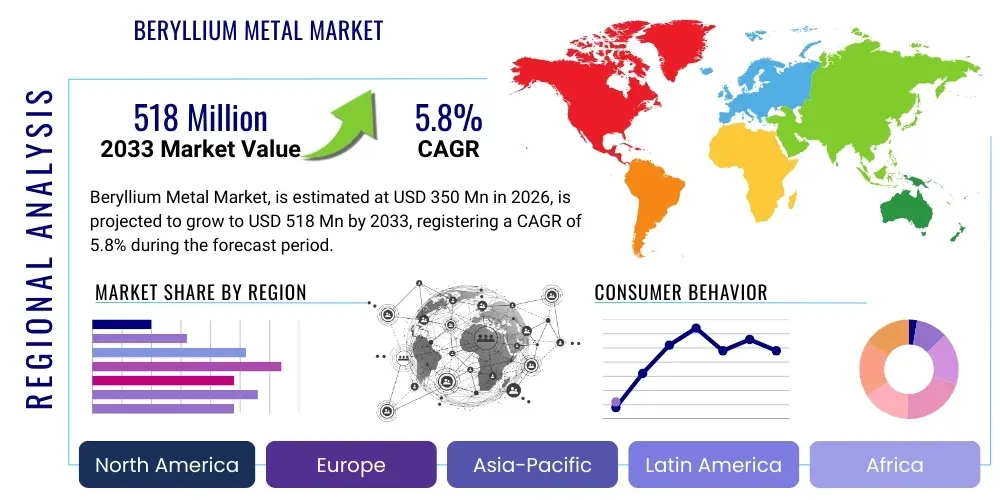

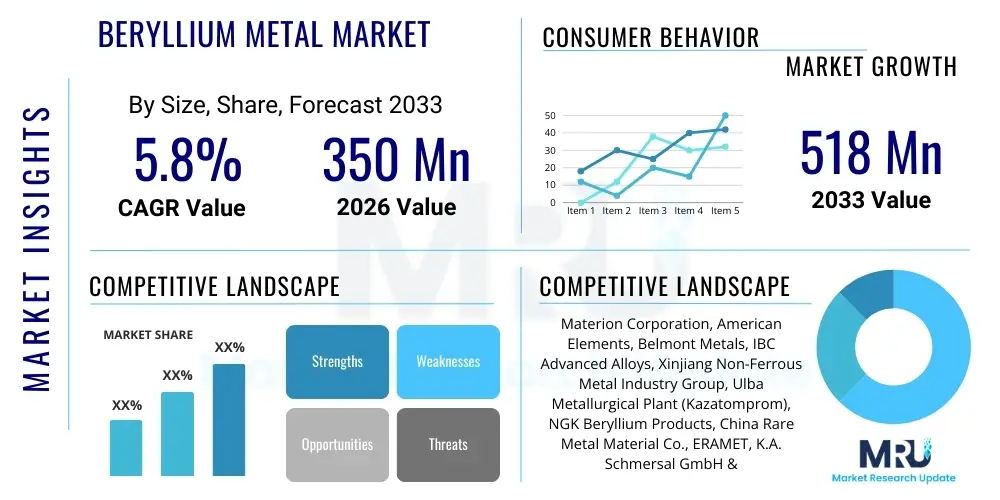

Beryllium Metal Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 443500 | Date : Feb, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Beryllium Metal Market Size

The Beryllium Metal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 185 Million in 2026 and is projected to reach USD 285 Million by the end of the forecast period in 2033.

Beryllium Metal Market introduction

The Beryllium Metal Market encompasses the extraction, processing, and application of pure beryllium and its alloys. Beryllium is a strategic material characterized by exceptionally high stiffness-to-weight ratio, excellent thermal conductivity, low density, and transparency to X-rays. These unique physical properties make it indispensable in demanding applications where performance constraints outweigh the high material cost and complex processing requirements associated with its inherent toxicity. Historically, the market has been intrinsically linked to government defense spending, particularly in the United States and Russia, given its use in guidance systems, nuclear applications, and advanced aircraft components.

The product description spans pure Beryllium metal—primarily utilized in mirrors for space telescopes and nuclear reactors as a moderator or reflector—and its specialized alloys, such as Copper Beryllium (CuBe) and Aluminum Beryllium (AlBe). CuBe alloys constitute the largest segment of the market, prized for their strength, hardness, and non-magnetic characteristics, making them suitable for electrical connectors, spring applications, and precision tooling. The inherent benefits driving market expansion include miniaturization trends in electronics requiring superior heat dissipation capabilities, and the persistent need in aerospace for materials that reduce structural weight without compromising integrity or thermal resilience.

Major applications driving sustained demand are categorized across the Aerospace and Defense sector (for inertial navigation systems, structural components, and heat sinks), Industrial sector (for specialized machinery and mold making), and Electronics and Telecommunications (for high-frequency connectors and thermal management solutions). Driving factors for market growth include the escalating global investment in satellite technology and space exploration, the modernization of military platforms necessitating high-performance materials, and technological advancements mitigating the risks associated with handling beryllium, thus potentially expanding its use in niche industrial applications. Moreover, the increasing adoption of advanced radar systems and communication infrastructure relies heavily on the thermal management capabilities provided by beryllium materials.

Beryllium Metal Market Executive Summary

The Beryllium Metal Market is experiencing moderate yet stable growth, underpinned by sustained demand from strategic end-use industries like defense, aerospace, and specialized electronics. Key business trends indicate a shift towards advanced manufacturing techniques, such as additive manufacturing (3D printing) of beryllium components, which reduces material waste and allows for the creation of complex geometries previously unattainable through traditional methods. Market stability is also maintained by a highly consolidated supply structure, where a few key vertically integrated players control the majority of global production, minimizing rapid price fluctuations despite geopolitical supply risks. Furthermore, innovation is focused on developing safer processing methods and high-performance alloys that maintain beryllium’s core properties while potentially reducing manufacturing complexity and cost.

Regional trends highlight North America, particularly the United States, as the dominant market due to massive domestic defense expenditures and the concentration of major aerospace manufacturers and research facilities. The Asia Pacific region, led by China and India, is emerging as the fastest-growing market segment, driven by increasing investment in indigenous defense programs, the expansion of telecommunication infrastructure requiring high-grade thermal materials, and burgeoning space exploration initiatives. Europe remains a significant consumer, though growth is tempered by stringent environmental and occupational health regulations pertaining to hazardous materials, requiring significant capital investment in emission control and worker safety protocols by manufacturers.

Segment trends demonstrate the Alloy segment, specifically Copper Beryllium (CuBe), maintaining the largest market share due to its widespread adoption across commercial and industrial applications beyond high-end defense uses. However, the Pure Beryllium segment is projected to exhibit the highest CAGR, primarily fueled by specialized requirements in military reconnaissance satellites, high-energy physics research, and the production of optical systems where unparalleled stiffness and thermal stability are paramount. The market structure, defined by stringent regulatory oversight (OSHA, REACH), necessitates continuous investment in specialized processing equipment and environmental monitoring, acting as a significant barrier to entry for new competitors and reinforcing the dominance of established, compliant market leaders.

AI Impact Analysis on Beryllium Metal Market

Common user questions regarding AI's impact on the Beryllium Metal Market often revolve around optimizing the complex and costly refining processes, predicting material performance under extreme operational conditions, and enhancing quality control to reduce waste, given the material's expense. Users are also concerned with how AI can assist in compliance and safety monitoring, particularly regarding minimizing worker exposure to toxic beryllium dust (berylliosis prevention). The consensus expectation is that AI will not fundamentally alter the material's strategic relevance but will significantly improve supply chain efficiency and product quality. Specifically, key themes involve utilizing machine learning for predictive maintenance on specialized melting and casting equipment, optimizing alloy composition formulations for specific applications, and integrating real-time sensor data during extraction and purification to maximize yield from limited beryl and bertrandite reserves. This integration is crucial for maintaining profitability in a market characterized by high fixed costs and intense regulatory scrutiny, thereby ensuring higher purity levels and consistent mechanical properties essential for highly sensitive end-use components.

- AI optimizes beryl ore processing parameters, increasing extraction efficiency and purity yields.

- Machine learning algorithms enhance quality control by predicting component structural integrity based on real-time manufacturing data.

- Predictive modeling assists in simulating the performance of beryllium components in extreme environments (space, nuclear), accelerating R&D cycles.

- AI systems monitor worker exposure levels to beryllium particulates, enhancing safety compliance and reducing long-term occupational health risks (Chronic Beryllium Disease).

- Supply chain risk management is strengthened through AI analysis of geopolitical stability, resource availability, and refining bottlenecks.

- Additive manufacturing optimization via generative design algorithms uses AI to minimize material waste during component fabrication.

DRO & Impact Forces Of Beryllium Metal Market

The market is predominantly driven by increasing global military modernization initiatives, particularly within the United States, China, and Russia, where beryllium is essential for advanced inertial guidance systems, targeting mechanisms, and stealth technology components due to its superior strength-to-weight ratio and radar transparency. Concurrently, the burgeoning global space economy, including commercial satellite launches and governmental deep space missions, necessitates ultra-lightweight and thermally stable materials for optical benches, satellite bus structures, and cryogenic instruments. These application demands provide robust, high-value anchors for long-term market stability. However, the market faces significant restraints, primarily centered around the material's inherent toxicity, which mandates extremely high safety and environmental compliance costs. This stringent regulatory burden not only increases operational expenses but also limits the geographical scope of manufacturing and processing facilities, creating bottlenecks in the supply chain. Furthermore, the limited global availability of commercially viable beryl ore deposits concentrates mining risk and contributes to supply volatility and high material pricing, making substitute materials attractive for less demanding applications.

Opportunities for market expansion are substantial within the high-end industrial and medical imaging sectors. The superior mechanical properties of beryllium alloys are finding increasing relevance in specialized tooling for plastic molding and resistance welding, where durability and thermal efficiency are critical. In the medical field, the material’s transparency to X-rays is driving its application in high-performance diagnostic imaging equipment, allowing for clearer resolution and reduced radiation exposure. Moreover, there is a developing opportunity in solid-state computing and high-power laser systems, where the unique combination of stiffness and thermal dissipation capabilities is highly sought after for managing intense heat fluxes generated during operation. Strategic investment in new extraction technologies aimed at accessing lower-grade ores or recycling used materials could significantly mitigate the supply restraint.

The impact forces within the Beryllium Metal market are primarily driven by technological imperatives and regulatory constraints. Substitution risk remains a medium-level impact force; while materials like carbon fiber composites or specialized aluminum alloys (e.g., Al-Li) can substitute beryllium in certain structural applications, they cannot yet replicate the combined stiffness, thermal conductivity, and lightweight profile required for critical defense and aerospace components. Supplier bargaining power is exceptionally high due to the oligopolistic nature of the market and the strategic scarcity of raw material sources. Buyer bargaining power is moderate to high, concentrated among large government agencies (DoD, NASA, ESA) who purchase in significant volumes, though their dependence on the material for mission-critical systems limits their leverage regarding price negotiation. Overall, the market remains highly strategic, where external geopolitical factors and domestic regulatory shifts exert more profound and immediate impact than typical commercial market dynamics.

Segmentation Analysis

The Beryllium Metal Market is segmented based on the Product Type (Pure Beryllium and Beryllium Alloys), by Form (Blocks, Sheets, Rods, Tubes), and by End-Use Industry (Aerospace & Defense, Electronics & Telecommunications, Industrial, Automotive, and Others). The segmentation reflects the varied purity and compositional requirements dictated by end-user applications. Beryllium Alloys dominate the revenue landscape due to the versatility of Copper Beryllium (CuBe), which is utilized extensively in electronic connectors and industrial molds. In contrast, Pure Beryllium, while smaller in volume, commands a higher price point and is critical for highly specialized applications such as neutron reflectors in nuclear reactors and high-precision optical mirrors for satellites, highlighting the dichotomy between commercial volume usage and strategic, high-value applications within the market structure.

- By Product Type:

- Pure Beryllium (Strategic applications in nuclear, optics, and extreme structural parts)

- Beryllium Alloys (Higher volume commercial use)

- Copper Beryllium (CuBe)

- Aluminum Beryllium (AlBe)

- Nickel Beryllium (NiBe)

- By Form:

- Blocks (Used for large structural components and subsequent processing)

- Sheets and Foils (Thin-walled structures, X-ray windows)

- Rods and Tubes (Connectors, springs, machined parts)

- Powder and Pellets (For powder metallurgy and 3D printing applications)

- By End-Use Industry:

- Aerospace & Defense (Guidance systems, satellites, military aircraft brakes)

- Electronics & Telecommunications (Connectors, heat sinks, high-frequency devices)

- Industrial (Molds, non-sparking tools, resistance welding electrodes)

- Automotive (Specialized sensors and components in high-performance vehicles)

- Others (Medical devices, scientific instrumentation, nuclear research)

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Beryllium Metal Market

The Beryllium Metal value chain is characterized by high integration and rigorous controls, starting with the upstream segment involving the mining of beryl and bertrandite ores, primarily concentrated in a few global locations. Upstream analysis reveals that raw material sourcing is highly sensitive to geopolitical factors and environmental regulations, as only a small number of entities globally possess the technological know-how and permitted infrastructure to safely extract and concentrate these ores. The subsequent step, primary processing, involves the reduction of the ore into beryllium hydroxide or oxide, an energy-intensive and chemically complex process that acts as a significant barrier to entry. Given the strategic nature of the material, stability in the upstream segment is paramount, often secured through long-term contracts and government support to mitigate supply disruptions and ensure the required material quality for defense applications.

The midstream segment involves the refinement of beryllium oxide into pure beryllium metal or the creation of master alloys. This stage is dominated by specialized metallurgical facilities employing sophisticated vacuum melting, powder metallurgy, and hot pressing techniques to achieve the desired material density and purity. Manufacturers must strictly adhere to complex environmental, health, and safety standards, particularly concerning dust control and waste disposal, which drives up production costs significantly. The efficiency of the midstream processing dictates the final cost and performance characteristics of the product; hence, process optimization, often involving proprietary technologies, is a key competitive differentiator among the limited number of global processors.

The downstream analysis focuses on component fabrication and distribution. Beryllium metal and alloys are typically distributed through direct channels to major end-users—large aerospace and defense contractors (e.g., Lockheed Martin, Northrop Grumman) and major electronics manufacturers—where specialized technical consultation is required for machining and integration. Indirect distribution, often through highly specialized, authorized distributors, services smaller industrial and electronics customers needing standard alloy forms (rods, sheets). Due to the high value and customization of the product, the value chain emphasizes strong technical support and long-term relationships over transactional exchanges. The final stage involves the integration of these components into mission-critical systems, often requiring rigorous certification and testing protocols unique to the aerospace and defense sectors, solidifying the importance of product quality throughout the entire supply chain.

Beryllium Metal Market Potential Customers

Potential customers for the Beryllium Metal Market are highly diversified across strategic, technology-intensive sectors, with government defense and space agencies representing the most consistent and highest-volume end-users for pure beryllium. These entities, including the US Department of Defense, NASA, ESA, and their affiliated prime contractors, require the material for precision guidance systems, satellite optics, and neutron moderation in naval reactors due to its unique combination of mechanical, thermal, and nuclear properties. The purchasing decisions of these customers are primarily driven by material specifications, reliability, and long-term supply assurance rather than price sensitivity, given the mission-critical nature of the applications. These buyers necessitate materials that meet extremely stringent certifications and often engage in proprietary development programs with suppliers.

Another significant customer base resides within the Electronics and Telecommunications industry. Manufacturers of advanced consumer electronics, high-speed data centers, and 5G telecommunication infrastructure require Beryllium Copper (CuBe) alloys for connectors, relays, and specialized thermal management solutions. These applications utilize CuBe for its superior electrical conductivity, fatigue strength, and resistance to corrosion, ensuring the long-term reliability of electrical connections under demanding conditions. While these customers are more price-sensitive than the defense sector, they still prioritize performance and compliance with RoHS (Restriction of Hazardous Substances) and REACH regulations, driving demand for innovative, safer alloy formulations.

Industrial customers form the third major segment, including manufacturers of precision injection molds, resistance welding components, and non-sparking safety tools used in potentially explosive environments. In these scenarios, Beryllium Metal offers excellent wear resistance and thermal dissipation properties, leading to reduced downtime and increased productivity in manufacturing processes. Key buyers are in the automotive manufacturing sector (specialty plastics molding), oil and gas (safety tools), and general metallurgy. The demand from these industrial end-users is often cyclical and tied closely to global capital expenditure cycles, but their reliance on the material for performance advantage ensures sustained low-to-medium volume procurement across various specialized product forms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185 Million |

| Market Forecast in 2033 | USD 285 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, Ulba Metallurgical Plant (UMZ), NGK Metals Corporation, IBC Advanced Alloys Corp, Belmont Metals, American Beryllia Corporation, BRUSH TSL, China Minmetals Corporation, H.C. Starck GmbH, Kazatomprom, Talbros Automotive Components Ltd., Xinjiang Nonferrous Metals Group, Hunan Nonferrous Metals Corporation, Beryllium Metals & Chemicals, CoorsTek, Inc., Shanghai Metal Corporation, Etrema Products, Inc., Precision Castparts Corp., ThyssenKrupp AG, Allegheny Technologies Incorporated (ATI) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Beryllium Metal Market Key Technology Landscape

The technological landscape of the Beryllium Metal market is defined by continuous advancements focused on addressing the dual challenges of reducing material toxicity risks and improving material performance consistency, particularly for high-purity applications. Key technologies employed upstream include solvent extraction and flotation techniques for refining beryl and bertrandite ores, aiming for higher efficiency and lower environmental impact during the purification of beryllium hydroxide. Midstream, the use of vacuum induction melting and hot isostatic pressing (HIP) is standard practice to create dense, void-free beryllium components. The most critical technological focus is on enhancing powder metallurgy processes, which are essential for producing fine-grained, high-strength beryllium structures used in missile guidance systems and space mirrors, ensuring homogeneity and superior mechanical properties under extreme operational temperatures.

A major technological paradigm shift influencing the market is the increasing adoption of Additive Manufacturing (AM), or 3D printing, for complex beryllium components. While traditionally challenging due to the material’s toxicity and high melting point, specialized powder bed fusion (PBF) and directed energy deposition (DED) techniques are being developed to print near-net-shape components. This technological advancement promises substantial material waste reduction—a critical economic factor given the material's high cost—and allows for the fabrication of complex cooling channels and optimized structural geometries, significantly benefiting thermal management in electronics and aerospace heat sinks. However, mastering the control of atmospheric contaminants and post-processing treatments in AM remains a significant research area to ensure printed parts meet the structural integrity required by defense standards.

Furthermore, technology related to safety and compliance plays a central role. Advanced monitoring systems utilizing real-time sensor data and computational fluid dynamics (CFD) modeling are employed in manufacturing facilities to ensure optimal ventilation and containment, thereby minimizing worker exposure to airborne beryllium particulates and complying with stringent OSHA standards regarding Chronic Beryllium Disease (CBD) prevention. In the alloy segment, continuous research is focused on developing next-generation alloys, such as enhanced Aluminum-Beryllium (AlBeMet) composites, which offer superior strength and reduced density compared to conventional alloys, driving their adoption in aerospace structures where weight savings are paramount. These ongoing material science and processing technology developments are crucial for maintaining beryllium's competitive edge against alternative lightweight materials.

Regional Highlights

- North America (Dominant Market Leader): The North American region, particularly the United States, holds the largest market share due to substantial governmental investment in defense and space programs, specifically the procurement of strategic materials for advanced military aircraft, missiles, and orbital assets (e.g., James Webb Space Telescope components). The presence of Materion Corporation, a major global supplier, and leading aerospace original equipment manufacturers (OEMs) ensures robust demand and technological leadership. Strict environmental regulations mandate high expenditure on compliance and specialized handling, reinforcing the vertically integrated nature of key players in the region. Demand is heavily concentrated in the Pure Beryllium and high-performance Beryllium-Aluminum alloys segments.

- Asia Pacific (Fastest Growing Region): The APAC region is projected to register the highest growth rate, fueled by rapid industrialization, massive investments in 5G and fiber optic telecommunications infrastructure, and expanding indigenous defense modernization programs, especially in China, India, and South Korea. China’s focus on establishing self-sufficiency in high-tech materials and its burgeoning space program are significant market drivers. While local production often faces technological disparities compared to North America, the sheer volume of electronics manufacturing ensures high consumption of Beryllium Copper alloys for connectors and electrical components.

- Europe (Mature and Regulatory-Driven Market): European market stability is maintained by steady demand from the region's advanced manufacturing base, including precision machinery, medical devices, and contributions to pan-European space projects (e.g., ESA programs). Growth is constrained by the strict adherence to REACH regulations regarding material safety and usage, prompting manufacturers to prioritize closed-loop material handling and advanced recycling initiatives. Germany, France, and the UK are key consumers, often relying on imported finished material forms or specialized components rather than primary processing due to high domestic environmental compliance costs.

- Latin America & Middle East and Africa (Niche Growth): These regions represent smaller, specialized markets. In the Middle East, demand is largely associated with defense procurement and oil & gas exploration, specifically for non-sparking tools and specialized sensor components. Latin America exhibits sporadic demand tied primarily to industrial manufacturing and local electronics assembly operations. Market growth in MEA is often dependent on geopolitical stability and foreign direct investment in infrastructure projects requiring robust electrical connectivity and reliable sensing equipment, often sourced through international prime contractors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Beryllium Metal Market.- Materion Corporation

- Ulba Metallurgical Plant (UMZ)

- NGK Metals Corporation

- IBC Advanced Alloys Corp

- Belmont Metals

- American Beryllia Corporation

- BRUSH TSL

- China Minmetals Corporation

- H.C. Starck GmbH

- Kazatomprom

- Talbros Automotive Components Ltd.

- Xinjiang Nonferrous Metals Group

- Hunan Nonferrous Metals Corporation

- Beryllium Metals & Chemicals

- CoorsTek, Inc.

- Shanghai Metal Corporation

- Etrema Products, Inc.

- Precision Castparts Corp.

- ThyssenKrupp AG

- Allegheny Technologies Incorporated (ATI)

Frequently Asked Questions

Analyze common user questions about the Beryllium Metal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor restraining growth in the Beryllium Metal market?

The most significant restraint is the extreme toxicity of beryllium dust and fumes, which necessitates stringent occupational safety standards (such as OSHA and Chronic Beryllium Disease prevention protocols) and results in significantly higher processing costs and regulatory burden compared to alternative materials.

Which end-use industry is the largest consumer of Pure Beryllium metal?

The Aerospace and Defense industry is the largest consumer of high-purity Beryllium metal, utilizing it for critical, mission-specific applications such as optical systems in space telescopes, inertial guidance system components, and neutron reflectors in nuclear reactors due to its low density and thermal stability.

How does the use of Beryllium Copper (CuBe) alloys impact the Electronics sector?

Beryllium Copper alloys are vital in the Electronics sector because they provide superior electrical conductivity, exceptional resistance to fatigue, and high tensile strength, making them ideal for high-reliability electrical connectors, relays, and springs that must maintain performance under repetitive stress and corrosive conditions.

What role does Additive Manufacturing (3D Printing) play in the Beryllium market?

Additive Manufacturing is an emerging technology for Beryllium, primarily researched to enable the production of highly complex, near-net-shape components. This technology helps reduce the substantial material waste associated with traditional machining and allows for complex thermal management designs, optimizing material use efficiency.

What are the key geographical areas for Beryllium ore mining?

Beryllium ore, sourced mainly as beryl and bertrandite, is primarily extracted in countries including the United States, Russia, China, and Kazakhstan. The concentration of processing technology and reserves in these regions makes the upstream supply chain highly concentrated and strategically important.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager