Anaerobic Digestion Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2025 to 2032 (Financial Impact Analysis)

ID : MRU_ 429737 | Date : Nov, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Anaerobic Digestion Market Size

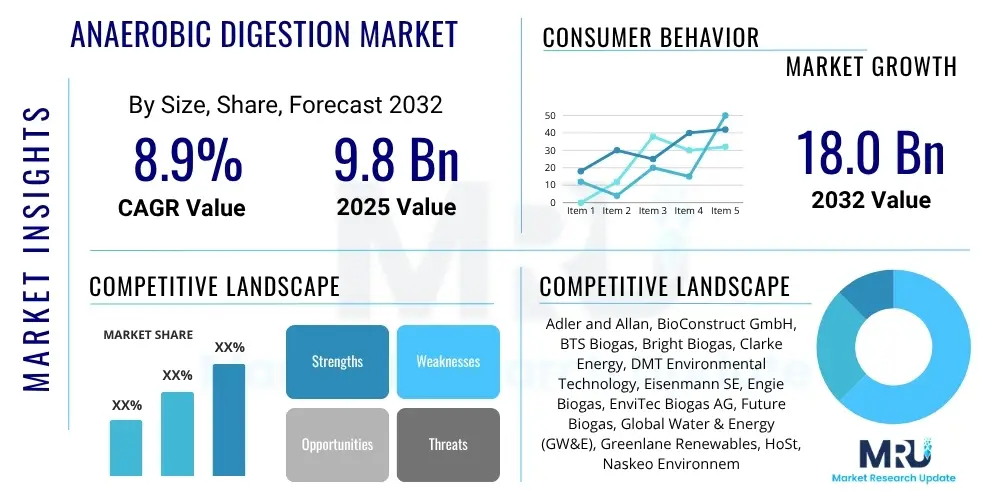

The Anaerobic Digestion Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2025 and 2032. The market is estimated at $9.8 Billion in 2025 and is projected to reach $18.0 Billion by the end of the forecast period in 2032.

Anaerobic Digestion Market introduction

Anaerobic digestion (AD) stands as a foundational biotechnology process wherein microorganisms meticulously break down organic matter in the absence of oxygen, yielding two primary products: biogas and digestate. Biogas, a versatile renewable energy carrier composed predominantly of methane (CH4) and carbon dioxide (CO2), can be directly combusted for heat and electricity, or upgraded to biomethane for injection into natural gas grids or utilization as a sustainable vehicle fuel. The accompanying digestate, a nutrient-rich effluent, offers a sustainable alternative to synthetic fertilizers, enhancing soil fertility and structure while completing a vital nutrient recycling loop. This dual-product generation system positions AD as a cornerstone technology for advancing circular economy principles, facilitating the transformation of various organic waste streams into valuable resources, and significantly contributing to a more sustainable future.

The scope of organic feedstocks suitable for anaerobic digestion is remarkably broad, encompassing agricultural residues such as animal manures and crop byproducts, municipal solid waste (MSW) organic fractions, industrial organic wastes from food and beverage processing, and sewage sludge from wastewater treatment plants. The versatility of AD allows for its deployment across diverse scales and applications, ranging from small-scale farm digesters producing energy for on-site consumption to large-scale industrial plants managing substantial volumes of urban waste and feeding energy into national grids. Its inherent ability to process a wide array of problematic organic wastes, transforming them into revenue streams and environmental assets, underscores its growing importance in global waste management strategies, moving societies away from landfilling and incineration towards resource recovery and valorization.

The market's robust growth trajectory is underpinned by a compelling array of driving factors, including increasingly stringent global environmental regulations aimed at reducing landfill waste and mitigating greenhouse gas emissions. Governments worldwide are implementing supportive policies, offering incentives, and setting ambitious renewable energy targets that specifically encourage the development and deployment of AD technologies. Furthermore, escalating energy prices, coupled with a heightened global demand for energy security and a transition away from fossil fuels, position biogas and biomethane as attractive, locally sourced energy alternatives. The multiple benefits of AD—encompassing waste reduction, nutrient recycling, soil amendment, and the production of dispatchable renewable energy—collectively contribute to its expanding adoption, making it an indispensable tool in addressing contemporary challenges related to energy, environment, and resource scarcity. Technological advancements, such as improved digester designs, more efficient pre-treatment methods, and advanced biogas upgrading techniques, further enhance the economic viability and operational performance of AD facilities, solidifying its role in the global bio-economy.

Anaerobic Digestion Market Executive Summary

The Anaerobic Digestion Market is currently experiencing a dynamic expansion, characterized by a complex interplay of evolving business trends, distinct regional growth patterns, and significant advancements across key market segments. A paramount business trend driving this growth is the accelerating global transition towards a circular economy model, where waste is redefined as a valuable resource. This paradigm shift encourages corporations and municipalities to invest in AD solutions that not only manage organic waste but also generate renewable energy and biofertilizers, aligning with corporate sustainability goals and environmental, social, and governance (ESG) commitments. Concurrently, there is an increasing emphasis on technological innovation, leading to more efficient, scalable, and cost-effective AD systems, attracting diverse investors and expanding the accessibility of these solutions to a broader range of applications and operational scales.

Regionally, the market presents a varied but universally positive outlook. Europe, with its well-established regulatory frameworks and extensive experience in renewable energy, continues to lead in terms of installed capacity and technological sophistication, particularly in biomethane production and its integration into gas grids. Asia Pacific is rapidly emerging as a primary growth engine, driven by burgeoning populations, rapid urbanization, and escalating organic waste generation, coupled with robust government support for waste-to-energy projects in countries like China and India. North America is also witnessing substantial momentum, propelled by increasing legislative support for renewable natural gas (RNG) and significant private sector investments in agricultural and municipal waste-to-energy facilities. These regional developments highlight a global commitment to leveraging AD for both environmental stewardship and energy independence, with each region adapting the technology to its unique resource availability and policy landscape.

Segment-wise, the market is observing notable shifts and accelerated growth. Feedstock diversity is expanding, with traditional agricultural waste and sewage sludge now being augmented by increasing volumes of municipal solid waste (MSW) and specialized industrial organic residues. This diversification enhances the robustness and scalability of AD projects. In terms of application, while electricity generation remains a significant output, there is a pronounced shift towards biogas upgrading to biomethane for direct grid injection or use as vehicle fuel, reflecting a broader energy sector strategy to decarbonize gas networks and transport. Process advancements, including co-digestion and high-solids AD, are improving efficiency and expanding feedstock flexibility. These segmental trends collectively underscore a market maturing beyond its initial phases, embracing greater complexity, efficiency, and integration into the wider energy and waste management infrastructure, indicating a strong, sustained growth trajectory throughout the forecast period.

AI Impact Analysis on Anaerobic Digestion Market

Common inquiries from stakeholders regarding Artificial Intelligence (AI) in the Anaerobic Digestion market primarily focus on its potential to revolutionize operational efficiency, reduce costs, and enhance the predictability and stability of AD processes. Users are keenly interested in how AI can move AD plants towards greater autonomy, optimize energy outputs, and provide intelligent solutions for managing the inherent variability of organic feedstocks. Questions frequently arise about AI's capabilities in real-time diagnostics, predictive maintenance scheduling, and adaptive process control to respond to dynamic environmental and operational conditions. There's an underlying expectation that AI will unlock new levels of performance and sustainability, transforming AD from a complex biological process into a more streamlined, data-driven industrial operation. However, concerns also exist regarding the initial investment costs for AI integration, the need for robust data infrastructure, and the specialized skill sets required to deploy and maintain these advanced systems effectively, highlighting a critical balance between innovation and practical implementation.

The strategic integration of AI into Anaerobic Digestion operations promises a significant leap forward in optimizing plant performance and resource utilization. AI-powered analytics can process vast amounts of sensor data from digesters, including parameters like temperature, pH, volatile fatty acids, and gas composition, to identify optimal operating conditions that maximize biogas yield and methane content. Machine learning algorithms can predict feedstock characteristics and their impact on digestion, enabling proactive adjustments to blend ratios and feeding schedules, thereby mitigating process upsets caused by inconsistent input materials. Beyond process control, AI can facilitate predictive maintenance, anticipating equipment failures before they occur and minimizing costly downtime, while also optimizing energy consumption within the plant itself, leading to substantial operational cost reductions and enhanced overall economic viability for AD facilities.

Furthermore, AI applications extend into sophisticated areas such as smart grid integration and digestate management. AI can optimize biogas utilization by forecasting energy demand and pricing, allowing AD plants to sell electricity or biomethane to the grid at opportune times, thereby maximizing revenue. In terms of digestate, AI algorithms can analyze its nutrient composition and tailor recommendations for its application as a biofertilizer, ensuring optimal soil health and nutrient delivery while minimizing environmental impact. The deployment of AI also contributes to enhanced safety protocols through anomaly detection and automated shutdown procedures in critical situations. By leveraging advanced data processing and learning capabilities, AI transforms raw operational data into actionable insights, enabling plant operators to make more informed decisions, refine their strategies, and elevate the environmental and economic performance of anaerobic digestion systems to unprecedented levels of efficiency and sustainability.

- Enhanced process optimization: AI algorithms analyze real-time data from sensors (temperature, pH, VFA, gas composition) to dynamically adjust parameters for maximum biogas yield and methane content.

- Predictive maintenance: AI models forecast equipment failures based on operational data, reducing unplanned downtime and maintenance costs through proactive scheduling.

- Feedstock management and optimization: AI identifies optimal blending ratios and feeding schedules for diverse and variable organic feedstocks, ensuring consistent and efficient digestion.

- Automated fault detection and diagnosis: AI systems rapidly detect anomalies and operational issues, providing early warnings and suggesting corrective actions, thereby improving plant stability.

- Improved resource efficiency: AI-driven insights lead to better utilization of substrates, water, and energy within the AD plant, reducing overall operational expenses.

- Biogas quality control and upgrading optimization: AI monitors and adjusts conditions to maintain optimal biogas composition and enhances the efficiency of upgrading processes to biomethane.

- Smart energy grid integration: AI optimizes biogas/biomethane injection into electricity or gas grids based on real-time demand, market prices, and grid stability requirements, maximizing revenue.

- Digestate quality assessment and application: AI analyzes digestate nutrient profiles to recommend precise application rates for agricultural use, enhancing soil health and reducing synthetic fertilizer reliance.

DRO & Impact Forces Of Anaerobic Digestion Market

The Anaerobic Digestion Market is propelled by a robust set of drivers that underscore its critical role in modern waste management and renewable energy portfolios. A primary driver is the global imperative to manage escalating organic waste volumes, driven by population growth and urbanization. Landfilling and incineration are increasingly restricted due to environmental concerns, making AD an attractive alternative for waste diversion and resource recovery. Simultaneously, stringent governmental regulations and ambitious targets for renewable energy generation and greenhouse gas emission reductions provide a powerful impetus for AD adoption. Policy instruments such as feed-in tariffs, renewable energy certificates, and carbon pricing schemes offer financial incentives, significantly improving the economic viability of AD projects. Furthermore, the growing corporate and public awareness of circular economy principles and sustainability goals motivates investments in technologies that close material and energy loops, positioning AD as a key enabler for environmental stewardship and resource efficiency across industrial and agricultural sectors.

Despite the strong tailwinds, the market faces notable restraints that can impede its growth trajectory. The most significant barrier remains the high upfront capital investment required for the construction of AD facilities, which can be prohibitive for smaller developers or regions with limited access to financing. Operational complexities, including the need for specialized technical expertise in managing biological processes and maintaining sophisticated equipment, also pose challenges. Furthermore, ensuring a consistent and high-quality supply of suitable organic feedstocks can be problematic due to seasonal variations, competition for resources, and logistical hurdles. The variability in feedstock composition directly impacts biogas yield and process stability, necessitating advanced pre-treatment and process control measures. Public perception and acceptance, particularly in proximity to AD plants, can also present localized resistance, requiring effective community engagement and transparent communication strategies.

Opportunities within the Anaerobic Digestion market are expansive, promising continued innovation and market expansion. The increasing focus on biogas upgrading to biomethane (Renewable Natural Gas, RNG) for injection into existing gas grids or use as vehicle fuel represents a significant growth avenue, tapping into larger energy markets. Integration of AD plants with other bio-refinery concepts or broader waste management systems, such as composting or material recovery facilities, can enhance synergistic benefits and economic returns. Moreover, the growing recognition of digestate as a valuable biofertilizer, capable of replacing synthetic counterparts and improving soil health, opens new markets and revenue streams. Advancements in digester technology, including modular designs, efficient pre-treatment systems, and intelligent process control facilitated by AI and IoT, are continuously improving operational performance and reducing costs. The impact forces shaping this market include evolving climate change policies, which heighten the urgency for decarbonization, fluctuating fossil fuel prices that impact the competitiveness of biogas, and continuous technological innovation driving efficiency and expanding the range of applications. Socio-economic factors, such as job creation in green industries and rural development, also exert influence, contributing to the broader appeal and strategic importance of anaerobic digestion technologies on a global scale.

Segmentation Analysis

The Anaerobic Digestion market's comprehensive segmentation provides a granular view of its intricate landscape, enabling stakeholders to discern specific growth drivers, competitive dynamics, and emerging opportunities across various operational and technological dimensions. This detailed categorization is fundamental for conducting precise market sizing, forecasting future trends, and developing tailored strategies for different customer groups and applications. The market is primarily delineated by the type of organic feedstock processed, the end-use application of the generated biogas and digestate, the specific AD process technology employed, and the industrial or municipal end-user sectors, each representing distinct challenges and potential for valorization.

Understanding these segments allows for a targeted approach to market development and resource allocation. For instance, the agricultural feedstock segment is vast and geographically dispersed, requiring solutions adaptable to varying farm sizes and waste characteristics, while municipal solid waste (MSW) presents challenges related to contamination and heterogeneity but offers substantial volumes. Similarly, the shift from basic electricity generation to higher-value applications like biomethane production for grid injection or vehicle fuel reflects technological maturity and evolving market demands for decarbonized energy. Each segment is characterized by unique regulatory considerations, investment requirements, and technological preferences, making a nuanced analysis indispensable for successful market navigation. This segmentation analysis not only illuminates current market structures but also provides foresight into future innovation pathways and strategic investment areas within the rapidly expanding anaerobic digestion industry.

- By Feedstock: This segment categorizes the market based on the type of organic material used in the digestion process, significantly influencing plant design and biogas yield.

- Agricultural Waste (e.g., animal manure, crop residues like straw and silage, food processing byproducts from farms)

- Municipal Solid Waste (MSW) (e.g., household food waste, garden waste, market waste, other organic fractions of urban refuse)

- Industrial Organic Waste (e.g., wastewater sludge from food and beverage industries, pharmaceutical waste, slaughterhouse waste, distillery effluents)

- Animal Manure (specifically from livestock farms, including cattle, swine, poultry)

- Sewage Sludge (byproducts from municipal wastewater treatment plants, often co-digested)

- Energy Crops (e.g., maize, grass silage, sugar beet, specifically grown for biogas production, prevalent in some European countries)

- By Application: This segment defines how the produced biogas and digestate are ultimately utilized, impacting revenue streams and environmental benefits.

- Electricity Generation (using biogas in combined heat and power (CHP) engines or gas turbines)

- Heat Generation (direct use of biogas for heating, especially for district heating or industrial processes)

- Combined Heat and Power (CHP) (simultaneous generation of electricity and useful heat from biogas, maximizing energy efficiency)

- Biofuel Production (upgrading biogas to biomethane/renewable natural gas (RNG) for various uses)

- Vehicle Fuel (biomethane compressed natural gas (Bio-CNG) or liquefied natural gas (Bio-LNG) for transportation)

- Biogas Upgrading (purification of raw biogas to biomethane for grid injection or specific industrial applications)

- By Process: This segment differentiates the market based on the technological approach to digestion, influenced by feedstock properties and desired outcomes.

- Wet Digestion (high water content feedstock, common for slurries and sewage sludge, CSTR digesters)

- Dry Digestion (low water content feedstock, suitable for solid organic wastes like MSW and crop residues, plug-flow or batch digesters)

- Co-Digestion (mixing two or more different feedstocks to improve biogas yield and process stability, common for manure and food waste)

- High Solids Anaerobic Digestion (HSAD) (specifically designed for feedstocks with high total solids content, reducing water consumption and digester volume)

- By End-Use: This segment identifies the primary sectors adopting anaerobic digestion solutions, highlighting market demand drivers.

- Industrial (e.g., food and beverage manufacturers, chemical plants, pulp & paper mills treating their organic waste streams)

- Commercial (e.g., hotels, restaurants, shopping centers managing their food waste, often via centralized AD facilities)

- Residential (e.g., decentralized AD units for domestic waste, or centralized municipal AD plants processing household organic waste)

- Agricultural (e.g., farms utilizing AD for manure management, crop residue processing, and on-site energy generation)

- Municipal (e.g., city councils and waste management authorities for treating municipal solid waste, sewage sludge, and generating public utility energy)

Value Chain Analysis For Anaerobic Digestion Market

The value chain within the Anaerobic Digestion market is a multi-faceted and integrated system, commencing with the critical upstream activities of feedstock sourcing and pre-processing. This initial stage involves the collection, sorting, and sometimes mechanical or thermal pre-treatment of diverse organic materials such as agricultural residues, industrial byproducts, municipal solid waste, and animal manures. Key players in this phase include agricultural cooperatives, waste collection companies, and specialized pre-treatment technology providers. Ensuring a consistent, quality-controlled, and cost-effective supply of feedstock is paramount, as it directly impacts the efficiency and economic viability of the entire AD process. Equipment manufacturers supplying digester vessels, pumps, agitators, and gas handling systems also represent a significant upstream component, providing the foundational technology for AD plant construction.

Midstream activities encompass the core process of anaerobic digestion itself, involving the design, engineering, construction, and operation of the AD plants. Engineering, Procurement, and Construction (EPC) contractors play a crucial role in delivering turnkey solutions, integrating various technologies from different vendors. This stage also includes plant commissioning, ongoing biological process monitoring, and operational management, often provided by specialized AD plant operators or technology licensors. The efficiency of the digestion process, including factors like temperature control, pH balance, and microbial health, is critical at this stage to maximize biogas yield and methane content while ensuring process stability and compliance with environmental discharge regulations. Innovation in digester design, co-digestion strategies, and enhanced process control systems are continuously developed at this stage to improve overall performance.

Downstream activities focus on the valorization, distribution, and utilization of the two primary outputs: biogas and digestate. For biogas, this involves upgrading technologies (e.g., membrane separation, pressure swing adsorption) to remove impurities and enrich methane content, transforming it into biomethane (Renewable Natural Gas). This upgraded gas can then be injected into national gas grids, compressed for use as vehicle fuel (Bio-CNG), or directly used in combined heat and power (CHP) units for electricity and heat generation. Key players here include energy utility companies, gas grid operators, and fuel distributors. For digestate, the focus is on post-treatment (e.g., dewatering, nutrient recovery) and its distribution as a biofertilizer to agricultural end-users, potentially displacing synthetic fertilizers. Distribution channels for energy outputs are typically direct to grids or large industrial consumers, while digestate distribution can involve agricultural merchants, cooperatives, or direct sales to farms. The successful monetization and sustainable use of both biogas and digestate are essential for closing the loop of the circular economy and maximizing the economic and environmental benefits derived from anaerobic digestion facilities, making the downstream segment crucial for market growth and impact.

Anaerobic Digestion Market Potential Customers

The Anaerobic Digestion market targets a broad spectrum of end-users and buyers, each motivated by distinct operational needs, environmental compliance requirements, and economic incentives. Foremost among these are municipal authorities and public utility companies, which represent a significant customer base due to their mandate to manage urban organic waste, sewage sludge, and wastewater efficiently. For these entities, AD offers a robust solution for diverting waste from landfills, reducing environmental pollution, generating renewable energy for public infrastructure (like street lighting or wastewater treatment plants), and contributing to local sustainability goals. Their decision-making is often influenced by public policy, environmental regulations, and the long-term cost-effectiveness of waste management strategies, making AD an increasingly attractive and strategic investment for urban centers aiming for circular economy principles.

Agricultural enterprises, ranging from family-owned farms to large-scale industrial livestock operations, constitute another cornerstone of the potential customer base. Farmers leverage AD technology primarily for managing copious amounts of animal manure and crop residues, which, if untreated, can pose significant environmental challenges through nutrient runoff and greenhouse gas emissions. The benefits for this segment are multifaceted: on-site generation of electricity and heat for farm operations, reduction in energy costs, improved nutrient management through the production of biofertilizer (digestate) that reduces reliance on synthetic alternatives, and the potential for additional revenue streams from selling surplus energy or carbon credits. The economic and environmental pressures on the agricultural sector continue to drive the adoption of AD as a sustainable farming practice, enhancing resource efficiency and mitigating ecological footprints.

Beyond municipalities and agriculture, industrial facilities, particularly those within the food and beverage, pulp and paper, and pharmaceutical sectors, are increasingly becoming key buyers. These industries generate substantial volumes of organic process waste and wastewater, which can be challenging and costly to dispose of. Anaerobic digestion provides an effective on-site solution for treating these high-strength organic effluents, simultaneously reducing discharge costs, minimizing environmental impact, and producing valuable biogas that can offset factory energy demands. Waste management companies also actively invest in AD plants as part of integrated waste processing hubs, enhancing their capabilities in resource recovery and offering advanced solutions to their clients. Furthermore, independent power producers (IPPs) and energy developers view AD projects as opportunities to contribute to renewable energy portfolios and benefit from energy market incentives. Essentially, any organization facing organic waste management challenges, seeking sustainable energy solutions, or aiming to improve its environmental performance can be considered a potential customer, highlighting the broad applicability and expanding market reach of anaerobic digestion technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2025 | $9.8 Billion |

| Market Forecast in 2032 | $18.0 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2023 |

| Base Year | 2024 |

| Forecast Year | 2025 - 2032 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adler and Allan, BioConstruct GmbH, BTS Biogas, Bright Biogas, Clarke Energy, DMT Environmental Technology, Eisenmann SE, Engie Biogas, EnviTec Biogas AG, Future Biogas, Global Water & Energy (GW&E), Greenlane Renewables, HoSt, Naskeo Environnement, PlanET Biogas Group GmbH, Puregas Solutions, Quadrogen Power Systems, Schmack Biogas GmbH, Sebigas, Veolia Environnement S.A., Xylem Inc., Waterleau, Weltec Biopower GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Anaerobic Digestion Market Key Technology Landscape

The Anaerobic Digestion market is underpinned by a diverse and rapidly advancing technological landscape, continually evolving to enhance process efficiency, expand feedstock flexibility, and optimize the valorization of both biogas and digestate. At the core of any AD plant is the digester, and the market features a variety of designs tailored for different feedstocks and operational scales. These include the widely utilized Continuously Stirred Tank Reactors (CSTRs) for liquid-rich feedstocks, Plug-Flow Digesters suitable for semi-solid materials, Upflow Anaerobic Sludge Blanket (UASB) reactors primarily for industrial wastewater, and High Solids Anaerobic Digesters (HSAD) specifically designed for solid organic wastes like municipal food waste. Recent innovations focus on modular digester systems, which offer scalability and reduced construction times, as well as multi-stage digestion configurations that allow for optimized conditions in different biological phases, leading to higher biogas yields and greater process stability.

Beyond the primary digestion vessel, a suite of sophisticated ancillary technologies plays a crucial role in improving overall plant performance and product quality. Feedstock pre-treatment is becoming increasingly important, encompassing mechanical methods (shredding, grinding), thermal treatments (hydrolysis), chemical processes (acid or alkaline pre-treatment), and biological methods (enzymatic hydrolysis). These pre-treatment steps enhance the biodegradability of complex organic matter, accelerating the digestion process and increasing biogas production. Post-digestion, significant technological efforts are directed towards biogas upgrading, where raw biogas is purified to biomethane (Renewable Natural Gas, RNG) by removing CO2, H2S, and other contaminants. Common upgrading technologies include membrane separation, pressure swing adsorption (PSA), water scrubbing, and amine scrubbing, all aimed at achieving grid-quality biomethane suitable for injection into natural gas pipelines or use as a high-value vehicle fuel.

Furthermore, the efficient and sustainable management of digestate represents another critical technological frontier. Technologies for digestate dewatering (e.g., screw presses, centrifuges) reduce volume and transportation costs, while nutrient recovery systems (e.g., ammonia stripping, struvite precipitation) extract valuable phosphorus and nitrogen for concentrated fertilizer products. Advanced monitoring and control systems, integrating sophisticated sensors, real-time data analytics, and increasingly, Artificial Intelligence (AI) and Machine Learning (ML), are transforming AD plant operations. These intelligent systems enable precise parameter adjustments, predictive maintenance, and automated fault detection, significantly enhancing operational reliability, reducing human intervention, and maximizing economic returns. The synergistic application of these technologies across the AD value chain ensures that plants are not only environmentally compliant but also economically competitive and resilient in a dynamic energy and waste management landscape, driving the continuous evolution and adoption of anaerobic digestion solutions globally.

Regional Highlights

The global Anaerobic Digestion market exhibits significant regional disparities in terms of maturity, growth drivers, and technological adoption, reflecting diverse policy landscapes, waste management challenges, and energy security priorities. Europe stands as the undisputed leader in anaerobic digestion, characterized by a highly mature market, extensive installed capacity, and a robust regulatory framework that has historically incentivized renewable energy and waste valorization. Countries such as Germany, France, Italy, and the United Kingdom have pioneered AD development, particularly focusing on agricultural feedstocks, municipal biowaste, and the production of biomethane for grid injection and transportation fuel. Strong government support through feed-in tariffs, green certificates, and mandates for organic waste diversion has created a stable investment environment, fostering continuous technological innovation and the widespread integration of AD into national energy and waste infrastructures. The region also benefits from a well-established supply chain and expertise, positioning it as a global benchmark for sustainable AD deployment.

The Asia Pacific (APAC) region is rapidly emerging as the fastest-growing market for anaerobic digestion, driven by unprecedented rates of urbanization, industrial expansion, and the consequent surge in organic waste generation. Countries like China and India are at the forefront of this growth, implementing ambitious national policies and significant investments in large-scale AD projects to address critical issues such as energy scarcity, environmental pollution, and public health concerns associated with inadequate waste management. While the focus in APAC often includes smaller, decentralized AD units for rural energy needs and agricultural waste, there_is also increasing development of large centralized facilities for treating municipal solid waste and industrial effluents. The sheer volume of waste generated and the growing commitment to renewable energy targets make APAC a pivotal region for future AD market expansion, albeit with challenges related to infrastructure development, financing, and technical expertise.

North America is experiencing accelerated growth in the AD sector, primarily spurred by evolving federal and state-level policies promoting renewable natural gas (RNG) and waste-to-energy solutions. The United States and Canada are witnessing significant investments in agricultural manure digesters and municipal solid waste facilities, with a strong emphasis on upgrading biogas to RNG for pipeline injection or use as vehicle fuel, capitalizing on attractive incentives such as the Renewable Fuel Standard (RFS) program. This region is characterized by a growing understanding of the economic and environmental benefits of AD, driving demand from diverse sectors. Latin America, while still in relatively early stages, shows substantial potential, particularly in countries like Brazil and Mexico, due to abundant agricultural waste (e.g., sugarcane bagasse) and the increasing need for sustainable waste management in rapidly developing urban areas. Similarly, the Middle East and Africa (MEA) regions, though nascent, are exploring AD as a viable solution for managing organic waste from growing populations and industries, enhancing energy access, and contributing to climate change mitigation efforts, with increasing interest from governments and international development organizations to support project initiation and development. These regional dynamics collectively paint a picture of a global market poised for significant expansion, driven by both established environmental mandates and emerging socio-economic imperatives for sustainable resource management.

- Europe: Dominant and mature market, leading in installed capacity and technological advancements, strong policy support (feed-in tariffs, green certificates), extensive biomethane production for grid injection and transport, key countries include Germany, UK, France, Italy.

- Asia Pacific (APAC): Fastest-growing region, driven by rapid urbanization, industrialization, escalating organic waste volumes, and government initiatives in China, India, and Southeast Asian nations for waste-to-energy and rural electrification.

- North America: Accelerating growth attributed to increasing renewable natural gas (RNG) mandates, federal and state incentives (e.g., RFS), significant investments in agricultural and municipal waste digestion, particularly in the US and Canada for vehicle fuel and grid injection.

- Latin America: Emerging market with substantial untapped potential, fueled by large agricultural sectors (e.g., Brazil's sugarcane industry, Argentina's livestock), growing need for sustainable waste management in urban centers, and increasing awareness of renewable energy benefits.

- Middle East and Africa (MEA): Nascent but developing market, driven by urbanization, increasing waste generation, and efforts to diversify energy sources and improve sanitation; opportunities in countries like South Africa, UAE, and others exploring waste-to-energy solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Anaerobic Digestion Market.- Adler and Allan

- BioConstruct GmbH

- BTS Biogas

- Bright Biogas

- Clarke Energy

- DMT Environmental Technology

- Eisenmann SE

- Engie Biogas

- EnviTec Biogas AG

- Future Biogas

- Global Water & Energy (GW&E)

- Greenlane Renewables

- HoSt

- Naskeo Environnement

- PlanET Biogas Group GmbH

- Puregas Solutions

- Quadrogen Power Systems

- Schmack Biogas GmbH

- Sebigas

- Veolia Environnement S.A.

- Xylem Inc.

- Waterleau

- Weltec Biopower GmbH

Frequently Asked Questions

What is Anaerobic Digestion and its primary outputs?

Anaerobic Digestion (AD) is a biological process that converts organic matter into biogas and digestate in the absence of oxygen. Biogas, composed mainly of methane, is a renewable energy source for electricity, heat, or vehicle fuel. Digestate is a nutrient-rich byproduct used as a biofertilizer, enhancing soil quality and nutrient cycling.

What are the key environmental benefits of implementing Anaerobic Digestion?

Implementing AD offers substantial environmental benefits including diverting organic waste from landfills, which significantly reduces methane emissions (a potent greenhouse gas). It also minimizes water and soil pollution by treating waste, conserves natural resources by producing renewable energy, and recycles nutrients back into the soil, thus lowering the demand for synthetic fertilizers.

Which types of organic waste are most suitable for Anaerobic Digestion?

A wide range of organic wastes are suitable, including animal manures, agricultural residues (crop byproducts), municipal solid waste (especially food and garden waste), sewage sludge from wastewater treatment, and various industrial organic wastes from food processing, breweries, and distilleries. The optimal choice often depends on local availability and specific AD plant design.

What factors are driving the growth of the Anaerobic Digestion market globally?

The global AD market is driven by several factors: stringent environmental regulations concerning waste disposal and emissions, escalating demand for renewable energy and energy independence, government incentives and supportive policies (e.g., feed-in tariffs), and the increasing adoption of circular economy models that emphasize waste valorization and resource recovery.

How is Artificial Intelligence (AI) transforming Anaerobic Digestion plant operations?

AI is transforming AD operations by enabling real-time process optimization through data analysis, leading to maximized biogas yields and methane content. It facilitates predictive maintenance, reducing costly downtime, and improves feedstock management by optimizing blending and feeding schedules. AI also enhances safety, resource efficiency, and aids in smart integration with energy grids, making plants more autonomous and economically efficient.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager