Braided Packing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436761 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Braided Packing Market Size

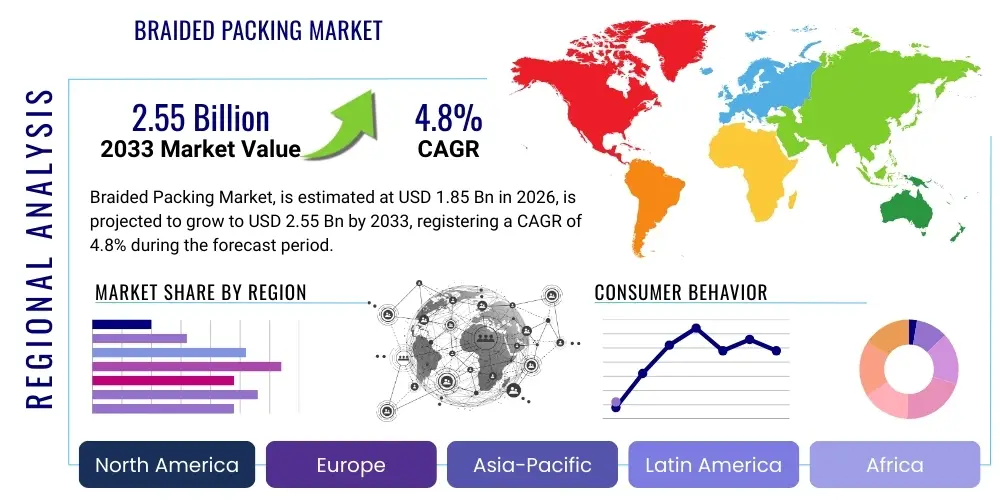

The Braided Packing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

This projected growth is primarily driven by the consistent demand for reliable sealing solutions across heavy industries, particularly oil and gas, chemical processing, and power generation. Braided packing, crucial for sealing rotating and reciprocating equipment such as pumps, valves, and agitators, maintains critical operational integrity in high-pressure and high-temperature environments. The necessity of minimizing leakage, reducing environmental emissions, and extending equipment lifespan underscores the intrinsic value of high-performance braided packing materials.

Furthermore, stringent regulatory frameworks concerning environmental protection and industrial safety globally compel end-users to adopt advanced, low-emission sealing technologies. The shift towards newer materials like expanded graphite and aramid fibers, which offer superior thermal stability and chemical resistance compared to traditional asbestos-based solutions, significantly contributes to market expansion and value appreciation during the forecast period.

Braided Packing Market introduction

The Braided Packing Market encompasses the manufacturing, distribution, and utilization of flexible sealing materials, typically manufactured by braiding various fibers—natural, synthetic, or metallic—into dense cross-sections. These products are predominantly utilized in static and dynamic applications within industrial machinery to prevent fluid leakage (liquids or gases) along the shaft or stem of equipment like valves, pumps, compressors, and mixers. Key products include PTFE packing, graphite packing, and synthetic fiber packing, each tailored for specific operational parameters related to temperature, pressure, and chemical compatibility. The inherent flexibility and resilience of braided packing allow it to conform effectively to gland dimensions, ensuring a reliable barrier against process media.

Major applications of braided packing span critical industrial sectors, including upstream and downstream oil and gas activities, pulp and paper production, wastewater treatment, mining, and conventional and nuclear power generation. In these demanding environments, the reliable performance of sealing components is non-negotiable for maintaining operational safety, maximizing uptime, and complying with stringent environmental regulations regarding volatile organic compound (VOC) emissions. The versatility of braiding patterns, such as lattice, braid-over-braid, or square interlock, allows manufacturers to customize the density, resilience, and pressure handling capabilities of the final product.

The primary benefits driving market adoption include the cost-effectiveness of braided packing compared to mechanical seals in certain applications, ease of installation and maintenance, and exceptional resistance to harsh chemicals and extreme temperatures. Market driving factors include the rapid industrialization in developing economies, the continuous need for maintenance and replacement in aging infrastructure in developed regions, and technological advancements focusing on non-asbestos and low-friction materials. The global push towards optimizing energy efficiency and reducing environmental footprint further accelerates the demand for advanced, high-integrity sealing solutions.

Braided Packing Market Executive Summary

The Braided Packing Market is positioned for stable growth, underpinned by robust demand from the process industries globally. Business trends indicate a strong focus on material innovation, shifting away from traditional materials toward high-performance substitutes such as carbon fiber and expanded PTFE (ePTFE), driven by the need for enhanced durability and lower emission capabilities. Strategic mergers and acquisitions among major manufacturers are consolidating market share and enabling greater efficiency in complex supply chains, particularly in sourcing specialized raw fibers. Furthermore, manufacturers are increasingly offering comprehensive training and technical support, leveraging application-specific engineering to ensure optimal product selection and performance, thus cementing long-term client relationships and securing recurring revenue streams.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive investments in chemical manufacturing, power generation infrastructure, and expansion of oil refining capacities, notably in China and India. North America and Europe, characterized by mature industrial bases, exhibit growth driven more by replacement demand, regulatory compliance (especially EPA and REACH standards for low-emission packing), and the adoption of premium, long-life sealing products. The Middle East and Africa (MEA) region shows accelerating demand, closely linked to expansion projects within the oil and gas extraction and processing sector, requiring heavy-duty packing capable of enduring high pressures and corrosive media inherent to hydrocarbon processing.

Segment trends highlight the dominance of the fiber/synthetic segment due to its versatility and cost-efficiency, though the graphite segment is experiencing the fastest growth, favored in ultra-high-temperature and nuclear applications for its superior fire safety and chemical inertness. Application-wise, the valve segment maintains the largest market share, essential for managing flow control, while the pump segment, dealing with dynamic movement, drives innovation toward reduced friction and extended mean time between maintenance (MTBM). Overall, the executive landscape points toward a technologically advancing market where product lifespan, emission control, and application-specific optimization are the principal competitive differentiators.

AI Impact Analysis on Braided Packing Market

Common user inquiries concerning the influence of Artificial Intelligence (AI) in the Braided Packing market frequently revolve around predictive maintenance integration, material science optimization, and automated quality control during the braiding process. Users are keen to understand if AI can forecast seal degradation rates based on operational data (temperature, vibration, pressure), thereby facilitating just-in-time replacement scheduling and minimizing catastrophic equipment failure. Furthermore, there is significant interest in how machine learning algorithms can accelerate the discovery and testing of novel composite materials, optimizing fiber blend ratios and impregnation techniques for superior chemical and thermal resistance. The key thematic concerns center on the practical deployment cost of AI systems in legacy industrial plants and the intellectual property implications of AI-driven material formulation.

The practical application of AI in this industrial niche primarily targets efficiency gains and improved product performance consistency. In manufacturing, computer vision systems powered by AI are being utilized to monitor the braiding tension and consistency in real-time, drastically reducing defects related to uneven density or fiber entanglement, which are critical determinants of sealing effectiveness. On the end-user side, AI-driven sensor data analytics can correlate specific operational parameters (e.g., thermal cycling frequency) with specific types of packing wear (e.g., oxidation or extrusion), providing prescriptive maintenance recommendations far more accurate than traditional scheduled maintenance, ultimately extending the service life of both the packing and the equipment.

While AI will not directly replace the physical manufacturing of braided packing, its influence on design optimization, quality assurance, and predictive maintenance protocols is transformative. This integration enhances the value proposition of high-end braided packing by guaranteeing performance consistency and integrating the product into broader Industrial Internet of Things (IIoT) ecosystems. The long-term impact involves creating 'smart packing solutions' where the seal itself becomes a data point, optimizing industrial operational continuity.

- AI-enabled Predictive Maintenance (PdM) forecasts packing wear based on real-time operational metrics, optimizing replacement cycles.

- Machine Learning algorithms accelerate the R&D of novel fiber blends and impregnants for superior thermal and chemical resistance.

- Computer Vision systems ensure high-precision quality control during the braiding process, guaranteeing uniform density and tension.

- AI optimizes supply chain logistics, predicting raw material demand volatility for specialized fibers (e.g., aramid, carbon).

- Generative AI tools assist engineers in designing complex, geometrically optimized braided structures tailored for specific gland dimensions.

DRO & Impact Forces Of Braided Packing Market

The dynamics of the Braided Packing Market are shaped by critical Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market evolution. The primary driver is the pervasive requirement for reliable fluid sealing across foundational heavy industries, coupled with strict global mandates (e.g., API 622, ISO 15848) enforcing low-emission standards, particularly in the hydrocarbon and chemical sectors, compelling the transition to premium, high-integrity packing solutions. However, market growth is significantly restrained by increasing competition from advanced mechanical seals, which offer zero-leakage capabilities in certain highly critical applications, and the inherent volatility in the pricing and supply of essential raw materials, particularly high-performance synthetic fibers. The overarching opportunity lies in the burgeoning maintenance, repair, and overhaul (MRO) demand stemming from the expanding global infrastructure and the development of application-specific, non-contaminating packing materials tailored for sensitive sectors like food processing and pharmaceuticals, driving innovation and market niche creation.

These forces exert a considerable impact on manufacturing strategies and end-user purchasing decisions. Regulatory drivers necessitate continuous investment in research and development to achieve certification for increasingly demanding emission control standards, raising the barrier to entry for conventional manufacturers. Concurrently, the competitive restraint imposed by mechanical seals forces braided packing producers to emphasize the cost-effectiveness, ease of installation, and field maintainability advantages of their products. The economic viability of oil and gas exploration and production heavily influences demand for high-pressure packing, making this sector a critical, yet cyclical, impact force.

The synthesis of these forces dictates a future where resilience, material performance, and compliance are paramount. Manufacturers focusing on sustainable, PFAS-free, and high-purity materials are better positioned to capitalize on opportunities. Furthermore, establishing robust distribution networks capable of delivering customized solutions rapidly to global MRO sites will be key to mitigating supply chain restraints. The market momentum is therefore centered on balancing cost optimization with achieving peak operational performance in the most challenging industrial environments worldwide.

- Drivers: Stringent environmental regulations (fugitive emissions control), continuous industrial expansion (APAC), and robust maintenance requirements (MRO).

- Restraints: Intense competition from high-performance mechanical seals, fluctuating raw material costs (graphite, synthetic fibers), and inherent leakage rates compared to zero-leak alternatives.

- Opportunities: Development of eco-friendly, non-asbestos materials, increased adoption in non-traditional high-purity applications (food/pharma), and integration with IIoT for predictive maintenance.

- Impact Forces: Regulatory compliance (high influence), global MRO cycle expenditure (moderate influence), and technological substitution risk (high influence).

Segmentation Analysis

The Braided Packing market segmentation provides a granular view of product usage and demand patterns based on material composition, cross-sectional design, and end-use application. Understanding these segments is crucial for manufacturers targeting specific operational requirements, such as extreme temperatures or corrosive chemical exposure. The market is primarily categorized into material types, including PTFE, graphite, aramid, and carbon fiber, each possessing distinct chemical resistance and thermal properties that dictate their suitability across diverse industrial settings. Additionally, the market is differentiated by the specific equipment they seal—valves, pumps, mixers, and agitators—with valves generally dominating demand due to their high volume in fluid handling systems.

Further analysis reveals that the structure or cross-section of the packing, such as lattice braid or square braid, also influences performance characteristics like sealing capability and shaft friction. The trend within segmentation highlights a move towards composite packing solutions, often blending two or more materials (e.g., aramid corners with graphite core) to leverage the strengths of each component, thus offering a balanced solution in terms of durability, chemical inertness, and cost. This blending strategy allows product lines to address complex sealing challenges that a single material cannot effectively manage.

The application segment remains the most crucial differentiator, reflecting the economic drivers of the market. Industries like oil & gas and chemical processing demand high-end, low-emission graphite and carbon packing, while sectors such as water treatment and general industry often utilize more cost-effective PTFE or synthetic fiber options. This segmentation dynamic ensures that market players can tailor their manufacturing processes and go-to-market strategies to capture value across the entire spectrum of industrial demand.

- By Material:

- Graphite (Expanded Graphite, Foil)

- PTFE (Pure PTFE, Expanded PTFE, PTFE blended)

- Aramid (Kevlar, Twaron)

- Carbon Fiber/Carbonized Fiber

- Synthetic Fibers (Acrylic, Fiberglass)

- Vegetable/Natural Fibers (Ramie, Cotton)

- By Product Type/Design:

- Interlock Braid

- Lattice Braid

- Braid-over-Braid

- Square Braid

- Diagonal Braid

- By Application/Equipment:

- Valves (Gate, Globe, Ball Valves)

- Pumps (Centrifugal, Reciprocating)

- Mixers and Agitators

- Expansion Joints

- Other Equipment (Stuffing Boxes, Expansion Joints)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream, Downstream)

- Chemical and Petrochemical

- Power Generation (Fossil Fuel, Nuclear)

- Pulp and Paper

- Water and Wastewater Treatment

- Mining and Metallurgy

- Food and Beverage / Pharmaceutical

Value Chain Analysis For Braided Packing Market

The Braided Packing market value chain begins with upstream activities involving the sourcing and processing of core raw materials, predominantly specialized fibers such as graphite foil, high-purity PTFE resin, aramid yarn, and various carbon fibers. The complexity and cost structure of the final product are highly dependent on the quality and consistency of these inputs. Manufacturers must maintain robust supply chain relationships with global material producers to ensure stable procurement, especially given the geopolitical sensitivity surrounding critical fiber components. The core value addition stage is the manufacturing process itself, where sophisticated braiding machinery, impregnation techniques (using lubricants, binders, or blocking agents), and quality control procedures convert raw materials into application-specific packing solutions. Proprietary braiding technologies and impregnation formulas are key competitive differentiators at this stage.

Downstream activities involve effective distribution, marketing, and the provision of technical support to end-users. Distribution channels are typically a mix of direct sales to large, integrated industrial clients (e.g., major chemical plants or power utilities) and indirect sales through specialized industrial distributors, MRO supply houses, and system integrators. The indirect channel often handles the high volume of replacement and maintenance orders, requiring distributors to maintain extensive local inventory and provide immediate technical assistance regarding material compatibility and installation procedures. The direct channel focuses on major capital projects and contracts requiring specialized engineering and custom solutions.

The profitability across the chain is highly influenced by the technical complexity of the product; standard, general-purpose packing sees lower margins, while high-temperature, low-emission, chemically inert packing commands premium pricing. Effective integration of technical support—ensuring correct sizing, installation, and troubleshooting—adds significant value, positioning manufacturers not just as suppliers but as sealing solutions partners. This holistic approach strengthens customer loyalty and minimizes competitive pressure from purely price-driven suppliers.

Braided Packing Market Potential Customers

Potential customers for braided packing solutions are concentrated across heavy and continuous process industries where the integrity of fluid containment is crucial for safety, compliance, and productivity. The largest segment of customers includes organizations operating high-pressure and high-temperature systems, such as major oil refineries, petrochemical complexes, and independent power producers (IPPs). These end-users require packing designed to meet severe service conditions, often prioritizing low fugitive emission certification (e.g., API 622) and long operational lifespans to minimize downtime and maintenance costs. These customers typically engage in long-term supply contracts with established manufacturers to ensure material standardization across their extensive plant operations.

Another significant customer base lies within the maintenance, repair, and overhaul (MRO) sectors, comprising industrial maintenance contractors, plant engineers, and procurement managers across various mid-sized manufacturing facilities, municipal water treatment plants, and mining operations. These customers rely heavily on localized industrial distributors for immediate replacement needs, favoring versatility, ease of installation, and cost-effectiveness. The demand here is less focused on customized, highly specialized solutions and more on reliable, general-purpose packing that can handle moderate service conditions efficiently.

Emerging segments include specialty customers in the food and beverage and pharmaceutical sectors, who require ultra-pure, non-contaminating packing materials, often made from FDA-compliant PTFE or specialized synthetics. While the volume of packing used in these sectors might be lower than in petrochemicals, the demand for high-grade compliance and certification drives premium pricing and specialized product development, representing a high-value customer niche for manufacturers capable of meeting stringent regulatory purity requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garlock Sealing Technologies, Teadit, John Crane (A Smiths Group Company), Klinger Group, Flowserve Corporation, Chesterton, Flexitallic, Seal & Design Inc., W. L. Gore & Associates, Meccanotecnica Umbra, A.W. Chesterton Company, Carrara S.p.A., Latty International, James Walker, NICHIAS Corporation, Burgmann Industries GmbH & Co. KG, Parker Hannifin Corp., Sepco Inc., Slade Inc., SGL Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Braided Packing Market Key Technology Landscape

The technology landscape for the Braided Packing market is characterized by advancements in material science, improved braiding techniques, and specialized impregnation processes designed to enhance sealing performance and longevity. A primary focus is the continuous development of non-asbestos materials, with expanded PTFE (ePTFE) and pure graphite foil serving as foundational high-performance options. Technological innovation centers on engineering these materials to achieve ultra-low friction coefficients for dynamic applications (pumps) while simultaneously maintaining excellent resistance to pressure and thermal cycling in static applications (valves). New formulations often incorporate inorganic fillers or specialized composite fibers to boost thermal conductivity and chemical inertness, extending the operational envelope far beyond traditional synthetic packing limits.

Key processing technologies include the implementation of high-speed, precision interlock braiding machines that produce highly dense, structurally integrated packing with exceptional dimensional stability. This structural integrity minimizes packing volume loss under pressure and subsequent leakage. Furthermore, advanced impregnation technologies are critical; these involve sophisticated dispersion of PTFE emulsions, graphite lubricants, or specialized blocking agents deep into the fiber matrix using vacuum or pressurized systems. This ensures uniform saturation, which is vital for preventing stem pitting, reducing friction, and improving overall sealing effectiveness against fugitive emissions, meeting the rigorous standards set by industries like petrochemicals.

The integration of digital technology, although subtle, is increasingly relevant, focusing on quality assurance and design optimization. Computer-Aided Design (CAD) and simulation tools are utilized to model the behavior of different braided structures under specific operational loads, pressure, and temperature gradients, allowing manufacturers to predict performance accurately and customize packing geometry. This predictive capability reduces the need for extensive physical prototyping, accelerating time-to-market for specialized sealing solutions required in complex industrial upgrades or new plant construction projects.

Regional Highlights

- Asia Pacific (APAC): The APAC region is projected to register the highest growth rate and maintain the largest market share during the forecast period. This dominance is attributable to aggressive industrial expansion, particularly in China, India, and Southeast Asia, where substantial investments are being made in new chemical processing plants, thermal power stations, and infrastructure development. The increasing focus on local manufacturing and export-oriented industrial policies drives immense demand for MRO supplies, including braided packing. While cost-sensitivity remains a factor, regulatory pressures regarding environmental protection are beginning to push adoption of higher-grade graphite and PTFE packing in newly established industrial zones.

- North America: North America represents a mature, high-value market driven primarily by strict regulatory compliance, notably the EPA's mandates on fugitive emissions from valves and pumps in refineries and chemical facilities. Market growth here is less about new capacity and more about replacement demand and upgrading existing equipment to meet best available control technology (BACT) standards. Demand is concentrated on premium, API 622 certified graphite and carbon-based packing designed for low-leakage performance and extended service life, minimizing maintenance labor costs. The revitalized oil and gas sector (shale) also sustains robust demand for robust packing solutions in highly abrasive and cyclical operations.

- Europe: The European market is characterized by high technological standards and strong emphasis on sustainability and occupational safety, dictated by regulations like REACH. Demand is steady, focused on advanced, highly specialized non-asbestos products, particularly those offering exceptional chemical compatibility required by the region’s diverse chemical, pharmaceutical, and high-tech manufacturing base. Germany, France, and the UK are key contributors. European manufacturers often lead the way in developing composite packing materials that prioritize low-friction characteristics and superior energy efficiency in pump applications.

- Middle East and Africa (MEA): Growth in the MEA region is intricately linked to large-scale investments in national oil and gas infrastructure expansion, including new refineries and liquefied natural gas (LNG) facilities, particularly in the Gulf Cooperation Council (GCC) countries. These severe-service applications require extremely robust packing capable of handling high-pressure sour gas and crude oil environments. The market is primarily served by international suppliers, with purchase decisions heavily influenced by technical specifications, reliability track records, and adherence to international oil company (IOC) safety standards.

- Latin America: This region presents moderate growth, largely influenced by economic stability and investment cycles in mining, petrochemicals (Brazil and Mexico), and aging public infrastructure. Demand is often price-sensitive, balancing performance against cost, leading to strong sales volumes for standard synthetic and vegetable fiber packing. However, modernization efforts in the energy sector are gradually introducing demand for higher-performance graphite and carbon-based solutions for critical applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Braided Packing Market.- Garlock Sealing Technologies

- Teadit

- John Crane (A Smiths Group Company)

- Klinger Group

- Flowserve Corporation

- Chesterton

- Flexitallic

- Seal & Design Inc.

- W. L. Gore & Associates

- Meccanotecnica Umbra

- A.W. Chesterton Company

- Carrara S.p.A.

- Latty International

- James Walker

- NICHIAS Corporation

- Burgmann Industries GmbH & Co. KG

- Parker Hannifin Corp.

- Sepco Inc.

- Slade Inc.

- SGL Group

Frequently Asked Questions

Analyze common user questions about the Braided Packing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between braided packing and mechanical seals in industrial applications?

Braided packing, often used in valve stems and pump shafts, is a compressible seal known for ease of field replacement, cost-effectiveness, and ability to tolerate shaft run-out. Mechanical seals offer virtually zero leakage, require higher initial investment, and are generally preferred for critical, high-speed rotating equipment where minimal emissions are mandatory.

Which braided packing material is preferred for high-temperature and low-emission valve applications?

Expanded graphite packing is the industry standard for severe-service, high-temperature (up to 1200°F) valve applications. It exhibits excellent fire safety and thermal stability and is often certified to stringent low-emission standards like API 622 due to its structural integrity under thermal cycling.

How do fugitive emission regulations impact the selection of braided packing?

Strict fugitive emission regulations (e.g., those set by the EPA or ISO 15848) compel end-users, especially in oil and gas, to adopt high-performance, validated packing systems, typically composed of graphite or advanced carbon fibers. This drives market growth for premium, certified packing solutions that guarantee leakage rates below regulatory thresholds.

What are the key drivers for market growth in the Asia Pacific region?

The key drivers in APAC are accelerated industrialization, large-scale infrastructure investments in power generation and petrochemical complexes, and the subsequent high demand for maintenance, repair, and overhaul (MRO) supplies needed to sustain newly constructed and expanding facilities.

What is the role of PTFE in modern braided packing formulations?

PTFE (Polytetrafluoroethylene) is essential for applications requiring exceptional chemical resistance and low friction, often used in food, pharmaceutical, and corrosive chemical environments. It is frequently utilized in expanded forms (ePTFE) or as an impregnant to enhance the chemical inertness and resilience of other fiber materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Braided Packing Sales Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Braided Packing Market Statistics 2025 Analysis By Application (Pump Packing, Valve Packing), By Type (Square Braided, Braid Over Braid, Braid Over Core, Interbraid, Die Form), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Braided Packing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Square Braided, Braid Over Braid, Braid Over Core, Interbraid, Die Form), By Application (Pump Packing Applications, Valve Packing Applications, Other Mechanical Sealing Applications), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager