Boron Trichloride Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433957 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Boron Trichloride Market Size

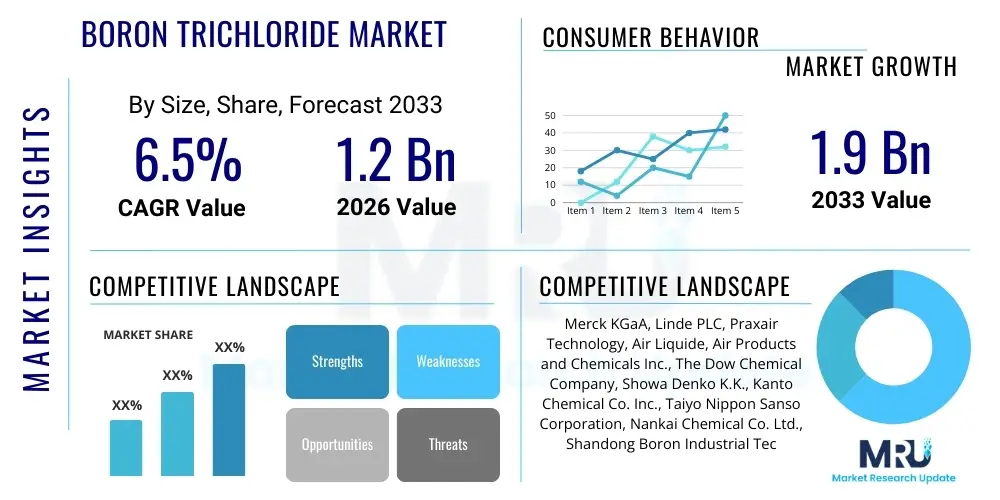

The Boron Trichloride Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Boron Trichloride Market introduction

Boron Trichloride (BCl3) is a colorless, fuming liquid or gas recognized for its potent electrophilic nature, making it an indispensable reagent and etching agent across several high-technology industries. Its primary market driver stems from its critical role in the semiconductor industry, particularly in plasma etching processes for manufacturing integrated circuits (ICs) and microelectronic components. The high purity grades of BCl3 are essential to ensure the precision and quality required for advanced lithography and doping techniques, directly linking the market's trajectory to global developments in consumer electronics, data centers, and advanced computing technologies. Furthermore, BCl3 serves as a key precursor for synthesizing various boron compounds, including elemental boron, boron fibers, and other specialized chemical intermediates used in pharmaceuticals and aerospace applications, cementing its position as a strategically important industrial chemical.

The market landscape for Boron Trichloride is characterized by stringent regulatory requirements concerning purity, handling, and transportation, given its corrosive and toxic properties. Production methodologies typically involve the chlorination of boron carbide or ferroboron, followed by rigorous purification steps such as distillation or adsorption to achieve the required electronic and ultra-high purity grades. Demand dynamics are heavily influenced by the cyclical nature of the semiconductor fabrication industry (fabs), where capacity expansions directly correlate with increased BCl3 consumption. Long-term growth is further underpinned by the increasing complexity of chip designs, which necessitate more precise and deeper plasma etching, driving demand for specialized and high-quality etching gases.

Key applications extend beyond electronics into chemical synthesis, where BCl3 acts as a powerful Lewis acid catalyst in various organic reactions, including Friedel-Crafts alkylation and polymerization processes. In the metallurgical sector, it is utilized for refining and purifying certain metals. The inherent benefits of using Boron Trichloride, such as its high volatility, controllable reactivity, and ability to form stable by-products, ensure its continued dominance over potential substitutes in critical applications. The ongoing focus on developing higher purity grades, particularly 99.999% and above, remains a major operational and technological challenge for manufacturers aiming to cater to the evolving needs of advanced electronics manufacturing.

Boron Trichloride Market Executive Summary

The Boron Trichloride market exhibits robust growth driven primarily by the relentless expansion of the global semiconductor industry, particularly within Asia Pacific, which is rapidly becoming the epicenter for advanced electronics manufacturing and foundry operations. Business trends highlight a pronounced shift towards ultra-high purity (UHP) BCl3 grades, necessitated by shrinking transistor sizes and the emergence of 3D-NAND and advanced logic architectures. Manufacturers are intensely focused on optimizing supply chains and ensuring gas delivery consistency to meet the demanding specifications of major semiconductor fabrication plants (fabs). Strategic collaborations between gas suppliers and equipment manufacturers are becoming increasingly common to integrate BCl3 delivery systems seamlessly into plasma etching apparatus, minimizing contamination risks and maximizing process efficiency. Furthermore, the market is witnessing capacity expansions, particularly in regions where governmental incentives are stimulating domestic chip production, such as the U.S. and Europe, aiming to diversify the global semiconductor supply chain away from concentrated regions.

Regional trends unequivocally indicate that Asia Pacific, spearheaded by countries like China, Taiwan, South Korea, and Japan, commands the largest market share due to the concentration of major semiconductor foundries and display panel manufacturers. This region acts as both the largest consumer and a significant production hub, influencing global pricing and supply stability. North America and Europe, while smaller in volume consumption, represent high-value markets focused on specialized applications in aerospace, defense, and niche pharmaceutical synthesis, where BCl3 purity and traceability are paramount. The ongoing geopolitical tension surrounding technology exports and domestic manufacturing mandates is creating opportunities for localized production capabilities in these Western markets, potentially reshaping future regional consumption patterns.

Segmentation trends reveal that the Semiconductor Manufacturing application segment remains the undisputed leader, consuming the vast majority of UHP Boron Trichloride. Within the purity grades, the 99.999% purity segment is experiencing the fastest growth rate, reflecting the industry's continuous march towards advanced nodes below 10nm. While chemical synthesis and other industrial applications provide essential baseline demand, the volatility and growth projections of the overall market are intrinsically tied to capital expenditure cycles within the electronics sector. Investment in sustainable and safe handling technologies for BCl3 is also emerging as a key trend, addressing the environmental and operational hazards associated with this corrosive chemical.

AI Impact Analysis on Boron Trichloride Market

Common user questions regarding AI's impact on the Boron Trichloride market typically revolve around efficiency improvements in semiconductor fabrication, predictive maintenance for gas delivery systems, and optimizing the complex plasma etching process itself. Users are concerned about whether AI-driven process optimization could lead to reduced BCl3 consumption per wafer, or conversely, if the exponential growth in AI hardware (specialized chips, high-density memory) will accelerate overall demand. The consensus themes suggest that AI's primary influence will be indirect but profound, focusing less on the chemical manufacturing of BCl3 and more on improving its application in end-user sectors, thereby dictating consumption efficiency and driving demand for ultra-consistent, high-purity inputs. Key expectations include using machine learning to fine-tune plasma parameters for perfect etch profiles, leading to fewer scrapped wafers and maximizing the yield of BCl3 usage.

- AI-Driven Process Optimization: Utilizing machine learning algorithms to precisely control flow rates, temperature, and plasma power during semiconductor etching, reducing waste and increasing yield per unit of BCl3.

- Predictive Maintenance: AI tools monitoring gas delivery equipment (valves, purifiers) to predict potential failures or contamination events, ensuring uninterrupted supply of ultra-high purity BCl3 to critical fabrication steps.

- Demand Forecasting: Enhanced AI models correlating global technology trends (e.g., AI adoption rates, cloud computing expansion) with semiconductor fabrication cycles to provide more accurate Boron Trichloride demand forecasts for suppliers.

- Quality Control Automation: Implementing computer vision and AI analysis for real-time detection of impurities or inconsistencies in BCl3 supply, ensuring adherence to demanding electronic-grade specifications.

- Hardware Acceleration Demand: The massive computational needs of AI and data centers drive unprecedented demand for advanced microchips (GPUs, specialized accelerators), directly boosting the overall consumption volume of BCl3 used in etching these components.

DRO & Impact Forces Of Boron Trichloride Market

The Boron Trichloride market is highly sensitive to the dynamics of the global electronics supply chain, with major market forces simultaneously propelling growth and constraining expansion. The fundamental growth driver is the insatiable demand for advanced semiconductors, fueled by transformative technologies such as 5G, IoT, electric vehicles, and artificial intelligence, all of which require complex, high-performance chips dependent on BCl3 for etching. However, the market faces significant restraints, primarily related to the hazardous nature of BCl3, which necessitates complex, capital-intensive handling, storage, and transportation infrastructure, coupled with stringent environmental, health, and safety (EHS) regulations that raise operating costs. Opportunities lie in the diversification of BCl3 applications beyond traditional etching, particularly in advanced materials synthesis, defense technologies, and high-energy battery components, offering resilience against semiconductor market volatility. The impact forces are generally high, reflecting the non-substitutability of BCl3 in its primary high-purity applications, meaning technological necessity drives demand regardless of short-term cost pressures.

A primary driver is the ongoing investment in semiconductor fabrication plant capacity expansion worldwide, catalyzed by both commercial demand and geopolitical initiatives to localize supply chains. Governments in North America, Europe, and India are providing substantial subsidies and incentives for constructing new fabs (foundries), which inherently translates into long-term bulk demand for Boron Trichloride. Conversely, a major restraint is the vulnerability of the market to production outages or supply chain disruptions. Because only a few global suppliers can reliably produce BCl3 at ultra-high purity levels, any incident affecting a major producer can cause severe shortages, impacting global electronics manufacturing schedules and prices. Furthermore, the high initial investment required for sophisticated purification technology creates significant barriers to entry for potential new manufacturers, maintaining a concentrated market structure.

Opportunities for market players include focusing research and development efforts on optimizing BCl3 delivery systems to enhance safety and efficiency, potentially through encapsulated or precursor forms that are easier to handle. The expansion of the use of BCl3 as a doping agent in specific types of solar cells and its role in the synthesis of specialized military and aerospace materials (e.g., high-strength fibers) present niche growth avenues less tied to consumer electronics cycles. The competitive impact force is moderate but increasing, driven by customer demands for supplier reliability and quality assurance, forcing established players to invest continuously in quality control and logistics infrastructure to maintain market share against emerging regional competitors.

Segmentation Analysis

The Boron Trichloride market segmentation is primarily determined by the purity level required for the end application, which subsequently dictates the production complexity and cost structure, and the specific industrial sector utilizing the gas. Analyzing these segments provides critical insights into market growth vectors, revealing that the high-purity segments tied to advanced electronics are the fastest growing and highest value segments. The standard purity grades serve traditional chemical and metallurgical industries, offering a stable demand base. Understanding the market split by application is essential, as the semiconductor sector dictates technological requirements, while other sectors, such as pharmaceuticals, value chemical reactivity and batch consistency over ultra-trace-level purity.

Within the purity segment, the difference between standard industrial grade and electronic grade BCl3 is substantial, affecting pricing by orders of magnitude. Electronic grade BCl3 must meet stringent specifications for metallic contaminants and particulate matter, often requiring purification processes like cryogenic distillation or specialized membrane separation, which greatly increase production costs. The market is thus highly bifurcated, with niche specialists serving the UHP segment and broader chemical companies supplying standard industrial quantities. This high-value concentration means that fluctuations in global semiconductor capital expenditure have a disproportionate impact on the overall market revenue.

The application segmentation underscores the market's reliance on plasma etching, a necessary step in patterning integrated circuits. While chemical synthesis uses BCl3 as a versatile Lewis acid catalyst, the volume consumed in this sector is significantly lower compared to the continuous, high-volume requirements of a modern semiconductor fabrication plant operating 24/7. Future growth is anticipated to be driven by sectors demanding increasingly sophisticated materials, such as thin-film deposition precursors for advanced memory and display technologies, further pushing the need for meticulously purified BCl3 streams.

- By Purity Grade

- Standard Purity (99% - 99.9%)

- High Purity (99.99% - 99.999%)

- Ultra-High Purity (UHP, >99.999%)

- By Application

- Semiconductor Manufacturing (Plasma Etching, Doping)

- Pharmaceutical Synthesis

- Chemical Synthesis (Catalysts and Reagents)

- Metallurgical Processes (Refining, Casting)

- Aerospace & Defense (Specialized Materials)

- By End-User

- Electronics & Electrical Industry

- Chemical Industry

- Aerospace & Defense

- Healthcare and Pharmaceuticals

Value Chain Analysis For Boron Trichloride Market

The value chain for Boron Trichloride is highly integrated and complex, starting with the extraction and processing of raw materials, primarily boron sources such as boron carbide or ferroboron, through sophisticated chemical synthesis and purification, and concluding with specialized, high-pressure gas distribution. The upstream segment involves mining and converting raw boron ores into suitable input materials for chlorination, which is energy-intensive and requires substantial capital investment in chemical processing facilities. Due to the inherent toxicity and corrosiveness of BCl3, the midstream phase—involving the reaction of boron source material with chlorine gas followed by multi-stage purification (often cryogenic distillation)—is the most critical, determining the final purity grade (especially UHP), which adds significant value to the product.

The downstream analysis focuses on packaging, logistics, and end-user consumption. Given that BCl3 is typically delivered as a compressed liquid or gas, specialized containers, high-integrity valves, and robust transportation protocols are non-negotiable, adding significant cost and requiring specialized logistics providers. The distribution channel is heavily weighted towards indirect sales via industrial gas distributors and specialty chemical suppliers who possess the necessary expertise and infrastructure for safe handling and just-in-time delivery to fabs. Direct sales are generally reserved for high-volume, long-term contracts with major semiconductor manufacturers who may lease dedicated storage and delivery equipment from the BCl3 producer itself.

The distinction between direct and indirect channels often hinges on the end-user's size and geographic location. Major global electronics players prefer direct sourcing for strategic security and consistency, demanding tight integration between their process controls and the supplier's quality assurance system. Smaller chemical producers or research facilities typically rely on indirect distribution, leveraging the distributors' broad logistics network and smaller volume packaging capabilities. The overall value chain is characterized by high barriers to entry in the purification and distribution stages due to the technical demands of maintaining ultra-high purity levels and ensuring regulatory compliance regarding hazardous material handling.

Boron Trichloride Market Potential Customers

Potential customers for Boron Trichloride are predominantly concentrated within the high-technology manufacturing sectors that require precise material modification, etching, or specialized chemical reactions. The most significant buyers are integrated device manufacturers (IDMs) and pure-play foundries in the semiconductor industry, who utilize BCl3 daily in their plasma etching chambers to create the intricate circuitry on silicon wafers. These end-users demand UHP grade BCl3 in large, consistent volumes, making them the primary revenue drivers for the market. Their procurement decisions are based heavily on supplier reliability, purity certification, and secure, redundant supply chain logistics, reflecting the high cost associated with process interruptions in semiconductor fabrication.

Secondary yet vital customer segments include specialty chemical manufacturers that use Boron Trichloride as a catalyst or reagent in synthesizing complex organic compounds, polymers, or fine chemicals, often for the pharmaceutical industry. These buyers typically require standard or high-purity grades, valuing chemical reactivity and batch consistency. Furthermore, the aerospace and defense sectors constitute a crucial niche market, utilizing BCl3 in the production of specialized materials, such as boron fibers or high-performance ceramics, where the material's structural integrity and thermal resistance are key requirements. These customers often have unique, intermittent demands and stringent traceability requirements for defense-related materials.

The emerging market for high-performance displays (OLED, QLED) also represents a growing customer base, as BCl3 can be used in the fabrication process of certain display components. Additionally, research institutions and universities involved in materials science, particularly those investigating advanced doping techniques or novel chemical synthesis pathways, are consistent, albeit smaller, purchasers. Effectively serving these diverse potential customers requires producers to offer a varied portfolio, ranging from large bulk deliveries of UHP gas to smaller, packaged cylinders of specialized chemical grades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Linde PLC, Praxair Technology, Air Liquide, Air Products and Chemicals Inc., The Dow Chemical Company, Showa Denko K.K., Kanto Chemical Co. Inc., Taiyo Nippon Sanso Corporation, Nankai Chemical Co. Ltd., Shandong Boron Industrial Technology Co., Wuxi Xisheng Chemical Co., American Borate Company, Noah Technologies Corporation, Alfa Aesar (Thermo Fisher Scientific), BOC Sciences, Central Glass Co. Ltd., SB Chemicals, Solvay S.A., Saint-Gobain. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Boron Trichloride Market Key Technology Landscape

The technology landscape in the Boron Trichloride market is dominated by purification and handling advancements, as the performance of the end product (semiconductor chips) is directly proportional to the purity of the BCl3 used in the etching process. The primary manufacturing technology involves the high-temperature chlorination of boron compounds; however, the crucial technological differentiation lies in the subsequent refinement steps. Key technologies deployed include multi-stage fractional distillation, which separates BCl3 from trace contaminants like phosgene or silicon compounds based on boiling point differences. Continuous technological refinement in distillation column design and operational control is essential to consistently achieve the required part-per-billion (ppb) impurity levels necessary for advanced node semiconductor fabrication.

Another crucial technological area is the development of advanced purification systems, often utilizing proprietary adsorption or chemical scrubbing techniques to remove specific trace contaminants that cannot be eliminated solely through distillation. These systems are typically integrated directly into the gas delivery infrastructure at the point of use to maintain ultra-high purity until the moment of application. Furthermore, the technology for safe and efficient handling, storage, and transport of BCl3, including the use of specialized, corrosion-resistant cylinders and sophisticated leak detection systems, forms a vital part of the market’s technological framework. Innovation here focuses on mitigating environmental risks and enhancing worker safety, often involving real-time monitoring and automated shutdown procedures.

The future technology trajectory is moving towards developing even higher purity grades (often termed 7N purity, 99.99999%), driven by the transition to sub-5nm semiconductor architectures. This necessitates innovation in analytical detection technology (e.g., advanced mass spectrometry) to accurately measure and certify these minute contaminant levels. Additionally, there is growing interest in developing solid or liquid precursors to BCl3 that offer safer handling characteristics while decomposing cleanly to yield high-purity BCl3 gas at the point of use, potentially simplifying logistics and enhancing process control in the fab environment.

Regional Highlights

The Boron Trichloride market exhibits distinct regional dynamics heavily skewed towards Asia Pacific, which dominates global consumption. This dominance is attributed to the presence of the world's largest semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. These nations host major foundries and memory chip producers whose constant demand for BCl3, particularly UHP electronic grade, dictates global supply requirements and pricing benchmarks. The rapid build-out of new fabrication facilities in mainland China, fueled by government industrial policies, is a critical growth driver, positioning APAC as the undisputed engine of market expansion throughout the forecast period. The region not only consumes the product but also hosts significant production capacity for BCl3, leading to shorter supply chains and competitive local pricing.

North America and Europe constitute mature markets characterized by stable, high-value demand, primarily catering to specialized segments such as aerospace, defense electronics, and advanced R&D. While the volume consumed is less than in APAC, the revenue per unit is often higher due to the premium placed on quality, guaranteed origin, and compliance with stringent Western regulatory standards. Recent governmental initiatives, such as the CHIPS and Science Act in the U.S. and the European Chips Act, are stimulating significant investment in domestic semiconductor manufacturing, which is expected to moderately increase BCl3 consumption and production localization in these regions over the medium to long term, seeking to reduce reliance on Asian supply.

The Middle East, Africa (MEA), and Latin America currently represent nascent markets for BCl3. Demand in MEA is primarily driven by emerging chemical processing industries and small-scale electronics assembly, while Latin America's market remains largely dependent on imports to support local chemical synthesis and limited manufacturing. Growth opportunities in these regions are slower, tied to broad industrialization efforts and the potential development of localized material science capabilities. However, these areas play a minimal role in the ultra-high purity segment dominated by the global semiconductor giants.

- Asia Pacific (APAC): Largest market share; high growth driven by massive semiconductor foundry investments (Taiwan, South Korea, China); epicenter of UHP BCl3 demand for advanced chip nodes.

- North America: Mature, high-value market; demand concentrated in R&D, aerospace, defense electronics, and specialized chemical synthesis; future growth supported by government-led domestic semiconductor manufacturing expansion.

- Europe: Stable market with increasing focus on localizing specialty chemical production and developing regional semiconductor capabilities; strong regulatory emphasis on safety and supply security.

- Latin America & MEA: Emerging markets; small consumption volume focused on industrial chemical applications; growth potential linked to overall industrial infrastructure development and technological transfer.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Boron Trichloride Market.- Linde PLC

- Air Liquide

- Air Products and Chemicals Inc.

- Merck KGaA

- Praxair Technology (A Linde Company)

- The Dow Chemical Company

- Showa Denko K.K.

- Kanto Chemical Co. Inc.

- Taiyo Nippon Sanso Corporation

- Nankai Chemical Co. Ltd.

- Shandong Boron Industrial Technology Co.

- Wuxi Xisheng Chemical Co.

- American Borate Company

- Noah Technologies Corporation

- Alfa Aesar (Thermo Fisher Scientific)

- BOC Sciences

- Central Glass Co. Ltd.

- SB Chemicals

- Solvay S.A.

- Saint-Gobain

Frequently Asked Questions

Analyze common user questions about the Boron Trichloride market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Ultra-High Purity (UHP) Boron Trichloride?

The primary factor driving UHP BCl3 demand is the advancement in semiconductor technology, specifically the migration to smaller process nodes (sub-10nm) and the manufacturing of complex 3D-NAND structures, which require extremely precise plasma etching with minimal contaminants to ensure high chip yield and performance. The growth of AI and 5G hardware necessitates these higher purity grades.

How does the hazardous nature of Boron Trichloride affect its market dynamics and pricing?

The highly corrosive and toxic nature of BCl3 necessitates significant investment in specialized production facilities, stringent safety protocols, and certified transportation logistics. This high operational complexity and regulatory overhead act as a major barrier to entry, concentrating supply among a few expert players and contributing substantially to the overall premium pricing, especially for electronic-grade gas.

Which application segment consumes the largest volume of Boron Trichloride globally?

The Semiconductor Manufacturing segment, specifically the plasma etching process used in fabricating integrated circuits, consumes the vast majority of globally produced Boron Trichloride. This application dictates the technological requirements for purity and drives large, continuous bulk demand.

Is Boron Trichloride susceptible to substitution by other etching gases in semiconductor fabrication?

While various other halogen-based gases (like Chlorine or certain fluorocarbons) are used in etching, BCl3 offers unique process characteristics, particularly its ability to etch aluminum and its excellent profile control in deep reactive ion etching (DRIE). For many critical processes, particularly those involving compound semiconductors and aluminum metallization layers, BCl3 remains non-substitutable due to its specific chemical reactivity and performance profile.

How is geopolitical risk influencing the Boron Trichloride supply chain?

Geopolitical tensions and trade policies are compelling major consuming regions, particularly North America and Europe, to invest heavily in localizing semiconductor production and, consequently, localizing specialty gas supply chains. This shift is influencing suppliers to expand production and purification capacity outside of the dominant Asia Pacific region to enhance supply resilience and security for critical domestic industries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Boron Trichloride Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Boron Trichloride Market Statistics 2025 Analysis By Application (Semiconductor Industry for Plasma Etching, Gas for CVD, Raw Material for Boron Nitride (BN), Raw Material for Pharmaceutical And Agrochemicals, Raw Material for Catalysts), By Type (Electronic Grade, Industrial Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager