Automotive Alternator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432316 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Automotive Alternator Market Size

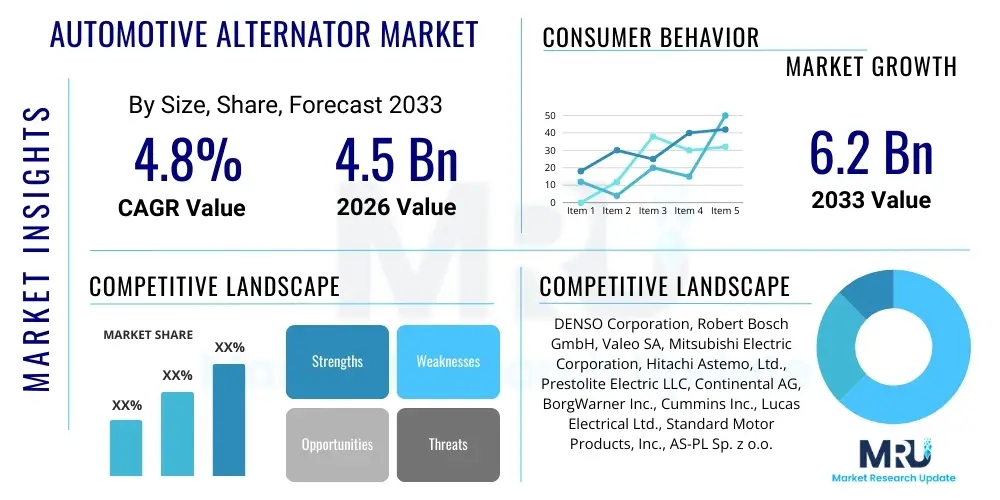

The Automotive Alternator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.2 billion by the end of the forecast period in 2033.

Automotive Alternator Market introduction

The Automotive Alternator Market encompasses the manufacturing, distribution, and sale of electrical energy conversion devices crucial for maintaining the operational integrity of internal combustion engine (ICE) and hybrid vehicles. These devices, fundamentally electro-mechanical generators, convert mechanical energy derived from the engine's crankshaft (via a drive belt system) into electrical alternating current (AC), which is subsequently rectified into direct current (DC) by integrated semiconductor components. This DC power is essential for two primary functions: recharging the vehicle's 12V battery system and instantaneously powering all on-board electrical consumers, including lighting, ignition systems, complex sensor arrays, sophisticated infotainment systems, and critical Advanced Driver-Assistance Systems (ADAS). The continuous evolution of vehicle safety and comfort features has resulted in a substantial increase in the vehicle's electrical load, mandating the development and widespread adoption of higher output, more thermally efficient, and electronically regulated alternators, moving beyond simple power generation to becoming critical components of the vehicle's energy management strategy.

The product scope of the market extends beyond conventional models to include advanced systems like Integrated Starter Generators (ISGs) and Belt-Driven Starter Generators (BSGs), critical components in 48V mild-hybrid architectures. These hybrid systems utilize enhanced alternators not only for power generation but also for functions such as engine starting, regenerative braking, and torque assistance, thereby significantly improving vehicle performance and reducing emissions. Modern product offerings are heavily influenced by the global imperative for improved fuel efficiency and reduced carbon emissions, catalyzing the proliferation of High-Efficiency (HE) Alternators and Starter-Generator combinations. Specifically, the introduction of 48V mild-hybrid architectures has necessitated the widespread adoption of the Belt-Driven Starter Generator (BSG) and the more integrated, complex Integrated Starter Generator (ISG). These advanced units fulfill a triple role: power generation, engine starting, and kinetic energy recovery through regenerative braking. Their capability to provide modest torque assist during acceleration further cements their role as critical components in powertrain electrification. Consequently, the core benefits of modern alternators are transitioning from mere battery charging to active contributions toward emission reduction and enhanced vehicle performance, requiring advanced thermal and power electronics management capabilities.

Major applications of these alternators span the entire vehicle spectrum, from small passenger cars (PVs) and light commercial vans (LCVs) to heavy-duty commercial trucks (HCVs) and off-highway industrial machinery. The sustained high volume in the Original Equipment Manufacturer (OEM) segment is directly proportional to global vehicle production, demanding specialized, high-durability components tailored to specific engine specifications and regulatory environments, particularly those enforced in North America and Europe concerning electrical system redundancy and resilience. Furthermore, the immense and perpetually renewing Aftermarket segment ensures long-term revenue stability, as conventional alternators are subject to wear and require replacement typically every 80,000 to 150,000 miles, driven by the fatigue life of bearings, brushes, and electronic components. Key driving factors sustaining market growth include the mandatory electrification push via MHEVs, the non-negotiable need for electrical reliability in an aging global vehicle fleet, and the ceaseless integration of power-hungry electronic features, such as enhanced communication modules and advanced Lidar/Radar sensor sets. The focus on high power density and lightweight design remains paramount for all application segments, particularly in space-constrained engine compartments.

Automotive Alternator Market Executive Summary

The Automotive Alternator Market is undergoing a strategic evolution, primarily dictated by the global automotive industry's pivot toward electrification and enhanced efficiency. Current business trends indicate a strong bifurcation: the conventional alternator segment continues to thrive due to a large installed base requiring aftermarket replacements and sustained production of affordable ICE vehicles, particularly in developing economies. Concurrently, the OEM segment is witnessing rapid growth in advanced generator systems, notably BSG and ISG technologies, driven by regulatory mandates promoting 48V mild-hybrid adoption in mature markets like Europe and North America. Manufacturers are heavily investing in lightweight materials and sophisticated voltage regulation systems to improve energy efficiency, thereby contributing to lower carbon footprints across the internal combustion and hybrid segments. A key competitive trend involves leveraging digital integration capabilities, specifically embedding LIN/CAN communication features, to allow the alternator to participate actively in the vehicle’s sophisticated energy management network.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing market, propelled by rapid industrialization, burgeoning vehicle production, and increasing consumer demand for technologically advanced vehicles in countries like China and India. North America and Europe maintain high revenue shares, primarily due to the high average age of vehicles supporting a lucrative aftermarket sector, coupled with stringent emission standards that accelerate the adoption of high-efficiency and mild-hybrid solutions in new vehicle fleets. The focus in these developed regions is increasingly on smart alternators capable of complex communication with the vehicle's electrical architecture to optimize power supply based on real-time driving conditions and electrical load, maximizing fuel economy benefits. European dominance in advanced technology is driven by rigorous EU directives, forcing Tier 1 suppliers to pioneer robust 48V components suitable for mass-market deployment and high operational cycling requirements inherent in modern start-stop systems.

Segmentation trends confirm that the OEM segment holds the largest value share, as every new vehicle requires an alternator, often a high-specification unit designed for the specific electrical load profile and thermal environment. However, the aftermarket segment offers substantial volume and resilience, characterized by stable demand fueled by routine wear and tear replacements, a non-negotiable service requirement for vehicle longevity across billions of vehicles globally. From a technology perspective, while conventional alternators still represent the largest installed base, the Belt-Driven Starter Generator (BSG) segment is exhibiting the highest growth trajectory, reflecting its cost-effectiveness and relatively straightforward integration into existing powertrain designs, making it the preferred choice for mass-market mild-hybridization efforts globally, pushing overall market value expansion. Furthermore, the heavy-duty segment (HCV) continues to demand specialized brushless alternators engineered for extreme durability and continuous high-output applications.

AI Impact Analysis on Automotive Alternator Market

User queries regarding AI's influence typically revolve around how artificial intelligence and machine learning (ML) contribute to component longevity, energy harvesting optimization, and manufacturing process quality assurance. The key concerns addressed include the feasibility of integrating AI-driven fault prediction capabilities into standard alternator units, the methods used to train ML models on complex vibration and thermal datasets indicative of wear, and the return on investment for smart manufacturing systems utilizing AI for real-time quality control. Users recognize that the alternator is now a data point within the vehicle's electrical nervous system and are keenly interested in how AI can translate operational data into tangible benefits, such as maximizing energy yield during regenerative events in hybrid vehicles and ensuring the component operates at peak efficiency throughout its service life, thus reducing total cost of ownership (TCO) for fleet operators and consumers alike.

AI algorithms are fundamentally reshaping the operational profile of advanced alternators, particularly the BSG and ISG units within mild-hybrid ecosystems. By analyzing continuous data streams—including engine speed, battery State of Charge (SoC), ambient temperature, accessory load, and driver inputs—AI models execute sophisticated predictive control strategies. For instance, an AI system can anticipate the need for maximum power output before the demand actually materializes, managing the transition smoothly and preventing voltage sags. Conversely, during periods of low electrical demand and high state of charge, the system intelligently decouples or reduces the alternator's output, minimizing the parasitic drag imposed on the engine. This dynamic, predictive load shedding, impossible with traditional rule-based controllers, directly translates into measurable fuel savings and reduced CO2 emissions, transforming the alternator from a passive supplier to an active energy management partner, capable of complex communication via integrated LIN/CAN bus systems.

Beyond in-vehicle performance, the application of AI in manufacturing provides a substantial competitive advantage. High-volume alternator production involves intricate processes, such as the precise winding of copper coils and the integrity of solder joints in the rectifier assembly. AI-powered computer vision systems, integrated with high-resolution cameras on the assembly line, perform real-time, non-destructive inspection of these critical components. These ML models are trained on thousands of examples of acceptable and defective components, enabling the identification of subtle anomalies—such as minor insulation breaches or inconsistencies in winding density—far more accurately and rapidly than human inspectors. This capability ensures near-zero defect rates for OEM batches, significantly lowering warranty claims and recall risks, which are exceptionally costly in the automotive supply chain. Furthermore, AI optimizes machine parameters, anticipating when equipment maintenance is due based on vibrational analysis (predictive maintenance on the manufacturing machinery itself), thereby ensuring continuous production uptime and efficiency and lowering overall operational expenses for manufacturers.

- AI-driven optimization of power generation efficiency, minimizing parasitic engine drag by dynamically adjusting output voltage and current.

- Predictive maintenance analytics forecasting impending mechanical or electrical failures based on operational sensor data, including vibration and thermal signatures.

- Enhanced quality control and defect detection in manufacturing using machine vision systems trained to identify minute flaws in windings and rectifier assemblies.

- Optimization of regenerative braking and torque assist functions in BSG/ISG systems via machine learning algorithms for maximum kinetic energy recovery.

- Intelligent voltage regulation adjusting output dynamically based on real-time vehicle load, battery State of Health (SoH), and ambient conditions.

- Supply chain optimization using AI to manage inventory, forecast aftermarket demand based on vehicle parc age distribution, and rationalize procurement strategies for high-cost materials like copper.

- Development of digital twins for simulating alternator wear and tear under various operating conditions, accelerating product validation and R&D cycles.

DRO & Impact Forces Of Automotive Alternator Market

The Automotive Alternator Market trajectory is heavily influenced by a nexus of global regulatory drivers and transformative technological opportunities, counterbalanced by long-term structural restraints specific to the automotive industry's electrification roadmap. A primary driver is the non-stop increase in vehicle electrical content, requiring ever-higher power outputs; features like high-power stereo systems, complex networked ECUs, heated seats, and critical Level 2/3 ADAS functionalities demand robust and consistent power supply exceeding 150 Amperes, pushing the design envelope for efficiency and thermal management in a constrained engine bay environment. This driver is powerfully reinforced by the global adoption of mandatory Start-Stop systems, which require alternators capable of higher reliability under frequent cycling, demanding specialized high-durability components and advanced voltage regulation for seamless operation, thus driving volume and value growth in the OEM segment. Furthermore, stringent global emission standards, such as future Euro 7 regulations, necessitate micro-hybridization using BSG technology as a necessary, cost-effective tool to meet CO2 reduction targets without a full powertrain redesign.

A significant, almost existential, restraint on market growth is the irreversible global commitment towards Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs). While MHEVs and HEVs provide a near-term growth surge, BEVs eliminate the need for a belt-driven, mechanical alternator entirely, instead relying on high-voltage battery power and DC-DC converters for the 12V system. Although the transition period is projected to span several decades, the market capitalization and long-term investment risk assessment are heavily weighted against ICE-dependent components. This long-term constraint complicates investment decisions in specialized manufacturing assets. Additionally, the high initial cost and integration complexity associated with the advanced 48V starter-generator systems (BSG/ISG) pose a near-term barrier for cost-sensitive segments, particularly in emerging markets where consumers prioritize upfront affordability over long-term fuel savings benefits afforded by mild-hybrid technology, slowing the pace of modernization in these high-volume regions.

Opportunities are prominently clustered around the 48V mild-hybrid segment and the geographical expansion into high-growth, high-volume regions. The cost-effectiveness of 48V architecture, offering regulatory compliance gains at a fraction of the cost of full-hybrid systems, positions BSGs as the essential bridge technology. Manufacturers focusing R&D efforts on maximizing the efficiency and thermal capacity of BSGs stand to capture substantial market share as global vehicle manufacturers scale up MHEV production across all platforms, from entry-level to premium segments. Concurrently, the robust, resilient aftermarket demand in regions like India, Brazil, and Africa offers unparalleled volume stability, driven by the large and often poorly maintained vehicle parc which necessitates frequent replacement of essential components. Strategic opportunities also exist in developing next-generation rectifier technologies utilizing materials like Silicon Carbide (SiC), which promises drastically reduced power loss and improved thermal performance, enabling smaller, lighter, and more powerful alternators essential for future vehicle design flexibility and efficiency targets across all automotive segments.

Segmentation Analysis

The Automotive Alternator Market is meticulously segmented based on key criteria including Technology, Vehicle Type, and Sales Channel, reflecting the diverse application landscape and varying demands across the global automotive industry. This structured segmentation allows for a precise understanding of market dynamics, identifying high-growth niches within the rapidly evolving powertrain landscape. The Technology segment distinguishes between traditional components and advanced systems crucial for hybridization efforts, indicating where R&D resources are being concentrated toward high-efficiency magnetics and power electronics. Vehicle Type segmentation highlights the differing electrical needs and replacement rates between passenger vehicles and commercial applications, where durability and continuous high output are paramount requirements.

Detailed analysis of the Technology segment reveals that while conventional alternators retain volume leadership due to the existing car parc, the growth trajectory is overwhelmingly directed towards Integrated Starter Generators (ISG) and Belt-Driven Starter Generators (BSG). These advanced units are inherently tied to the proliferation of mild-hybrid electric vehicles (MHEVs), offering critical functionalities like regenerative braking and instantaneous engine restart. The shift signals a move towards components that are not merely power generators but active, intelligent elements of the powertrain management system, demanding higher complexity and integration capabilities from manufacturers, particularly in thermal management and bi-directional power flow control, thereby raising the technological barrier to entry for new market participants and increasing the value proposition of established Tier 1 suppliers.

The Sales Channel segmentation provides crucial strategic insights; the Original Equipment Manufacturer (OEM) segment is defined by high quality requirements, strict regulatory compliance, and long-term contracts, typically commanding high volumes linked directly to new vehicle production cycles. This channel demands extensive validation and often requires highly customized solutions specific to the vehicle platform. Conversely, the Aftermarket segment, consisting of repair shops, independent distributors, and service centers, is characterized by price sensitivity, brand loyalty, and recurring demand driven by vehicle maintenance cycles, representing a stable revenue stream resistant to new vehicle market fluctuations and essential for long-term business stability. Successfully managing the aftermarket necessitates a vast inventory of diverse Stock Keeping Units (SKUs) to service the global vehicle parc effectively and efficiently, coupled with robust logistics networks capable of ensuring prompt parts availability.

- By Technology:

- Conventional Alternators (Standard claw-pole design for basic ICE vehicles)

- High-Efficiency Alternators (Optimized claw-pole or segment conductor designs with improved voltage regulation and cooling, typically 14V systems)

- Belt-Driven Starter Generator (BSG) (48V systems used in MHEVs, capable of energy recovery and engine assist)

- Integrated Starter Generator (ISG) (More integrated 48V or high-voltage units mounted directly on the crankshaft or transmission, offering enhanced hybrid functionality)

- By Vehicle Type:

- Passenger Vehicles (PV) (Focus on low noise, compact size, and high integration)

- Light Commercial Vehicles (LCV) (Focus on durability and moderate continuous output)

- Heavy Commercial Vehicles (HCV) (Focus on extreme durability, high continuous amperage, often brushless designs)

- By Sales Channel:

- Original Equipment Manufacturer (OEM) (Primary supply for new vehicle assembly)

- Aftermarket (Replacement parts sold through distributors, retailers, and service centers)

Value Chain Analysis For Automotive Alternator Market

The value chain for the Automotive Alternator Market begins with upstream activities involving the sourcing of crucial raw materials, primarily copper for windings, specialized magnetic steel or aluminum for casings and rotor/stator cores, and advanced semiconductor materials for the rectifier and voltage regulator circuits. Key upstream suppliers include magnet wire producers, silicon diode and increasingly Silicon Carbide (SiC) manufacturers, and precision casting companies. The quality and availability of these specialized components directly influence the performance metrics (output, efficiency) and cost structure of the final alternator unit. Strategic partnerships with reliable material suppliers are paramount, especially given recent volatility in global copper and steel prices, requiring manufacturers to employ sophisticated hedging and procurement strategies to maintain cost competitiveness and production schedules, while simultaneously exploring alternative lightweight materials like specialized aluminum alloys for housings to meet vehicle mass reduction goals.

The midstream phase focuses on the core manufacturing processes: stamping, automated winding (often using high-speed robotic systems), assembly, and rigorous endurance testing. This is where advanced technologies, such as lean manufacturing principles, robotics, and integrated machine vision systems, are applied to achieve high volume production with minimal defects, crucial for meeting the stringent quality standards demanded by OEM customers. The transition to advanced alternators (BSG/ISG) requires significant capital investment in specialized assembly lines capable of handling complex power electronics and thermal management systems integral to these hybrid components. Manufacturing expertise must bridge the gap between traditional electro-mechanics and sophisticated electronics integration, ensuring reliability under high-frequency operation and high current loads. Manufacturers must also continuously innovate in rotor and stator designs (e.g., hairpin stators) to maximize power density while reducing overall weight and footprint, a major requirement for modern engine bays and powertrain modularity.

The downstream segment encompasses the distribution and sales channels, categorized primarily into OEM and Aftermarket pathways. The OEM channel is characterized by direct sales to vehicle assembly plants, involving complex logistical coordination and just-in-time (JIT) delivery systems, often requiring suppliers to co-locate or maintain buffers close to the customer assembly plant. This channel demands long-term contract stability and technological alignment. The Aftermarket channel, conversely, relies on a vast, geographically dispersed network of authorized distributors, independent wholesalers, repair garages, and specialized auto parts retailers. Effective downstream management requires robust inventory systems capable of managing thousands of unique SKUs across multiple generations of vehicle models and regional variations. Direct distribution is common for high-volume OEM contracts, while the aftermarket predominantly operates through indirect channels, requiring strong channel partnerships, sophisticated digital cataloging, and competitive pricing strategies to maintain market share and service the diverse, geographically fragmented global repair demand.

Automotive Alternator Market Potential Customers

Potential customers for the Automotive Alternator Market are predominantly categorized into Original Equipment Manufacturers (OEMs) and end-users served by the Aftermarket. OEMs represent the primary volume buyers, encompassing global automotive conglomerates producing Passenger Vehicles (PVs), Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). These customers demand components that adhere strictly to vehicle platform specifications, including compatibility with complex electrical architectures (CAN/LIN bus communication) and specified durability metrics, often demanding testing far exceeding minimum regulatory standards. The purchasing decision for OEMs is heavily influenced by quality certifications (e.g., IATF 16949), price competitiveness over the vehicle lifecycle (TCO), reliability track record, and the supplier's ability to innovate, particularly in delivering cost-effective and highly efficient hybrid power generation solutions essential for meeting fleet-wide CO2 reduction targets.

The aftermarket customer base is highly fragmented but provides essential, stable demand driven by component wear-out cycles. This segment includes independent auto repair shops, authorized dealership service centers, dedicated fleet maintenance operators, and specialized rebuilders. For independent repair shops and consumers, purchasing decisions are primarily driven by brand recognition, component availability (speed of fulfillment), warranty coverage, and the balance between price and perceived quality/durability. There is a discernible trend where consumers are moving away from the cheapest generic options towards established brands offering superior reliability to mitigate the risk of repeat repairs. Fleet operators, managing large numbers of commercial vehicles (buses, trucks), prioritize durability, uptime, and total cost of ownership (TCO), making high-efficiency, robust replacement units particularly attractive to minimize operational downtime and maximize asset utilization rates.

Furthermore, specialized industrial customers, such as marine and off-highway equipment manufacturers (e.g., construction and agriculture machinery), also constitute an important niche within the broader market, demanding ruggedized, high-output alternators designed for hostile operating environments. These buyers require customized solutions featuring superior sealing, resistance to vibration, and specialized cooling mechanisms necessary for continuous operation under heavy load, often at varying engine speeds. This heavy-duty and non-automotive niche market provides an opportunity for manufacturers specializing in durable, high-amperage, often brushless designs, which command premium pricing due to the specialized engineering required to meet the severe operational demands outside the typical passenger car envelope, ensuring product diversification beyond the mass-market challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.2 billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DENSO Corporation, Robert Bosch GmbH, Valeo SA, Mitsubishi Electric Corporation, Hitachi Astemo, Ltd., Prestolite Electric LLC, Continental AG, BorgWarner Inc., Cummins Inc., Lucas Electrical Ltd., Standard Motor Products, Inc., AS-PL Sp. z o.o., Remy Power Products (BorgWarner Group), Mando Corporation, Magneti Marelli SpA, Mahle GmbH, Visteon Corporation, Delco Remy, NGK Spark Plug Co., Ltd., Hella GmbH & Co. KGaA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Automotive Alternator Market Key Technology Landscape

The technological evolution within the Automotive Alternator Market is principally focused on maximizing energy conversion efficiency, reducing weight, and enabling intelligent communication with the vehicle's electrical system architecture. Conventional claw-pole alternators are nearing their performance peak but continue to benefit from incremental improvements, such as optimized electromagnetic designs (e.g., revised claw pole geometry and stator tooth profiles) to minimize eddy current losses and maximize flux density. A key refinement involves the shift from traditional copper wire windings to segment conductor (hairpin) stators, predominantly used in high-efficiency variants. Hairpin technology significantly increases the fill factor, allowing more copper within the stator slot, which reduces resistance, improves thermal management, and dramatically boosts overall power output within the same physical envelope, essential for powering high electrical loads without excessive fuel penalty. Furthermore, advancements in thermal management, utilizing integrated heat sinks and optimized air flow paths, are crucial for allowing these high-output units to function reliably under high engine compartment temperatures prevalent in modern, downsized, turbocharged engines.

The most transformative technology in the current landscape is the 48V Starter-Generator system, categorized primarily as Belt-Driven Starter Generators (BSGs) and crankshaft-mounted Integrated Starter Generators (ISGs). BSGs leverage advanced permanent magnet technology and highly sophisticated three-phase AC induction motors, coupled with state-of-the-art power electronics (inverters/rectifiers) capable of handling high bi-directional current flow necessary for both generation and motoring functions. The critical technological hurdle addressed in these systems is the robust management of the high switching frequency and thermal stress imposed on the semiconductor components during rapid regenerative braking and engine restart events. The evolution toward Silicon Carbide (SiC) MOSFETs in the power inverter stages is a game-changer for 48V systems, offering significantly lower conduction losses and higher switching speeds than traditional silicon devices, leading to smaller, lighter, and vastly more efficient inverters, which translates directly into better system performance and efficiency gains for the mild-hybrid vehicle, reinforcing the supplier's competitive edge and future-proofing the component design against increasing performance demands.

Beyond the core electro-mechanical design, the technological capability for seamless digital integration defines modern alternators. The widespread use of the Local Interconnect Network (LIN) and, increasingly, Controller Area Network (CAN) bus protocols allows the alternator's internal voltage regulator to communicate directly with the Engine Control Unit (ECU) or Battery Management System (BMS). This 'smart alternator' functionality enables dynamic voltage control, allowing the vehicle to strategically increase charging during deceleration (decoupling the load during acceleration) or when excess engine torque is available, maximizing fuel efficiency through load point shifting and ensuring optimal battery health. Furthermore, the specialized heavy-duty segment utilizes brushless alternators, which eliminate the primary wear components (brushes and slip rings), drastically extending service intervals and enhancing reliability, particularly in demanding commercial and off-highway applications where minimizing downtime is paramount. The continuous convergence of high-power density magnetics, advanced semi-conductor technology (SiC), and intelligent communication protocols (LIN/CAN) dictates the technological trajectory of the entire market, pushing manufacturers towards complex electrical system expertise and system-level integration rather than component supply alone.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest global share of the Automotive Alternator Market by volume, underpinned by the world’s largest vehicle production base in China and the rapidly growing passenger vehicle parc in India and Southeast Asian nations. The regional dynamics are characterized by massive demand for both conventional and, increasingly, high-efficiency alternators, driven by sheer scale and urbanization. However, the regulatory environment in key markets like China is accelerating the adoption of 48V mild-hybrid technologies across mid-range and premium segments to comply with national energy consumption targets, creating a dual market where low-cost replacements coexist with cutting-edge BSG production. Market competitiveness is exceptionally high, with strong domestic suppliers vying for both OEM and highly price-sensitive aftermarket contracts, emphasizing localized production, robust supply chain strength, and rapid component delivery to manage the fast-paced nature of regional vehicle production cycles.

- Europe: Europe is the undisputed technological epicenter and highest value market for advanced alternator systems. Stringent European Union emission standards (targeting continuous CO2 reduction, including preparation for Euro 7) have functionally mandated the widespread deployment of mild-hybridization in all mass-market vehicle categories, making Europe the primary consumer and innovator in BSG and ISG technologies. The high ASPs in this region are attributable to the complex specifications, including integrated power electronics, LIN/CAN communication protocols, and the requisite high thermal reliability for Start-Stop systems that cycle frequently in urban driving environments. The European aftermarket is mature and highly quality-conscious, demanding premium components with lengthy warranties, often focusing on parts that guarantee full compatibility with sophisticated electrical architectures to prevent complex diagnostic issues and ensure seamless integration with vehicle control systems.

- North America: The North American market is highly valued due to its robust heavy-duty segment (HCVs and large SUVs/Trucks) requiring high-amperage alternators (often 200A+) to power heavy electrical loads, including extensive cabin features and towing systems. The aftermarket here is exceptionally large and resilient, driven by the longer vehicle lifecycles and higher average age of the operational fleet, ensuring stable, continuous demand for replacement parts. While the transition to BEVs is significant, ongoing regulatory pressure from CAFE standards necessitates optimization of the remaining ICE fleet, driving OEM adoption of high-efficiency alternators and 48V BSG systems, particularly in popular pickup truck and SUV platforms. Manufacturers must navigate unique market requirements concerning reliability under extreme temperature fluctuations (from Canadian winters to Texan summers) and the logistical demands of servicing a geographically vast distribution network effectively.

- Latin America (LATAM): LATAM, heavily centered around manufacturing hubs in Mexico and Brazil, is largely a traditional ICE market, offering sustained volume for conventional and robust standard alternators. The demand profile is highly cost-sensitive in both OEM and aftermarket sectors. Regulatory drives for efficiency are less aggressive than in Europe or North America, meaning complex 48V systems have slower penetration rates, limited primarily to premium imported vehicles. The aftermarket in LATAM is vast and often relies on extensive import networks for branded replacement components, demanding durability suitable for varying fuel quality and often challenging road conditions. Local production centers often serve as export hubs to North American and European assembly plants, adding complexity to the supply chain requirements, necessitating dual product lines catering to both local and international specifications.

- Middle East and Africa (MEA): The MEA market presents logistical challenges and unique product demands. High ambient temperatures necessitate alternators with specialized thermal management systems and robust sealing to protect against dust ingress (particularly in the GCC and North African regions). The market is heavily influenced by imported vehicle fleets, leading to a highly diverse aftermarket requirement profile across brands and models. Demand for heavy-duty alternators is consistent, driven by significant infrastructure, mining, and oil & gas operations utilizing large commercial vehicles and off-highway equipment. Economic diversification efforts are slowly introducing advanced vehicle technologies, though the core remains focused on durable, cost-effective replacement components. Supply chain reliability and local service network presence are critical success factors in this region due to complex import/export procedures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Automotive Alternator Market.- DENSO Corporation

- Robert Bosch GmbH

- Valeo SA

- Mitsubishi Electric Corporation

- Hitachi Astemo, Ltd. (a leader in high-efficiency hybrid components)

- Prestolite Electric LLC (specializing in heavy-duty applications)

- Continental AG (focusing heavily on 48V technology and electronics)

- BorgWarner Inc. (significant player following acquisitions in the starter/alternator space)

- Cummins Inc. (major supplier for heavy-duty commercial vehicle applications)

- Lucas Electrical Ltd.

- Standard Motor Products, Inc. (strong presence in the North American Aftermarket)

- AS-PL Sp. z o.o. (leading European aftermarket supplier)

- Remy Power Products (a key subsidiary of BorgWarner Group)

- Mando Corporation

- Magneti Marelli SpA (now part of Marelli)

- Mahle GmbH (focusing on thermal and engine management components)

- Visteon Corporation

- Delco Remy (known for heavy-duty and specialized alternators)

- NGK Spark Plug Co., Ltd. (expanding portfolio beyond ignition components)

- Hella GmbH & Co. KGaA (strong in automotive electronics and lighting)

Frequently Asked Questions

Analyze common user questions about the Automotive Alternator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for high-efficiency alternators?

The increasing electrical load required by modern vehicle safety systems (ADAS), infotainment units, and sophisticated ECUs is the primary driver. Additionally, stringent global emission standards necessitate improved fuel economy, pushing OEMs to adopt alternators with enhanced efficiency and smart charging capabilities (LIN/CAN communication) to minimize engine parasitic losses and optimize energy management.

How do Belt-Driven Starter Generators (BSGs) differ from conventional alternators?

BSGs are fundamental components in 48V mild-hybrid systems, replacing both the traditional alternator and starter motor. Unlike conventional alternators which only generate power, BSGs utilize advanced permanent magnet technology to act as powerful bi-directional motor-generators, enabling functions like regenerative braking, rapid engine restart for start-stop systems, and instantaneous torque assist, yielding significant fuel savings and emission reductions.

Which geographical region holds the largest market share for automotive alternators?

Asia Pacific (APAC) holds the largest market share by volume, driven by high vehicle production volumes, robust sales of ICE vehicles, and the massive, growing vehicle population requiring consistent aftermarket replacements, particularly in developing economies like China and India, although Europe leads in the adoption and value share of advanced 48V technologies.

What is the long-term restraint impacting the growth of the alternator market?

The dominant long-term restraint is the accelerating global shift towards pure Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs). Since BEVs draw power from their large traction battery and utilize DC-DC converters instead of mechanical alternators, this transition represents a structural limitation on the future growth potential of both conventional and mild-hybrid generator systems.

How does AI contribute to the Automotive Alternator Market?

AI primarily impacts the market through predictive maintenance, using machine learning models trained on thermal and vibration data to forecast potential component failures and optimize service schedules, thus extending component life. In manufacturing, AI-powered vision systems ensure superior quality control for critical processes like coil winding, drastically reducing defect rates and improving product reliability for OEM clients.

Why are Silicon Carbide (SiC) components becoming important in the alternator technology landscape?

SiC technology is crucial for high-efficiency applications, particularly in the power electronics of BSG and ISG systems. SiC MOSFETs offer significantly lower energy loss and higher thermal stability compared to traditional silicon components. This enables the development of smaller, lighter, and more efficient inverters necessary to manage the high bi-directional power flow required for 48V mild-hybrid functions under extreme thermal conditions.

What is the primary difference between the OEM and Aftermarket sales channels?

The OEM channel is characterized by high-volume, highly customized, and zero-defect component supply for new vehicle production under long-term contracts. The Aftermarket channel, conversely, focuses on replacement parts for existing vehicles, characterized by broad SKU complexity, intense price competition, reliance on indirect distribution (wholesalers, garages), and demand driven by periodic maintenance and component wear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Automotive Alternator Slip Ring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Automotive Alternator And Starter Motor Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Starter Motor, Alternator), By Application (Commercial Vehicle, Passenger Vehicle), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager