Catering Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432405 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Catering Market Size

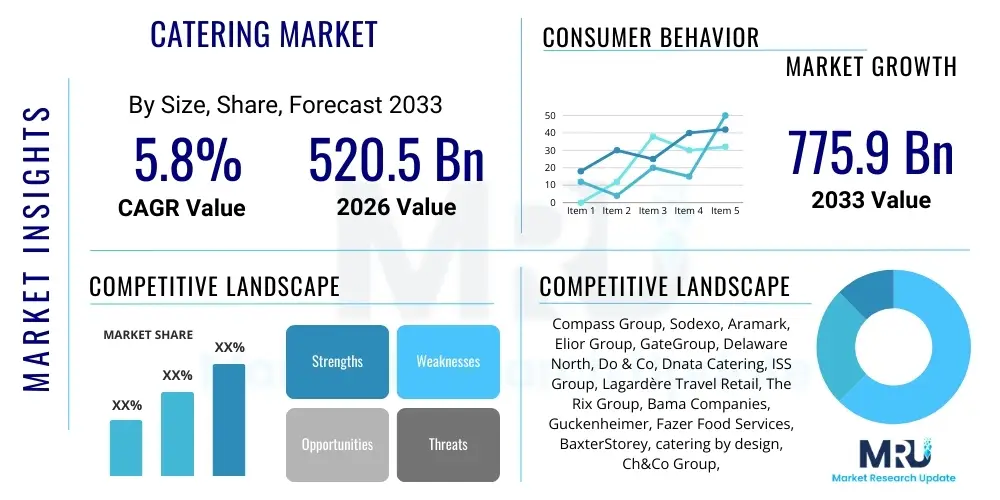

The Catering Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 520.5 Billion in 2026 and is projected to reach USD 775.9 Billion by the end of the forecast period in 2033.

Catering Market introduction

The global catering market encompasses the extensive provision of food and beverage services across diverse operational settings, ranging from large-scale corporate events and institutional dining halls (such as those found in schools and healthcare facilities) to bespoke private functions and highly specialized sectors like airline and remote site operations. This sophisticated industry is fundamentally characterized by the requirement for high levels of logistical precision, adherence to stringent international food safety standards, and a robust capability for menu customization to meet increasingly complex dietary and cultural requirements. The core service portfolio spans complete end-to-end meal preparation, sophisticated beverage service solutions, and comprehensive event management support, all designed to ensure seamless food delivery and superior guest experience, irrespective of the scale or location of the service requirement. The market’s continued expansion is intricately linked to global macroeconomic factors, including the acceleration of global business activity, resulting in higher MICE (Meetings, Incentives, Conferences, and Exhibitions) spending, alongside the undeniable global trend of urbanization which increases reliance on convenient, professionally prepared food solutions.

Major applications for catering services are broadly and strategically segmented into non-commercial and commercial categories. The non-commercial sector is dominated by institutional catering, providing essential, high-volume meal services within public and private infrastructures such as major educational campuses, large hospitals requiring therapeutic diets, and government facilities. The commercial sector includes the pivotal corporate catering segment, which covers executive dining, employee cafeterias, and specialized catering for business events, where quality and promptness are key competitive differentiators. A third crucial segment is social catering, which focuses on high-margin, event-driven services like weddings, high-profile private parties, and large public festivals. The primary value proposition offered by professional catering firms is the delivery of consistent, high-quality food experiences at scale, which enables client organizations to strategically focus their resources on their core business activities while delegating complex food service management to experts. This outsourcing trend is a major underlying driver, underpinned by the economic benefits of managed culinary provision.

Driving factors propelling the market forward include the sustained global economic recovery, which has led to a revitalization of corporate spending on employee engagement and external client events, necessitating reliable catering provision. Furthermore, the persistent global demand for health-conscious and specialized dietary options—including vegan, plant-based, allergy-friendly, and ethnic cuisines—forces caterers to innovate continually in menu development and supply chain management. Technological innovation serves as a crucial accelerator; the implementation of advanced supply chain management software, centralized cloud kitchens, and automated ordering platforms significantly improves operational efficiencies, reduces food wastage, and allows for rapid scalability of services. Regulatory environments, particularly those focused on mandatory nutritional standards in institutional settings and escalating hygiene protocols globally, also influence market dynamics by setting a high bar for operational professionalism and compliance, subtly favoring larger, well-established catering enterprises capable of meeting these strict standards.

Catering Market Executive Summary

The global catering market is currently undergoing a transformative period marked by profound shifts towards hyper-efficiency through digitization and a non-negotiable commitment to sustainable operating practices. Strategic business trends indicate a distinct move by large multinational corporations and major healthcare providers to transition from self-operated dining services to integrated outsourcing models, driven by the need to manage rising operational costs and the increasing complexity of food safety regulations. This shift favors large contract catering specialists capable of leveraging economies of scale and standardized procedures across multiple geographic locations. Furthermore, the rise of specialized 'dark' or 'ghost' kitchens, dedicated solely to off-site preparation and delivery, is reshaping the competitive terrain, enabling caterers to minimize overhead associated with customer-facing infrastructure while maximizing preparation efficiency through data-optimized production schedules. Crucially, the demand for transparent supply chains and meals supporting personalized nutrition goals is mandating rapid innovation in menu design and ethical sourcing policies across the industry.

In terms of regional market performance, North America and Europe retain their market leadership, primarily due to their established corporate infrastructures, high levels of disposable income supporting premium social catering, and mature regulatory environments that encourage large-scale professional contract services. However, the Asia Pacific (APAC) region is strategically positioned as the primary growth engine, exhibiting an accelerating Compound Annual Growth Rate (CAGR). This expansion is largely attributed to massive urbanization trends, significant foreign direct investment into corporate and hospitality infrastructure, and a rapidly expanding middle class that is increasingly adopting westernized dining preferences and demanding high-quality catering for both corporate and personal events. Conversely, Latin America and the Middle East and Africa (MEA) are demonstrating steady, albeit more project-driven, growth, heavily influenced by cyclical investments in tourism, resource extraction camps, and major government-backed infrastructure and cultural events.

Analysis of market segmentation reveals that the Contract Catering segment, defined by long-term service agreements with institutional and corporate clients, provides the most robust and predictable revenue streams and is therefore attracting the majority of strategic investment. Within this segment, healthcare and education continue to show resilience, being largely decoupled from short-term economic fluctuations. The Event Catering (non-contract) segment, while offering higher margin potential, remains more susceptible to macroeconomic volatility and public health concerns. A key macro trend unifying all segments is the strategic focus on technology adoption, including real-time inventory tracking and AI-driven demand forecasting, which provides a critical competitive edge by mitigating the structural risks associated with perishable goods, labor dependency, and optimizing complex multi-site service delivery schedules.

AI Impact Analysis on Catering Market

Common user questions regarding the integration of Artificial Intelligence (AI) in the catering market predominantly center on the tangible benefits of operational optimization, focusing on how AI can systematically drive down the significant costs associated with food waste, logistics, and manual labor management. There is a keen interest among market players about leveraging AI for predictive analytics—specifically, forecasting precise ingredient quantities needed for upcoming events or daily institutional dining cycles, thereby dramatically improving inventory management and reducing spoilage. User concerns often pivot around the necessity of substantial initial capital investment for AI implementation, the complexity of integrating these advanced systems with legacy kitchen management software, and the critical need to preserve the creativity and 'human touch' which remains essential in the provision of high-end, experiential catering services. The overarching consensus is that AI’s primary role is to serve as a powerful analytical and organizational tool, handling the logistics and data processing, allowing human staff to focus exclusively on execution, quality, and direct client interaction.

The transformative effect of AI is most profound in the back-of-house operations and supply chain management. AI algorithms, fed by vast datasets including past event success metrics, seasonal demand patterns, and even localized weather data, can generate remarkably accurate demand forecasts for perishable goods, reducing buffer stock requirements and minimizing the financial losses associated with excess inventory. Furthermore, AI-powered systems are rapidly becoming integral in optimizing the complex cold chain logistics inherent to catering. These systems automatically calculate the most efficient, temperature-compliant delivery routes for multiple service locations, taking into account real-time traffic updates and mandated delivery windows. This logistical precision is critical for maintaining food safety and quality, particularly for large, decentralized contract catering operations serving institutional clients where adherence to strict timing and temperature standards is contractual.

In the domain of customer engagement and quality control, AI offers highly personalized service capabilities that were previously unattainable. Machine learning models analyze customer feedback, demographic data, and observed consumption patterns to automatically suggest bespoke menus that align with established client preferences or dietary guidelines, significantly reducing the sales cycle time and improving customer satisfaction. Moreover, in high-volume production facilities, the use of computer vision integrated with AI is starting to monitor food preparation processes in real time. These systems can automatically verify adherence to recipe specifications, ensure consistent portion control, and immediately flag potential hygiene or safety deviations. This application not only enhances food quality standardization across multi-site operations but also proactively supports compliance with stringent public health regulations, solidifying AI's position as a crucial tool for both efficiency and quality assurance in the modern catering industry.

- Enhanced Demand Forecasting: AI models predict required quantities of ingredients and prepared meals based on historical data, seasonal variations, and real-time event schedules, dramatically minimizing perishable inventory spoilage and operational waste.

- Automated Logistics and Route Optimization: Machine learning algorithms dynamically optimize complex, multi-stop delivery routes, ensuring timely arrival and compliance with stringent cold chain temperature requirements through real-time data analysis.

- Personalized Menu Engineering: AI analyzes aggregated customer preference data, dietary restrictions, and demographic profiles to generate customized, high-conversion menu suggestions, streamlining the client consultation and decision process.

- Operational Efficiency in Kitchens: Computer vision and sensors monitor food preparation, ensuring consistent portion sizing, strict adherence to quality standards, and immediate detection of potential hygiene breaches in high-volume production environments.

- Predictive Equipment Maintenance: AI monitors the performance metrics of critical kitchen equipment (e.g., ovens, cold storage units), predicting failures before they occur, thereby preventing costly operational downtime and potential food safety risks.

DRO & Impact Forces Of Catering Market

The Catering Market's trajectory is determined by a powerful combination of systemic Drivers, structural Restraints, and latent Opportunities, which collectively constitute the core Impact Forces shaping industry strategy and investment. Key market drivers include the sustained global corporate trend towards outsourcing non-core functions, particularly in areas like employee dining and facility management, to specialist caterers who offer scalable and quality-controlled services. This outsourcing is complemented by a burgeoning consumer demand for specialized and health-conscious menu items, forcing innovation in food procurement and preparation. Furthermore, the recovery and growth of international tourism and major sporting/cultural events act as critical demand catalysts for high-end event catering. These drivers push caterers toward greater efficiency, diversification, and adherence to premium service standards, demanding continuous technological investment to remain competitive.

Significant restraints challenge sustained market expansion and profitability. The industry remains highly vulnerable to dramatic fluctuations in global commodity prices—specifically inputs like meat, grain, and energy—which severely impact raw material costs and, consequently, profit margins, especially under long-term contract agreements. An equally pressing restraint is the chronic shortage of skilled culinary and service labor across mature markets, forcing wage inflation and increasing reliance on automation. Regulatory hurdles, particularly the continuously evolving and intensifying global standards for food hygiene, allergen control, and environmental reporting, introduce complexity and raise operational compliance costs, particularly burdening smaller, independent catering businesses that lack centralized resources to manage these multifaceted requirements effectively across geographies.

Despite these challenges, substantial opportunities exist, primarily through the strategic leveraging of technology and specialization. The opportunity for market penetration lies in the adoption of cloud-based kitchen models and specialized, sustainable service offerings (e.g., zero-waste catering, hyper-local sourcing). Geographically, the underserved and rapidly developing markets in Southeast Asia and parts of Africa present significant growth potential for contract caterers willing to adapt their models to localized cultural and logistical needs. The overall impact forces compel industry participants to adopt resilient, technology-enabled business models. Successfully navigating the market requires a strategic balance: capitalizing on stable contract revenues and specialization opportunities while simultaneously implementing robust AI and automation solutions to mitigate the unavoidable constraints imposed by labor scarcity and commodity price volatility, ensuring long-term operational viability and competitive differentiation.

Segmentation Analysis

The global catering market is systematically segmented to analyze revenue streams, growth dynamics, and competitive positioning across various operational and demand characteristics. The primary segmentation distinguishes between Contract Catering and Non-Contract Catering (or Event Catering). Contract catering involves long-term, stable agreements, typically lasting several years, for continuous food provision to entities such as corporate campuses, hospitals, or educational institutions. This segment values efficiency, scale, and compliance, offering caterers predictable revenue streams and justifying major investment in centralized infrastructure. Conversely, non-contract catering is project-based, serving one-off events like weddings, conferences, or private banquets, characterized by higher operational complexity, greater customization demands, and higher profit margins per event, though with significantly less revenue stability than contract arrangements.

Segmentation by End-User further defines market characteristics. The Institutional sector (Healthcare and Education) requires highly customized services focused on therapeutic diets, nutritional guidelines, and strict budgetary control, representing a high-volume, low-margin, yet extremely resilient customer base. The Corporate sector demands premium quality, flexibility, and often requires integrated service solutions spanning executive dining to staff cafeterias, with demand fluctuating based on economic cycles and business travel trends. The Aviation and Transportation sector is highly specialized, requiring massive logistical precision and strict compliance with international security and hygiene standards for airline meals, representing a high-barrier-to-entry niche. Understanding the unique procurement cycles and regulatory demands of each end-user segment is crucial for developing targeted service packages and optimizing pricing strategies.

Contemporary market analysis increasingly focuses on granular segmentation based on service execution and cuisine. The move towards specialized diet catering—including meals catering to specific allergies (e.g., nut-free, gluten-free), cultural needs (Kosher, Halal), or lifestyle choices (vegan, paleo)—has become a significant differentiating factor. Furthermore, the operational location, distinguishing between On-Premise catering (food prepared and served at the client's fixed location) and Off-Premise catering (food prepared at a central kitchen and transported to the event site), dictates the logistical technologies and infrastructure required. The growth of specialized, off-premise, technology-enabled 'ghost catering' focused solely on efficient delivery highlights how operational model segmentation is rapidly evolving to capitalize on urbanization and digital ordering trends.

- Service Type:

- Contract Catering (Long-term Institutional, Corporate, Industrial, Remote Sites)

- Non-Contract Catering (Event, Banquet, Private Function, Weddings, Festivals)

- End-User:

- Corporate (Offices, Business Meetings, Conferences, Executive Dining)

- Institutional (Education, Healthcare, Government/Defense, Industrial Canteens)

- Aviation and Transportation (Airlines, Railways, Cruise Ships, Airport Lounges)

- Sports and Leisure (Stadiums, Arenas, Theme Parks, Concert Venues)

- Social/Private Events (Weddings, Galas, Receptions)

- Cuisine Type:

- Traditional Cuisine (Regional Specialties)

- Specialty and Dietary Catering (Vegan, Gluten-Free, Organic, Allergy-Sensitive)

- Fusion and International Catering

- Location Type:

- On-Premise Catering (Managed Cafeterias, Fixed Site Operations)

- Off-Premise Catering (Delivery to External Venue, Cloud Kitchen Operations)

Value Chain Analysis For Catering Market

The catering value chain initiates with the Upstream Analysis, which focuses on the procurement and primary processing of raw materials. This stage is dominated by relationships with food producers, agricultural suppliers, and large-scale distributors. Effective upstream management is critically dependent on securing stable contracts, mitigating price volatility risks associated with agricultural commodities, and ensuring compliance with increasing demands for ethical sourcing, sustainability certifications, and full ingredient traceability. Modern caterers are increasingly bypassing traditional intermediaries where possible, favoring direct, short-chain partnerships with local producers to guarantee freshness, reduce carbon footprint, and respond flexibly to sudden changes in menu requirements, thereby achieving a competitive advantage through superior raw material quality.

The Midstream phase constitutes the core operational activities: preparation, cooking, quality control, and initial packaging and staging. For large contract caterers, this phase is executed within highly centralized, high-capacity production units or 'cloud kitchens,' which leverage standardization and sophisticated technology to achieve massive economies of scale. Investment in advanced manufacturing techniques, such as cook-chill and blast-freezing technologies, is vital here to ensure food longevity and safety during transport. Distribution channels diverge significantly in this stage: Direct distribution involves the caterer managing the entire logistics chain (from preparation to final delivery and service setup) for maximum quality control, typically used for high-end events. Indirect distribution often relies on partnerships with third-party logistics firms or major facility management companies who integrate the food service into a broader operational package, allowing the caterer to access highly protected institutional or industrial markets.

The Downstream Analysis addresses the final mile delivery, on-site service, presentation, and crucially, customer feedback collection. This stage determines perceived service quality and client satisfaction. For event catering, downstream success depends on high-touch service execution, impeccable presentation, and rapid, flexible response to unforeseen issues. For institutional contract catering, success is measured by consistent on-time delivery, compliance with service level agreements (SLAs), and efficient management of dining facilities. The integration of technology, particularly digital feedback loops and ordering systems, optimizes this final interaction, allowing caterers to instantly adapt service delivery. The robustness of the entire value chain—from ethical sourcing upstream to impeccable service downstream—ultimately dictates the competitiveness and revenue stability of the catering enterprise in a highly quality-sensitive market.

Catering Market Potential Customers

The Catering Market serves a highly diverse customer ecosystem, where demand profiles and procurement sensitivities vary significantly based on sector. The primary purchasing entities fall into three broad categories: Corporate, Institutional/Governmental, and Social/Private. Corporate customers, including multinational corporations, technology firms, and financial institutions, seek reliable, premium-quality daily dining services for employees (either subsidized or paid-for), and high-end catering for board meetings, conferences, and internal celebrations. Corporate procurement is primarily driven by supplier reliability, menu diversity to support employee wellness and retention goals, and increasingly, alignment with strict corporate social responsibility (CSR) policies regarding sustainability and waste reduction.

Institutional customers represent the backbone of the contract catering segment, characterized by high-volume, long-term contractual needs. This includes educational establishments (K-12 schools, universities), healthcare facilities (hospitals, nursing homes), and government/defense agencies. These buyers prioritize rigid adherence to complex regulatory standards—such as nutritional guidelines mandated for school meals or therapeutic requirements in clinical settings—over flexibility. Their buying cycle is typically long, involving rigorous tendering processes, and decisions are fundamentally based on demonstrated scalability, compliance track record, and the ability to maintain consistent service quality at extremely high volumes while adhering to strict cost controls, making this a highly predictable but intensely competitive segment.

The Social and Private Events segment constitutes a demand pool driven by discretionary spending and the desire for memorable, unique experiences. These customers include wedding planners, high-net-worth individuals hosting private galas, and managers of large public festivals. Their purchasing criteria are centered on culinary creativity, personalized service, flexibility in accommodating theme-specific requests, and the caterer’s ability to manage complex logistics at unique venues. This segment offers the highest potential for margin growth due to the premium nature of the service, but it is highly sensitive to economic downturns and social restrictions, requiring caterers focused here to prioritize exceptional customer relationship management and bespoke service customization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520.5 Billion |

| Market Forecast in 2033 | USD 775.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Compass Group, Sodexo, Aramark, Elior Group, GateGroup, Delaware North, Do & Co, Dnata Catering, ISS Group, Lagardère Travel Retail, The Rix Group, Bama Companies, Guckenheimer, Fazer Food Services, BaxterStorey, catering by design, Ch&Co Group, Hostmark Hospitality Group, Centerplate, Restaurant Associates |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Catering Market Key Technology Landscape

The technological evolution within the catering market is primarily concentrated on developing integrated, full-stack solutions that manage everything from initial procurement to final consumption analysis, driving the sector towards a model of 'Food Service as a Platform'. Central to this landscape are sophisticated, cloud-based Kitchen Management Systems (KMS) which integrate inventory tracking, standardized recipe management, and real-time scheduling across multi-site operations, a necessity for global contract caterers. The deployment of Internet of Things (IoT) sensors is rapidly increasing, particularly for monitoring critical parameters like temperature and humidity in remote storage units and during complex transportation legs, ensuring strict adherence to food safety protocols and providing an immutable digital log for regulatory compliance, significantly mitigating risks associated with cold chain breaches in off-premise services.

Furthermore, consumer engagement is being redefined by digital tools that optimize the sales and ordering process. Advanced mobile ordering applications now integrate personalized dietary filters and loyalty programs, facilitating high-volume pre-orders in corporate and institutional settings, minimizing wait times and improving service personalization. On the operational side, the application of Robotics and advanced automation is beginning to address persistent labor cost pressures and skill shortages. Automated portioning machines, robotic arms for repetitive cooking tasks, and AI-driven dispensing units are enhancing consistency, improving hygiene control, and allowing scarce human labor to be redeployed to high-value, client-facing roles where human interaction is irreplaceable. These investments are driven by a need to maximize Return on Investment (ROI) in mature markets where labor efficiency is paramount.

In the crucial area of supply chain integrity and waste management, the technology landscape features increasing reliance on Big Data analytics and emerging Blockchain technology. Big Data analytics fuels the aforementioned AI demand forecasting, optimizing ingredient purchasing to prevent overstocking of perishable items. Blockchain applications offer unprecedented levels of transparency by creating tamper-proof records of ingredient origins, transit conditions, and certifications. This is a powerful tool for caterers who must satisfy corporate clients demanding verifiable proof of ethical sourcing and compliance with environmental, social, and governance (ESG) standards. Collectively, this technological suite transforms catering operations into highly scalable, auditable, and data-optimized entities, shifting the competitive focus from sheer volume provision to intelligent, resilient service delivery.

Regional Highlights

North America maintains its influential position in the global catering market, driven by the massive scale of its corporate and institutional sectors. The region benefits from a highly mature outsourcing culture, where large businesses and healthcare networks routinely contract specialized caterers for comprehensive food service management. Technological adoption is highest here, with significant investment in delivery logistics, app-based ordering systems, and AI-driven efficiency tools utilized to manage high labor costs effectively. Growth is robust in the contract segment, specifically due to the increasing focus on employee wellness programs in corporations and the continuous need for highly specialized food services in the vast U.S. and Canadian healthcare systems. However, the market is intensely competitive, forcing differentiation through customization and technological superiority.

Europe represents a technologically sophisticated but highly fragmented market, characterized by deep cultural preferences for regional cuisines and extremely rigorous regulatory environments governing food safety and environmental impact. Western European countries, particularly the UK, Germany, and France, host major global catering conglomerates and demonstrate high market penetration in corporate and defense contract catering. A key regional characteristic is the strong consumer and governmental push for sustainability; this drives demand for local sourcing, reductions in food miles, and robust waste management programs. Market expansion in Central and Eastern Europe is accelerating, following infrastructural investment and the modernization of public sector services, creating new opportunities for major international caterers to secure long-term contracts previously managed in-house.

The Asia Pacific (APAC) region is indisputably the high-growth frontier for the catering industry, recording the fastest growth rate globally. This rapid expansion is underpinned by massive urbanization, a demographic shift toward Westernized consumption patterns, and significant infrastructure spending on airports, convention centers, and major corporate headquarters across key economies like China, India, and Southeast Asia. Aviation catering, tied to the region's explosive growth in air travel, is a dominant sub-segment, alongside burgeoning opportunities in corporate campus dining. Latin America and the Middle East and Africa (MEA) offer selective, project-based growth. MEA benefits significantly from ongoing mega-events (like Saudi Arabia's Vision 2030 projects and continuous hosting of international conferences), fueling demand for premium, luxury event catering and large-scale remote site catering for oil, gas, and construction industries. Latin America's growth is tied primarily to the recovery of its tourism sector and increased foreign investment in corporate infrastructure.

- North America: Market leader, driven by robust corporate outsourcing, high technological integration (AI/IoT), and strong demand for tailored healthcare and educational institutional catering.

- Europe: High maturity and strong regulatory emphasis on hygiene and sustainability; growth focused on consolidation and green catering solutions across major economies.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid urbanization, substantial investment in infrastructure, and exponential growth in corporate and aviation catering markets.

- Latin America: Moderate growth tied to tourism recovery, hospitality sector expansion, and increasing penetration of international contract catering firms into local industries.

- Middle East and Africa (MEA): Growth heavily dependent on government-backed mega-projects, luxury event catering (driven by high-net-worth tourism), and specialized remote site catering for resource extraction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Catering Market.- Compass Group

- Sodexo

- Aramark

- Elior Group

- GateGroup

- Delaware North

- Do & Co

- Dnata Catering

- ISS Group

- Lagardère Travel Retail

- The Rix Group

- Bama Companies

- Guckenheimer

- Fazer Food Services

- BaxterStorey

- catering by design

- Ch&Co Group

- Hostmark Hospitality Group

- Centerplate

- Restaurant Associates

- LSG Group

- Newrest Group

- Eurest (Part of Compass Group)

- Alshaya Group

- Servest Group

Frequently Asked Questions

Analyze common user questions about the Catering market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary growth driver for the global catering market?

The primary driver is the increasing tendency of corporate entities and institutions (such as hospitals and schools) to outsource food services (contract catering) to achieve cost efficiencies and maintain high standards of quality and regulatory compliance, alongside the global revival of large-scale social and MICE events.

How is technology impacting the efficiency of catering operations?

Technology, particularly AI-driven predictive analytics and cloud-based Kitchen Management Systems, is crucial for optimizing inventory, minimizing food waste, streamlining complex delivery logistics, and providing precise, personalized menu recommendations to clients, thereby boosting operational efficiency and margins.

Which segment of the catering market is expected to grow fastest during the forecast period?

The Contract Catering segment, particularly within the Institutional End-User category (healthcare and education), is anticipated to show the most stable and significant growth, driven by long-term service agreements and the demand for high-volume, standardized meal delivery.

What are the key sustainability trends influencing menu decisions in the catering sector?

Caterers are heavily influenced by demands for sustainable sourcing, including increased adoption of locally sourced ingredients, reduction of single-use plastics, focus on plant-based menus, and strict implementation of food waste reduction protocols to align with corporate and consumer environmental goals.

Which region offers the highest growth potential for new entrants?

The Asia Pacific (APAC) region, driven by rapid economic development, urbanization, and expanding infrastructure in hospitality and corporate sectors, presents the highest potential for new market entrants focusing on scalable and technologically advanced catering services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Catering and Food Services Contractor Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Contract Catering Service Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Catering Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Carmine Market Size Report By Type (Liquid, Crystal), By Application (Dairy & Frozen Products, Food & Beverages, Cosmetics, Bakery & Confectionery, Meat Products, Food Processing Companies, Beverage Industry, Catering Industry, Cosmetics and Pharmaceutical Industry), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Soft Serve Freezer Market Size Report By Type (Multi Cylinder, Single Cylinder), By Application (Catering Industry, Entertainment Venue, Shop, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager