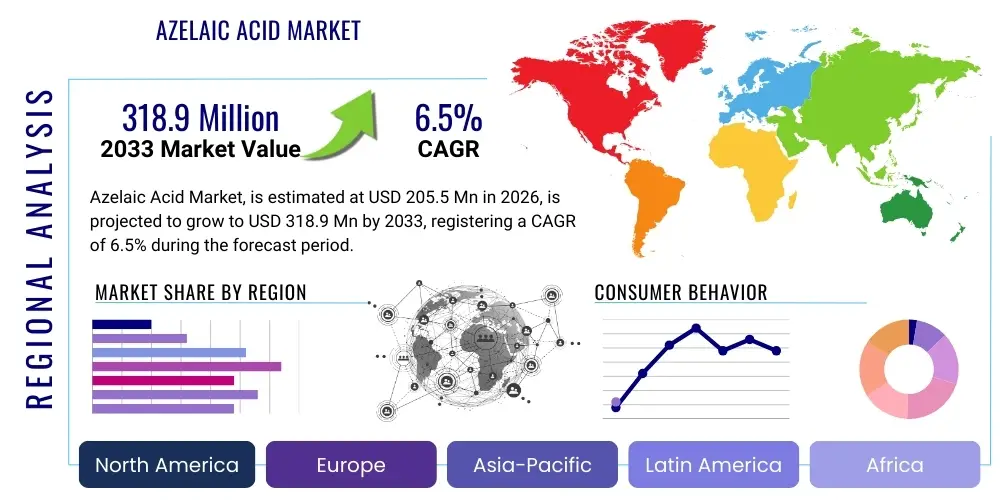

Azelaic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438897 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Azelaic Acid Market Size

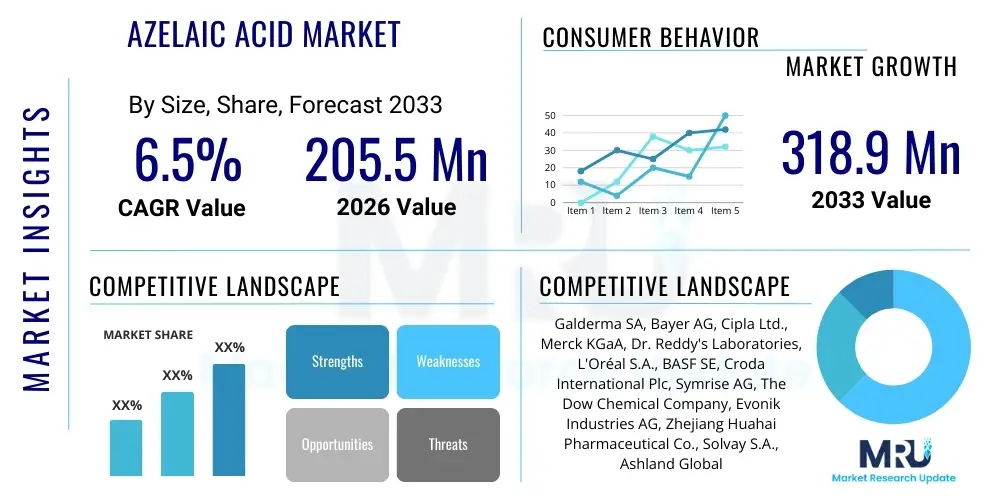

The Azelaic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $205.5 Million in 2026 and is projected to reach $318.9 Million by the end of the forecast period in 2033.

Azelaic Acid Market introduction

Azelaic acid, a naturally occurring dicarboxylic acid found in grains like wheat, rye, and barley, serves as a pivotal ingredient across the pharmaceutical and cosmeceutical sectors due to its multifaceted therapeutic properties. Primarily recognized for its effectiveness as an anti-inflammatory, antimicrobial, and comedolytic agent, it is extensively utilized in topical formulations aimed at treating common dermatological conditions. Its unique mechanism of action, which includes inhibiting tyrosinase, makes it highly effective in addressing post-inflammatory hyperpigmentation (PIH) and uneven skin tone, thereby expanding its applications beyond traditional acne and rosacea treatments into the broader aesthetic market. The increasing consumer focus on skin health and the rising prevalence of chronic skin disorders globally are fundamental elements driving the adoption of azelaic acid-based products.

The primary applications of azelaic acid are centered around its capacity to normalize keratinization and reduce the proliferation of cutibacterium acnes (formerly propionibacterium acnes) in acne vulgaris. Furthermore, its anti-inflammatory efficacy makes it a preferred active ingredient for managing the erythema and papules associated with mild to moderate rosacea. The shift towards milder, scientifically proven ingredients, distinct from harsh treatments like retinoids or benzoyl peroxide for sensitive skin types, positions azelaic acid favorably in the market landscape. Regulatory bodies worldwide generally recognize azelaic acid as a safe and effective ingredient, further bolstering manufacturer confidence and accelerating product innovation in both prescription and over-the-counter (OTC) segments.

Market growth is significantly bolstered by driving factors such as rapid urbanization leading to increased exposure to environmental stressors, which exacerbate skin conditions, coupled with higher disposable incomes fueling demand for premium dermatological solutions. The expanding geriatric population, susceptible to various skin ailments, also contributes substantially to market expansion. Moreover, continuous advancements in formulation technology, including micro-encapsulation and enhanced delivery systems, are improving the stability and bioavailability of azelaic acid, enabling its incorporation into a wider array of consumer products, from serums and creams to specialized prescription treatments.

Azelaic Acid Market Executive Summary

The Azelaic Acid Market is experiencing robust growth fueled by burgeoning demand within the pharmaceutical sector for highly effective, yet gentle, treatments for acne, rosacea, and pigmentary disorders. Key business trends indicate a strong focus on strategic mergers and acquisitions among major cosmetic and pharmaceutical manufacturers seeking to integrate specialized dermatological portfolios. Furthermore, there is a pronounced trend toward clean beauty and naturally derived ingredients, which favors azelaic acid due to its plant-derived sourcing options. Investment in advanced clinical trials to validate new indications, particularly concerning melasma and other severe hyperpigmentation issues, is a defining business strategy adopted by market leaders aiming to secure proprietary advantages and strengthen prescription market share.

Regional trends highlight the Asia Pacific (APAC) as the fastest-growing market, driven by a massive consumer base concerned with skin brightening and anti-aging, alongside increasing healthcare expenditure in countries like China and India. North America and Europe maintain dominance, primarily due to established regulatory frameworks, high awareness of topical treatments, and significant utilization of azelaic acid in prescription-strength formulations. However, stringent regulatory compliance and the necessity for robust clinical data pose slight restraints, particularly for new entrants. The Middle East and Africa (MEA) region is emerging, spurred by rising aesthetic tourism and the subsequent introduction of specialized skincare clinics offering advanced dermatological solutions that frequently incorporate azelaic acid.

Segment trends reveal that the Application segment dominated by Acne Treatment, remains the largest revenue contributor, although the Hyperpigmentation segment is projected to exhibit the highest CAGR, reflecting shifting consumer focus toward aesthetic improvement. By Grade, Pharmaceutical Grade azelaic acid commands a premium due to rigorous quality standards and mandatory regulatory approvals for prescription formulations, while Cosmetic Grade variants see high volumes in the OTC market. Manufacturers are increasingly exploring synthetic production pathways to ensure scalable, cost-effective supply, yet the demand for naturally sourced azelaic acid continues to rise in response to evolving consumer preferences for sustainable ingredients.

AI Impact Analysis on Azelaic Acid Market

User queries regarding the impact of Artificial Intelligence on the Azelaic Acid market primarily revolve around three core themes: accelerated drug discovery and formulation optimization, precision dermatology diagnostics, and personalized skincare recommendations. Consumers and industry professionals frequently question how AI can shorten the lengthy process of identifying optimal azelaic acid delivery systems—such as liposomal encapsulation or microneedle patches—to enhance efficacy and minimize irritation. Another significant concern relates to AI's ability to analyze vast patient genetic and phenotypic data to predict individual responsiveness to azelaic acid treatment for complex conditions like rosacea, thus moving away from generalized dosing and formulation. Finally, stakeholders are interested in AI-powered virtual dermatologists and diagnostic tools that can accurately assess skin conditions (acne severity, pigmentation levels) and recommend azelaic acid concentration based on real-time photographic input, transforming the direct-to-consumer digital commerce experience for cosmeceutical products.

- AI-Driven Formulation Optimization: Utilizing machine learning algorithms to predict stability, efficacy, and sensory attributes of new azelaic acid formulations, reducing R&D cycle time.

- Precision Diagnostics in Dermatology: Employing computer vision and deep learning models to accurately classify skin conditions (e.g., distinguishing between acne types or rosacea subtypes) guiding precise product recommendation.

- Accelerated Clinical Trial Analysis: Using AI to analyze large datasets from clinical studies, identifying key biomarkers and patient subsets most likely to benefit from azelaic acid therapies.

- Personalized Digital Skincare Consultation: Implementing AI chatbots and recommendation engines to suggest optimal azelaic acid concentrations and complementary ingredients based on user skin profile and environmental factors.

- Supply Chain Forecasting: Utilizing predictive analytics to manage raw material sourcing (natural vs. synthetic) and optimizing inventory levels for high-demand azelaic acid derivatives.

DRO & Impact Forces Of Azelaic Acid Market

The Azelaic Acid Market is significantly influenced by powerful dynamics characterized by increasing awareness of its broad dermatological benefits (Driver) alongside the challenge of formulation stability and consumer irritation (Restraint). The compelling driver is the growing global prevalence of chronic inflammatory skin conditions like acne vulgaris and rosacea, necessitating reliable, long-term topical treatments. Furthermore, azelaic acid’s dual role as both a pharmaceutical agent and a cosmetic ingredient—addressing concerns from inflammation to aesthetic pigmentation—provides a unique market advantage. However, the primary restraint lies in its relatively poor solubility and formulation challenges, often requiring high solvent loads or specialized delivery systems, which can increase manufacturing costs and potential skin sensitivity. The ongoing research into advanced drug delivery systems, such as nano-emulsions, represents a crucial opportunity, aiming to overcome these bioavailability limitations and unlock new application potentials in concentrated topical therapies.

Opportunity forces are strongly present in developing new combination therapies where azelaic acid is paired with ingredients like retinoids or salicylic acid, offering synergistic effects and expanding the scope of treatable conditions. Specifically, leveraging its anti-inflammatory profile in sensitive skin products and expanding its use in areas such as post-procedure care (following laser treatments or chemical peels) presents lucrative pathways. Simultaneously, the regulatory environment acts as a double-edged sword: strict quality controls ensure product safety but also impose lengthy approval processes. The increasing demand for non-antibiotic treatments for acne due to rising antimicrobial resistance further cements azelaic acid's position as an essential market component, providing a long-term growth driver that transcends temporary aesthetic trends.

The impact forces operating on this market are centered around technological innovation in synthesis and delivery, coupled with shifting consumer values toward transparency and efficacy. The market responsiveness to new scientific publications demonstrating broader benefits of azelaic acid, such as its antioxidant capabilities, directly influences consumer purchasing decisions and product development priorities. Furthermore, the competitive landscape is intensely focused on patenting novel formulation methods to secure intellectual property over enhanced stability and skin penetration. These forces collectively dictate pricing strategies, market penetration rates, and the speed at which generic and branded azelaic acid products are introduced across different global jurisdictions.

Segmentation Analysis

The Azelaic Acid market is segmented primarily based on its Application in dermatology, its Source (natural versus synthetic derivation), and the Grade required for its end-use (Pharmaceutical versus Cosmetic). This segmentation is crucial for understanding the distinct market dynamics, regulatory compliance levels, and pricing structures associated with different product categories. The Application segment dominates analysis, reflecting the therapeutic areas where azelaic acid demonstrates maximum efficacy. Acne treatment remains the cornerstone, but the rapid expansion in usage for hyperpigmentation underscores the growing demand for multi-functional ingredients in advanced skincare formulations. Furthermore, the distinction between Pharmaceutical Grade and Cosmetic Grade dictates quality assurance requirements, purity standards, and the associated cost of production, directly influencing the product's final retail placement, whether prescription or over-the-counter.

- By Application: Acne Treatment, Rosacea Treatment, Hyperpigmentation (including Melasma and PIH), Skin Brightening, Pharmaceutical, Cosmetics and Personal Care

- By Source: Natural (Derived from Grains), Synthetic (Chemical Synthesis)

- By Grade: Pharmaceutical Grade (High Purity), Cosmetic Grade (Standard Purity)

- By Formulation: Gels, Creams, Foams, Lotions, Suspensions

Value Chain Analysis For Azelaic Acid Market

The value chain for the Azelaic Acid market begins with the upstream sourcing and production of raw materials, which involves either agricultural sourcing (grains like barley and rye for natural extraction) or chemical synthesis of intermediates for the synthetic pathway. Upstream activities require stringent quality control, especially for pharmaceutical applications where impurity profiles are critically monitored. Key chemical manufacturers specialize in synthesizing high-purity azelaic acid, representing a bottleneck stage requiring significant technical expertise and capital investment. This stage significantly determines the cost and purity of the final active pharmaceutical ingredient (API) or cosmetic ingredient. Managing sustainable sourcing and optimizing the energy-intensive synthetic processes are major upstream strategic priorities.

Downstream activities focus heavily on formulation, packaging, and distribution. Formulators (pharmaceutical companies and cosmetic manufacturers) transform the raw API into end products such as creams, gels, and foams, requiring specialized excipients and stability enhancers to ensure optimal shelf life and dermal penetration. The distribution channel is bifurcated into direct sales to prescription outlets (pharmacies and hospitals) for pharmaceutical-grade products, and indirect sales through retail chains, e-commerce platforms, and specialized dermatological clinics for cosmetic and OTC products. The shift towards e-commerce platforms is rapidly expanding the indirect channel's reach, demanding robust digital marketing and efficient logistical fulfillment to reach the global consumer base.

Direct distribution, characterized by established pharmaceutical supply agreements and wholesaler relationships, maintains strict controls over product temperature, authentication, and regulatory tracking, essential for prescription items. Indirect distribution, particularly through high-end specialty retailers and online marketplaces, relies heavily on brand positioning, consumer education, and influencer marketing to drive sales volume. The efficiency of the distribution network significantly impacts product accessibility and pricing across different geographic markets. Continuous investment in optimizing cold chain logistics and mitigating counterfeiting risks remains a central focus throughout the downstream segment of the azelaic acid value chain.

Azelaic Acid Market Potential Customers

Potential customers for Azelaic Acid span a broad spectrum, categorized mainly into institutional buyers, healthcare professionals, and end-consumers. The primary institutional buyers are large pharmaceutical companies and cosmeceutical manufacturers who purchase Azelaic Acid in bulk as a key active ingredient for their proprietary formulations. These corporate buyers prioritize purity, consistent supply, and competitive pricing, often requiring certifications specific to Pharmaceutical Grade standards (e.g., USP/EP). Their purchasing decisions are driven by the need to develop stable, effective topical treatments compliant with global regulatory standards, targeting large-scale chronic skin condition markets.

Healthcare professionals, including dermatologists, general practitioners, and licensed aestheticians, serve as key decision-makers and indirect consumers, prescribing or recommending azelaic acid formulations. These professionals look for clinical evidence supporting efficacy in conditions like papulopustular rosacea, severe acne, and post-inflammatory hyperpigmentation. Their product choices are influenced by patient tolerance profiles, concentration availability (e.g., 15% or 20% prescription strength), and formulary coverage. Specialized aesthetic clinics also represent a rapidly growing customer base, utilizing azelaic acid products for adjunctive therapy following in-office procedures.

The final and most numerous customers are the end-users, individuals suffering from skin conditions or seeking aesthetic improvements. This demographic includes adolescents and adults dealing with acne vulgaris, middle-aged women seeking treatment for melasma and skin brightening, and individuals with sensitive skin who require gentle anti-inflammatory agents. This consumer segment is heavily influenced by digital content, product reviews, and brand reputation, increasingly demanding clean formulations and transparent ingredient sourcing. The growth in the OTC market reflects this segment’s willingness to self-treat mild to moderate conditions using lower concentrations of azelaic acid.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $205.5 Million |

| Market Forecast in 2033 | $318.9 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Galderma SA, Bayer AG, Cipla Ltd., Merck KGaA, Dr. Reddy's Laboratories, L'Oréal S.A., BASF SE, Croda International Plc, Symrise AG, The Dow Chemical Company, Evonik Industries AG, Zhejiang Huahai Pharmaceutical Co., Solvay S.A., Ashland Global Holdings Inc., DSM Nutritional Products, Vantage Specialty Chemicals, Sino Lion USA, Specific companies specializing in Azelaic Acid production/formulation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Azelaic Acid Market Key Technology Landscape

The technological landscape surrounding the Azelaic Acid market is primarily focused on overcoming inherent challenges related to its poor water solubility and crystalline nature, which often limit its bioavailability and cause mild skin irritation at high concentrations. Advanced synthesis techniques, including proprietary crystallization processes, are being employed by major chemical producers to achieve ultra-high purity pharmaceutical grades, crucial for meeting stringent regulatory standards and minimizing side effects. Furthermore, manufacturers are exploring enzymatic synthesis methods as an alternative to traditional chemical routes, aiming to offer more sustainable and environmentally friendly production of azelaic acid, aligning with global trends toward green chemistry.

The most critical technological innovations are concentrated in drug delivery systems designed to enhance penetration and sustained release. Nanotechnology, specifically the use of liposomes, solid lipid nanoparticles (SLNs), and nano-emulsions, is rapidly transforming azelaic acid formulations. These nano-carriers encapsulate the active ingredient, improving its stability, enabling deeper dermal penetration, and providing a controlled release profile, which significantly mitigates the burning or stinging sensation often associated with conventional cream or gel bases. This technological shift is pivotal for developing higher concentration products that are well-tolerated by patients with sensitive skin conditions like rosacea.

Beyond nanotechnology, sophisticated polymer matrix systems are being utilized to create novel foam and suspension formulations. These delivery technologies offer improved cosmetic elegance, patient compliance, and enhanced spreadability over larger affected areas, which is especially important for broad-spectrum acne management. The development of advanced transdermal patches or dissolvable micro-spicule patches for targeted, high-dose delivery of azelaic acid is also an area of active research, promising a revolution in the localized treatment of severe hyperpigmentation spots or cystic acne lesions, further solidifying the link between technological innovation and market viability.

Regional Highlights

The Azelaic Acid market exhibits distinct regional dynamics, dictated by healthcare access, dermatological prevalence rates, and consumer purchasing power. North America, encompassing the United States and Canada, currently holds a dominant share of the market, primarily driven by a high awareness of aesthetic dermatology, advanced regulatory acceptance of azelaic acid in prescription formulations, and high per capita healthcare spending. The sophisticated distribution network and the presence of major pharmaceutical innovators ensure steady market growth. Europe follows closely, with Germany, France, and the UK being key contributors, largely due to established healthcare systems and high demand for European-manufactured cosmeceuticals that incorporate certified high-purity azelaic acid.

The Asia Pacific (APAC) region is poised to be the fastest-growing market segment throughout the forecast period. This accelerated growth is attributed to rising incidences of skin disorders linked to pollution and environmental factors, coupled with a booming demand for skin lightening and anti-pigmentation products, where azelaic acid plays a crucial role. China, Japan, and South Korea are leading this surge, characterized by rapidly expanding middle-class populations seeking premium, science-backed skincare solutions and increasing governmental initiatives aimed at improving public health standards. Local manufacturers are heavily investing in synthetic production capacity to meet the soaring regional demand.

Latin America (LATAM) and the Middle East & Africa (MEA) represent emerging markets for azelaic acid. Growth in LATAM is spurred by urbanization and increasing access to dermatological care in countries like Brazil and Mexico. The MEA region’s expansion is closely linked to the growing influence of aesthetic medical tourism and increasing disposable incomes in Gulf Cooperation Council (GCC) countries, driving demand for advanced clinical treatments and high-end cosmeceuticals. However, regulatory harmonization and supply chain challenges remain more pronounced in these developing regions, impacting market entry and penetration strategies.

- North America: Market leader; driven by advanced R&D, high prescription rates for rosacea and acne, and robust regulatory framework facilitating quick product approval.

- Europe: Strong consumption in pharmaceutical and cosmetic sectors; focus on stringent purity standards (Ph. Eur.) and high demand for natural/green chemistry sourcing.

- Asia Pacific (APAC): Highest projected growth rate; fueled by aesthetic trends (skin brightening, PIH treatment), increasing disposable income, and massive consumer base in populous nations.

- Latin America (LATAM): Emerging market; growth tied to expanding private healthcare sector and rising awareness of advanced topical treatment options for inflammatory skin conditions.

- Middle East and Africa (MEA): Growth driven by medical tourism, affluent consumers demanding premium dermatological treatments, and rapid urbanization leading to increased skin concerns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Azelaic Acid Market.- Galderma SA (Focus on Dermatological Pharmaceuticals)

- Bayer AG (Diversified Healthcare and Consumer Products)

- Cipla Ltd. (Global Generic and Specialty Pharmaceutical Player)

- Merck KGaA (Life Science and High-Tech Materials)

- Dr. Reddy's Laboratories (Generic Drug Manufacturer)

- L'Oréal S.A. (Global Cosmetics and Skincare Leader)

- BASF SE (Chemical Supplier focusing on Cosmetic Ingredients)

- Croda International Plc (Specialty Chemical and Ingredient Supplier)

- Symrise AG (Flavor, Nutrition, and Cosmetic Ingredients)

- The Dow Chemical Company (Chemical Manufacturing)

- Evonik Industries AG (Specialty Chemicals and Performance Materials)

- Zhejiang Huahai Pharmaceutical Co., Ltd. (API Manufacturer)

- Solvay S.A. (Advanced Materials and Specialty Chemicals)

- Ashland Global Holdings Inc. (Specialty Ingredients and Additives)

- DSM Nutritional Products (Health, Nutrition and Bioscience)

- Vantage Specialty Chemicals (Natural-based ingredients)

- Sino Lion USA (Cosmetic Ingredient Supplier)

- LEO Pharma A/S (Dermatology Specialist)

- Bausch Health Companies Inc. (Through subsidiary brands)

- Sun Pharmaceutical Industries Ltd. (Global Generic Drugs)

Frequently Asked Questions

Analyze common user questions about the Azelaic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Azelaic Acid Market?

The primary driver is the increasing global prevalence of chronic skin conditions such as acne vulgaris and rosacea, coupled with rising consumer preference for mild, non-antibiotic, multi-functional topical treatments capable of addressing both inflammatory symptoms and associated pigmentation issues.

How is Azelaic Acid segmented by grade, and why is this important?

Azelaic acid is segmented into Pharmaceutical Grade and Cosmetic Grade. This distinction is critical as Pharmaceutical Grade demands much higher purity, stringent regulatory compliance, and clinical evidence for use in prescription medications, commanding a higher market value than Cosmetic Grade used in over-the-counter products.

What major technological advancement is impacting Azelaic Acid formulation?

Nanotechnology, specifically the use of solid lipid nanoparticles (SLNs) and nano-emulsions, is the key advancement. These technologies improve azelaic acid’s solubility, enhance dermal penetration, and reduce irritation by providing controlled and sustained release, overcoming the ingredient's inherent formulation challenges.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is anticipated to demonstrate the fastest Compound Annual Growth Rate (CAGR), driven by high consumer demand for skin brightening products, increasing healthcare accessibility, and rising disposable incomes fueling premium skincare purchasing.

What role does Artificial Intelligence (AI) play in the Azelaic Acid value chain?

AI's role focuses on optimizing formulation stability, accelerating the analysis of clinical trial data, and enabling precision dermatology through diagnostic tools that recommend individualized azelaic acid concentrations based on specific patient skin characteristics and needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Azelaic Acid Suspension Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Azelaic Acid Market Size Report By Type (Industrial Grade, Pharmaceutical Grade, GMP Pharmaceutical Grade), By Application (Plastics, Lubricants, Electronics, Pharmaceuticals & Cosmetics, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager