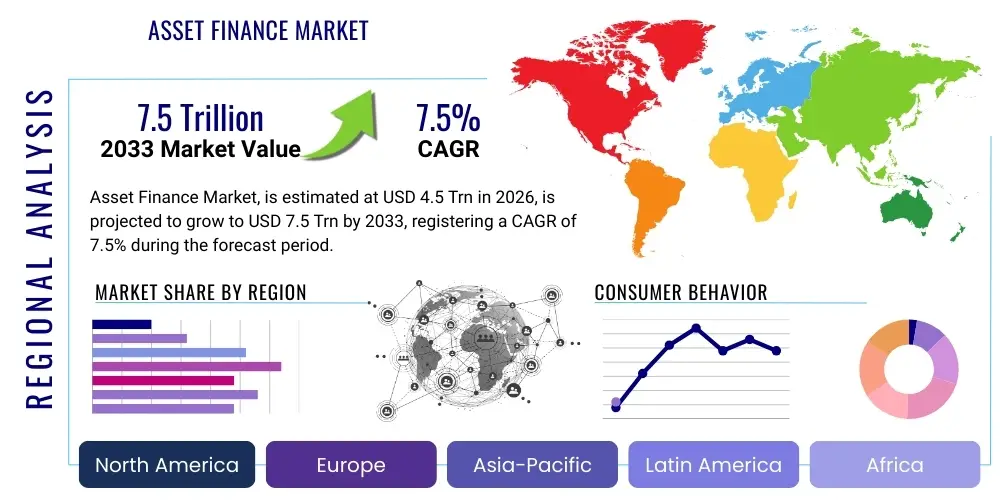

Asset Finance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436016 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Asset Finance Market Size

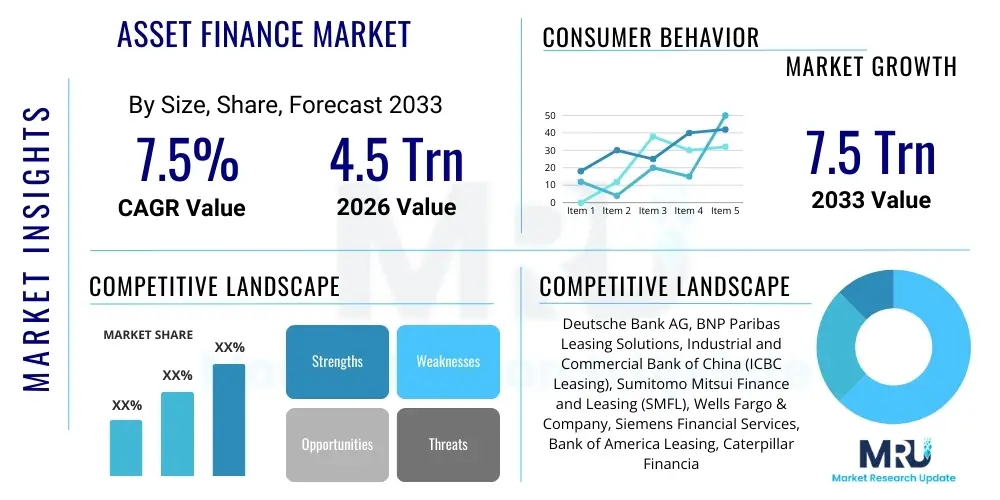

The Asset Finance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. This robust expansion is fueled by increasing infrastructure spending, digitalization of lending processes, and strong demand for flexible capital solutions across various industries, including transportation, construction, and manufacturing. Asset finance provides crucial liquidity, enabling businesses of all sizes, particularly Small and Medium Enterprises (SMEs), to acquire essential equipment without massive upfront capital expenditure, thereby supporting operational continuity and expansion objectives globally. The market's stability and growth trajectory reflect its intrinsic link to global economic health and industrial investment cycles.

The market is estimated at $4.5 Trillion in 2026, driven primarily by the strong uptake of leasing and hire purchase agreements in mature North American and European markets, coupled with rapid industrialization efforts in the Asia Pacific region. Financial institutions are increasingly leveraging sophisticated risk modeling and digital platforms to streamline the application-to-disbursement process, making asset acquisition more accessible and competitive. Furthermore, the shift towards sustainable and green assets (like electric vehicles and renewable energy equipment) is introducing new, high-value segments into the overall financing structure, securing continued large-scale investments.

The Asset Finance Market is projected to reach $7.5 Trillion by the end of the forecast period in 2033. This significant growth is predicated on advancements in FinTech, which are reducing transaction costs and improving customer experience, alongside favorable regulatory frameworks that encourage investment in tangible assets. Specialized finance providers, often niche players, are carving out substantial market share by offering tailored solutions, particularly in complex asset categories such as aircraft and heavy machinery. The resilience of the market, even during economic volatility, underscores its essential role in maintaining the flow of goods and services globally.

Asset Finance Market introduction

Asset finance, fundamentally, involves financing the acquisition of tangible assets for business use, encompassing products such as leasing, hire purchase, secured loans, and contract hire. This mechanism allows businesses to utilize equipment—ranging from IT infrastructure and vehicle fleets to industrial plant and machinery—by spreading the cost over the asset's useful economic life, thus preserving working capital. The core benefit of asset finance is its capital efficiency; it substitutes large capital outlays with predictable, manageable periodic payments. This is particularly vital for capital-intensive sectors seeking technological upgrades or expansion without eroding immediate cash reserves. The flexibility in repayment structures and ownership options, depending on the specific finance product chosen, makes it a highly attractive financial instrument globally, catering to diverse commercial needs and regulatory environments.

Major applications of asset finance span virtually every commercial sector. In the transportation industry, it facilitates the procurement of commercial vehicles, shipping containers, and specialized rolling stock. For the manufacturing and construction sectors, asset finance is critical for acquiring heavy equipment, production lines, and advanced robotics, driving productivity improvements. Additionally, the proliferation of technology assets—servers, network equipment, and high-value software licenses—is increasingly managed through asset-backed financing, reflecting the evolving nature of ‘assets’ in the modern economy. The rising global focus on sustainability has also amplified the application of asset finance towards green assets, such as solar panels, wind turbines, and energy-efficient building systems, positioning finance providers as key facilitators of the energy transition.

Key driving factors propelling the Asset Finance Market include the sustained global demand for new industrial equipment, favorable tax depreciation allowances in major economies, and the continuous need for technological refresh cycles across enterprises. Furthermore, the competitive lending landscape among financial institutions, coupled with the entry of disruptive FinTech platforms, is lowering borrowing costs and expanding the reach of asset finance to underserved market segments. Economic recovery post-global disruptions often sees a surge in asset financing as businesses accelerate delayed investment plans. The inherent security provided by the asset itself minimizes risk for lenders, often resulting in more favorable terms compared to unsecured lending, thereby maintaining the product's fundamental appeal and accelerating its adoption rate worldwide.

Asset Finance Market Executive Summary

The Asset Finance Market is characterized by accelerating digitalization and a profound shift toward specialized, sector-specific financing solutions. Current business trends indicate a strong prioritization of operational leasing, particularly for high-turnover assets like IT equipment and commercial vehicle fleets, allowing companies to minimize balance sheet risk and maintain operational agility. The integration of advanced data analytics and Artificial Intelligence (AI) is revolutionizing credit assessment and risk management, significantly reducing turnaround times and improving portfolio quality for finance providers. Furthermore, the market is witnessing robust consolidation among traditional banks and leasing firms aiming to achieve economies of scale and combat competition from agile FinTech disruptors who offer superior user experiences and faster digital onboarding processes, defining a highly competitive operational landscape centered on speed and personalization.

Regionally, the market dynamics are highly heterogeneous. North America and Europe remain foundational markets, distinguished by high transaction volumes and sophisticated product penetration, though growth rates are moderate compared to emerging economies. The Asia Pacific (APAC) region is poised to exhibit the highest growth CAGR, fueled by massive government investment in infrastructure, rapid industrial expansion in economies like India and Southeast Asia, and escalating demand for machinery to support manufacturing output. Meanwhile, Latin America and the Middle East & Africa (MEA) are seeing steady uptake, driven by extractive industries and energy sector development, often relying on syndicated finance for large-scale, high-value asset acquisition. Regulatory stability and investment policies favoring asset ownership are critical determinants of regional performance, guiding capital flows toward high-potential geographies.

In terms of segmentation trends, financing for transport and construction equipment continues to dominate the market share, reflecting fundamental global needs for logistics and urban development. However, the fastest growth is observed in the technology and industrial equipment segments, particularly those related to automation, robotics, and cloud infrastructure deployment. Within end-users, SMEs represent a significant and growing segment, requiring flexible finance options that traditional commercial lending often fails to provide adequately. The increasing adoption of usage-based financing models, moving away from traditional fixed contracts, is a structural shift, aligning financing costs directly with operational benefit and demonstrating the market’s responsiveness to modern business practices that prioritize flexibility and performance measurement over rigid ownership structures.

AI Impact Analysis on Asset Finance Market

Common user questions regarding AI's impact on asset finance often center on "How AI enhances credit scoring for non-traditional assets," "What are the ethical implications of using machine learning in loan approval," and "Will automation displace human underwriters?" Users are primarily concerned with AI's capability to deliver faster, more accurate risk assessment in complex scenarios, particularly concerning the valuation of used assets or predicting maintenance costs, which directly affects residual value risk. There is also significant interest in AI's role in fraud detection, ensuring compliance, and personalizing the customer journey. Key themes revolve around optimization (speed and accuracy), risk mitigation (fraud and residual value), and the required skills transition for finance professionals in an AI-augmented environment. The overriding expectation is that AI will move asset finance from a reactive, documentation-heavy process to a proactive, predictive, and highly efficient digital service, ultimately lowering operational costs and expanding access to capital.

AI technologies, including machine learning (ML), natural language processing (NLP), and predictive analytics, are fundamentally reshaping the operational backbone of asset finance firms. ML algorithms are now capable of processing vast amounts of structured and unstructured data—including geospatial data, operational performance logs from IoT-enabled assets, and macroeconomic indicators—to generate highly precise credit risk models that surpass traditional scorecard methods. This depth of analysis allows financiers to underwrite deals previously considered too complex or risky, such as specialized machinery or emerging technology assets, by providing a real-time, dynamic assessment of the borrower's probability of default and the asset's economic viability. The result is a significant reduction in the time required for decision-making, moving processing from days to mere hours, thereby enhancing competitiveness and improving the overall customer experience through streamlined operations.

Furthermore, AI is driving significant efficiencies in the middle and back-office functions. NLP is being deployed to automate the review and extraction of critical data from complex legal and contractual documentation, minimizing manual errors and accelerating compliance checks. Predictive maintenance models, built using AI on asset usage data, allow finance providers offering full-service leases (like contract hire) to proactively manage the residual value of the assets, scheduling necessary interventions before critical failures occur. This shift towards predictive lifecycle management ensures the asset retains its value upon return, mitigating one of the largest financial risks in operating leases. Despite the benefits, concerns remain regarding data privacy, model bias, and the transparency of decision-making, necessitating robust governance frameworks to maintain stakeholder trust and regulatory adherence in the deployment of sophisticated AI systems.

- Enhanced Credit Underwriting: Utilizing machine learning to analyze proprietary and external data for highly accurate, non-linear risk assessment and dynamic pricing.

- Predictive Residual Value: AI models forecast asset depreciation and wear-and-tear using IoT data, crucial for structuring profitable operating leases and mitigating end-of-term risks.

- Fraud and Compliance Automation: NLP and anomaly detection algorithms screen applications and monitor transactions for suspicious activity, ensuring regulatory adherence and reducing financial crime exposure.

- Personalized Customer Journey: AI-driven chatbots and recommendation engines provide instant assistance and tailor financing offers based on inferred customer needs and purchasing history.

- Operational Cost Reduction: Automation of routine data entry, document verification, and contract management accelerates processing times and lowers administrative overhead.

DRO & Impact Forces Of Asset Finance Market

The dynamics of the Asset Finance Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces determining market growth velocity and direction. A primary driver is the global need for operational efficiency, pushing businesses toward acquiring high-cost, specialized equipment necessary for competitive advantage without straining balance sheets. Asset finance offers a practical solution, particularly in environments of high capital expenditure requirements. Conversely, market restraints often revolve around economic instability and volatile interest rate environments, which increase the cost of capital for finance providers and may suppress borrower confidence, leading to delayed investment decisions. The opportunity lies heavily in digitalization and penetrating emerging markets with customized, technology-enabled financing products. These combined forces dictate the pace of innovation and risk appetite among financial institutions engaged in asset-backed lending.

Drivers: Key market drivers include robust infrastructure investment initiatives globally, the increasing adoption of consumption-based business models (shifting from ownership to usage), and the accelerated pace of technological obsolescence, especially in IT and manufacturing sectors, necessitating frequent equipment upgrades. Favorable accounting standards, such as IFRS 16, which mandates the capitalization of most leases on the balance sheet but still differentiates between finance methods, influence the choice of product, often favoring operational leases that minimize balance sheet impact. The sheer necessity for SMEs to access essential tools—often having limited collateral or credit history for traditional bank loans—drives demand for secured asset finance products where the asset itself serves as primary security, fostering economic inclusion and supporting small business growth.

Restraints: Significant restraints include the inherent complexity of valuation for specialized, niche assets, which requires expert appraisal and increases transaction costs. Regulatory fragmentation across international borders poses compliance challenges for multinational finance providers, demanding complex localization of processes and risk management frameworks. Furthermore, the volatility associated with used asset values, especially during economic downturns or rapid technological shifts (e.g., the transition from internal combustion engines to electric vehicles), creates significant residual value risk for lessors, requiring stringent risk mitigation strategies and potentially higher pricing, which can deter potential customers. The reliance on external capital markets for funding also exposes lessors to liquidity risks and interest rate fluctuations, dampening growth prospects during tightening financial cycles.

Opportunities: Major opportunities reside in leveraging advanced technology, particularly blockchain for secure contract management and asset tracking, enhancing transparency and reducing administrative friction. The burgeoning demand for green and sustainable asset financing, driven by environmental, social, and governance (ESG) mandates, opens vast new markets for financing electric vehicle fleets, renewable energy infrastructure, and energy-efficient machinery. Furthermore, strategic partnerships between traditional financial institutions and FinTech companies allow for rapid deployment of digital platforms, extending market reach into underserved segments and geographies with tailored, instant financing solutions, unlocking substantial unrealized market potential by democratizing access to capital for productive assets.

Segmentation Analysis

The Asset Finance Market is broadly segmented based on the type of asset, the financial product employed, and the end-user industry, providing a granular view of market dynamics and specialized financing needs. Segmentation allows financial institutions to tailor their marketing strategies, risk models, and product development efforts to specific high-growth niches. The type of asset is a fundamental differentiator, ranging from soft assets (like IT and office equipment) characterized by rapid depreciation and short-term leases, to hard assets (such as heavy machinery and aircraft) which require long-term, high-value financing structures and sophisticated residual value management. This diversification reflects the varied capital intensity and operational requirements across the global economy.

Product segmentation reveals the preferences of borrowers concerning ownership and risk transfer. Operating leases, where the lessor retains ownership and residual value risk, are popular for assets requiring frequent upgrades (e.g., technology) or for companies prioritizing off-balance sheet treatment. Conversely, finance leases and hire purchase agreements, which eventually transfer ownership to the lessee, appeal to firms seeking eventual ownership and long-term asset utilization, typically for high-utility, long-life assets like real estate or specialized manufacturing equipment. The mix between these products is a crucial indicator of market maturity and the prevailing economic sentiment toward capital investment versus operational expenditure.

End-user segmentation highlights where the capital is deployed most actively. While sectors such as transportation, construction, and manufacturing consistently represent the largest market shares due to their intrinsic need for heavy machinery, the fastest-growing segments are often found in IT, healthcare (financing medical imaging equipment), and agriculture (precision farming technology). The varying credit profiles and regulatory environments of these sectors necessitate highly customized financing offerings, requiring finance providers to develop deep domain expertise to accurately assess asset utility, operational risk, and the specific macroeconomic factors influencing each vertical's investment cycles.

- By Asset Type:

- Transportation Equipment (Commercial vehicles, Railcars, Aircraft, Shipping containers)

- Construction and Industrial Equipment (Excavators, Cranes, Production lines, Robotics)

- IT Equipment (Servers, Data centers, Software licenses, Computers)

- Medical and Healthcare Equipment (MRI machines, Diagnostic devices, Laboratory systems)

- Agricultural Equipment (Tractors, Harvesters, Precision farming technology)

- Other Assets (Office equipment, Renewable energy installations)

- By Product Type:

- Leasing (Operating Lease, Finance Lease/Capital Lease)

- Hire Purchase/Conditional Sale

- Commercial Loans/Secured Term Loans

- Invoice Factoring (Related to asset management liquidity)

- Refinancing and Sale-and-Leaseback

- By End User:

- Small and Medium Enterprises (SMEs)

- Large Enterprises/Corporations

- Public Sector/Government Entities

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Asset Finance Market

The value chain for the Asset Finance Market begins upstream with the capital providers and manufacturers of the assets being financed. Capital providers include large banks, non-bank financial institutions (NBFIs), specialized leasing companies, and increasingly, captive finance arms of major equipment manufacturers. These entities raise funds through deposits, capital markets, and securitization, determining the supply-side interest rate and overall market liquidity. Manufacturers play a crucial role by influencing the demand through product innovation, production quality, and often offering direct captive finance options, creating a closed-loop system that reduces customer friction and accelerates sales cycles. Effective upstream coordination, especially in syndicated deals for high-value assets, is essential for securing competitive financing terms and ensuring timely asset delivery.

Midstream activities involve core financial services processing, specifically origination, underwriting, risk management, and contract management. This is where digitalization and technological adoption have the most profound impact. Origination involves customer acquisition and application processing, often utilizing digital portals and AI-driven assessment tools for rapid decision-making. Underwriting focuses on evaluating the creditworthiness of the borrower and the intrinsic value and residual risk of the asset itself, often requiring complex modeling for specialized equipment. Contract management, including billing, maintenance tracking (for operating leases), and ensuring regulatory compliance throughout the contract life cycle, forms the operational backbone that ensures the profitability and regulatory integrity of the financing agreement.

Downstream analysis focuses on asset utilization, distribution channels, and end-of-life management. Distribution is complex, involving direct sales forces, independent brokers, equipment dealers, and online marketplaces. Brokers and dealers often serve as critical intermediaries, connecting end-users with suitable finance products and facilitating the transaction. End-of-life management, including asset recovery, remarketing, or disposal, is crucial for mitigating residual value losses, especially for operating leases. The most effective value chains integrate asset tracking technologies (IoT) throughout the utilization phase, providing real-time data on usage and condition, which enhances residual value prediction, streamlines maintenance, and optimizes the final disposition process, thereby maximizing the total economic return for the lessor.

Asset Finance Market Potential Customers

The primary end-users or buyers of asset finance are organizations requiring immediate use of capital equipment without immediate full ownership costs. This encompasses a vast array of economic actors, ranging from local proprietorships needing a single commercial vehicle to multinational corporations requiring entire fleets of aircraft or sophisticated manufacturing assembly lines. The unifying characteristic of potential customers is the need for productive assets that generate revenue or enhance efficiency, coupled with a preference for spreading capital expenditure over time. Small and Medium Enterprises (SMEs) constitute a critical and high-volume segment, often relying on asset finance due to limited access to traditional secured bank lending. For SMEs, asset finance acts as a vital tool for capacity expansion and technological modernization, directly contributing to economic vitality and job creation in local markets.

Large enterprises and multinational corporations represent the segment for high-value, complex transactions, often involving syndicated finance or specialized vendor financing arrangements. These customers use asset finance strategically—not necessarily due to capital constraints, but to optimize tax positions, manage balance sheet exposure, and maintain flexibility in technology refresh cycles. For instance, large logistics firms rely heavily on contract hire for fleet management, outsourcing maintenance and residual value risk to the lessor, thereby focusing internal resources on core logistical operations. The sophisticated requirements of these large clients drive innovation in finance products, pushing providers toward highly structured, bespoke financing solutions that often integrate maintenance and insurance packages.

Beyond traditional businesses, emerging customer groups include public sector bodies, such as municipal governments financing utility vehicles or IT infrastructure, and specialized sectors like healthcare and education. The healthcare segment demands continuous investment in high-cost, rapidly evolving medical technology, making leasing an attractive option to manage obsolescence risk. Furthermore, with the global push for sustainability, entities involved in renewable energy generation—from large utility projects to distributed rooftop solar installations—are increasingly becoming significant customers, driving demand for specialized green asset financing structures. Ultimately, any organization with a quantifiable, productive use for a tangible asset is a potential customer, demonstrating the market's fundamental breadth and resilience across economic sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Trillion |

| Market Forecast in 2033 | $7.5 Trillion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deutsche Bank AG, BNP Paribas Leasing Solutions, Industrial and Commercial Bank of China (ICBC Leasing), Sumitomo Mitsui Finance and Leasing (SMFL), Wells Fargo & Company, Siemens Financial Services, Bank of America Leasing, Caterpillar Financial Services, De Lage Landen International B.V. (DLL), Toyota Financial Services, Hitachi Capital Corporation, Mitsubishi UFJ Lease & Finance, Volvo Financial Services, Societe Generale Equipment Finance, Scotiabank. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Asset Finance Market Key Technology Landscape

The technological landscape of the Asset Finance Market is defined by the integration of digital platforms aimed at enhancing efficiency, security, and data-driven decision-making throughout the entire asset lifecycle. The core technologies deployed include advanced cloud-based origination and servicing platforms, which provide scalable and flexible infrastructure for managing high volumes of leasing and loan contracts. These platforms facilitate seamless data exchange between dealers, finance providers, and customers, drastically reducing processing time and improving transparency. Furthermore, API integrations are becoming standard, enabling asset finance providers to embed their offerings directly into manufacturer or dealer point-of-sale systems, creating frictionless "instant finance" options that cater to modern customer expectations for speed and convenience, thereby shortening the sales cycle significantly.

Crucially, the rise of Distributed Ledger Technology (DLT), specifically blockchain, is poised to revolutionize asset registration and ownership transfer. By creating immutable, tamper-proof records of asset titles, maintenance history, and financing agreements, blockchain mitigates risks associated with fraud and simplifies the complexity of collateral management and cross-border transactions. This is particularly relevant for high-value assets like aircraft or maritime vessels, where proving provenance and lien status is cumbersome. Concurrently, the proliferation of Internet of Things (IoT) sensors installed on financed assets provides real-time operational data. This data stream feeds into Artificial Intelligence (AI) and Machine Learning (ML) models, offering finance providers unparalleled insights into asset utilization, condition monitoring, and risk prediction, enabling the creation of innovative, usage-based financing contracts (pay-per-use models) that align finance costs precisely with the asset’s productivity.

The continued investment in Cybersecurity and Regulatory Technology (RegTech) is also paramount, given the sensitive nature of financial data and contractual obligations. Robust cybersecurity measures are essential to protect digital origination platforms and customer data from sophisticated cyber threats. RegTech solutions automate compliance monitoring, particularly concerning anti-money laundering (AML) and know-your-customer (KYC) requirements, which are increasingly stringent globally. The strategic adoption of these technologies moves asset finance from a traditionally paper-heavy, relationship-based service to a highly automated, data-centric industry, ensuring faster service delivery, more accurate risk pricing, and superior scalability across diverse regional markets and complex asset classes, fundamentally reshaping competitive dynamics among incumbents and disruptors alike.

Regional Highlights

Regional dynamics play a crucial role in shaping the Asset Finance Market, reflecting varying economic growth rates, regulatory environments, and capital expenditure priorities across different geographies. North America and Europe, as mature markets, exhibit high penetration rates for sophisticated products like operating leases and securitized asset pools. Growth in these regions is primarily driven by technological upgrades (IT and automation equipment) and the continuous renewal of aging infrastructure. The competitive landscape is dominated by large universal banks and captive finance companies, focusing on leveraging AI and digitalization to optimize existing processes and reduce operational expenditure, maintaining profitability in highly saturated environments. Regulatory stability in these regions provides a favorable environment for large-scale, long-term financing agreements.

The Asia Pacific (APAC) region is the engine of global growth for asset finance, characterized by rapid industrialization, massive infrastructure projects (e.g., in China, India, and Indonesia), and an expanding base of SMEs seeking capital. The demand for construction and manufacturing equipment is exceptionally high. While traditional secured loans and finance leases are prevalent, the region is quickly adopting digital financing solutions, often leapfrogging older operational models. Local banks and regional specialized finance companies, alongside global giants, are aggressively competing for market share, often utilizing government incentives and favorable tax policies aimed at stimulating local manufacturing and logistics capabilities. The sheer volume of transactions and the scope of infrastructure needs ensure APAC will maintain the highest growth trajectory throughout the forecast period.

Latin America (LATAM) and the Middle East & Africa (MEA) present markets with high potential but often greater volatility. In LATAM, commodity-driven economies heavily rely on asset finance for mining, agriculture, and energy sector equipment. Economic volatility and currency fluctuations pose significant underwriting challenges, leading to higher-risk premiums and a preference for shorter-term or US Dollar-denominated contracts. The MEA region, particularly the GCC countries, sees strong demand related to diversification efforts away from oil, including investments in tourism, smart city development, and logistics hubs, driving significant financing for transportation and specialized high-tech assets. Growth here is often linked directly to major governmental Vision plans and associated large-scale project financing, necessitating sophisticated structuring expertise.

- North America (NA): Characterized by high adoption of technological assets and sophisticated securitization; focuses heavily on optimizing credit models using advanced data analytics.

- Europe: Driven by strict regulatory frameworks (IFRS 16 implications) and a strong push toward sustainable finance (green vehicles and energy assets); operating leases are highly favored.

- Asia Pacific (APAC): Highest expected growth rate due to rapid infrastructure development, manufacturing expansion, and increasing penetration of finance into the vast SME segment.

- Latin America (LATAM): Growth tied to extractive industries and agricultural modernization; faces challenges related to economic and currency instability, impacting contract pricing.

- Middle East & Africa (MEA): Focus on large-scale infrastructure and economic diversification projects, particularly in transport and construction; driven by state-led investment initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Asset Finance Market.- Deutsche Bank AG

- BNP Paribas Leasing Solutions

- Industrial and Commercial Bank of China (ICBC Leasing)

- Sumitomo Mitsui Finance and Leasing (SMFL)

- Wells Fargo & Company

- Siemens Financial Services

- Bank of America Leasing

- Caterpillar Financial Services

- De Lage Landen International B.V. (DLL)

- Toyota Financial Services

- Hitachi Capital Corporation

- Mitsubishi UFJ Lease & Finance

- Volvo Financial Services

- Societe Generale Equipment Finance

- Scotiabank

- J.P. Morgan Asset Management

- GE Capital

- Close Brothers Group plc

- Aldermore Group PLC

- CIT Group (part of First Citizens Bank)

Frequently Asked Questions

Analyze common user questions about the Asset Finance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between an operating lease and a finance lease?

The primary difference lies in risk and ownership transfer. An operating lease treats the asset as an operational expense; the lessor retains ownership and bears residual value risk, making it suitable for technology needing frequent upgrades. A finance lease (or capital lease) essentially acts as a loan; the lessee assumes substantially all the risks and benefits of ownership, and the asset is typically recorded on the lessee's balance sheet under IFRS 16 rules, leading to eventual ownership.

How is residual value risk managed in the Asset Finance Market?

Residual value (RV) risk, the risk that an asset's worth at the end of the lease term is lower than projected, is managed primarily through sophisticated AI-driven predictive modeling based on usage data (IoT), robust maintenance schedules, and effective remarketing strategies. Finance providers mitigate this risk by analyzing historical data, market forecasts, and asset condition monitoring to set conservative RV estimates and optimize disposal channels.

Which asset classes are driving the highest growth in asset financing currently?

While traditional asset classes like construction and transportation remain largest by volume, the highest growth rates are currently driven by technology assets (IT infrastructure, cloud computing hardware, robotics), due to accelerated digitalization, and Green Assets, including Electric Vehicles (EVs) and renewable energy generation equipment, propelled by global ESG mandates and energy transition investments.

What role does FinTech play in challenging established asset finance institutions?

FinTech firms challenge incumbents by focusing on digital-first, highly streamlined processes. They leverage advanced algorithms for instant credit decisions and offer superior user experiences, often utilizing alternative data sources for underwriting SMEs. This efficiency reduces transaction costs and drastically speeds up the time-to-funding, forcing traditional banks to accelerate their own digital transformation strategies to remain competitive.

What is the significance of captive finance companies in the Asset Finance ecosystem?

Captive finance companies, owned by manufacturers (e.g., Caterpillar Financial, Volvo Financial Services), are significant because they integrate finance directly into the equipment sales process. They use proprietary knowledge of their assets to offer competitive rates and flexible terms, capture a large share of sales financing, and provide specialized support that independent finance houses may lack, thereby stabilizing sales volumes for the parent company.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager