Anaerobic Digestion Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440126 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Anaerobic Digestion Market Size

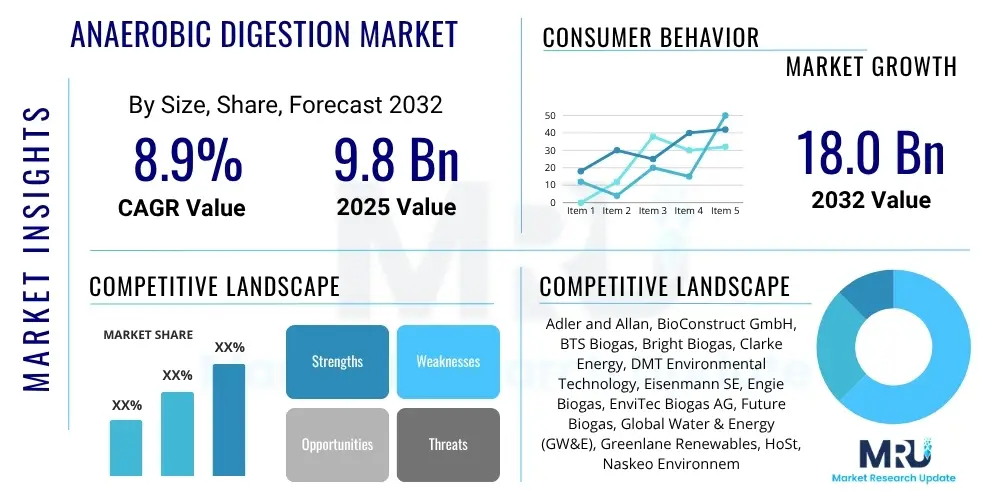

The Anaerobic Digestion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.8% between 2026 and 2033. The market is estimated at USD 7.5 billion in 2026 and is projected to reach USD 14.5 billion by the end of the forecast period in 2033.

Anaerobic Digestion Market introduction

Anaerobic digestion (AD) represents a cornerstone technology in the global transition towards a circular economy and sustainable energy systems. It is a naturally occurring, yet highly controllable, biochemical process where diverse consortia of microorganisms decompose biodegradable organic matter in an oxygen-free environment. This intricate biological conversion culminates in the production of two primary valuable outputs: biogas, a versatile renewable energy carrier composed predominantly of methane (CH4) and carbon dioxide (CO2), and digestate, a nutrient-rich organic residue that serves as an excellent bio-fertilizer. The inherent appeal and increasing global adoption of anaerobic digestion stem from its unparalleled ability to address critical environmental challenges, such as escalating waste generation and greenhouse gas emissions, while simultaneously generating economic value through resource recovery and energy production. This dual functionality positions AD as a pivotal technology for integrated waste management and renewable energy portfolios.

The biogas produced through anaerobic digestion is a highly adaptable energy resource with multifaceted applications. It can be directly combusted in combined heat and power (CHP) units to generate both electricity and useful thermal energy, significantly enhancing energy efficiency. Alternatively, raw biogas can undergo a purification and upgrading process to remove impurities and carbon dioxide, yielding high-purity biomethane, often referred to as Renewable Natural Gas (RNG). This biomethane is pipeline-quality, allowing for seamless injection into existing natural gas grids, or compression for use as a sustainable transportation fuel, thereby decarbonizing hard-to-abate sectors. The digestate, the other vital output, is rich in essential plant nutrients such as nitrogen, phosphorus, and potassium, along with valuable organic matter. When applied to agricultural land, it significantly improves soil fertility, enhances soil structure, and reduces the reliance on synthetic chemical fertilizers, fostering more resilient and environmentally friendly farming practices. These diverse applications underscore the holistic value proposition of AD technology across energy, agriculture, and waste management sectors.

The robust expansion of the anaerobic digestion market is fundamentally underpinned by several compelling driving factors. Foremost among these is the accelerating global organic waste generation from municipal, agricultural, and industrial sources, necessitating advanced and environmentally sound disposal and valorization solutions. Concurrently, increasingly stringent environmental regulations worldwide are mandating diversion of organic waste from landfills, which are significant emitters of potent greenhouse gases like methane, thereby creating a regulatory push for AD adoption. Furthermore, the urgent global imperative to mitigate climate change and enhance energy security has fueled an intensified demand for diversified, decentralized, and sustainable energy sources. Anaerobic digestion directly contributes to these goals by converting waste into clean energy and reducing carbon footprints. The combined benefits of waste reduction, renewable energy generation, nutrient recycling, and substantial greenhouse gas emission reductions position anaerobic digestion as an indispensable technology in achieving global sustainability targets and advancing a resilient, low-carbon future.

Anaerobic Digestion Market Executive Summary

The Anaerobic Digestion market is undergoing a period of dynamic and sustained expansion, propelled by a confluence of global sustainability imperatives, robust policy frameworks, and continuous technological innovation. Business trends within the sector highlight a pronounced shift towards larger-scale, integrated AD facilities that can process a wider array of feedstocks and maximize value extraction from both biogas and digestate. There is a noticeable increase in mergers, acquisitions, and strategic partnerships as companies seek to consolidate market share, leverage complementary technologies, and expand their geographical footprint. Investment patterns reflect a growing confidence in the AD sector, with significant capital flowing into projects focused on biomethane production for grid injection and transportation, driven by attractive incentives and the high market value of renewable natural gas. Additionally, advanced digitalization and automation are becoming standard in new plant designs, enhancing operational efficiency and reliability, making the business model more attractive to investors.

Regional dynamics are playing a pivotal role in shaping the market's trajectory. Europe maintains its leadership position, characterized by well-established policy support mechanisms like feed-in tariffs and renewable energy quotas, alongside sophisticated waste management infrastructures that funnel organic waste to AD plants. The European market is increasingly focused on upgrading biogas to biomethane for gas grid integration, significantly contributing to the decarbonization of the heating and transport sectors. Conversely, the Asia Pacific region, particularly rapidly developing economies such as China and India, is emerging as the fastest-growing market. This growth is spurred by rapid urbanization leading to immense municipal waste generation, substantial agricultural sectors providing abundant feedstock, and national policies aimed at promoting rural electrification, agricultural sustainability, and renewable energy development. North America is experiencing steady, policy-driven growth, especially in the US, where federal and state incentives for renewable fuels, such as the Renewable Fuel Standard (RFS), are accelerating the deployment of RNG projects, particularly from agricultural and landfill gas sources.

Segmentation trends within the Anaerobic Digestion market underscore the diversification of its applications and feedstock utilization. The agricultural feedstock segment continues to expand vigorously, driven by the dual need for sustainable manure management and on-farm energy production, particularly in regions with intensive livestock farming. Municipal solid waste (MSW) and industrial organic waste remain critical segments, with increasing regulatory pressure for diversion from landfills catalyzing the development of large-scale centralized AD facilities. From an application perspective, the production of biomethane (RNG) for grid injection and use as vehicle fuel is rapidly gaining prominence over direct electricity generation. This shift is primarily due to the higher economic value associated with biomethane and supportive policies aimed at decarbonizing gas networks and the transportation sector, offering a more flexible and higher-value product stream. Furthermore, the market for digestate valorization into specialized bio-fertilizers and soil amendments is developing, adding another layer of economic viability and environmental benefit to AD projects.

AI Impact Analysis on Anaerobic Digestion Market

User inquiries concerning the integration of Artificial Intelligence (AI) within the Anaerobic Digestion market predominantly center on the transformative potential of AI to revolutionize operational efficiency, enhance process stability, and ultimately boost the economic viability of AD facilities. Users are particularly interested in how AI can address inherent challenges such as the variability of feedstock composition, the unpredictability of biological reactions within the digester, and the need for optimal resource allocation. There's a strong expectation that AI will move AD plants towards more autonomous operation, minimizing human error and intervention, while concurrently maximizing biogas yield and quality. Common questions also touch upon AI's role in predictive maintenance, smart energy management, and sophisticated data analytics for informed decision-making, signaling a clear user anticipation for AI to be a game-changer rather than just a supplementary tool, ultimately driving the industry towards a more intelligent and sustainable future.

- Enhanced real-time monitoring and advanced data analytics of digester parameters (pH, temperature, VFA, alkalinity) to maintain optimal conditions.

- Predictive modeling of biogas yield and composition based on feedstock characteristics and environmental variables, enabling more accurate energy forecasting.

- Automated optimization of feedstock blending and feeding rates to maximize methane production and prevent process upsets from inconsistent inputs.

- Implementation of predictive maintenance algorithms for pumps, mixers, and gas handling equipment, significantly reducing unplanned downtime and maintenance costs.

- Early detection and diagnosis of process instabilities or biological inhibitions through machine learning, allowing for proactive intervention before system failure.

- Optimization of energy consumption within the AD plant itself, for instance, through smart control of heating and mixing, leading to improved net energy output.

- Advanced management of digestate quality and nutrient recovery processes, ensuring consistency and maximizing the value of the bio-fertilizer product.

- Development of digital twins for AD facilities, enabling virtual testing of operational strategies and scenarios for continuous improvement and operator training.

DRO & Impact Forces Of Anaerobic Digestion Market

The Anaerobic Digestion market is significantly propelled by a robust set of driving forces that underscore its critical role in sustainable development. Foremost among these is the escalating global demand for renewable energy sources as nations strive to reduce their reliance on fossil fuels and meet ambitious climate targets. Simultaneously, the persistent and growing challenge of organic waste management, stemming from urban, agricultural, and industrial expansion, necessitates efficient and environmentally sound processing technologies; AD offers a proven solution by diverting waste from landfills and mitigating methane emissions. Stringent environmental regulations and policies, including landfill bans on organic waste, mandates for renewable energy integration, and carbon pricing mechanisms, further incentivize the adoption and expansion of AD infrastructure worldwide. The inherent benefits of AD in resource recovery, transforming waste into valuable energy and nutrient products, align perfectly with the principles of a circular economy, thereby solidifying its position as a key enabling technology for sustainable resource management and energy security.

Despite these powerful market drivers, the Anaerobic Digestion market encounters several formidable restraints that can impede its growth and widespread adoption. A primary challenge is the high initial capital expenditure (CAPEX) required for the construction of AD plants, which can be a significant barrier for potential investors, particularly for smaller-scale projects or in regions with nascent renewable energy markets. Beyond capital costs, the operational complexity of biological processes, including maintaining optimal microbial conditions, managing diverse and variable feedstocks, and ensuring consistent biogas quality, demands specialized expertise and robust monitoring systems. Public perception and community opposition, often fueled by concerns over odor, increased traffic, and land use (NIMBYism), can significantly delay or even halt project development. Furthermore, the variability in feedstock availability and composition presents ongoing operational challenges, while a lack of standardized policies and fragmented regulatory frameworks across different jurisdictions can create uncertainty and hinder market penetration, making project development less predictable.

Conversely, the Anaerobic Digestion market is brimming with promising opportunities that are poised to accelerate its growth and innovation. A significant opportunity lies in the advanced valorization of biogas through upgrading to biomethane (Renewable Natural Gas, RNG), which can command higher market prices than electricity and offers greater flexibility for grid injection or use as a transport fuel, contributing to the decarbonization of gas networks and the transport sector. The valorization of digestate presents another substantial opportunity, moving beyond simple land application to producing high-value bio-fertilizers, soil conditioners, and even bioplastics or other biochemicals through integrated biorefinery concepts. The development of decentralized, small-to-medium scale AD systems, particularly for on-farm applications or rural communities, offers sustainable energy and waste management solutions, promoting local self-sufficiency. Moreover, technological advancements, including novel digester designs, enhanced pre-treatment methods, and the integration of artificial intelligence for process optimization, are continuously improving the efficiency and economic attractiveness of AD, opening new markets and applications.

Segmentation Analysis

The Anaerobic Digestion market is intricately segmented to provide a detailed and nuanced understanding of its various components, enabling stakeholders to identify specific growth areas and tailor strategies effectively. This comprehensive segmentation typically disaggregates the market based on critical parameters such as the specific type of digester technology employed, the nature and origin of the organic feedstock utilized, the primary application or end-use of the produced biogas and digestate, and the operational scale of the AD facility. Each segment reflects distinct technological requirements, economic drivers, and regulatory considerations, highlighting the diverse pathways through which anaerobic digestion contributes to waste management, renewable energy, and agricultural sustainability. A thorough analysis of these segments is instrumental for pinpointing market niches, assessing competitive landscapes, and formulating targeted investment strategies across the global AD industry.

- By Digester Type:

- Wet Anaerobic Digestion: Typically processes feedstocks with high moisture content (e.g., slurries, wastewater), common in municipal wastewater treatment and agricultural manure management.

- Dry Anaerobic Digestion: Designed for high-solids feedstocks (e.g., solid municipal organic waste, agricultural residues), offering smaller footprints and handling solid materials more efficiently.

- By Feedstock Type:

- Agricultural Waste: Includes animal manures, crop residues, and agricultural by-products, widely used for on-farm biogas production.

- Municipal Solid Waste (MSW): Primarily the organic fraction of household and commercial waste, a growing segment due to urbanization and landfill diversion policies.

- Industrial Organic Waste: Waste from food and beverage processing, pulp and paper, pharmaceuticals, and other industries, often with high organic content.

- Sewage Sludge: A significant feedstock from wastewater treatment plants, utilized for energy recovery and sludge volume reduction.

- Energy Crops: Crops specifically grown for energy production, though their use is often debated due to competition with food production.

- By Application:

- Electricity Generation: Direct conversion of biogas into electricity using CHP engines or gas turbines, often for on-site use or grid export.

- Heat Generation: Utilization of biogas directly for heating purposes or through CHP systems where heat is recovered.

- Combined Heat and Power (CHP): Simultaneous generation of electricity and useful heat from biogas, maximizing energy efficiency.

- Biomethane/Renewable Natural Gas (RNG) for Grid Injection: Upgrading biogas to pipeline-quality natural gas for injection into existing gas grids.

- Biomethane/RNG for Vehicle Fuel: Compressed or liquefied biomethane used as a sustainable alternative to fossil fuels in transportation.

- Bioproducts (e.g., bio-fertilizer from digestate): Focus on the valorization of digestate into marketable soil amendments, nutrient concentrates, or other biochemicals.

- By Scale:

- Small-Scale: Typically on-farm or decentralized community digesters, often processing less than 5,000 tonnes of feedstock per year.

- Medium-Scale: Facilities processing 5,000 to 50,000 tonnes per year, serving multiple farms or small municipalities.

- Large-Scale: Centralized industrial or municipal plants processing over 50,000 tonnes per year, often integrated with major waste management infrastructures.

Value Chain Analysis For Anaerobic Digestion Market

The value chain of the Anaerobic Digestion market is a complex network of interconnected activities that collectively deliver sustainable waste management and renewable energy solutions. The upstream segment is fundamentally concerned with feedstock sourcing and pre-treatment, which are critical determinants of a project's success. This involves identifying reliable and consistent sources of organic waste, such as agricultural residues, municipal organic waste, industrial food processing by-products, and wastewater sludge. Key activities at this stage include efficient collection logistics, transportation to the AD facility, and rigorous quality control to ensure feedstock suitability. Pre-treatment processes, which may involve shredding, grinding, screening, depackaging, pasteurization, or hydrolysis, are often necessary to optimize the organic matter for digestion, increase biogas yield, and prevent operational issues within the digester. Stakeholders in this phase typically include waste management companies, agricultural suppliers, and specialized equipment manufacturers for feedstock handling.

Midstream activities form the core of the anaerobic digestion process, encompassing the design, engineering, construction, and ongoing operation of the AD plant itself. This stage involves crucial decisions regarding the appropriate digester technology (e.g., mesophilic vs. thermophilic, wet vs. dry, CSTR vs. plug-flow), which is selected based on feedstock characteristics, desired output, and project scale. Process optimization, including temperature control, mixing regimes, nutrient balancing, and monitoring of microbial activity, is paramount to ensure stable operation and maximize biogas production efficiency. Energy management within the plant, such as utilizing generated heat for digester warming, is also a key consideration for overall economic viability. Downstream analysis then focuses on the valorization and distribution of the primary outputs: biogas and digestate. Biogas processing involves critical purification steps to remove impurities like hydrogen sulfide (H2S) and moisture, followed by upgrading technologies (e.g., pressure swing adsorption, membrane separation, water scrubbing) to achieve biomethane quality suitable for grid injection or use as vehicle fuel. Digestate valorization is equally crucial, involving separation into liquid and solid fractions, nutrient recovery (e.g., ammonia stripping, struvite precipitation), and further processing (e.g., composting, drying) to create marketable bio-fertilizers, soil conditioners, or other value-added products, effectively closing the nutrient loop.

The distribution channels for products derived from anaerobic digestion are diverse and strategically vital for market penetration. For the energy component, biogas can be directly utilized on-site for the plant's own energy needs (e.g., heating digesters, powering auxiliary equipment), or it can be converted into electricity and heat via combined heat and power (CHP) units, with excess electricity sold to the national grid – representing both direct and indirect distribution pathways. Upgraded biomethane (RNG) enjoys a broader range of distribution options, including direct injection into existing natural gas pipelines for widespread distribution to homes and industries, or compression/liquefaction for supply to dedicated vehicle refueling stations, serving the transportation sector. The distribution of digestate products typically involves direct sales to local farmers and agricultural businesses, or through established agricultural supply cooperatives. The strategic selection and management of these distribution channels are paramount for maximizing revenue streams, ensuring product reach, and integrating AD outputs effectively into existing energy and agricultural markets, thereby enhancing the overall commercial attractiveness and environmental impact of AD projects.

Anaerobic Digestion Market Potential Customers

The Anaerobic Digestion market caters to a broad and expanding spectrum of potential customers, each driven by distinct needs related to waste management, renewable energy, and resource recovery. A significant segment comprises agricultural enterprises, ranging from small-to-medium sized family farms to large-scale industrial livestock operations. These customers are motivated by the imperative to sustainably manage vast quantities of animal manure and crop residues, mitigate odors, prevent nutrient runoff, and reduce their environmental footprint. By adopting AD, they can transform these waste streams into valuable on-farm energy (electricity, heat, or vehicle fuel for farm equipment) and nutrient-rich digestate, which can displace costly synthetic fertilizers, thereby improving operational economics and enhancing farm sustainability. The ability to generate revenue from waste while simultaneously reducing input costs makes AD an increasingly attractive investment for the agricultural sector, particularly in regions with strong environmental regulations or renewable energy incentives.

Municipalities and local governments represent another critical customer segment, driven by their responsibilities for managing urban organic waste, meeting landfill diversion targets, and pursuing local renewable energy initiatives. Faced with growing populations and escalating waste volumes, urban centers are actively seeking advanced solutions to process municipal solid waste (MSW) organic fractions and sewage sludge from wastewater treatment plants. AD offers a compelling solution by reducing waste volumes sent to landfills, lowering methane emissions, and producing renewable energy that can power municipal facilities or contribute to the local energy grid. The public sector's interest is also fueled by commitments to climate action, enhancing energy resilience, and improving the overall environmental quality of their communities. Large-scale municipal AD plants often form an integral part of comprehensive integrated waste management strategies, providing a centralized and efficient solution for diverse organic waste streams.

Furthermore, various industrial sectors constitute a burgeoning customer base for anaerobic digestion technology. Industries such as food and beverage processing, breweries, pulp and paper manufacturing, and certain chemical industries generate substantial volumes of organic-rich wastewater and solid by-products. These companies are motivated by stringent effluent discharge regulations, the desire to reduce their operational costs (particularly energy expenses), and strong corporate sustainability mandates aimed at achieving zero-waste goals and enhancing their brand image. Implementing AD allows them to treat their industrial waste streams on-site, produce their own renewable energy, and potentially recover valuable resources from the digestate, leading to significant cost savings, improved environmental performance, and greater energy independence. Energy utilities and independent power producers (IPPs) are also increasingly becoming key off-takers and developers of AD projects, driven by renewable portfolio standards, the need to decarbonize gas grids, and the economic opportunities presented by selling renewable electricity and biomethane to the market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 14.5 Billion |

| Growth Rate | 9.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BioConstruct GmbH, Engie Biogas, Veolia Environnement S.A., Suez S.A., Waga Energy, Xergi A/S, Weltec Biopower GmbH, Eisenmann Corporation, EnviTec Biogas AG, PlanET Biogastechnik GmbH, BTS Biogas S.p.A., Bright Biomethane, Strabag Umwelttechnik GmbH, ADI Systems Inc., Agraferm Technologies AG, Zorg Biogas AG, Puregas Solutions, DMT Environmental Technology, SNF SAS, Renergon International AG, Bio-Ferm GmbH, BTA International GmbH, Clarke Energy, Future Biogas Ltd., Schmack Biogas GmbH, Hitachi Zosen Inova AG, Biogas Nord AG, Biogest Energie- und Wassertechnik GmbH, Farmatic Biogasanlagen GmbH, Kawasaki Heavy Industries, Ltd. |

| Regions Covered | North America (U.S., Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific), Latin America (Brazil, Argentina, Rest of Latin America), Middle East, and Africa (MEA) (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anaerobic Digestion Market Key Technology Landscape

The Anaerobic Digestion market's technological landscape is characterized by continuous innovation and diversification, aiming to enhance process efficiency, broaden feedstock flexibility, and maximize the value recovery from both biogas and digestate. At the core are various digester designs, each optimized for specific feedstock characteristics and operational scales. Wet digestion systems, typically employing continuously stirred tank reactors (CSTRs) or upflow anaerobic sludge blanket (UASB) reactors, are highly effective for processing liquid-rich feedstocks such as municipal wastewater sludge, animal slurries, and industrial effluents. These systems excel in ensuring homogeneous mixing and consistent microbial activity, which are crucial for stable biogas production. Conversely, dry digestion technologies, including garage-type plug-flow digesters or tunnel fermenters, are specifically engineered for high-solids organic waste, such as municipal solid waste's organic fraction and agricultural residues. These systems operate with higher organic loading rates and smaller footprints, making them suitable for sites with limited space or for handling drier materials.

Beyond the primary digestion phase, significant advancements are being made in biogas upgrading and purification technologies. Raw biogas, typically containing 40-70% methane along with substantial carbon dioxide and trace impurities like hydrogen sulfide, must be upgraded to meet stringent quality standards for grid injection or use as vehicle fuel. Key upgrading technologies include water scrubbing, which removes CO2 and H2S by dissolving them in water; pressure swing adsorption (PSA), which uses adsorbents to separate gases based on molecular characteristics; and membrane separation, which utilizes semi-permeable membranes to selectively separate methane. Chemical absorption methods, often using amine solutions, are also employed for highly efficient CO2 removal. The selection of an upgrading technology is critical and depends on factors such as biogas volume, desired purity, operational costs, and environmental regulations. The continuous refinement of these technologies is enabling the widespread production of high-purity biomethane (Renewable Natural Gas or RNG), a key driver for market growth as it integrates seamlessly into existing natural gas infrastructure and helps decarbonize the transport sector.

The technological evolution also extends to advanced digestate treatment and valorization, transforming a byproduct into a valuable resource. Initial treatment often involves dewatering through screw presses or centrifuges to separate liquid and solid fractions. Further processing can include nutrient recovery techniques such as ammonia stripping or struvite precipitation to recover phosphorus and nitrogen in a concentrated, readily usable form, thereby reducing the environmental impact of digestate and creating marketable fertilizer products. Drying and composting technologies are also used to enhance digestate's shelf-life, reduce volume, and improve its market appeal as a soil amendment. Furthermore, advanced monitoring and control systems, increasingly integrating sensor technology, automation, and data analytics, are vital for optimizing digester performance, detecting process anomalies early, and ensuring consistent output quality. The nascent but rapidly developing application of Artificial Intelligence and Machine Learning in AD processes promises to revolutionize operations by enabling predictive maintenance, optimizing feedstock management, and improving overall system efficiency and resilience, paving the way for more autonomous and intelligent AD plants.

Regional Highlights

- Europe: Leading the global Anaerobic Digestion market with a robust installed capacity, Europe benefits from well-established policy frameworks including generous feed-in tariffs, renewable energy quotas, and stringent directives on waste management, particularly promoting organic waste diversion from landfills. Countries such as Germany, France, Italy, and the United Kingdom have extensive experience and significant infrastructure for AD, with a growing focus on upgrading biogas to biomethane for injection into natural gas grids and for sustainable transportation fuel, contributing significantly to decarbonization efforts across the continent.

- North America: This region is experiencing dynamic growth, largely driven by escalating environmental awareness, state-level mandates for organic waste recycling, and lucrative federal incentives, notably the Renewable Fuel Standard (RFS) in the U.S., which provides economic benefits for Renewable Natural Gas (RNG) production. Both the U.S. and Canada are seeing substantial investments in new AD facilities for agricultural waste and municipal organics, alongside significant upgrades to existing wastewater treatment plants to maximize biogas recovery and conversion into high-value biomethane for energy and transportation sectors.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, the APAC region is propelled by rapid urbanization, which leads to immense municipal waste generation, alongside massive agricultural sectors that yield abundant organic residues. Countries like China and India are at the forefront, implementing ambitious national policies and substantial investments in large-scale AD projects aimed at addressing waste management challenges, promoting rural energy independence, and meeting burgeoning energy demands. The region's growth is also supported by increasing governmental focus on clean energy and environmental protection initiatives.

- Latin America: This is an emerging market with considerable untapped potential, primarily due to vast agricultural resources, particularly from the livestock industry, and a pressing need for sustainable waste management solutions in rapidly expanding urban centers. Countries such as Brazil, Mexico, and Argentina are witnessing increasing interest and initial investments in AD projects, often supported by international development programs and private sector collaborations, focused on converting agricultural waste and municipal organic waste into local renewable energy and bio-fertilizers.

- Middle East and Africa (MEA): Representing a nascent but promising market, the MEA region possesses immense potential driven by fast-growing populations, escalating waste volumes, and a strategic imperative to diversify energy matrices away from fossil fuels. While infrastructure development and supportive policy frameworks are still evolving, significant opportunities exist across both agricultural and municipal waste streams. Early investments are primarily focused on addressing pressing waste management issues and leveraging AD for decentralized energy generation in rural and remote communities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anaerobic Digestion Market.- BioConstruct GmbH

- Engie Biogas

- Veolia Environnement S.A.

- Suez S.A.

- Waga Energy

- Xergi A/S

- Weltec Biopower GmbH

- Eisenmann Corporation

- EnviTec Biogas AG

- PlanET Biogastechnik GmbH

- BTS Biogas S.p.A.

- Bright Biomethane

- Strabag Umwelttechnik GmbH

- ADI Systems Inc.

- Agraferm Technologies AG

- Zorg Biogas AG

- Puregas Solutions

- DMT Environmental Technology

- SNF SAS

- Renergon International AG

- Bio-Ferm GmbH

- BTA International GmbH

- Clarke Energy

- Future Biogas Ltd.

- Schmack Biogas GmbH

- Hitachi Zosen Inova AG

- Biogas Nord AG

- Biogest Energie- und Wassertechnik GmbH

- Farmatic Biogasanlagen GmbH

- Kawasaki Heavy Industries, Ltd.

Frequently Asked Questions

Analyze common user questions about the Anaerobic Digestion market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Anaerobic Digestion (AD) and its primary products?

Anaerobic Digestion is a biological process where organic matter decomposes without oxygen, producing biogas (a renewable energy source primarily methane and carbon dioxide) and digestate (a nutrient-rich organic fertilizer), offering dual benefits of waste management and resource recovery.

What are the main benefits of implementing Anaerobic Digestion technology?

Key benefits include renewable energy generation (electricity, heat, biomethane), effective organic waste management by diverting from landfills, significant reduction in greenhouse gas emissions, production of high-quality bio-fertilizer, and enhanced energy independence for communities and industries.

What types of feedstocks are suitable for Anaerobic Digestion and where do they come from?

A wide range of organic materials are suitable, including agricultural waste (animal manures, crop residues), municipal solid waste (food waste from households and businesses), industrial organic waste (by-products from food and beverage processing), and sewage sludge from wastewater treatment plants.

How does Anaerobic Digestion contribute to the circular economy and environmental sustainability?

AD contributes significantly by transforming organic waste into valuable resources (renewable energy and organic fertilizer), reducing landfill reliance, mitigating harmful methane emissions, recycling nutrients back to soil, and lowering the need for fossil fuels and synthetic fertilizers, thereby closing resource loops and fostering sustainability.

What are the typical applications for the energy products derived from Anaerobic Digestion?

Biogas can be used directly for electricity and heat generation (often via Combined Heat and Power, CHP), or it can be upgraded to biomethane (Renewable Natural Gas - RNG). RNG is pipeline-quality, suitable for injection into natural gas grids, or compressed/liquefied for use as a sustainable vehicle fuel, offering versatile energy solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager