Beauty and Personal Care Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435203 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Beauty and Personal Care Market Size

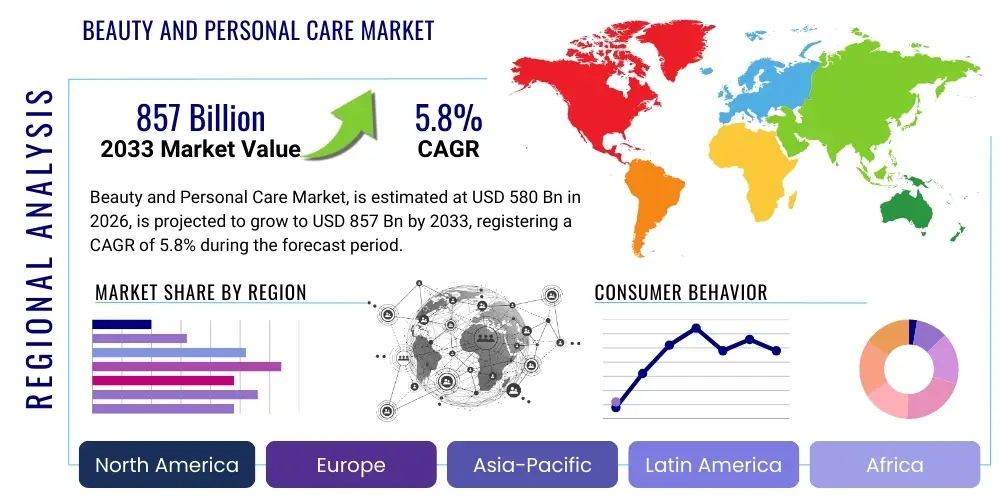

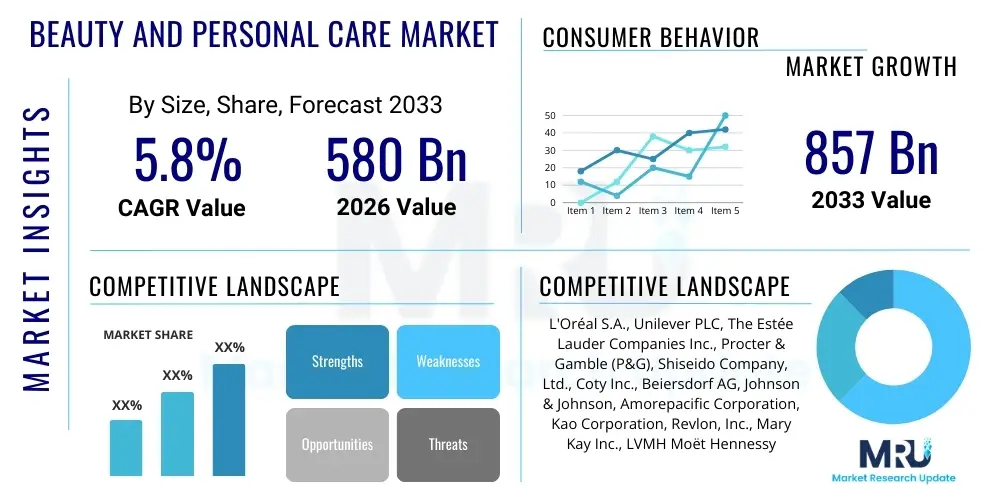

The Beauty and Personal Care Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 580 Billion in 2026 and is projected to reach USD 857 Billion by the end of the forecast period in 2033.

Beauty and Personal Care Market introduction

The global Beauty and Personal Care Market encompasses a vast array of products designed for hygiene, grooming, and aesthetic enhancement, ranging from basic skincare and cosmetics to complex hair care and fragrance formulations. This market is fundamentally driven by evolving consumer lifestyles, increasing disposable incomes, heightened awareness of personal wellness, and significant innovation in product development, particularly in sustainable and natural ingredients. The continuous expansion of product lines catering to diverse demographic needs, such as anti-aging, sensitive skin, and specialized male grooming, serves as a crucial engine for market growth across all geographical regions.

Product categories within this sector are broadly segmented into skincare, haircare, cosmetics, oral care, and deodorants, with skincare and cosmetics commanding the largest market shares due to daily consumer engagement and high value-added propositions. Major applications span retail consumption, professional spa services, and medical aesthetics, reflecting a market that is deeply integrated into consumer routines and discretionary spending habits. Key benefits sought by consumers include improved appearance, enhanced self-esteem, better personal hygiene, and protective health measures against environmental damage. The increasing consumer sophistication necessitates a transparent supply chain and clinically backed efficacy claims, driving manufacturers toward advanced biotechnological research and formulation science.

The primary driving factors propelling the market forward include rapid urbanization, the influential role of social media in setting beauty trends, and the premiumization of products, particularly in emerging economies. Moreover, the shifting demographic structure, characterized by an aging population demanding anti-aging solutions and Gen Z’s preference for personalized, clean beauty, ensures sustained high demand. Strategic investments in digitalization, including virtual try-ons and direct-to-consumer (DTC) models, further streamline market access and responsiveness, enabling brands to quickly adapt to niche consumer demands and maintain competitive relevance in a highly fragmented industry.

Beauty and Personal Care Market Executive Summary

The Beauty and Personal Care Market is experiencing robust acceleration, primarily fueled by significant shifts towards digital engagement, sustainable sourcing, and personalized wellness solutions. Key business trends indicate a strong focus on mergers and acquisitions among large conglomerates seeking to absorb innovative, niche clean-beauty brands, alongside substantial investments in research and development aimed at biotech-derived and synthetic biological ingredients that offer enhanced efficacy and environmental compliance. The emphasis on transparent ingredient labeling and ethical supply chain management is reshaping operational procedures, positioning sustainability not merely as a marketing tool but as a fundamental business imperative necessary for long-term consumer trust and regulatory adherence.

Regionally, Asia Pacific (APAC) continues to dominate the market in terms of volume and growth potential, driven by vast populations, increasing middle-class income levels, and a strong cultural affinity for rigorous skincare routines, particularly in South Korea and China. North America and Europe, while mature, are characterized by high rates of product premiumization, rapid adoption of advanced dermatological treatments, and intense demand for vegan, cruelty-free, and ethically sourced products. Emerging markets in Latin America and the Middle East & Africa (MEA) are witnessing rapid infrastructural development in retail and e-commerce, leading to increased accessibility of global and local brands, often focusing on color cosmetics and specialized hair care formulated for diverse climate conditions and hair types.

In terms of segment trends, the skincare category remains the largest and fastest-growing sector, propelled by prophylactic consumer behavior focused on skin health, not just appearance. Within cosmetics, the shift is noticeable from heavy traditional makeup to lighter, multi-functional products that emphasize 'skinimalism.' E-commerce channels are dominating distribution, providing unprecedented reach and allowing smaller DTC brands to compete effectively against established industry giants. Furthermore, specialized segments such as men's grooming and baby care are showing accelerated growth, indicating diversification beyond traditional female-centric marketing, driven by increased social acceptance and greater focus on holistic family wellness.

AI Impact Analysis on Beauty and Personal Care Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Beauty and Personal Care Market frequently revolve around personalization capabilities, the ethical implications of data usage, and the future of physical retail versus virtual experiences. Consumers and industry professionals are keenly interested in how AI algorithms can analyze complex skin conditions and recommend hyper-personalized product routines, often querying the accuracy of diagnostic tools powered by machine learning (ML). There is a significant focus on the efficiency of AI in accelerating R&D by predicting molecular efficacy or optimizing formulation stability. Furthermore, users often express concerns about job displacement in human-centric roles like cosmetology and the security of biometric data collected via AI-enabled diagnostic apps. The consensus expectation is that AI will fundamentally revolutionize consumer interaction, product development cycles, and supply chain management, making personalization scalable and highly efficient.

- Enhanced personalized product recommendation through complex data analysis (skin type, climate, lifestyle).

- Accelerated Research and Development (R&D) via AI-driven molecular screening and formulation optimization.

- Implementation of virtual try-on technologies (VTO) using Augmented Reality (AR) and ML algorithms.

- Optimized supply chain and inventory management through predictive demand forecasting.

- Automated customer service via chatbots and conversational AI providing instant beauty advice.

- Development of smart beauty devices integrated with AI for real-time skin diagnostics and treatment tracking.

- Improved quality control and manufacturing efficiency through AI-powered visual inspection systems.

DRO & Impact Forces Of Beauty and Personal Care Market

The dynamics of the Beauty and Personal Care Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces determining market trajectory. The primary Drivers include rising disposable incomes in developing nations, profound consumer emphasis on health and wellness extending beyond appearance, and the ubiquitous influence of social media and influencer marketing in rapidly disseminating trends and accelerating product turnover. These drivers necessitate continuous product innovation and marketing agility from market players. The strong cultural shift towards preventative self-care routines has solidified daily product usage, underpinning consistent market expansion across all major categories.

Conversely, significant Restraints challenge rapid growth and profitability. These include stringent regulatory frameworks governing ingredient safety and claims substantiation, particularly in regions like the European Union, which often necessitate costly and time-consuming reformulation. The high degree of market fragmentation, characterized by intense competition from local, niche, and private-label brands, often leads to pricing pressure and diluted market share for large multinational corporations. Furthermore, persistent consumer skepticism regarding "greenwashing" and unsubstantiated natural claims poses a risk to brand reputation, requiring substantial investment in transparent supply chain verification and robust testing protocols.

The primary Opportunities lie in leveraging technological advancements, specifically AI and genomics, for hyper-personalization, allowing brands to cater to individual biological needs on a scalable platform. The underserved market segment of sustainable packaging and refillable options presents a major area for innovation, appealing directly to environmentally conscious consumers. Impact Forces suching as urbanization and the rising digital literacy globally amplify both the drivers and opportunities, particularly by enabling direct consumer feedback and rapid adaptation of global trends to local markets. Conversely, economic downturns or pandemics act as significant restraint forces, leading to reduced discretionary spending on premium items, though essential hygiene products typically maintain stable demand, reflecting the market’s inherent resilience.

Segmentation Analysis

The Beauty and Personal Care Market is meticulously segmented based on product type, distribution channel, and end-user, allowing for precise market analysis and targeted strategic planning. Product segmentation highlights the dominance of skincare and cosmetics, which represent the highest value proposition categories, while distribution channel segmentation reveals the ongoing transition towards e-commerce as the preferred purchasing medium, overtaking traditional retail formats such as hypermarkets and specialty stores. Analyzing these segments provides critical insights into consumer preferences, purchasing behavior, and regional market saturation levels, guiding product portfolio diversification and market entry strategies for new entrants.

- By Product Type:

- Skincare (Facial Care, Body Care, Sun Care)

- Haircare (Shampoo, Conditioner, Hair Styling, Hair Colorants)

- Cosmetics (Facial Makeup, Lip Products, Eye Makeup, Nail Products)

- Oral Care (Toothpaste, Mouthwash, Toothbrushes)

- Deodorants and Antiperspirants

- Fragrances

- Men's Grooming Products

- By Distribution Channel:

- Hypermarkets and Supermarkets

- Specialty Stores (e.g., Sephora, Ulta)

- Pharmacies and Drug Stores

- Online Retail/E-commerce (DTC, Marketplaces)

- Direct Selling

- By End User:

- Female

- Male

- Kids & Baby

- By Pricing Strategy:

- Mass Products

- Premium/Luxury Products

Value Chain Analysis For Beauty and Personal Care Market

The value chain for the Beauty and Personal Care Market is extensive and complex, beginning with upstream activities focused on raw material sourcing and formulation R&D, moving through manufacturing, and culminating in highly diversified distribution and sales channels. Upstream analysis highlights critical dependencies on the supply of natural extracts, chemical ingredients, and specialized packaging materials, where quality, sustainability certification, and cost efficiency are paramount. Innovation in this stage focuses heavily on green chemistry and biotechnological synthesis to meet clean beauty standards, reducing reliance on conventional, often petroleum-derived, raw materials. Procurement efficiency and securing long-term contracts with certified suppliers are key competitive advantages at the upstream level.

Midstream activities involve large-scale manufacturing, filling, packaging, and quality assurance. Automation and adherence to Good Manufacturing Practices (GMP) are crucial for maintaining consistency and scalability. Downstream analysis is characterized by highly sophisticated marketing, branding, and distribution logistics. The distribution channel landscape is highly variegated, incorporating both direct channels—such as branded e-commerce sites and retail stores—and indirect channels, which involve wholesalers, distributors, and major retail chains like pharmacies, department stores, and supermarkets. Effective inventory management and rapid fulfillment capabilities are essential for meeting the high demand volatility inherent in trend-driven consumer goods.

The rapid growth of the e-commerce distribution channel has fundamentally altered the direct and indirect sales mix. Direct-to-Consumer (DTC) models have empowered smaller brands to bypass traditional middlemen, offering greater margin control and direct access to customer data for personalized marketing. However, indirect channels remain vital, especially for mass-market products where extensive physical shelf presence and immediate consumer accessibility are required. The interplay between these channels, often referred to as 'omnichannel strategy,' requires seamless integration of physical and digital touchpoints to optimize the consumer experience, ensuring product availability and consistent brand messaging across all purchasing routes.

Beauty and Personal Care Market Potential Customers

The potential customer base for the Beauty and Personal Care Market is exceptionally broad, essentially encompassing the entire global population, but strategic market focus identifies specific end-user segments based on needs, purchasing power, and demographic characteristics. Core buyers include individuals across all age groups and genders seeking products for basic hygiene, aesthetic enhancement, and therapeutic skin or hair treatment. High-value customers are typically those with higher disposable incomes who prioritize premium, science-backed, or sustainable products and demonstrate high loyalty to specialized brands, often driven by an interest in preventative aging routines and specialized wellness regimes.

Key demographics showing accelerated growth include Millennial and Gen Z consumers, who are digitally native and heavily influenced by social media reviews and ethical claims such as veganism and zero-waste initiatives. This group acts as a powerful driver for innovation in sustainable packaging and transparent sourcing. Another significant segment comprises the aging population globally, which fuels demand for sophisticated anti-aging and restorative dermatology products, representing a stable, high-value consumer group focused on product efficacy and clinical validation. Furthermore, the rising awareness and acceptance of male grooming have positioned men as a rapidly expanding and underserved customer segment, increasingly seeking specialized skincare, hair loss treatments, and advanced hygiene products.

Beyond individual consumers, institutional buyers such as professional spas, salons, dermatology clinics, hotels, and healthcare facilities represent another vital customer segment. These B2B buyers require bulk products and specialized professional formulations, such as high-grade chemical peels, massage oils, and institutional hygiene products. These customers prioritize professional-grade quality, bulk pricing, and reliable supply contracts. Understanding the distinct procurement needs of B2B versus B2C customers is crucial for manufacturers in tailoring product formats, packaging, and distribution strategies to maximize penetration across all viable end-user channels.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Billion |

| Market Forecast in 2033 | USD 857 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L'Oréal S.A., Unilever PLC, The Estée Lauder Companies Inc., Procter & Gamble (P&G), Shiseido Company, Ltd., Coty Inc., Beiersdorf AG, Johnson & Johnson, Amorepacific Corporation, Kao Corporation, Revlon, Inc., Mary Kay Inc., LVMH Moët Hennessy Louis Vuitton SE, Chanel, Natura &Co., PZ Cussons, Henkel AG & Co. KGaA, The Body Shop (A subsidiary of Natura &Co.), Kiehl's, Clinique |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beauty and Personal Care Market Key Technology Landscape

The technological landscape of the Beauty and Personal Care Market is characterized by rapid integration of digital, biological, and material science innovations aimed at improving product efficacy, customization, and consumer engagement. A central technological shift is the use of Artificial Intelligence (AI) and Machine Learning (ML) algorithms for detailed skin diagnostics and hyper-personalized product recommendation engines. These technologies analyze vast datasets related to consumer genetics, microbiome health, and environmental exposure to tailor product formulations precisely to individual needs, moving the industry beyond generalized mass-market offerings into bespoke beauty solutions. This personalization extends to the physical retail space through AR-enabled virtual try-on mirrors and apps, reducing reliance on physical product testing while enhancing the shopping experience.

In terms of formulation and manufacturing, key technologies include advances in green chemistry, fermentation technology, and synthetic biology. Green chemistry focuses on developing sustainable, non-toxic synthesis routes for cosmetic ingredients, minimizing environmental waste and resource consumption. Fermentation technology utilizes microorganisms to produce high-value ingredients, such as hyaluronic acid or specific proteins, in a controlled, sustainable manner. Synthetic biology is increasingly deployed to engineer yeasts or bacteria to reliably produce rare, efficacious natural compounds, bypassing the challenges associated with agricultural sourcing and fluctuating yields, thus ensuring supply chain resilience and cost-effectiveness for premium active ingredients.

Furthermore, the market relies heavily on sophisticated packaging technologies that address sustainability and convenience. This includes the development of lightweight, recyclable, or biodegradable packaging materials and innovative dispensing systems, such as airless pumps and refillable containers designed to preserve ingredient potency and minimize contamination. Traceability technology, including blockchain implementation, is also gaining traction, offering consumers verifiable proof of ingredient origin and ethical sourcing practices. These technological advancements collectively drive both consumer trust and operational efficiency, positioning technology as a foundational pillar for competitive differentiation in the modern beauty industry.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing region, driven by countries like China, Japan, South Korea, and India. South Korea and Japan serve as global innovation hubs, particularly in skincare and high-tech beauty devices, setting international trends. The market benefits immensely from a cultural prioritization of preventative skincare, high population density, and rapidly expanding middle-class consumption. Local brands possess strong market resonance, though international giants are aggressively expanding their digital footprints.

- North America: Characterized by high consumer spending on premium and luxury segments, North America is a mature market focused intensely on clean beauty, CBD-infused products, and science-backed clinical treatments. The region shows rapid adoption of e-commerce and DTC brand models. Regulatory scrutiny, particularly regarding ingredient safety and sustainability claims, heavily influences product development and marketing strategies here.

- Europe: Europe represents a highly competitive market defined by strict regulatory standards (e.g., EU Cosmetic Regulation), which drives innovation towards safer, more sustainable formulations. Consumer trends lean heavily toward natural, organic, and ethically sourced ingredients. Western Europe (Germany, France, UK) leads the regional demand, with strong segments in fragrances and anti-aging products, often utilizing sophisticated biotechnological ingredients.

- Latin America (LATAM): LATAM is experiencing dynamic growth, propelled by significant demand for fragrances, hair care, and color cosmetics, particularly in Brazil and Mexico. The market is highly price-sensitive, balancing demand for global brands with strong local preference for affordable, high-volume products. Direct selling remains a powerful distribution channel, though organized retail and e-commerce are rapidly gaining market share, driven by increasing digital penetration.

- Middle East & Africa (MEA): This region is characterized by high consumption of premium fragrances and luxury cosmetics, especially in the Gulf Cooperation Council (GCC) countries, driven by significant discretionary spending and cultural preferences. Africa presents substantial long-term opportunity, particularly for functional hygiene products and specialized hair care catering to diverse hair types, though market penetration is often constrained by logistical and economic disparities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beauty and Personal Care Market.- L'Oréal S.A.

- Unilever PLC

- The Estée Lauder Companies Inc.

- Procter & Gamble (P&G)

- Shiseido Company, Ltd.

- Coty Inc.

- Beiersdorf AG

- Johnson & Johnson

- Amorepacific Corporation

- Kao Corporation

- Revlon, Inc.

- Mary Kay Inc.

- LVMH Moët Hennessy Louis Vuitton SE

- Chanel

- Natura &Co.

- PZ Cussons

- Henkel AG & Co. KGaA

- The Body Shop (A subsidiary of Natura &Co.)

- Kiehl's

- Clinique

Frequently Asked Questions

Analyze common user questions about the Beauty and Personal Care market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Beauty and Personal Care Market?

The primary factor driving market growth is the heightened global consumer focus on health, wellness, and self-care routines, coupled with increased disposable incomes in emerging economies. This drives demand for specialized, premium, and functional products like advanced anti-aging skincare and personalized routines enabled by digital technologies.

How is technology, specifically AI, influencing product personalization in the beauty industry?

AI is critically influencing personalization by enabling sophisticated analysis of consumer data, including skin biology and environmental factors, to recommend hyper-customized products and regimens. AI algorithms also power virtual try-on experiences and optimize ingredient efficacy testing, making tailored beauty scalable.

Which product segment holds the largest share of the Beauty and Personal Care Market?

The Skincare segment consistently holds the largest market share globally. This dominance is attributed to high consumer engagement with daily routines, continuous product innovation in anti-aging and sun protection, and the increasing consumer willingness to invest in preventative skin health over aesthetic correction alone.

What are the key sustainability challenges faced by beauty companies?

Key sustainability challenges include reducing plastic waste through innovative packaging (refillable/recyclable formats), sourcing ethical and traceable raw materials without environmental degradation, and minimizing water usage in manufacturing processes. Consumers increasingly demand verifiable proof of sustainable and ethical practices.

Why is the Asia Pacific region dominating the global Beauty and Personal Care Market?

APAC dominates due to its large population base, rapidly expanding middle class with increasing purchasing power, and a strong cultural emphasis on intensive, multi-step skincare routines (particularly in East Asia). Furthermore, countries like South Korea and Japan lead global product innovation, fueling high regional market dynamism.

What role do specialty stores play amidst the rise of e-commerce distribution?

Specialty stores maintain a crucial role by offering curated product selections, expert advice, and vital tactile consumer experiences like product sampling and demonstrations, which are difficult to replicate online. They serve as essential physical touchpoints for premium and luxury brands, complementing digital sales channels through omnichannel integration.

How significant is the male grooming segment to overall market growth?

The male grooming segment is significantly important and represents one of the fastest-growing niches. It is expanding beyond basic shaving products to include specialized skincare, hair loss treatments, and targeted cosmetic products, driven by changing social perceptions and increased attention to male personal aesthetics and wellness.

What impact do macroeconomic factors, such as inflation, have on market purchasing habits?

Macroeconomic factors like inflation tend to drive consumer behavior towards essential hygiene products while potentially causing a slight downturn or 'trading down' in the premium and luxury categories. However, essential skincare often remains resilient, suggesting that consumers prioritize preventative health even during economic pressures.

Define 'Clean Beauty' and its regulatory implications.

'Clean Beauty' typically refers to products free from certain controversial ingredients (e.g., parabens, sulfates) and often emphasizes natural, non-toxic, and transparently sourced components. While the term lacks universal regulatory definition, the trend forces companies toward stricter self-regulation and adherence to consumer-driven ethical ingredient lists.

What is the current trend regarding ingredient sourcing, particularly focusing on biotechnology?

The current trend heavily favors sustainable and high-efficacy ingredient sourcing, with biotechnology—specifically fermentation and synthetic biology—gaining prominence. These technologies allow for the sustainable, cost-effective, and ethical production of highly complex active ingredients, reducing reliance on conventional, environmentally intensive agricultural methods.

How are mergers and acquisitions shaping the competitive landscape?

M&A activities are intensely shaping the landscape, with large conglomerates acquiring successful small-to-midsize DTC brands, particularly those focused on niche areas like clean beauty or specialized sustainability. This allows major players to rapidly acquire innovative technology, capture new consumer segments, and diversify their product portfolios swiftly.

What are the growth prospects for the Fragrance segment?

The Fragrance segment shows stable growth, driven by premiumization and the introduction of artisanal, bespoke, and clean scent formulations. Digital engagement and personalized scent profiling are enhancing consumer discovery, while high luxury consumption in regions like the Middle East sustains the segment's value proposition.

What regulatory constraints pose the biggest challenge to market entry for new cosmetic brands?

The most significant constraints are the stringent requirements for ingredient safety documentation, mandatory toxicological assessments, and complex labeling requirements, particularly in the European and North American markets. These standards necessitate substantial investment in compliance and quality assurance before product launch.

Describe the role of social media influencers in modern beauty marketing.

Social media influencers (SMI) are paramount, acting as vital intermediaries between brands and consumers. They drive immediate demand, disseminate emerging trends rapidly, and establish product credibility through authentic (or perceived authentic) reviews and tutorials. SMI strategy is now central to product launch success and ongoing brand visibility.

How is supply chain transparency impacting consumer purchasing decisions?

Supply chain transparency is increasingly critical, with consumers actively seeking information on ingredient origin, labor practices, and environmental impact. Brands that provide verifiable data, often via digital tools or blockchain, gain a significant competitive edge, as trust and ethical sourcing become non-negotiable purchasing criteria for conscious consumers.

What is the significance of the shift from traditional makeup to 'skinimalism'?

'Skinimalism' signifies a consumer trend prioritizing skin health and natural appearance over heavy corrective makeup. This shift drives demand for hybrid products that offer both cosmetic coverage and skincare benefits, such as tinted serums and multi-functional moisturizers, benefiting the high-growth skincare category.

How does climate change affect the Beauty and Personal Care Market?

Climate change drives demand for specialized products addressing environmental stressors, such as advanced SPF formulations, anti-pollution skincare, and products designed for extreme humidity or dryness. It also pressures companies to develop sustainable, water-conscious manufacturing processes and climate-resilient supply chains for natural ingredients.

What are the main growth drivers within the professional beauty segment (salons, spas)?

Growth in the professional segment is driven by consumer demand for advanced, clinical-grade treatments (e.g., high-concentration peels, medical aesthetics), specialized hair services, and holistic wellness experiences. This segment relies on high-quality professional formulations and continuous training on sophisticated beauty technology.

Explain the concept of Direct-to-Consumer (DTC) models in the beauty industry.

DTC models involve manufacturers selling products directly to the end-consumer via branded e-commerce platforms, bypassing traditional retail intermediaries. This grants brands superior control over pricing, branding, and, critically, customer data, enabling precise marketing and rapid feedback loops necessary for product optimization and fostering brand loyalty.

What differentiates premium/luxury products from mass-market products in terms of consumer expectation?

Premium products are differentiated by higher-concentration active ingredients, sophisticated formulation science, unique packaging, and exclusive branding. Consumers expect superior, scientifically proven efficacy, a luxurious sensory experience, and often, a commitment to ethical sourcing and sustainable business practices, justifying the higher price point.

How does the growth of digital health influence the beauty sector?

The growth of digital health integrates beauty and wellness, leading to 'skin health' being viewed through a medical lens. Consumers use digital tools (apps, wearable devices) to monitor skin parameters, driving demand for products based on quantified personal data, further intertwining cosmetic efficacy with measurable health outcomes.

What emerging trends are shaping the haircare segment specifically?

Emerging haircare trends include scalp health prioritization, personalization based on hair texture and environment, and the proliferation of clean and specialized ingredients mimicking skincare components (e.g., hyaluronic acid for hair). The shift towards addressing hair thinning and specialized color maintenance also drives innovation.

What is the role of customized packaging in current market strategy?

Customized packaging is a critical strategic element, serving not only aesthetic branding but also functional and sustainability goals. Refillable systems, minimalist design, and materials that maximize product integrity (e.g., UV protection) are key, reflecting consumer desire for both premium presentation and reduced environmental footprint.

What are the primary factors contributing to market fragmentation?

Market fragmentation is primarily driven by low barriers to entry for digital-first brands, the efficacy of targeted social media marketing, and the consumer demand for hyper-niche, specialized solutions (e.g., products for specific micro-biomes, climate zones, or ethical criteria). This allows many small, specialized players to coexist with industry giants.

How does regulatory divergence between regions (e.g., EU vs. US) affect global market operations?

Regulatory divergence forces multinational corporations to maintain disparate product portfolios, undergoing costly and time-consuming reformulation and relabeling to comply with regional ingredient restrictions and claim substantiation standards. This increases operational complexity and extends time-to-market for global launches.

What is the long-term forecast for traditional brick-and-mortar distribution channels?

Traditional brick-and-mortar distribution channels, particularly pharmacies and supermarkets, will stabilize, focusing on convenience and mass-market essentials. Their long-term viability depends on successful integration with digital operations, offering services like in-store pick-up and personalized consultations to complement the efficiency of online retail.

How is the concept of beauty evolving across different cultures globally?

The concept of beauty is evolving towards inclusivity and diversity, emphasizing natural features and individual skin tones, moving away from monolithic Western standards. This drives demand for diverse color cosmetic ranges and culturally specific skincare tailored to regional climates and traditional beauty practices, especially in APAC and MEA.

What impact does counterfeiting have on the luxury beauty segment?

Counterfeiting significantly erodes brand equity, compromises consumer trust, and poses potential health risks due to unverified ingredient content in illicit products. Luxury brands invest heavily in anti-counterfeiting measures, including sophisticated serialization and blockchain technology, to protect their premium positioning and consumer safety.

What are the key technological advancements expected in oral care?

Key technological advancements in oral care include smart toothbrushes integrated with AI sensors for personalized brushing pattern analysis, specialized microbiome-balancing toothpastes, and products utilizing advanced materials science for superior plaque removal and enamel repair, emphasizing therapeutic and preventative dental hygiene.

How do economic downturns influence consumer loyalty in the mass versus luxury segments?

In economic downturns, mass-market loyalty remains relatively stable for essential items. However, luxury consumers may seek 'affordable luxuries'—smaller, high-end products (like lipsticks or fragrances) that maintain brand connection without the expense of major premium purchases—a phenomenon known as the 'lipstick index' effect.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Online Beauty and Personal Care Products Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Online Beauty and Personal Care Products Market Size Report By Type (Skin Care, Hair Care, Color Cosmetics, Fragrances, Oral Hygiene Products, Bath and Shower Products, Male Grooming Products, Deodorants, Baby and Child Care Products), By Application (Luxuary/Pharmarcy Market, Mass Market), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Beauty and Personal Care Surfactants Market Statistics 2025 Analysis By Application (Skin Care, Hair Care, Others), By Type (Nonionics, Cationics, Amphoterics, Anionics, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Online Beauty and Personal Care Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Skin Care, Hair Care, Color Cosmetics, Fragrances, Oral Hygiene Products, Bath and Shower Products, Male Grooming Products, Deodorants, Baby and Child Care Products, Others), By Application (Research and Academic Institutes, Hospitals and Diagnostic Laboratories, Biotechnology and Pharmaceutical Companies), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Beauty and Personal Care Products Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Hair Care Products, Facial Care Products, Shower Gels, Oral Care, Mens Grooming Products, Deodrants and Antiperspirants, Cosmetics/Make-up Products), By Application (Specialist Retail Stores, Supermarkets/Hypermarkets, Convenience Stores, Pharmacies/Drug Stores, Online Retail Channels, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager