Business Loan Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436963 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Business Loan Market Size

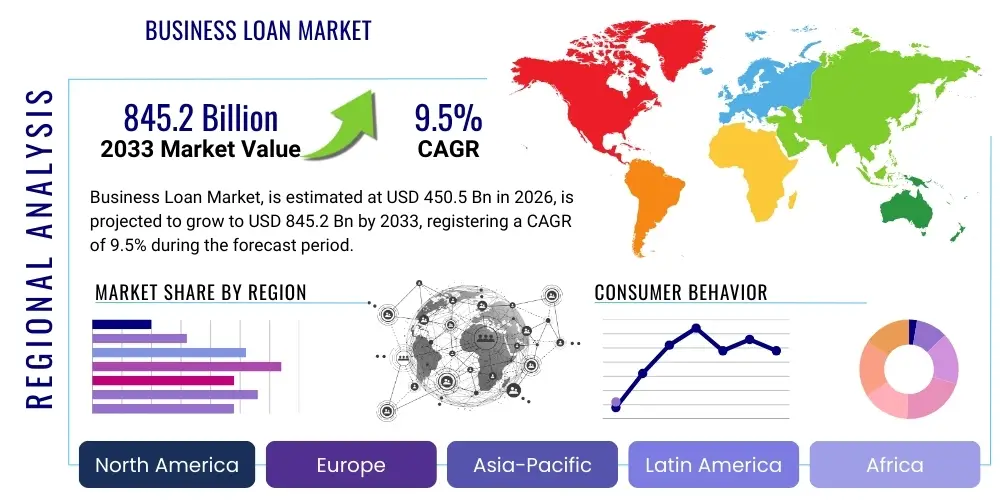

The Business Loan Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 845.2 Billion by the end of the forecast period in 2033.

Business Loan Market introduction

The Business Loan Market encompasses diverse financial products provided by banks, credit unions, non-banking financial companies (NBFCs), and FinTech lenders to enterprises ranging from small and medium-sized enterprises (SMEs) to large corporations. These financial instruments are essential for funding capital expenditures, managing working capital, facilitating expansion, and bridging temporary cash flow gaps. Products include term loans, lines of credit, equipment financing, commercial mortgages, and invoice factoring. The core application of these loans is to stimulate economic activity, enabling businesses to invest in technology upgrades, inventory, property, and hiring, thereby driving overall market dynamics and productivity across global industries. The availability and affordability of business financing directly influence the entrepreneurial ecosystem and economic resilience.

A key driver for market expansion is the continuous global emphasis on supporting SMEs, which are widely recognized as the backbone of most national economies, coupled with significant technological advancements that have streamlined the loan application and approval process. Digitalization, particularly through the adoption of online lending platforms and automated credit scoring models, has dramatically reduced turnaround times and operational costs for lenders, making financing more accessible to a broader range of businesses, including those previously underserved by traditional banking institutions. Furthermore, favorable government policies promoting business startup and expansion, alongside fiscal incentives for capital investment, continue to fuel demand for tailored financing solutions, ensuring sustained market momentum.

The primary benefits of business loans include providing scalable capital infusion without diluting ownership (unlike equity financing) and offering predictable repayment structures that aid in long-term financial planning. Major applications span industrial expansion, merger and acquisition financing, seasonal inventory purchases, and the transition to sustainable business practices. Driving factors are multifaceted, involving declining interest rate environments in specific geographies, the proliferation of specialized lending niches catering to industry-specific needs (e.g., SaaS financing, healthcare equipment), and increased competition among lenders, forcing greater product innovation and better pricing for borrowers globally.

Business Loan Market Executive Summary

The Business Loan Market is experiencing a pivotal transformation driven by the integration of sophisticated digital technologies and shifting regulatory landscapes, favoring rapid growth in the alternative lending sector. Key business trends highlight a move towards hyper-personalized lending products, risk assessment powered by machine learning, and an increasing reliance on open banking infrastructure to verify applicant data and assess creditworthiness more accurately than traditional methods. The dominance of conventional banks is being steadily challenged by agile FinTech firms offering faster disbursement and highly specialized lending models targeting niche industries, particularly in technology and e-commerce. Furthermore, sustainability-linked loans (SLLs) are emerging as a notable trend, incentivizing businesses to meet environmental, social, and and governance (ESG) targets in exchange for favorable interest rates, reflecting broader corporate responsibility mandates.

Regionally, North America maintains its leadership, fueled by robust capital markets, a dense concentration of FinTech innovation, and strong demand from large enterprises and venture-backed startups. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR), primarily due to the rapid urbanization, rising middle-class entrepreneurship in China and India, and government initiatives promoting financial inclusion and digital infrastructure build-out. Europe's market growth is supported by favorable regulatory harmonization across the Eurozone and significant penetration of open banking standards, making cross-border lending and data sharing more efficient, although economic stability challenges in certain member states periodically impact overall lending confidence.

Segmentation trends indicate that short-term loans and lines of credit remain highly demanded segments, essential for managing daily operational fluidity, particularly among SMEs. Based on end-user, the manufacturing, retail, and technology sectors are the largest consumers of business credit, reflecting their intense need for capital expenditure and rapid scalability. In terms of technology, AI-driven underwriting platforms are rapidly becoming standard, increasing the efficiency and decreasing the risk profile of loan portfolios across all major lending institutions. Secured loans, despite requiring collateral, still represent a substantial portion of the market, offering lower interest rates and higher loan amounts for large-scale corporate investments.

AI Impact Analysis on Business Loan Market

Common user questions regarding the impact of AI on the Business Loan Market generally center on several critical themes: how AI changes credit risk assessment accuracy, the speed of loan approval processes, the potential for reduced bias or, conversely, the introduction of new algorithmic bias, and the overall security and future role of human loan officers. Users frequently seek reassurance about whether AI algorithms can handle complex or non-traditional business structures and how personalized lending offers can become. The consensus expectation is that AI will dramatically increase efficiency and personalization, moving underwriting away from static historical data toward dynamic, real-time predictive analytics. Concerns often revolve around data privacy, regulatory compliance for AI models, and ensuring equitable access to credit for all business demographics, particularly underserved communities, ensuring transparency in black-box decision-making processes.

- Enhanced Credit Risk Modeling: AI and Machine Learning (ML) models analyze thousands of data points beyond traditional credit scores (e.g., social media sentiment, supply chain stability, real-time cash flows), offering significantly improved predictive accuracy regarding default probability.

- Automated Underwriting and Instant Decisions: AI-powered Loan Origination Systems (LOS) automate data verification, compliance checks, and risk calculation, reducing loan approval times from weeks to minutes, particularly for smaller loans.

- Fraud Detection and Security: AI algorithms continuously monitor transaction patterns and application anomalies, dramatically increasing the ability to detect and prevent sophisticated application fraud in real time, reducing lender losses.

- Personalized Loan Products: AI facilitates dynamic pricing and personalized interest rates based on the borrower's specific financial profile and predictive future performance, optimizing loan structure and repayment schedules.

- Operational Cost Reduction: By automating routine tasks such as document processing, data input, and initial screening, AI significantly lowers the operational costs associated with maintaining a large loan officer staff, contributing to lower overheads.

- Regulatory Compliance Monitoring: AI systems continuously track evolving compliance requirements (e.g., Know Your Customer (KYC), Anti-Money Laundering (AML)) and automatically flag potential breaches, minimizing legal and financial penalties for lending institutions.

- Chatbots and Customer Service: AI-driven chatbots handle initial customer inquiries, pre-qualification checks, and basic documentation guidance, improving the user experience and availability of support 24/7.

- Mitigation of Human Bias: While AI can introduce algorithmic bias if trained on non-representative data, properly monitored systems aim to standardize lending decisions, potentially reducing arbitrary human bias and promoting fairness in credit access.

DRO & Impact Forces Of Business Loan Market

The Business Loan Market is strongly influenced by a combination of inherent growth drivers (D), constraining factors (R), emerging opportunities (O), and external impact forces. Key drivers include sustained global demand for working capital and expansion funds from the vibrant SME sector, coupled with the rapid adoption of digital lending platforms that streamline the borrower experience and reduce institutional costs. However, the market faces significant restraints, notably the stringent regulatory environment post-2008 financial crisis, which imposes high capital adequacy requirements on traditional banks, and macroeconomic volatility, which increases default risks, prompting cautious lending practices. Opportunities abound in geographical expansion into emerging markets, developing specialized niche lending products (e.g., green financing), and utilizing Big Data analytics for superior risk identification. These forces collectively shape the competitive dynamics, capital flow, and technological direction of the market, determining accessibility and pricing for business financing globally.

Segmentation Analysis

The Business Loan Market is fundamentally segmented across three primary axes: Type, Provider, and End-user Industry, allowing for precise risk assessment and tailored product development. Segmentation by Type includes major categories such as term loans, which provide fixed capital over a specific period; lines of credit, offering flexible, revolving capital access; and specialized financing like equipment loans and commercial mortgages. The Provider segment differentiates between traditional financial institutions (large banks), alternative lenders (FinTechs and peer-to-peer platforms), and specialized non-banking financial companies (NBFCs). Finally, End-user segmentation categorizes borrowers based on industry, such as Manufacturing, Service, Retail, IT and Telecom, and Healthcare, each exhibiting distinct capital requirements and risk profiles essential for targeted marketing and regulatory compliance.

- By Type

- Term Loans (Short-term, Long-term)

- Lines of Credit/Revolving Credit

- Invoice Financing/Factoring

- Equipment Loans

- Commercial Mortgages

- SBA Loans (Specific to the US market and similar government-backed schemes globally)

- Bridge Loans

- By Provider

- Banks/Traditional Financial Institutions

- Non-Banking Financial Companies (NBFCs)

- FinTech/Digital Lenders (Alternative Lenders)

- Credit Unions

- By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-user Industry

- Manufacturing

- Retail and E-commerce

- Service Industry (Professional Services, Hospitality)

- IT and Telecommunication

- Construction and Real Estate

- Healthcare and Pharmaceuticals

- Transportation and Logistics

Value Chain Analysis For Business Loan Market

The Business Loan Market value chain commences with upstream activities focused on capital procurement and technological infrastructure development. Upstream players, primarily large commercial and investment banks, source capital through deposits, bond issuance, and interbank lending. Technology vendors provide the foundational digital infrastructure, including Loan Origination Systems (LOS), credit scoring engines, and compliance management software. This stage is heavily influenced by global interest rate policies and liquidity requirements. Efficiency at the upstream level is critical, as competitive interest rates and rapid technological deployment directly impact the final pricing and delivery speed of the loan product. FinTech disruption in the upstream segment often involves utilizing alternative data sources and cloud-based architecture to reduce funding costs and increase processing speed, setting a high standard for traditional incumbents.

The midstream section involves the core lending processes: origination, underwriting, and servicing. Origination involves marketing, application intake, and preliminary vetting. Underwriting, the most critical step, assesses borrower risk using a combination of automated scoring (AI/ML models) and human review, determining the loan structure, interest rate, and terms. Servicing includes managing the loan portfolio post-disbursement, handling collections, managing collateral (for secured loans), and maintaining regulatory reporting. Distribution channels are highly fragmented, leveraging both direct channels—in-house loan officers and proprietary digital platforms—and indirect channels through loan brokers, independent sales organizations (ISOs), and referral partnerships. The increasing sophistication of indirect channels, particularly digital broker networks that aggregate multiple lender offers, optimizes the customer journey.

Downstream activities focus on the secondary loan market and end-user engagement. This includes the securitization of business loan portfolios, allowing lenders to free up capital by selling the loan assets to institutional investors (e.g., pension funds, hedge funds). Servicers often continue to manage the loans on behalf of these investors. Furthermore, the downstream focus includes customer relationship management, repeat business generation, and offering supplementary financial services such as treasury management or cash flow forecasting tools. The quality of customer support and the seamless integration of digital post-disbursement services are vital for retaining customers and maximizing the lifetime value of the borrower relationship, completing the full financial ecosystem surrounding the business loan lifecycle.

Business Loan Market Potential Customers

Potential customers for business loans span the entire spectrum of commerce, fundamentally categorized by size, lifecycle stage, and industry sector, each with unique capital needs and risk profiles. Small and Medium Enterprises (SMEs) represent the largest volume of potential customers, requiring financing primarily for working capital, equipment upgrades, and moderate expansion projects. Startups, particularly those in high-growth technology sectors, seek early-stage loans or venture debt to bridge funding rounds or finance initial commercialization efforts before achieving profitability. Medium-sized firms often require financing for scaling operations, penetrating new markets, or undertaking moderate mergers and acquisitions (M&A) activities, requiring slightly larger and often secured term loans to facilitate capital intensive investments.

Large enterprises constitute a segment defined by complex, high-value financing needs, often utilizing commercial mortgages, syndicated loans, and sophisticated debt instruments for significant M&A activities, massive infrastructure projects, and international expansion. These organizations prioritize flexibility, competitive interest rates often tied to LIBOR or SOFR replacements, and the capacity of the lender to handle large, multi-jurisdictional transactions. Specific industry segments also present significant opportunities: the rapidly evolving IT and Telecommunications sector requires constant capital investment for network infrastructure and software development; the Healthcare sector needs financing for specialized equipment and facility expansion; and the Manufacturing sector demands credit for inventory management and supply chain optimization, especially those involved in complex global trade.

The identification of potential customers is increasingly reliant on predictive analytics and behavioral data, moving beyond traditional financial statements. Lenders are targeting businesses showing robust, consistent revenue growth, strong management teams, and clear market differentiation, regardless of their collateral availability—a trend particularly prevalent among FinTech lenders focusing on cash flow-based lending. Geographically, emerging economies with rapidly expanding infrastructure and a rising entrepreneurial class, such as Southeast Asia and Latin America, represent significant untapped customer bases. These regions prioritize micro-lending and financial products accessible via mobile platforms, contrasting with the more established corporate lending practices dominant in North America and Western Europe, demonstrating the breadth of the market's customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 845.2 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Goldman Sachs Group, LendingClub Corporation, PayPal Holdings, Inc., Kabbage, Inc. (Now part of Amex), OnDeck Capital, Inc., Funding Circle Limited, Mitsubishi UFJ Financial Group (MUFG), Industrial and Commercial Bank of China (ICBC), Credit Suisse Group AG, Deutsche Bank AG, HSBC Holdings plc, Capital One Financial Corporation, Citigroup Inc., Santander Group, Societe Generale S.A., Mizuho Financial Group, Oportun Financial Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Business Loan Market Key Technology Landscape

The technology landscape governing the Business Loan Market is undergoing radical modernization, driven primarily by the need for speed, accuracy, and operational cost reduction. Central to this transformation is the widespread adoption of cloud-based Loan Origination Systems (LOS) and Loan Management Systems (LMS). These cloud platforms offer scalable infrastructure, enabling lenders, particularly FinTechs and challenger banks, to handle high transaction volumes and rapidly deploy product updates without heavy investment in proprietary on-premise hardware. Furthermore, cloud integration facilitates seamless interoperability with third-party data providers, such as credit bureaus, government registries, and accounting software APIs, crucial for comprehensive and rapid underwriting decisions. This move away from legacy systems provides a foundational advantage in data security and regulatory compliance, offering real-time audit trails and automated reporting capabilities essential in a highly regulated financial environment.

Machine Learning (ML) and Artificial Intelligence (AI) constitute the most significant technological evolution in risk assessment and customer engagement. ML algorithms are deployed to analyze vast, non-traditional datasets—including transaction histories, website traffic, and supply chain data—to create dynamic credit scores that are far more predictive of future default risk than static FICO scores. This capability allows lenders to approve loans for businesses that might be rejected by traditional models, expanding the addressable market while maintaining risk integrity. AI also powers automated compliance tools (RegTech), ensuring that loan documentation and underwriting processes strictly adhere to constantly changing global financial regulations, minimizing the risk of non-compliance penalties. Chatbots and natural language processing (NLP) further enhance the front-end user experience, offering instant support and guiding applicants through complex documentation requirements.

Open Banking Application Programming Interfaces (APIs) and Distributed Ledger Technology (DLT), including blockchain, are also reshaping core lending processes. Open banking mandates, especially prominent in Europe (PSD2) and increasingly adopted globally, allow secure, permissioned sharing of financial data between banks and third-party providers. This significantly accelerates financial verification and cash flow analysis, which is crucial for quick business loan decisions. Although still nascent in core commercial lending, blockchain holds promise for streamlining syndicated loan processes, enhancing transparency in collateral management, and reducing settlement times in the secondary loan market by providing an immutable, verifiable ledger of all transaction histories and collateral ownership, potentially revolutionizing the efficiency and trust infrastructure of global lending consortiums.

Regional Highlights

- North America (NA): North America, particularly the United States, dominates the Business Loan Market due to a sophisticated financial infrastructure, high levels of digital adoption, and a strong presence of both traditional mega-banks and innovative FinTech lenders. The region benefits from robust capital market liquidity and favorable regulatory support for small business financing (e.g., SBA loans). The high competition among lenders drives continuous innovation in personalized loan products and expedited digital underwriting. The demand is strong across all segments, particularly technology, healthcare, and advanced manufacturing sectors seeking large-scale capital for strategic investments and expansion.

- Europe: The European market is characterized by regulatory harmonization (EU standards) and the advanced implementation of Open Banking initiatives (PSD2), which have fostered a vibrant digital lending ecosystem. Germany and the UK are key markets, with the UK leading in FinTech innovation and alternative lending penetration. Growth is spurred by strong SME activity and mandates for sustainable and green financing, driving demand for ESG-linked loan products. However, regional economic disparities and varying levels of credit data access across member states present moderate challenges to uniform growth rates across the continent.

- Asia Pacific (APAC): APAC is the fastest-growing market, driven by rapidly expanding economies, government support for SME development (especially in China, India, and Southeast Asia), and massive untapped populations transitioning into formal financial systems. Digital lending is booming here, often leapfrogging traditional banking infrastructure due to high mobile penetration. China and India are experiencing explosive growth in FinTech lending, focused heavily on efficiency and accessibility for micro and small enterprises. Infrastructure development projects across the region also create substantial demand for large commercial loans and syndicated financing.

- Latin America (LATAM): The LATAM region presents a high-growth opportunity, albeit coupled with higher geopolitical and economic volatility. Countries like Brazil and Mexico are leading the charge in modernizing their banking sectors, adopting digital lending technologies, and improving credit bureau coverage. The market is primarily focused on addressing the financing gap for SMEs that traditionally lacked access to formal credit. FinTech penetration is rising sharply, often focusing on cash flow lending models to mitigate risks associated with informal economies and limited historical credit data.

- Middle East and Africa (MEA): Growth in the MEA region is segmented. The Middle East (GCC countries) is driven by government diversification strategies away from oil dependence, leading to investment in tourism, technology, and non-oil industries, generating demand for large corporate loans. Africa is characterized by high demand for micro and small business loans, often delivered via mobile money platforms and local FinTech initiatives focused on financial inclusion and essential working capital. Regulatory frameworks are evolving rapidly, focusing on stabilizing financial systems and encouraging digital innovation in lending services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Business Loan Market.- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Goldman Sachs Group

- LendingClub Corporation

- PayPal Holdings, Inc.

- Kabbage, Inc. (Now part of Amex)

- OnDeck Capital, Inc.

- Funding Circle Limited

- Mitsubishi UFJ Financial Group (MUFG)

- Industrial and Commercial Bank of China (ICBC)

- Credit Suisse Group AG

- Deutsche Bank AG

- HSBC Holdings plc

- Capital One Financial Corporation

- Citigroup Inc.

- Santander Group

- Societe Generale S.A.

- Mizuho Financial Group

- Oportun Financial Corporation

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Business Loan Market?

The Business Loan Market is projected to grow at a robust CAGR of 9.5% between 2026 and 2033, driven primarily by digital transformation in lending and increased demand from the global SME segment for expansion and working capital.

How are FinTech companies disrupting traditional business lending models?

FinTech lenders leverage AI-driven underwriting, Big Data analytics, and simplified digital platforms to offer significantly faster loan approvals and personalized interest rates, challenging traditional banks by focusing on operational efficiency and a superior borrower experience.

Which geographical region is expected to show the highest growth rate in business loan demand?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR, propelled by rapid industrialization, strong government initiatives supporting small enterprises, and the swift adoption of mobile and digital financial services across countries like China and India.

What role does Artificial Intelligence play in modern business loan underwriting?

AI models analyze comprehensive real-time and non-traditional data points to assess credit risk dynamically, automating the underwriting process, minimizing human error, drastically reducing decision times, and enhancing fraud detection capabilities for lenders.

What are the primary types of business loans available in the market?

The primary types include fixed-term loans for long-term investments, revolving lines of credit for flexible working capital needs, equipment financing for asset purchases, and commercial mortgages for real estate acquisition, catering to varied corporate financial requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager