Cast Grinding Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431431 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cast Grinding Market Size

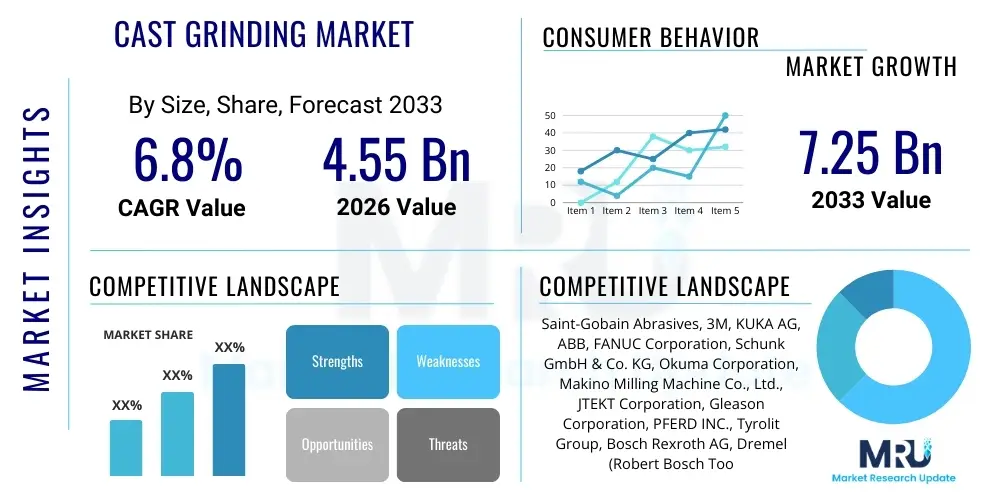

The Cast Grinding Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $4.55 Billion in 2026 and is projected to reach $7.25 Billion by the end of the forecast period in 2033.

Cast Grinding Market introduction

The Cast Grinding Market encompasses the tools, machinery, and abrasives utilized for the precise removal of material from cast metal components, ensuring dimensional accuracy, improved surface finish, and compliance with stringent quality specifications. These processes are fundamental in manufacturing sectors where cast parts form the structural backbone of complex machinery, including engine blocks, transmission cases, aerospace components, and heavy industrial equipment. Cast grinding primarily involves processes like fettling, deburring, snagging, and precision grinding, utilizing specialized wheels made from materials such as aluminum oxide, silicon carbide, or superabrasives like Cubic Boron Nitride (CBN) and diamond, depending on the casting material and required tolerance levels.

Key products within this market include grinding machines (manual, semi-automatic, and CNC), robotic grinding systems, and consumable grinding media (wheels, belts, and discs). The primary objective of cast grinding is to refine parts produced via casting methods (sand casting, die casting, investment casting) that often result in excess material, surface imperfections, and geometric inconsistencies. The ability of modern grinding technologies to achieve micron-level tolerances is a major benefit, crucial for applications such as high-performance engine manufacturing and sophisticated tooling, where friction reduction and perfect fitment are non-negotiable requirements.

The market is predominantly driven by the continuous demand for lightweight and high-strength metal components, particularly within the automotive and aerospace industries, necessitating advanced material handling and finishing processes. Furthermore, the shift toward automation and the integration of smart manufacturing principles are pushing manufacturers to adopt highly efficient, robotic grinding solutions that minimize human intervention, reduce operational costs, and ensure repeatable quality across high-volume production lines. Regulatory pressures demanding enhanced fuel efficiency and reduced emissions further mandate superior component quality, positioning cast grinding as a critical bottleneck process in the production value chain.

Cast Grinding Market Executive Summary

The Cast Grinding Market is undergoing a rapid evolution characterized by a fundamental shift from manual operations towards high-precision robotic and CNC-integrated systems, primarily aimed at boosting productivity and mitigating the risks associated with labor-intensive, hazardous grinding environments. Business trends indicate a robust focus on developing advanced superabrasive materials, such as CBN and synthetic diamonds, which offer extended tool life and higher material removal rates, directly impacting overall operational efficiency and reducing downtime in large-scale foundries and machining centers. Furthermore, key players are investing heavily in software solutions that enable adaptive grinding strategies, using sensors and artificial intelligence to monitor tool wear and adjust parameters in real-time, thereby maximizing throughput and maintaining quality control.

Regional trends highlight the Asia Pacific (APAC) region as the dominant growth engine, driven by massive investments in automotive manufacturing, infrastructure development, and the establishment of large-scale industrial foundries in countries like China, India, and South Korea. North America and Europe, characterized by mature industrial bases, are focusing primarily on implementing high-value, automated, and specialized grinding solutions tailored for aerospace, medical devices, and high-performance automotive sectors, prioritizing precision and customization over sheer volume. The competitive landscape is intensely focused on mergers, acquisitions, and strategic partnerships, enabling technology transfer and broadening geographical reach, especially regarding robotic system integration expertise.

Segmentation trends reveal that the precision grinding sub-segment, utilizing automated CNC machines, is experiencing the fastest growth, largely due to rising demands for tightly tolerance components in electric vehicles (EVs) and advanced aircraft engines. The ferrous castings application segment remains the largest consumer, but non-ferrous cast grinding (aluminum and magnesium) is gaining momentum driven by lightweighting initiatives across transportation sectors. Overall, the market trajectory is strongly linked to global industrial output and the ongoing digitalization of manufacturing processes, ensuring sustained growth through the forecast period as manufacturers seek efficiency improvements to remain globally competitive.

AI Impact Analysis on Cast Grinding Market

Common user questions regarding AI's impact on the Cast Grinding Market revolve around predictive quality control, optimization of grinding paths for complex geometries, and minimizing human error and tool breakage. Users frequently inquire about the feasibility and return on investment (ROI) of integrating Machine Learning (ML) algorithms for determining optimal feed rates, spindle speeds, and coolant flow based on real-time acoustic emission and vibration data. There is significant interest in using AI to predict the remaining useful life (RUL) of expensive grinding wheels and to automate the intricate programming required for robotic fettling of non-uniform cast parts. Consequently, the key theme emerging is the transition from static, pre-programmed grinding routines to dynamic, adaptive processes that significantly enhance material removal efficiency, reduce scrap rates, and drive the overall concept of lights-out manufacturing in foundries and machining operations.

- Predictive Maintenance: AI algorithms analyze sensor data (vibration, temperature, power consumption) to predict tool wear and potential machine failure, optimizing maintenance schedules and minimizing unscheduled downtime.

- Process Optimization: Machine Learning is used to dynamically adjust grinding parameters (speed, pressure, coolant) based on workpiece material properties and real-time surface quality measurements, ensuring consistent output and maximizing material removal rates (MRR).

- Quality Control Automation: Computer Vision and AI-driven inspection systems rapidly detect surface defects, cracks, and dimensional inaccuracies post-grinding, eliminating manual quality checks.

- Robotic Path Planning: AI enables robots to autonomously generate efficient grinding paths for complex, non-uniform castings (fettling), significantly reducing programming time and improving consistency compared to manual teaching.

- Adaptive Control: Systems use reinforcement learning to adapt to variations in raw casting input (e.g., flash variations), ensuring consistent application of force and maintaining required tolerances despite material variability.

DRO & Impact Forces Of Cast Grinding Market

The Cast Grinding Market is primarily driven by the escalating demand for high-precision components in critical sectors like automotive (especially EVs), aerospace, and industrial machinery, coupled with the global push for industrial automation to enhance productivity and worker safety. However, the market faces significant restraints, notably the high initial capital expenditure required for sophisticated CNC and robotic grinding systems and the increasing scarcity of skilled technicians capable of operating and maintaining these advanced technologies. Opportunities abound through the development of next-generation superabrasives (CBN and diamond) offering superior longevity and efficiency, and the expansion of the market into emerging economies focusing on heavy infrastructure investment. These forces combine to create an environment where technological superiority and efficiency gains are paramount, accelerating the adoption of high-cost, high-value automated solutions over traditional manual methods.

Drivers: The dominant driver is the stringent quality and dimensional requirements imposed by modern engine and transmission component manufacturing, which necessitates grinding processes capable of achieving sub-micron level surface finishes and tight geometric tolerances. Furthermore, the rapid global adoption of industrial robotics in foundries to replace hazardous manual grinding tasks is fueling the demand for robotic grinding end-effectors and integrated solutions. The increasing complexity of cast parts, often featuring intricate internal geometries and advanced alloys, requires corresponding advancements in grinding precision and efficiency, necessitating continuous technological upgrades across the industry. The lightweighting trend, particularly in transportation, demands higher volumes of aluminum and magnesium alloy castings that require specialized, precise grinding techniques to preserve material integrity.

Restraints: The market faces substantial hurdles due to the high upfront investment costs associated with advanced CNC grinding machines and integrated automation cells, which can be prohibitive for small and medium-sized foundries. Additionally, the operational expenses, including the cost of high-performance abrasives and specialized cooling lubricants, contribute significantly to the total cost of ownership. A critical constraint is the shortage of highly specialized labor—including CNC programmers, robotics engineers, and maintenance personnel—needed to maximize the performance of complex grinding systems, leading to underutilized capacity in some regions. Environmental regulations concerning dust control and coolant disposal also impose operational limitations and require costly compliance measures.

Opportunities: Significant growth opportunities exist in integrating Industry 4.0 technologies, such as IoT sensors, digital twins, and AI, into grinding processes to enable predictive maintenance and adaptive optimization. The expansion of manufacturing bases in Southeast Asia and Latin America presents untapped markets for automated grinding solutions as these regions modernize their industrial infrastructure. Furthermore, continuous material science breakthroughs in abrasive technology, particularly tailored superabrasives for difficult-to-machine alloys (e.g., nickel-based superalloys used in aerospace), offer high-margin opportunities for specialization. The modularization and standardization of robotic grinding cells, making them easier to deploy and scale, represent a clear pathway for broader market penetration across various foundry sizes.

Segmentation Analysis

The Cast Grinding Market is comprehensively segmented based on technology type, material type, application, and end-user, providing a granular view of market dynamics and growth potential across various industrial sub-sectors. Technology segmentation differentiates between conventional manual and semi-automatic grinding operations and highly advanced automated systems like CNC grinding and specialized robotic cells. Material segmentation is crucial as it dictates the required abrasive composition and machine specifications, distinguishing between ferrous metals (iron, steel) and non-ferrous alloys (aluminum, titanium). Application analysis focuses on the specific industry demand drivers, ranging from mass-produced components in the automotive sector to highly certified parts required by the aerospace and medical device industries, allowing vendors to tailor their offerings to specific tolerance and volume requirements.

The evolution of these segments highlights a clear transition towards solutions that offer higher levels of precision, repeatability, and safety. Automated systems are increasingly preferred globally due to rising labor costs and demands for consistent quality that manual processes struggle to match. The dominance of the automotive segment, particularly its rapid shift towards electric vehicle platforms, is driving demand for high-throughput grinding solutions for motor housings and battery casings. Meanwhile, the aerospace sector continues to demand highly specialized, low-volume, ultra-precision grinding for turbine blades and structural components, sustaining growth in the superabrasives and specialized CNC machine segments. This detailed segmentation aids in strategic planning, identifying areas where technological innovation yields the highest commercial impact.

- By Technology:

- Conventional/Manual Grinding

- Semi-Automatic Grinding

- CNC Grinding Machines

- Robotic Grinding Systems

- By Product Type (Abrasives):

- Standard Abrasives (Aluminum Oxide, Silicon Carbide)

- Superabrasives (Cubic Boron Nitride (CBN), Diamond)

- Coated Abrasives (Belts, Discs)

- By Material Type:

- Ferrous Castings (Grey Iron, Ductile Iron, Steel Castings)

- Non-Ferrous Castings (Aluminum, Magnesium, Titanium, Nickel Alloys)

- By Application:

- Automotive and Transportation

- Aerospace and Defense

- Heavy Machinery and Industrial Equipment

- Die and Mold Manufacturing

- Medical Devices

Value Chain Analysis For Cast Grinding Market

The Cast Grinding market value chain begins with upstream activities, primarily involving the sourcing and processing of raw materials necessary for machine construction and abrasive manufacturing. This includes procuring raw minerals like bauxite and silicon carbide for standard abrasives, alongside specialized synthesis processes for producing superabrasives like CBN and industrial diamonds. Key upstream players are chemical and material suppliers who ensure the quality and purity of these foundational components. Downstream, the value chain extends through equipment manufacturing, system integration, distribution, and ultimately, end-user application. Equipment manufacturers design and assemble the grinding machines, while system integrators play a vital role in customizing robotic cells and CNC setups to fit specific foundry floor layouts and production requirements, adding significant value through specialized engineering services.

Distribution channels are multifaceted, utilizing both direct and indirect routes to reach the diverse global customer base. Direct sales are common for high-value, complex equipment such as large CNC grinding centers and bespoke robotic systems, where manufacturers work closely with end-users to provide installation, training, and ongoing technical support. This direct approach ensures precise technical alignment between the machine capabilities and the customer’s production needs. Conversely, indirect channels, relying on a network of authorized distributors, local agents, and specialized industrial equipment resellers, are more prevalent for standard abrasive consumables, smaller grinding tools, and replacement parts. These distributors offer localized inventory and faster turnaround times, essential for maintaining continuous operation in foundries.

The efficiency of this value chain is increasingly reliant on strong vertical integration, particularly among major equipment manufacturers who seek to control both machine production and the supply of proprietary consumables to ensure system compatibility and performance guarantees. Collaboration between machine builders and specialized software firms (often third-party AI developers) is also becoming critical in the midstream, enabling the development of advanced monitoring and adaptive control features. Ensuring a robust, localized service and support network is critical in the downstream segment, as machine reliability and rapid troubleshooting directly impact the operational continuity of high-volume manufacturing clients.

Cast Grinding Market Potential Customers

The primary consumers and end-users in the Cast Grinding Market are organizations involved in the mass production of metal components requiring high levels of precision and surface integrity following the casting process. Foundries, both captive (owned by large manufacturers) and commercial (serving multiple clients), constitute the largest segment of potential customers, relying heavily on grinding processes for fettling, removing risers, runners, and flash from raw castings. Original Equipment Manufacturers (OEMs), particularly those in the automotive and aerospace sectors, represent a crucial customer base, as they often require specialized grinding solutions for internal production of highly critical components like engine components, brake calipers, and turbine parts where quality compliance is strictly regulated.

Furthermore, specialized machining job shops and tool and die makers are significant consumers, demanding highly flexible and ultra-precise grinding equipment for producing intricate molds and tooling inserts, often utilizing advanced superabrasives. The medical device industry is an emerging, high-value customer segment, requiring extremely fine finishing and polishing of cast components for surgical instruments and implants, necessitating stringent process validation. The heavy machinery sector, including manufacturers of agricultural equipment, construction vehicles, and power generation turbines, requires high-throughput grinding solutions for large, heavy cast components, driving demand for powerful, automated snagging and surface grinding machines. All these customer segments share a common need for solutions that minimize manual handling, optimize material removal rates, and guarantee traceable quality documentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.55 Billion |

| Market Forecast in 2033 | $7.25 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain Abrasives, 3M, KUKA AG, ABB, FANUC Corporation, Schunk GmbH & Co. KG, Okuma Corporation, Makino Milling Machine Co., Ltd., JTEKT Corporation, Gleason Corporation, PFERD INC., Tyrolit Group, Bosch Rexroth AG, Dremel (Robert Bosch Tool Corporation), Grinding Wheel Co. of India, Precision Grinding Systems, Norton Abrasives, United Grinding Group, ANCA Pty Ltd, Toyoda Grinding Machine. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cast Grinding Market Key Technology Landscape

The technological landscape of the Cast Grinding market is rapidly transforming, moving away from conventional, fixed-speed grinding processes towards highly sophisticated, adaptable, and automated systems. A crucial innovation lies in the widespread adoption of superabrasive materials, specifically Cubic Boron Nitride (CBN) and monocrystalline or polycrystalline diamond grits. These materials offer superior hardness and thermal stability compared to traditional aluminum oxide or silicon carbide, enabling significantly faster material removal rates, drastically extended tool life (sometimes 50 to 100 times longer), and the ability to machine extremely hard or difficult-to-grind materials like high-nickel alloys and chilled cast iron with exceptional surface finish quality. The formulation of specialized bonding agents, such as vitrified, resin, and metal bonds, is crucial in optimizing superabrasive performance for specific casting materials and grinding machine dynamics.

Another major technological advancement is the integration of high-precision robotics and collaborative robots (cobots) into the grinding cell. Robotic systems are increasingly equipped with advanced force-sensing technology, allowing them to apply consistent and appropriate pressure to irregular cast surfaces, which is essential for uniform material removal during fettling operations. These systems minimize the risks associated with manual grinding and ensure repeatable dimensional accuracy, essential for high-volume manufacturing lines. Furthermore, the convergence of Computer Numerical Control (CNC) technology with multi-axis grinding heads allows for complex, simultaneous movements, enabling the precision grinding of intricate internal and external geometries required for components in advanced transmissions and fluid handling systems.

The third critical technology pillar is the implementation of Industry 4.0 paradigms, encompassing IoT, digital twin technology, and advanced process monitoring. IoT sensors embedded in grinding spindles and fixtures provide real-time data on vibration, thermal drift, and power consumption, feeding into analytical platforms. Digital twin simulations allow manufacturers to model and optimize grinding strategies virtually before implementation, reducing physical prototyping costs and time. Acoustic emission monitoring is gaining traction as a non-invasive method to detect microscopic crack formation, wheel loading, and imminent tool failure, ensuring proactive intervention and maximizing both quality assurance and equipment uptime. These digital technologies are instrumental in achieving the necessary levels of automation and process reliability expected by high-tier manufacturing clients.

Regional Highlights

Market dynamics for cast grinding solutions vary significantly across major geographical regions, influenced by industrial base maturity, labor costs, and governmental manufacturing policies. Asia Pacific (APAC) stands as the dominant and fastest-growing region, driven by its expansive automotive production capacity, massive investments in infrastructure (rail, power generation), and the relocation of global manufacturing operations. Countries like China, India, and Southeast Asian nations are characterized by high-volume production needs, fueling demand for both efficient manual tools (in smaller foundries) and large-scale automated robotic fettling systems (in major OEM facilities). The focus in APAC is often on efficiency and scaling production rapidly.

North America and Europe represent mature markets characterized by stringent quality standards, high labor costs, and a concentration of specialized, high-value manufacturing sectors such as aerospace, medical implants, and luxury/performance automotive. The primary growth driver in these regions is the replacement of legacy equipment with advanced CNC and robotic grinding cells that leverage superabrasives and integrated monitoring technologies. Innovation here centers on achieving ultra-high precision and integrating advanced materials processing capabilities. Regulatory environments, particularly regarding worker safety and emissions, further accelerate the shift towards automated solutions in these regions.

- Asia Pacific (APAC): Dominates the market due to robust growth in automotive and electronics manufacturing; high investment in new foundry capacity and rapid automation adoption to meet scaling demand; focus on cost-effective, high-throughput solutions.

- North America: Strong demand from aerospace and defense sectors requiring ultra-high precision grinding for turbine components; significant expenditure on integrating robotics and AI for process optimization in established manufacturing centers.

- Europe: Leading advancements in advanced manufacturing and Industry 4.0; strong market for specialized abrasive tools and high-end CNC grinding machines driven by the German and Italian automotive and machinery industries; high emphasis on energy efficiency and environmental compliance in grinding processes.

- Latin America (LATAM): Growth driven by expanding automotive assembly and heavy industrial sectors, particularly in Brazil and Mexico; emerging market for semi-automatic and conventional grinding tools, with increasing investment in specialized machinery to upgrade local production quality.

- Middle East and Africa (MEA): Growth tied to diversification efforts away from oil dependency, leading to investments in localized heavy machinery assembly and infrastructure projects; slower initial adoption of advanced automation but steady demand for durable standard abrasives and robust grinding equipment for maintenance, repair, and overhaul (MRO).

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cast Grinding Market.- Saint-Gobain Abrasives

- 3M

- KUKA AG

- ABB

- FANUC Corporation

- Schunk GmbH & Co. KG

- Okuma Corporation

- Makino Milling Machine Co., Ltd.

- JTEKT Corporation

- Gleason Corporation

- PFERD INC.

- Tyrolit Group

- Bosch Rexroth AG

- Dremel (Robert Bosch Tool Corporation)

- Grinding Wheel Co. of India

- Precision Grinding Systems

- Norton Abrasives

- United Grinding Group

- ANCA Pty Ltd

- Toyoda Grinding Machine

Frequently Asked Questions

Analyze common user questions about the Cast Grinding market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of robotic cast grinding systems?

The primary factor driving robotic system adoption is the need to automate hazardous, labor-intensive fettling and snagging operations, significantly enhancing worker safety, improving process consistency, and compensating for rising labor costs in industrial economies.

How do superabrasives, like CBN and Diamond, influence grinding efficiency?

Superabrasives drastically influence efficiency by offering superior hardness and wear resistance, leading to extended tool life, fewer wheel changes, and the ability to achieve much higher material removal rates (MRR) and tighter surface finish specifications compared to conventional abrasives.

Which application segment holds the largest share in the Cast Grinding Market?

The Automotive and Transportation segment holds the largest market share, driven by the mass production of high-volume, precision cast components such as engine blocks, braking systems, and transmission parts, with increasing demand fueled by the electric vehicle transition.

What role does Industry 4.0 play in modern cast grinding processes?

Industry 4.0 plays a critical role by integrating IoT sensors, predictive analytics, and digital twin technology to enable real-time monitoring, adaptive control of grinding parameters, and optimized predictive maintenance schedules, thereby maximizing throughput and minimizing downtime.

What are the key challenges facing small and medium-sized enterprises (SMEs) in adopting advanced grinding technologies?

The key challenges for SMEs are the high initial capital investment required for advanced CNC and robotic equipment, coupled with the difficulty in recruiting and retaining skilled technical personnel necessary to program, operate, and maintain these sophisticated systems efficiently.

What differentiates precision grinding from general fettling in the casting industry?

Fettling is a coarse grinding process used primarily to remove excess material (runners, risers, flash) and defects from rough castings. Precision grinding, conversely, is a secondary operation focused on achieving tight dimensional tolerances and specified surface finishes essential for functional component performance.

Which material type requires the most specialized grinding solution?

Non-ferrous castings, specifically high-nickel superalloys and titanium alloys used in aerospace and high-temperature applications, require the most specialized grinding solutions due to their high thermal conductivity and propensity to cause rapid wear on standard abrasive materials, necessitating the use of specialized superabrasives (CBN/Diamond) and optimized coolant delivery systems.

How is the focus on lightweighting impacting the demand for cast grinding equipment?

The focus on lightweighting, particularly in the automotive industry, is increasing the demand for precision grinding solutions tailored for non-ferrous materials like aluminum and magnesium castings. These materials require specific abrasive chemistries and lower grinding pressures to prevent material deformation and ensure dimensional integrity, driving innovation in machine tooling and abrasive formulations.

What are the primary maintenance considerations for automated grinding machines?

Primary maintenance considerations include regular monitoring and replacement of grinding wheels and tools, maintaining strict coolant purity and concentration levels, managing dust and swarf extraction systems to prevent contamination, and ensuring the calibration and mechanical integrity of multi-axis CNC or robotic components to maintain positional accuracy.

Why is tool path optimization crucial in robotic grinding applications?

Tool path optimization is crucial in robotic grinding because cast parts often have highly variable and irregular surface geometries. Optimized paths, frequently generated using 3D scanning and software simulations, ensure uniform material removal, prevent excessive force that could damage the casting, and significantly reduce overall cycle time, thereby maximizing productivity.

What is the projected growth trajectory for the Cast Grinding Market in the Asia Pacific region?

The APAC region is projected to exhibit the highest growth trajectory, supported by rapid industrialization, massive governmental investment in manufacturing infrastructure, and the establishment of numerous global supply chain hubs, particularly in countries with large automotive production capabilities like China and India.

How do environmental regulations affect the market for grinding fluids and coolants?

Environmental regulations demand biodegradable, low-toxicity, and easily disposable grinding fluids and coolants. This pushes manufacturers to innovate safer, synthetic, and semi-synthetic products, sometimes requiring investment in advanced filtration and recycling systems to comply with strict discharge limits and workplace exposure standards.

What role does workforce safety play in driving automation investments in foundries?

Workforce safety is a major driver, as manual grinding exposes workers to high levels of noise, vibration, dust (silica), and ergonomic risks. Automation, particularly through robotic grinding cells, removes humans from these hazardous environments, leading to regulatory compliance, reduced liability, and improved employee retention.

What are the common materials used for conventional grinding wheels?

The common materials used for conventional grinding wheels include Aluminum Oxide (Al2O3), typically used for grinding high-tensile strength materials like steel, and Silicon Carbide (SiC), which is preferred for materials with low tensile strength, such as cast iron, non-ferrous metals, and ceramics.

How is digital twin technology utilized in the Cast Grinding process?

Digital twin technology creates a virtual replica of the entire grinding cell and process, allowing engineers to simulate different tooling setups, test new programming strategies, predict component wear, and optimize production throughput before making any physical adjustments, thereby saving time and reducing material waste.

Which segment of the market, abrasive or machinery, accounts for a higher revenue share?

While machinery involves higher initial capital outlay, the Abrasives segment (consumables) often accounts for a significant and recurring revenue share due to the continuous replacement cycle of grinding wheels, belts, and discs required for ongoing high-volume production operations.

What is the impact of additive manufacturing (3D printing) on the need for cast grinding?

While additive manufacturing (AM) produces near-net-shape components, parts still require post-processing, often involving precision grinding, especially for critical surfaces demanding high dimensional accuracy and superior finish, thereby creating a demand for new types of specialized grinding solutions adapted for AM materials.

What are the key technical challenges when grinding ductile iron castings?

Ductile iron castings pose technical challenges primarily due to their microstructure, which can lead to rapid abrasive loading (clogging) and heat generation during grinding, requiring specialized superabrasive formulations and high-efficiency coolant systems to maintain surface integrity and prevent thermal damage.

How is customization affecting the sales strategy of grinding equipment manufacturers?

Customization is increasingly critical, as manufacturers must offer tailored grinding cells that integrate seamlessly with specific foundry processes (e.g., automated part loading/unloading, specific defect detection systems), shifting the sales strategy from selling standard machinery to providing bespoke, integrated engineering solutions.

What is the expected long-term effect of electric vehicles (EVs) on the cast grinding market?

The long-term effect of EVs is a shift in demand away from complex engine component grinding (ferrous) towards high-volume, precision grinding of lightweight non-ferrous castings for battery housings, motor rotors, and chassis components, necessitating investments in specialized aluminum and magnesium alloy grinding technologies.

What are the primary differences between vitrified and resin bond grinding wheels?

Vitrified bond wheels are rigid and porous, offering excellent material removal rates and stability, typically used for precision internal and external grinding. Resin bond wheels are elastic and less rigid, favored for surface finishing, cutoff operations, and applications requiring higher shock resistance and faster cycle times.

How do manufacturers ensure quality traceability in automated grinding?

Quality traceability in automated grinding is ensured by integrating in-process gauging systems, capturing real-time data on dimensional tolerances, vibration, and energy consumption (the "grinding signature"), and logging this data against unique component IDs using centralized manufacturing execution systems (MES).

What measures are taken to mitigate thermal damage (grinding burn) on cast components?

Mitigation of thermal damage involves optimized cooling strategies (high-pressure, high-volume coolant delivery), selecting abrasive materials with high thermal conductivity, using segmented grinding wheels to facilitate coolant access, and utilizing adaptive feed rate control systems based on real-time temperature sensing.

Which geographical region shows the highest propensity for adopting collaborative robotic grinding solutions?

North America and Europe show the highest propensity for adopting collaborative robotic grinding solutions, driven by high labor costs, stringent safety regulations, and the need for flexible, high-mix/low-volume production runs characteristic of their specialized manufacturing sectors.

How is the availability of recycled materials impacting the need for specialized grinding?

The increasing use of recycled cast metals often introduces greater variability and inclusions in the material structure. This variability necessitates more robust and adaptable grinding solutions, including wheels designed to handle greater inconsistencies and adaptive control systems to maintain surface quality despite material differences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cast Grinding Media Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Grinding Media Market Size Report By Type (Forged Grinding Media, High Chrome Cast Grinding Media, Other Cast Grinding Media), By Application (Chemistry industry, Metallurgy industry, Cement plant, Power plant, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager