Beryllium Metal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435293 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Beryllium Metal Market Size

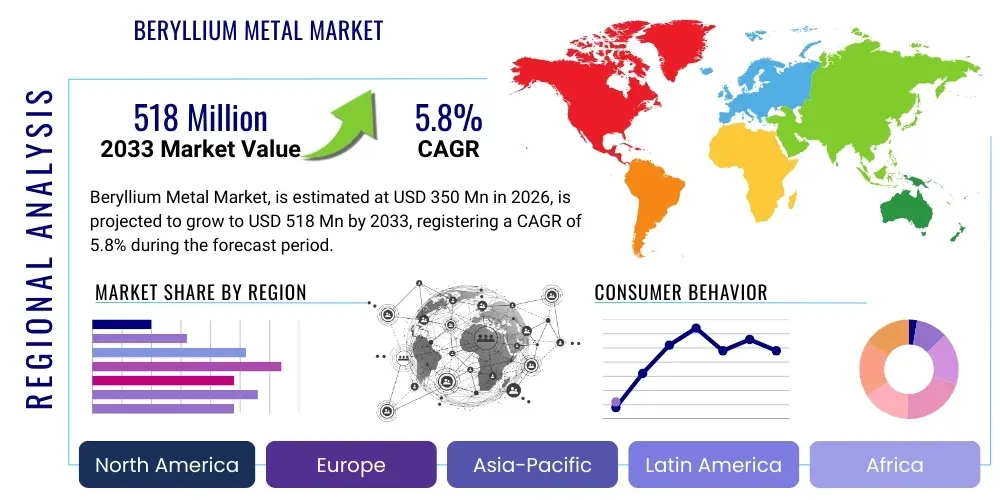

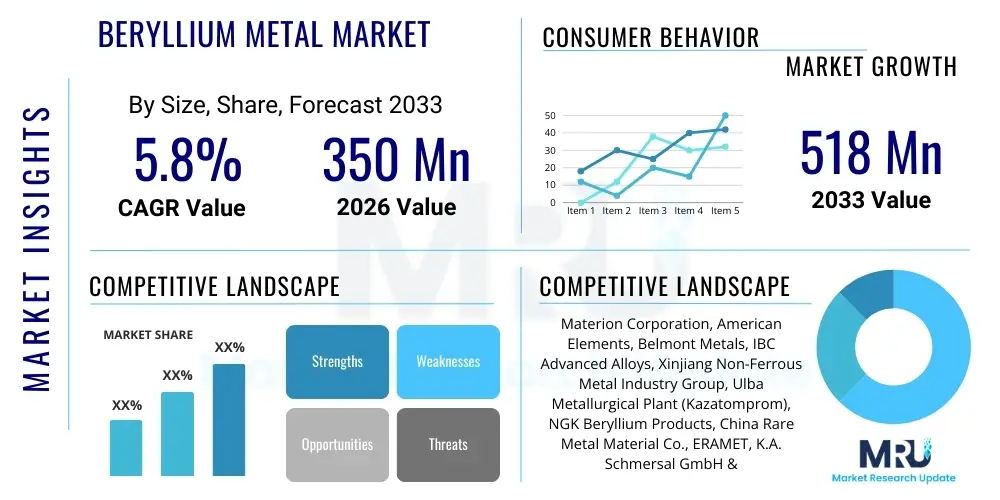

The Beryllium Metal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 518 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the escalating demand from highly specialized industries, particularly aerospace, defense, and advanced electronics, where Beryllium's unique combination of lightweight properties, high stiffness, and exceptional thermal conductivity is indispensable. The increasing geopolitical complexities driving defense modernization and the persistent miniaturization trends in consumer electronics are key quantitative drivers influencing this valuation.

The valuation reflects robust investment cycles in military surveillance systems and next-generation telecommunications infrastructure. Beryllium, often utilized in high-performance mirrors for satellites and guidance systems, experiences demand tied directly to government spending in these critical technological domains. Furthermore, the push towards cleaner energy solutions, specifically in nuclear fusion research, although nascent, provides a long-term, high-value growth avenue for ultra-pure Beryllium metal, potentially pushing the market size beyond current conservative estimates if commercial fusion becomes viable within the extended forecast period.

Market expansion is also characterized by technological advancements in alloy formulation and processing techniques, which aim to mitigate the inherent costs and toxicity risks associated with Beryllium handling. These innovations are broadening its applicability beyond traditional high-end niche uses, allowing Beryllium alloys (such as Copper Beryllium) to penetrate mass-market industrial applications requiring excellent wear resistance and electrical conductivity, thereby contributing significantly to the overall market size expansion over the seven-year forecast horizon.

Beryllium Metal Market introduction

The Beryllium Metal Market encompasses the extraction, processing, and application of Beryllium (Be), a lightweight, gray-white alkaline earth metal recognized for its superior mechanical, thermal, and electrical properties. Beryllium metal is primarily sourced from minerals like bertrandite and beryl, undergoing complex refining processes to produce pure metal or master alloys. The resulting products are used in highly demanding environments where performance constraints are stringent, making them foundational components in advanced technological systems globally. Beryllium's exceptional stiffness-to-weight ratio (six times that of steel), coupled with its low density and high melting point, distinguishes it from conventional engineering materials, positioning it as a strategic commodity.

Major applications of Beryllium metal span across critical sectors including military and defense (in missile guidance systems, armored vehicle components, and satellite optics), aerospace (structural components and brake pads), electronics (heat sinks, connectors, and specialty components for high-frequency circuits), and nuclear energy (neutron reflectors and moderators). The versatility derived from its unique blend of properties ensures its continued relevance despite high manufacturing costs and environmental regulations. The growing proliferation of sophisticated radar systems, telecommunication satellites requiring high-precision mirrors, and advanced thermal management solutions directly fuels the market demand for Beryllium and its derivatives.

Key driving factors accelerating market growth include increasing global defense expenditures focused on system modernization, rapid expansion in 5G and future 6G telecommunication network rollouts necessitating high-performance interconnectivity components, and persistent R&D efforts in experimental physics, particularly concerning the ITER fusion project and related nuclear research facilities. Furthermore, advancements in materials science that enhance the safe handling and recycling of Beryllium are expected to sustain its market growth by addressing historical constraints related to material toxicity and disposal.

Beryllium Metal Market Executive Summary

The Beryllium Metal Market is experiencing sustained growth driven by macroeconomic trends favoring technological superiority in defense and exponential expansion in high-frequency data transmission infrastructure. Business trends indicate a focus on vertical integration among key players, securing the supply chain from raw material extraction through complex component manufacturing, which helps manage price volatility and ensure product quality consistency necessary for aerospace and defense specifications. Strategic partnerships between miners, refiners, and end-use component manufacturers are becoming crucial to navigating stringent regulatory environments and optimizing throughput. The market structure remains highly concentrated due to the complexity of extraction and processing, meaning competitive strategies revolve heavily around technological patents and securing long-term supply contracts.

Regionally, North America maintains market dominance, primarily due to the concentration of major defense contractors and aerospace manufacturing hubs, supported by substantial government investment in military hardware and space exploration initiatives (Regional Trends). Asia Pacific, however, is emerging as the fastest-growing region, fueled by rapid industrialization, massive infrastructure development in telecommunications (especially China and South Korea), and increasing indigenous defense capabilities being built in countries like India. Europe shows stable demand, primarily centered around collaborative defense projects and established industrial applications, alongside significant contributions to nuclear research and high-energy physics facilities.

In terms of segmentation (Segments Trends), Beryllium Alloys, particularly Copper Beryllium (CuBe), dominate the market volume due to their wide usage in electrical connectors, springs, and bearings that require high durability and conductivity. However, Pure Beryllium Metal commands a higher valuation and is witnessing strong growth, driven specifically by applications in sophisticated optical systems (mirrors and lenses) and nuclear reactors where unparalleled thermal and mechanical performance is mandatory. The Aerospace and Defense application segment remains the primary revenue generator, while the Electronics and Telecommunications segment is exhibiting the most aggressive growth rate, reflecting the global shift towards advanced connectivity solutions and miniaturization.

AI Impact Analysis on Beryllium Metal Market

Common user inquiries concerning AI's influence on the Beryllium Metal Market often revolve around how artificial intelligence can optimize the notoriously complex and high-risk extraction and refining processes, whether AI-driven materials discovery platforms might accelerate the development of Beryllium substitutes, and how AI can enhance Beryllium component manufacturing precision for critical applications like optics and defense systems. Users are keenly interested in the potential of predictive maintenance enabled by AI to monitor Beryllium components, particularly in high-stress environments such as satellites or nuclear facilities, thereby extending operational lifetimes and ensuring safety. The synthesis of these concerns indicates an expectation that AI will primarily serve as an optimization tool—improving efficiency, reducing waste, enhancing safety during processing, and accelerating high-precision component quality assurance, rather than fundamentally changing Beryllium's strategic demand profile.

The immediate impact of AI is focused on manufacturing efficiency and supply chain resilience. Machine learning algorithms are being deployed to analyze sensor data from smelting and casting processes, predicting yield failures and optimizing energy consumption, which is critical given the high costs associated with Beryllium production. Furthermore, AI is central to quality control for Beryllium components used in critical defense and space optics. By employing computer vision and machine learning for defect detection at microscopic levels, manufacturers can achieve the extremely tight tolerances required for laser, radar, and astronomical applications, ensuring that the finished product meets demanding performance specifications while minimizing expensive scrap rates inherent in high-precision machining.

- AI-driven Predictive Maintenance: Enhancing reliability and lifespan of Beryllium components in satellites, reducing failure rates and costly replacements.

- Optimized Extraction and Refining: Machine learning algorithms improve yield, reduce energy usage, and increase safety compliance in hazardous processing environments.

- Accelerated Component Design: AI simulations and generative design aid in rapidly modeling Beryllium alloy components for optimal thermal and structural performance in aerospace.

- Enhanced Quality Control (QC): Computer vision systems ensure ultra-high precision machining and surface finish requirements for Beryllium mirrors and optical systems.

- Supply Chain Forecasting: AI models provide accurate demand forecasts for strategic Beryllium reserves, mitigating risks associated with geopolitical supply disruptions.

DRO & Impact Forces Of Beryllium Metal Market

The dynamics of the Beryllium Metal Market are dictated by a stringent interplay of drivers (D), restraints (R), and opportunities (O), collectively shaping the impact forces. The primary drivers stem from continuous technological advancement in sectors requiring extreme performance, such as space exploration, advanced radar technology, and high-speed computing, necessitating Beryllium's unique combination of low density, high modulus, and excellent thermal characteristics. However, these drivers are counterbalanced by significant restraints, chiefly the severe toxicity concerns associated with Beryllium dust (berylliosis), leading to highly regulated and costly handling procedures, and the concentrated, oligopolistic nature of the global supply chain, which creates vulnerability to geopolitical and mining policy shifts. The core opportunity lies in developing closed-loop recycling processes and exploring novel applications, such as fusion energy components and lightweight components for next-generation electric vehicles, which require material properties exceeding those of aluminum or titanium.

The impact forces are fundamentally strong, maintaining positive market momentum despite the restraining factors. The defense sector, driven by global security imperatives and large government contracts, acts as the foundational demand force, ensuring baseline stability and continuous investment in Beryllium technologies. This essential need in military and intelligence hardware insulates the market from typical economic volatility experienced by standard industrial metals. Furthermore, the material's properties are exceptionally difficult to replicate by substitutes for key applications (e.g., satellite optics, neutron reflectors), cementing its strategic importance and inelastic demand in high-value niches. Regulatory compliance acts as both a restraint (increasing cost) and an impact force (creating barriers to entry, thus protecting incumbent players).

The structural characteristics of the Beryllium market—high entry barriers due to complex processing, capital intensity, and regulatory burden—ensure that while growth might be steady rather than explosive, the market remains highly valuable. The opportunity for growth is significantly influenced by successful R&D into safer processing technologies and the expansion of advanced electronics, which promises volume growth in the Beryllium alloy segment. Successfully managing the impact forces requires market participants to invest heavily in safety protocols, robust recycling infrastructures, and vertical integration to control both costs and compliance risks.

- Drivers: Escalating defense expenditures globally; rapid deployment of advanced telecommunication systems (5G/6G); increasing demand for high-performance thermal management in electronics.

- Restraints: High material toxicity requiring stringent and costly safety regulations; concentrated global supply chain (monopolistic/oligopolistic structure); high cost of production and machining.

- Opportunity: Application expansion in clean energy technologies (nuclear fusion); advancements in safe Beryllium processing and recycling techniques; niche integration into high-performance medical devices.

- Impact Forces: Government procurement cycles in aerospace and defense; technological obsolescence of substitutes in critical applications; environmental and safety regulations influencing manufacturing costs.

Segmentation Analysis

The Beryllium Metal Market is strategically segmented based on product type, reflecting the different purity levels and alloy compositions required for specific end-use environments, and by application, which defines the primary demand drivers. The segmentation by type differentiates between highly refined, pure Beryllium metal, utilized almost exclusively for optical and nuclear applications demanding maximum performance stability, and the high-volume Beryllium alloys, which blend Beryllium with other metals like copper, aluminum, or nickel to impart superior conductivity, strength, and corrosion resistance for industrial and electronic components. This structure allows market participants to tailor their offerings based on the varying specifications and price points across disparate industrial requirements.

The application-based segmentation clearly highlights the strategic importance of the market, with Aerospace & Defense historically commanding the largest revenue share due to the critical nature of Beryllium in guidance systems, structural components, and advanced sensor optics. The Electronics & Telecommunications segment, leveraging Beryllium Copper (BeCu) for high-reliability connectors and thermal heat sinks, is the fastest growing segment, reflecting the pervasive need for miniaturization and high-frequency performance. Understanding these segments is crucial for strategic planning, as the pure metal segment drives technological development and high margin revenue, while the alloy segment provides volume stability and access to broader commercial markets.

- By Type:

- Pure Beryllium Metal (High Purity Grade)

- Beryllium Alloys

- Copper Beryllium (BeCu)

- Aluminum Beryllium (AlBe)

- Nickel Beryllium (NiBe)

- By Application:

- Aerospace & Defense

- Electronics & Telecommunications

- Industrial Components (Molds, Tools, Springs)

- Nuclear Energy

- Medical (Imaging Equipment, Surgical Tools)

Value Chain Analysis For Beryllium Metal Market

The Beryllium Metal value chain is complex and highly concentrated, initiating at the upstream stage with the mining and extraction of Beryllium-containing ores, primarily bertrandite and beryl. This is followed by critical refining processes, including conversion into Beryllium hydroxide and subsequently into Beryllium oxide or Beryllium fluoride, which are then processed into pure Beryllium metal or master alloys. Due to the specialized chemical processing required and the environmental hazards involved, the upstream and midstream stages are dominated by a handful of technologically advanced companies with the requisite safety infrastructure and intellectual property, creating significant barriers to entry and exerting considerable influence over raw material pricing and availability. The quality and purity achieved at this stage directly impact the final performance characteristics required by demanding downstream customers.

The midstream phase involves the transformation of master alloys and pure metal into semi-finished products such as rods, tubes, plates, and specialized powders. This phase requires sophisticated metallurgical expertise and specialized equipment for high-precision machining, particularly for pure Beryllium components used in optical systems where surface finishing must be near-perfect. Distribution channels are typically short and highly controlled. For strategic applications, such as defense and nuclear energy, components often move directly from specialized fabricators to the Original Equipment Manufacturers (OEMs) via secure, direct distribution contracts, ensuring traceability and adherence to strict governmental quality mandates. Indirect distribution, involving specialized metals distributors, is more common for standard Beryllium Copper alloy products destined for broader industrial or electronics markets.

The downstream segment is dominated by end-product manufacturing, where Beryllium components are integrated into final systems such as satellites, missiles, high-speed circuit boards, and oil exploration tools. Demand here is highly inelastic, driven by performance mandates rather than price sensitivity. End-users require guaranteed consistency and long-term reliability. The unique properties of Beryllium often necessitate the direct involvement of the material producers in the design and engineering phase, blurring the lines between supplier and customer. The value generated in the downstream stage is substantial, reflecting the high-value nature of the final system, whether it is a sophisticated F-35 fighter jet component or a critical deep-sea telecommunication repeater.

Beryllium Metal Market Potential Customers

Potential customers for Beryllium Metal are predominantly high-technology, capital-intensive organizations where failure is catastrophic and performance optimization is paramount. The largest segment of end-users consists of global aerospace and defense prime contractors, including companies that manufacture military aircraft, missile systems, satellite communication equipment, and advanced surveillance radar arrays. These customers require ultra-lightweight, dimensionally stable materials for optical benches, guidance systems, and inertial components, where Beryllium’s properties are non-negotiable substitutes. Government agencies and national laboratories involved in nuclear research and high-energy physics also represent a crucial, albeit niche, customer base for high-purity Beryllium used in neutron moderation and plasma confinement experiments.

Another significant group of buyers resides in the electronics and telecommunications sector. These customers are manufacturers of high-performance electrical connectors, switches, springs, and heat dissipation components for consumer electronics, industrial automation, and communication infrastructure (5G/6G). Specifically, manufacturers of high-frequency switches and high-density circuit boards are crucial buyers of Beryllium Copper alloys, valuing their superior fatigue strength and electrical conductivity under temperature variations. The medical device industry, including manufacturers of diagnostic imaging equipment (CT scanners, X-ray machines) and specialized surgical instruments, also represents a growing customer base, utilizing Beryllium for its radiolucency and non-magnetic properties.

In the industrial sphere, potential customers include manufacturers of specialized injection molding tools, non-sparking safety tools, and heavy-duty bearings and bushings. These applications utilize Beryllium alloys for their exceptional wear resistance, strength, and thermal transfer characteristics, which significantly extend the tool life or operational efficiency in extreme industrial conditions, such as petrochemical plants or automotive manufacturing. Ultimately, the purchasing decision across all customer segments is primarily driven by performance specifications and compliance certifications, with price being a secondary, though still important, consideration compared to ensuring mission success or product longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 518 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, American Elements, Belmont Metals, IBC Advanced Alloys, Xinjiang Non-Ferrous Metal Industry Group, Ulba Metallurgical Plant (Kazatomprom), NGK Beryllium Products, China Rare Metal Material Co., ERAMET, K.A. Schmersal GmbH & Co. KG, Hunan Nonferrous Metals, Kaimeite Precision Metals, Kazatomprom, Talison Lithium. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beryllium Metal Market Key Technology Landscape

The Beryllium Metal market relies on highly specialized and advanced technological processes spanning extraction, purification, and fabrication. The key upstream technology involves the fluoride extraction process or the hydroxide process to refine Beryllium ore into usable compounds, which are then reduced via electrowinning or vacuum casting into pure metal. Due to the high reactivity and toxicity of Beryllium, process optimization focuses heavily on closed-loop systems, vacuum metallurgy, and continuous monitoring to ensure zero contamination and maximize material yield. Furthermore, advances in powder metallurgy are crucial, enabling the production of fine Beryllium powder used in hot isostatic pressing (HIP) and vacuum hot pressing (VHP) techniques to create complex, near-net-shape components with superior homogeneity and mechanical integrity required for optical mirrors and nuclear applications.

In the fabrication and processing phase, technologies are centered around achieving ultra-high precision machining and non-conventional processing methods. Given Beryllium's high stiffness and propensity to cause material hardening and tool wear, specialized diamond cutting tools and computer numerical control (CNC) machining centers with high rigidity are essential. Emerging technologies include additive manufacturing (AM) techniques adapted for Beryllium alloys, although this remains largely experimental due to challenges related to powder handling and microstructure control. The goal of these fabrication advancements is to reduce material waste, which is costly due to Beryllium's price and inherent toxicity, and to produce intricate geometries impossible through conventional milling, particularly vital for next-generation defense sensors and compact satellite structures.

Furthermore, technology related to safety and environmental stewardship is paramount. Development in materials testing and quality assurance involves sophisticated non-destructive evaluation (NDE) techniques, such as eddy current testing and advanced ultrasonic inspection, tailored to detect micro-defects unique to Beryllium structures. Crucially, the technology landscape includes mandatory, advanced industrial hygiene monitoring systems to detect airborne Beryllium particles (Beryllium monitoring systems) and specialized detoxification and recycling facilities. These technologies are integral to the operational viability of any Beryllium producer, ensuring compliance with strict occupational safety and health administration (OSHA) standards globally, thereby influencing market competition based on safety technology adoption.

Regional Highlights

- North America: Market Dominance Fueled by Defense and Aerospace

North America, led by the United States, represents the largest market share for Beryllium metal, primarily driven by substantial and sustained governmental expenditure on military and defense systems. The presence of major defense prime contractors (e.g., Lockheed Martin, Northrop Grumman) and advanced space agencies (NASA) ensures a constant, high-volume demand for pure Beryllium metal in precision optics, structural components for missiles, and advanced satellite communication payloads. The region's technological leadership in semiconductor manufacturing also supports robust demand for Beryllium Copper alloys in high-reliability electronic components. The regulatory environment, while strict concerning Beryllium handling (OSHA regulations), also fosters innovation in safety protocols, maintaining the region's position as a global center for Beryllium processing and application expertise. Furthermore, the concentration of established refining capabilities gives North America significant control over the global supply chain dynamics and pricing mechanisms, making it the most influential region in the overall market structure.

- United States: Largest consumer driven by strategic military applications, missile defense, and NASA programs.

- Canada: Niche demand primarily focused on nuclear research facilities and high-end industrial tooling.

- Asia Pacific (APAC): Fastest Growing Market Driven by Industrialization and 5G Rollout

The Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fundamentally fueled by extensive industrialization, significant investments in 5G and future 6G telecommunication infrastructure (especially in China, South Korea, and Japan), and the rapid modernization of indigenous defense capabilities across major countries. China, in particular, is both a significant consumer and an increasingly important producer of Beryllium products, focusing on self-sufficiency in strategic materials. The demand for Beryllium Copper alloys is booming in this region due to the enormous scale of consumer electronics manufacturing and the continuous push towards higher density and performance in electrical connectors. While the region is still developing the high-purity processing capabilities seen in the West, its sheer volume of electronics output makes it a critical driver for the alloy segment. Government support for critical mineral acquisition and processing further accelerates market growth in APAC.

- China: Major growth driver in electronics manufacturing and rapidly expanding defense modernization programs.

- Japan/South Korea: High demand for Beryllium alloys in advanced automotive electronics and precise tooling applications.

- India: Growing defense procurement and space exploration budget fueling pure Beryllium demand.

- Europe: Stable Market Anchored by Industrial and Research Applications

Europe maintains a stable and mature Beryllium market, characterized by high-value industrial applications and strategic participation in international scientific collaborations. Key demand comes from the automotive sector for specialized molds and components, and from sophisticated industrial machinery requiring durable, high-performance alloys. Crucially, Europe houses world-leading research facilities, including major high-energy physics laboratories and significant contributions to the ITER fusion project, necessitating high-purity Beryllium for specific scientific components. Regulatory compliance in Europe (REACH standards) imposes strict controls on Beryllium handling and import, potentially increasing operating costs but also ensuring high standards of environmental protection and worker safety. Collaborative European defense programs provide a steady, but less dominant, demand stream compared to the U.S. market.

- Germany: Strong industrial base driving demand for Beryllium alloys in high-precision tooling and industrial springs.

- France/UK: Significant consumers within collaborative European aerospace and nuclear energy sectors.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging and Niche Markets

The markets in Latin America and the Middle East & Africa are currently smaller, representing niche or emerging opportunities. Demand in MEA is primarily driven by expanding defense budgets, particularly in Gulf Cooperation Council (GCC) countries investing in surveillance and military hardware requiring imported Beryllium components. The oil and gas sector also generates demand for specialized, non-sparking drilling tools and high-strength downhole logging equipment utilizing Beryllium alloys due to their resistance to harsh environments. Latin America's demand is concentrated in the extractive industries and localized defense modernization efforts. Growth in these regions is highly dependent on commodity price stability and geopolitical security, which often dictates national defense spending patterns and infrastructure investments.

- Middle East: Increasing defense procurement and infrastructure projects driving niche demand.

- Brazil: Focus on specialized industrial components and minor defense requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beryllium Metal Market.- Materion Corporation

- American Elements

- Belmont Metals

- IBC Advanced Alloys

- Xinjiang Non-Ferrous Metal Industry Group

- Ulba Metallurgical Plant (Kazatomprom)

- NGK Beryllium Products

- China Rare Metal Material Co. Ltd.

- ERAMET (Via its participation in relevant processing activities)

- K.A. Schmersal GmbH & Co. KG (Component focus)

- Hunan Nonferrous Metals

- Kaimeite Precision Metals

- Fujian Rare Earth Group

- Talison Lithium (Indirectly through Beryl sourcing)

- Toho Titanium Co., Ltd. (Advanced material competitor/collaborator)

Frequently Asked Questions

Analyze common user questions about the Beryllium Metal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Beryllium Metal Market?

Market growth is primarily driven by mandatory demand from strategic sectors, including escalating global defense expenditures for advanced radar and missile systems, critical requirements for high-precision optics in space exploration and satellite communication, and the rapid expansion of 5G/6G infrastructure requiring superior Beryllium Copper connectors and thermal management solutions.

What is Beryllium Copper and where is it predominantly used?

Beryllium Copper (BeCu) is an alloy containing up to 2% Beryllium, renowned for its excellent strength, hardness, and electrical conductivity. It is predominantly used in the Electronics and Telecommunications sector for manufacturing high-reliability electrical connectors, springs, switch components, and specialized tooling that requires non-sparking properties and resistance to wear and fatigue.

What are the major challenges facing Beryllium producers and users?

The foremost challenge is the severe material toxicity (Berylliosis risk) associated with processing Beryllium, which necessitates extremely strict safety protocols (OSHA compliance) and significantly increases operational costs. Other challenges include highly concentrated, often geopolitical-sensitive, supply chains and the difficulty and expense associated with specialized high-precision machining.

How does the Beryllium Metal Market contribute to the aerospace and defense sectors?

In aerospace and defense, Beryllium is critical due to its stiffness-to-weight ratio and dimensional stability. It is used extensively in high-performance optical mirrors for telescopes and guided systems, inertial navigation systems, aircraft brake components, and structural elements of satellites where minimized mass and maximized thermal stability are paramount for mission success.

Which regions hold the largest market share for Beryllium metal and why?

North America currently holds the largest market share, predominantly due to massive governmental investment in strategic military technology, advanced space programs (NASA), and the presence of leading defense and aerospace OEM headquarters. Asia Pacific, driven by electronics manufacturing and defense modernization, is projected to be the fastest-growing region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager