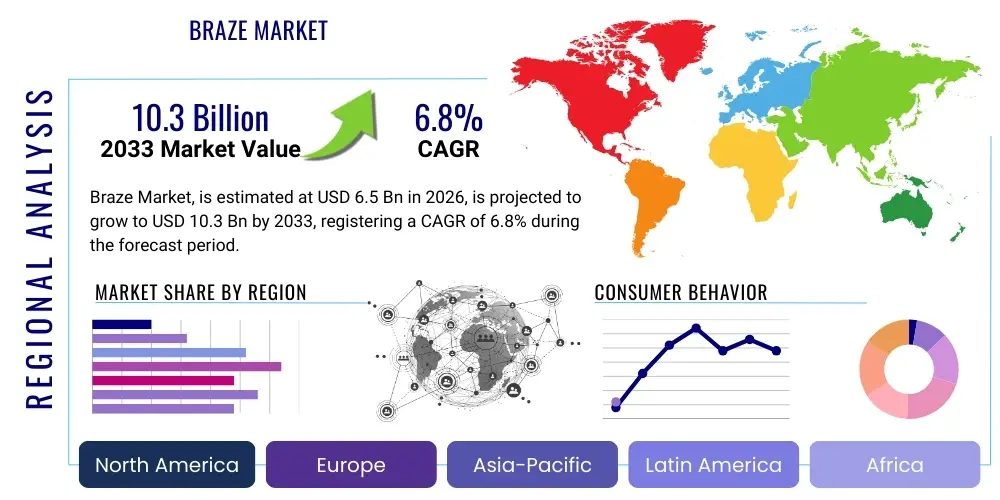

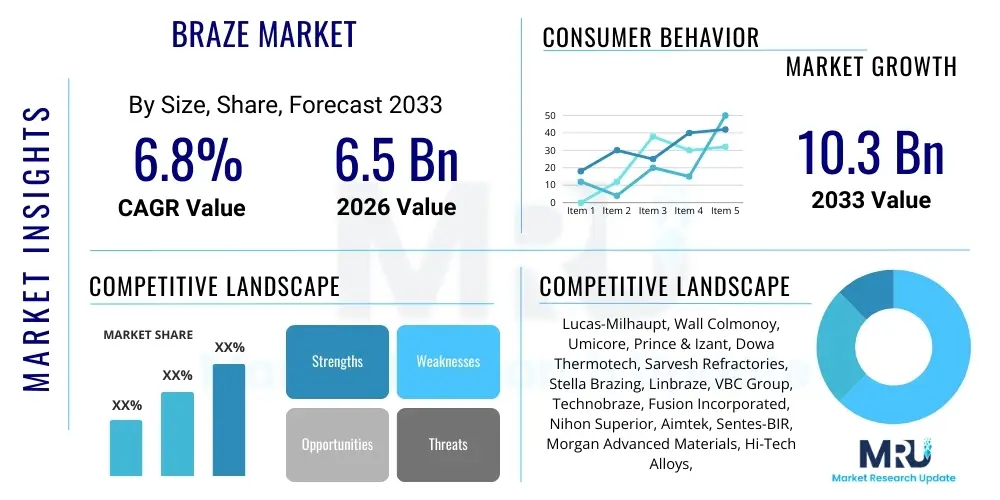

Braze Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438040 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Braze Market Size

The Braze Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally driven by the escalating demand for high-integrity, complex metal joining solutions across critical industrial sectors such as aerospace, automotive manufacturing, and HVAC systems. The reliance on brazing for creating durable, leak-proof, and aesthetically superior joints in heat exchangers, fuel lines, and electronic components cements its indispensable role in modern engineering. Furthermore, the push towards lightweighting materials in vehicle and aircraft design mandates joining processes that maintain structural integrity without adding significant weight, a requirement optimally fulfilled by advanced brazing techniques. The market expansion is also significantly influenced by ongoing infrastructural development in emerging economies, which fuels demand for robust components in power generation and distribution apparatus.

The valuation reflects the increasing sophistication of filler materials and brazing equipment, particularly the shift towards nickel-based and silver-based alloys designed for high-temperature and harsh-environment applications. Specialized technologies like vacuum brazing and controlled atmosphere brazing (CAB) command premium pricing due to the superior quality and repeatability they offer, particularly for critical components used in aerospace engine parts and high-efficiency thermal management systems. The market forecast accounts for the high investment costs associated with automated brazing equipment and the necessity for highly trained technical personnel to operate these specialized systems. However, the operational efficiency and reduction in post-braze processing requirements inherent in these advanced methods justify the expenditure, leading to sustained demand from high-precision manufacturing segments. Geopolitical stability, fluctuating raw material prices, particularly for silver and copper, and stringent environmental regulations concerning flux residues are key variables that have been factored into this projected market valuation.

Market analysts observe a strong correlation between the capital expenditure in the automotive electrification sector and the growth of advanced brazing services. Electric vehicles (EVs) rely heavily on complex battery cooling systems, which necessitate numerous high-quality brazed joints to ensure thermal stability and long-term performance. Similarly, the continued modernization of the global defense industry, demanding high-performance radar and missile components, serves as a steady revenue stream for specialized brazing solution providers. Therefore, the projected CAGR of 6.8% is underpinned by both volume growth in traditional heavy industries and significant value addition from niche, technology-intensive applications. Strategic partnerships between material suppliers and original equipment manufacturers (OEMs) aimed at developing customized alloy compositions that meet specific performance metrics are expected to further accelerate the market value progression through 2033, reinforcing the market’s resilient growth outlook despite cyclical economic pressures.

Braze Market introduction

The Braze Market encompasses the global industry dedicated to supplying materials, equipment, and services required for the brazing process, a metal joining technique utilizing a filler metal that melts above 450°C (840°F) but below the melting point of the base materials. This capillary-action-driven process creates high-strength, leak-tight joints, making it superior to soldering in terms of mechanical strength and thermal stability, yet distinct from welding as it does not involve melting the base materials. Key products within this market include specialized filler metals (such as silver, copper, aluminum, nickel, and gold alloys), fluxes (chemical compounds used to prevent oxidation), and sophisticated equipment, including vacuum furnaces, controlled atmosphere furnaces, induction heaters, and torch brazing setups. The procedural integrity and resultant component performance are paramount, ensuring that brazed assemblies meet rigorous operational specifications, particularly in extreme temperature or pressure environments. The increasing complexity of materials being joined, including dissimilar metals and high-performance superalloys, continues to drive innovation in filler metal chemistry and atmospheric control equipment.

Major applications of brazing technology span across several critical industrial verticals. The automotive industry utilizes brazing extensively for radiators, condensers, heat exchangers, and exhaust components, where reliable thermal management and durability are essential. In the aerospace sector, brazing is crucial for manufacturing turbine blades, honeycomb structures, and heat shields, demanding materials capable of withstanding extreme thermal cycling and mechanical stress. The Heating, Ventilation, Air Conditioning, and Refrigeration (HVAC/R) industry relies heavily on copper and aluminum brazing for connecting coils and tubes, ensuring hermetic sealing for refrigerants. Beyond these core areas, electronics manufacturing uses vacuum brazing for precision components and packaging, while the medical sector employs it for surgical instruments and implants requiring biocompatible and sterilized joints. The adaptability and consistency of the brazing process across diverse material combinations and intricate geometries underscore its broad utility and sustained market relevance in modern manufacturing practices.

The market is primarily driven by macro factors such as global urbanization and the resultant need for efficient infrastructure, stimulating demand in construction and utility sectors. Furthermore, the persistent focus on energy efficiency across all industries, particularly evidenced by the shift toward high-performance heat exchange solutions in renewable energy systems, heavily promotes brazing adoption. Benefits derived from using brazing include the ability to join dissimilar metals effectively, the minimization of thermal distortion compared to welding, excellent joint conductivity (both thermal and electrical), and high throughput capabilities when utilizing automated furnace processes. These compelling benefits, combined with technological advancements in reducing noxious emissions from fluxes and developing high-strength, lead-free alloys, solidify brazing's position as a preferred joining method for demanding, high-volume, and safety-critical applications globally. The rigorous quality standards imposed by end-user industries necessitate continuous improvement in process control and quality assurance methodologies within the Braze Market.

Braze Market Executive Summary

The Braze Market is characterized by robust expansion, underpinned by significant technological shifts favoring automated, high-precision joining techniques such as vacuum brazing and Controlled Atmosphere Brazing (CAB). Current business trends indicate a strong focus on sustainability, with manufacturers investing heavily in developing lead-free filler metals and fluxless brazing processes to comply with stringent environmental regulations, particularly REACH and RoHS directives in Europe and similar mandates globally. This green shift is not just regulatory compliance but a value proposition, attracting environmentally conscious OEMs, especially in the medical and consumer electronics sectors. Furthermore, there is a pronounced trend towards vertical integration among major market players, where material suppliers are acquiring equipment manufacturers to offer holistic, end-to-end brazing solutions, simplifying the procurement process for large industrial clients and ensuring process optimization through standardized consumables and machinery. The increasing adoption of predictive maintenance systems integrated with brazing furnaces is enhancing operational efficiency and reducing unplanned downtime, thereby improving overall manufacturing throughput and efficiency across key user industries.

From a regional perspective, the Asia Pacific (APAC) region dominates the Braze Market, primarily due to the massive scale of manufacturing operations in China, India, Japan, and South Korea, particularly in automotive production, HVAC/R systems, and electronics assembly. Rapid industrialization and heavy investment in infrastructure, especially in Southeast Asian nations, are further accelerating the region's market share growth. North America and Europe, while growing at a slower pace compared to APAC, remain crucial markets characterized by high-value applications, such as advanced aerospace components, precision medical devices, and high-end power generation equipment. These regions lead innovation in automated brazing technologies and high-performance alloy development, often setting the global benchmarks for quality and process control. The regulatory landscape in Europe, emphasizing energy efficiency standards (e.g., in heat exchangers), provides a specific driver for premium brazing solutions that ensure optimal thermal performance.

Segmentation trends highlight the increasing demand for Nickel-based filler alloys, driven by their superior performance in high-temperature, high-stress environments characteristic of jet engines and industrial gas turbines. While Copper and Silver alloys continue to hold the largest volumetric share due to their widespread use in HVAC/R and electronics, the value-segment growth is concentrated in specialized materials. Technology-wise, furnace brazing, particularly vacuum brazing, is gaining traction over torch brazing for complex, mission-critical components, attributed to its ability to yield oxide-free joints without the need for traditional fluxes, thus simplifying cleaning and reducing potential corrosion issues. The end-use application segment shows automotive and aerospace as the primary revenue generators, although the electronics and battery manufacturing segments are exhibiting the fastest compound annual growth, directly linked to the global expansion of electric vehicle infrastructure and 5G network deployment which require high-reliability electronic packaging solutions utilizing precision brazing techniques.

AI Impact Analysis on Braze Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly reshaping the Braze Market, fundamentally transforming process control, quality assurance, and predictive maintenance protocols. Users are primarily concerned with how AI can mitigate the pervasive issue of inconsistent joint quality—a key challenge in manual and semi-automated brazing operations—and whether the significant capital investment in AI-enabled equipment yields a demonstrable return on investment (ROI). Common user inquiries revolve around the effectiveness of deep learning algorithms in real-time defect detection (e.g., void formation, incomplete fill) using thermal imaging and acoustic sensors, reducing reliance on expensive and time-consuming post-braze non-destructive testing (NDT). Furthermore, manufacturers are keenly interested in how AI can optimize furnace parameters, such as atmosphere composition, temperature ramping profiles, and holding times, to achieve optimal metallurgical results for varying alloy combinations, thereby maximizing throughput and minimizing material wastage. The expectation is that AI-driven process optimization will lead to standardized, six-sigma levels of quality output, minimizing variability inherent in traditional control systems and significantly lowering operational expenditure related to rework.

The core theme emerging from user questions is the perceived threat and opportunity related to the skilled labor gap. While many see AI as a tool to automate repetitive tasks and compensate for the shortage of experienced brazing technicians, there is concern about the knowledge required to maintain and calibrate complex ML-based systems. Users anticipate that AI models trained on vast datasets of successful and failed braze runs will become essential intellectual property, enabling companies to capture and scale the expertise traditionally held by a few senior engineers. This shift promises enhanced resilience against labor volatility. Another critical area of user focus is predictive modeling for equipment failure. High-temperature furnaces and complex gas mixing systems are prone to wear; AI-driven sensor data analysis can predict component degradation, allowing for scheduled, preemptive maintenance, dramatically increasing equipment uptime and lifecycle. This transition from reactive to predictive maintenance represents a massive operational efficiency gain sought by large-scale production facilities in automotive and HVAC sectors.

The analysis suggests that the market is moving toward AI-as-a-Service (AIaaS) models, where specialized software firms offer subscription-based process optimization modules tailored for existing brazing equipment, mitigating the high upfront cost of new hardware. Users are currently evaluating the cost-benefit of integrating AI, understanding that successful implementation requires robust data infrastructure and clear objectives, such as a measurable reduction in scrap rates or a defined increase in first-pass quality yield. The overriding expectation is that AI will democratize high-quality brazing by making complex process control accessible and automatic, thereby lowering the barrier to entry for achieving stringent industry standards like those demanded in aerospace (e.g., AMS specifications). The resulting transparency and traceability offered by AI-documented processes are also highly valued for regulatory compliance and audit trails, further driving its adoption in regulated industries.

- AI-enabled real-time defect detection and anomaly identification via visual and thermal sensors.

- Machine Learning algorithms optimize furnace temperature profiles, atmospheric gas flows, and holding times for material-specific quality maximization.

- Predictive maintenance analytics for brazing equipment (furnaces, induction coils) to minimize unplanned downtime.

- Automated quality control reporting and digital traceability of every joint for regulatory compliance and audit trails.

- Simulation tools powered by AI for optimizing joint design and filler metal selection before physical prototyping.

- Expert system development capturing tribal knowledge to train new technicians and standardize complex procedures.

DRO & Impact Forces Of Braze Market

The Braze Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that determine market trajectory. A primary driver is the pervasive demand for lightweight and high-performance components across automotive and aerospace industries. As manufacturers strive to reduce carbon emissions and enhance fuel efficiency, there is a strong shift towards joining dissimilar materials (e.g., aluminum to steel, ceramics to metal) which brazing handles significantly better than traditional welding, thereby accommodating innovative design requirements. Concurrently, the proliferation of electric vehicle (EV) technology necessitates sophisticated thermal management systems, relying on complex, multi-layered heat exchangers that require high-integrity, large-volume brazed joints, acting as a massive demand stimulant. These technological demands necessitate continuous innovation in filler metal chemistry to withstand higher operational temperatures and corrosive environments, pushing the market towards higher-value, specialized alloys and automated processing equipment.

Despite strong drivers, the market faces significant restraints. The high initial capital expenditure required for advanced brazing equipment, particularly vacuum furnaces and sophisticated controlled atmosphere systems, poses a barrier to entry for small and medium-sized enterprises (SMEs) and can slow adoption in emerging markets. Furthermore, the industry grapples with a persistent shortage of highly skilled brazing technicians and metallurgical engineers proficient in advanced process control and troubleshooting. Brazing, especially for critical applications, requires specific technical expertise that automation, while mitigating some labor requirements, cannot entirely replace, leading to bottlenecks in production scaling. Another key restraint involves regulatory hurdles, particularly environmental concerns surrounding toxic flux residues and the increasing limitations placed on heavy metals like cadmium and lead historically used in certain filler alloys, compelling manufacturers to undertake costly reformulation and process modification efforts. Fluctuations in the prices of critical raw materials, such as silver, copper, and nickel, also introduce volatility and uncertainty into the supply chain, impacting overall cost structure.

Opportunities for market expansion are predominantly centered around the adoption of advanced materials and next-generation technologies. The rise of Additive Manufacturing (AM) creates a synergistic opportunity, as 3D-printed metal components often require post-processing joining or sealing, where precision brazing techniques are invaluable. Moreover, the robust growth in the renewable energy sector, specifically concentrated solar power (CSP) and high-efficiency fuel cells, requires highly specialized brazed assemblies capable of operating under extreme thermal stress, opening lucrative niche markets. Geographically, untapped potential in Southeast Asia and parts of Africa, driven by massive infrastructure and utility modernization projects, offers significant future growth trajectories for equipment and consumable suppliers. Successfully capitalizing on these opportunities necessitates strategic investments in R&D to develop automated, fluxless processes for challenging materials like aluminum alloys and metal matrix composites, thereby overcoming current technical and regulatory restraints and solidifying brazing’s competitive advantage against alternative joining methods.

Segmentation Analysis

The Braze Market segmentation provides a granular view of demand distribution across various product types, end-use applications, and technological implementations, reflecting the diversity and complexity of industrial joining needs. The market is primarily segmented based on the type of filler material utilized, the technology employed for the heating and atmospheric control, and the final end-use application industry. The filler metal segment is crucial as performance requirements dictate material choice; high-temperature applications utilize nickel or gold alloys, while standard thermal and electrical conductivity requirements lean toward copper and silver alloys. The choice of filler material directly impacts the required processing temperature, the necessity of flux, and the overall joint integrity and cost structure. Furthermore, the geographical segmentation underscores regional variances in regulatory compliance and technological maturity, with advanced manufacturing hubs leading the adoption of sophisticated technologies like vacuum and induction brazing over traditional torch methods.

The technology segmentation differentiates between traditional, manual methods and modern, automated, high-precision processes. Furnace brazing, particularly in vacuum or controlled atmosphere environments (Nitrogen, Hydrogen), accounts for the highest value share due to its superior repeatability, ability to handle large batches, and capacity to join complex assemblies without oxidation or flux. Induction brazing, known for its rapid, localized heating capabilities, holds a strong position in high-volume, automated production lines, such as those found in the automotive industry for connecting pipes and tubes. The operational efficiency derived from these automated systems, coupled with decreasing labor involvement, makes them increasingly attractive for large manufacturers seeking cost reduction and quality consistency, thereby driving the technological segment's evolution towards greater automation and integration with digital control systems. The inherent scalability of furnace brazing ensures its continued dominance in industries where component uniformity is non-negotiable, such as the aircraft engine manufacturing sector.

Application segmentation illustrates the revenue streams generated by different end-user industries, revealing sectors with high growth potential. The automotive industry, driven by EV battery cooling systems and traditional engine components, remains the largest volume consumer. However, the fastest growth is projected from the electronics sector, focusing on semiconductor packaging, thermal interface material bonding, and high-frequency communication devices, where miniature and defect-free joints are critical for device performance and longevity. The medical device and aerospace segments, while smaller in volume, contribute significantly to market value due to the stringent quality requirements, high material costs, and customization associated with specialized, high-reliability assemblies. Analyzing these segments is crucial for market participants to tailor their material offerings and equipment capacities to align with specific industry compliance standards and technological trajectories, ensuring optimal market penetration and sustained revenue growth in targeted verticals.

- By Filler Material Type:

- Silver Alloys

- Copper Alloys

- Nickel Alloys

- Aluminum Alloys

- Gold Alloys and Palladium Alloys

- Others (e.g., Active Filler Metals for Ceramics)

- By Technology:

- Furnace Brazing (Vacuum Brazing, Controlled Atmosphere Brazing - CAB)

- Induction Brazing

- Torch Brazing

- Dip Brazing

- Resistance Brazing

- By Application (End-Use Industry):

- Automotive (Heat Exchangers, EV Battery Coolers, HVAC)

- Aerospace and Defense (Engine Components, Honeycomb Structures)

- HVAC and Refrigeration (Coils, Piping)

- Electronics and Semiconductors (Heat Sinks, Packaging)

- Medical Devices

- Tooling and General Manufacturing

- By Form:

- Paste

- Wire/Rod

- Preforms (Rings, Washers)

- Foil/Tape

Value Chain Analysis For Braze Market

The Braze Market value chain begins with the highly specialized Upstream Analysis, which focuses on the sourcing and processing of core raw materials essential for filler metal production. This stage is dominated by global mining and refining companies supplying high-purity metals such as silver, copper, nickel, gold, and aluminum. The volatility and scarcity of precious metals, particularly silver and gold, introduce significant cost variability early in the chain, requiring sophisticated hedging strategies by large filler metal manufacturers. Upstream processing also includes the manufacturing of specialized fluxes and atmospheres, which are critical for controlling the brazing environment. Quality control at this stage is paramount, as impurities in raw materials can lead to catastrophic joint failures in mission-critical applications. Key upstream players include specialized chemical companies and large metallurgical firms focused on producing metal powders and high-purity ingots specifically tailored for brazing alloy formulation, ensuring precise elemental ratios that dictate the alloy’s liquidus and solidus temperatures, flow characteristics, and mechanical performance.

The core Manufacturing and Processing stage involves converting raw materials into marketable brazing products, including wire, rods, foil, preforms, and paste forms. This midstream process requires specialized fabrication equipment, such as vacuum melting furnaces for high-purity alloys and sophisticated drawing and rolling machinery to produce precise preforms, which are crucial for automated high-volume assembly. Integrated firms often manage both material production and equipment manufacturing (e.g., brazing furnaces), leveraging synergies to ensure compatibility between consumables and machinery, which is a key differentiator in offering optimized brazing solutions. Downstream Analysis centers on the application and consumption of these products by end-user industries, specifically Automotive, Aerospace, and HVAC/R. The quality of the downstream process, which involves strict adherence to brazing schedules and quality standards (e.g., NADCAP accreditation in aerospace), determines the final component integrity and functionality. Downstream value addition comes from specialized brazing service providers (job shops) who offer high-precision brazing services for clients lacking in-house capabilities or requiring highly complex, low-volume assemblies.

The Distribution Channel analysis is segmented into Direct and Indirect sales models. Due to the technical nature of the product and the need for application-specific consultation, many large filler metal and equipment manufacturers prefer a Direct distribution model to major OEMs in aerospace and high-volume automotive production. This allows for closer technical support, customized product development, and tighter supply chain integration. Conversely, the Indirect distribution channel utilizes specialized industrial distributors and technical sales representatives to reach smaller job shops, maintenance, repair, and overhaul (MRO) facilities, and general manufacturing entities. These indirect partners often provide localized stocking, technical troubleshooting, and small-volume sales, ensuring broader market accessibility. The efficiency of the distribution network, particularly the ability to rapidly supply customized preforms or specialized fluxes, directly impacts the customer's production uptime. Successful companies leverage a hybrid model, utilizing direct sales for high-value strategic accounts and a robust indirect network for widespread general market coverage and rapid technical service delivery across diverse geographical regions.

Braze Market Potential Customers

The primary End-Users or Potential Customers of the Braze Market are large-scale manufacturing enterprises across heavy and high-tech industries that require reliable, permanent metal joining for critical components. The Automotive Sector is arguably the largest volume customer base, particularly with the transition to electric vehicles (EVs). These customers rely on brazing for crucial components like aluminum radiators, complex multi-port heat exchangers for thermal management, condensers, and essential fluid lines. The shift to EV manufacturing has intensified demand for high-integrity joints in battery cooling plates and power electronics, demanding specialized aluminum and copper brazing processes. Automotive OEMs seek suppliers who can deliver high-volume components with minimal defect rates, standardized processes, and competitive unit costs, often preferring automated furnace or induction brazing techniques integrated directly into their assembly lines to maintain rapid throughput and stringent quality standards, particularly ISO/TS 16949 compliance.

The Aerospace and Defense industries represent the highest value segment of potential customers due to the extreme performance demands placed on components. These customers, including major aircraft engine manufacturers (e.g., jet engine turbine assemblies, combustion chambers) and defense contractors (e.g., missile fins, radar waveguides), require materials joined using premium nickel and gold-palladium filler alloys, often processed exclusively in ultra-high vacuum furnaces. The fundamental requirement here is reliability under intense thermal cycling, vibration, and corrosive environments, making failure unacceptable. These potential customers are heavily regulated and mandated by standards such as NADCAP and various Military Specifications (MIL-SPEC), requiring suppliers not only to provide certified materials but also to demonstrate rigorous process control, comprehensive traceability, and extensive metallurgical expertise. The contractual longevity and high margins associated with these specialized segments make them highly attractive targets for high-end brazing equipment and material providers.

The HVAC/R (Heating, Ventilation, Air Conditioning, and Refrigeration) sector constitutes another vast customer segment, relying heavily on copper and copper-to-aluminum brazing for coils, compressors, and piping systems. The increasing global demand for energy-efficient air conditioning units, particularly in densely populated and warming urban centers, ensures a steady and growing market. Customers in this sector demand robust, hermetically sealed joints capable of containing high-pressure refrigerants, typically achieved through high-volume, automated torch, or controlled atmosphere brazing processes. Finally, the Electronics and Semiconductor industry represents a fast-growing customer segment, utilizing vacuum and active brazing techniques for joining dissimilar materials in microelectronic packaging, heat sinks, and vacuum tubes. These customers prioritize thermal conductivity, dimensional accuracy, and void-free joints for optimal performance of sensitive electronic devices, driving demand for specialized paste filler materials and ultra-clean processing environments crucial for semiconductor reliability and longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lucas-Milhaupt, Wall Colmonoy, Umicore, Prince & Izant, Dowa Thermotech, Sarvesh Refractories, Stella Brazing, Linbraze, VBC Group, Technobraze, Fusion Incorporated, Nihon Superior, Aimtek, Sentes-BIR, Morgan Advanced Materials, Hi-Tech Alloys, SinterBraze, Praxair Surface Technologies, Harris Products Group, Oerlikon Balzers |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Braze Market Key Technology Landscape

The technological landscape of the Braze Market is predominantly defined by the mastery of atmosphere control and the precision of heating methods, designed to achieve clean, high-integrity metallurgical bonds. Vacuum Brazing stands out as a critical technology, particularly for aerospace and demanding high-purity applications. This process involves heating components in a high-vacuum environment, typically below 10-4 Torr, which inherently eliminates the need for flux by removing oxygen and volatile contaminants, thereby preventing the formation of oxides that impede filler metal flow. The resultant joints are exceptionally clean, structurally robust, and suitable for high-temperature service with minimal post-braze cleaning requirements. Technological advancements in vacuum furnace design focus on improved pumping systems, better temperature uniformity across large working zones, and integrated data logging and process monitoring systems, essential for compliance with stringent industry standards like NADCAP. The ability of vacuum brazing to join complex geometries and expensive materials like titanium and nickel-based superalloys ensures its sustained relevance and growth in the premium segment of the market.

Controlled Atmosphere Brazing (CAB) technology is equally significant, particularly dominating the high-volume production of aluminum heat exchangers in the automotive and HVAC/R sectors. CAB typically utilizes a flux-based process but operates within a furnace filled with a protective atmosphere, often nitrogen or a mixture of nitrogen and hydrogen (forming a reducing atmosphere), to minimize oxidation. Key technological innovation in CAB focuses on developing non-corrosive, specialized fluxes (e.g., Nocolok® flux systems) and optimizing the atmosphere composition and dew point control to achieve high-quality joints consistently and rapidly. The economic advantage of CAB—lower initial equipment cost and high throughput capacity compared to vacuum brazing—makes it the preferred method for mass-produced components. Furthermore, the integration of Induction Brazing technology, which employs electromagnetic fields for highly localized and rapid heating, is increasingly favored in automated production lines requiring fast cycle times and precise thermal control for specific joint areas, reducing the overall heat input and minimizing distortion in adjacent material sections, thus improving efficiency and material handling speed.

In addition to heating methods, the market is undergoing a profound shift through the implementation of Industry 4.0 principles, emphasizing automation, sensing, and data integration. The use of robotic handling systems for component placement and filler material application (e.g., paste dispensing) ensures repeatability and reduces human error in high-volume settings. Advanced sensing technologies, including thermal imaging cameras and acoustic monitoring, are being integrated into brazing equipment to provide real-time quality feedback and flag potential defects during the process itself, moving quality control from post-process inspection to in-process verification. Furthermore, filler metal development continues to be a technological frontier, focusing on developing lead-free, cadmium-free, and even fluxless alternatives for traditionally challenging materials. This includes the formulation of innovative amorphous alloys and specialized brazing pastes that ensure optimal flow characteristics and fill gaps effectively, catering to the ever-increasing complexity of assembly designs and the persistent industry mandate for environmentally responsible joining solutions without compromising on mechanical strength or electrical conductivity performance.

Regional Highlights

- Asia Pacific (APAC): The APAC region commands the largest market share and exhibits the fastest growth trajectory, driven primarily by its position as the global hub for automotive manufacturing, consumer electronics, and large-scale infrastructure development, especially in China, India, and Southeast Asia. Rapid urbanization and massive investment in residential and commercial construction directly fuel the demand for HVAC/R systems, which rely heavily on copper and aluminum brazing for coils and compressors. The region is seeing significant capital investment in advanced manufacturing facilities, leading to a strong uptake of automated furnace brazing and Controlled Atmosphere Brazing (CAB) technologies to meet the high volume and consistency demands of global supply chains. Furthermore, government initiatives in nations like China to promote indigenous aerospace and high-speed rail industries are creating lucrative, high-value opportunities for specialized nickel and silver alloy suppliers and advanced vacuum brazing service providers.

- North America: North America represents a mature, high-value market characterized by stringent quality demands from the aerospace, defense, and high-tech energy sectors. The regional market growth is primarily driven by technological upgrades and the high demand for premium, mission-critical components that mandate vacuum brazing for absolute reliability and cleanliness. The resurgence of domestic manufacturing, particularly in aerospace maintenance, repair, and overhaul (MRO), ensures sustained demand for high-performance filler metals and specialized brazing services. Furthermore, the aggressive push toward electric vehicle (EV) production and the associated need for complex thermal management solutions is a significant current driver, requiring rapid adoption of automated aluminum brazing processes. Companies in this region focus heavily on R&D, compliance with strict regulatory standards (e.g., ITAR), and integration of Industry 4.0 technologies to maintain a competitive edge in quality and innovation.

- Europe: The European market is defined by high technological maturity, strict environmental regulations (such as REACH and RoHS), and strong focus on energy efficiency. These factors compel manufacturers to adopt lead-free and fluxless brazing techniques, driving demand for specialized alloys and high-precision equipment like advanced vacuum and induction brazing systems. The automotive sector, particularly premium vehicle and commercial transport manufacturers, remains a core segment, alongside significant demand from the power generation (including nuclear and renewable energy) and industrial machinery sectors. Germany, France, and the UK are key markets, leading innovation in process control and automation. The emphasis on minimizing waste and maximizing energy efficiency in manufacturing processes across the European Union ensures that suppliers offering sustainable and highly repeatable brazing solutions gain a distinct competitive advantage over their counterparts utilizing traditional methods.

- Latin America (LATAM) and Middle East & Africa (MEA): LATAM and MEA represent emerging markets with substantial long-term growth potential, largely contingent on infrastructural investment and industrial diversification. In LATAM, growth is correlated with investments in oil and gas infrastructure, automotive assembly, and basic manufacturing. In the MEA region, particularly the Gulf Cooperation Council (GCC) states, diversification away from oil and gas and into aerospace, defense, and ambitious infrastructure projects (e.g., NEOM in Saudi Arabia) stimulates specialized brazing demand. The primary demand in these regions is currently focused on HVAC/R systems due to climatic requirements, utilizing more conventional torch and basic atmosphere brazing methods, but there is a clear upward trend in adopting more advanced technologies as foreign direct investment (FDI) and local technological capabilities increase, suggesting these regions will be pivotal for market expansion post-2028.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Braze Market.- Lucas-Milhaupt

- Wall Colmonoy

- Umicore

- Prince & Izant

- Dowa Thermotech

- Sarvesh Refractories

- Stella Brazing

- Linbraze

- VBC Group

- Technobraze

- Fusion Incorporated

- Nihon Superior

- Aimtek

- Sentes-BIR

- Morgan Advanced Materials

- Hi-Tech Alloys

- SinterBraze

- Praxair Surface Technologies

- Harris Products Group

- Oerlikon Balzers

Frequently Asked Questions

Analyze common user questions about the Braze market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Braze Market?

The market growth is primarily driven by the increasing global demand for lightweight components in the automotive and aerospace sectors, the expansion of the Electric Vehicle (EV) industry requiring advanced battery thermal management systems, and the need for high-integrity metal joints in complex HVAC/R and power generation equipment, mandating highly reliable joining solutions.

Which brazing technology is dominating the high-value segment, and why?

Vacuum Brazing dominates the high-value segment, particularly in aerospace and defense, due to its ability to create extremely clean, oxide-free, and high-strength joints without the use of chemical fluxes. This technology is critical for joining sensitive materials like superalloys and titanium used in mission-critical applications.

How is the shift towards electric vehicles impacting the demand for brazing materials?

The EV transition is significantly increasing the demand for aluminum and copper brazing alloys, specifically for manufacturing highly efficient and reliable heat exchangers and cooling plates essential for maintaining the operational temperature and safety of large battery packs and power electronics in electric vehicles.

What are the key restraints currently affecting the Braze Market?

Key restraints include the substantial initial capital investment required for automated brazing equipment (like vacuum furnaces), the persistent shortage of skilled technical labor, and the complexity and cost associated with complying with strict environmental regulations regarding flux disposal and heavy metal content in filler alloys.

How is Artificial Intelligence (AI) expected to improve brazing process efficiency?

AI integration is expected to drastically improve efficiency by enabling real-time defect detection, optimizing furnace parameters (temperature curves, atmosphere composition) automatically, and implementing predictive maintenance for equipment, which collectively minimizes scrap rates, ensures consistent quality, and maximizes machine uptime across production runs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Braze Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- High Frequency Induction Heating Machine Market Size Report By Type (The Welding Equipment, Heat Treatment Equipment, Annealing Equipment, Other), By Application (Heating (Hot Forging, Hot Fitting and Smelting), Heat Treatment (Surface Quench), Welding (Braze Welding, Silver Soldering and Brazing), Annealing (Tempering and Modulation)), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Nickel Base Brazing Materials Market Statistics 2025 Analysis By Application (Appliance Industry, Transportation Industry, Electrical and Electronic Industry, Construction Industry, Medical Industry), By Type (Braze Powder, Braze Paste, Braze Tape, Braze Rod and Wire), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Aluminum Base Brazing Materials Market Statistics 2025 Analysis By Application (HVAC, Automotive, Aerospace), By Type (Braze Powder, Braze Paste, Braze Tape, Braze Rod and Wire), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Silver Base Brazing Materials Market Statistics 2025 Analysis By Application (HVAC, Automotive, Aerospace), By Type (Braze Powder, Braze Paste, Braze Tape, Braze Rod and Wire), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager