Amorphous Metal Ribbons Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439712 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Amorphous Metal Ribbons Market Size

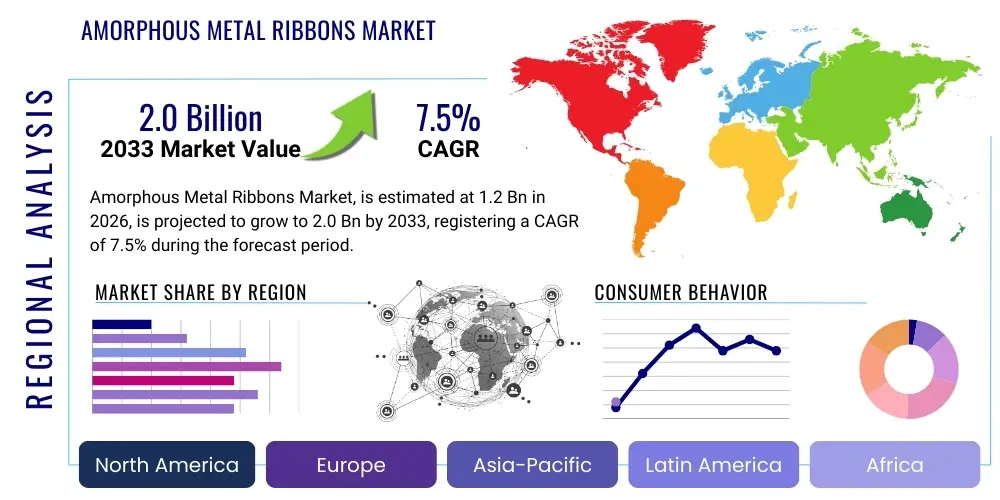

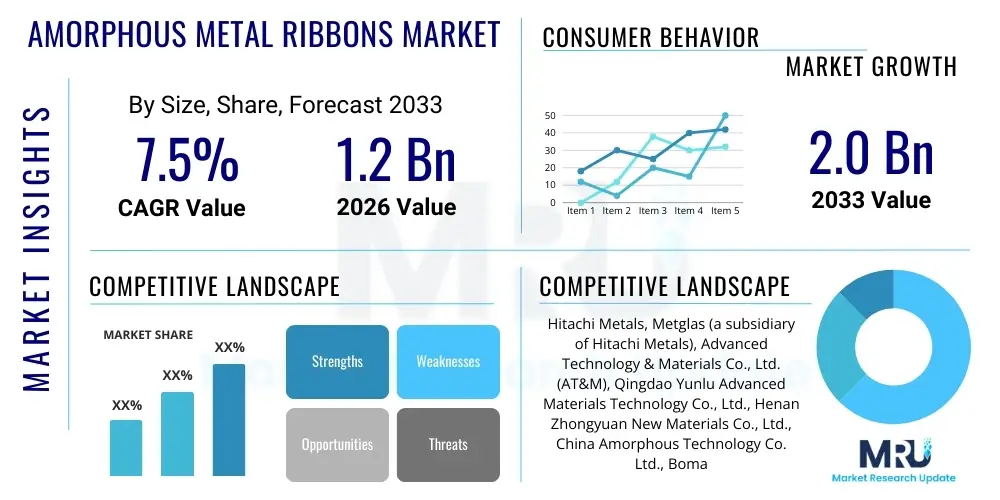

The Amorphous Metal Ribbons Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.0 Billion by the end of the forecast period in 2033.

Amorphous Metal Ribbons Market introduction

Amorphous metal ribbons represent a distinctive class of metallic materials characterized by their non-crystalline atomic structure, contrasting sharply with the ordered lattice found in traditional crystalline metals. These ribbons are typically fabricated through rapid solidification processes, such as melt spinning, where molten metal alloys are cooled at extremely high rates, preventing the atoms from arranging into a regular crystalline pattern. This unique atomic arrangement imparts a combination of exceptional physical and magnetic properties, including high strength, superior corrosion resistance, excellent soft magnetic properties (high permeability, low core loss), and significant hardness.

Major applications for amorphous metal ribbons span across various high-technology sectors. They are predominantly utilized in the manufacturing of energy-efficient transformers, particularly distribution and power transformers, where their low core loss significantly reduces energy waste. Beyond power applications, these materials find extensive use in advanced sensors, magnetic shielding, anti-theft labels, high-frequency inductors, and even certain medical devices. The intrinsic benefits derived from their amorphous structure, such as enhanced energy efficiency, reduced electromagnetic interference (EMI), miniaturization capabilities, and prolonged operational lifespan, make them highly desirable across these diverse industries.

The market for amorphous metal ribbons is primarily driven by a confluence of factors including stringent global energy efficiency regulations, the accelerating demand for high-performance electronic components, the rapid expansion of the electric vehicle (EV) market, and the growing adoption of renewable energy systems. As industries strive for greater energy conservation and miniaturization, the distinctive attributes of amorphous metal ribbons position them as critical enablers for next-generation technologies. Furthermore, ongoing research and development efforts aimed at reducing production costs and enhancing material properties continue to broaden their applicability and market reach.

Amorphous Metal Ribbons Market Executive Summary

The Amorphous Metal Ribbons market is currently experiencing robust growth, fueled by global imperatives for energy efficiency and technological advancement across numerous sectors. Key business trends indicate a concentrated effort by leading manufacturers to innovate in alloy compositions and manufacturing processes, aiming to enhance the magnetic properties and mechanical strength of these ribbons while simultaneously striving for cost reduction. Strategic partnerships and collaborations between material suppliers and end-product manufacturers are becoming increasingly prevalent, fostering integrated solutions and accelerating market penetration. Furthermore, there is a noticeable trend towards capacity expansion, particularly in Asia Pacific, to meet escalating demand from burgeoning electronics and power infrastructure projects. Companies are also investing heavily in sustainable manufacturing practices to align with environmental regulations and corporate social responsibility initiatives, creating a competitive edge.

Regional trends highlight Asia Pacific as the dominant and fastest-growing market for amorphous metal ribbons, driven by significant investments in smart grid infrastructure, renewable energy projects, and the thriving electronics manufacturing industry in countries like China, Japan, and South Korea. North America and Europe also demonstrate substantial growth, propelled by the increasing adoption of electric vehicles, strict energy efficiency standards, and advancements in industrial automation and medical technologies. Latin America and the Middle East & Africa are emerging markets, showing promising growth potential as industrialization and infrastructure development projects gain momentum, leading to increased demand for energy-efficient power components and advanced electronic materials. These regions are actively exploring the benefits of amorphous metals in modernizing their energy grids and expanding their manufacturing capabilities.

In terms of segment trends, the power and distribution transformers segment continues to hold the largest market share, primarily due to the superior energy efficiency offered by amorphous metal cores, which directly translates into significant reductions in energy loss. This is further bolstered by governmental mandates for energy conservation worldwide. The automotive sector, particularly the electric vehicle segment, is exhibiting rapid growth, driven by the demand for high-performance inductors, motor cores, and sensors that benefit from the compact size and low core loss properties of amorphous materials. Additionally, the electronics and telecommunication segments are witnessing increasing adoption for EMI shielding and high-frequency components, reflecting the ongoing miniaturization and performance enhancement trends in these industries. The medical and industrial sectors are also expanding their use of these ribbons for specialized sensors and high-precision applications, underscoring the versatile utility of these advanced materials.

AI Impact Analysis on Amorphous Metal Ribbons Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Amorphous Metal Ribbons market frequently revolve around its potential to revolutionize material discovery, optimize manufacturing processes, and enhance the performance of end-user applications. Common questions include how AI can accelerate the development of novel amorphous alloys with superior properties, whether it can reduce production costs, and what new market opportunities might arise from AI-driven integration. Users are keen to understand if AI can address existing challenges such as scalability limitations and the complexity of processing these materials. The overarching theme is an expectation that AI will act as a significant catalyst, enabling greater efficiency, precision, and innovation throughout the amorphous metal ribbons value chain, ultimately expanding their utility and market penetration.

- AI can significantly accelerate the discovery and design of novel amorphous alloy compositions by simulating material properties and predicting optimal atomic structures, reducing the need for extensive physical experimentation.

- Implementation of AI-powered predictive maintenance in melt-spinning lines can optimize production parameters, minimize defects, improve yield rates, and reduce operational downtime, leading to lower manufacturing costs.

- AI-driven quality control systems can perform real-time analysis of ribbon dimensions, surface integrity, and magnetic properties, ensuring consistent product quality and adherence to stringent specifications.

- Enhanced supply chain management through AI-powered demand forecasting and inventory optimization can lead to more efficient resource allocation and reduced lead times for amorphous metal ribbon production.

- AI can enable the development of more sophisticated sensors incorporating amorphous metal ribbons, offering greater sensitivity, accuracy, and real-time data processing capabilities for various industrial and automotive applications.

- Robotics and automation, often integrated with AI, can improve the precision and efficiency of handling, cutting, and shaping amorphous metal ribbons, addressing challenges related to their unique mechanical properties.

- The integration of AI in advanced simulation tools can help manufacturers better understand the long-term performance and degradation mechanisms of amorphous metal ribbons in demanding applications, facilitating material improvement.

- AI could facilitate the development of new market segments by identifying unmet needs where the unique properties of amorphous metals, combined with intelligent systems, offer unparalleled solutions in areas like smart infrastructure or advanced medical diagnostics.

DRO & Impact Forces Of Amorphous Metal Ribbons Market

The Amorphous Metal Ribbons market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities, which collectively constitute the core impact forces influencing its trajectory. A primary driver is the escalating global emphasis on energy efficiency, particularly within the power transmission and distribution sector, where the superior low-loss properties of amorphous metal cores in transformers offer substantial energy savings and reduced carbon footprint. This is further compounded by the rapid expansion of the electric vehicle (EV) market, which demands high-performance, compact, and lightweight magnetic components, and the burgeoning renewable energy sector, necessitating efficient power conversion systems. Conversely, the market faces notable restraints, including the relatively higher initial manufacturing costs of amorphous metal ribbons compared to traditional crystalline silicon steel, which can pose a barrier to widespread adoption in certain cost-sensitive applications. Furthermore, the specialized processing requirements and limited large-scale production capacities, coupled with the inherent brittleness of some amorphous alloys, present technical and economic challenges that can hinder market expansion.

Despite these restraints, significant opportunities are emerging that promise to propel the market forward. The continuous advancements in material science and processing technologies are leading to the development of novel amorphous alloy compositions with enhanced properties and reduced production costs, making them more competitive. The increasing proliferation of 5G technology, the Internet of Things (IoT), and advanced industrial automation creates new niches for high-frequency inductive components, magnetic sensors, and EMI shielding, where amorphous ribbons excel. Strategic collaborations between research institutions, material suppliers, and end-product manufacturers are fostering innovation and accelerating the integration of these materials into new applications. Additionally, supportive governmental policies and incentives aimed at promoting energy-efficient technologies and sustainable infrastructure development are providing a conducive environment for market growth. These evolving dynamics underscore a promising future for amorphous metal ribbons, contingent on overcoming current production and cost barriers through sustained innovation and strategic market development.

Segmentation Analysis

The Amorphous Metal Ribbons market is comprehensively segmented across various dimensions, including type, application, end-user industry, and region, to provide a granular understanding of its diverse landscape. This segmentation allows for precise market analysis, identifying key growth drivers and competitive strategies within specific niches. By type, the market is differentiated primarily by the chemical composition of the alloys, which significantly influences their magnetic and mechanical properties. Applications categorize the market based on the specific functions these ribbons perform in end products, highlighting their versatility across numerous technological domains. End-user industry segmentation focuses on the primary sectors that integrate amorphous metal ribbons into their manufacturing processes, revealing the diverse industries reliant on these advanced materials. Finally, regional segmentation offers insights into geographical market dynamics, reflecting varying levels of industrial development, regulatory frameworks, and technological adoption.

Each segment within the amorphous metal ribbons market plays a crucial role in its overall growth trajectory. For instance, the iron-based amorphous metal ribbons dominate the market due to their excellent soft magnetic properties and relatively lower cost, making them ideal for transformer cores and power applications. Cobalt-based ribbons, while more expensive, offer superior magnetic performance at high frequencies and temperatures, finding specialized use in high-performance sensors and aerospace applications. The application segments, such as power & distribution transformers, continue to be the largest consumers, driven by global energy efficiency mandates. However, emerging applications in electric vehicles, consumer electronics, and medical devices are showing accelerated growth, indicative of the expanding utility of these materials. Understanding these segmentations is critical for stakeholders to identify lucrative opportunities, tailor product offerings, and devise effective market entry and expansion strategies.

- By Type:

- Iron-based Amorphous Metal Ribbons

- Cobalt-based Amorphous Metal Ribbons

- Nickel-based Amorphous Metal Ribbons

- Other Amorphous Metal Ribbons (e.g., Fe-Si-B, Co-Fe-Ni)

- By Application:

- Power & Distribution Transformers (e.g., Amorphous Core Transformers)

- Inductors & Chokes (e.g., High-frequency Inductors, Common Mode Chokes)

- Sensors (e.g., Magnetic Sensors, Stress Sensors, Position Sensors)

- Anti-theft Labels & Electronic Article Surveillance (EAS) Systems

- Motor Cores (e.g., in Electric Motors for EVs, Industrial Motors)

- Electromagnetic Interference (EMI) Shielding Materials

- Medical Devices (e.g., Biomedical Implants, Diagnostic Equipment)

- Other Applications (e.g., Brazing Foils, Data Storage, Vibrating Wire Sensors)

- By End-User Industry:

- Power & Energy Utilities (e.g., Grid Infrastructure, Renewable Energy Systems)

- Electronics & Telecommunication (e.g., Consumer Electronics, Data Centers, 5G Infrastructure)

- Automotive (e.g., Electric Vehicles, Hybrid Electric Vehicles, Automotive Sensors)

- Industrial Manufacturing (e.g., Industrial Automation, Robotics, Welding)

- Medical & Healthcare (e.g., Imaging Equipment, Drug Delivery Systems, Surgical Tools)

- Aerospace & Defense (e.g., Radar Systems, Avionics, Stealth Technology)

- Consumer Electronics (e.g., Smartphones, Laptops, Wearable Devices)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Amorphous Metal Ribbons Market

The value chain for the Amorphous Metal Ribbons market is a complex network involving multiple stages, beginning from the sourcing of raw materials to the ultimate delivery of finished products to end-users. At the upstream end, the process commences with the extraction and purification of various metallic and metalloid elements such as iron, cobalt, nickel, silicon, and boron, which form the base alloys. These raw material suppliers, including mining companies and specialized chemical producers, provide the essential inputs for alloy preparation. Research and development activities also form a crucial part of the upstream segment, focusing on designing novel alloy compositions and optimizing melt-spinning parameters to achieve desired properties and improve manufacturing efficiency. This initial stage requires significant investment in material science and metallurgical expertise to ensure the quality and purity of the precursor elements, which directly impacts the performance of the final amorphous ribbons.

Moving downstream, the value chain encompasses the specialized manufacturing processes for amorphous metal ribbons. This includes the preparation of the molten alloy, followed by rapid solidification through techniques like melt spinning, where the molten metal is rapidly quenched onto a high-speed rotating wheel to form thin, continuous ribbons. Manufacturers of amorphous metal ribbons then undertake further processing steps such as annealing (to optimize magnetic properties), slitting, and cutting to meet specific dimensions and performance requirements of various applications. These ribbon manufacturers often specialize in producing different types of amorphous alloys tailored for diverse industries. Following this, component manufacturers integrate these ribbons into specific products like transformer cores, inductors, sensors, and shielding materials. This stage involves intricate engineering and assembly to capitalize on the unique properties of the amorphous metals.

The final stages of the value chain involve distribution channels and the end-users. Distribution can be direct, where amorphous metal ribbon manufacturers or component integrators supply directly to large-scale end-user industries such as power utilities, automotive manufacturers, or major electronics companies. Indirect distribution involves working through a network of distributors, wholesalers, and specialized industrial suppliers who cater to smaller businesses or niche markets. These channels ensure the product reaches a diverse customer base globally. End-users span across power & energy, automotive, electronics & telecommunication, medical, and industrial sectors, utilizing amorphous metal ribbons in their final products due to their superior energy efficiency, miniaturization capabilities, and high-performance magnetic properties. The efficiency and optimization of each stage in this value chain are critical for cost-effectiveness, quality assurance, and overall market competitiveness, requiring close collaboration and strategic alignment among all stakeholders.

Amorphous Metal Ribbons Market Potential Customers

The potential customers for Amorphous Metal Ribbons are diverse, spanning various high-technology and industrial sectors that prioritize energy efficiency, miniaturization, and high-performance magnetic properties in their products and infrastructure. Utility companies and grid operators represent a significant customer segment, particularly those investing in smart grid initiatives and modernizing their power transmission and distribution networks, where amorphous core transformers offer substantial energy savings and reduced operational costs. The increasing global focus on sustainable energy and reducing carbon emissions makes these ribbons a crucial component for national energy strategies. Furthermore, manufacturers of renewable energy systems, such as solar inverters and wind turbine generators, are also key consumers, leveraging the efficiency benefits of amorphous metals in their power conversion electronics to maximize energy harvesting.

Beyond the power sector, the automotive industry, especially manufacturers of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs), constitutes a rapidly growing customer base. These companies require high-performance, compact, and lightweight magnetic components for traction motors, onboard chargers, DC-DC converters, and various sensors. The low core losses and excellent magnetic permeability of amorphous ribbons enable higher efficiency and reduced heat generation, critical factors for extending battery range and enhancing vehicle performance. Similarly, the vast electronics and telecommunication sector, including manufacturers of consumer electronics, data center equipment, and 5G infrastructure, are significant potential customers. They seek amorphous materials for high-frequency inductors, EMI shielding, and advanced sensors to achieve miniaturization, higher data rates, and improved signal integrity in their increasingly sophisticated devices.

Moreover, the industrial manufacturing sector, encompassing producers of industrial automation equipment, robotics, and advanced welding technology, represents another vital customer group. Amorphous metal ribbons are used in precision sensors, highly efficient power supplies, and specialized transducers that demand robust and reliable magnetic performance. The medical device industry is also emerging as a niche but high-value customer segment, utilizing these materials in advanced diagnostic imaging equipment, biomedical implants, and various precision sensors where biocompatibility, corrosion resistance, and specific magnetic properties are paramount. The defense and aerospace industries also incorporate amorphous metal ribbons for their lightweight, high-strength, and specialized electromagnetic shielding capabilities in sensitive electronic systems. The collective demand from these varied sectors underscores the broad applicability and expanding market reach of amorphous metal ribbons.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.0 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hitachi Metals, Metglas (a subsidiary of Hitachi Metals), Advanced Technology & Materials Co., Ltd. (AT&M), Qingdao Yunlu Advanced Materials Technology Co., Ltd., Henan Zhongyuan New Materials Co., Ltd., China Amorphous Technology Co. Ltd., Bomatec, VACUUMSCHMELZE GmbH & Co. KG (VAC), Daido Steel Co., Ltd., Materion Corporation, Elettronica, Magnet-Physik, TDK Corporation, Fuji Electric Co., Ltd., MK Electron Co., Ltd., Toshiba Corporation, Sumitomo Electric Industries, Ltd., POSCO, Nippon Steel Corporation, JFE Steel Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Amorphous Metal Ribbons Market Key Technology Landscape

The technological landscape of the Amorphous Metal Ribbons market is defined by a continuous evolution of manufacturing processes, alloy development, and post-processing techniques aimed at enhancing material properties and reducing production costs. The cornerstone technology remains rapid solidification, predominantly executed through the melt spinning process. This involves rapidly quenching molten metal alloys onto a rotating copper or steel wheel at cooling rates exceeding 10^5 Kelvin per second. This ultra-fast cooling prevents the atoms from crystallizing, instead freezing them into a disordered, amorphous state. Advances in melt spinning focus on improving ribbon uniformity, width, and minimizing defects, as well as developing larger-scale production capabilities to meet growing industrial demand. Innovations in nozzle design, cooling drum materials, and process control systems are critical for achieving high-quality ribbons consistently.

Further along the technological spectrum, significant efforts are dedicated to alloy development. Researchers are continually exploring new compositions of iron-based, cobalt-based, and nickel-based alloys, often incorporating metalloids such as boron, silicon, and phosphorus, to optimize magnetic properties (e.g., higher saturation magnetization, lower core losses, increased permeability), mechanical strength, and corrosion resistance. The goal is to tailor specific amorphous alloys for demanding applications such as high-frequency power electronics, advanced sensors, and high-temperature environments. This includes the development of nanocrystalline materials, which are formed by controlled annealing of amorphous precursors, leading to a finer grain structure that can further enhance soft magnetic properties beyond those of purely amorphous alloys, offering a bridge between amorphous and conventional crystalline materials.

Post-processing technologies also play a crucial role in realizing the full potential of amorphous metal ribbons. This includes precision slitting and cutting techniques to achieve the exact dimensions required for various components, as well as specialized annealing treatments. Annealing, often performed in a magnetic field, is critical for relieving internal stresses and optimizing the magnetic domain structure, thereby enhancing the soft magnetic properties of the ribbons. Furthermore, advancements in lamination and winding technologies are essential for assembling amorphous ribbons into transformer cores and inductive components efficiently. The potential integration of advanced manufacturing processes, such as 3D printing for complex magnetic structures using amorphous powders, is also an area of nascent research, promising future breakthroughs in design freedom and customization. The convergence of these technological advancements continues to drive innovation and expand the application scope of amorphous metal ribbons across diverse industries.

Regional Highlights

- North America: This region is characterized by significant investments in smart grid infrastructure upgrades and a burgeoning electric vehicle market, driving demand for energy-efficient transformers and high-performance magnetic components. The U.S. and Canada are leading the adoption of amorphous metal ribbons due to stringent energy efficiency regulations and a robust R&D ecosystem. The presence of key automotive manufacturers and advanced electronics industries further bolsters market growth, particularly for sensors and power electronics.

- Europe: European countries, especially Germany, France, and the UK, are at the forefront of renewable energy integration and industrial automation, fostering a strong market for amorphous metal ribbons. Strict environmental regulations and a focus on reducing carbon emissions are compelling industries to adopt energy-efficient technologies, including amorphous core transformers. The region also benefits from a mature automotive industry and significant research in advanced materials, supporting innovation and application diversification.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for amorphous metal ribbons, primarily driven by rapid industrialization, urbanization, and massive infrastructure development in countries like China, India, Japan, and South Korea. These nations are heavily investing in smart grids, power transmission, and electronics manufacturing, creating immense demand. The region is also a major hub for electric vehicle production and consumer electronics, further accelerating the adoption of amorphous materials.

- Latin America: The market in Latin America is witnessing gradual growth, propelled by ongoing efforts to modernize aging power grids and expand industrial capabilities, particularly in Brazil and Mexico. Increasing foreign direct investment in manufacturing and infrastructure projects is creating opportunities for amorphous metal ribbons in energy-efficient applications. However, market penetration is slower compared to developed regions, primarily due to cost considerations and less stringent energy efficiency mandates.

- Middle East and Africa (MEA): The MEA region presents emerging opportunities, driven by significant investments in economic diversification, infrastructure development, and renewable energy projects, especially in the UAE and Saudi Arabia. As these countries strive to reduce reliance on fossil fuels and develop sustainable energy solutions, the demand for energy-efficient power components is expected to rise. However, the market is still in its nascent stage, with growth reliant on government initiatives and increasing industrialization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Amorphous Metal Ribbons Market.- Hitachi Metals

- Metglas (a subsidiary of Hitachi Metals)

- Advanced Technology & Materials Co., Ltd. (AT&M)

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- Henan Zhongyuan New Materials Co., Ltd.

- China Amorphous Technology Co. Ltd.

- Bomatec

- VACUUMSCHMELZE GmbH & Co. KG (VAC)

- Daido Steel Co., Ltd.

- Materion Corporation

- Elettronica

- Magnet-Physik

- TDK Corporation

- Fuji Electric Co., Ltd.

- MK Electron Co., Ltd.

- Toshiba Corporation

- Sumitomo Electric Industries, Ltd.

- POSCO

- Nippon Steel Corporation

- JFE Steel Corporation

Frequently Asked Questions

Analyze common user questions about the Amorphous Metal Ribbons market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are amorphous metal ribbons and why are they important?

Amorphous metal ribbons are metallic alloys with a non-crystalline, disordered atomic structure, produced by rapid cooling of molten metal. They are important due to their superior soft magnetic properties, high strength, and excellent corrosion resistance, making them ideal for energy-efficient transformers, high-performance sensors, and electromagnetic shielding applications.

What are the primary applications of amorphous metal ribbons?

The primary applications include cores for energy-efficient power and distribution transformers, high-frequency inductors and chokes in power electronics, various magnetic sensors, anti-theft labels, and electromagnetic interference (EMI) shielding. They are also increasingly used in electric vehicle components and specialized medical devices.

What drives the growth of the Amorphous Metal Ribbons market?

Market growth is driven by increasing global demand for energy efficiency, stringent energy conservation regulations, the rapid expansion of the electric vehicle (EV) market, the growth of renewable energy systems, and the ongoing trend towards miniaturization in electronics. These factors highlight the superior performance benefits offered by amorphous metals.

What challenges does the Amorphous Metal Ribbons market face?

Key challenges include the relatively higher manufacturing costs compared to conventional crystalline materials, complex production processes requiring specialized equipment, limited scalability for very large volume applications, and the inherent brittleness of some amorphous alloys which can complicate post-processing and handling.

How is AI impacting the Amorphous Metal Ribbons market?

AI is significantly impacting the market by accelerating the discovery of novel amorphous alloy compositions, optimizing manufacturing processes through predictive maintenance and quality control, and enabling the development of more sophisticated and efficient amorphous-based sensors. This leads to cost reduction, enhanced performance, and new application possibilities for these advanced materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cobalt Based Amorphous Metal Ribbons Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Cobalt Based Amorphous Metal Ribbons Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Amorphous Metal Ribbons Market Size Report By Type (Iron-Based, Cobalt-Based, Other Types), By Application (Distribution Transformer, Electric Machinery, Electronic Components, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Iron Based Amorphous Metal Ribbons Market Statistics 2025 Analysis By Application (Consumer Electronics, Aerospace, Medical, Industrial Power, Electricity, Electric Cars & High-Speed Rail), By Type (5-50mm, 50mm-100mm, 142mm-213mm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cobalt Based Amorphous Metal Ribbons Market Statistics 2025 Analysis By Application (Consumer Electronics, Aerospace, Medical, Industrial Power, Electricity, Electric Cars & High-Speed Rail), By Type (5-50mm, 50mm-100mm, 142mm-213mm), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager