Art Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439215 | Date : Jan, 2026 | Pages : 251 | Region : Global | Publisher : MRU

Art Insurance Market Size

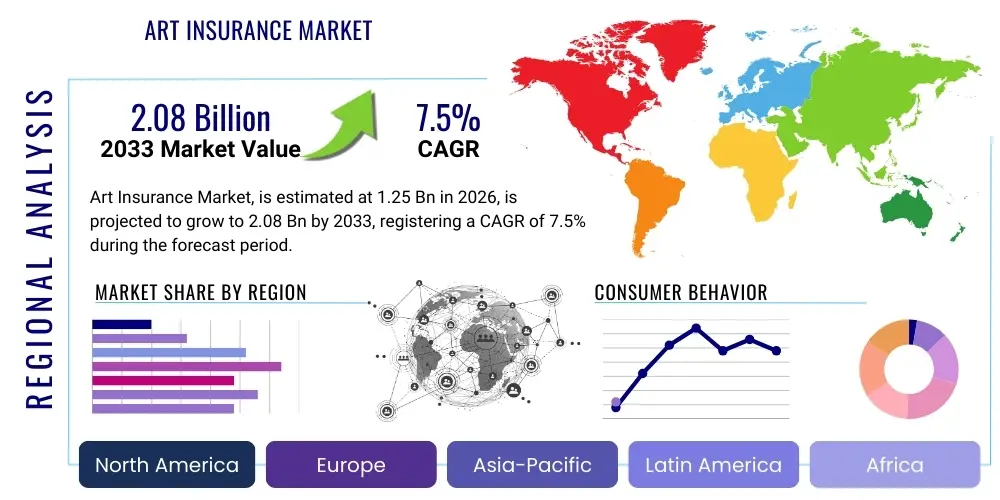

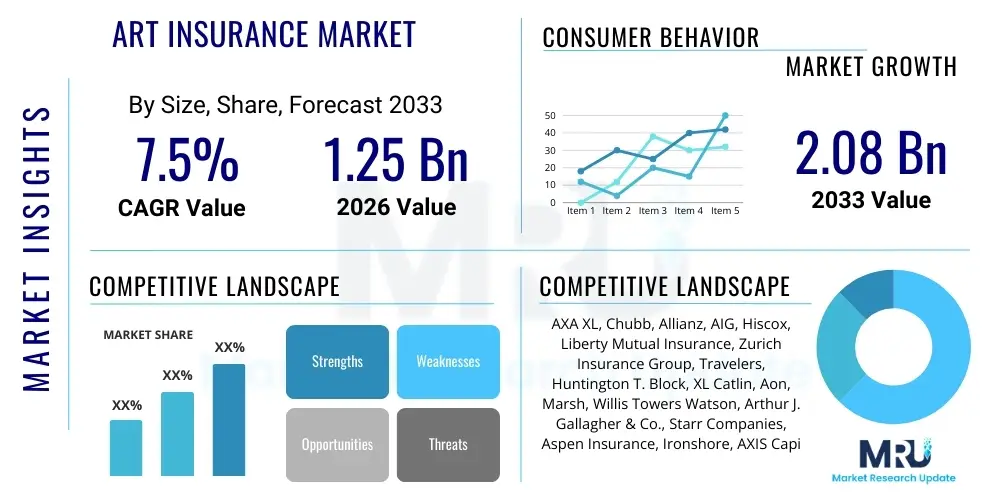

The Art Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 2.08 billion by the end of the forecast period in 2033.

Art Insurance Market introduction

The Art Insurance Market, a highly specialized and evolving sector within the broader insurance industry, focuses on safeguarding valuable artworks, collectibles, and cultural artifacts against a wide array of risks. This niche market serves a diverse clientele, including high-net-worth individuals, private collectors, public and private museums, art galleries, auction houses, corporate collections, and even individual artists. The unique nature of art as both a cultural asset and a financial investment necessitates bespoke insurance solutions that go beyond standard property coverage, addressing specific challenges such as fluctuating market values, authenticity concerns, and the complex logistics of art handling, storage, and transit. The market's growth is intricately linked to the expansion of the global art market, increasing awareness among collectors about the need for specialized protection, and the rising financial value of artworks. As the art world becomes more globalized and dynamic, encompassing traditional masterpieces, contemporary art, and emerging digital forms, the demand for sophisticated art insurance solutions continues to accelerate, driven by the imperative to protect significant cultural and monetary investments. These policies are designed to mitigate potential losses from physical damage, theft, fraud, natural disasters, and other unforeseen events, providing a critical layer of financial security for art owners and custodians. The comprehensive nature of these offerings ensures that clients can confidently engage in the acquisition, exhibition, and conservation of their valuable assets.

Art Insurance Market Executive Summary

The Art Insurance Market is experiencing robust growth, primarily fueled by the increasing global wealth, a burgeoning art investment landscape, and a heightened awareness among collectors and institutions regarding risk management. Business trends indicate a shift towards more sophisticated, tailored policies that address niche segments, such as digital art and NFTs, alongside traditional fine art and collectibles. Insurers are leveraging advanced technologies, including artificial intelligence and blockchain, to enhance valuation accuracy, combat fraud, and streamline claims processing, thereby improving efficiency and customer satisfaction. Partnerships between insurers, art market professionals (appraisers, conservators, logistics providers), and technology firms are becoming increasingly common to offer integrated risk management solutions. The market is also witnessing an expansion of services beyond mere indemnification to include preventative measures, risk advisory, and crisis management. This comprehensive approach reflects a maturing market focused on proactive protection rather than just reactive compensation. The competitive landscape is characterized by a mix of large global insurers with specialized art divisions and boutique agencies that offer highly personalized services.

Regionally, North America and Europe remain the dominant markets due to their long-established art markets, high concentration of museums, galleries, and high-net-worth individuals. However, the Asia Pacific (APAC) region is emerging as a significant growth hub, driven by rapid economic development, increasing disposable incomes, and a growing base of art collectors, particularly in countries like China, India, and Southeast Asian nations. Latin America and the Middle East are also showing promising potential, with investments in cultural infrastructure and a rising appreciation for local and international art contributing to market expansion. Each region presents unique challenges and opportunities, influenced by local regulations, cultural preferences, and economic stability. Global art market trends, such as the rise of online art sales and international art fairs, further underscore the need for cross-border insurance solutions, prompting insurers to develop a more globally integrated service delivery model. This regional diversification is crucial for the overall resilience and growth of the art insurance sector.

Segment trends highlight a growing demand for specialized coverage for categories beyond traditional oil paintings and sculptures, including rare books, historical artifacts, jewelry, and luxury watches. The emergence of digital art and NFTs has created an entirely new, albeit nascent, segment with unique risk profiles, driving innovation in policy design to cover cyber theft, smart contract failures, and digital provenance issues. Coverage types are evolving to include not just physical damage and theft but also depreciation in value due to damage, restoration costs, and even loss of market value due to contested provenance. End-user segments show a steady demand from private collectors, who seek discretion and comprehensive coverage for their personal treasures, while institutions require extensive policies for their vast and often rotating collections, including public liability and exhibition coverage. Distribution channels are diversifying, with traditional brokers and agents still playing a crucial role, alongside a growing emphasis on direct online channels for simpler, smaller-value policies. This segmentation reflects the market's adaptability to the multifaceted needs of the art world, ensuring that diverse forms of artistic expression and investment can be adequately protected.

AI Impact Analysis on Art Insurance Market

User questions concerning the impact of AI on the Art Insurance Market frequently revolve around its potential to revolutionize valuation accuracy, enhance fraud detection, and personalize risk assessments, while simultaneously raising concerns about data privacy, algorithmic bias, and the potential displacement of human expertise. Users are keenly interested in how AI can streamline claims processing and improve the efficiency of policy underwriting, anticipating a future where insurance operations are faster and more precise. There is also significant curiosity about AI's role in identifying emerging risks, such as those associated with digital art and NFTs, and its capacity to offer predictive insights into market trends. Conversely, questions often touch upon the ethical implications of using AI for sensitive appraisals, the transparency of AI models in decision-making, and the need for human oversight to prevent errors or biases in automated processes. The expectation is that AI will drive innovation, but with a strong emphasis on maintaining trust, accuracy, and fairness within a traditionally high-touch and expert-driven market.

- Enhanced Fraud Detection: AI algorithms can analyze vast datasets to identify patterns indicative of fraudulent claims, fake artworks, or misrepresentation, significantly improving the industry's ability to combat art crime and forgery.

- Automated Valuation and Appraisal: Machine learning models can process historical sales data, artist provenance, condition reports, and market trends to provide more objective and real-time art valuations, reducing reliance on manual appraisals.

- Personalized Risk Assessment and Underwriting: AI can analyze individual collector profiles, collection history, environmental factors, and security measures to offer highly customized policies and more accurate premium calculations.

- Streamlined Claims Processing: AI-powered tools can accelerate the claims settlement process by automating damage assessment, verifying documentation, and facilitating communication, leading to faster payouts and improved customer satisfaction.

- Predictive Analytics for Market Trends: AI can forecast shifts in art market values, identify emerging collecting categories, and predict potential risks (e.g., climate change impact on storage), allowing insurers to proactively adjust policies and offerings.

- Improved Data Management and Security: AI can help manage and secure sensitive client and artwork data, ensuring compliance with privacy regulations and protecting against cyber threats.

- Development of New Insurance Products: AI facilitates the creation of innovative insurance solutions for novel art forms, such as digital art, NFTs, and augmented reality installations, by assessing their unique risk profiles.

DRO & Impact Forces Of Art Insurance Market

The Art Insurance Market is propelled by a confluence of driving factors, including the global increase in wealth, particularly among high-net-worth individuals, which fuels a robust art investment market and a growing demand for art acquisition. The escalating financial value of individual artworks and entire collections further underscores the necessity for specialized protection, as potential losses from damage or theft can be substantial. A heightened awareness among collectors and institutions about the inherent risks associated with art ownership, coupled with a desire to preserve cultural heritage, also acts as a significant driver. Moreover, the globalization of the art market, characterized by international art fairs, cross-border transactions, and increased art mobility, necessitates comprehensive insurance solutions that cover complex transit and exhibition risks. The expansion of online art sales platforms and the rise of new art forms, such as digital art and NFTs, introduce new client segments and risk scenarios, creating fresh demand for innovative insurance products. These elements collectively foster an environment conducive to sustained market expansion.

Despite the favorable growth drivers, the Art Insurance Market faces several restraints that temper its expansion. High premium costs, often perceived as prohibitive by smaller collectors or emerging artists, can limit market penetration. The inherent difficulty in accurately valuing unique artworks, especially contemporary pieces or those with contested provenance, poses a challenge for both insurers and policyholders, potentially leading to disputes during claims. A limited number of specialized insurers and brokers with deep expertise in the intricacies of the art market can restrict competition and specialized service offerings in certain regions. Economic downturns or geopolitical instability can significantly impact art market activity, reducing demand for new acquisitions and consequently for art insurance. The lack of standardized valuation methodologies and authentication processes across the global art market also presents complexities, making risk assessment and underwriting more challenging for insurers. These factors contribute to a somewhat constrained operational environment, requiring insurers to innovate continuously to overcome these barriers.

Opportunities for growth in the Art Insurance Market are substantial and diverse. The burgeoning art markets in emerging economies, particularly in Asia Pacific, Latin America, and the Middle East, represent untapped potential as wealth creation continues in these regions. The increasing acceptance and integration of digital art, NFTs, and blockchain technology offer a fertile ground for developing new insurance products and services that address cyber risks, smart contract failures, and digital asset provenance. Insurers can also expand their offerings to include comprehensive risk management services, providing clients with expertise in art handling, conservation, security, and estate planning, thus creating additional revenue streams and enhancing client relationships. The development of more flexible and modular policies, catering to a broader spectrum of collectors and collection types, could lower barriers to entry for new clients. Furthermore, strategic partnerships with art market players, technology providers, and logistics firms can create integrated solutions that offer end-to-end protection and value-added services. These opportunities highlight a dynamic market poised for significant evolution and diversification.

The impact forces influencing the Art Insurance Market are multifaceted, driven by a complex interplay of economic, technological, regulatory, and socio-cultural factors. Economically, global wealth distribution and disposable income levels directly correlate with art acquisition and the demand for insurance. Technological advancements, particularly in AI for valuation and blockchain for provenance, are reshaping risk assessment, fraud detection, and claims management, driving efficiency and innovation. Regulatory changes pertaining to cultural heritage, international trade of art, and data privacy also dictate policy structures and operational frameworks for insurers. Socio-culturally, changing perceptions of art as an investment class, coupled with an increasing appreciation for cultural preservation, fuel the demand for comprehensive protection. Environmental factors, such as climate change and natural disasters, also play an increasing role, necessitating coverage for artworks vulnerable to extreme weather events. These interconnected forces continuously shape the competitive landscape and strategic direction of the Art Insurance Market, compelling industry players to adapt and evolve their offerings to remain relevant and resilient.

Segmentation Analysis

The Art Insurance Market is comprehensively segmented to address the diverse needs of its clientele and the varied nature of the assets it covers. This segmentation allows insurers to develop specialized products and services, ensuring that policies are tailored to specific types of art, coverage requirements, end-user profiles, and distribution preferences. By dissecting the market along these distinct lines, insurers can more effectively assess risks, price policies accurately, and deliver targeted value propositions to different segments of the art world. This granular approach not only enhances customer satisfaction but also enables insurers to identify niche opportunities and navigate the complexities of a highly specialized market. Understanding these segments is crucial for strategic market positioning and for developing innovative solutions that cater to the evolving demands of art collectors, institutions, and professionals globally. The segmentation framework reflects the intricate ecosystem of the art market itself, ensuring that all facets of artistic value and ownership are adequately addressed by insurance provisions.

- By Type

- Fine Art (Paintings, Sculptures, Drawings, Prints)

- Decorative Art (Antiques, Furniture, Tapestries)

- Collectibles (Stamps, Coins, Rare Books, Memorabilia, Jewelry, Watches, Wine)

- Digital Art and Non-Fungible Tokens (NFTs)

- Historical Artifacts and Cultural Heritage

- By Coverage Type

- All-Risk Coverage

- Named Perils Coverage (Fire, Theft, Flood, Vandalism)

- Transit Coverage

- Exhibition Coverage

- Storage Coverage

- Restoration and Conservation Coverage

- Loss of Value Coverage

- Cyber and Digital Asset Coverage

- By End-User

- Private Collectors (High-Net-Worth Individuals)

- Art Galleries

- Museums and Cultural Institutions

- Auction Houses

- Corporate Collections

- Artists and Art Dealers

- Educational Institutions

- By Distribution Channel

- Brokers and Agents

- Direct Insurers

- Online Platforms

Value Chain Analysis For Art Insurance Market

The value chain for the Art Insurance Market is intricate, involving a specialized network of stakeholders that contribute to the creation, delivery, and ongoing support of art insurance products. This chain begins upstream with entities responsible for the creation, valuation, and physical care of art, extending through the core insurance provision, and culminating downstream with the clients and supporting services that ensure proper protection and claims resolution. Understanding this value chain is critical for identifying opportunities for efficiency, collaboration, and value addition at each stage. It underscores the collaborative nature of the art insurance ecosystem, where various experts and service providers must seamlessly integrate their efforts to deliver comprehensive and effective risk management solutions. The specialized nature of the assets involved necessitates deep expertise across the entire chain, from initial appraisal to final claim settlement.

Upstream analysis in the Art Insurance Market focuses on the sources and initial handling of the insured assets, as well as the foundational information required for underwriting. This includes art creators (artists, artisans), art market intermediaries such as galleries, dealers, and auction houses that facilitate sales and establish initial values, and crucially, independent art appraisers and conservators. Appraisers provide expert valuations essential for policy inception and claims assessment, while conservators ensure the long-term preservation of artworks and offer damage assessment services. Security firms specializing in art protection, transportation logistics companies with art-specific handling expertise, and authentication experts also form vital upstream components. The quality and reliability of services from these upstream providers directly impact the insurer's ability to accurately assess risk and offer appropriate coverage, as they establish the baseline conditions and values of the artworks being insured. Digital provenance platforms using blockchain also represent an emerging upstream component, enhancing trust and authenticity.

The downstream analysis centers on the distribution channels and the ultimate beneficiaries of art insurance services. This involves the direct and indirect methods through which policies reach end-users. Direct channels include insurers offering policies directly to clients through their own sales force or online platforms, often favored by clients seeking simpler, more standardized coverage or those with existing relationships. Indirect channels primarily involve specialist art insurance brokers and independent agents. These intermediaries play a crucial role in advising clients, comparing policies from multiple underwriters, and often managing the claims process on behalf of the insured. Their deep understanding of both the art market and insurance products adds significant value, especially for complex collections or high-value items. Potential customers, including private collectors, museums, and galleries, form the ultimate downstream link, receiving the protective benefits of the insurance policies. Post-claim, services like art restoration specialists and legal advisors also form part of the extended downstream value chain, assisting with recovery and dispute resolution. The efficiency of these downstream channels is paramount for client acquisition, retention, and overall market reach.

Art Insurance Market Potential Customers

The Art Insurance Market caters to a highly specific and discerning clientele whose primary objective is the protection of valuable artistic and cultural assets. These end-users, or buyers, span a wide spectrum of the art world, each with unique needs and risk profiles, necessitating tailored insurance solutions. Understanding their diverse requirements is fundamental for insurers to develop effective products and distribution strategies. The market is not merely about indemnifying against loss but also about providing peace of mind and supporting the ongoing stewardship of significant cultural and financial investments. As the art market continues to globalize and diversify, the pool of potential customers is expanding, bringing new opportunities for specialized coverage. The common thread among these varied buyers is the high value, often irreplaceable nature, and the specialized handling requirements of their collections, making standard insurance policies inadequate for their protection needs. Insurers must engage with these potential customers through expert knowledge and customized offerings.

High-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) constitute a significant segment of potential customers. These private collectors typically possess extensive and valuable art portfolios, ranging from fine art masterpieces to rare collectibles, and require comprehensive, discreet, and flexible coverage that accounts for the global mobility of their assets and often includes agreed-value clauses. Museums, both public and private, represent another critical customer base. They hold vast collections, often with significant historical and cultural importance, necessitating complex policies that cover permanent collections, temporary exhibitions, loans, and public liability. Art galleries and dealers, who manage fluctuating inventories, consignments, and regular exhibitions, also depend heavily on art insurance to protect their stock and ensure business continuity. Auction houses, which handle high volumes of valuable art for sale, require specialized coverage for items on consignment, during transit, and while on display, mitigating risks associated with their high-stakes operations. These institutional buyers often have dedicated risk management teams and seek long-term, comprehensive partnerships with their insurers.

Beyond these traditional segments, emerging customer groups are expanding the market. Corporate collections, housed in office buildings or public spaces, are increasingly seeking specialized coverage to protect their assets and manage associated public liability. Individual artists, especially those with high-value works or exhibiting globally, may require insurance for their own creations and studio contents. Educational institutions with art departments or historical collections also represent a niche customer base. Moreover, the advent of digital art and NFTs is creating an entirely new category of potential buyers, including digital artists, crypto collectors, and platforms, who require innovative insurance products for intangible assets against cyber theft, smart contract vulnerabilities, and platform risks. As the definition of "art" evolves, so too does the profile of the potential customer for art insurance, underscoring the market's dynamic nature and its continuous adaptation to new forms of artistic expression and ownership. The growing interest in cultural heritage preservation also drives demand from government bodies and non-profit organizations for specific conservation and restoration coverage.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.08 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXA XL, Chubb, Allianz, AIG, Hiscox, Liberty Mutual Insurance, Zurich Insurance Group, Travelers, Huntington T. Block, XL Catlin, Aon, Marsh, Willis Towers Watson, Arthur J. Gallagher & Co., Starr Companies, Aspen Insurance, Ironshore, AXIS Capital, CNA Financial Corporation, Tokio Marine Holdings |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Art Insurance Market Key Technology Landscape

The Art Insurance Market is increasingly adopting a range of advanced technologies to enhance its operational efficiency, improve risk assessment accuracy, and develop innovative products. These technologies are crucial for addressing the unique challenges of art insurance, such as verifying authenticity, accurately valuing diverse artworks, and managing the specialized logistics of art handling and storage. The integration of these tools is transforming how policies are underwritten, claims are processed, and clients are served, moving the industry towards a more data-driven and proactive risk management approach. The specialized nature of art and its inherent value necessitates sophisticated technological solutions that can handle complex data, provide predictive insights, and ensure a high level of security and transparency across the value chain. As the art market continues to evolve with new forms of artistic expression and transactional methods, the reliance on cutting-edge technology will only intensify, making technological prowess a key differentiator for insurers.

One of the most impactful technologies is Artificial Intelligence (AI) and Machine Learning (ML), which are being leveraged for automated valuation, fraud detection, and personalized risk assessment. AI algorithms can analyze vast datasets, including auction results, market trends, artist provenance, and condition reports, to provide more objective and real-time appraisals, reducing human subjectivity and improving efficiency. In fraud detection, AI identifies patterns indicative of forged artworks or fraudulent claims, enhancing security. Furthermore, AI-powered predictive analytics allows insurers to forecast market fluctuations and identify emerging risks, enabling proactive policy adjustments. Another transformative technology is Blockchain, particularly for digital art and Non-Fungible Tokens (NFTs). Blockchain provides immutable records of ownership, provenance, and transaction history, which are critical for authenticating digital assets and establishing their insurable value. It also offers transparency and security, mitigating risks associated with cyber theft and smart contract vulnerabilities in the nascent digital art market.

Beyond AI and Blockchain, several other technologies are playing a significant role. Internet of Things (IoT) sensors are being deployed in storage facilities and exhibition spaces to monitor environmental conditions such as temperature, humidity, and light levels. These sensors provide real-time data, allowing for immediate intervention to prevent damage to sensitive artworks and offering insurers more granular risk data for underwriting. Advanced imaging technologies, including high-resolution photography, multispectral imaging, and 3D scanning, are used for detailed condition reporting and damage assessment, creating a precise digital twin of an artwork for insurance purposes. Big Data Analytics enables insurers to process and interpret large volumes of structured and unstructured data, leading to deeper insights into market trends, risk exposures, and customer behavior. Cloud computing infrastructure provides the scalable and secure platforms necessary to host these complex applications and manage vast amounts of data. These interconnected technologies collectively empower art insurers to offer more accurate, efficient, and innovative services, adapting to the dynamic landscape of art ownership and protection.

Regional Highlights

- North America: This region represents a mature and dominant market for art insurance, driven by a high concentration of high-net-worth individuals, numerous world-class museums, galleries, and auction houses (e.g., New York's prominent role). The U.S. and Canada benefit from a sophisticated insurance infrastructure and a strong culture of art collecting and investment. Demand for specialized policies, including those for digital art, is robust here.

- Europe: As the historical cradle of the global art market, Europe remains a critical region for art insurance. Countries like the UK, France, Germany, and Switzerland boast a rich heritage of art collecting, extensive museum networks, and a significant presence of art dealers and auction houses. Regulatory diversity across EU nations influences policy structures, while an increasing focus on cultural heritage preservation fuels demand.

- Asia Pacific (APAC): APAC is the fastest-growing region in the art insurance market, propelled by rapid economic growth, rising disposable incomes, and an expanding base of new art collectors, particularly in China, Japan, Hong Kong, Singapore, and India. The region's increasing participation in global art fairs and online art sales is driving demand for both traditional and digital art insurance solutions.

- Latin America: This region presents emerging opportunities, with a growing appreciation for local and international art, coupled with investments in cultural infrastructure. Countries like Brazil, Mexico, and Argentina are seeing increased collecting activity, leading to a rising need for specialized insurance to protect diverse art forms and cultural artifacts.

- Middle East and Africa (MEA): The MEA region is witnessing significant development in its art market, especially with ambitious cultural projects and growing wealth in the Gulf Cooperation Council (GCC) countries. This is leading to an increased demand for art insurance, particularly for public and private collections, as well as for unique cultural heritage items.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Art Insurance Market.- AXA XL

- Chubb

- Allianz

- AIG

- Hiscox

- Liberty Mutual Insurance

- Zurich Insurance Group

- Travelers

- Huntington T. Block

- XL Catlin

- Aon

- Marsh

- Willis Towers Watson

- Arthur J. Gallagher & Co.

- Starr Companies

- Aspen Insurance

- Ironshore

- AXIS Capital

- CNA Financial Corporation

- Tokio Marine Holdings

Frequently Asked Questions

Analyze common user questions about the Art Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What does art insurance typically cover?

Art insurance typically provides comprehensive "all-risk" coverage, protecting against physical damage, theft, mysterious disappearance, and loss during transit or exhibition. It can also include provisions for restoration costs, depreciation in value, and even cyber risks for digital art.

How is the value of an artwork determined for insurance purposes?

The value of an artwork for insurance is usually determined by an agreed-value policy, where the insurer and policyholder concur on a specific amount before the policy term. This often relies on professional appraisals, recent sales data, and market trends, ensuring a clear settlement in case of a loss.

Is digital art and NFTs insurable?

Yes, the art insurance market is evolving to offer coverage for digital art and NFTs. Policies are being developed to address unique risks such as cyber theft, smart contract vulnerabilities, platform failures, and provenance issues associated with these intangible assets, albeit it is a nascent and complex area.

What factors influence the cost of art insurance premiums?

Premiums are influenced by several factors, including the total value and type of the collection, the artwork's fragility, security measures in place (e.g., alarms, vaults), storage conditions, geographical location, frequency of transit or exhibition, and the policyholder's claims history.

Do I need specialized art insurance if I already have homeowner's insurance?

Yes, homeowner's insurance typically offers limited coverage for high-value artworks, often with low caps on payouts and numerous exclusions. Specialized art insurance provides broader "all-risk" coverage, agreed-value settlements, and expertise in art-specific claims, making it essential for true protection.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fine Art Insurance Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fine Art Insurance Market Statistics 2025 Analysis By Application (Private, Commercial), By Type (Property Insurance, Title Insurance, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager