role played by the pharmaceutical sector, demanding high-quality, standardized containers, while also showcasing the diverse needs of the beverage industry, which requires various bottle formats for differentiation. Understanding these segments is crucial for manufacturers to align their production capabilities and product offerings with specific market requirements, particularly concerning regulatory standards and capacity constraints.

- By End-Use Industry

- Pharmaceuticals (Vials, Ampoules, Syringes, Bottles for Oral Medications)

- Beverages (Beer, Spirits, Soft Drinks, Juices)

- Cosmetics and Personal Care (Essential Oils, Serums, Lotions)

- Food Packaging (Sauces, Extracts, Syrups)

- Chemicals and Laboratory Applications

- By Product Type

- Bottles and Jars (Standard Bottles, Wide-mouth Jars)

- Vials and Ampoules (Injection Vials, Diagnostic Vials)

- Others (Droppers, Custom Containers)

- By Capacity

- Up to 50 ml (Small capacity for pharmaceuticals and essential oils)

- 51 ml to 200 ml (Medium capacity for cosmetics and specific beverages)

- Above 200 ml (Large capacity for beer, spirits, and food products)

Value Chain Analysis For Amber Glass Market

The value chain for the Amber Glass Market begins with upstream activities involving the sourcing of crucial raw materials, primarily silica sand, soda ash, limestone, and cullet (recycled glass), along with specific coloring agents like sulfur, iron, and carbon. Efficiency in this initial stage is paramount, as the quality and consistency of these inputs directly influence the final glass integrity and UV protection characteristics. Key upstream challenges include managing price volatility of energy sources and ensuring a stable supply of high-quality cullet to maximize sustainability metrics and reduce reliance on virgin materials. Optimized inventory management and long-term contracts with material suppliers are essential for minimizing operational risks in the melting process.

Midstream activities encompass the complex manufacturing process: batch mixing, high-temperature melting in continuous furnaces, forming (blowing or pressing), annealing, and critical surface treatment. This stage is highly capital-intensive and requires advanced technology, particularly in forming techniques like NNPB to reduce weight. Quality control is rigorously applied here, often utilizing automated inspection systems to check for defects such as blisters, stones, or inconsistent wall thickness, which are critical for pharmaceutical-grade packaging. The downstream segment involves secondary processing, including labeling, printing, and customization, followed by packaging and distribution to end-use industries.

Distribution channels are categorized into direct and indirect methods. Direct distribution involves supplying large-volume customers, such as multinational pharmaceutical corporations and major beverage brands, directly from the manufacturing plant, often through dedicated long-term contracts. Indirect distribution utilizes specialized packaging distributors, brokers, and logistics providers to serve smaller customers, local businesses, and specific regional markets, especially within the cosmetics and specialty food sectors. The reliance on indirect channels is higher in fragmented markets, demanding robust partnerships to ensure safe and timely delivery of fragile glass products, thereby optimizing last-mile efficiency and reducing breakage rates.

Amber Glass Market Potential Customers

Potential customers for the Amber Glass Market are broadly categorized by the necessity for superior product protection against photodegradation and the requirement for inert, non-reactive packaging materials. The largest buyer segment is the global pharmaceutical industry, encompassing both generic and specialized drug manufacturers who require high-volume, sterile amber glass vials, ampoules, and bottles for injectable and oral medications, complying strictly with regulatory standards like ISO and USP guidelines. This segment demands reliability, extremely low defect rates, and consistent material certification to safeguard drug stability and efficacy throughout its shelf life, representing a non-discretionary procurement market.

The second major group comprises beverage manufacturers, particularly those in the craft brewing and premium spirits sectors. Craft beer brewers favor amber glass for its ability to shield hop compounds from UV light, preventing the formation of "skunked" flavors (lightstruck taint), a critical quality attribute for maintaining brand reputation. Similarly, high-end spirits and artisanal juice producers use amber glass to convey a premium image while offering essential UV protection for ingredients sensitive to light exposure. These buyers often require highly customized bottle shapes, specialized closures, and advanced surface treatments to support marketing and aesthetic objectives.

Additionally, the rapidly expanding cosmetics and nutraceutical industries represent a high-growth customer base. Essential oil producers, vitamin manufacturers, and organic skincare brands rely heavily on small-capacity amber glass containers (typically droppers and jars) to protect active ingredients, such as Vitamin C and retinoids, from light-induced oxidation and degradation. These customers prioritize smaller batch sizes, quick turnaround times for custom branding, and robust sustainability credentials, including the guaranteed use of high levels of Post-Consumer Recycled (PCR) content in the glass manufacturing process.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerresheimer AG, Owens-Illinois, Inc. (O-I), Verallia, Ardagh Group S.A., Shandong Medicinal Glass Co., Ltd., Piramal Glass Pvt Ltd., Stölzle Glass Group, Consol Glass (Pty) Ltd., Nihon Yamamura Glass Co., Ltd., Hwa Hsia Glass Co., Ltd., SGD Pharma, West Pharmaceutical Services, Inc., Schott AG, Vidrala, Vetropack Holding AG, Bormioli Pharma S.p.A., Hindustan National Glass & Industries Ltd., Zignago Vetro S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amber Glass Market Key Technology Landscape

The technology landscape within the Amber Glass Market is primarily focused on enhancing efficiency, reducing energy consumption, and improving the intrinsic quality of the glass product. One of the most impactful technological advancements is the deployment of Narrow Neck Press and Blow (NNPB) technology, which allows for the manufacture of significantly lighter glass containers without compromising mechanical strength or barrier performance. This reduction in material usage translates directly into lower raw material costs, reduced energy expenditure during melting, and substantial savings in transportation logistics, addressing the key restraint related to glass weight. Furthermore, the integration of advanced automation systems, including robotics for handling and packing, minimizes human error and increases line speeds, which is crucial for high-volume pharmaceutical packaging.

Another critical area of technological focus is the optimization of the melting furnace itself. Manufacturers are increasingly adopting oxy-fuel firing systems instead of traditional air-fuel combustion. Oxy-fuel systems use pure oxygen, leading to higher flame temperatures, improved heat transfer efficiency, and significantly reduced nitrogen oxide (NOx) emissions, aligning with stricter global environmental regulations. Moreover, advanced refractories and furnace designs that facilitate electric boosting (hybrid furnaces) are being utilized to manage energy costs and ensure a more consistent melt quality, essential for achieving the uniform amber color required for optimal UV protection across different product batches.

Quality assurance technology has also evolved considerably, moving from manual inspection to sophisticated machine vision and sensor-based systems. High-speed, 360-degree inspection machines utilizing polarized light and multiple cameras are now standard, ensuring every container meets rigorous dimensional, structural, and aesthetic specifications, particularly critical for pharmaceutical vials requiring perfect sealing surfaces. Additionally, manufacturers are exploring innovative barrier technologies, such as internal surface treatments (siliconization), applied post-production to enhance the chemical resistance and reduce delamination risk in specialized drug delivery systems, further cementing the market's reliance on technological precision.

Regional Highlights

The regional analysis reveals distinct market maturity and growth profiles globally, heavily influenced by local regulatory environments and industrial concentration. North America and Europe currently hold the largest combined market share, driven by highly mature pharmaceutical industries, established consumer markets for premium alcoholic beverages, and stringent regulatory frameworks that mandate high-quality packaging. In North America, the rapid expansion of the craft brewery segment, coupled with significant demand for packaging light-sensitive nutraceuticals, maintains a steady, moderate growth trajectory. European growth is supported by a strong circular economy focus, driving continuous investment in recycling capabilities and the adoption of lightweight packaging standards across key markets like Germany and France.

Asia Pacific (APAC) is projected to be the engine of future market growth, expected to register the highest CAGR during the forecast period. This acceleration is attributed to massive demographic expansion, increasing disposable incomes, and subsequent surges in demand for packaged food, cosmetics, and over-the-counter pharmaceuticals. Countries such as China and India are seeing huge domestic and foreign investments in pharmaceutical production capacity, directly translating to increased requirements for amber glass vials and bottles. Furthermore, lower operating costs compared to Western counterparts encourage global manufacturers to establish or expand production facilities in this region, further stabilizing the supply chain and catering to escalating local demand.

Latin America and the Middle East & Africa (MEA) present emerging market opportunities, characterized by growing urbanization and evolving healthcare systems. In Latin America, the strong traditional use of glass in beverage packaging, particularly for beer and sodas, acts as a foundation for market growth, with recent expansion seen in the domestic cosmetics and specialty food sectors. The MEA region, particularly the GCC countries, shows promising growth in pharmaceutical manufacturing self-sufficiency efforts, driven by governmental diversification strategies. However, market penetration in these regions can be volatile, often challenged by fragmented distribution networks and reliance on imported manufacturing technology and raw materials, requiring strategic partnerships for successful market entry.

- Asia Pacific (APAC): Highest projected CAGR, driven by booming pharmaceutical and personal care industries in China and India; focus on new capacity installations.

- North America: Market leader in terms of technological adoption and premium beverage consumption; stable demand from established pharmaceutical regulatory requirements.

- Europe: High market maturity with strong emphasis on sustainability, recycling targets, and lightweight glass innovation; key hub for high-quality packaging standards.

- Latin America: Growing consumer base and established beverage packaging market; increasing foreign investment in local manufacturing capabilities.

- Middle East & Africa (MEA): Emerging market focused on developing regional pharmaceutical self-sufficiency; opportunities in specialized cosmetic and nutraceutical imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amber Glass Market.- Gerresheimer AG

- Owens-Illinois, Inc. (O-I)

- Verallia

- Ardagh Group S.A.

- Shandong Medicinal Glass Co., Ltd.

- Piramal Glass Pvt Ltd.

- Stölzle Glass Group

- Consol Glass (Pty) Ltd.

- Nihon Yamamura Glass Co., Ltd.

- Hwa Hsia Glass Co., Ltd.

- SGD Pharma

- West Pharmaceutical Services, Inc.

- Schott AG

- Vidrala

- Vetropack Holding AG

- Bormioli Pharma S.p.A.

- Hindustan National Glass & Industries Ltd.

- Zignago Vetro S.p.A.

- Ampoule-Tech Inc.

- Nipro Corporation

Frequently Asked Questions

Analyze common user questions about the Amber Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of amber glass in packaging?

The primary function of amber glass is to provide superior protection against ultraviolet (UV) and short-wavelength blue light. This light filtration capability is essential for safeguarding sensitive contents, such as pharmaceuticals, essential oils, and certain beverages, from photodegradation and maintaining product efficacy and shelf life as required by regulatory bodies.

Which industry segment drives the highest demand for amber glass?

The Pharmaceutical industry segment is the dominant driver of demand for amber glass, particularly for high-value applications like vials and ampoules used in injectable medications, and bottles for light-sensitive oral liquids. Stringent global health regulations mandating light protection for drug stability ensure consistent high demand from this sector.

How does lightweighting technology impact the amber glass market?

Lightweighting technology, primarily through processes like Narrow Neck Press and Blow (NNPB), significantly impacts the market by reducing material costs, lowering energy consumption during manufacturing, and decreasing transportation expenses. This innovation makes amber glass more competitive against lighter packaging alternatives while retaining its barrier properties.

Is amber glass considered a sustainable packaging option?

Yes, amber glass is highly regarded as a sustainable packaging option. Glass is 100% and infinitely recyclable without loss of quality. The industry is heavily focused on increasing the percentage of cullet (recycled glass) content in manufacturing, reducing the reliance on virgin raw materials and lowering the carbon footprint of production.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region, specifically encompassing major economies like China and India, is expected to exhibit the fastest Compound Annual Growth Rate (CAGR). This rapid expansion is fueled by massive infrastructure development in domestic pharmaceutical manufacturing and significant growth in the consumer goods and cosmetic sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Amber Glass Vials Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Pharmaceutical Amber Glass Bottles Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Amber Glass Bottles Market Statistics 2025 Analysis By Application (Pharmaceuticals, Consumer Goods, Food and Beverages), By Type (Ampoules, Vials, Cartridges), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Pharmaceutical Amber Glass Bottles Market Statistics 2025 Analysis By Application (Pills, Injection), By Type (Dropper Bottles, Ampoules, Vials), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager