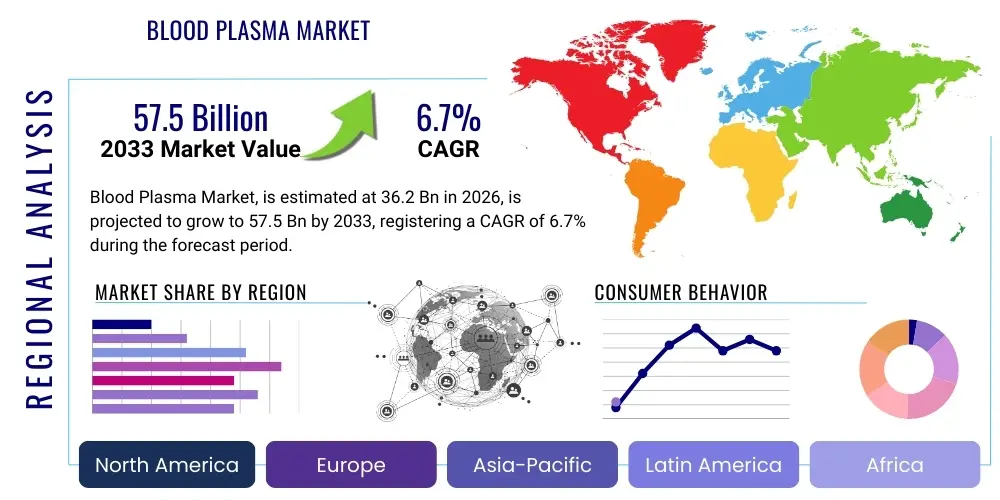

Blood Plasma Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440562 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

Blood Plasma Market Size

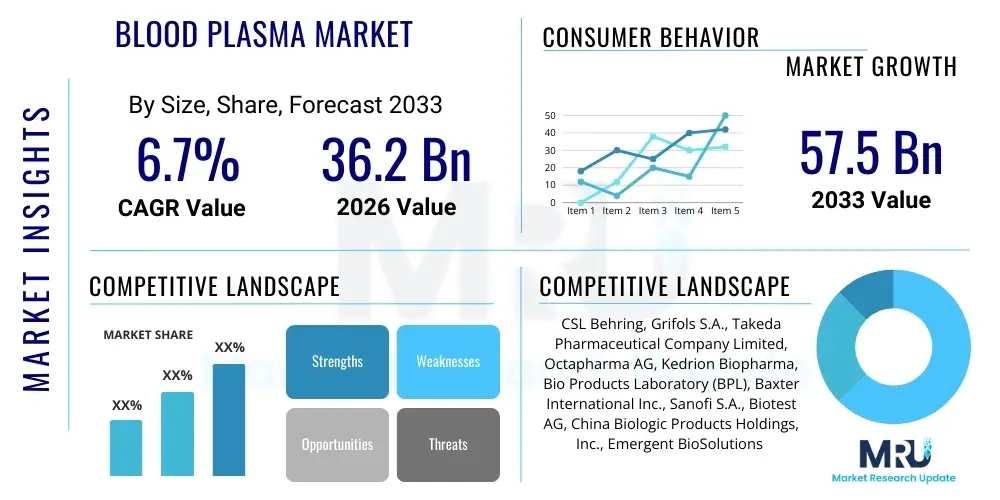

The Blood Plasma Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 36.2 Billion in 2026 and is projected to reach USD 57.5 Billion by the end of the forecast period in 2033.

Blood Plasma Market introduction

The blood plasma market is a critical segment of the biopharmaceutical industry, focused on the collection, fractionation, and distribution of plasma-derived medicinal products (PDMPs). Blood plasma, the liquid component of blood, is rich in proteins such as albumin, immunoglobulins, and clotting factors, which are vital for numerous physiological functions. These proteins are extracted through a complex fractionation process to create life-saving therapies. The market is driven by the increasing prevalence of rare and chronic diseases requiring plasma-derived therapies, an aging global population more susceptible to these conditions, and continuous advancements in plasma collection and processing technologies that enhance product safety and efficacy.

Major applications for blood plasma products span a wide range of medical conditions, including primary immunodeficiency disorders (PID), hemophilia, alpha-1 antitrypsin deficiency (AATD), hereditary angioedema (HAE), and various neurological disorders. These therapies offer profound benefits, often serving as the only effective treatment options for patients, significantly improving their quality of life and prognosis. For instance, intravenous immunoglobulins (IVIg) are indispensable for patients with compromised immune systems, while factor VIII and IX concentrates are crucial for managing bleeding episodes in hemophiliacs. The inherent demand for these essential medicines underpins the market's stability and growth trajectory.

Key driving factors include the global rise in diagnosis rates for plasma-responsive conditions, expanding access to healthcare in developing regions, and robust research and development activities leading to new indications and more purified, safer products. Strategic initiatives by market players, such as expanding plasma collection centers and investing in advanced manufacturing capacities, are also contributing to market expansion. However, the market also faces challenges related to plasma donor recruitment, regulatory complexities, and the high cost associated with plasma-derived therapies, which necessitate careful balancing of supply, demand, and accessibility.

Blood Plasma Market Executive Summary

The global blood plasma market is experiencing robust growth, primarily fueled by an escalating demand for plasma-derived medicinal products (PDMPs) across various therapeutic areas. Business trends indicate a significant consolidation among major players, coupled with substantial investments in expanding plasma collection infrastructure and advanced fractionation capabilities to meet growing global demand. Pharmaceutical companies are increasingly focusing on strategic partnerships and acquisitions to strengthen their product portfolios and geographical reach, particularly in emerging markets where diagnostic rates and treatment access are improving. Innovation in product development, aimed at enhancing purity, safety, and patient convenience, also remains a central business imperative.

Regional trends highlight North America as the dominant market, driven by high disease prevalence, advanced healthcare infrastructure, and favorable reimbursement policies. Europe also represents a mature market with steady demand, supported by well-established healthcare systems and robust regulatory frameworks. The Asia Pacific region is poised for the fastest growth, propelled by a large patient pool, increasing healthcare expenditure, and improving diagnostic capabilities, particularly in countries like China and India. Latin America, the Middle East, and Africa are emerging as significant markets due to rising awareness, expanding healthcare access, and the unmet medical needs in these regions, presenting considerable opportunities for market expansion and new collection center development.

Segment trends underscore the continued dominance of immunoglobulins (IVIg and SCIg) due to their broad applications in neurological, immunological, and autoimmune disorders. Albumin remains a foundational product, widely used in critical care and liver disease management. Coagulation factors, especially for hemophilia A and B, also maintain a substantial share, driven by increasing patient diagnoses and the shift towards prophylactic treatment. The increasing recognition and diagnosis of rare diseases that require plasma-derived therapies are continually expanding the application landscape. Innovation within these segments includes the development of recombinant alternatives, although plasma-derived products continue to hold significant clinical importance due to their complex biological composition and proven efficacy.

AI Impact Analysis on Blood Plasma Market

User inquiries concerning AI's influence on the blood plasma market frequently revolve around its potential to enhance efficiency, improve safety, and accelerate therapeutic development. Key themes include the application of AI in optimizing donor screening and recruitment, streamlining plasma collection logistics, improving the safety and quality control of plasma-derived products, and accelerating the discovery and development of novel therapies. Concerns often touch upon data privacy, the ethical implications of AI-driven decision-making in healthcare, and the investment required for integrating such advanced technologies. Expectations are high regarding AI's capability to address challenges like donor shortages and manufacturing bottlenecks, ultimately making life-saving plasma therapies more accessible and affordable.

- AI-powered analytics can significantly enhance plasma donor screening processes by analyzing vast datasets of donor health records, geographic information, and demographic trends to identify suitable donors and predict potential risks more accurately, thus improving overall plasma safety and yield.

- Predictive modeling capabilities of AI can optimize the logistics of plasma collection centers, including donor scheduling, inventory management, and resource allocation, leading to increased operational efficiency and reduced wastage. This optimization helps address issues related to supply chain stability.

- Machine learning algorithms can be employed in quality control during the plasma fractionation process, detecting impurities or inconsistencies more rapidly and precisely than traditional methods, thereby ensuring higher product purity and safety standards for final therapeutic products.

- AI accelerates drug discovery and development by identifying potential therapeutic targets within plasma proteins and predicting the efficacy and safety profiles of new plasma-derived therapies, potentially shortening development timelines and bringing innovative treatments to market faster.

- AI-driven personalized medicine approaches could tailor plasma-derived therapies to individual patient needs by analyzing genetic and physiological data, optimizing treatment outcomes, and minimizing adverse reactions, thereby revolutionizing the application of these complex biological products.

- Enhanced surveillance systems powered by AI can monitor the global blood plasma supply chain for emerging pathogens or contamination risks, providing early warning systems and reinforcing biosecurity measures crucial for maintaining public health and trust in plasma-derived products.

DRO & Impact Forces Of Blood Plasma Market

The blood plasma market is shaped by a dynamic interplay of driving forces, inherent restraints, and compelling opportunities that collectively determine its growth trajectory and strategic landscape. A primary driver is the increasing global prevalence of chronic and rare diseases such as hemophilia, primary immunodeficiency disorders, and alpha-1 antitrypsin deficiency, all of which rely heavily on plasma-derived therapies for management and treatment. Alongside this, a growing and aging global population inherently contributes to a larger patient pool requiring these specialized treatments. Advancements in diagnostic technologies leading to earlier and more accurate disease identification, coupled with expanding access to healthcare services, particularly in emerging economies, are further propelling demand. The continuous investment in research and development for new indications and enhanced product safety profiles also serves as a significant growth catalyst.

Despite robust demand, the market faces several significant restraints. The most prominent challenge is the persistent issue of plasma donor shortages, as the collection process is time-consuming and labor-intensive, relying on voluntary donations. Regulatory hurdles are stringent, with varying requirements across different regions concerning donor screening, collection protocols, and product manufacturing, which can lead to complex compliance issues and increased operational costs. The high cost of plasma collection and fractionation, coupled with the expensive nature of plasma-derived therapies, often poses affordability challenges, particularly in healthcare systems with limited budgets. Ethical considerations surrounding plasma donation, especially compensated donations, also present ongoing discussions and potential limitations on supply.

Opportunities within the market are substantial and diverse. Emerging economies represent untapped potential, characterized by improving healthcare infrastructure, increasing disposable incomes, and a growing awareness of rare diseases, creating new avenues for market penetration and establishing collection centers. Technological advancements in plasmapheresis techniques, pathogen inactivation methods, and fractionation processes promise to enhance the safety, purity, and yield of plasma products, making them more accessible and effective. Furthermore, the exploration of novel indications for existing plasma therapies and the development of next-generation plasma-derived products, potentially leveraging recombinant technologies or biosimilars, offer significant long-term growth prospects. Strategic collaborations between pharmaceutical companies, plasma collectors, and research institutions are also opening doors for innovative product development and market expansion.

Segmentation Analysis

The blood plasma market is extensively segmented based on product type, application, and end-user, providing a granular view of its diverse landscape. Each segment represents distinct market dynamics, driven by specific medical needs, technological advancements, and economic factors. Understanding these segmentations is crucial for stakeholders to identify key growth areas, tailor product development strategies, and optimize market penetration efforts. The complexity and efficacy of plasma-derived products necessitate a clear categorization to analyze trends and forecasts accurately.

- Product Type:

- Immunoglobulins (IVIg, SCIg)

- Albumin

- Coagulation Factors (Factor VIII, Factor IX, vWF, Prothrombin Complex Concentrates)

- Hyperimmune Globulins (Anti-D, Tetanus, Rabies, Hepatitis B)

- Other Plasma-Derived Products (Alpha-1 Antitrypsin, C1-Esterase Inhibitor, Fibrinogen)

- Application:

- Primary Immunodeficiency Disorders (PID)

- Hemophilia (Hemophilia A, Hemophilia B)

- Alpha-1 Antitrypsin Deficiency (AATD)

- Neurological Disorders (CIDP, GBS, Multifocal Motor Neuropathy)

- Hereditary Angioedema (HAE)

- Other Applications (Trauma, Burns, Liver Disease, Autoimmune Conditions)

- End-User:

- Hospitals

- Clinics

- Research Laboratories & Academic Institutions

- Ambulatory Surgical Centers

Value Chain Analysis For Blood Plasma Market

The value chain for the blood plasma market is intricate and multi-layered, beginning with the critical upstream activities of plasma collection and culminating in the downstream distribution and patient administration of life-saving therapies. Upstream analysis focuses on donor recruitment, screening, and plasma collection through plasmapheresis centers. This phase is highly regulated, requiring stringent health checks for donors, advanced collection equipment, and robust inventory management systems. The efficiency and ethical considerations of this initial stage significantly impact the entire supply chain, as consistent, high-quality plasma supply is paramount for subsequent manufacturing processes. Building and maintaining a network of reliable plasma donation centers is a fundamental component of this initial value creation.

Midstream activities involve the transportation of collected plasma to fractionation facilities, where it undergoes a complex series of purification and separation processes to extract specific proteins like immunoglobulins, albumin, and coagulation factors. This fractionation process utilizes advanced biochemical engineering and strict quality control measures to ensure product purity, safety, and efficacy. Pathogen inactivation steps are integral to mitigate the risk of viral transmission, reinforcing the safety profile of plasma-derived medicinal products (PDMPs). Manufacturing efficiency, technological expertise, and adherence to Good Manufacturing Practices (GMP) are critical differentiators in this labor-intensive and capital-intensive stage of the value chain.

Downstream analysis encompasses the packaging, storage, and distribution of finished plasma products to healthcare providers and ultimately to patients. Distribution channels are typically specialized, involving a network of wholesalers, distributors, and direct sales teams to hospitals, clinics, and pharmacies. The direct channel involves manufacturers selling directly to large institutional buyers or through their own specialty pharmacies, allowing for greater control over pricing and customer relationships. Indirect channels involve third-party distributors who manage logistics, warehousing, and delivery, often providing broader market reach. Effective cold chain management is vital throughout the distribution process to maintain product integrity, ensuring that these temperature-sensitive biologicals reach patients in optimal condition, ready for therapeutic use. The final stage involves patient administration, often requiring specialized medical supervision.

Blood Plasma Market Potential Customers

The potential customers for the blood plasma market primarily comprise a broad spectrum of healthcare entities and individuals suffering from a range of chronic and acute medical conditions. These include patients diagnosed with primary immunodeficiency disorders (PID), who require lifelong immunoglobulin replacement therapy to maintain immune function, representing a significant and consistent demand base. Similarly, individuals with hemophilia A or B, characterized by impaired blood clotting, are critical customers for coagulation factor concentrates, which prevent or treat bleeding episodes. The increasing diagnosis rates for these genetic disorders directly translate into a growing customer base, driven by improved healthcare access and diagnostic capabilities worldwide.

Beyond rare genetic conditions, the customer landscape extends to patients with alpha-1 antitrypsin deficiency (AATD), who rely on plasma-derived AAT replacement therapy to slow the progression of lung and liver damage. Individuals suffering from various neurological disorders, such as chronic inflammatory demyelinating polyneuropathy (CIDP) and Guillain-Barré syndrome (GBS), also constitute a substantial customer segment, benefiting significantly from intravenous immunoglobulin (IVIg) therapy to modulate their immune responses. Furthermore, patients undergoing major surgeries, experiencing severe burns, or suffering from hypovolemia or liver failure often require albumin infusions, making hospitals and critical care units key institutional customers.

Moreover, specialized medical centers, clinics, and research institutions are significant purchasers of blood plasma products. Hospitals and outpatient clinics frequently stock a range of PDMPs for immediate use in acute care settings, as well as for long-term management of chronic conditions. Research laboratories and academic institutions also constitute a niche customer segment, utilizing plasma components for scientific studies, diagnostic development, and preclinical research. The direct end-users are the patients themselves, whose quality of life and survival are directly dependent on the availability and efficacy of these life-saving plasma-derived therapies, making their needs and access to treatment a central focus for market stakeholders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 36.2 Billion |

| Market Forecast in 2033 | USD 57.5 Billion |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CSL Behring, Grifols S.A., Takeda Pharmaceutical Company Limited, Octapharma AG, Kedrion Biopharma, Bio Products Laboratory (BPL), Baxter International Inc., Sanofi S.A., Biotest AG, China Biologic Products Holdings, Inc., Emergent BioSolutions Inc., ADMA Biologics, Kamada Ltd., Shire plc (now Takeda), PlasmaGen BioSciences Pvt. Ltd., Spark Therapeutics, Inc., Prothya Biosolutions, Merck KGaA, LFB S.A., Green Cross Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Blood Plasma Market Key Technology Landscape

The blood plasma market is underpinned by a sophisticated array of technologies crucial for the safe and efficient collection, processing, and manufacturing of plasma-derived medicinal products (PDMPs). At the forefront are advancements in plasmapheresis technology, which enables the selective extraction of plasma from whole blood, returning red blood cells and other components to the donor. Modern apheresis machines offer improved automation, enhanced donor comfort, and higher efficiency, allowing for increased plasma yield and reduced collection times. These technologies are continually refined to ensure donor safety and optimize the quality of the collected plasma, forming the bedrock of the market's supply chain and directly impacting the availability of raw material for life-saving therapies.

Following collection, a critical technological phase is plasma fractionation, a complex biochemical process involving sequential precipitation and separation techniques, primarily Cohn’s method and its variants. This process separates specific proteins (e.g., albumin, immunoglobulins, clotting factors) from the raw plasma. Innovations in fractionation technologies focus on increasing product purity, improving yield, and developing more environmentally friendly and scalable methods. Complementing fractionation are advanced purification technologies, such as chromatography and ultrafiltration, which further refine the extracted proteins, removing impurities and potential contaminants to meet stringent pharmaceutical standards. These purification steps are vital for ensuring the therapeutic efficacy and safety of the final products.

Pathogen inactivation and removal technologies represent another pivotal technological domain, essential for mitigating the risk of transmitting infectious agents through plasma-derived products. Techniques like solvent/detergent treatment, pasteurization (heat treatment), nanofiltration, and low pH incubation are routinely employed to inactivate or remove viruses and other potential pathogens, significantly enhancing product safety. Ongoing research in this area aims to develop even more robust and broad-spectrum pathogen reduction methods without compromising protein integrity. Furthermore, advancements in analytical and quality control technologies, including highly sensitive immunoassays and molecular diagnostics, ensure rigorous testing of plasma donations and final products, guaranteeing compliance with global regulatory requirements and maintaining patient trust in these vital biological medicines.

Regional Highlights

- North America: This region consistently holds the largest share of the blood plasma market, primarily driven by a high prevalence of rare and chronic diseases requiring plasma-derived therapies, a well-established and robust healthcare infrastructure, and favorable reimbursement policies. The presence of major market players and extensive plasma collection networks further solidifies its dominant position.

- Europe: As a mature market, Europe demonstrates steady demand for blood plasma products, supported by universal healthcare coverage, high awareness of plasma-responsive conditions, and strong regulatory frameworks governing plasma collection and product manufacturing. Countries like Germany, France, and the UK are key contributors.

- Asia Pacific (APAC): Expected to exhibit the fastest growth, the APAC region is propelled by a rapidly expanding patient population, increasing healthcare expenditure, and improving diagnostic capabilities, particularly in emerging economies such as China, India, and Japan. Rising awareness of rare diseases and government initiatives to enhance healthcare access are key drivers.

- Latin America: This region is characterized by an emerging market for blood plasma, with increasing investment in healthcare infrastructure and growing access to specialized treatments. Countries like Brazil and Mexico are seeing a rise in demand, albeit with challenges related to donor availability and economic constraints.

- Middle East and Africa (MEA): The MEA region represents a developing market with significant untapped potential. Growth is fueled by a rising burden of chronic diseases, improving healthcare facilities, and increasing government focus on healthcare development. However, limited access to advanced therapies and lower diagnostic rates present challenges and opportunities for market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Blood Plasma Market.- CSL Behring

- Grifols S.A.

- Takeda Pharmaceutical Company Limited

- Octapharma AG

- Kedrion Biopharma

- Bio Products Laboratory (BPL)

- Baxter International Inc.

- Sanofi S.A.

- Biotest AG

- China Biologic Products Holdings, Inc.

- Emergent BioSolutions Inc.

- ADMA Biologics

- Kamada Ltd.

- Shire plc (now Takeda)

- PlasmaGen BioSciences Pvt. Ltd.

- Spark Therapeutics, Inc.

- Prothya Biosolutions

- Merck KGaA

- LFB S.A.

- Green Cross Corporation

Frequently Asked Questions

Analyze common user questions about the Blood Plasma market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is blood plasma and why is it important in medicine?

Blood plasma is the liquid component of blood containing vital proteins like albumin, immunoglobulins, and clotting factors. It is crucial for producing life-saving therapies for various conditions, including immune deficiencies, hemophilia, and neurological disorders, acting as a raw material for plasma-derived medicinal products (PDMPs).

Which diseases are primarily treated with plasma-derived products?

Plasma-derived products primarily treat primary immunodeficiency disorders (PID), hemophilia A and B, alpha-1 antitrypsin deficiency (AATD), hereditary angioedema (HAE), and certain neurological conditions like CIDP and Guillain-Barré syndrome (GBS). They are often the only effective treatments available.

What are the main drivers of growth in the blood plasma market?

Key growth drivers include the rising global prevalence of chronic and rare diseases, an aging population, increasing diagnostic rates, expanding access to healthcare services in emerging economies, and continuous advancements in plasma collection and processing technologies that enhance product safety and efficacy.

What challenges does the blood plasma market face?

The blood plasma market faces significant challenges such as persistent donor shortages, stringent and varying regulatory requirements across regions, the high cost of plasma collection and manufacturing, and ethical considerations surrounding plasma donation, all of which impact supply and accessibility.

How is AI expected to impact the future of the blood plasma market?

AI is anticipated to revolutionize the blood plasma market by optimizing donor screening and recruitment, streamlining collection logistics, enhancing quality control and safety during fractionation, and accelerating the discovery and development of novel plasma-derived therapies, ultimately improving efficiency and accessibility of treatments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Animal Blood Plasma and Derivatives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Blood And Organ Bank Market Size Report By Type (Red Blood Cell Collection, Processing, and Distribution Services, Blood Plasma Collection, Processing, and Distribution Services, Organ Bank Services, Tissue Bank Services, Health Screening Services, All Other Human Blood Services, Reproductive and Stem Cell Bank Services, By Activity, Collecting Blood, Storing Blood, Distributing Blood, Storing Organs, Distributing Organs, Researching Storage Technologies, Reproducing Tissues), By Application (Hospitals, Diagnostic Canters, Blood Banks, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Bovine Blood Plasma Derivatives Market Size Report By Type (Bovine Serum, FBS, Bovine Serum Albumin, Fibrinogen, Protein Ingredient, Others), By Application (Scientific Research, Industrial Production, Feed, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Blood Plasma Fractionators Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Membrane Plasma Plasma Fractionator, Non-Membrane Plasma Fractionator), By Application (Hospital, Health Institutions, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Blood Plasma Products Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Immunoglobulin, Albumin, Hyperimmune Globulin, Coagulation Factor Concentrates, Other), By Application (Hospitals and Clinics, Research Laboratories, Academic Institutions, Blood Transfusion Centers.), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager