Cashmere Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437527 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cashmere Market Size

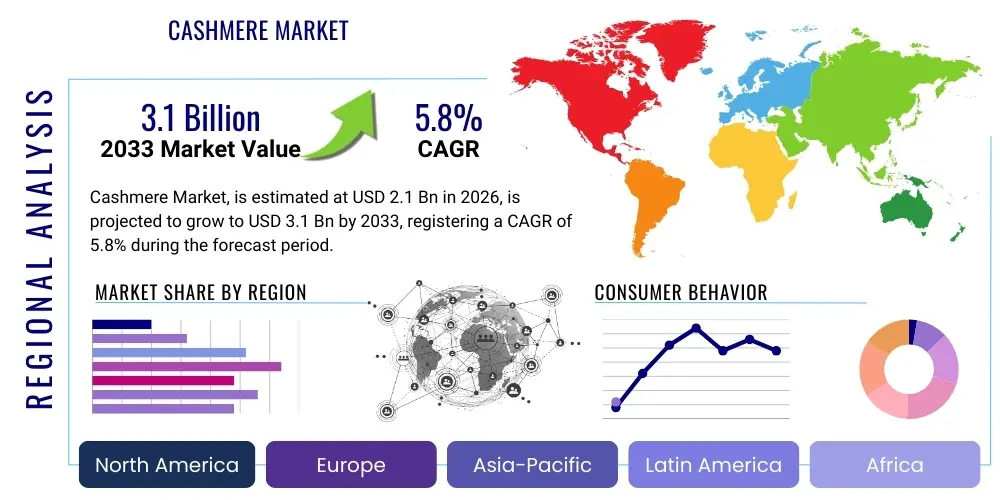

The Cashmere Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Cashmere Market introduction

The Cashmere Market encompasses the global production, processing, distribution, and sale of products derived from the fine undercoat fibers of Cashmere and other types of goats. Cashmere is highly valued globally for its exceptional softness, warmth, lightweight nature, and luxurious appeal, positioning it as a premium commodity within the global textile and luxury goods industries. The market spans raw fiber procurement, initial processing (de-hairing and spinning), manufacturing of finished goods (primarily apparel, but also home furnishings and accessories), and final retail distribution. Key segments driving growth include high-end apparel like sweaters, scarves, and coats, alongside niche applications in high-performance outdoor wear where its thermal regulation properties are advantageous. The industry is heavily influenced by geopolitical stability in major sourcing regions, primarily Mongolia and China, and increasingly by sustainability standards and ethical sourcing practices demanded by Western consumers.

The core product in this market is the Cashmere fiber itself, classified based on its length, fineness (micron count), and color. Pure Cashmere products, which contain 100% Cashmere fiber, command the highest prices, while blended Cashmere (mixed with materials like wool, silk, or synthetic fibers) offers more accessible price points, broadening the consumer base. Major applications revolve around winter and transitional weather apparel, reflecting Cashmere’s superior insulation capabilities without added bulk. The intrinsic benefits of Cashmere—including its hypoallergenic properties, natural elasticity, and durability when properly maintained—drive consistent demand among affluent consumers seeking investment pieces. The market structure involves complex international supply chains, beginning with nomadic herders and extending through specialized processors and established luxury fashion houses.

Driving factors for sustained market expansion include the increasing disposable income of the middle and upper classes in emerging economies, particularly across Asia Pacific, leading to greater demand for luxury textiles. Furthermore, the persistent trend toward sustainable and natural fibers, coupled with effective marketing that emphasizes the heritage and craftsmanship of Cashmere production, supports premium pricing. Technological advancements in de-hairing and spinning minimize waste and enhance fiber yield, while innovations in knitting and weaving allow for lighter-weight and more versatile finished products. However, the market faces significant challenges, notably the volatility of raw material prices tied to climate conditions and herd sizes, alongside the critical need for traceability and verification to combat counterfeiting and ensure ethical livestock treatment, all of which necessitate robust investment in supply chain transparency.

Cashmere Market Executive Summary

The Cashmere Market is demonstrating resilient growth, driven fundamentally by robust demand from the luxury apparel sector and significant penetration into emerging markets, particularly China and India, where wealth accumulation is accelerating consumer interest in status symbols and high-quality textiles. Current business trends indicate a critical shift toward vertical integration among major players, aiming to secure reliable fiber supply, control quality from farm to shelf, and implement sophisticated traceability systems to meet stringent consumer demands for ethical sourcing. Furthermore, there is a pronounced move towards digital transformation across the distribution channels, with e-commerce platforms and Direct-to-Consumer (DTC) models capturing an increasing share of sales, allowing brands to better control narrative and margin. Innovation in product diversification, including the use of recycled or ‘reclaimed’ cashmere fibers and the blending of cashmere with performance materials, addresses both sustainability concerns and the need for product differentiation in a competitive landscape.

Regionally, Asia Pacific maintains its dual role as the dominant supplier of raw material (led by China and Mongolia) and the fastest-growing consumption hub, fueled by domestic consumption and strong export manufacturing capabilities. North America and Europe remain mature, high-value markets, characterized by discerning consumers who prioritize brand reputation, sustainability certifications, and timeless designs over fast fashion trends. Geopolitical factors affecting trade tariffs and environmental regulations in these regions significantly influence market dynamics. For instance, increasing restrictions on textile waste disposal in Europe are spurring investment in sustainable processing technologies and circular economy initiatives within the Cashmere sector. The Middle East also shows increasing potential as disposable incomes rise and local preferences for high-end, modest apparel incorporating luxury fibers gain prominence.

Segment trends highlight the enduring dominance of the Apparel segment, especially in luxury knitwear, but also note rapid expansion in the Accessories category (scarves, shawls, hats), which offers consumers a more affordable entry point into the luxury Cashmere market. Within the Type segmentation, Pure Cashmere continues to command premium pricing due to its scarcity and quality, but the Blended Cashmere segment is expanding rapidly, driven by innovation in blending ratios that enhance functionality (e.g., moisture-wicking, durability) while maintaining a significant portion of the characteristic softness. Distribution channel segmentation shows traditional brick-and-mortar stores holding substantial sway for high-ticket items, where tactile inspection is crucial, yet online sales are forecasted to exhibit superior growth rates, reflecting the convenience and global reach afforded by digital marketplaces and brand-specific e-commerce sites.

AI Impact Analysis on Cashmere Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cashmere Market frequently center on themes of supply chain optimization, counterfeit detection, consumer personalized marketing, and the potential for AI to manage sustainability metrics and herd health. Users are primarily concerned with how AI can ensure the authenticity of high-value Cashmere products against rampant counterfeiting, often asking about AI-driven fiber tracing technologies and blockchain integration. Furthermore, there is strong interest in predictive analytics—specifically, how AI algorithms can forecast climate-related impacts on goat grazing patterns and fiber yield in primary sourcing regions (Mongolia, China), thereby stabilizing procurement costs and inventory management. The key expectation is that AI will introduce unprecedented levels of transparency and efficiency, moving the traditionally manual and opaque Cashmere supply chain toward a verifiable, data-driven system, thereby enhancing consumer trust and operational profitability.

The application of AI in the downstream sector focuses heavily on demand forecasting and hyper-personalized retail experiences. Luxury Cashmere retailers are exploring AI tools to analyze complex consumer behavior data, inventory turnover rates, and seasonal fluctuations with greater precision than traditional statistical models. This optimization leads to reduced stockouts of fast-moving items and minimization of surplus inventory, which is crucial given the high cost of holding Cashmere stock. Moreover, AI is instrumental in enhancing the online shopping experience through virtual try-ons and sophisticated recommendation engines that match fiber type, weave, and garment style to individual customer preferences, translating into higher conversion rates and improved customer loyalty metrics within the high-end retail landscape.

In the ethical sourcing and sustainability domain, AI-powered monitoring systems offer significant potential for enhancing Corporate Social Responsibility (CSR). These systems can utilize satellite imagery and IoT sensors placed on grazing lands to monitor herd density, prevent overgrazing, and track the overall health and welfare of Cashmere goats. By correlating environmental data with fiber quality output, manufacturers can make data-informed decisions about sourcing partners who adhere to the highest standards of animal welfare and ecological preservation. While implementation requires substantial upfront investment, the long-term benefits include mitigating supply chain risks associated with environmental degradation and satisfying the rapidly growing segment of environmentally conscious luxury consumers.

- AI-driven traceability and authentication systems utilizing computer vision and blockchain for verifying fiber origin and purity.

- Predictive analytics leveraging machine learning to forecast raw fiber yields based on climate patterns, optimizing procurement strategies.

- Enhanced inventory management and demand forecasting algorithms reducing high-cost stock wastage in retail operations.

- Personalized marketing and retail recommendation engines improving customer engagement and conversion rates in e-commerce.

- AI monitoring of grazing lands via satellite data to prevent overgrazing and support sustainable herd management practices.

- Automated quality control systems in processing plants using sensor technology to assess fiber fineness and consistency, reducing human error.

DRO & Impact Forces Of Cashmere Market

The Cashmere Market is fundamentally shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces originating from environmental, economic, and technological spheres. A primary driver is the escalating global demand for luxury goods, coupled with rising disposable incomes in APAC nations, which consistently positions Cashmere as a desirable, status-affirming textile. Another key driver is the consumer shift towards investing in high-quality, durable, and naturally sourced products, moving away from cheaper, synthetic alternatives. This driver is amplified by increasing consumer awareness regarding the environmental footprint of synthetic textiles. Conversely, the market faces acute restraints, dominated by the extreme volatility of raw Cashmere prices, which are highly susceptible to unpredictable weather events (e.g., Dzud, a severe winter phenomenon in Mongolia) affecting goat herds, and the persistent challenge of raw fiber supply concentration in a limited number of geographical regions, primarily China and Mongolia, leading to geopolitical supply chain risks. Furthermore, the difficulty in ensuring complete supply chain transparency and combating the proliferation of counterfeit products remains a significant drag on market integrity and brand trust.

Opportunities within the Cashmere market are manifold and highly focused on innovation and geographical expansion. Significant potential exists in developing verifiable, farm-to-shelf traceability programs using technologies such as blockchain and forensic marking, which can command a premium price for authenticated products and secure consumer loyalty. Product diversification presents another major opportunity; this includes integrating Cashmere into performance-wear textiles, expanding its application beyond traditional winter apparel, and the burgeoning market for recycled or reclaimed Cashmere, which aligns strongly with circular economy principles and reduces dependency on virgin fiber sources. Moreover, brands are increasingly leveraging the growth of DTC channels and specialized luxury e-commerce platforms to bypass traditional intermediaries, enhance margin control, and directly manage the brand-consumer relationship, offering opportunities for targeted marketing and faster feedback loops.

Impact forces critically influencing the market include profound environmental pressures and regulatory shifts. Climate change-induced desertification in Inner Mongolia and Central Asia necessitates significant changes in herding practices to maintain ecological balance and ensure long-term fiber quality, acting as a major external force. Economic forces, such particularly trade wars and tariffs between major consuming and producing nations, directly impact procurement costs and retail pricing. Technological impact forces, particularly advanced machine learning used for climate modeling and AI-driven authentication, are reshaping the supply chain architecture. Finally, the societal impact force emphasizing ethical consumption and animal welfare standards compels the industry to adopt Global Organic Textile Standards (GOTS) and similar certifications, increasing production costs but unlocking access to premium, socially conscious consumer segments who view ethical sourcing as a non-negotiable prerequisite for luxury purchases.

Segmentation Analysis

The Cashmere Market is systematically segmented across various dimensions, including Product Type, Application, Distribution Channel, and End-User, providing a granular view of market dynamics and consumer preferences. Understanding these segments is crucial for brands aiming to optimize their product portfolios and distribution strategies to maximize profitability. The segmentation by type differentiates between Pure Cashmere (100% fiber content) and Blended Cashmere (fiber mixed with wool, silk, or synthetics), reflecting distinct price points and target consumer demographics. While Pure Cashmere dominates the high-end luxury bracket, Blended Cashmere is critical for market accessibility and product innovation focusing on enhanced durability and wearability, serving as a vital volume driver. The analysis indicates that consumer preference is increasingly segmenting based on micron count, with ultra-fine Cashmere commanding ultra-premium prices, requiring highly specialized sourcing and processing capabilities.

Segmentation by Application reveals that the Apparel sector, encompassing knitwear, outerwear, and ready-to-wear clothing, constitutes the overwhelming majority of market revenue, driven by Cashmere’s status as the definitive cold-weather luxury fabric. However, the Accessories segment, which includes scarves, shawls, and gloves, is exhibiting a faster growth trajectory, particularly in gift-giving and as an introductory luxury purchase point. The Home Textiles category, though smaller, is gaining traction, propelled by the increasing demand for high-end home furnishings, such as blankets and throws, capitalizing on Cashmere’s inherent comfort and perceived value. Strategically, brands often use the Accessories segment to mitigate seasonal volatility typically associated with the heavier apparel lines, ensuring a more consistent revenue stream throughout the year.

The Distribution Channel segmentation highlights the ongoing transition in consumer purchasing behavior. Traditional Offline Channels, comprising dedicated brand stores, luxury department stores, and specialty textile retailers, remain integral for establishing brand prestige and allowing consumers tactile inspection of expensive garments. Conversely, Online Channels, including brand websites and major e-commerce marketplaces (e.g., Net-a-Porter, Farfetch), are the primary growth engines, offering unparalleled global reach, logistical efficiency, and the capacity for digital marketing. The market analysis shows that younger, digitally native luxury consumers are increasingly comfortable making significant Cashmere purchases online, provided the retailer offers robust returns policies and authenticated product guarantees, underscoring the necessity of secure and trustworthy digital storefronts for future market capture.

- By Type:

- Pure Cashmere (100% Cashmere fiber)

- Blended Cashmere (Mixed with Silk, Wool, or Synthetic Fibers)

- By Application:

- Apparel (Knitwear, Sweaters, Outerwear)

- Accessories (Scarves, Shawls, Gloves, Hats)

- Home Textiles (Blankets, Throws, Cushions)

- By Distribution Channel:

- Offline Channels (Specialty Stores, Department Stores, Retail Outlets)

- Online Channels (E-commerce Websites, Brand Direct-to-Consumer Platforms)

Value Chain Analysis For Cashmere Market

The Cashmere market value chain is extensive and highly fragmented, commencing with the rigorous Upstream Analysis centered on raw fiber procurement and initial processing. This phase is dominated by nomadic herders in key regions—Mongolia, China (Inner Mongolia), Iran, and Afghanistan—who shear or comb the goats. The quality of the raw fiber is critically dependent on climate conditions and husbandry practices. Following sourcing, raw fiber undergoes de-hairing, a specialized and often expensive process where coarse guard hairs are separated from the fine undercoat, yielding pure Cashmere. This de-hairing stage is crucial for determining the final quality and grade, often performed by large-scale processors in China. Technological efficiency in de-hairing directly impacts the yield rate and subsequent production costs, making it a critical choke point in the value chain where innovation offers significant cost savings and quality control improvements.

The Midstream component involves spinning, dyeing, and knitting or weaving. Spinning transforms the de-haired fiber into yarn, which requires high precision due to the fineness of the Cashmere staple. Dyeing processes must preserve the fiber’s softness and integrity. Manufacturing (knitting/weaving) then converts the yarn into finished garments or textiles. Many luxury brands engage in strict quality control at this stage, often opting for facilities in Italy or Scotland known for heritage techniques, although high-volume manufacturing often occurs in Asia. The complexities of this stage mean that strong relationships with specialized manufacturing partners are essential for maintaining brand reputation and consistency in product quality across different collections and product lines.

The Downstream Analysis focuses on distribution and retailing, encompassing both Direct and Indirect channels. Indirect distribution involves selling through wholesalers, department stores (often requiring significant margin sacrifices), and multi-brand luxury boutiques, which offer broad market exposure but dilute brand control. Direct distribution, increasingly favored by luxury Cashmere houses, utilizes brand-owned flagship stores and, most importantly, dedicated e-commerce platforms (DTC models). DTC provides enhanced control over pricing, brand experience, and customer data, driving higher profitability per unit. Key logistics considerations involve secure, high-speed international shipping for high-value items and robust inventory tracking systems to manage global stock levels effectively, ensuring the perceived luxury value is maintained throughout the final mile delivery process.

Cashmere Market Potential Customers

Potential customers for the Cashmere Market are diverse yet consistently clustered within high-net-worth individuals and affluent segments who prioritize quality, comfort, and timeless luxury over ephemeral fashion trends. The primary End-User/Buyer group consists of mature consumers (aged 40+) in developed economies (North America, Western Europe) seeking classic, investment-grade apparel. These customers are driven by brand heritage, traceability guarantees, and the intrinsic durability and thermal superiority of pure Cashmere garments. They often make repeat purchases, valuing pieces that integrate seamlessly into a sophisticated wardrobe and often represent conscious spending on long-lasting textile assets. Marketing efforts targeting this segment must emphasize craftsmanship, ethical sourcing credentials, and the long-term cost-effectiveness of high-quality items.

A rapidly expanding segment of potential customers includes the younger, high-earning Generation Z and Millennials in major Asian economies, particularly urban centers in China, Korea, and Southeast Asia. These buyers are less focused on traditional heritage but are highly responsive to contemporary designs, sustainability narratives, and influencer marketing, viewing Cashmere as an essential component of a modern, quiet luxury lifestyle. They tend to favor accessories and blended Cashmere products as accessible entry points into the luxury market. This group’s purchasing journey is heavily influenced by digital platforms, requiring brands to maintain a strong, engaging, and mobile-optimized online presence while ensuring seamless omnichannel integration between digital storefronts and physical retail touchpoints.

Another significant customer category involves corporate gifting and specialized B2B segments, such as luxury hotels, private aviation services, and high-end interior designers. These buyers procure cashmere throws, blankets, or custom accessories in bulk to enhance the exclusive experience offered to their clients. This segment requires high volume capacity, consistent quality control, and often demands specialized branding or customization capabilities. Furthermore, the market for recycled or sustainable Cashmere appeals to a growing niche of socially conscious consumers who, while affluent, are explicitly willing to pay a premium for certified circular products, shifting the focus from virgin fiber purity to environmental impact reduction and resource efficiency in textile production.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Loro Piana, Brunello Cucinelli, Pringle of Scotland, TSE Cashmere, Gobi Cashmere, Inner Mongolia Erdos Cashmere Products Co. Ltd., Malo, Ermenegildo Zegna, Ballantyne Cashmere, Goelap, Dawson Forte Cashmere, Tengen, Tod's S.p.A., Johnstons of Elgin, Cuddle Barn, Cashmere Holding, Shokay, Naadam, J. Crew Group, Inc., Ralph Lauren Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cashmere Market Key Technology Landscape

The technological landscape of the Cashmere Market is evolving rapidly, driven by the dual needs for enhancing production efficiency and meeting stringent consumer demands for sustainability and authenticity. One critical area is the advancement in fiber processing technology, particularly in automated de-hairing equipment. Modern machinery uses sophisticated optical sorting and air separation techniques to increase the yield of fine cashmere fiber while minimizing breakage and reducing the reliance on manual labor, which is often inconsistent. Furthermore, innovations in spinning techniques, such as vortex spinning and specialized compact spinning, are allowing manufacturers to create lighter, stronger yarns with minimized pilling, extending the longevity and perceived value of the final product. These processing improvements are essential for large-scale operations to maintain competitiveness and meet the exacting quality standards demanded by global luxury brands.

Traceability technology represents another pivotal development, moving beyond traditional paper trails to embrace digital solutions. Key technologies include the application of micro-marking substances or forensic tags embedded into the fiber itself, verifiable at microscopic levels, alongside robust implementation of distributed ledger technology (Blockchain). Blockchain provides an immutable record of the fiber’s journey from the herder to the final retailer, drastically improving transparency and building consumer trust by verifying the origin (country and often specific region) and authenticity of the Cashmere. This technology is instrumental in combating the significant issue of counterfeit goods and ensuring compliance with ethical sourcing protocols, thereby justifying the premium price point associated with authentic, responsibly sourced Cashmere.

Finally, the integration of digital technology is redefining the sales and design process. Computer-Aided Design (CAD) software allows for faster prototyping and precise pattern making, reducing material waste during the sampling phase. In retail, technologies like 3D body scanning and Augmented Reality (AR) try-on experiences are bridging the gap between physical and online shopping, providing consumers with confidence in fit and texture when purchasing high-value items digitally. Furthermore, predictive modeling, using AI to analyze weather patterns and commodity market trends, enables proactive inventory management and strategic procurement decisions, insulating manufacturers partially from the high price volatility inherent in the raw fiber market and ensuring operational resilience.

Regional Highlights

The global Cashmere market exhibits pronounced regional differentiations in terms of supply dynamics, consumption patterns, and technological adoption, making regional analysis crucial for strategic market entry and supply chain planning. Asia Pacific (APAC) stands as the undisputed heart of the Cashmere market, serving as both the primary source of raw fiber (over 80% globally) and the most significant consumption market, especially driven by China's robust domestic luxury demand and its massive processing infrastructure. The regional market growth in APAC is further fueled by rising affluence in markets like India, South Korea, and Japan, where Cashmere is highly esteemed. Key manufacturing hubs in China and Mongolia necessitate close monitoring of local environmental policies and geopolitical trade relations, as any disruption in these areas rapidly impacts global fiber prices and availability.

Europe represents a mature and highly discerning consumption market, characterized by consumers who value heritage brands, sustainable production methods, and exceptional craftsmanship. Countries such as Italy and the UK are not only major consumers but also hosts to historical Cashmere finishing houses (e.g., Loro Piana, Johnstons of Elgin) that specialize in high-end spinning and garment production, maintaining a reputation for quality that commands ultra-premium pricing. European regulatory requirements, particularly regarding material composition labeling, chemical use, and animal welfare, are exceptionally strict, compelling sourcing companies to adhere to the highest ethical and environmental standards to gain market access.

North America, dominated by the United States, is a key market for luxury imports. Demand is characterized by a strong consumer preference for branded lifestyle wear and practical, yet luxurious, apparel. While high-end department stores remain important, the North American market has rapidly embraced e-commerce and DTC strategies for Cashmere purchases, making digital marketing efficiency and logistical excellence paramount for success. Price sensitivity varies significantly, with strong demand for both ultra-premium pure Cashmere lines and competitively priced, fashion-forward blended Cashmere offerings, requiring brands to maintain diversified product portfolios catering to various price points.

The Middle East and Africa (MEA) region, while currently smaller in volume, offers immense potential, particularly within the Gulf Cooperation Council (GCC) states. High disposable incomes and a cultural affinity for luxury and high-quality textiles drive the demand for bespoke and high-end Cashmere garments and accessories. This market segment often prefers heavier weight fabrics and customized, exclusive designs, presenting an opportunity for specialized luxury brands capable of offering personalized services and unique product runs. Market entry here typically relies on strategic partnerships with local luxury retailers and high-end mall presence, catering to the unique local retail environment.

Latin America remains a developing market for Cashmere, with pockets of significant demand concentrated in major urban centers and among the affluent populations of countries such as Brazil and Mexico. The market here is sensitive to economic volatility and import taxes, necessitating careful pricing strategies. However, the slow but steady increase in luxury consumption and the growing international exposure of consumers present long-term growth opportunities, particularly for brands that can adapt their marketing messaging to resonate with the region's specific cultural interpretations of luxury and status, often favoring classic European luxury aesthetics.

- Asia Pacific (APAC): Dominant region for raw fiber sourcing (China, Mongolia) and the fastest-growing consumption market, driven by rising affluence and strong domestic demand.

- Europe: Mature high-value market focused on heritage, craftsmanship, and strict adherence to sustainability and ethical sourcing standards.

- North America: Large import market characterized by high digital adoption, strong preference for branded luxury, and demand for diversified product lines (pure and blended).

- Middle East & Africa (MEA): Emerging high-potential market, particularly the GCC, driven by high disposable income and demand for bespoke, premium luxury textiles.

- Latin America: Developing market showing opportunities in affluent urban clusters, requiring strategies tailored to high import costs and economic variability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cashmere Market.- Loro Piana (LVMH Moët Hennessy Louis Vuitton)

- Brunello Cucinelli S.p.A.

- Pringle of Scotland

- TSE Cashmere

- Gobi Cashmere

- Inner Mongolia Erdos Cashmere Products Co. Ltd.

- Malo

- Ermenegildo Zegna Group

- Ballantyne Cashmere

- Goelap

- Dawson Forte Cashmere

- Tengen

- Tod's S.p.A.

- Johnstons of Elgin

- Cuddle Barn

- Cashmere Holding

- Shokay

- Naadam

- J. Crew Group, Inc.

- Ralph Lauren Corporation

Frequently Asked Questions

What is the projected Compound Annual Growth Rate (CAGR) for the Cashmere Market?

The Cashmere Market is projected to exhibit a stable Compound Annual Growth Rate (CAGR) of 5.8% between the forecast period of 2026 and 2033, driven primarily by increasing global luxury consumption and expansion in key Asian consumer markets.

Which geographical region dominates the supply of raw Cashmere fiber?

Asia Pacific, specifically China (Inner Mongolia) and Mongolia, comprehensively dominates the global supply of raw Cashmere fiber, accounting for the vast majority of worldwide production volume and quality grades. Supply chain stability is highly reliant on climate conditions in these key producing regions.

How is technology, such as AI and Blockchain, impacting the Cashmere supply chain?

AI and Blockchain technology are fundamentally improving supply chain transparency and authenticity. Blockchain is used to create immutable records tracing fiber origin from the herder to the final garment, while AI assists in predictive modeling for yield forecasting, inventory optimization, and robust counterfeit detection systems.

What are the primary restraints affecting the profitability of the Cashmere Market?

The main restraints include the high volatility of raw fiber prices, which are sensitive to climate change impacts on goat populations, the geographical concentration of sourcing leading to supply chain risk, and the persistent challenge of ensuring verified traceability and combating widespread product counterfeiting.

Which Cashmere market segment is experiencing the fastest growth in terms of application?

While the Apparel segment maintains the largest revenue share, the Accessories segment, including scarves, shawls, and gloves, is experiencing the fastest growth rate. This segment provides a more accessible entry point for new consumers into the luxury Cashmere market and offers diversification for established brands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fashion Luxury Cashmere Clothing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Fashion Luxury Cashmere Clothing Market Size Report By Type (Coats, Trousers, Dresses, Other), By Application (Children, Women, Men), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Cashmere Clothing Market Size Report By Type (Sweater, Coats, Dresses), By Application (Children, Women, Men), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Pure Cashmere Market Statistics 2025 Analysis By Application (Cashmere Clothing, Cashmere Accessory, Cashmere Home Textiles), By Type (White Cashmere, Cyan Cashmere, Purple Cashmere), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Fashion Luxury Cashmere Clothing Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Coats, Trousers, Dresses, Other), By Application (Children, Women, Men), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager