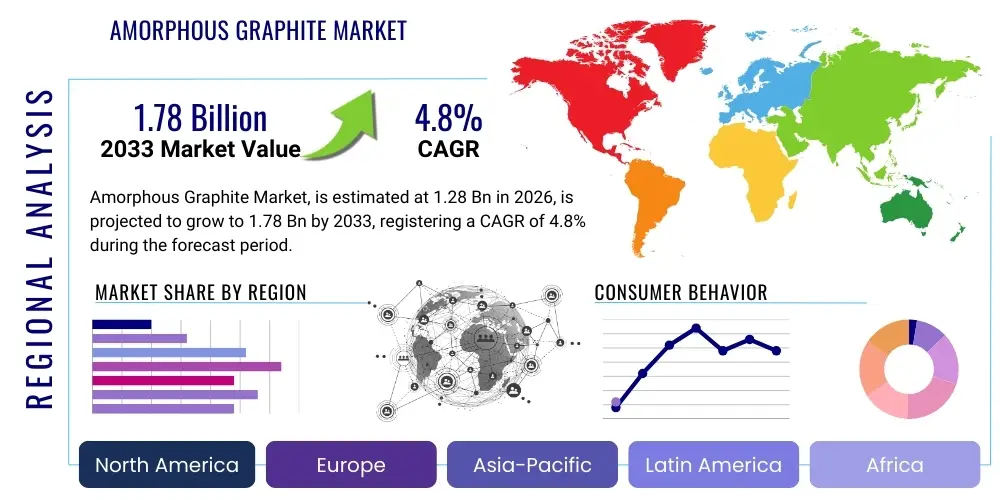

Amorphous Graphite Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440607 | Date : Feb, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Amorphous Graphite Market Size

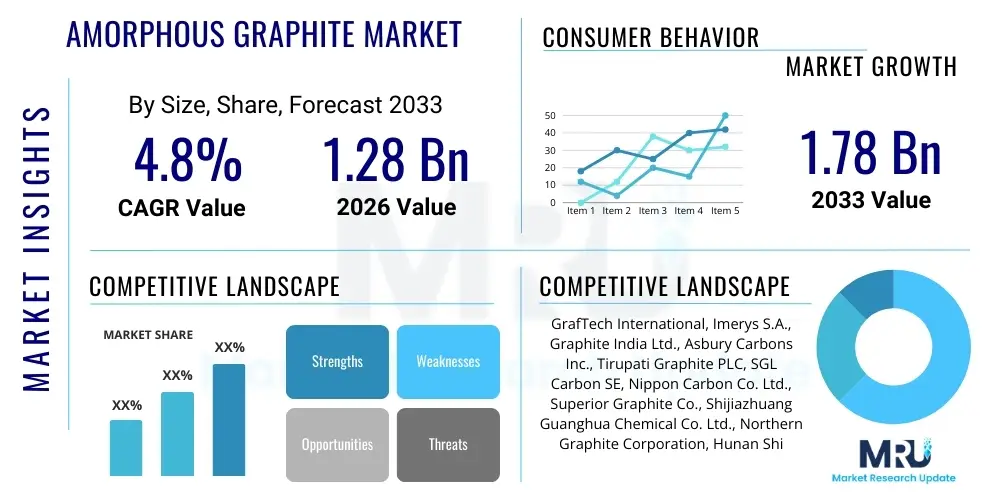

The Amorphous Graphite Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.28 Billion in 2026 and is projected to reach $1.78 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the sustained demand from traditional industrial sectors, particularly refractories and metallurgical applications, coupled with burgeoning needs from the energy storage segment where amorphous graphite acts as a critical precursor or additive in certain battery chemistries. The stability, cost-effectiveness, and availability of amorphous graphite, compared to its flake and synthetic counterparts, secure its dominant position in bulk industrial consumption.

Amorphous Graphite Market introduction

The Amorphous Graphite Market encompasses the production, processing, and consumption of naturally occurring, fine-grained, microcrystalline carbon characterized by its low-purity, high-volume usability, and cost efficiency. Unlike high-purity crystalline flake graphite, amorphous graphite is primarily utilized in applications where high fixed carbon content (typically 70% to 85%) is sufficient and cost optimization is paramount. Key industrial applications predominantly involve refractory materials used in steel and cement manufacturing, foundry coatings, brake linings, and lubricants where its thermal stability, electrical conductivity, and lubricating properties are highly valued. The product’s description centers on its geological formation in seams resulting from the metamorphism of coal deposits, yielding a material that is technically microcrystalline but termed "amorphous" due to its lack of visible flake structure.

Major applications driving the current market include the refractory industry, which uses amorphous graphite to enhance the thermal resistance and durability of bricks and monoliths in high-temperature furnaces, crucial for global steel production growth. Furthermore, the automotive sector uses it extensively in brake pads and clutch materials due to its friction-reducing capabilities and thermal management characteristics. The core benefits of utilizing amorphous graphite involve its favorable pricing structure, abundant reserves, and suitability for bulk industrial processes requiring high carbon content filler material. The primary driving factors for market expansion are rapid industrialization in emerging economies, notably in the Asia Pacific region, leading to increased steel production, and the sustained innovation in specialized refractory formulations that demand reliable and cost-effective carbon sources.

Amorphous Graphite Market Executive Summary

The Amorphous Graphite Market Executive Summary highlights a steady, moderate growth phase fueled predominantly by industrial recovery and sustained infrastructural development globally. Business trends indicate a focus on optimizing mining and beneficiation processes to enhance the fixed carbon content (FCC) purity, thereby enabling amorphous graphite to penetrate higher-value non-traditional applications previously dominated by synthetic or flake graphite. Consolidation among primary producers is observed, aiming for economies of scale and control over supply chains, particularly in regions like China and Mexico, which are major sourcing hubs. Furthermore, stakeholders are heavily investing in localized processing facilities near major consuming hubs in North America and Europe to mitigate geopolitical supply chain risks and fluctuating logistics costs, creating a more resilient market structure.

Regional trends distinctly favor the Asia Pacific (APAC) market, driven by its massive steel and cement industries, representing the largest consumption base for refractory materials globally. China and India remain the central growth engines, prioritizing infrastructural development and manufacturing expansion, which directly correlates with demand for amorphous graphite. Conversely, North America and Europe demonstrate mature market characteristics, focusing on advanced applications like high-performance polymer composites and niche energy storage additives, emphasizing material quality and sustainability standards. Segment trends show refractories maintaining the largest market share by volume, while specialized applications such as battery anode precursors and advanced lubrication agents, despite being smaller in volume, are exhibiting the highest compound annual growth rates, signaling a gradual shift toward technical grade requirements.

AI Impact Analysis on Amorphous Graphite Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Amorphous Graphite Market center on themes of operational efficiency, resource discovery, and supply chain predictive modeling. Common questions explore how AI-driven analysis can optimize mining parameters, reduce energy consumption during beneficiation, and forecast demand fluctuations driven by downstream industries like steel and electric vehicle (EV) production. The primary concerns revolve around the capital investment required for AI implementation in traditionally low-margin mining operations and the availability of specialized data scientists within the sector. Expectations include AI standardizing quality control measures for purity and moisture content, automating mineral sorting, and enhancing the safety profiles of deep mining operations. Ultimately, users expect AI to transition the market from reactive material sourcing to proactive, efficiency-led resource management, thereby improving overall profitability and resource utilization rates.

AI’s influence is rapidly emerging, primarily in optimizing the front end of the value chain. Machine learning algorithms are now being deployed to analyze geophysical data, improving the accuracy of exploration and resource modeling, which minimizes exploratory drilling costs and maximizes yield predictability. In processing plants, predictive maintenance systems powered by AI are reducing unplanned downtime of critical milling and classification equipment, leading to higher operational continuity. Furthermore, in the context of market strategy, AI algorithms are analyzing global commodity price trends, steel production forecasts, and geopolitical indicators to provide real-time pricing strategies and inventory management recommendations for producers, thus enhancing market responsiveness and competitive positioning.

- AI-driven geological modeling enhances the precision of amorphous graphite resource delineation, reducing exploration expenditures and time-to-market.

- Machine learning algorithms optimize crushing, grinding, and flotation processes to maximize fixed carbon recovery and purity levels during beneficiation.

- Predictive analytics in supply chain management stabilize procurement, inventory levels, and logistics, specifically mitigating risks related to cross-border shipping and customs delays.

- AI integration into quality control sensors enables continuous, real-time monitoring of carbon content and particle size distribution, ensuring material consistency for end-users like refractory manufacturers.

- Automated monitoring systems leveraging computer vision and sensor fusion enhance operational safety in underground mining environments by detecting structural anomalies and equipment failures preemptively.

DRO & Impact Forces Of Amorphous Graphite Market

The Amorphous Graphite Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the fundamental Impact Forces guiding market evolution. Key drivers include the robust, sustained demand from the global steel industry, which relies heavily on graphite-based refractories for furnace linings, a demand intrinsically linked to global industrialization and infrastructure spending, particularly in APAC. The inherent cost advantage of amorphous graphite over high-purity alternatives ensures its continued preference in high-volume, cost-sensitive applications. However, significant restraints challenge market growth, notably the varying quality and impurities associated with naturally occurring deposits, which necessitate costly and energy-intensive beneficiation processes, hindering its adoption in highly sensitive electronic or advanced energy applications. Furthermore, regulatory environmental pressures in key mining regions regarding waste management and processing effluent pose operational challenges, driving up compliance costs and restricting new mining ventures.

Opportunities for market growth are primarily found in the diversification of end-use applications and technological advancements. The emerging demand for conductive carbon materials in specialized polymer composites, high-performance battery additives (particularly in non-lithium-ion chemistries), and advanced friction materials presents new, higher-margin avenues. Technological innovation in purification techniques, such as advanced acid leaching or thermal upgrading, allows producers to achieve higher Fixed Carbon Content (FCC) levels, opening the door for amorphous graphite to compete in markets traditionally reserved for synthetic grades. The impact forces are thus heavily weighted by global economic vitality, as evidenced by steel production metrics, and the speed at which producers can address purity constraints through innovative processing technologies.

Another crucial impact force is the geopolitical concentration of supply, particularly with major reserves and processing capacity located in China. Any shifts in export policies or mining regulations within these dominant supply nations can instantly impact global pricing and security of supply for international consumers. This concentration necessitates strategic hedging and long-term procurement agreements by major industrial consumers in North America and Europe. The shift towards sustainable industrial practices is an overarching opportunity, as amorphous graphite is viewed as a foundational material for high-efficiency refractory linings, which ultimately reduce energy consumption in downstream metallurgical processes, supporting global efforts toward energy conservation.

Segmentation Analysis

The Amorphous Graphite Market segmentation provides a crucial framework for understanding the diverse applications and underlying value propositions of this material. The market is primarily segmented based on Fixed Carbon Content (FCC), defining the purity required for different industrial uses; Application, detailing the end-use sectors; and geography. The FCC segmentation is vital as it directly dictates the material’s price and suitability, ranging from lower-grade material (70-75% FCC) used primarily in basic foundry applications to higher-grade material (80-85% FCC) essential for critical refractory bricks and high-performance friction products. The diversity in required specifications means producers must maintain flexible processing capabilities to serve varied industry demands efficiently.

Application segmentation reveals the refractory industry as the dominant consumer, leveraging graphite’s thermal resilience in magnesia-carbon bricks and continuous casting molds. Other significant applications include metallurgical processes where amorphous graphite acts as a carbon raiser to adjust the final carbon content in steel and cast iron production, ensuring desired mechanical properties. Furthermore, its use in specialized lubricants and pencil leads, while smaller in volume, represents stable, mature markets requiring consistent particle size and purity. Analyzing these segments is critical for forecasting, as the growth rates of these industries (e.g., rapid expansion in the electric arc furnace steel sector) directly influence demand intensity for the respective graphite grades.

- By Fixed Carbon Content (FCC):

- Low Purity (70% - 75%)

- Medium Purity (75% - 80%)

- High Purity (80% - 85%)

- By Application:

- Refractory Materials (e.g., Magnesia-Carbon Bricks, Monolithics)

- Metallurgy (e.g., Carbon Raisers, Fluxing Agents)

- Friction Products (e.g., Brake Linings, Clutch Facings)

- Pencils and Writing Instruments

- Lubricants and Greases

- Foundry Coatings and Molds

- Advanced Materials and Composites

- By End-Use Industry:

- Steel and Iron Manufacturing

- Automotive

- Chemical and Petrochemical

- Foundry and Casting

- Aerospace and Defense

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Amorphous Graphite Market

The value chain for the Amorphous Graphite Market commences with upstream activities involving geological exploration, mining, and initial beneficiation. Upstream analysis focuses on securing access to high-quality deposits, characterized by thick seams and relatively low impurity content, followed by efficient crushing, grinding, and flotation processes necessary to separate the graphite carbon from gangue material. The profitability at this stage is highly sensitive to energy costs and regulatory burdens related to land use and environmental compliance. Key players in the upstream segment invest heavily in technological improvements for dry processing and advanced flotation reagents to maximize yield and minimize water consumption, addressing both efficiency and sustainability concerns.

Midstream activities involve sophisticated purification and sizing, where the crude concentrate is refined to meet specific FCC requirements through acid treatments, thermal upgrading, or micronization, tailoring the product for specialized applications like battery additives or high-end friction materials. Distribution channels are typically dual: direct sales to large, strategic end-users, such as major refractory producers (indirect), and sales through specialized industrial distributors (direct) who manage inventory, logistics, and smaller, fragmented buyer segments. Direct channels facilitate customized product specifications and long-term procurement contracts, ensuring stability for both the supplier and the consumer.

Downstream analysis focuses on the large industrial consumers, primarily the steel and foundry sectors, where amorphous graphite is integrated into final products. Its inclusion improves material performance characteristics like heat resistance (in refractories) or mechanical strength (in metals). The downstream market significantly influences upstream product specifications, as demand for specialized products, such as ultra-fine powder for specialty lubricants, drives micronization techniques in the midstream. The overall efficiency of the value chain is increasingly reliant on seamless logistical integration, particularly for cross-continental shipping between major production hubs (China, Mexico) and consumption centers (Europe, North America).

Amorphous Graphite Market Potential Customers

The potential customers and end-users of amorphous graphite are predominantly large industrial entities operating within high-temperature manufacturing and heavy engineering sectors. The single largest customer segment resides in the refractory industry, encompassing global manufacturers of high-performance thermal insulation and lining materials, such as magnesia-carbon bricks used extensively in Electric Arc Furnaces (EAFs) and Basic Oxygen Furnaces (BOFs) for steel production. These refractory companies require consistent, high-volume supply of 80%+ FCC amorphous graphite to maintain the structural integrity and performance longevity of their products, which is critical for minimizing downtime in steel mills.

Another major segment includes metallurgical companies, specifically steel mills and foundries, which utilize amorphous graphite directly as a cost-effective carbon raiser to adjust the chemistry of molten metal or as a protective coating for molds to enhance surface finish. Automotive suppliers constitute a growing customer base, purchasing significant volumes for manufacturing friction materials like brake pads and clutch plates, where the material’s lubricating and thermal stability properties are non-negotiable for safety and performance standards. Smaller but high-value customers exist in specialty chemical formulation, requiring micro-powdered amorphous graphite for high-performance greases and conductive fillers in specialized polymer matrices used in aerospace and electronics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.28 Billion |

| Market Forecast in 2033 | $1.78 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | GrafTech International, Imerys S.A., Graphite India Ltd., Asbury Carbons Inc., Tirupati Graphite PLC, SGL Carbon SE, Nippon Carbon Co. Ltd., Superior Graphite Co., Shijiazhuang Guanghua Chemical Co. Ltd., Northern Graphite Corporation, Hunan Shinestar Graphite Co. Ltd., Black Rock Mining, Focus Graphite Inc., Qingdao Haida Graphite Co. Ltd., China Carbon Graphite Group, Saint Jean Carbon, Nacional de Grafite, Tokai Carbon Co. Ltd., AMG Advanced Metallurgical Group, BTR New Material Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Graphite Market Key Technology Landscape

The technology landscape in the Amorphous Graphite Market is centered not on creating new forms of graphite, but on enhancing the efficiency and yield of existing mining and processing operations, crucial for maintaining competitiveness in a volume-driven commodity market. Primary technological advancements focus heavily on optimizing the beneficiation process, moving toward highly selective flotation techniques. Flotation cells are increasingly utilizing advanced sensor technology and sophisticated reagent schemes to improve the separation efficiency of microcrystalline graphite from silica and other impurities, allowing producers to achieve higher Fixed Carbon Content (FCC) grades (upwards of 85%) more reliably and at a lower operational cost. This refinement in flotation technology is key to reducing the amount of waste generated and lowering the energy intensity associated with prolonged milling.

Further technological integration is seen in the area of particle size distribution control and micronization. As demand for amorphous graphite in specialized applications like polymer composites and fine lubricants grows, producers are deploying state-of-the-art jet mills and specialized air classifiers to achieve ultra-fine particle sizes (down to 5-10 microns) with tight distribution tolerances. This precision is essential for ensuring material homogeneity when used as a filler or functional additive. Additionally, thermal upgrading and chemical purification technologies are employed, although less frequently than for flake graphite, primarily to meet stringent impurity requirements for high-end refractory applications or when targeting markets sensitive to heavy metal contamination. These processes, while increasing costs, unlock new market opportunities for standard amorphous graphite deposits.

The utilization of automation and digitalization throughout the mining process represents a significant technological shift. Modern amorphous graphite mines are implementing IoT sensors for real-time monitoring of equipment health and performance, optimizing excavation patterns based on geological models, and automating material handling. This focus on Industry 4.0 principles, combined with AI-driven process control in the beneficiation plants, allows manufacturers to maintain stringent quality standards necessary for large-scale supply contracts while simultaneously addressing the pressing industry need to reduce energy consumption and improve resource recovery rates, thereby increasing the sustainable footprint of operations.

Regional Highlights

The regional dynamics of the Amorphous Graphite Market are characterized by a significant disparity between production centers and consumption hubs, dictated largely by geological availability and the scale of heavy industry across continents. The Asia Pacific (APAC) region dominates both consumption and production, anchoring the global market due to its overwhelming presence in steel, cement, and foundry sectors. North America and Europe, while having smaller production footprints, represent mature markets focused on higher-value, technical-grade amorphous graphite applications, prioritizing supply chain stability and environmental compliance over sheer volume.

Asia Pacific (APAC) is the undisputed epicenter of amorphous graphite demand, primarily due to the expansive manufacturing base in China, which controls the largest share of global steel production and is a massive consumer of refractory materials. The robust infrastructure development programs in India and Southeast Asian nations further fuel demand for basic industrial inputs. Furthermore, China is a critical global supplier, possessing extensive reserves and highly competitive processing capabilities, influencing global pricing dynamics and material availability. The regional growth rate is strongly correlated with national GDP growth and large-scale public and private construction projects, necessitating continuous investment in high-temperature industrial furnaces.

North America represents a key consumer of imported amorphous graphite, driven by domestic steel production (utilizing EAF technology), a mature automotive sector requiring advanced friction materials (brake pads, clutch facings), and specialized lubricant markets. Production within North America, particularly in Mexico, focuses on maintaining high-quality standards to satisfy the sophisticated demands of industrial consumers who prioritize purity and consistency. The market here is characterized by high operational costs compared to Asia, leading to a strong reliance on imports but also a greater willingness to invest in high-performance grades for specialized aerospace and defense applications.

Europe maintains a steady demand stream, driven by its sophisticated industrial base, including leading refractory manufacturers, specialty chemical producers, and automotive component suppliers adhering to stringent EU regulations. While domestic graphite mining is minimal, European consumers emphasize secure, ethical sourcing and increasingly demand materials processed using environmentally sustainable methods. The growth here is moderate but focused on R&D for next-generation materials, specifically exploring amorphous graphite's role in advanced polymer matrices and high-efficiency thermal management solutions, distinguishing it from the volume-driven APAC market.

Latin America, anchored by Brazil and Mexico, serves as both a substantial producer and a growing consumer. Mexico is a globally significant source of amorphous graphite, providing key feedstock to North American consumers. Internal demand in countries like Brazil is tied to domestic steel and aluminum industries. The market expansion relies on foreign investment to modernize mining techniques and improve beneficiation efficiency, allowing local producers to compete effectively against dominant Chinese imports, particularly in regional refractory markets.

Middle East and Africa (MEA) currently represent a relatively smaller consumer base, though growth is anticipated, driven by ambitious regional infrastructure projects in the Gulf Cooperation Council (GCC) countries and emerging industrialization in South Africa. Demand is concentrated in construction-related industries and petrochemical processing, requiring specific grades for sealants and refractory linings. The region faces logistical challenges in securing supply but offers significant untapped potential as domestic heavy industries mature and expand their capacities, increasing the regional demand for high-volume, cost-effective carbon materials.

- Asia Pacific (APAC): Largest market share driven by dominant steel production (China, India). Key focus on high-volume consumption in refractories and metallurgy. The primary global production hub.

- North America: Mature market with high demand for technical grades in automotive friction products and specialized lubricants. Relies heavily on imports from Mexico and Asia.

- Europe: Moderate growth focusing on high-value applications, R&D in composites, and strict environmental compliance in sourcing. Demand driven by advanced manufacturing and specialty chemical sectors.

- Latin America: Important production region (Mexico, Brazil) supplying both local and international markets. Growth linked to regional infrastructure and domestic steel output.

- Middle East and Africa (MEA): Emerging market with increasing demand tied to construction and oil & gas industry expansion, representing future high-growth potential in infrastructure development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Graphite Market.- GrafTech International

- Imerys S.A.

- Graphite India Ltd.

- Asbury Carbons Inc.

- Tirupati Graphite PLC

- SGL Carbon SE

- Nippon Carbon Co. Ltd.

- Superior Graphite Co.

- Shijiazhuang Guanghua Chemical Co. Ltd.

- Northern Graphite Corporation

- Hunan Shinestar Graphite Co. Ltd.

- Black Rock Mining

- Focus Graphite Inc.

- Qingdao Haida Graphite Co. Ltd.

- China Carbon Graphite Group

- Saint Jean Carbon

- Nacional de Grafite

- Tokai Carbon Co. Ltd.

- AMG Advanced Metallurgical Group

- BTR New Material Group

Frequently Asked Questions

Analyze common user questions about the Amorphous Graphite market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between amorphous graphite and flake graphite?

Amorphous graphite is defined by its microcrystalline, fine-grained structure, lower fixed carbon content (typically 70%-85%), and cost-effectiveness, making it suitable for high-volume industrial uses like refractories. Flake graphite has a highly crystalline, visible flake structure, higher purity (often 90%+), and is essential for high-tech applications such as lithium-ion battery anodes.

Which application segment holds the largest share in the Amorphous Graphite Market?

The refractory materials application segment constitutes the largest consumer of amorphous graphite globally. It is heavily utilized in manufacturing heat-resistant materials, such as magnesia-carbon bricks and continuous casting molds, critical for the global steel and metallurgy industries due to its excellent thermal stability and conductivity.

What are the main geographical constraints affecting the supply of amorphous graphite?

Supply is geographically concentrated, with China and Mexico being the dominant producers. Geopolitical factors, environmental regulations in these key mining regions, and international trade policies significantly impact global price stability, logistical costs, and security of supply for major consumers in North America and Europe.

How is technological advancement influencing the quality of amorphous graphite?

Technological advancements are focused on refining the beneficiation process using sophisticated flotation and micronization techniques. This allows producers to consistently achieve higher fixed carbon content (FCC) grades and finer particle sizes, enabling amorphous graphite to penetrate specialized, higher-margin applications traditionally reserved for synthetic or high-purity natural grades.

Is amorphous graphite used in battery technology, and if so, how?

Yes, while flake graphite dominates primary anode material, high-purity amorphous graphite is increasingly utilized as a conductive additive or precursor material in certain battery chemistries, including non-lithium-ion systems and specialized high-power applications, leveraging its cost advantage and favorable particle morphology when properly micronized.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Natural Amorphous Graphite Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Amorphous Graphite Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Formed by Carbon Black, Formed by Charcoal, Formed by Coke), By Application (Lubrication Products, Machinery Seal, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager