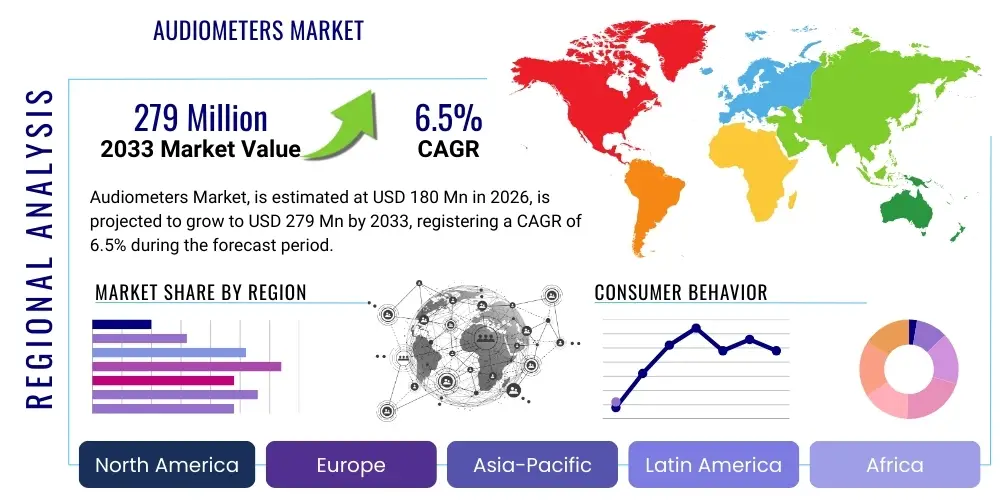

Audiometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438071 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Audiometers Market Size

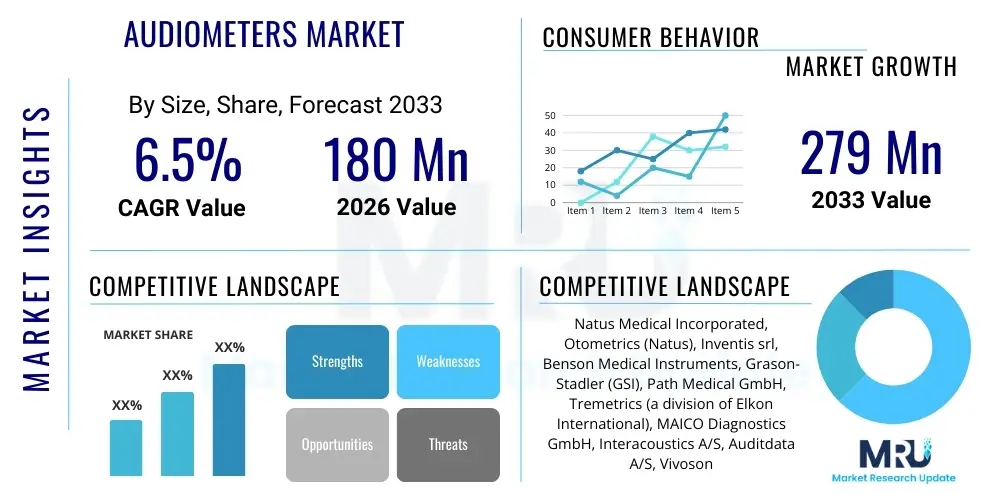

The Audiometers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 180 Million in 2026 and is projected to reach USD 279 Million by the end of the forecast period in 2033. This growth trajectory is fueled primarily by the global aging population, increasing awareness regarding early diagnosis of hearing impairments, and significant technological advancements leading to the development of highly accurate and portable diagnostic devices suitable for various clinical and non-clinical settings.

Audiometers Market introduction

The Audiometers Market encompasses devices crucial for measuring hearing sensitivity and diagnosing various types of hearing loss, ranging from mild to profound. These specialized medical devices generate pure tones and speech stimuli across a defined frequency and intensity range, enabling clinicians to chart an individual's audiogram. The market includes both clinical audiometers, which offer sophisticated diagnostic capabilities, and screening audiometers, utilized primarily in schools, occupational health settings, and primary care centers for rapid assessment. The fundamental product description involves hardware (transducers, processors) and software interfaces essential for accurate calibration and data interpretation, adhering strictly to international standards for acoustic measurements.

Major applications of audiometers extend across diverse healthcare environments, including specialized audiology clinics, tertiary care hospitals, ENT (Ear, Nose, and Throat) departments, and public health screening programs, particularly newborn hearing screening initiatives. The increasing global burden of hearing impairment, driven by factors such as noise pollution, ototoxic drug exposure, and congenital issues, mandates effective diagnostic tools. Audiometers provide objective and reliable metrics necessary for subsequent intervention, such as fitting hearing aids or cochlear implants, thereby significantly enhancing the quality of life for affected individuals.

The core benefits derived from advanced audiometry include precise determination of the degree and type of hearing loss (conductive, sensorineural, or mixed), localized site-of-lesion testing, and monitoring the progression of hearing disorders over time. Driving factors include government initiatives promoting hearing health, rapid urbanization leading to increased noise exposure, and continuous innovation focused on miniaturization, enhanced connectivity, and user-friendly interfaces, making advanced diagnostics accessible even in resource-limited settings. These advancements are transforming traditional audiological testing protocols into streamlined, data-driven procedures.

Audiometers Market Executive Summary

The global Audiometers Market is poised for robust expansion, reflecting key business trends centered around digital transformation and integrated healthcare solutions. Manufacturers are increasingly prioritizing the development of PC-based and tablet-controlled audiometers that leverage sophisticated software for improved workflow efficiency and seamless integration with Electronic Health Records (EHRs). A prominent trend is the shift towards tele-audiology, driven by the need for remote diagnostic capabilities, which significantly expands market reach, particularly in rural or underserved areas. Furthermore, intense competition among key players is focusing on enhancing portability and calibration reliability, crucial features for occupational health and mobile clinics, thus ensuring high operational efficacy across varied diagnostic scenarios.

Regionally, North America continues to dominate the market due to high healthcare expenditure, established reimbursement policies, and early adoption of advanced medical technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), fueled by rapidly improving healthcare infrastructure in countries like China and India, rising prevalence of age-related hearing loss due and significant government investment in public health screening programs. Europe maintains a strong presence, characterized by stringent regulatory environments ensuring high product quality and the widespread adoption of standardized hearing assessment protocols across the European Union. Latin America and the Middle East & Africa (MEA) are emerging markets, driven by increasing health awareness and modernization of existing healthcare facilities, although growth here is currently constrained by lower accessibility to specialized diagnostic equipment.

Segmentation trends indicate strong growth in the Diagnostic Audiometers segment due to the rising demand for comprehensive audiological assessments in clinical settings. Technology-wise, PC-based audiometers are gaining traction over traditional standalone devices, offering superior data management and analytical capabilities. Moreover, the End-User segment is witnessing substantial growth in the private clinic and independent practitioner category, reflecting the trend towards decentralized healthcare services. This granular segmentation reveals that the need for both highly accurate clinical systems and cost-effective screening tools ensures broad-based market expansion across all major product lines and applications, adapting to the varying needs of the global healthcare ecosystem.

AI Impact Analysis on Audiometers Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Audiometers Market frequently center on automation, diagnostic accuracy improvement, and the potential for remote, unsupervised testing. Common concerns include the reliability of AI algorithms in diverse patient populations, the necessity for robust data security protocols, and how AI integration will change the role of human audiologists. Users are keenly interested in AI's capacity to interpret complex audiogram patterns, identify subtle indicators of specific hearing pathologies, and automate the calibration and quality control process of the equipment itself. Key themes emerging from this analysis reveal high expectations for AI to democratize access to sophisticated diagnostics by enabling efficient, large-scale screening and providing decision support systems that minimize human error, thereby accelerating the diagnostic pathway and optimizing treatment planning, particularly for complex or challenging cases.

- AI integration facilitates automated interpretation of audiometric data, enhancing diagnostic speed and consistency.

- Machine learning algorithms enable predictive modeling for hearing loss progression and personalized treatment recommendations.

- AI supports remote calibration and quality assurance checks for audiometric equipment, ensuring data reliability across distributed networks.

- Advanced noise reduction techniques, powered by AI, improve the accuracy of testing, especially in non-ideal clinical environments.

- AI aids in classifying specific types of hearing disorders by recognizing complex patterns within the acoustic data that might be missed by manual observation.

- Development of smart screening tools utilizing AI allows for self-administered or minimally supervised hearing tests, expanding accessibility.

DRO & Impact Forces Of Audiometers Market

The market trajectory for audiometers is shaped by a confluence of powerful drivers (D), significant restraints (R), and compelling opportunities (O), which collectively define the impact forces influencing industry stakeholders. A major driver is the escalating prevalence of hearing impairments globally, primarily linked to the demographic shift towards an older population segment, which naturally experiences higher rates of presbycusis (age-related hearing loss), necessitating frequent and reliable diagnostic testing. Furthermore, heightened public health awareness campaigns, coupled with mandatory newborn hearing screening programs implemented in numerous developed and developing nations, significantly boost the demand for both sophisticated diagnostic and high-throughput screening audiometers, ensuring early detection and intervention for optimal developmental outcomes.

Conversely, the market faces notable restraints, chiefly the relatively high initial acquisition cost of advanced clinical audiometers and the complexities associated with their regular maintenance and rigorous calibration requirements, which often prohibit adoption in smaller clinics or healthcare facilities in low-resource settings. Another significant impediment is the scarcity of trained audiology professionals and technicians, particularly across emerging economies, which limits the effective deployment and utilization of sophisticated audiometric equipment, thereby hindering market penetration. The regulatory landscape, while ensuring quality, often imposes lengthy approval processes for new devices, potentially slowing down the commercialization of technological innovations, which impacts time-to-market for pioneering products.

Opportunities for growth are abundant, particularly in the realm of telehealth and mobile health (mHealth) solutions, where the integration of compact, portable, and wireless audiometers allows clinicians to serve remote patient populations effectively, expanding diagnostic reach beyond traditional clinical boundaries. The growing focus on occupational health and safety mandates the routine hearing testing of employees exposed to industrial noise, opening substantial avenues in the industrial audiology segment. Furthermore, the development of sophisticated software platforms that seamlessly integrate audiometric data with other patient health records presents a significant opportunity for creating comprehensive, longitudinal patient care profiles, improving clinical decision-making and patient management efficiency across various healthcare disciplines.

Segmentation Analysis

The Audiometers Market is meticulously segmented based on Type, Technology, and End-User, allowing for granular analysis of market dynamics and targeted strategic development. The segmentation reflects the diverse clinical and screening needs of the global healthcare system, ranging from high-precision diagnostic assessments to routine, fast-paced population screenings. Understanding these segments is critical for manufacturers aiming to align their product development efforts with specific market demands, such as the increasing need for portable screening devices in primary care settings versus the requirement for highly specialized clinical instruments in tertiary referral centers. This detailed breakdown highlights the contrasting demand patterns across the diagnostic workflow.

Based on Type, the market is primarily divided into Diagnostic and Screening audiometers. Diagnostic audiometers represent the segment requiring complex testing protocols, crucial for detailed evaluation of hearing loss characteristics, whereas Screening audiometers are designed for quick and efficient pass/fail tests, commonly used for high-volume public health initiatives. In terms of Technology, the shift towards PC-based audiometers, which offer superior software functionality and connectivity, is rapidly outpacing traditional Stand-alone audiometers, which historically dominated the market but lack modern data integration capabilities. This technological evolution is a major driver of change in the segmentation landscape.

The End-User segmentation categorizes demand sources into major groups such as Hospitals, Clinics, and Research Institutes. Hospitals and large clinical settings remain the primary purchasers of high-end diagnostic equipment due to their capacity for managing complex cases and conducting extensive audiological evaluations. However, specialized Audiology Clinics are gaining prominence as they offer focused services, often adopting advanced technology earlier than general hospital settings. Research Institutes contribute significantly through their demand for highly specialized, calibrated equipment used in clinical trials and auditory science research, necessitating stringent technical specifications and continuous hardware and software updates to meet evolving research needs.

- By Type:

- Diagnostic Audiometers

- Screening Audiometers

- By Technology:

- Stand-alone Audiometers

- PC-based Audiometers

- Portable and Handheld Audiometers

- By End-User:

- Hospitals and Clinics

- Audiology Centers and Private Practices

- Research Institutes

- Occupational Health Departments

Value Chain Analysis For Audiometers Market

The Value Chain for the Audiometers Market begins with the upstream analysis, which involves the procurement of highly specialized electronic components, including sophisticated digital signal processors (DSPs), high-precision transducers (headphones, bone conductors), calibrated microphones, and specialized acoustic sensors. Key suppliers in this segment provide essential components that dictate the measurement accuracy and reliability of the final audiometric device, emphasizing the need for robust quality control and compliance with stringent medical device standards (e.g., IEC 60645). Partnerships with specialized electronics manufacturers are crucial for maintaining a competitive edge and ensuring a reliable supply of cutting-edge microprocessors necessary for advanced features like noise reduction and automated testing protocols integrated within modern audiometers.

The midstream segment involves the core manufacturing, assembly, software development, and rigorous calibration processes. Manufacturing involves integrating sensitive electronics with user-interface hardware and developing proprietary diagnostic software compliant with medical data privacy regulations (like HIPAA or GDPR). Calibration is a continuous and critical step, ensuring that the devices meet or exceed national and international audiometric standards, requiring specialized acoustic laboratories and highly skilled technical personnel. Distribution channels play a vital role, often leveraging a mix of direct sales forces for large hospital systems and specialized indirect distributors or authorized dealers who provide local support, maintenance, and essential calibration services, particularly in geographically diverse regions or highly decentralized markets.

Downstream analysis focuses on the end-users—hospitals, specialized clinics, and government health agencies—who utilize the audiometers for clinical diagnosis and screening. The adoption rate is significantly influenced by the efficacy of the distribution channel in providing post-sale support, training, and routine recalibration services, which are non-negotiable requirements for certified audiological practice. Direct channels are preferred for high-volume governmental tenders or large corporate clients seeking personalized service and integration consulting. Conversely, indirect channels often excel in penetrating smaller private practices or international markets where local expertise and established logistical networks are essential for effective market access and continued customer satisfaction.

Audiometers Market Potential Customers

The primary potential customers and end-users of audiometers span a wide spectrum within the healthcare ecosystem, ranging from large, publicly funded hospital systems to independent, specialty private practices and institutions dedicated to research and education. Hospitals, particularly those with dedicated Ear, Nose, and Throat (ENT) departments and audiology clinics, represent major buyers, demanding comprehensive diagnostic audiometers capable of performing advanced battery of tests, including speech audiometry, immittance measurements, and specialized testing like ABR (Auditory Brainstem Response) and OAE (Otoacoustic Emissions). These organizations require durable, network-integrated equipment that can handle high patient throughput and seamlessly link diagnostic results with centralized patient management systems.

Specialized audiology centers and independent private practices constitute another critical customer segment. These facilities often focus purely on hearing health and rehabilitation, leading them to prioritize precision, user-friendly interfaces, and portability in their purchasing decisions, especially for devices used in hearing aid fitting and follow-up care. Furthermore, government agencies and non-profit organizations focused on public health initiatives are significant buyers, primarily driving demand for high-volume, cost-effective screening audiometers utilized in school health programs, military physical examinations, and industrial health surveillance programs designed to meet regulatory standards for noise exposure monitoring across various occupational settings.

Beyond clinical care, academic and research institutions are key potential customers, requiring state-of-the-art audiometers with highly customizable parameters and extensive data logging capabilities for conducting controlled experiments, clinical trials, and developing new diagnostic methodologies. Lastly, the industrial sector, through occupational health clinics, represents a growing customer base, driven by the mandate to regularly screen employees exposed to high levels of workplace noise, thereby focusing their procurement efforts on robust, frequently calibrated, and easily deployable screening audiometers compliant with workplace safety regulations and industrial hygiene standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 180 Million |

| Market Forecast in 2033 | USD 279 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Natus Medical Incorporated, Otometrics (Natus), Inventis srl, Benson Medical Instruments, Grason-Stadler (GSI), Path Medical GmbH, Tremetrics (a division of Elkon International), MAICO Diagnostics GmbH, Interacoustics A/S, Auditdata A/S, Vivosonic Inc., Welch Allyn (Hillrom/Baxter), Amplivox Ltd., Micro-DSP, Beijing Beiyang Medical Instrument Co. Ltd., Rion Co. Ltd., HORENTEK Kft., Starkey Hearing Technologies, Medtronic plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Audiometers Market Key Technology Landscape

The technology landscape of the Audiometers Market is undergoing rapid transformation, largely driven by the shift from purely analog or electromechanical devices to sophisticated digital systems that emphasize software-driven diagnostics and enhanced connectivity. The prominence of PC-based audiometry has fundamentally altered clinical workflow, utilizing standard commercial hardware and integrating specialized software for signal generation, patient data management, and test protocol automation. This technological evolution allows for high-resolution frequency control, sophisticated noise handling capabilities, and the capacity to run complex, multi-variable test batteries essential for accurate differential diagnosis, all managed through a centralized and user-friendly graphical interface that minimizes setup time and potential for procedural errors.

A critical area of technological development involves the integration of wireless communication standards and miniaturization techniques, leading to the proliferation of highly portable and handheld audiometers. These devices often rely on tablet or smartphone interfaces, utilizing Bluetooth or Wi-Fi to connect calibrated transducers, thereby enabling clinical-grade testing outside traditional sound booths. This portability is vital for expanding services into remote locations, optimizing health screening initiatives, and facilitating tele-audiology consultations, where remote control and secure data transmission are paramount. Furthermore, advancements in specialized transducers, particularly lightweight, highly stable insert headphones and bone conduction oscillators, ensure accurate, calibrated stimuli presentation across the full diagnostic frequency range, improving patient comfort while maintaining measurement integrity.

Beyond hardware and connectivity, proprietary software and calibration technologies form the backbone of modern audiometry. Manufacturers are heavily investing in algorithms that ensure automatic calibration checks and drift compensation, mitigating the risks associated with equipment performance degradation over time and use. The incorporation of advanced noise cancellation techniques and environmental monitoring within the testing software is crucial for improving test reliability in acoustically challenging environments, further driving the utility of portable devices. Moreover, the industry is increasingly adopting standardized communication protocols (like HL7) to ensure seamless and secure integration of audiometric test results into broader healthcare information systems, addressing compliance requirements and streamlining the overall clinical documentation process across various institutional settings.

Regional Highlights

North America, comprising the United States and Canada, stands as the leading region in the Audiometers Market, characterized by its mature healthcare infrastructure, significant per capita healthcare spending, and proactive adoption of advanced diagnostic technologies. The region benefits from well-established audiology practice guidelines and high consumer awareness regarding hearing health. Government initiatives, coupled with widespread insurance coverage for diagnostic services, contribute to a high volume of audiological testing. Furthermore, a strong presence of key market players and research institutions drives continuous innovation, particularly in PC-based systems and tele-audiology solutions. The United States market is particularly large, influenced by stringent occupational safety regulations mandating regular hearing surveillance for employees in high-noise industries, cementing its dominant position in terms of both revenue generation and technological adoption.

Europe represents the second-largest market, driven by universal healthcare access in many Western European nations and a strong commitment to public health screening programs, including compulsory newborn hearing screening. Countries such as Germany, the United Kingdom, and France exhibit high demand for high-quality, calibrated audiometric equipment, adhering strictly to European Union medical device regulations, which emphasize precision and reliability. The market in Europe is characterized by the presence of strong local manufacturers who are pioneers in developing highly accurate clinical audiometers. The increasing aging population across the continent further ensures sustained demand for diagnostic services for age-related hearing loss, while the expanding geriatric care sector necessitates continuous investment in diagnostic technologies that support long-term patient monitoring.

Asia Pacific (APAC) is forecast to be the fastest-growing regional market throughout the forecast period. This rapid expansion is primarily attributable to massive investments in healthcare infrastructure development across emerging economies like China, India, and Southeast Asian countries, coupled with an escalating population base and rising disposable incomes. While penetration rates were historically low, government efforts to standardize healthcare services and implement national hearing screening initiatives are dramatically increasing the market size. The APAC region sees high demand for cost-effective, durable, and highly portable audiometers suitable for deployment in remote or primary care settings, indicating a strong focus on screening and basic diagnostics before referral to specialized centers, creating unique opportunities for market entry and localized product adaptation.

- North America: Dominant market share driven by high healthcare expenditure, established reimbursement frameworks, and strong focus on occupational health testing and advanced clinical diagnostics.

- Europe: Significant market size supported by universal healthcare access, strict regulatory standards (MDR), and mandatory public health screening programs, sustaining demand for high-precision devices.

- Asia Pacific (APAC): Highest CAGR expected, fueled by improving healthcare infrastructure, massive population size, rising hearing impairment prevalence, and government push for widespread early detection initiatives.

- Latin America (LATAM): Emerging market with increasing adoption spurred by modernization of clinical facilities and rising awareness, though constrained by economic instability and variable public health funding.

- Middle East & Africa (MEA): Growth driven by healthcare tourism, infrastructural development in GCC countries, and initiatives to address congenital hearing disorders, creating demand for specialized equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Audiometers Market.- Natus Medical Incorporated

- Otometrics (A division of Natus Medical)

- Inventis srl

- Benson Medical Instruments Co.

- Grason-Stadler (GSI)

- Path Medical GmbH

- Tremetrics (a division of Elkon International)

- MAICO Diagnostics GmbH

- Interacoustics A/S

- Auditdata A/S

- Vivosonic Inc.

- Welch Allyn (owned by Hillrom/Baxter International)

- Amplivox Ltd.

- Micro-DSP Technology Inc.

- Beijing Beiyang Medical Instrument Co. Ltd.

- Rion Co. Ltd.

- HORENTEK Kft.

- Starkey Hearing Technologies

- Medtronic plc

- Döppler Medical Instruments

Frequently Asked Questions

Analyze common user questions about the Audiometers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Audiometers Market?

The key drivers are the global increase in the geriatric population, leading to higher incidence of age-related hearing loss, the mandatory implementation of newborn hearing screening programs globally, and continuous technological advancements resulting in portable, cost-effective, and highly accurate diagnostic devices suitable for diverse clinical and non-clinical environments. Public awareness campaigns regarding early hearing loss detection also significantly fuel demand for routine testing equipment across occupational and educational settings, ensuring sustained market expansion throughout the forecast period.

How is tele-audiology influencing the demand for modern audiometers?

Tele-audiology is a transformative trend driving demand for PC-based and wireless portable audiometers that facilitate remote testing and consultation. This paradigm shift enables clinicians to deliver calibrated diagnostic services to patients in geographically isolated or underserved areas, significantly improving access to care. Modern audiometers must be equipped with secure data transmission capabilities and robust remote control software to meet the stringent technical and privacy requirements of effective tele-audiology platforms, thereby expanding market potential beyond traditional clinical confines.

Which technology segment is expected to show the fastest growth rate?

The PC-based Audiometers segment is projected to exhibit the fastest growth rate. These systems leverage superior computing power and customizable software interfaces, offering advantages in data management, integration with Electronic Health Records (EHRs), and the ability to seamlessly incorporate advanced diagnostic algorithms, including AI-powered interpretation tools. The flexibility, upgradeability, and enhanced analytical capabilities of PC-based systems make them increasingly preferred over traditional stand-alone units in sophisticated clinical practices seeking optimized workflow efficiency and standardized patient data protocols.

What is the main challenge restraining market expansion in emerging economies?

The primary restraint in emerging economies is the lack of specialized infrastructure and the critical shortage of trained audiology professionals required to operate, maintain, and correctly interpret results from advanced audiometric equipment. Although portable screening devices are relatively accessible, the high capital cost of advanced clinical audiometers and the complex calibration requirements remain a significant barrier, limiting full adoption in resource-constrained public healthcare settings, necessitating focused investment in both equipment and specialized human capital development for sustained market growth.

What role does Artificial Intelligence play in future audiometric testing?

Artificial Intelligence (AI) is set to revolutionize audiometric testing by enabling automated interpretation of complex audiograms, providing decision support to clinicians, and accelerating the diagnostic process with enhanced accuracy. AI algorithms are crucial for developing smart screening tools that can be utilized without direct specialist supervision, expanding the reach of preliminary testing. Furthermore, AI contributes to predictive maintenance and quality assurance by constantly monitoring equipment calibration status and ensuring the consistency and reliability of data collected across various testing locations and environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Medical Audiometers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Medical Audiometers (Diagnostic Audiometer) Market Size Report By Type (Stand-alone Audiometer, Hybrid Audiometer, PC-Based Audiometer), By Application (Diagnose, Screening, Clinical), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Medical Audiometers Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Stand-alone Audiometer, Hybrid Audiometer, PC-Based Audiometer), By Application (Diagnose, Screening, Clinical), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager